-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: More Fed Speakers Ahead

- MNI FED: Fed's Mester Sees Rate Cuts Likely Later This Year

- MNI BRIEF: Yellen Has Concerns About Commercial Real Estate

- MNI BOC: BOC Speech Drops Reference To Need For Rate Hike

US

FED (MNI) Fed's Mester Sees Rate Cuts Likely Later This Year

- The Federal Reserve will likely be comfortable lowering interest rates at a gradual rate later this year while allowing the balance sheet to continue to shrink, Cleveland Fed President Loretta Mester said Tuesday, echoing Fed Chair Jerome Powell's message after last week's FOMC meeting.

- "The current strength in labor market conditions and the strong spending data give us the opportunity to keep the nominal funds rate at its current level while we gather more evidence that inflation truly is on a sustainable and timely path back to 2%," she said in remarks prepared for an Ohio Bankers League summit in Columbus, Ohio.

- "If the economy evolves as expected, I think we will gain that confidence later this year, and then we can begin moving rates down. My base case is that we will do so at a gradual pace so that we can continue to manage the risks to both sides of our mandate."

NEWS

US BRIEF (MNI): Yellen Has Concerns About Commercial Real Estate

U.S. Treasury Secretary Janet Yellen said Tuesday she has concerns about commercial real estate, adding that banking supervisors are working closely with banks to build up loan loss reserves. "I do have a concern about commercial real estate," she told lawmakers on Capitol Hill in Q&A. "I believe it's manageable, although there may be some institutions that are quite stressed by this problem."

BOC (MNI): BOC Speech Drops Reference To Need For Rate Hike

Bank of Canada Governor Tiff Macklem's speech Tuesday dropped language about the potential need for raising interest rates an 11th time while reiterating the debate is shifting to how long to hold the highest borrowing costs since 2001 with inflation seen on a bumpy road back to target.

US (MNI): DC Court-Trump Not Immune From Prosecution In Federal 2020 Election Case

The District of Columbia circuit court has ruled that former president and frontrunner for the 2024 Republican nomination Donald Trump is not immune from charges in relation to the federal 2020 election case.

US (MNI): House To Vote On DHS Secretary Mayorkas Impeachment Today

The House of Representatives will vote today on impeaching DHS Secretary Alejandro Mayorkas – the first bid to impeach a Cabinet Secretary in nearly 150 years.

ISRAEL (MNI): WH NSC-'Positive Feedback' On Future Normalisaton Talks w/Saudi

White House National Security Council spox John Kirby has stated that he has 'recieved positive feedback' that Saudi Arabia and Israel are willing to continue to have normalisation discussions.

SECURITY (MNI): Qatar PM: Hamas Response To Ceasefire Proposal, "In General Positive"

Qatari Prime Minister and Foreign Minister Mohammed bin Abdulrahman Al Thani, speaking at a press conference in Doha alongside US Secretary of State Antony Blinken, has told reporters that Qatar, "has received a reply from Hamas" on the ceasefire/hostage exchange proposal framework negotiated in Paris last week.

RUSSIA-TURKEY (MNI): Putin And Erdogan To Discuss Regional Gas Hub

Wires reporting comments from the Kremlin stating that Russian President Vladimir Putin and Turkish President Recep Tayyip Erdogan will discuss plans to create a regional gas during an upcoming trip to Turkey, expected to take place on February 12.

US TSYS Fed Rhetoric Cools Slightly

- Treasury futures holding firmer after the bell as markets inched off post-jobs related lows. Markets have come a long way in unwinding rate cut pricing since Friday's blowout job gains for January, while today saw a slight softening of Fed rhetoric.

- Initial muted react to Cleveland Fed Mester economic outlook comments: "POLICY IS IN A GOOD PLACE, MISTAKE TO CUT RATE TOO SOON .. CAN'T COUNT AS MUCH ON SUPPLY SIDE TO LOWER INFLATION" was largely in-line with Chairman Powell comments.

- Addressing the media later in the afternoon, Mester reiterated the likelihood of three rate cuts in 2024. MN Fed President Kashkari also sounded more placative of late.

- In turn, projected rate cut pricing gained slightly by Tuesday's close: March 2024 chance of 25bp rate cut currently -20.3% vs. -17.4% this morning w/ cumulative of -5.1bp at 5.270%, May 2024 at -61.2% vs. -57% w/ cumulative -20.4bp at 5.118%, while June 2024 back to -89.2% from -83.8% (105% pre-NFP for comparison) w/ cumulative -42.7bp at 4.895%. Fed terminal at 5.325% in Feb'24.

- Wednesday Data Calendar: Continued Focus on Fed Speakers, 10Y Sale

OVERNIGHT DATA

- NEW YORK FED: TOTAL HOUSEHOLD DEBT UP $212 BLN TO $17.5 TRILLION IN FOURTH QUARTER OF 2023

- DELIQUENCY RATES ROSE IN Q4 2023 BUT REMAIN BELOW PRE-PANDEMIC LEVEL

- 3.1% OF DEBT WAS IN SOME TYPE OF DELINQUENCY DURING 4Q 2023

- DELINQUENCY TRANSITION RATES UP FOR ALL BORROWING TYPES EXCEPT STUDENT LOANS - Reuters

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 60 points (0.16%) at 38439.42

- S&P E-Mini Future up 4.75 points (0.1%) at 4966.5

- Nasdaq down 16.3 points (-0.1%) at 15581.45

- US 10-Yr yield is down 6.8 bps at 4.0904%

- US Mar 10-Yr futures are up 16/32 at 111-9

- EURUSD up 0.0008 (0.07%) at 1.0751

- USDJPY down 0.73 (-0.49%) at 147.95

- WTI Crude Oil (front-month) up $0.77 (1.06%) at $73.55

- Gold is up $11.22 (0.55%) at $2036.30

- European bourses closing levels:

- EuroStoxx 50 up 35.6 points (0.76%) at 4690.87

- FTSE 100 up 68.15 points (0.9%) at 7681.01

- German DAX up 129.18 points (0.76%) at 17033.24

- French CAC 40 up 49.01 points (0.65%) at 7638.97

US TREASURY FUTURES CLOSE

- 3M10Y -6.439, -129.616 (L: -130.128 / H: -120.868)

- 2Y10Y +0.117, -31.728 (L: -32.293 / H: -29.564)

- 2Y30Y +2.67, -11.248 (L: -12.896 / H: -8.57)

- 5Y30Y +3.692, 25.345 (L: 22.2 / H: 26.921)

- Current futures levels:

- Mar 2-Yr futures up 3.5/32 at 102-14.625 (L: 102-10.625 / H: 102-16.375)

- Mar 5-Yr futures up 10.5/32 at 107-20.5 (L: 107-09 / H: 107-23)

- Mar 10-Yr futures up 16/32 at 111-09 (L: 110-23.5 / H: 111-12.5)

- Mar 30-Yr futures up 28/32 at 121-00 (L: 120-00 / H: 121-04)

- Mar Ultra futures up 1-02/32 at 127-15 (L: 126-08 / H: 127-20)

US 10Y FUTURE TRECHS: (H4) Bearish Threat Remains Present

- RES 4: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-00 Round number resistance

- RES 2: 113-12 High Dec 27 and the bull trigger

- RES 1: 111-21/113-06+ 20-day EMA / High Feb 1

- PRICE: 111-09 @ 1525 ET Feb 6

- SUP 1: 110-22+ Low Feb 5

- SUP 2: 110-16 Low Dec 13

- SUP 3: 109-31+ Low Dec 11

- SUP 4: 109-17 50.0% of the Oct 19 - Dec 27 bull phase

Treasuries remain soft following the latest reversal and pullback from last week’s 113-06+ high (Feb 1). The bear trigger at 110-26, the Jan 19 low, has been pierced. A clear break would highlight a stronger reversal and open 110-16, the Dec 13 low, ahead of 109-31+, Dec 11 low. Initial key resistance has been defined at 113-06+, Feb 1 high, where a break would reinstate a bullish theme and expose the bull trigger at 113-12, the Dec 27 high.

SOFR FUTURES CLOSE

- Mar 24 +0.020 at 94.790

- Jun 24 +0.055 at 95.175

- Sep 24 +0.070 at 95.575

- Dec 24 +0.080 at 95.925

- Red Pack (Mar 25-Dec 25) +0.080 to +0.085

- Green Pack (Mar 26-Dec 26) +0.090 to +0.095

- Blue Pack (Mar 27-Dec 27) +0.095 to +0.10

- Gold Pack (Mar 28-Dec 28) +0.095 to +0.10

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00060 to 5.32309 (+0.00098/wk)

- 3M +0.00645 to 5.32258 (+0.03212/wk)

- 6M +0.02449 to 5.21103 (+0.11493/wk)

- 12M +0.04779 to 4.90712 (+0.21432/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (-0.01), volume: $1.731T

- Broad General Collateral Rate (BGCR): 5.30% (-0.01), volume: $688B

- Tri-Party General Collateral Rate (TGCR): 5.30% (-0.01), volume: $677B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $96B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $269B

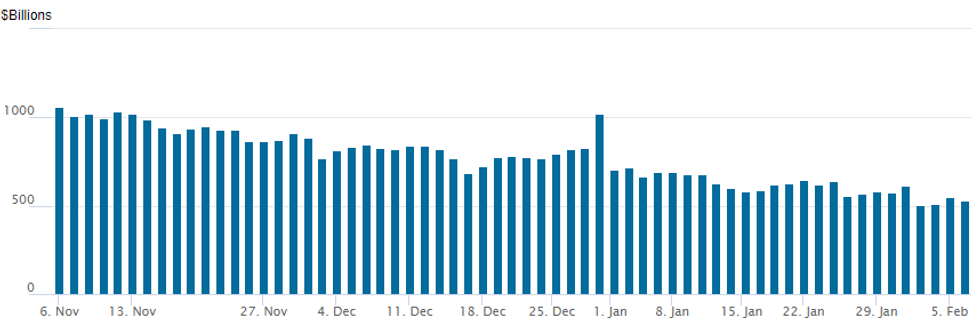

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage slips to $532.439B vs. $552.289B Monday. Holding above recent cycle low of $503.548B from Thursday, February 1, the lowest level since mid-2021.

- Meanwhile, the number of counterparties holds steady at 80 from 74 last Thursday (compares to 65 on January 16, the lowest since July 7, 2021).

PIPELINE $2.5B Air Products 3Pt Launched

$25.9B to price Tuesday, $43.625B/wk

- Date $MM Issuer (Priced *, Launch #

- 2/6 $5.5B #Citigroup $3B 6NC5 +115, $2.5B 11NC10 +175

- 2/6 $4B *EIB 10Y SOFR+50

- 2/6 $3.5B *Export Development Canada 5Y SOFR+41

- 2/6 $3B *KDB 3Y $1.75B SOFR+66, $1.25B 5Y SOFR+78

- 2/6 $2.5B #Air Products $750M 5Y +60, $600M 7Y +70, $1.15B 10Y +80

- 2/6 $2B #Bahrain $1B 7Y Sukuk 6.0%, $1B 12Y 7.5%

- 2/6 $2B *Land NRW 3Y SOFR+35

- 2/6 $1.5B #Couche-Tard $900M 10Y +118, $600M 30Y +130

- 2/6 $750M #Rep of Benin 14Y 8.375%

- 2/6 $650M Swedbank PNC6.5 Reg S AT1 7.75%

- 2/6 $500M #CNA Financial 10Y +120

EGBs-GILTS CASH CLOSE: Solid Rebound

Gilts and Bunds bounced Tuesday after two consecutive down days.

- The negative tone of the previous sessions carried over in morning trade, exacerbated by a heavy data slate (including 30Y Spain syndication).

- A big upside surprise in German factory orders initially weighed on Bunds, though MNI notes it was largely due to one-off factors (ie aircraft orders) with core orders contracting further. Downward inflation expectations evident in the ECB's monthly consumer survey didn't have much impact.

- Bund and Gilt futures hit fresh lows in late morning but reversed higher in the afternoon.

- Multiple factors were at play, including the conclusion of the day's issuance which was well absorbed (large books for Spain, strong auction of 30Y Green Gilt), and renewed concern over US regional banks. All in all the rebound looked corrective.

- Both the German and UK curves bull flattened, with Gilts outperforming. Periphery EGB spreads ended mixed.

- German industrial production data features early Wednesday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.8bps at 2.595%, 5-Yr is down 2.2bps at 2.215%, 10-Yr is down 2.4bps at 2.292%, and 30-Yr is down 1bps at 2.51%.

- UK: The 2-Yr yield is down 3.9bps at 4.47%, 5-Yr is down 4.5bps at 3.953%, 10-Yr is down 5.7bps at 3.95%, and 30-Yr is down 6.5bps at 4.552%.

- Italian BTP spread down 0.5bps at 156.3bps / Spanish bond spread up 0.6bps at 91.8bps

FOREX USD Index Moderates Lower Amid Yields Pullback, AUD Outperforms

- Despite an early test of Monday's highs, the USD index has reversed and now sits 0.25% in the red on Tuesday. The moderate correction looks to be driven by US yields rolling off their highs on a combination of Treasury block buys and risk aversion stemming from the NYCB equity sell-off.

- Corresponding strength across the rest of G10 FX has been broad based, with moderate outperformance seen for the Australian dollar and relative weakness notable for the Euro.

- Initially, the Euro extended its slippage off overnight highs, with EUR/USD's new daily low well in closely matching the Monday pullback and cycle low of 1.0724. Despite the subsequent greenback weakness, EURUSD has only managed to recover to 1.0750, with the day’s range contained to a very narrow 39 pips. Clearance below 1.0923 opens levels last seen in November last year.

- The AUD was also boosted by the RBA not ruling out further tightening, although the subsequent central bank press conference was fairly balanced. AUDUSD has risen back above 0.6500 following yesterday’s breach of the pivotal chart point.

- 148.80 still appears to be capping the topside for USDJPY, with price action unable to build momentum through the prior January highs on Monday. Since then, the sensitivity to core rates has benefitted the Japanese Yen with USDJPY sliding all the way back to below the 148 handle in late trade.

- Similarly, lower US yields have boosted FX sentiment in emerging markets with the likes of ZAR and CLP outperforming. USDZAR is down 1.15% as we approach the APAC crossover and has now erased the entirety of yesterday’s move higher. A recovery in gold (which has bounced over 1% off Monday’s low) is likely accounting for rand outperformance in the EMEA region.

- New Zealand Employment data is first up on Wednesday, before German industrial production and Swiss currency reserves. US and Canadian trade balance data also crosses, as well as further Fed Speak, with expected comments from Fed’s Kugler, Collins, Barkin and Bowman all due.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/02/2024 | 0000/1900 |  | US | Philadelphia Fed's Pat Harker | |

| 07/02/2024 | 0645/0745 | ** |  | CH | Unemployment |

| 07/02/2024 | 0700/0800 | ** |  | DE | Industrial Production |

| 07/02/2024 | 0745/0845 | * |  | FR | Foreign Trade |

| 07/02/2024 | 0800/0900 | ** |  | ES | Industrial Production |

| 07/02/2024 | 0840/0840 |  | UK | BoE's Breeden Speaks At Women In Economics Event | |

| 07/02/2024 | 0900/1000 | * |  | IT | Retail Sales |

| 07/02/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/02/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 07/02/2024 | 1215/1215 |  | UK | BOE's Woods et al : Treasury Select Committee 'work of the PRA' | |

| 07/02/2024 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/02/2024 | 1330/0830 | ** |  | US | Trade Balance |

| 07/02/2024 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 07/02/2024 | 1600/1100 |  | US | Fed Governor Adriana Kugler | |

| 07/02/2024 | 1630/1130 |  | US | Boston Fed's Susan Collins | |

| 07/02/2024 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 07/02/2024 | 1830/1330 |  | CA | BOC Minutes (Summary of Deliberations) | |

| 07/02/2024 | 1900/1400 |  | US | Fed Governor Michelle Bowman | |

| 07/02/2024 | 2000/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.