-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Jackson Hole Steady Messaging, Tsys Off Lows

- MNI: Powell-Fed Will Hike More If Needed, To Stay Restrictive

- MNI: US Treasury Market Needs Restructuring-Jackson Hole Paper

- MNI BRIEF: Fed Debate Now More Around High For Long - Goolsbee

- MNI BRIEF: Lagarde-ECB To Stay Restrictive As Long As It Takes

- MNI U.Mich Inflation Expectations Revised Higher In Final August Release

US

FED: Federal Reserve Chair Jerome Powell said Friday the central bank stands ready to raise interest rates further if needed because progress on bringing down inflation, while encouraging, is far from complete.

- “We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective,” Powell said in his widely awaited Jackson Hole speech. “There is substantial further ground to cover to get back to price stability.”

- Powell said he’s pleased to see inflation coming down but is not yet fully convinced that price pressures are on a sustainable path downward to the Fed’s 2% target, particularly because inflation excluding food and energy prices remains more than twice that level.

- “The lower monthly readings for core inflation in June and July were welcome, but two months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal,” he said. For more see MNI Policy main wire at 1004ET.

FED: The U.S. Treasury market has grown too large and capital requirements too stringent to depend on dealers for intermediation, and regulators should look at options including all-to-all trading and official purchase programs to improve resilience and backstop market liquidity in times of enormous selling pressures, according to research presented Friday to the Federal Reserve's annual economic symposium in Jackson Hole.

- Darrell Duffie, a professor at Stanford University Graduate School of Business, told Fed and other central bank officials that insufficient dealer intermediation capacity impairs the resilience of Treasury market trading, risking "losses of market efficiency, higher costs for financing U.S. deficits, potential losses of financial stability and reduced save-haven services to investors."

- The Fed had to step in to offer virtually unlimited Treasury financing to dealers and purchase nearly a trillion dollars of Treasury securities over a three-week period during the Covid-19 pandemic in March 2020 when dealers' customers' daily bond buying surged to over 10 times the normal amount. For more see MNI Policy main wire at 1155ET.

FED: Chicago Federal Reserve President Austan Goolsbee said Friday the economy's recent path suggests officials are more likely to consider holding peak interest rates for longer rather than pushing ahead with further increases.

- “It does feel like we’re in a period where if conditions keep going like what we’ve seen the last couple of months, our argument is going to revolve around well how long should we keep rates at the levels they are, rather than how much higher should the rates go,” he said in a CNBC interview from the Fed's Jackson Hole conference.

- The economy still has a chance for an often elusive "golden path" of restoring price stability without a "big recession," said Goolsbee, in line with some of past comments. He said inflation remains too high and it would have been premature for Chair Jerome Powell to declare victory in his speech earlier Friday.

EUROPE

ECB: ECB President Christine Lagarde said Friday monetary policy must remain tight for as long as it takes in order to bring down inflation.

- "In this era of uncertainty, it is even more important that central banks provide a nominal anchor for the economy and ensure price stability in line with their respective mandates," she said in a speech at the Federal Reserve Bank of Kansas City Jackson Hole conference. "In the current environment, this means – for the ECB – setting interest rates at sufficiently restrictive levels for as long as necessary to achieve a timely return of inflation to our 2% medium-term target."

- The ECB has raised its interest rate on bank deposits for nine meetings in a row to 3.75%, matching its highest level since the euro's launch in 1999. But there are signs that it could pause hikes at its next gathering in September.

Tsys Off Lows, Chair Powell Tone Balanced At Jackson Hole

- US rates are holding mildly weaker after the bell, near the middle of the session range after early event driven volatility. Treasury futures initially trade weaker/extend lows in reaction to Fed Chairman Powell's keynote speech from Jackson Hole economic summit, and just as quickly reversed course.

- Stocks are trading firmer in late trade, headed back near early session highs as Fed Chairman Powell's speech from Jackson Hole deemed more balanced, or at the least: not as hawkish as it could have been.

- “We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective,” Powell said in his widely awaited Jackson Hole speech. “There is substantial further ground to cover to get back to price stability.”

- Powell said he’s pleased to see inflation coming down but is not yet fully convinced that price pressures are on a sustainable path downward to the Fed’s 2% target, particularly because inflation excluding food and energy prices remains more than twice that level.

- Front month 10Y futures marked 109-03.5 low (-15.5) are currently trading 109-13.5 after tapping 109-23 briefly this morning. Heavy futures volume by the close (TYU3>3.6M) due to a surge in quarterly futures rolls from Sep to Dec ahead next Thursday's First Notice. Sep'23 Treasury options expiration also added to heavy volumes.

- Slow start to the week ahead -- culminates with the latest employment data for August next Friday.

OVERNIGHT DATA

- UNIV OF MICHIGAN CONSUMER SENTIMENT FINAL AUG INDEX 69.5

- UMICH CURRENT ECONOMIC CONDITIONS FINAL AUG INDEX 75.7

- UMICH CONSUMER EXPECTATIONS FINAL AUG INDEX 65.5

US DATA: University of Mich Inflation Expectations

- 1Y inflation expectations: 3.5% (prelim 3.3%) after 3.4%, highest since May.

- 5-10Y inflation expectations: 3.0% (prelim 2.9%) after 3.0%. It keeps to the 2.9-3.1% range seen in all but one month since Aug’21.

- The higher inflation expectations chip into consumer sentiment, revised down from 71.2 to 69.5. Despite that, sentiment reached its second highest reading in 21 months and is now about 39% above the all-time historic low reached in June of 2022.

MARKETS SNAPSHOT

Key late session market levels:- DJIA up 296.36 points (0.87%) at 34395.8

- S&P E-Mini Future up 38.5 points (0.88%) at 4425

- Nasdaq up 152.6 points (1.1%) at 13617.06

- US 10-Yr yield is up 0.6 bps at 4.2433%

- US Sep 10-Yr futures are down 6.5/32 at 109-12.5

- EURUSD down 0 (0%) at 1.081

- USDJPY up 0.55 (0.38%) at 146.38

- Gold is down $3.16 (-0.16%) at $1913.73

- EuroStoxx 50 up 4.03 points (0.1%) at 4236.25

- FTSE 100 up 4.95 points (0.07%) at 7338.58

- German DAX up 10.33 points (0.07%) at 15631.82

- French CAC 40 up 15.14 points (0.21%) at 7229.6

US TREASURY FUTURES CLOSE

- 3M10Y -2.012, -125.492 (L: -128.579 / H: -119.971)

- 2Y10Y -3.589, -82.378 (L: -83.619 / H: -77.552)

- 2Y30Y -4.772, -77.064 (L: -79.418 / H: -70.883)

- 5Y30Y -3.124, -14.546 (L: -17.561 / H: -10.825)

- Current futures levels:

- Sep 2-Yr futures down 2.625/32 at 101-5.25 (L: 101-03.375 / H: 101-08.625)

- Sep 5-Yr futures down 5.25/32 at 105-19.75 (L: 105-13.75 / H: 105-26.25)

- Sep 10-Yr futures down 6.5/32 at 109-12.5 (L: 109-03.5 / H: 109-23)

- Sep 30-Yr futures down 5/32 at 119-22 (L: 119-05 / H: 120-09)

- Sep Ultra futures down 2/32 at 125-23 (L: 12-03 / H: 126-14)

Heavy Tsy quarterly futures roll volume from Sep'23 to Dec'23 below, has the roll approaching 75% complete before Dec'23 futures takes lead quarterly position Thursday morning, August 31. Current markets:

- TUU/TUZ 1,250,000 from -13.88 to -13.12, -13.5 last, 62% complete

- FVU/FVZ 2,068,000 from -16.5 to -15.75, -16.25 last, appr 69% complete

- TYU/TYZ 1,827,000 from -15.25 to -14.75, -15.50 last, appr 59% complete

- UXYU/UXYZ 518,200 from -19.75 to -18.25, -18.75 last, appr 56% complete

- USU/USZ 212,000 from -6.5 to -5.75, -6.25 last, appr 65% complete

- WNU/WNZ 350,400 from -121.75 to -119.5, -121.5 last, appr 70% complete

- Reminder, September futures won't expire until next month: 10s, 30s and Ultras on September 20, September 29 for 2s and 5s.

US 10Y FUTURE TECHS: (U3) Downtrend Remains Intact

- RES 4: 111-29 High Aug 10

- RES 3: 111-14 50-day EMA

- RES 2: 110-29 High Aug 11

- RES 1: 110-08+ 20-day EMA

- PRICE: 109-12.5 @ 1515 ET Aug 25

- SUP 1: 108-28/26+ Low Aug 22 / Low Oct 21 2022 (cont)

- SUP 2: 108-12 1.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 3: 107-22 2.0% 10-dma envelope

- SUP 4: 107.17 1.236 proj of the Jul 18 - Aug 4 - Aug 10 price swing

The trend direction in Treasuries remains down and Wednesday’s rally is considered corrective. The recent break of 109.24, the Aug 4 low, confirmed a continuation of the downtrend. Note too that moving average studies are in a bear-mode position, highlighting current market sentiment. The focus is on 108.12, a Fibonacci projection. Firm resistance is 110-08+, the 20-day EMA. Gains are considered corrective.

SOFR FUTURES CLOSE

- Sep 23 -0.023 at 94.543

- Dec 23 -0.045 at 94.510

- Mar 24 -0.075 at 94.640

- Jun 24 -0.085 at 94.915

- Red Pack (Sep 24-Jun 25) -0.075 to -0.02

- Green Pack (Sep 25-Jun 26) -0.02 to -0.01

- Blue Pack (Sep 26-Jun 27) -0.02 to -0.015

- Gold Pack (Sep 27-Jun 28) -0.01 to steady

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00859 to 5.32883 (+.01456/wk)

- 3M +0.01599 to 5.40389 (+0.02072/wk)

- 6M +0.02230 to 5.46731 (+0.02277/wk)

- 12M +0.03627 to 5.41166 (+0.02828/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $105B

- Daily Overnight Bank Funding Rate: 5.31% volume: $267B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.344T

- Broad General Collateral Rate (BGCR): 5.28%, $561B

- Tri-Party General Collateral Rate (TGCR): 5.28%, $553B

- (rate, volume levels reflect prior session)

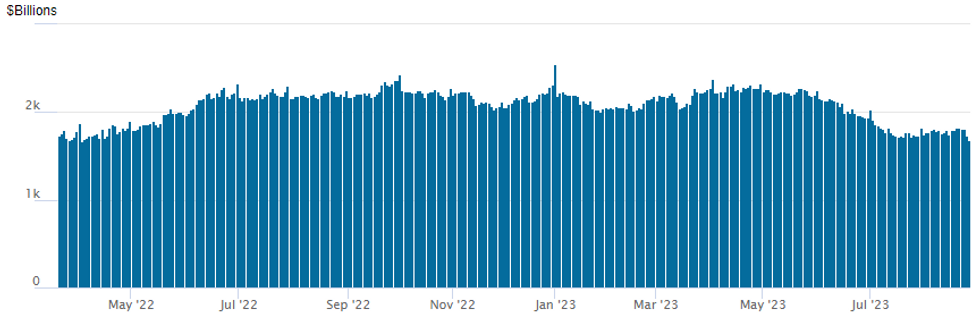

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation falls to $1,687.379B w/94 counterparties, the lowest since early April 2022, compared to $1,731.623B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

EGBs-GILTS CASH CLOSE: Curves Flatter To End The Week

UK and German yields reversed higher in late Friday trade in a flattening move. Periphery spreads closed slightly wider.

- Limited data flow in the morning was largely brushed aside (including a soft German IFO), with some attention on various ECB sources articles - MNI's ("ECH Mulls September Hawkish Pause, August CPI Key") pointed to the Sept 15 rate decision remaining in the balance.

- The main focus was Fed Chair Powell's Jackson Hole speech. It was hawkish but no moreso than the central bank's existing tightening bias would suggest, and the immediate reaction was a drop in yields. This reversed soon thereafter though, led by Treasuries which began to price in a slightly more hawkish Fed path.

- The UK curve twist flattened, with Germany's bear flattening.

- Attention turns to ECB's Lagarde who speaks at Jackson Hole after the market close (2100CET). Next week's focus will be Eurozone CPIs which will help shape the hold vs hike debate at the September ECB meeting.

- BoE's Broadbent will participate in a Jackson Hole panel Saturday on the topic of "Globalization at an Inflection Point." UK markets will be closed on Monday for a holiday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 7.7bps at 3.035%, 5-Yr is up 7.5bps at 2.587%, 10-Yr is up 4.8bps at 2.561%, and 30-Yr is up 4.4bps at 2.662%.

- UK: The 2-Yr yield is up 4.9bps at 5.022%, 5-Yr is up 4.2bps at 4.516%, 10-Yr is up 1.5bps at 4.441%, and 30-Yr is down 0.8bps at 4.639%.

- Italian BTP spread up 2bps at 168bps / Spanish up 0.2bps at 102.9bps

FOREX USDJPY Prints Fresh 2023 Highs At 146.63

- Despite some volatility in the aftermath of Fed Chair Powell’s Jackson Hole speech on Friday, the USD index remains close to unchanged on Friday, as we approach the week’s close. Slightly higher front-end yields in the US have placed some moderate downward pressure on the Japanese yen, prompting USDJPY to post a fresh yearly high at 146.63.

- With Jerome Powell providing little surprising information for markets, the USD completed a volatile spin cycle before general strength saw the DXY move to fresh trend highs just below 104.50. USDJPY briefly pierced a key short-term resistance level between 146.56/59, representing the August highs and the high dating back to November 10, 2022 before the lower than expected US October CPI data. However, with momentum waning ahead of the weekend, the pair settled back around 146.30.

- Overall, the uptrend in USDJPY remains intact and the latest pullback appears to have been a correction. Moving average studies are in a bull mode condition, highlighting an uptrend. The focus above will be on 147.49, a Fibonacci projection. Support to watch moves up to 144.39, the 20-day EMA.

- The Euro faced selling pressure through Asia-Pac hours and across the European open, resulting in a break below the key 200-dma support of 1.0804 (last broken below in Jun'21). EUR/USD then tested the base of the bull channel drawn off the March lows at 1.0769, before reverting to the 1.0800 mark ahead of this afternoon’s main event. In similar vein, a test of session lows following Powell’s speech was once again well supported and the pair slowly edged back above the 1.0800 handle once more ahead of the close.

- It is worth noting there is a UK bank holiday on Monday and the key data point next week will be the release of US non-farm payrolls on Friday.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/08/2023 | 0130/1130 | ** |  | AU | Retail Trade |

| 28/08/2023 | 0800/1000 | ** |  | EU | M3 |

| 28/08/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 29/08/2023 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 29/08/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 29/08/2023 | 0600/0800 | *** |  | SE | GDP |

| 29/08/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 29/08/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 29/08/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 29/08/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 29/08/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 29/08/2023 | 1300/0900 | ** |  | US | FHFA Quarterly Price Index |

| 29/08/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 29/08/2023 | 1300/0900 | ** |  | US | FHFA Quarterly Price Index |

| 29/08/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 29/08/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 29/08/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 29/08/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 29/08/2023 | 1430/1530 |  | UK | DMO Quarterly Investor/GEMM Consultation Meetings |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.