-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: More Balanced Fed Speak, Yields Recede

- MNI: Fed’s Collins Wants Greater Confidence In Disinflation

- MNI: Fed Has Ways To Go To Sustained 2% Inflation - Williams

- MNI INTERVIEW: Fed To Stay Patient Given Bumpy Inflation-Groen

US

FED (MNI): Fed’s Collins Wants Greater Confidence In Disinflation: Strong readings on inflation and employment highlight the need for Federal Reserve officials to take time to gain greater assurance that last year’s decline in inflation will persist, Boston Fed President Susan Collins said Wednesday.

- “Recent data illustrate the need for greater clarity that inflation is sustainably on a path back to the 2% target before adjusting the policy stance,” Collins said in prepared remarks.

FED (MNI): Fed Has Ways To Go To Sustained 2% Inflation - Williams: New York Fed President John Williams on Wednesday said there's been significant progress in restoring balance to the U.S. economy and bringing inflation down, but there is still a ways to go on the the journey to sustained 2% inflation.

- "While we’ve seen great progress toward achieving our goals, the journey is not yet over, and I am very focused on making sure we complete this mission successfully," he said in prepared remarks. Williams, a vice chair of the FOMC, is expecting GDP growth to slow to about 1.5% this year, and the unemployment rate to rise modestly, peaking at around 4%.

- He specifically notes that rate cuts don’t need to be tied to the quarterly Fed forecasts, whilst the rate cut pace is to depend on data and not be calendar-based. It builds on a Q&A just earlier in which he only wanted to clarify that the Fed can think about rate cuts "later" this year.

INTERVIEW (MNI): Fed To Stay Patient Given Bumpy Inflation-Groen: Federal Reserve officials will stay cautious about cutting interest rates until they gain greater conviction that disinflation is not stalling, which will not be clear until the middle of the year as growth and employment remain robust, former New York Fed economist Jan Groen told MNI.

- Groen expects the Fed to begin cutting interest rates in June and deliver three rate cuts this year, but that’s predicated on a resumption of disinflation after some bumps in the road at the start of this year.

- “There’s a possibility that the last mile everyone has been talking about, that might be a lot harder than we’d thought at the end of last year,” Groen said in an interview.

NEWS

US (MNI): Top Senate Republican Appropriator "Confident A Shutdown Will Be Avoided": Top Republican appropriator, Senator Susan Collins (R-ME), says she’s, "confident a [partial government] shutdown will be avoided," on Saturday as, "No one in leadership wants one," according to Bloomberg's Erik Wasson.

US (MNI): McConnell To Step Down As Republican Leader In November: Wires reporting that Senate Minority Leader Mitch McConnell (R-KY) will step down from his position as leader of the Senate Republican conference in November. McConnell isn't up for re-election until 2026 and there hasn't yet been a suggestion that McConnell will retire from Congress entirely ahead of that date despite a number of high profile health concerns over the past year.

US-EU (MNI): Yellen And Giorgetti Discuss Using Frozen Russian Assets To Support UKR: Reuters reporting that Italian Finance Minister Giancarlo Giorgetti and US Treasury Secretary Janet Yellen discussed, "a path to use frozen Russian assets to compensate Ukraine for war damage," in a meeting at the G20 Finance Ministers meetings in Brazil today.

ECB (MNI) Nagel Says It Would Be 'Fatal' To Ease Early and Have Inflation Rebound: Bloomberg running comments from ECB's Nagel from an earlier Reuters story: Nagel said it would be "fatal" if the ECB were to cut rates too early and inflation to then rebound, adding this would hurt the bank's credibility and stoke financial market volatility.

- "We have already achieved a lot with policy," Nagel said. "We can’t make any mistakes in the final stretch of the journey.”

- "We still lack more reliable data on wage developments and confirmation that with these data, we will get inflation back to 2% in 2025," Nagel told Reuters on the sidelines of a G7 meeting. "Next week's projections will be an important milestone.” (Reuters)

EU (MNI): No Agreement On Supply Chain Due Diligence Law: Permanent representatives to the EU failed to approve a new law focused on due diligence within supply chains, the Corporate Sustainability Due Diligence Directive (CSDDD), according to a statementfrom the Belgian presidency.

RUSSIA (MNI): Lavrov To Visit Turkey 1-2 March: A Foreign Ministry spox has confirmed that Foreign Minister Sergey Lavrov will travel to Turkey from 1-2 March. The confirmation of Lavrov's visit comes a short time after President Vladimir Putin's trip, originally scheduled for 12 Feb has been pushed backsignificantly to late April or May

US TSYS Extending Late Session Highs Ahead Month End

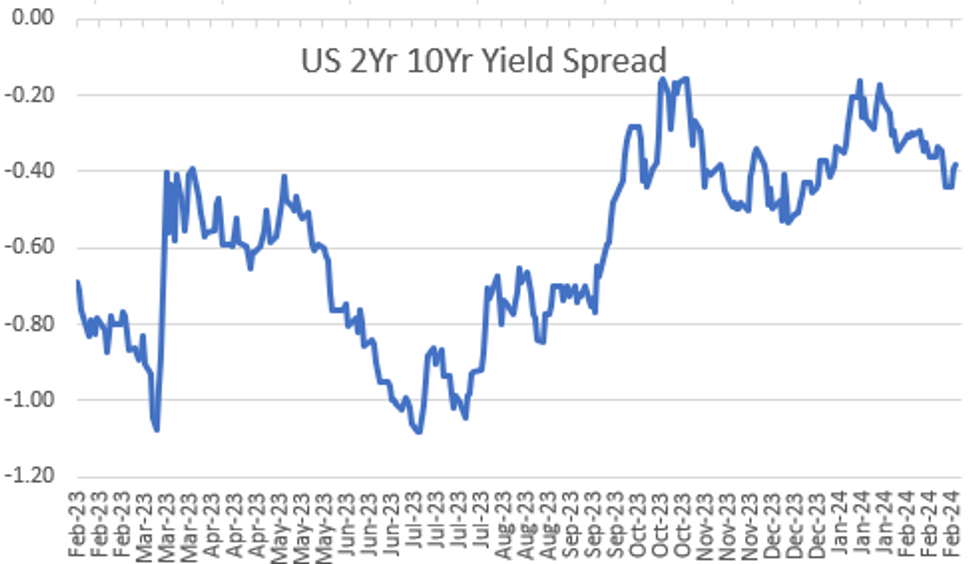

- Treasury futures continued to drift higher in late trade, just off the top end of the range after the bell. Tsys curves hold steeper (2s10s +1.210 at -37.994), while trading desks noted a surge in short end Dec'23 SOFR futures, appr 200k in the minutes leading up to the bell - potential month-end funding risk related.

- Treasuries supported following a flurry of balanced Fed speak:

- While Atlanta Fed President Bostic remains "comfortable" with a patient Fed strategy to address inflation, he still expects the first rate cut this summer.

- More cautiously, NY Fed President Williams reiterated the Fed has a "ways to go to sustained 2% inflation", while Boston Fed President Collins wants greater confidence in disinflation before soften policy.

- Nevertheless, projected rate cut pricing looking steady to mildly higher at midyear vs. this morning's read: March 2024 chance of 25bp rate cut currently -2.7% w/ cumulative of -0.07bp at 5.322%; May 2024 steady at -18.4% w/ cumulative -5.3bp at 5.276%; June 2024 -55.5% from -54.5% earlier w/ cumulative cut -19.2bp at 5.137%. First full cut priced in at July w/cumulative -33.4bp at 4.995%. Fed terminal at 5.327% in Mar'24.

- Tsy Jun'24 10Y futures are trading +10.5 at 110-12, inside technicals: resistance above at 110-28+ (20-day EMA) vs. support at 109-25+ (Low Feb 23).

- Focus on tomorrow's core PCE print for January, consensus sits at 0.4% M/M and the below unrounded analyst estimates average very close to that at 0.39. Supercore PCE could come in even stronger, with two eyeing a 0.55% increase.

OVERNIGHT DATA

US Q4 GDP +3.2

US DATA (MNI): GDP Revisions Bely Domestic Demand Strength: Real GDP was surprisingly revised down in Q4 from 3.28% to 3.21% annualized (cons 3.3). It follows an unrevised booming 4.86% in Q3.

Consumption however was surprisingly revised higher, from 2.83% to 2.97% (cons 2.7), for even less moderation after the 3.1% in Q3.

US DATA: Core PCE Sees Small Upward Revision For Q4: Core PCE inflation revised up from 1.99% to 2.07% annualized in Q4 on an unrounded basis. Recall these Q4 revisions included the effects from CPI annual revisions. It follows 2.04% in Q3.

US DATA (MNI): Mortgage Applications Continue Slide After Step Higher In Rates. MBA composite mortgage applications fell -5.6% last week for the third weekly decline and following a heavy -10.6% the week prior.

- After some disconnect between purchases and refis in Jan and early Feb, the two have recently more in unison, with purchases -4.5% after -10.1% and refis -7.3% after -11.4%.

- The latest declines have come with the pick-up in mortgage rates. The 30Y conforming rate was little changed on the week at 7.04% (-2bp) but having stepped higher from the 6.8% averaged through mid-Dec to early Feb.

- It sees the level of purchase applications drop close to October levels which marked lows since the mid-1990s.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 40.64 points (-0.1%) at 38929.88

- S&P E-Mini Future down 10.75 points (-0.21%) at 5079.5

- Nasdaq down 81.5 points (-0.5%) at 15954.3

- US 10-Yr yield is down 3.5 bps at 4.2678%

- US Mar 10-Yr futures are up 9.5/32 at 109-26.5

- EURUSD down 0.0007 (-0.06%) at 1.0837

- USDJPY up 0.19 (0.13%) at 150.7

- WTI Crude Oil (front-month) down $0.46 (-0.58%) at $78.41

- Gold is up $3.26 (0.16%) at $2033.73

- European bourses closing levels:

- EuroStoxx 50 down 1.97 points (-0.04%) at 4883.77

- FTSE 100 down 58.04 points (-0.76%) at 7624.98

- German DAX up 44.73 points (0.25%) at 17601.22

- French CAC 40 up 5.99 points (0.08%) at 7954.39

US TREASURY FUTURES CLOSE

- 3M10Y -4.244, -113.626 (L: -114.47 / H: -108.859)

- 2Y10Y +1.21, -38.201 (L: -40.735 / H: -36.814)

- 2Y30Y +2.336, -24.603 (L: -27.64 / H: -22.923)

- 5Y30Y +1.897, 13.276 (L: 11.308 / H: 14.116)

- Current futures levels:

- Mar 2-Yr futures up 3.125/32 at 101-28 (L: 101-25.5 / H: 101-28.625)

- Mar 5-Yr futures up 6.75/32 at 106-15.25 (L: 106-09 / H: 106-16)

- Mar 10-Yr futures up 9.5/32 at 109-26.5 (L: 109-17.5 / H: 109-28)

- Mar 30-Yr futures up 16/32 at 118-26 (L: 118-09 / H: 118-31)

- Mar Ultra futures up 23/32 at 125-9 (L: 124-17 / H: 125-13)

(M4) Trend Condition Remains Bearish

- RES 4: 112-04 High Feb 7

- RES 3: 111-24+ High Feb 13

- RES 2: 110-09 50-day EMA

- RES 1: 110-28+ 20-day EMA

- PRICE: 110-12 @ 1515 ET Feb 28

- SUP 1: 109-25+ Low Feb 23

- SUP 2: 109-14+ Low Nov 28

- SUP 3: 108-19+ 61.8% of the Oct 19 - Dec 27 bull phase

- SUP 4: 109-12+ 1.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

The trend direction in Treasuries is unchanged and remains down with the contract continuing to trade closer to its recent lows. Price has recently pierced the 110-00 handle. A clear break of this level would strengthen the bearish condition and signal scope for an extension towards 109-14+, the Nov 28 low. On the upside, initial firm resistance is seen at 110-09, the 50-day EMA.

SOFR FUTURES CLOSE

- Mar 24 +0.010 at 94.685

- Jun 24 +0.030 at 94.890

- Sep 24 +0.060 at 95.195

- Dec 24 +0.065 at 95.510

- Red Pack (Mar 25-Dec 25) +0.060 to +0.070

- Green Pack (Mar 26-Dec 26) +0.040 to +0.055

- Blue Pack (Mar 27-Dec 27) +0.030 to +0.035

- Gold Pack (Mar 28-Dec 28) +0.025 to +0.030

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00067 to 5.32559 (+0.00146/wk)

- 3M -0.00191 to 5.34125 (+0.01068/wk)

- 6M -0.00562 to 5.28687 (+0.01336/wk)

- 12M -0.00052 to 5.09332 (+0.02089/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.741T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $664B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $652B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $96B

- Daily Overnight Bank Funding Rate: 5.31% (+0.00), volume: $278B

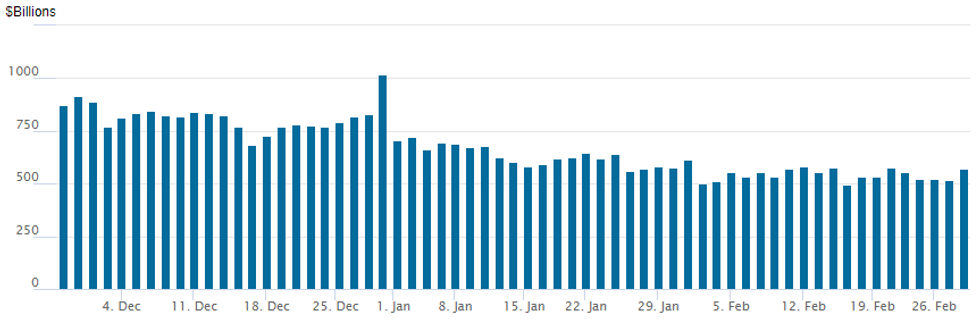

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage rebounds to $569.855B vs. 519.725B Tuesday; compares to $493.065B on Thursday, Feb 15 -- the lowest since early June 2021 .

- Meanwhile, the latest number of counterparties at 87 from 84 Tuesday (compares to 65 on January 16, the lowest since July 7, 2021).

PIPELINE $6B AON NA 5Pt Launched

AON 5-tranche issuance the lion's share of $16.65B to price Wednesday:

- Date $MM Issuer (Priced *, Launch #)

- 2/28 $6B #AON NA $600M 3Y +75, $1B 5Y +90, $650M 7Y +105, $1.75B 10Y +120, $2B 30Y +140

- 2/28 $2.25B #Sumi Trust $1B 3Y +80, $750M 5Y +95, $500M 10Y +110

- 2/28 $1.5B #Tyson Foods $600M 5Y +115, $900M 10Y +145

- 2/28 $1.5B #Raizen Fuels $1B 10Y +220, $500M 30Y +265

- 2/28 $1B #PSE&G $450M 10Y +93, $550M 30Y +108

- 2/28 $1B #Standard Chartered PerpNC6 7.875%

- 2/28 $1B *NRW Bank WNG 3Y SOFR+34a

- 2/28 $750M #Govt of Sharjah 12Y +195

- 2/28 $600M *Kommunalbanken 4Y SOFR+40

- 2/28 $550M #Citigroup WNG PerpNC5 7.2%

- 2/28 $500M *Coterra Energy 10Y +135

- 2/28 $Benchmark NatWest 10.25NC5.25 +220

- 2/28 $Benchmark Radian 5Y +195

FOREX NZD Consolidates Sharp RBNZ-Inspired Losses, Greenback Pares Gains

- Wednesday’s currency moves have been dominated by the overnight decline for the New Zealand dollar, falling sharply on the back of a dovish RBNZ decision. These losses gradually extended throughout the course of the day, with NZDUSD consolidating around 1.25% lower as we approach the APAC crossover.

- The main change from the RBNZ was the more neutral tone to the meeting assessment with November’s more hawkish elements removed. The tone suggested that the RBNZ is happy with where rates are for now. Pre RBNZ the market had attached a 29% chance of a 25bp hike at today’s meeting.

- NZDUSD has breached the 0.6100 handle and traded as low as 0.6082 and could set the tone for further weakness towards the mid Feb lows near 0.6050.

- In sympathy, AUDUSD has been dragged lower by its antipodean counterpart move and the generally softer equity tone across the first half of Tuesday’s session. AUDUSD is down 0.72% to 0.6495, close to session lows and notably piercing initial support at 0.6496. An additional headwind for the AUD was the lower-than-expected January CPI outcome which came in unchanged at 3.4% y/y. With kiwi underperforming, AUDNZD is 0.55% higher at 1.0660.

- Overall, the early weakness for major equity benchmarks on Tuesday supported the USD index to the best levels of the week at 1.0424. However, as US yields edged lower throughout the session and equities recovered, the greenback has been steadily paring its gains as we approach the APAC crossover.

- The January PCE deflator (out Thursday) will be the last reading of the Fed's preferred inflation gauge before the March FOMC meeting. Before this, Australian retail sales is scheduled overnight, ahead of regional inflation data from the Eurozone, including Germany, Spain and France.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/02/2024 | 0030/1130 | * |  | AU | Private New Capex and Expected Expenditure |

| 29/02/2024 | 0030/1130 | ** |  | AU | Retail Trade |

| 29/02/2024 | 0700/0800 | ** |  | DE | Retail Sales |

| 29/02/2024 | 0700/0800 | ** |  | SE | Retail Sales |

| 29/02/2024 | 0700/0800 | *** |  | SE | GDP |

| 29/02/2024 | 0745/0845 | *** |  | FR | GDP (f) |

| 29/02/2024 | 0745/0845 | ** |  | FR | Consumer Spending |

| 29/02/2024 | 0745/0845 | *** |  | FR | HICP (p) |

| 29/02/2024 | 0745/0845 | ** |  | FR | PPI |

| 29/02/2024 | 0800/0900 | *** |  | ES | HICP (p) |

| 29/02/2024 | 0800/0900 | ** |  | CH | KOF Economic Barometer |

| 29/02/2024 | 0800/0900 | *** |  | CH | GDP |

| 29/02/2024 | 0855/0955 | ** |  | DE | Unemployment |

| 29/02/2024 | 0900/1000 | *** |  | DE | North Rhine Westphalia CPI |

| 29/02/2024 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 29/02/2024 | 0930/0930 | ** |  | UK | BOE M4 |

| 29/02/2024 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/02/2024 | 1300/1400 | *** |  | DE | HICP (p) |

| 29/02/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 29/02/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 29/02/2024 | 1330/0830 | *** |  | CA | GDP - Canadian Economic Accounts |

| 29/02/2024 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/02/2024 | 1330/0830 | *** |  | CA | CA GDP by Industry & Economic Accounts Combined |

| 29/02/2024 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 29/02/2024 | 1445/0945 | *** |  | US | MNI Chicago PMI |

| 29/02/2024 | 1500/1000 | ** |  | US | NAR Pending Home Sales |

| 29/02/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 29/02/2024 | 1550/1050 |  | US | Atlanta Fed's Raphael Bostic | |

| 29/02/2024 | 1600/1100 |  | US | Chicago Fed's Austan Goolsbee | |

| 29/02/2024 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 29/02/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 29/02/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 29/02/2024 | 1815/1315 |  | US | Cleveland Fed's Loretta Mester | |

| 01/03/2024 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/03/2024 | 2330/0830 | * |  | JP | labor forcer survey |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.