-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Net Consumer Confidence Lowest Since November

- MNI FED Barkin: Willingness For Providers To Keep Trying To Push Price Increases

- MNI: Debt Limit Legislation Faces Final Test In Rules Committee

- MNI: Canada Could Earn CAD800M/Yr Ending Mortgage Bonds-Memo

- MNI: Conference Board Labor Differential Softens Ahead Of Payrolls

- MNI Regional Fed Manufacturing Surveys Imply Downside Risk For ISM

US

FED: Ahead of the media blackout starting the day after Friday's payrolls report, Richmond Fed's Barkin ('24 voter) reiterates the need to see demand being curbed.

- Obviously we’re seeing a couple of big labor releases this week with JOLTS tomorrow and payrolls Fri before CPI ahead of the FOMC. I’m looking to be convinced that demand is in fact coming down and that will indeed bring inflation down.

- I do believe rate hikes have an impact and that they work with a lag (earlier said lags were truly long and variable), but it’s awfully hard to convince myself that I can count on them to do all the work for me. R* has an awfully wide confidence interval.

- There's more willingness for providers to try pushing price increases at this point than you'd have seen three, four or ten years ago. Until customers or maybe competitors force these providers to back off they'll keep pushing, that's what I hear.

US: The legislation negotiated by the White House and House Republicans to raise the federal debt limit will face its final procedural hurdle today when it is considered by the House Rules Committee at 15:00 ET 20:00 BST.

- As part of a series of sweeteners to conservatives in January, House Speaker Kevin McCarthy (R-CA) placed three conservatives on the panel.

- For the legislation to stall in the Committee it would require all three conservatives and one other Republican to vote the bill down. This is highly unlikely but the House Freedom Caucus will hold a presser at 12:00 ET 17:00 BST to rally opposition to the bill and apply pressure on the panel.

- Punchbowl News notes the conservatives, Reps. Chip Roy (R-TX), Ralph Norman (R-SC) and Thomas Massie (R-KY), “are at risk to vote against the rule.” But highlights remarks from Massie earlier this year stating he wouldn't use his position, "to hold somebody hostage or hold legislation hostage.”

- If the legislation is discharged to the House floor, a full vote is likely to take place on Wednesday evening.

- For more analysis, see today's edition of our US Daily Brief.

CANADA

CMB: Ending Canada's flagship mortgage bonds could be profitable for the government, according to a Finance Department briefing memo obtained by MNI, a message contradicting other advice from the housing agency that runs the program.

- The Canada Mortgage Bond program has grown to CAD260 billion since it began in 2001 to provide more stable funding but those bonds carry a 30bp premium over regular government debt that could accomplish the same goal, the memo said. "We believe that consolidating CMBs could in theory generate up to $800M in revenue per year," said the 10-page memo dated Feb. 27 obtained by MNI through a freedom-of-information request.

- The report was the main one prepared in advance of Finance Minister Chrystia Freeland's March 28 budget announcing a consultation about consolidating the mortgage bond program into regular government borrowing. The budget mentioned cost savings that could be used to fund more housing programs, without giving a specific dollar estimate. For more see MNI Policy main wire at 1112ET.

US TSYS: Markets Roundup: Debt Deal Meets House Rules Hurdles

- US fixed income markets enjoyed strong support after returning from extended holiday weekend, risk appetite generally positive after a bipartisan agreement to suspend the debt limit for the next two years while keeping non-defense spending flat for the next year (+1% in the second year) was announced Saturday.

- Getting the deal to pass through a fractious Congress before the June 5 "X" date is the real challenge. The agreement faces its final procedural hurdle today when it is considered by the House Rules Committee at 15:00 ET 20:00 BST.

- Treasury futures briefly pared early support following stronger than expected Home Price Index (0.6% M/M; EST. 0.2%), rebounding to new session highs after Conference Board consumer confidence came out stronger than expected in May at 102.3 (cons 99.0) although still represented a decline on the month after a sizeable upward revision to 103.7 (initial 101.3). The net impact was lowest consumer confidence since November.

- Focus turns to key employment data later this week: ADP private employment data to be released Thursday, one day later than usual due to the holiday, while May NFP will be released Friday, current median estimate at +190k job gains for May vs. +253k prior. Fed enters policy blackout at midnight Friday.

OVERNIGHT DATA

- US MARCH FHFA HOME PRICE INDEX RISES 0.6% M/M; EST. 0.2%

- MARCH S&P CORELOGIC CS 20-CITY ADJUSTED INDEX UP 0.45% M/M, est 0.0

US: Conference Board consumer confidence was stronger than expected in May at 102.3 (cons 99.0) although still represented a decline on the month after a sizeable upward revision to 103.7 (initial 101.3). The net impact was lowest consumer confidence since November.

- The increase was led by expectations (little changed at 71.5 from an upward revised 71.7 vs 68.1 prior) whilst the present situation softened (at 148.6 from 151.8 vs 151.1 prior).

- Along with the revised trajectory, some of the gloss is taken off by the labor market differential dipping from 36.9 to 31 for technically its lowest since Apr’21 having got close in Oct/Nov.

- It was led by jobs plentiful falling from 47.5 to 43.5 (lowest since Apr’21) whilst hard to get increased from 10.6 to 12.5 (highest since Nov).

US: The miss for the Dallas Fed manufacturing index (-29.1 vs cons -18.0 after -23.4) completes a mixed month for regional Fed manufacturing surveys.

- Monthly gains were seen in Philly (from -31.3 to -10.4) and Kansas (from -10 to -1) but with declines in Empire (from +10.8 to -31.8), Dallas above and Richmond (from -10 to -15).

- An unweighted average of the five falls from -12.8 to -17.5, its lowest yet for the cycle at a level that excluding Mar-May’20 now hasn’t been seen since 2008/09.

- On its own it points to some further downside pressure for ISM mfg due Thu vs consensus of a broadly unchanged 47.0 (see chart) although before then comes the MNI Chicago PMI tomorrow.

- ISM service activity has however been holding up better than manufacturing, the latter on its own consistent with recession that hasn’t yet shown up in national accounts owing to service sector resilience.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 70.57 points (-0.21%) at 33028.21

- S&P E-Mini Future up 6 points (0.14%) at 4220

- Nasdaq up 75.1 points (0.6%) at 13052.7

- US 10-Yr yield is down 9.8 bps at 3.7%

- US Jun 10-Yr futures are up 24/32 at 113-5

- EURUSD up 0.0013 (0.12%) at 1.072

- USDJPY down 0.59 (-0.42%) at 139.86

- WTI Crude Oil (front-month) down $3.01 (-4.14%) at $69.67

- Gold is up $15.85 (0.82%) at $1959.05

- EuroStoxx 50 down 28.43 points (-0.66%) at 4291.58

- FTSE 100 down 105.13 points (-1.38%) at 7522.07

- German DAX down 43.82 points (-0.27%) at 15908.91

- French CAC 40 down 94.06 points (-1.29%) at 7209.75

US TREASURY FUTURES CLOSE

- 3M10Y -9.169, -159.032 (L: -164.769 / H: -156.223)

- 2Y10Y -1.532, -78.099 (L: -83.592 / H: -77.655)

- 2Y30Y +2.473, -57.859 (L: -68.014 / H: -57.423)

- 5Y30Y +4.452, 7.461 (L: -0.59 / H: 7.626)

- Current futures levels:

- Jun 2-Yr futures up 5.25/32 at 102-3.125 (L: 101-26.375 / H: 102-03.75)

- Jun 5-Yr futures up 15.75/32 at 108-2 (L: 107-10.75 / H: 108-03.75)

- Jun 10-Yr futures up 24/32 at 113-5 (L: 112-03.5 / H: 113-08.5)

- Jun 30-Yr futures up 1-17/32 at 127-5 (L: 125-13 / H: 127-15)

- Jun Ultra futures up 1-14/32 at 135-5 (L: 133-07 / H: 135-23)

US 10YR FUTURE TECHS: (M3) Corrective Bounce

- RES 4: 114-16+ 50-day EMA

- RES 3: 114-07 20-day EMA

- RES 2: 113-25 High May 24

- RES 1: 113-12+ High May 25

- PRICE: 113-05+ @ 1215ET May 30

- SUP 1: 112-03+ Intraday low

- SUP 2: 111-31 76.4% retracement of the Mar 2 - 24 rally

- SUP 3: 111-20+ Low Mar 10

- SUP 4: 111-00 Round number support

Treasury futures have registered another short-term trend low today of 112-03+. Price has also recovered from today’s low. The trend outlook is bearish and short-term gains are considered corrective. The recent break of 113-30+, the Apr 19 low and a key support, reinforced a bearish theme and the focus is on 111-31 next, 76.4% of the Mar 2 - 24 rally. Initial resistance is seen at 113-12+, the May 25 high.

SOFR FUTURES CLOSE

- Jun 23 -0.008 at 94.665

- Sep 23 +0.025 at 94.780

- Dec 23 +0.070 at 95.085

- Mar 24 +0.115 at 95.525

- Red Pack (Jun 24-Mar 25) +0.160 to +0.190

- Green Pack (Jun 25-Mar 26) +0.170 to +0.175

- Blue Pack (Jun 26-Mar 27) +0.135 to +0.160

- Gold Pack (Jun 27-Mar 28) +0.105 to +0.125

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00682 to 5.16026 (+.05971 total last wk)

- 3M +0.01291 to 5.27665 (+.10027 total last wk)

- 6M +0.02073 to 5.31909 (+.15183 total last wk)

- 12M +0.06031 to 5.16202 (+.22405 total last wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00014 to 5.06557%

- 1M +0.01672 to 5.17043%

- 3M +0.02029 to 5.49600 */**

- 6M +0.03757 to 5.61857%

- 12M +0.07000 to 5.73029%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.49600% on 5/30/23

- Daily Effective Fed Funds Rate: 5.08% volume: $136B

- Daily Overnight Bank Funding Rate: 5.07% volume: $286B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.476T

- Broad General Collateral Rate (BGCR): 5.05%, $588B

- Tri-Party General Collateral Rate (TGCR): 5.05%, $582B

- (rate, volume levels reflect prior session)

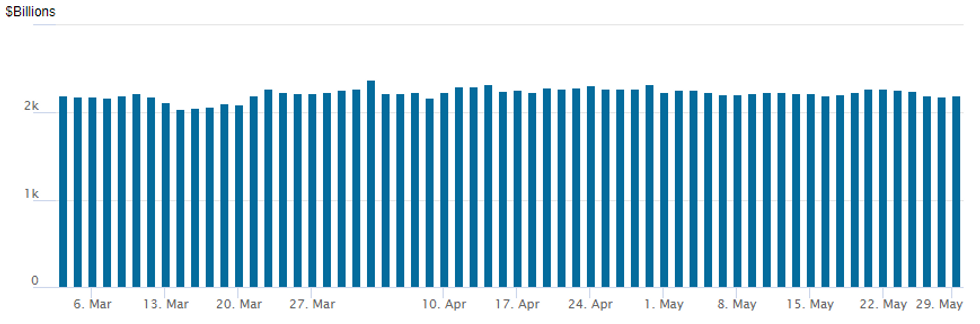

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebounds to $2,200.479B w/ 103 counterparties, compares to prior $2,189.638B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

$2.75B ATT Long 10Y Debt Launched

Total $13.35B in corporate bonds to price Tuesday.- Date $MM Issuer (Priced *, Launch #)

- 05/30 $5B #CVS Health Corp $1B +5Y +125, $750M +7Y +155, $1.25B 10Y +165, $1.25B 30Y +200, $750M 40Y +215

- 05/30 $2.75B #AT&T +10Y +175

- 05/30 $1.75B Bank of Montreal $1.35B 3Y +120, $400M 3Y SOFR+133

- 05/30 $1.6B #TD Bank 3Y SOFR+73

- 05/30 $1B #AerCap Ireland 5Y +217

- 05/30 $750M #NiSource $300M 5Y +135, $450M 10Y +175

- 05/30 $500M *Kexim Bank 10Y +90

- 05/30 $Benchmark FAB (First Abu Dhabi Bank) 5Y Green (order book >$1B)

EGBs-GILTS CASH CLOSE: Bunds Outperform

European core FI rallied Tuesday with Bunds outperforming Gilts, and periphery spreads tightening.

- Bunds rallied from the start, with weaker-than-expected Spanish inflation data sending a dovish signal ahead of the remaining Eurozone CPI prints this week.

- They continued to strengthen steadily over the course of the session, helped by a strong BTP auction, and the reversal lower in equities in the afternoon helping underpin core bonds.

- The soft Spanish inflation reading induced a retracement in ECB hike pricing, with terminal rates envisaged 5bp lower than prior.

- Notably UK hike pricing was relatively steady, following on from last week's significant sell-off.

- Attention first thing Wednesday will be on German state and French inflation data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 9.6bps at 2.784%, 5-Yr is down 10.4bps at 2.356%, 10-Yr is down 9.2bps at 2.342%, and 30-Yr is down 6.9bps at 2.499%.

- UK: The 2-Yr yield is down 5.6bps at 4.435%, 5-Yr is down 6.4bps at 4.211%, 10-Yr is down 8.7bps at 4.247%, and 30-Yr is down 5.9bps at 4.584%.

- Italian BTP spread down 3.4bps at 180.9bps / Spanish down 1.7bps at 104.6bps

FOREX: AUDJPY Slides 1% Amid Equities Turnaround, MOF Warning

- Despite printing a new cycle high of 140.93 in early European trade, USDJPY has backtracked on Tuesday following an unscheduled tri-party meeting held between the Japanese FSA, the Ministry of Finance and the Bank of Japan.

- Following the meeting, Japan's currency diplomat Kanda warned that the Ministry would take appropriate steps on currency markets if required, and outlined their intention to consider various options.

- This news, combined with the waning optimism for equity markets after the US open has placed downward pressure on the pair which fell as low as 139.57 in mid-session trade. The turnaround is interesting given that price earlier arrived at the top of the bull channel drawn from the Jan 16 low which intersects at 140.81, representing a key resistance.

- The softer tone for risk weighed on the likes of the Australian dollar, prompting AUDJPY to fall the best part of 1%.

- Particular weakness was observed in crude futures, with near 4.5% declines across WTI and Brent pressuring the Norwegian Krone to the lowest level against the Euro since March 2020 (EURNOK high of 12.1064). Worth noting this price action comes ahead of tomorrow's Daily FX Purchases release for June - after the May figure disappointed markets by confirming NOK 1.4bln in daily purchases over the course of the month - this ran counter to expectations NOK selling could shift to NOK buying in the coming months.

- More broadly, the USD index trades close to unchanged as we approach the APAC crossover, with the greenback unable to gather any directional momentum following Monday’s holiday thinned trade.

- RBA Governor Lowe is due to speak overnight before the release of Australian April CPI data. Focus then shifts to Europe and preliminary reads of German regional CPI figures ahead of the June 15 ECB meeting. Canadian GDP and US Jolts data will also cross amid potential month-end dynamics.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/05/2023 | 2350/0850 | ** |  | JP | Industrial production |

| 31/05/2023 | 2350/0850 | * |  | JP | Retail sales (p) |

| 31/05/2023 | 0130/1130 | *** |  | AU | CPI Inflation Monthly |

| 31/05/2023 | 0130/1130 | *** |  | AU | Quarterly construction work done |

| 31/05/2023 | 0530/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 31/05/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 31/05/2023 | 0630/0830 | ** |  | CH | Retail Sales |

| 31/05/2023 | 0630/0730 |  | UK | DMO to Publish Gilt Op Calendar for Jul-Sep | |

| 31/05/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/05/2023 | 0645/0845 | ** |  | FR | PPI |

| 31/05/2023 | 0645/0845 | *** |  | FR | GDP (f) |

| 31/05/2023 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/05/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 31/05/2023 | 0800/1000 | *** |  | IT | GDP (f) |

| 31/05/2023 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 31/05/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 31/05/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 31/05/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/05/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 31/05/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 31/05/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 31/05/2023 | 1230/0830 | *** |  | CA | GDP - Canadian Economic Accounts |

| 31/05/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/05/2023 | 1230/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 31/05/2023 | 1230/1430 |  | EU | ECB Lagarde Q&A at Generation Euro Students' Awards | |

| 31/05/2023 | 1250/0850 |  | US | Boston Fed's Susan Collins | |

| 31/05/2023 | 1250/0850 |  | US | Fed Governor Miki Bowman | |

| 31/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 31/05/2023 | 1315/1415 |  | UK | BOE Mann Panellist at Pictet Family Forum | |

| 31/05/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 31/05/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 31/05/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 31/05/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 31/05/2023 | 1730/1330 |  | US | Philadelphia Fed's Pat Harker | |

| 31/05/2023 | 1730/1330 |  | US | Fed Governor Philip Jefferson | |

| 31/05/2023 | 1800/1400 |  | US | Fed Beige Book | |

| 01/06/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.