-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: FED Jefferson On Track Bringing Inflation Down

- MNI: Jefferson Says Fed On Track To Bring Inflation Down

- MNI BRIEF: Ex-Fed Quarles Says US Bank Woes Not Over

- MNI: Forecasters Lift Payroll, Inflation Estimates-Philly Fed

- MNI Biden: Fed Nominees Understand Job Is Not A Partisan One

- MNI FED Goolsbee: Inflation Too High But At Least Coming Down

- US DATA: U.Mich Long-Term Inflation Expectations Surprisingly High

US

FED: Federal Reserve Governor Philip Jefferson said Friday the central bank is on track to bring inflation down in his first speech since being nominated for vice chair by President Joe Biden, while acknowledging there has been little progress on core inflation.

- "Since peaking last June, [PCE] inflation has declined about 2.75 percentage points — with nearly all the step-down explained by falling energy prices and slowing food prices. The bad news is that there has been little progress on core inflation," he said, noting disinflation in core goods prices is occurring at a slower pace than expected.

- Current disinflation has been uneven and slower than liked, but monetary policy affects the economy and inflation with long and varied lags and the full effects of the Fed's rapid tightening are still likely ahead of us, he said. Additionally, tightening in financial conditions is likely to be augmented by the effects on credit conditions from recent strains in the banking sector. For more see MNI Policy main wire at 1957ET.

US

FED: Higher-for-longer U.S. interest rates mean banking woes aren't over and regulators need to look at making changes to liquidity requirements now, former Fed vice chair for supervision Randal Quarles said Friday.

- "This is actually not over," he said in remarks at a conference at the Hoover Institution. "Interest rates will stay higher than many are currently expecting them to stay for longer and the consequence of that will be that this pressure will remain on this category of institutions and a broader category of institutions than we are currently expecting."

- Quarles also criticized the Fed's liquidity requirements for banks, the Fed's post-mortem report on the collapse of Silicon Valley Bank, and the regulators' push for strengthened supervision and capital regulation.

- "Why didn't SVB have any collateral at the discount window on the night before its failure? Because they had no incentive to do so," he said. "The Fed affirmatively disincentivized them to set collateral aside at the window because they couldn't count the window toward their liquidity requirements."

US: Analysts expect to see a stronger U.S. labor market amid more inflation than they did three months ago and pushed back their views of when the economy will potentially slow to the fourth quarter, according to a Federal Reserve Bank of Philadelphia survey released Friday.

- The Philly Fed’s quarterly Survey of Professional Forecasters predicted growth to slow from 1.3% growth in 2023 to 1.0% in 2024 before picking up again to over 2%. The 38 forecasters surveyed also revised upward their growth expectations for Q3 and revised downward their Q4 estimates to flat.

- The forecasters see stronger payroll employment growth in 2023 than they did three months ago, penciling in a monthly rate of 257,500 in 2023, up from 217,800 previously. The median estimate sees payrolls slowing to about 26,000 in Q4, before picking up to 37,000 in the first quarter next year with an annual average of 56,000 in 2024.

US/FED: President Biden has issued a statement on his nominations of Philip Jefferson for Fed Vice Chair, Adriana Kugler to the Fed board, and the re-nomination of Lisa Cook for a full term on the Fed board.

- Biden: "These nominees understand that this job is not a partisan one, but one that plays a critical role in pursuing maximum employment, maintaining price stability, and supervising many of our nation's financial institutions."

- Bloomberg reports that Jefferson is expected to "share the consensus view" of the committee and "amplify" Chair Jerome Powell's view that quelling inflation is the primary objective of the Fed.

- BBG notes that Kugler, a former Chief Economist at the Labor Department during the Obama administration and currently the US representative to the World Bank, may be more inclined to lean on the Dovish side, especially considering she would fill the seat of Lael Brainard who is now Director of the NEC.

FED: Chicago Fed’s Goolsbee (’23 voter) speaking on PBS notes that inflation is at least coming down whilst some indicators point to the Fed easing inflation without a recession.

- FOMC-dated OIS implied rates dip slightly (Dec -0.5/1bp) on the comments but broadly keep to the day’s trimming of prior cuts to a still heavy ~95bps from current levels with January’s meeting.

- Bloomberg headlines:

- GOOLSBEE: INFLATION RATE STILL TO HIGH BUT AT LEAST COMING DOWN

- GOOLSBEE: JOBS PART OF FED MANDATE GOING WELL, INFLATION NOT

- GOOLSBEE: HAVE SOME INDICATORS FED CAN EASE INF W/ NO RECESSION

- GOOLSBEE: US HAS NO ALTERNATIVE BUT TO RAISE THE DEBT CEILING

US TSYS: Sentiment Sours, Projected Rate Cuts Moderate

- Treasury futures are holding near lows after the bell, curves flatter, extending inversion with the short end underperforming.

- There were no obvious headline or Block-driven trigger as projected rate cuts continue to climb off Thursday's lows given the rise in UofM's long term inflation expectations and cooling sentiment.

- Even Chicago Fed Goolsbee's comment on PBS over decelerating inflation failed to elicit much of a lasting reaction (though equities are rebounding at the moment: SPX Eminis -7.0 at 4137.0 vs. 4112.25 low).

- Yesterday saw three consecutive 25bp cuts projected to start in September.

- At the moment, however, September cumulative -20.9bp at 4.858%, November cumulative -44.1bp at 4.625%, Dec'23 cumulative -68.5bp at 4.381%, while Jan'24 cumulative is at -91.4bp (vs. 110.2bp Thu) at 4.153%. Fed Terminal currently at 5.08% in Jun'23 and Jul'23.

- White House Press Secretary Karine Jean-Pierre has told reporters that President Biden will meet with the four leaders of Congress "early next week" for a second round of talks on the debt limit, but declined to provide a specific date. Jean-Pierre: "When we have a date, certainly we will share that will all of you," adding that "productive talks" have been ongoing between negotiators representing all parties and will continue over the weekend.

OVERNIGHT DATA

US DATA: University of Michigan consumer sentiment surprisingly fell to 57.7 (cons 63.0) from 63.5 in the May preliminary survey to its lowest since Nov. Higher inflation expectations clearly played a role, most notably with the 5-10Y measure surprisingly rising to 3.2% (cons 2.9) after 3.0, breaking out of the 2.9-3.1% seen in every month but one since Aug'21 for the highest since 2011.

- The 1Y measure meanwhile saw less moderation than expected, slowing marginally to 4.5% (cons 4.4) having surprisingly jumped 1pt to 4.6% back in April.

- From the press release: "While current incoming macroeconomic data show no sign of recession, consumers' worries about the economy escalated in May alongside the proliferation of negative news about the economy, including the debt crisis standoff."

- US APR IMPORT PRICES +0.4%

- US APR EXPORT PRICES +0.2%; NON-AG +0.2%; AGRICULTURE +0.4%

US: Total import prices were a tenth stronger than expected in April at 0.4% M/M (cons 0.3) but after a two tenths downward revision (-0.8% vs -0.6 prior). The revisions largely offset with the Y/Y as expected at -4.8%.

- Import prices ex petroleum meanwhile saw a clearer cut upside surprise, although still fell -0.1% M/M (cons -0.3) after an unrevised -0.64% M/M kept it to technically the largest monthly decline since Jan’15.

- Given the volatility of the data, the release doesn’t materially change the theme of input cost pressures moderating, but with underlying producer and consumer goods prices yet to see outright deflation.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 85.47 points (-0.26%) at 33223.3

- S&P E-Mini Future down 17 points (-0.41%) at 4126.5

- Nasdaq down 73.8 points (-0.6%) at 12255.01

- US 10-Yr yield is up 7.6 bps at 3.4606%

- US Jun 10-Yr futures are down 19.5/32 at 115-14

- EURUSD down 0.0063 (-0.58%) at 1.0853

- USDJPY up 1.18 (0.88%) at 135.71

- WTI Crude Oil (front-month) down $0.73 (-1.03%) at $70.14

- Gold is down $2.58 (-0.13%) at $2012.44

- EuroStoxx 50 up 8.13 points (0.19%) at 4317.88

- FTSE 100 up 24.04 points (0.31%) at 7754.62

- German DAX up 78.91 points (0.5%) at 15913.82

- French CAC 40 up 33.07 points (0.45%) at 7414.85

TREASURY FUTURES CLOSE

- 3M10Y +3.18, -175.653 (L: -184.96 / H: -173.584)

- 2Y10Y -1.568, -53.287 (L: -55.993 / H: -49.091)

- 2Y30Y -5.326, -21.449 (L: -24.334 / H: -13.19)

- 5Y30Y -5.56, 32.764 (L: 31.58 / H: 40.047)

- Current futures levels:

- Jun 2-Yr futures down 5.625/32 at 103-5.625 (L: 103-04.875 / H: 103-12.75)

- Jun 5-Yr futures down 14/32 at 110-1.5 (L: 110-01.25 / H: 110-19)

- Jun 10-Yr futures down 19.5/32 at 115-14 (L: 115-13.5 / H: 116-07)

- Jun 30-Yr futures down 26/32 at 130-23 (L: 130-22 / H: 131-30)

- Jun Ultra futures down 1-0/32 at 139-5 (L: 139-05 / H: 140-20)

US 10YR FUTURE TECHS: (M3) Support Stays Intact

RES 4: 117-29+ High Aug 26 2022 (cont)

- RES 3: 117-01+ High Mar 24 and bull trigger

- RES 2: 117-00 High May 4

- RES 1: 116-16 High May 11

- PRICE: 115-29+ @ 11:21 BST May 12

- SUP 1: 115-01+/114-29+ Low May 9 / 50-day EMA

- SUP 2: 114-10 Low May 1

- SUP 3: 113-30+ Low Apr 19 and a key support

- SUP 4: 113-26 Low Mar 22

Treasury futures continue to trade above support at 115-01+, the May 9 low. This level lies ahead of 114-29+, the 50-day EMA. A clear break of this average would signal scope for a deeper retracement towards 114-10 initially, May 1 low. For bulls, an extension of Wednesday’s bounce would open key resistance at 117-01+, the Mar 24 high. This is the bull trigger and a break would highlight an important bullish development.

SOFR FUTURES CLOSE

- Jun 23 -0.010 at 94.935

- Sep 23 -0.065 at 95.240

- Dec 23 -0.090 at 95.685

- Mar 24 -0.105 at 96.220

- Red Pack (Jun 24-Mar 25) -0.12 to -0.115

- Green Pack (Jun 25-Mar 26) -0.10 to -0.09

- Blue Pack (Jun 26-Mar 27) -0.08 to -0.07

- Gold Pack (Jun 27-Mar 28) -0.07 to -0.06

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00238 to 5.05691 (+.00665/wk)

- 3M -0.01954 to 5.06680 (+.02807/wk)

- 6M -0.03708 to 4.98547 (+.03996/wk)

- 12M -0.07141 to 4.60114 (+.04754/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00028 to 5.06143%

- 1M -0.00200 to 5.10543%

- 3M -0.00242 to 5.31829% */**

- 6M -0.00557 to 5.34314%

- 12M -0.00986 to 5.25600%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.34243% on 5/10/23

- Daily Effective Fed Funds Rate: 5.08% volume: $117B

- Daily Overnight Bank Funding Rate: 5.07% volume: $282B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.372T

- Broad General Collateral Rate (BGCR): 5.02%, $585B

- Tri-Party General Collateral Rate (TGCR): 5.02%, $573B

- (rate, volume levels reflect prior session)

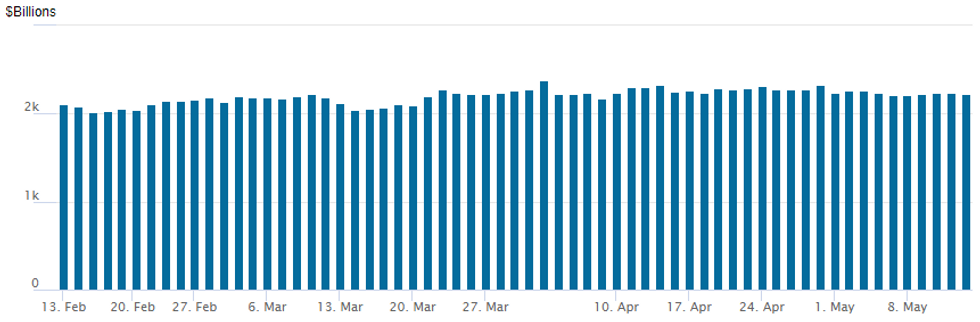

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,229.199B w/ 109 counterparties, compares to prior $2,242.243B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $1.75B Honeywell 2Pt Priced

- Date $MM Issuer (Priced *, Launch #)

- 05/12 $1.75B *Honeywell $750M +5Y +85, $1B +10Y +115

- $5.8B Priced Thursday, $35.05B total for the week

- 05/11 $1.6B *Texas Instruments $200M 5Y +76, $200M 10Y +102, $1.2B 40Y +137

- 05/11 $1.5B *BNG Bank 5Y SOFR+45

- 05/11 $1.5B *Mamoura 10.5Y +115a, 30Y +145a

- 05/11 $1.2B *EIDP 3Y +95, 10Y +145

- 05/11 $Benchmark FMC Corp investor calls

- 05/11 $Benchmark BGK Bank (State Dev Bank of Poland) 10Y investor calls

FOREX: USD Undergoes Late Rally Into European Close

- Currency markets are being led by fixed income here, with the greenback putting in a pre-London close rally to help USD/JPY back above Y135.00 and within range of the next upside level at 135.47.

- Moves coincide with re-jigging of Fed implied policy path after the University of Michigan sentiment data, which showed a stubborn turnout for inflation expectations (4.5% vs. Exp. 4.4% for 1y, 3.2% vs. Exp. 2.9% for 5-10y).

- NZD remains the poorest performer of the session so far, tilting NZD/USD through both the 100- and 50-dma to narrow in on the $0.62 handle.

- Despite the more active morning across currency futures, there is evidence that volumes have faded through the NY crossover, with the fade in EUR/USD seeing lighter participation relative to this morning's European trade.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/05/2023 | 2345/1945 |  | US | St. Louis Fed's James Bullard | |

| 12/05/2023 | 2345/1945 |  | US | Fed Governor Philip Jefferson | |

| 13/05/2023 | 1430/1030 |  | US | Fed Governor Lisa Cook | |

| 15/05/2023 | 0600/0800 | *** |  | SE | Inflation report |

| 15/05/2023 | 0900/1100 | ** |  | EU | Industrial Production |

| 15/05/2023 | - |  | EU | ECB Lagarde & Panetta in Eurogroup Meeting | |

| 15/05/2023 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 15/05/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 15/05/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/05/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 15/05/2023 | 1315/0915 |  | US | Minneapolis Fed's Neel Kashkari | |

| 15/05/2023 | 1400/1000 |  | CA | BOC Financial System Survey report | |

| 15/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 15/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 15/05/2023 | 1600/1700 |  | UK | BOE Pill Monetary Policy Report Q&A | |

| 15/05/2023 | 2000/1600 | ** |  | US | TICS |

| 15/05/2023 | 2100/1700 |  | US | Fed Governor Lisa Cook Fed Governor Lisa Cook |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.