-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Bullard Reiterates Higher Rates

- MNI FED: Bullard Reiterates Call For Higher Rates

- MNI Fed: Gov Bowman on Central Bank Digital Currency

- MNI INTERVIEW: US Community Banks Resilient, Trade Group Says

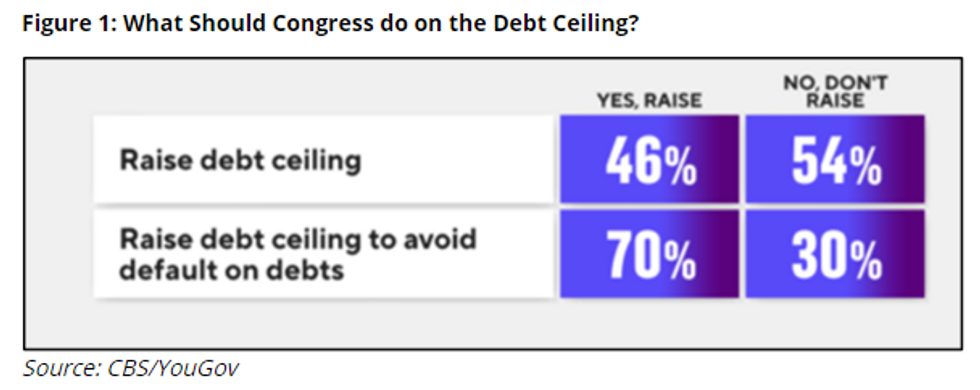

- MNI US: Voters Believe Congress Should Raise Debt Ceiling To Avoid Default

- MNI: Canada Bank Czar Says Housing And Liquidity Are Big Risks

US

FED: St Louis Fed’s Bullard (non-voter) spoke to Reuters and kept to previously made points, in turn not notably moving rate expectations with a 22bp hike priced for the May 3 FOMC and the first 25bp cut from current levels priced for Dec with -26.5bps. Pertinent points:

- STILL SEES ADEQUATELY RESTRICTIVE POLICY RATE AT 5.50%-5.75% RANGE, BIAS TO HOLD FOR LONGER UNTIL INFLATION CONTAINED

- US RECESSION PREDICTIONS IGNORE STRENGTH OF LABOR MARKET, PANDEMIC SAVINGS STILL TO BE USED

- NOT MUCH CLEAR PROGRESS ON INFLATION MEANS INTEREST RATES NEED TO CONTINUE TO RISE

- FED SHOULD AVOID EXTENSIVE FORWARD GUIDANCE AT NEXT MEETING, KEEP OPTIONS OPEN - Reuters

- Regarding CBDC, Bowman said "there could be some promise for wholesale CBDCs in the future for settlement of certain financial market transactions and processing international payments."

- However, "when it comes to some of the broader design and policy issues, particularly those around consumer privacy and impacts on the banking system, it is difficult to imagine a world where the tradeoffs between benefits and unintended consequences could justify a direct access CBDC for uses beyond interbank and wholesale transactions."

US: Local U.S. banks are pressing ahead with regular lending including for commercial real estate projects, an Independent Community Bankers of America executive told MNI, even after the failure of Silicon Valley Bank raised concerns about a credit squeeze.

- "Anecdotally, they have not seen the kind of predicted deposit runoff that everyone was concerned about following Silicon Valley Bank's collapse and instead they've seen some influx," said Anne Balcer, a senior executive vice president of the trade group that represents about 5,000 community banks. "There's still caution but no crisis."

- Higher deposit costs could increase the cost of funds and the cost of lending on the margin, but so far there is little to reason to expect a fundamentally different picture than before the collapse of SVB and two other lenders, Balcer said.

- Deposits at banks in the U.S. fell to USD17.3 trillion through April 5, Fed data shows, a USD413 billion decline from the start of March. A year earlier, banks had north of USD18 trillion in deposits. For more see MNI Policy main wire at 1347ET.

US: CBS has reported that US voters want Congress to raise the debt ceiling if the issue is framed as preventing a default.

- CBS: "When initially asked about raising the debt ceiling - defined as the limit on what the government can borrow to pay its current debts - a narrow majority oppose raising that limit. This is driven by Republicans and independents, including both self-described moderates and conservatives."

- "But when asked what they would support if the U.S. would end up defaulting on its current debt, many change their mind. In this case, seven in 10 Americans favor raising the ceiling to let the U.S. pay its debts."

CANADA

BOC: Canada's bank regulator OSFI said Tuesday that the jump in interest rates underpin the biggest risks to the financial system around weakness in domestic housing markets and a potential liquidity squeeze.

- "Given the rapidity at which interest rates globally have increased, the risk has grown that such an adjustment may not be completely smooth," OSFI said in the second edition of its Annual Risk Outlook.

- "Following record increases during the pandemic, house prices declined significantly in 2022. OSFI is preparing for the possibility that the housing market will experience continued weakness throughout 2023," said the report led by Superintendent Peter Routledge. "The steep increase in interest rates has eroded debt affordability. This is a growing concern from a prudential perspective."

US TSYS: Market Roundup: Short End Back Near March FOMC Levels

- Treasury futures trading firmer for the most part, curves flatter (2s10s -3.767 at -63.574) with Bonds outperforming mildly weaker short end rates (2s currently -1.38 at 102-29.75, yield +.0131 at 4.2073).

- Short end rates reversed support, traded weaker soon after StL Fed President Bullard reiterated in a Reuters interview his call for higher rates while avoiding "extensive forward guidance at the next FOMC meeting."

- Fed fund pricing for 25bp rate hike for May holds steady while June gained climbed to 27.5 cumulative at 5.104%; chances of Dec cut has receded back near March 22 FOMC level of appr -22bp at 4.603%.

- From a technical point of view after the 10Y futures contract breached both the 20- and 50-day EMAs Monday, a continuation lower would signal scope for weakness towards 114-07, the Mar 29, 30 low and 113.26, the Mar 22 low. The latest bear cycle does appear to be a correction.

- A reversal higher and a break of resistance at 116-08, Apr 12 high, would signal a resumption of the uptrend and expose 117-01+, the Mar 24 high and the bull trigger.

OVERNIGHT DATA

- US MAR HOUSING STARTS 1.420M; PERMITS 1.413M

- US FEB STARTS REVISED TO 1.432M; PERMITS 1.550M

- US MAR HOUSING COMPLETIONS 1.542M; FEB 1.552M (REV)

- US REDBOOK: APR STORE SALES +1.3% V YR AGO MO

- CANADA MAR CPI 4.3% YOY MATCHING FORECAST VS FEB 5.2%

- CANADA MAR CPI +0.5% MOM MATCHING FORECAST, FEB +0.4%

- CANADA MAR CPI EX FOOD & ENERGY +0.6% MOM; 4.5% YOY

- CANADA MAR CORE TRIM CPI 4.4% YOY, MEDIAN 4.6%

- CANADA INFLATION SLOWS ON GASOLINE, HOME UPKEEP COSTS

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 5.84 points (-0.02%) at 33981.24

- S&P E-Mini Future up 1.25 points (0.03%) at 4178.5

- Nasdaq down 14.2 points (-0.1%) at 12143.75

- US 10-Yr yield is down 2.1 bps at 3.5794%

- US Jun 10-Yr futures are up 1.5/32 at 114-13

- EURUSD up 0.0046 (0.42%) at 1.0972

- USDJPY down 0.39 (-0.29%) at 134.08

- WTI Crude Oil (front-month) up $0.04 (0.05%) at $80.87

- Gold is up $10.62 (0.53%) at $2005.86

- EuroStoxx 50 up 26.34 points (0.6%) at 4393.95

- FTSE 100 up 29.93 points (0.38%) at 7909.44

- German DAX up 93.14 points (0.59%) at 15882.67

- French CAC 40 up 35.45 points (0.47%) at 7533.63

US TREASURY FUTURES CLOSE

- 3M10Y -4.091, -156.868 (L: -171.856 / H: -155.341)

- 2Y10Y -3.619, -63.426 (L: -64.464 / H: -57.48)

- 2Y30Y -3.5, -42.27 (L: -43.589 / H: -35.684)

- 5Y30Y -0.235, 10.707 (L: 9.033 / H: 13.428)

- Current futures levels:

- Jun 2-Yr futures down 1.625/32 at 102-29.5 (L: 102-28.25 / H: 103-01.375)

- Jun 5-Yr futures up 0.75/32 at 109-4 (L: 109-00.75 / H: 109-09.5)

- Jun 10-Yr futures up 1.5/32 at 114-13 (L: 114-08 / H: 114-21.5)

- Jun 30-Yr futures up 5/32 at 129-29 (L: 129-15 / H: 130-10)

- Jun Ultra futures up 6/32 at 138-29 (L: 138-09 / H: 139-17)

US 10Y FUTURE TECHS: Bear Cycle Still In Play

- RES 4: 117-01+ High Mar 24 and bull trigger

- RES 3: 116-30 High Apr 5 / 6

- RES 2: 116-08 High Apr 12

- RES 1: 115-02+/23 20-day EMA / High Apr 14

- PRICE: 114-15 @ 1500ET Apr 18

- SUP 1: 114-08 Low Apr 17 and intraday low

- SUP 2: 114-07 Low Mar 29 and 30 and a key support

- SUP 3: 113-26 Low Mar 22

- SUP 4: 113-23 50.0% retracement of the Mar 3 - 24 bull run

Treasury futures traded lower Monday. The contract has breached both the 20- and 50-day EMAs. A continuation lower would signal scope for weakness towards 114-07, the Mar 29, 30 low and 113.26, the Mar 22 low. The latest bear cycle does appear to be a correction. A reversal higher and a break of resistance at 116-08, Apr 12 high, would signal a resumption of the uptrend and expose 117-01+, the Mar 24 high and the bull trigger.

STIR: SOFR FUTURES CLOSE

- Jun 23 -0.005 at 94.915

- Sep 23 -0.030 at 95.130

- Dec 23 -0.040 at 95.470

- Mar 24 -0.040 at 95.905

- Red Pack (Jun 24-Mar 25) -0.03 to +0.005

- Green Pack (Jun 25-Mar 26) +0.010 to +0.015

- Blue Pack (Jun 26-Mar 27) +0.010 to +0.015

- Gold Pack (Jun 27-Mar 28) +0.010 to +0.015

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.02095 to 4.93840 (+.04534/wk)

- 3M +0.02060 to 5.04845 (+.06557/wk)

- 6M +0.04701 to 5.06809 (+.12507/wk)

- 12M +0.07242 to 4.87069 (+.18642/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00000 to 4.80871%

- 1M +0.00142 to 4.95271%

- 3M -0.01457 to 5.25043% */**

- 6M +0.01643 to 5.41129%

- 12M +0.00557 to 5.42557%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.26500% on 4/17/23

- Daily Effective Fed Funds Rate: 4.83% volume: $106B

- Daily Overnight Bank Funding Rate: 4.82% volume: $279B

- Secured Overnight Financing Rate (SOFR): 4.80%, $1.406T

- Broad General Collateral Rate (BGCR): 4.77%, $527B

- Tri-Party General Collateral Rate (TGCR): 4.77%, $518B

- (rate, volume levels reflect prior session)

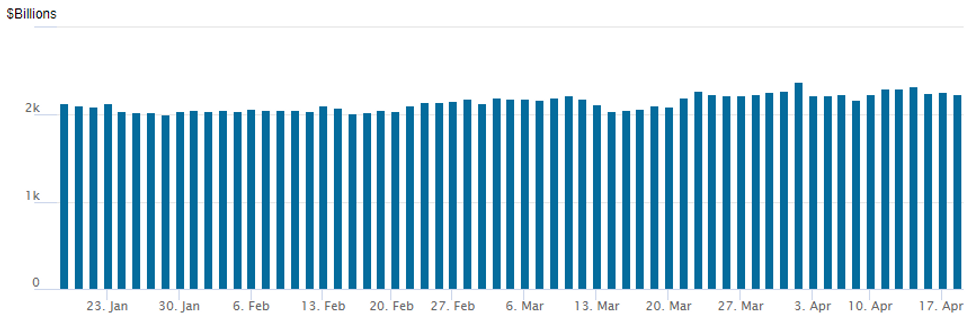

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,238.994B w/ 106 counterparties, compares to prior $2,256.845B. All-time record high of $2,553.716B reached December 30, 2022; high usage for 2023: $2,375.171B on Friday March 31, 2023

PIPELINE: $2.5B CK Hutchinson 2Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 04/18 $4B *European Inv Bank (EIB) 7Y SOFR+39

- 04/18 $3.5B *ADB 5Y SOFR+36 (Book was >$6.5B)

- 04/18 $2.5B #JBIC 3Y SOFR+47 (Book was >$3B)

- 04/18 $2.5B #CK Hutchinson $1.25B 5Y +110, $1.25B 10Y +135

- 04/18 $1.5B #Ontario Teachers Union 5Y SOFR+78 (Book was >$2.5B)

- 04/18 $1B Altice 5NC2

- Expected to launch Wednesday:

- 04/19 $1B Kommuninvest WNG -3Y SOFR+30a

- 04/19 $Benchmark Canadian Government Bond 5Y +14a

EGBs-GILTS CASH CLOSE: UK Short End Underperforms Pre-CPI

Weakness at the UK short end was the standout move in Tuesday's trade, with flattening seen across European curves.

- The 2Y UK segment underperformed, with an 8.8bp rise in implied BoE terminal Bank Rate pricing driving the move.

- The 4.86% rate implied for October is the highest since Mar 9, spurred by strong UK wage growth data Tue morning, and ahead of Wednesday's key CPI reading.

- The short end was the weak link on the German curve as well, though it easily outperformed its UK counterpart (ECB terminal pricing rose by just 3bp, with comments by Chief Econ Lane affirming that there would be a hike of at least some magnitude in May).

- Periphery spreads tightened slightly, though came off session lows in in the afternoon as equities came off their highs.

- Apart from UK CPI Wednesday, we get final Eurozone CPI and multiple ECB (Lane, Knot, de Cos, Schnabel) speakers, with BoE's Mann also appearing.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.7bps at 2.906%, 5-Yr is up 2.5bps at 2.52%, 10-Yr is up 0.4bps at 2.477%, and 30-Yr is down 1.8bps at 2.533%.

- UK: The 2-Yr yield is up 7.8bps at 3.691%, 5-Yr is up 7.7bps at 3.588%, 10-Yr is up 5.6bps at 3.747%, and 30-Yr is up 5.2bps at 4.098%.

- Italian BTP spread down 0.7bps at 182.4bps / Spanish down 0.8bps at 101.7bps

FOREX: Greenback Gives Up Monday Advance, GBP In Focus Ahead Of March CPI

- The dollar gave back the majority of the Monday gains early Tuesday and there was little impact on currency markets as we progressed through the US session. The USD index sits closed to unchanged on the week as we approach the APAC crossover.

- AUD and NZD are outperforming, rising just shy of 0.5% following the China GDP data overnight. GDP increased 4.5% y/y in Q1, beating the market consensus of 3.8% y/y, marking the quickest growth within a year and underpinning the bid for higher beta currencies. Initially firmer equities had acted as an additional tailwind to antipodean FX, and despite the turnaround for major indices, little effect was seen across G10 FX.

- Close to in line Canadian CPI kept USDCAD in a very tight range. With the pair sitting close to unchanged on the session, CAD underperformance is notable.

- GBPUSD has risen 0.45% as of writing, largely reversing the prior day’s declines in line with the general greenback sentiment. The pair did receive a boost from pay and jobs data this morning, which showed average weekly earnings beating forecast on both a inc. and ex. bonus basis. Resultingly, GBP is close to the top-end of the G10 leaderboard.

- Cable remains in an uptrend and the Friday / Monday pullback is - for now - considered corrective. A resumption of gains would refocus attention on Friday’s 1.2546 high where a break would resume the uptrend and open 1.2599, Jun 7 2022 high.

- On Wednesday, the focus will be on UK March CPI data where the headline annual rate is expected to moderate to 9.8% and the core reading at 6.0%. Markets will also receive the final reading of Eurozone March CPI figures.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/04/2023 | 0430/1330 | ** |  | JP | Industrial production |

| 19/04/2023 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 19/04/2023 | 0600/0700 | *** |  | UK | Producer Prices |

| 19/04/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 19/04/2023 | 0830/0930 | * |  | UK | ONS House Price Index |

| 19/04/2023 | 0900/1100 | *** |  | EU | HICP (f) |

| 19/04/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 19/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 19/04/2023 | 1035/1235 |  | EU | ECB Lane Speech at Enterprise Ireland Summit | |

| 19/04/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 19/04/2023 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 19/04/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/04/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 19/04/2023 | 1500/1700 |  | EU | ECB Schnabel Lecture at Leibniz-Zentrum ZEW | |

| 19/04/2023 | 1630/1730 |  | UK | BOE Mann Panellist at Brandeis International Business School | |

| 19/04/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 19/04/2023 | 1800/1400 |  | US | Fed Beige Book | |

| 19/04/2023 | 2300/1900 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.