-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Focus On CPI

EXECUTIVE SUMMAY

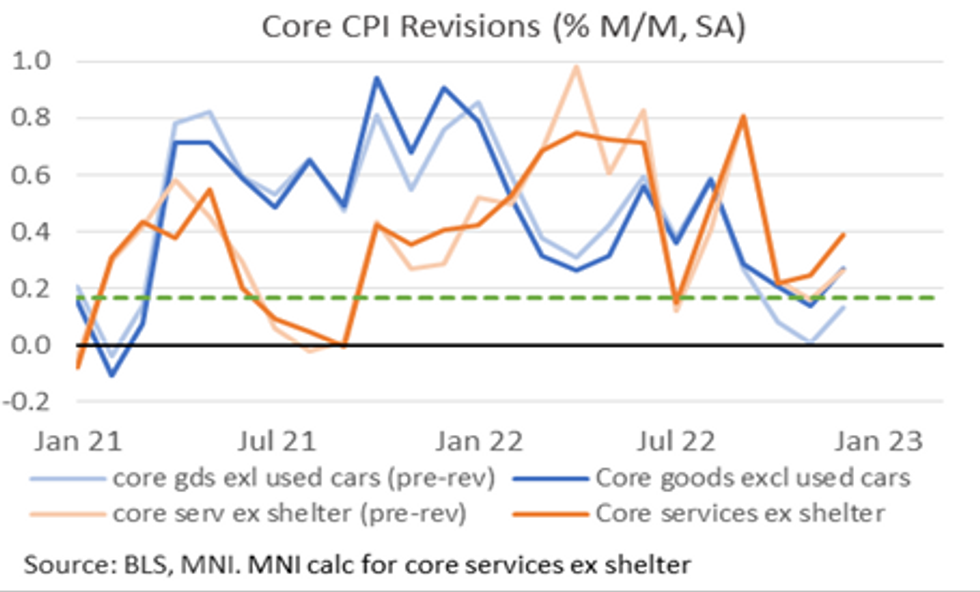

What To Watch Within Core CPI After Seasonal Revisions

- Sequential moves remain in focus, especially after notable upward revisions to two of the three major core components in Friday's new seasonally adjusted figures.

- Rent of shelter saw little change but both core services ex shelter and in particular core goods ex used cars were revised higher in the last 2-3 months.

- It left non-shelter core services accelerating to 0.39% M/M in Dec in a move more consistent with Chair Powell at the FOMC Feb 1 presser saying there hasn’t been any sign of disinflation here.

- Meanwhile, core goods prices ex used cars still ticked higher at 0.27% M/M rather than pausing, better reflecting a stalling in the downtrend in the NY Fed’s supply chain pressure gauge. The upward revision of the latter wasn’t enough to offset still large declines in used car prices from pushing outright core goods deflation through Q4, although it averaged -0.17% M/M per month rather than the initially thought -0.41% M/M.

- One finding of note here is that whilst new seasonal factors have pushed Q4 inflation higher and might have continued to do the same in January, the new pattern has also pushed core goods inflation softer in the spring. That could be increasingly important if the Fed is starting to move nearer to pausing its hiking cycle at that point.

US

US: Watching If Newfound Strength Sustained. Core CPI inflation is seen at 0.4% M/M in January with a survey skewed to a miss, holding at its recently revised rate for Dec after what was originally a 0.30% increase before new seasonal adjustment factors.

- Those SA revisions plus (known) revisions to CPI weights might muddy initial market reaction, potentially increasing volatility whilst the report is assessed.

- With some upward monthly drivers seen coming from typically volatile categories such as used cars and airfares, watch other components for a better clue of more sustained market reaction.

- Core services ex housing will continue to get extra attention after Chair Powell’s continued focus, especially after its upward revised 0.39% in December.

- Underlying strength could further stoke an already significant push higher in 2H23 Fed rate expectations whilst a miss in the context of storming payrolls would further downplay wage-price spiral risks.

FED: Federal Reserve Governor Michelle Bowman Monday said it's possible the U.S. may see conditions persisting for a so-called soft landing with moderating inflation and a strong labor market, but the central bank needs to continue raising interest rates.

- NY Fed reverse repo usage bounces to $2,107.775B w/ 102 counterparties vs. prior session's $2,042.893B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

- "We are seeing some moderation in inflation, not as much as we would like," she said.

UK

BOE: The Bank of England’s downbeat view on British productivity is shaped by the enduring effects of a collapse in investment in intangibles like software, research and development and brands since the global financial crisis of 2007-2008 which shows little sign of regaining former levels, economist Maarten de Ridder told MNI.

- While credit access recovered after 2008, there was no catch-up bounce in investment to make up for the losses that were incurred during the crisis, said London of School Economics Assistant Professor de Ridder, whose work has been cited by BOE Governor Andrew Bailey and was referenced in the Bank's February Monetary Policy Report's re-examination of productivity and potential growth.

- "A temporary drop in productivity-enhancing investments can permanently affect the level of productivity and GDP," de Ridder said in written response to questions from MNI. ”As a consequence, GDP has remained far below levels forecast prior to the crisis." For more see MNI Policy main wire at 0955ET.

US TSYS: Late Rate Lock Unwinds Underpins Tsys, Focus on Tue's CPI

Tsys trading mixed, bonds near midmorning highs after early whipsaw action, curves re-flattening (2s10s -3.351 at -82.290) after the close. Thin early volumes with no data Monday, many sidelined to await Tuesday's CPI release MoM (0.1% rev, 0.5%); YoY 6.5%, 6.2%).

- Tsys gained ahead the NY open, coinciding with Fed Gov Bowman talk at bank conf. Nothing exceptionally market moving "I'll expect that we will continue to increase the federal funds rate, because we have to, we have to bring inflation back down to our 2% goal," she said in a question and answer session at an American Bankers Association event.

- Tsys reverse from pre-open highs on rate lock selling vs. several multi-tranche issuers CVS, Pepsi, Philip Morris. Precedent: CVS ranks third overall largest debt issuer w/ $40B over 9 tranches in Sep 2018. Philip Morris issued $6B over 5tranches in Nov 2022 while Pepsi has averaged $2.75B last couple years.

- Tsys rebounded - see-sawing to new session highs over the next hour on the back of 5s (6.6k) and 10Y (16.9k) Block buys.

- Late rate lock unwinds following $18.45B swappable corporate bond issuance provided late support across the curve.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 332.21 points (0.98%) at 34198.38

- S&P E-Mini Future up 41.25 points (1.01%) at 4140.5

- Nasdaq up 153.3 points (1.3%) at 11870.67

- US 10-Yr yield is down 2.1 bps at 3.7111%

- US Mar 10-Yr futures are up 3/32 at 112-25

- EURUSD up 0.0042 (0.39%) at 1.072

- USDJPY up 1.01 (0.77%) at 132.37

- WTI Crude Oil (front-month) down $0.26 (-0.33%) at $79.44

- Gold is down $12.05 (-0.65%) at $1853.66

Prior European bourses closing levels:

- EuroStoxx 50 up 43.42 points (1.03%) at 4241.36

- FTSE 100 up 65.15 points (0.83%) at 7947.6

- German DAX up 89.36 points (0.58%) at 15397.34

- French CAC 40 up 78.86 points (1.11%) a 7208.59

US TSY FUTURES CLOSE

- 3M10Y -2.743, -107.461 (L: -108.871 / H: -102.227)

- 2Y10Y -3.393, -82.332 (L: -83.748 / H: -76.909)

- 2Y30Y -3.975, -74.734 (L: -77.63 / H: -68.59)

- 5Y30Y -2.803, -13.664 (L: -15.448 / H: -9.438)

- Current futures levels:

- Mar 2-Yr futures down 1.25/32 at 102-5.875 (L: 102-04.125 / H: 102-07.625)

- Mar 5-Yr futures down 1.25/32 at 107-27.75 (L: 107-23.75 / H: 107-30.25)

- Mar 10-Yr futures up 3.5/32 at 112-25.5 (L: 112-17 / H: 112-28)

- Mar 30-Yr futures up 17/32 at 127-15 (L: 126-23 / H: 127-19)

- Mar Ultra futures up 1-2/32 at 139-01 (L: 137-26 / H: 139-14)

US 10YR FUTURES TECHS: (H3) Approaching Trendline Support

- RES 4: 115-22+ High Feb 3

- RES 3: 115-00 Round number resistance

- RES 2: 114-06+ 20-day EMA

- RES 1: 114-00+ 50-day EMA

- PRICE: 112-23+ @ 15:57 GMT Feb 13

- SUP 1: 112-17 Low Feb 13

- SUP 2: 112-14+ Trendline support drawn from the Oct 21 low

- SUP 3: 112-00 Round number support

- SUP 4: 111-28 Low Dec 30 and a key support

Treasury futures remain bearish and printed a new pullback low early Monday. Attention is on a trendline support that intersects 112-14+. The trendline is drawn from the Oct 21 low. A break of this level would strengthen the current bearish theme and expose 111-28, the Dec 30 low. Key short-term resistance is seen at the 50-day EMA which intersects at 114-00+. A break of this EMA would ease bearish pressure.

US EURODOLLAR FUTURES CLOSE

- Mar 23 +0.005 at 94.940

- Jun 23 -0.025 at 94.620

- Sep 23 -0.025 at 94.585

- Dec 23 -0.020 at 94.860

- Red Pack (Mar 24-Dec 24) -0.04 to -0.02

- Green Pack (Mar 25-Dec 25) -0.035 to -0.01

- Blue Pack (Mar 26-Dec 26) -0.01 to +0.005

- Gold Pack (Mar 27-Dec 27) +0.010 to +0.025

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00043 to 4.55886% (+0.00658 total last wk)

- 1M +0.00986 to 4.58786% (+0.00614 total last wk)

- 3M -0.00586 to 4.86357% (+0.03529 total last wk)*/**

- 6M +0.02486 to 5.15200% (+0.06971 total last wk)

- 12M +0.02043 to 5.50500% (+0.23343 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.87257% on 2/9/23

- Daily Effective Fed Funds Rate: 4.58% volume: $112B

- Daily Overnight Bank Funding Rate: 4.57% volume: $291B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.186T

- Broad General Collateral Rate (BGCR): 4.52%, $468B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $455B

- (rate, volume levels reflect prior session)

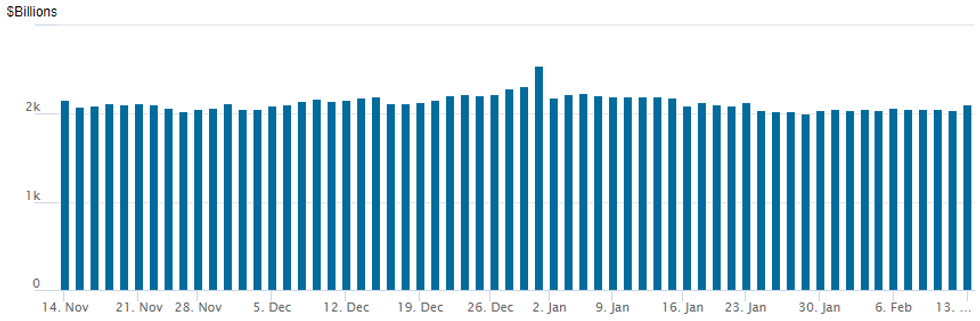

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage bounces to $2,107.775B w/ 102 counterparties vs. prior session's $2,042.893B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $6B CVS 4Pt, $3B PepsiCo 5Pt Launched

CVS leads w/ $6B total over 4 tranches. Total issuance on day at $18.45B

- Date $MM Issuer (Priced *, Launch #)

- 02/13 $6B #CVS $1.5B 3Y +90, $1.5B 7Y +140, $1.75B 10Y +155, $1.25B 30Y +18

- 02/13 $5.25B #Philip Morris $1.25B 3Y +80, $1B 5Y +110, $1.5B 7Y +145, $1.5B 10Y +170

- 02/13 $3B #Pepsi $500M 3Y +35, $350M 3Y SOFR+40, $650M 5Y +55, $1B 10Y +75, $500M 30Y +87.5

- 02/13 $1.5B #American Express $1.2B 3Y +72, $300M 3Y SOFR+76

- 02/13 $1B #Union Pacific $500M 3Y +55, $500M 30Y +118

- 02/13 $700M #Consumer Energy 10Y +97

- 02/13 $500M #McKesson 3NC1 +110

- 02/13 $500M #Jacobs 10Y +220a

EGBs-GILTS CASH CLOSE: BTPs Outperform

The UK and German curves flattened modestly to start the week, with the short end/belly continuing to weaken on firming central bank hike expectations.

- In early morning trade, Gilt and Bund futures ticked to their weakest levels since early January, but recovered over the course of the session to close nearly unchanged.

- Italian spreads saw their tightest close to Bunds since Feb 2 (ECB meeting), testing 180bp again as equities strengthened throughout a risk-on session.

- Gilts edged higher in the afternoon after the BoE's long-dated Gilt APF sale, which saw unremarkable 1.33x cover but somewhat of a relief compared with last week's short-dated sale which didn't see the full target amount sold.

- Tuesday sees UK jobs data and the prelim Eurozone Q4 GDP release, with the US inflation report the main event.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.1bps at 2.782%, 5-Yr is up 2.3bps at 2.423%, 10-Yr is up 0.4bps at 2.368%, and 30-Yr is down 0.1bps at 2.322%.

- UK: The 2-Yr yield is up 1.1bps at 3.639%, 5-Yr is up 1.3bps at 3.349%, 10-Yr is up 0.6bps at 3.402%, and 30-Yr is up 0.1bps at 3.814%.

- Italian BTP spread down 4.2bps at 180.3bps / Spanish down 1.1bps at 93.8bps

FOREX: Greenback Moderately Weaker, JPY Under Pressure Ahead Of US CPI

- The USD index is moderately lower on Monday, amid some optimism across major equity indices ahead of the key event risk for the week on Tuesday in the form of US CPI. The Japanese Yen is set to post standout losses on Monday with the currency weaker against all others in G10.

- The firmer sentiment in equity markets this afternoon has lent underpinned cross/JPY support, with notable advances of around 1.5% for the likes of AUDJPY, NZDJPY and GBPJPY.

- USDJPY has briefly traded above the 50-day EMA, at 132.77, an average that represents a key short-term level. A sustained break is required to suggest scope for an extension higher that would expose 134.77, the Jan 6 high.

- In EURJPY, attention is on 142.99, the Feb 6 high, where a break would confirm a continuation of the recovery that started on Jan 3.

- Markets look to Tuesday for short-term impetus, with the key January US CPI report in focus. Analysts look for CPI to slow to 6.2% Y/Y, and 5.5% for the core metric.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/02/2023 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 14/02/2023 | 0700/0800 | ** |  | NO | Norway GDP |

| 14/02/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 14/02/2023 | 1000/1100 | *** |  | EU | GDP (p) |

| 14/02/2023 | 1000/1100 | * |  | EU | Employment |

| 14/02/2023 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 14/02/2023 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 14/02/2023 | 1330/0830 | *** |  | US | CPI |

| 14/02/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 14/02/2023 | 1600/1100 |  | US | Dallas Fed's Lorie Logan | |

| 14/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 14/02/2023 | 1800/1300 |  | US | Philadelphia Fed's Patrick Harker | |

| 14/02/2023 | 1905/1405 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.