-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Collins, Fed Won't Wait for 2% Inflation

- MNI FED: Fed Will Cut Rates Before Inflation Hits 2%-Collins

- MNI FED: Fed’s Kugler On March: ‘Every Meeting Is Live’

- MNI: CBO Expects Fed To Start Cuts Mid-Year

- MNI: BOC Wants To Avoid U-Turn After Any Rate Cut: Minutes

- MNI INTERVIEW: ECB Could Cut In April Or June- Simkus

- MNI US CPI Revisions Preview - Feb 2024

- MNI US DATA: Real Net Exports Ended 2023 With A Boost To Growth

- MNI US DATA: Mortgage Applications Lift With Second Week Of Refi Strength

US

MNI BRIEF: Fed Will Cut Rates Before Inflation Hits 2%-Collins. Federal Reserve Bank of Boston President Susan Collins on Wednesday said waiting until 12-month inflation hits 2% for the central bank to begin cutting interest rates would be waiting too long.

- "I totally agree that if we were to wait until we were all the way there, so that our 12 month measure of inflation's all the way back to 2%, that's waiting too long," she said in Q&A at a Boston Economic Club event. "That certainly is not my expectation of what I'm looking for. When I say more confidence, I'm talking about confidence that the trajectory [of inflation] will continue to bring us back down to price stability over time." Collins said there are still risks that inflation stalls at a level above the Fed's 2% goal.

- The comments from the Boston Fed chief echo those from Chair Jay Powell who recently said the Fed wouldn't wait for inflation to get to 2% to cut rates. (See: MNI INTERVIEW: Fed Could Cut When Core PCE Reaches About 2.8%)

MNI BRIEF: Fed’s Kugler On March: ‘Every Meeting Is Live’. Federal Reserve Governor Adriana Kugler said Wednesday she could not close the door to policy action at any upcoming meetings, including March.

- “Every meeting is live. That’s the way it goes. We can’t make decisions or close the door. We have to react,” she said at a Brookings Institution event, in response to a question whether March is a live meeting. She said it’s hard to say whether the Fed will be gradual or aggressive when it does begin to cut rates because the evolution of the data will set the course.

- “We don’t actually know. Even from now until March we’re going to get two new reports on inflation, one more jobs report, ECI data. We cannot say once we cut we’ll go gradually.” (See: MNI: Fed Will Wait On Rate Cuts In Strong Economy-Stevenson)

US FED (MNI): CBO Expects Fed To Start Cuts Mid-Year: The Congressional Budget Office is projecting the Federal Reserve will respond to slowing inflation and rising unemployment by starting to lower the federal funds rate in the second quarter, with the effective fed funds rate averaging 5.1% for the year, a tenth higher than its 2023 average, then falling to annual averages of 4.1% in 2025 and 3.3% in 2026.

NEWS

BOC (MNI): BOC Wants To Avoid U-Turn After Any Rate Cut: Minutes

Bank of Canada officials explored alternate scenarios around potential interest-rate cuts at their meeting last month and strongly agreed on the need to avoid any U-turn once they move, according to minutes of the Jan. 24 decision to hold rates at their highest since 2001.

INTERVIEW (MNI): ECB Could Cut In April Or June- Simkus

The European Central Bank could cut rates in April or June, but uncertainty is too great for clear forward guidance and more confirmation is needed of a sustainable decline in inflation before deciding on the timing and the pace of subsequent easing, Bank of Lithuania Governor Gediminas Simkus told MNI.

MNI NATO/US (MNI): Stoltenberg & US' Sullivan Reiterate Need For Ukraine Funding

NATO Secretary General Jens Stoltenberg and US National Security Adviser Jake Sullivan have been speaking at a presser in Brussels. Stoltenberg claims that it is "Vital that the US Congress agrees on continued support for Ukraine in the near future". Sullivan says that the Biden administration is "Focused on Plan A to get Ukraine aid through Congress", claiming that the administration is "not focusing on a Plan B".

ISRAEL (MNI): Hamas Ceasefire Draft Has 'Non-Negotiable Demands'-Snr Israeli Official:

Israel's Channel 13 reporting that according to an unnamed senior Israeli official, the draft ceasefire proposal offered by Hamas has points that are "tantamount to "non-negotiable demands" from Israel."

US TSYS Fed Tone Remains Balanced

- Tsys modestly weaker across the board after the bell - holding inside a narrow session range (TYH4 -3 at 111-06, 111-01 low/111-16.5 high). Curves held steeper most of the day turned flatter late (2s10s -1.150 at -31.170).

- Light midweek data: MBA Mortgage Applications reported 3.7% earlier, up from -7.2% prior, Trade Balance reported -$62.2B vs. -$62.0B est (-$63.2B prior) wraps up the morning releases.

- Continued focus on Fed speakers: MN Fed Kashkari popped up in morning trade posited he expects 2-3 25bp cuts this year "seems appropriate".

- Federal Reserve Governor Adriana Kugler said she could not close the door to policy action at any upcoming meetings, including March, “Every meeting is live," Kugler added.

- Federal Reserve Bank of Boston President Susan Collins on Wednesday said waiting until 12-month inflation hits 2% for the central bank to begin cutting interest rates would be waiting too long.

- Treasury futures pared losses briefly following decent $42B 10Y sale (91282CJZ5) stops 1.2bp through: 4.093% high yield vs. 4.105% WI; 2.56x bid-to-cover steady to prior.

- Look ahead: Thursday Data Calendar includes Weekly Claims, Fed Speak, 30Y Bond Sale.

OVERNIGHT DATA

US CPI Revisions Preview (MNI) - Feb 2024: BLS will update seasonal factors affecting CPI inflation through 2019-23 on Friday, Feb 9 “from 0830ET”.

- This won’t impact the underlying NSA data, but will sway near-term trends and has been flagged by both Fed Governor Waller and Chair Powell referencing the upside surprise in last year’s annual revision.

- Analysts are mixed, seeing either very little impact or modest uplift in recent trend rates.

US DATA (MNI): Mortgage Applications Lift With Second Week Of Refi Strength

- MBA composite mortgage applications increased a seasonally adjusted 3.7% in the week to Feb 2 after -7.2% prior.

- Continued large discrepancy between purchases and refis: Purchase applications -0.6% after a particularly heavy -11.4%, refis +12.3% after +1.6%.

- Over the limited year to date, purchase applications are 9% higher vs 40% for refis.

- The 30Y conforming mortgage rate lifted just 2bps to 6.80%, having largely plateaued at these levels since mid-Dec.

- Jumbo loan rates are starting to adjust lower though, with the conforming to jumbo spread at -8bps from -16bps prior, its least negative since mid-Nov.

US DATA (MNI): Real Net Exports Ended 2023 With A Boost To Growth

- The goods & services trade deficit was close to expected in December at -$62.2bn after a smaller than first thought -$61.9bn (initial -$63.2bn).

- It sees the three-month deficit at circa 2.7% GDP, a level it’s mostly sustained through 2H23 at the smallest deficits since mid-2020 and mostly back at pre-pandemic levels.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 164.34 points (0.43%) at 38687.61

- S&P E-Mini Future up 41.5 points (0.83%) at 5016.25

- Nasdaq up 155.4 points (1%) at 15764.68

- US 10-Yr yield is down 0.2 bps at 4.098%

- US Mar 10-Yr futures are down 2/32 at 111-7

- EURUSD up 0.0018 (0.17%) at 1.0772

- USDJPY up 0.18 (0.12%) at 148.12

- WTI Crude Oil (front-month) up $0.66 (0.9%) at $73.96

- Gold is down $0.33 (-0.02%) at $2035.81

- European bourses closing levels:

- EuroStoxx 50 down 12.02 points (-0.26%) at 4678.85

- FTSE 100 down 52.26 points (-0.68%) at 7628.75

- German DAX down 111.28 points (-0.65%) at 16921.96

- French CAC 40 down 27.71 points (-0.36%) at 7611.26

US TREASURY FUTURES CLOSE

- 3M10Y -0.383, -129.3 (L: -135.22 / H: -126.085)

- 2Y10Y -1.468, -32.028 (L: -32.27 / H: -28.774)

- 2Y30Y -1.003, -11.599 (L: -11.99 / H: -7.695)

- 5Y30Y -0.261, 25.003 (L: 24.633 / H: 28.224)

- Current futures levels:

- Mar 2-Yr futures down 0.625/32 at 102-14.125 (L: 102-13.5 / H: 102-17.375)

- Mar 5-Yr futures down 1.5/32 at 107-19 (L: 107-16.5 / H: 107-26.5)

- Mar 10-Yr futures down 2/32 at 111-7 (L: 111-01 / H: 111-16.5)

- Mar 30-Yr futures down 2/32 at 120-30 (L: 120-12 / H: 121-10)

- Mar Ultra futures down 4/32 at 127-11 (L: 126-20 / H: 127-26)

US 10Y FUTURE TECHS: (H4) Bearish Threat Still Present

- RES 4: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-00 Round number resistance

- RES 2: 113-12 High Dec 27 and the bull trigger

- RES 1: 111-20/113-06+ 20-day EMA / High Feb 1

- PRICE: 111-06+ @ 1250 ET Feb 7

- SUP 1: 110-22+ Low Feb 5 and the bear trigger

- SUP 2: 110-16 Low Dec 13

- SUP 3: 109-31+ Low Dec 11

- SUP 4: 109-17 50.0% of the Oct 19 - Dec 27 bull phase

Treasuries remain in a bear-mode set-up following the reversal and pullback from last week’s 113-06+ high (Feb 1). The bear trigger at 110-26, the Jan 19 low, has been pierced. A clear break would highlight a stronger reversal and open 110-16,the Dec 13 low, ahead of 109-31+, Dec 11 low. Initial key resistance has been defined at 113-06+, Feb 1 high, where a break would reinstate a bullish theme and expose the bull trigger at 113-12, Dec 27 high.

SOFR FUTURES CLOSE

- Mar 24 +0.005 at 94.790

- Jun 24 steady at 95.170

- Sep 24 -0.010 at 95.560

- Dec 24 -0.015 at 95.905

- Red Pack (Mar 25-Dec 25) -0.02 to -0.02

- Green Pack (Mar 26-Dec 26) -0.025 to -0.02

- Blue Pack (Mar 27-Dec 27) -0.025 to -0.015

- Gold Pack (Mar 28-Dec 28) -0.015 to -0.005

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00198 to 5.32111 (-0.00100/wk)

- 3M -0.00832 to 5.31426 (+0.02380/wk)

- 6M -0.01759 to 5.19344 (+0.09734/wk)

- 12M -0.03378 to 4.87334 (+0.18054/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.738T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $682B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $672B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $97B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $261B

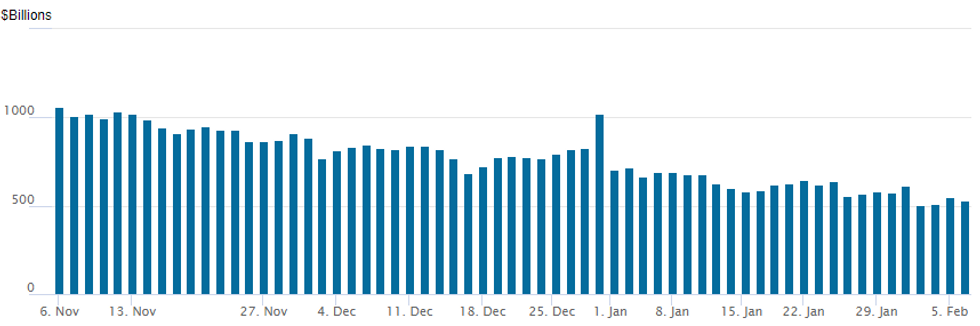

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage backs up to $533.055B vs. $532.439B Tuesday. Holding above recent cycle low of $503.548B from Thursday, February 1, the lowest level since mid-2021.

- Meanwhile, the number of counterparties is at 75 from 71 Tuesday (compares to 65 on January 16, the lowest since July 7, 2021).

PIPELINE $6.5B Eli Lilly 5Pt, $2.5B Rogers Communication Launched

- Date $MM Issuer (Priced *, Launch #

- 2/7 $6.5B Eli Lilly $1B 3Y +30, $1B 5Y +45, $1.5B 10Y +60, $1.5B 30Y +70, $1.5B 40Y +77 (for comparison, Eli Lilly issued $4B on Feb 23 last year: $750M 3NC1 +65, $1B 10Y +85, $1.25B 30Y +100, $1B 40Y +115)

- 2/7 $2.5B #Rogers Communications $1.25B 5Y +100, $1.25B 10Y +130

- 2/7 $1B #Constellation Software $500M 5Y +110, $500M 10Y +135

- 2/7 $1B *Inter-American Inv Bank (IDB) 5Y SOFR+51

- 2/7 $1B #UBS WNG Perp NC7.2 7.75%

- 2/7 $500M #NEDC 5Y Sukuk +160

- 2/7 $Benchmark Dow Chemical 10Y +105, 30Y +130

- 2/7 $500M Turkiye Wealth Fund WNG 5Y 9.125%a

EGBs-GILTS CASH CLOSE: Long "Last Mile" For ECB Sees Bunds Weaken

European government bond yields closed weaker Wednesday, with Bund and Gilt yields retracing most of Tuesday's drop.

- Bunds were pressured early in the session after the FT published an interview with ECB's Schnabel who cited concern over the "last mile" of the fight against inflation. That spilled over into Gilt weakness.

- There was little impact from comments by BoE's Breeden who noted a focus on data dependence in the next few months while determining how long to hold rates.

- MNI published an interview with ECB's Simkus who noted cuts could start in April or June.

- Data showed German and Spanish industrial production ended 2023 on a weak note, but there was little reaction.

- The afternoon saw further gyrations stemming from US banking sector uncertainty, with NYCB headlines (and share price) in focus.

- The German curve bear flattened, with the UK's bear steepening. European equities closed flat/lower, mirrored by periphery EGB spreads closing modestly wider, with the exception of GGBs which saw some tightening.

- Thursday's focus will be ECB speakers including Lane, Vujcic and Wunsch, and BoE's Mann.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.5bps at 2.63%, 5-Yr is up 2.8bps at 2.243%, 10-Yr is up 2.4bps at 2.316%, and 30-Yr is up 3bps at 2.54%.

- UK: The 2-Yr yield is up 0.7bps at 4.477%, 5-Yr is up 1.9bps at 3.972%, 10-Yr is up 3.8bps at 3.988%, and 30-Yr is up 1.8bps at 4.57%.

- Italian BTP spread up 1bps at 157.3bps / Spanish up 0.5bps at 92.3bps

FOREX USD Index Holds Narrow Range, EURCHF Rises 0.70%

- Wednesday saw the USD index (-0.14%) trade in a very narrow range, broadly consolidating a moderate early decline. Some further initial weakness for NYCB at the cash open, prompted a brief greenback selloff (most notable for USDJPY), however, stabilisation on this front quickly sapped any downside momentum for the dollar.

- This USDPY downtick saw the pair quickly move from the upper end of the day’s range at 148.20, to fresh session lows of 147.63, before the pair then gradually edged higher throughout the US session. USDJPY is consolidating back around the 148.20 mark as we approach the APAC crossover, with the week’s highs at 148.80 still marking the nearer technical resistance point.

- A phase of CHF weakness followed the publication of FX reserves data for January, which ticked up to 662.4bln from 653.7bln. Revaluation factors are likely at play, however EUR/CHF (0.70%) has subsequently tested and breached the down-trending 50-day moving average, which intersected today at 0.9404.

- The recovery off breakout lows for GBP/USD extended into a second session on Wednesday, coinciding with the very moderate slippage in the greenback. GBP/USD's two-day rally puts spot just shy of the Monday high of 1.2640 as price re-enters the early 2024 range and erases the range breakout posted earlier in the week. Nonetheless, GBPUSD bearish conditions remain intact, with the current recovery deemed technically corrective.

- Chinese January CPI & PPI is scheduled on Thursday, before the focus for global markets turns to the latest jobless claims data from the US and further potential comments from Fed’s Barkin. In the UK, Bank of England member Mann is due to speak on inflation.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/02/2024 | 0130/0930 | *** |  | CN | CPI |

| 08/02/2024 | 0130/0930 | *** |  | CN | Producer Price Index |

| 08/02/2024 | 0500/1400 |  | JP | Economy Watchers Survey | |

| 08/02/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 08/02/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 08/02/2024 | 1500/1000 | ** |  | US | Wholesale Trade |

| 08/02/2024 | 1500/1500 |  | UK | BoE's Mann Speaks At OMFIF | |

| 08/02/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 08/02/2024 | 1530/1630 |  | EU | ECB's Lane at Brookings Institution | |

| 08/02/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 08/02/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 08/02/2024 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 08/02/2024 | 1705/1205 |  | US | Richmond Fed's Tom Barkin | |

| 08/02/2024 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.