-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA OPEN: Fed Sees Peak Rate Over 5%?

EXECUTIVE SUMMARY

- MNI: Ex-Officials Now See Fed Rate Peak At 5% Or Higher

- MNI INTERVIEW: Another Fed 75BP Hike Likely In Dec.- Rosengren

- MNI BRIEF: Too Soon For Fed To Consider Rate Pause- Kashkari

- MNI INTERVIEW: Sterling To Fall Significantly Over Time -Weale

- MNI: Italy's Coalition Eyes Bigger 2023 Deficit Target-Sources

- MNI BRIEF: EU Fiscal Rules Proposal Seen Pushed Back To Nov 2

US

FED: Federal Reserve policymakers will likely be forced to raise interest rates more than their own forecasts suggest because of persistent inflation pressures, but the time still may be nearing for the central bank to slow the pace of those rate increases, former Fed officials and economists told MNI.

- The FOMC in September said rates were likely to rise to 4.6% by the end of next year, but sticky inflation and rising core services prices raise the chances the fed funds rate might need to peak above 5%, they said.

- The September CPI reading "reinforces that conviction of tightening and might lead you to think about maybe an extra 25 basis points at one meeting or another," said Steven Kamin, former director of the division of international finance at the Fed Board. For more see MNI Policy main wire at 1347ET.

FED: The Federal Reserve likely needs to push rates higher than officials had expected as recently as last month's meeting because inflation remains stubborn even in the face of substantial moves to wrestle it under control, and policymakers will likely resort to a fifth straight 75 basis point hike in December, former Boston Fed president Eric Rosengren told MNI.

- While the central bank in September had penciled in a peak rate of 4.6% next year, that is likely to be nudged up above 5% in the central bank's next forecast to be released in December unless data shows inflation surprising to the downside before then, he said.

- "To date, they have not seen substantial progress towards bringing the inflation rate down and they're not seeing substantial improvement in bringing the wage rate down either. Until they start actually seeing a clear turn in measures of inflation, I think it's going to be hard not to continue to raise interest rates higher," he said, noting that trimmed mean measures of core CPI and PCE inflation are still going up. For more see MNI Policy main wire at 0857ET.

- “We’re not even sure we’ve got rates high enough to push services prices down,” he said when asked if it's time to pause and assess the impact of past rate hikes. “We still have a ways to go” he said about further hikes, and it's also unclear whether overall core inflation has peaked.

- The U.S. economy likely isn't in a recession absent the significant weakness in the job market that usually accompanies such a downturn, Kashkari said. The Fed is in "an aggressive campaign" to curb inflation, he said. Atlanta Fed economist Brent Meyer told MNI's FedSpeak podcast last week high inflation has become entrenched and it will take months if not another year for tighter monetary policy and supply-side relief to change those dynamics.

UK

BOE: The UK’s historically large current account deficit is likely to prompt significant depreciation of the pound sterling over time, against the dollar and other currencies, former Bank of England Monetary Policy Committee member Martin Weale, told MNI.

- With the current account deficit widening from 2% of GDP in 2021 to 7.2% of GDP in Q1 on the back of surging energy costs before dropping back to 5.5% in Q2, the currency will either hvae to weaken or the UK’s trade performance, a laggard in recent years, will need to improve significantly, Weale said in an interview.

- "There are two ways it can work. One is to improve the current balance through trade. The other is to create a point where people think it [sterling] can only appreciate. Both of those would likely need fairly large adjustments," Weale said. For more see MNI Policy main wire at 0926ET.

EUROPE

ITALY: Italy’s incoming right-wing coalition government has agreed on its first economic policy measures, and is already thinking about running a larger budget deficit next year, despite distractions from internal arguments over ministerial jobs, coalition sources told MNI.

- Among measures to be approved in days after the government is expected to be formed next week are a EUR5 billion decree extending energy support measures, currently due to expire on Nov 30, through December, sources said. Higher revenues from indirect taxes and a windfall tax on energy companies will mean that this should not affect the 2022 fiscal deficit target of 5.1% of gross domestic product, they said. For more see MNI Policy main wire at 1052ET.

EU: Publication of the EU Commission’s Orientation Paper on fiscal rules reform could be further delayed to Nov 2 from Oct 26, officials told MNI.

- It would be “materially difficult” for the Commission to be ready for publication of the paper by next week, one official said.

- The Orientation Paper is likely to suggest replacing the EU’s current 1/20 rule for high-debt states, which obliges them to reduce excess debt over the maximum permitted 60% of GDP by 5% each year, with customised plans which could significantly extend the timeframe for such reductions.

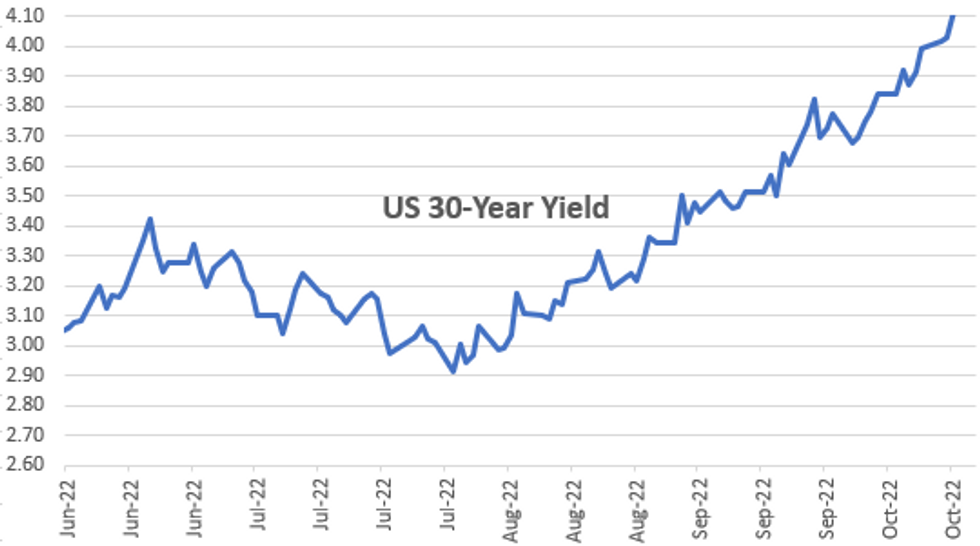

US TSYS: New Cycle Highs for Tsy Yields

Tsys weaker after the close, near session lows w/ TYZ2 through 110-00 psychological support of 110-00 briefly to 109-30.5 low, new cycle highs for yields: 10YY 4.1335%, 30YY 4.1302%.- Tsys tendency to mirror moves in EGBs, particularly Gilts reversed this morning after initially following EGBs lower (UK inflation rising to 40Y highs).

- Tsys continued to decline amid on rising inflation and tighter policy from the Fed (MN Fed Kashkari late Tue: rates could go above 4.5-4.75% if no progress with CPI and former Boston Fed's Rosengren telling MNI he sees prospects of a 2023 rates above 5%.).

- Gilts, on the other hand, reversed course, rebound a strong vote of confidence in new finance minister Jeremy Hunt in cleaning up UK markets since the Sep-23 mini-budget inception. Exclusion of longer dated Gilts as sales resume Nov 1, helping long end.

- Any react to mixed data lost in the shuffle: housing start weaker than expected (including revision) while build permits stronger (including revision). Tsy $12B 20Y bond auction re-open (912810TK4) tail didn't help matters any: 4.395% high yield vs. 4.375% WI; 2.5x bid-to-cover vs. prior month's 2.65x.

- More Fed speak this evening: Chicago Fed Evans economic outlook at 1800ET, StL Fed Bullard at 1830ET. Philly Fed Harker economic outlook at noon Thursday.

OVERNIGHT DATA

- US SEP HOUSING STARTS 1.439M; PERMITS 1.564M

- US AUG STARTS REVISED TO 1.566M; PERMITS 1.542M

- US SEP HOUSING COMPLETIONS 1.427M; AUG 1.345M (REV)

- FED BEIGE BOOK: ECONOMY EXPANDED MODESTLY ON NET

- FED: FOUR DISTRICTS NOTED FLAT ACTIVITY, TWO CITED DECLINES

- FED: OUTLOOKS GREW MORE PESSIMISTIC AMID DEMAND CONCERNS

- CANADA SEP CPI INFLATION +0.1% M/M, +6.9% YY

- CANADA SEP CPI 6.9% YOY VS FORECAST 6.7%, AUG 7.0%

- CANADA SEP CPI 0.1% MOM VS FORECAST -0.1%, AUG -0.3%

- CANADA SEP CPI EX FOOD & ENERGY 0.3% MOM; 5.4% YOY

- CANADA TRIM CPI 5.2% YOY, MEDIAN 4.7%, BOTH FLAT FROM AUG

- CANADA INFLATION SLOWS AS GASOLINE -7.4% MOM, 13% YOY

- CANADA SEP INDUSTRIAL PRICES +0.1% MOM; EX-ENERGY +0.4%

- CANADA SEP RAW MATERIALS PRICES -3.2% MOM; EX-ENERGY -2.8%

MARKETS SNAPSHOT

Key late session market levels:- DJIA down 137.17 points (-0.45%) at 30386.84

- S&P E-Mini Future down 34.5 points (-0.92%) at 3699

- Nasdaq down 126.3 points (-1.2%) at 10646.79

- US 10-Yr yield is up 12.1 bps at 4.1272%

- US Dec 10Y are down 29/32 at 110-0

- EURUSD down 0.0089 (-0.9%) at 0.9769

- USDJPY up 0.6 (0.4%) at 149.86

- WTI Crude Oil (front-month) up $2.47 (2.98%) at $85.21

- Gold is down $23.25 (-1.41%) at $1628.95

European bourses closing levels:

- EuroStoxx 50 up 7.41 points (0.21%) at 3471.24

- FTSE 100 down 11.75 points (-0.17%) at 6924.99

- German DAX down 24.2 points (-0.19%) at 12741.41

- French CAC 40 down 26.28 points (-0.43%) at 6040.72

US TSY FUTURES CLOSE

- 3M10Y +3.061, 12.854 (L: 4.698 / H: 15.207)

- 2Y10Y +0.569, -42.271 (L: -45.401 / H: -40.722)

- 2Y30Y -1.664, -42.296 (L: -45.776 / H: -40.456)

- 5Y30Y -2.433, -21.912 (L: -25.022 / H: -18.992)

- Current futures levels:

- Dec 2Y down 7.375/32 at 102-2.125 (L: 102-01.625 / H: 102-10.25)

- Dec 5Y down 18.25/32 at 106-3.25 (L: 106-01.75 / H: 106-22.25)

- Dec 10Y down 29/32 at 110-0 (L: 109-30.5 / H: 110-29)

- Dec 30Y down 56/32 at 121-26 (L: 121-24 / H: 123-15)

- Dec Ultra 30Y down 74/32 at 129-2 (L: 128-29 / H: 131-12)

US EURODOLLAR FUTURES CLOSE

- Dec 22 -0.060 at 94.870

- Mar 23 -0.075 at 94.755

- Jun 23 -0.095 at 94.805

- Sep 23 -0.120 at 94.945

- Red Pack (Dec 23-Sep 24) -0.16 to -0.135

- Green Pack (Dec 24-Sep 25) -0.16 to -0.15

- Blue Pack (Dec 25-Sep 26) -0.15 to -0.14

- Gold Pack (Dec 26-Sep 27) -0.14 to -0.135

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00172 to 3.06057% (-0.00557/wk)

- 1M +0.01157 to 3.50071% (+0.05771/wk)

- 3M +0.03500 to 4.27757% (+0.08386/wk) * / **

- 6M +0.02243 to 4.73743% (+0.05214/wk)

- 12M +0.00057 to 5.33943% (+0.05629/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.24257% on 10/18/22

- Daily Effective Fed Funds Rate: 3.08% volume: $103B

- Daily Overnight Bank Funding Rate: 3.07% volume: $276B

- Secured Overnight Financing Rate (SOFR): 3.04%, $967B

- Broad General Collateral Rate (BGCR): 3.00%, $388B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $375B

- (rate, volume levels reflect prior session)

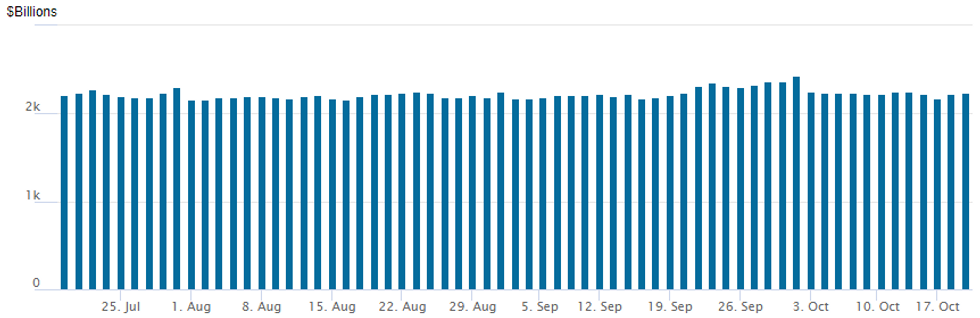

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,241.835B w/ 101 counterparties vs. $2,226.725B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

PIPELINE: $2B Diageo Capital 3Pt Launched

$8.5B to price Wednesday- Date $MM Issuer (Priced *, Launch #)

- 10/19 $4B #Lockheed Martin (LMT) $500M 3Y +50, $750M 5Y +80, $1B +10Y +120, $1B 32Y +160, $750M 41Y +180

- 10/19 $2B #Diageo Capital $500M 3Y +70, $750M 5Y +100, $750M +10Y +145

- 10/19 $1.5B *Export Finance Australia 5Y SOFR+66

- 10/19 $1B *Kommuninvest WNG 3Y SOFR+39

EGBs-GILTS CASH CLOSE: Gilt Bull Flattening Continues

Gilt bull flattening continued Wednesday, with 30Y yields nearly erasing October's rise following overnight news that the BoE would not initially target longer-dated instruments in its upcoming QT operations.

- European bonds had sold off on the open following a slightly higher than expected UK inflation print, but diverged thereafter. Gilts rallied for almost the entire session, while German yields rose, with bear flattening in the curve.

- Bunds came under pressure after the German finance agency announced it would increase its bond holdings in order to make available more instruments for repo operations.

- German cash bond yields rose as swap spreads fell sharply, as the finance agency's move was seen easing long-standing repo market pressure.

- Periphery spreads were relatively steady.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 11.8bps at 2.095%, 5-Yr is up 12.3bps at 2.213%, 10-Yr is up 9.1bps at 2.376%, and 30-Yr is up 2.5bps at 2.347%.

- UK: The 2-Yr yield is down 6.2bps at 3.506%, 5-Yr is down 2.6bps at 3.872%, 10-Yr is down 7.2bps at 3.878%, and 30-Yr is down 31.7bps at 3.989%.

- Italian BTP spread down 1bps at 239.7bps / Spanish up 0.3bps at 115bps

FOREX: USD Bounces Back As US Yields Surge To Fresh Highs

- The greenback rallied firmly on Wednesday, with the USD index erasing the majority of the week’s weakness amid further pressure on US treasuries with yields climbing to fresh cycle highs and major equities turning back lower.

- Greenback strength was broad based against G10 and EM currencies alike, with notable 1% declines for GBP, CHF and EUR standing out during the session.

- EURUSD traded back below its 20-day EMA and for now the trend remains down. This week’s rally fell short of key resistance at 0.9910 - the top of the bear channel drawn from the Feb 10 high. Gains are still considered to be corrective at this juncture - key short-term support is at 0.9633, the Oct 13 low.

- USDJPY continues to edge higher and print within 11 pips of the psychological 150.00 mark. Above here we have 150.45, a Fibonacci projection, with markets continually assessing the probability of another round of intervention from Japanese officials. Additionally, 1.0065-75 provides a strong horizontal technical point in USDCHF, that has seen strong 1.10% gains today.

- USDCNH also breached the September highs above 7.2674 and has consolidated around 7.27 as we approach the APAC crossover.

- Technical levels of note on the topside include 7.2851, a Fibonacci projection, before 7.3000, round number resistance.

- Thursday’s APAC session is highlighted by Australian employment data for September. In Europe, minor releases of German PPI and Swiss trade balance are scheduled. In the US, Philly Fed Manufacturing Index, unemployment claims and existing home sales are in focus.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/10/2022 | 0030/1130 | *** |  | AU | Labor force survey |

| 20/10/2022 | 0600/0800 | ** |  | DE | PPI |

| 20/10/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 20/10/2022 | 0720/0320 |  | ID | Bank of Indonesia Rate Decision | |

| 20/10/2022 | 0800/1000 | ** |  | EU | EZ Current Account |

| 20/10/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 20/10/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 20/10/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 20/10/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/10/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 20/10/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 20/10/2022 | 1600/1200 |  | US | Philadelphia Fed's Patrick Harker | |

| 20/10/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 20/10/2022 | 1730/1330 |  | US | Fed Governor Philip Jefferson | |

| 20/10/2022 | 1745/1345 |  | US | Fed Governor Lisa Cook | |

| 20/10/2022 | 1805/1405 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.