-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Projected Rate Cuts Consolidate Post Data

- MNI US FED: St Louis Fed's Musalem Shifts In Dovish Direction, Open To Sept Cut

- MNI US DATA: Jobless Claims Again Rule Out Sharper Labor Deterioration

- MNI US DATA: Import Prices Offer Some Mild Inflationary Pressure

- MNI US DATA: Core Retail Sales Momentum Picking Up

US

US FED (MNI): St Louis Fed's Musalem Shifts In Dovish Direction, Open To Sept Cut

St Louis Fed Pres Musalem is one of the most hawkish members of the FOMC, but his comments today suggest he is falling in line with the Fed leadership's view that risks to the inflation vs employment mandates have come into balance.

- Importantly, the 2025 voter notes that the tight labor market no longer appears to pose upside inflation risks, and that while policy is merely "moderately" restrictive, "inflation seems to have returned to a path consistent with 2% over time".

- By saying that "the time may be nearing when an adjustment to moderately restrictive policy may be appropriate", there doesn't appear to be much remaining opposition on the Committee to a September rate cut. As recently as mid-June he said it would more likely take "quarters" than "months" before he would be "confident" about cutting rates.

NEWS

US (MNI): Senate Leader Schumer Embraces Crypto Industry

Senate Majority Leader Chuck Schumer (D-NY) is the latest senior politician to embrace the crypto industry, speaking yesterday at the virtual campaign event: “Crypto4Harris”. Schumer’s remarks cap a successful streak in Washington that has seen major legislative wins and a series of heavyweight politicians, including former President Trump, lining up behind the industry.

UKRAINE (MNI): Pres. Adviser-Ukraine Not Interested In Occupying Russian Territory:

Ukraine's assault into Russia's Kursk oblast continues amid a fog of war that makes verifying any claims of territorial gain or defence by either side a difficult prospect. A short time ago, Russian state-run RIA reported comments from Chechen Akhmat special forces commander Apti Alaudinov claiming that Ukrainian troops do not have full control over the town of Sudzha.

ISRAEL (MNI): Ceasefire Talks Begin, NYT: US Offs-IDF Has Achieved All It Can In Gaza:

Talks involving a high-level Israeli delegation, and mediators from the US, Egypt and Qatar meet in Doha today to begin the latest round of talks on reaching a hostages-for-ceasefire agreement with Hamas. Hamas will not participate directly in the talks, arguing that a UNSC-approved resolution is already on the table, but will talk to mediators afterwards.

US TSYS Retail Sales Pickup Tempers Rate Cut Projections

- Treasuries gapped lower following better than expected Retail Sales this morning, trading sideways near lows through the balance of the session as markets digested the flood of additional data.

- Decent volumes (TYU4 >2M, FVU4 >1.5M) as Sep'10Y futures trade 113-00 (-25) vs. 112-25.5 low, above technical support of 112-11 (20-Day EMA); curves bear flattened 2s10s -5.320 at -18.007.

- Projected rate cuts through year end moderated vs. earlier pre-data levels (*): Sep'24 cumulative -31.8bp (-35.2bp), Nov'24 cumulative -62.0bp (-69.6bp), Dec'24 -93.5bp (-104.1bp).

- July's advance retail sales report showed that the recent unexpected pickup in consumer momentum continues. June retail sales came in well above expectations at 1.0% M/M (0.4% expected, -0.2% prior rev from 0.0%).

- Initial jobless claims surprised lower for the second consecutive week with a seasonally adjusted 227k (cons 235k) in the week to Aug 10 after a marginally upward revised 234k (initial 233k).

- Import prices were stronger than expected in July as they increased 0.1% M/M (cons -0.1) after 0.0%, with non-oil import prices also a little stronger than expected at 0.2% M/M (cons 0.1).

- Industrial production fell by more than expected in July, at -0.64% M/M (cons -0.3) along with a downward revised 0.3% (initial 0.6) in June and 0.8% (initial 0.9) in May.

OVERNIGHT DATA

US DATA (MNI): Core Retail Sales Momentum Picking Up

July's advance retail sales report showed that the recent unexpected pickup in consumer momentum continues. June retail sales came in well above expectations at 1.0% M/M (0.4% expected, -0.2% prior rev from 0.0%).

- The core readings also impressed, with slight upward revisions (on an unrounded basis): ex-auto sales rose 0.4% (vs 0.1% expected, 0.5% prior rev up 0.1pp), with ex-auto/gas up 0.4% (0.2% expected, 0.8% prior) and the key Control Group up 0.3% (0.1% expected, 0.9% prior).

- Touching briefly on the sectoral dynamics, the beat was driven by a sharp rebound in motor vehicle sales (+3.6% vs -3.4% prior), which is the largest single retail category, with food/beverage and food services/drinking places, and general merchandise store sales all accelerating. Those helped offset a large slowdown in the 2nd largest category, nonstore retail (+0.2% from +2.2% prior).

US DATA (MNI): Jobless Claims Again Rule Out Sharper Labor Deterioration

Initial jobless claims surprised lower for the second consecutive week with a seasonally adjusted 227k (cons 235k) in the week to Aug 10 after a marginally upward revised 234k (initial 233k). The four-week moving average dropped from 241k to 237k as the first week of the initial Beryl boost drops out, after the 241k had been the highest since Aug 2023.

- Within the NSA data, there were no major drivers behind -4.5k weekly change. California the largest at -2.2k, then Texas (-1.4k). The latter continues to correct from its Beryl spike and at 18.5k sees another step closer to the ~15k typically seen at this time of year.

- Continuing claims also surprised lower at a seasonally adjusted 1864k (cons 1870k) in the week to Aug 3 after a downward revised 1871k (initial 1875k). To be clear though this is only a small dip after what had been the highest since Nov 2021.

- The NSA continuing claims data continue to paint a very similar picture to recent weeks, i.e. tracking right at the top of typical ranges in the three years prior to the pandemic but they haven’t shown a marked increase against that relative basis for more than a month now.

US DATA (MNI): Import Prices Offer Some Mild Inflationary Pressure

Import prices were stronger than expected in July as they increased 0.1% M/M (cons -0.1) after 0.0%, with non-oil import prices also a little stronger than expected at 0.2% M/M (cons 0.1).

- Non-oil import prices have recently better tracked the monthly spikes in core PPI measures, with both exceeding CPI core goods prices in a sign of curtailed ability to pass costs on as surveys have been noting.

- Nevertheless, in trend terms, non-oil import price inflation has now increased to 1.1% Y/Y, off the recent low of -2.2% Y/Y from May 23 and from -1.3% Y/Y back in January.

US DATA (MNI): IP Miss And Downward Revisions Take Gloss Off Recent Recovery

Industrial production fell by more than expected in July, at -0.64% M/M (cons -0.3) along with a downward revised 0.3% (initial 0.6) in June and 0.8% (initial 0.9) in May. The July miss was placated a bit by the manufacturing component coming in as expected at -0.29% M/M (cons -0.3) although it also saw solid downward revisions to 0.0% (initial 0.4) in June. The additional monthly drag was driven by utilities, at -3.7% M/M after a 2.6% increase in June.

US DATA (MNI): Philly Fed Mfg Slips, Expected Price Components Reverse Prior Spike

The Empire and Philly Fed manufacturing reports were on balance softer than expected in August. Empire improved a touch (to -4.7 vs cons -6.0, after -6.6) but Philly fell more notably (-7.0 vs cons +5.2, after +13.9) - we put more weight on Philly as Empire tends to be more volatile.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 506.45 points (1.27%) at 40514.02

- S&P E-Mini Future up 83 points (1.52%) at 5560.5

- Nasdaq up 372 points (2.2%) at 17563.97

- US 10-Yr yield is up 8 bps at 3.915%

- US Sep 10-Yr futures are down 25/32 at 112-31.5

- EURUSD down 0.0039 (-0.35%) at 1.0973

- USDJPY up 1.69 (1.15%) at 149.02

- WTI Crude Oil (front-month) up $0.92 (1.2%) at $77.90

- Gold is up $7.51 (0.31%) at $2455.38

- European bourses closing levels:

- EuroStoxx 50 up 80.17 points (1.7%) at 4807.77

- FTSE 100 up 66.3 points (0.8%) at 8347.35

- German DAX up 297.64 points (1.66%) at 18183.24

- French CAC 40 up 90.01 points (1.23%) at 7423.37

US TREASURY FUTURES CLOSE

- 3M10Y +6.753, -131.224 (L: -139.11 / H: -127.594)

- 2Y10Y -5.738, -18.425 (L: -18.634 / H: -6.745)

- 2Y30Y -9.015, 7.276 (L: 7.152 / H: 21.143)

- 5Y30Y -6.349, 37.982 (L: 37.705 / H: 47.007)

- Current futures levels:

- Sep 2-Yr futures down 9.5/32 at 103-2.625 (L: 103-01.625 / H: 103-12)

- Sep 5-Yr futures down 19.25/32 at 108-21.5 (L: 108-18.75 / H: 109-07.5)

- Sep 10-Yr futures down 25/32 at 112-31.5 (L: 112-25.5 / H: 113-23)

- Sep 30-Yr futures down 1-07/32 at 123-12 (L: 122-21 / H: 124-17)

- Sep Ultra futures down 1-17/32 at 131-23 (L: 130-19 / H: 133-04)

US 10Y FUTURE TECHS:

- RES 4: 116-00 Round number resistance

- RES 3: 115-30+ 2.764 proj of the Apr 25 - May 16 - 29 price swing

- RES 2: 115-17 2.618 proj of the Apr 25 - May 16 - 29 price swing

- RES 1: 114-03/115-03+ High Aug 6 / 5 and the bull trigger

- PRICE: 112-31 @ 1520 ET Aug 15

- SUP 1: 112-11 20-day EMA

- SUP 2: 111-10+ 50-day EMA values

- SUP 3: 110-18+ Low Jul 22

- SUP 4: 110-07 Low Jul 9

A bullish theme in Treasuries remains intact following recent gains and this week’s recovery is seen as a positive development. Moving average studies are in a bull-mode position and the recent breach of 111-01, the Jun 14 high, confirmed a resumption of the uptrend. Scope is seen for 115-17, a Fibonacci projection. The recent move down is considered corrective. Initial support to watch is 112-11, the 20-day EMA.

SOFR FUTURES CLOSE

- Sep 24 -0.060 at 95.050

- Dec 24 -0.140 at 95.650

- Mar 25 -0.190 at 96.105

- Jun 25 -0.210 at 96.390

- Red Pack (Sep 25-Jun 26) -0.205 to -0.16

- Green Pack (Sep 26-Jun 27) -0.145 to -0.12

- Blue Pack (Sep 27-Jun 28) -0.115 to -0.09

- Gold Pack (Sep 28-Jun 29) -0.08 to -0.065

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00293 to 5.34157 (+0.00805/wk)

- 3M +0.00602 to 5.10155 (-0.01114/wk)

- 6M +0.00234 to 4.78062 (-0.02535/wk)

- 12M -0.01283 to 4.28661 (-0.06947/Wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (-0.01), volume: $2.108T

- Broad General Collateral Rate (BGCR): 5.32% (-0.02), volume: $801B

- Tri-Party General Collateral Rate (TGCR): 5.32% (-0.02), volume: $781B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $99B

- Daily Overnight Bank Funding Rate: 5.32% (-0.01), volume: $247B

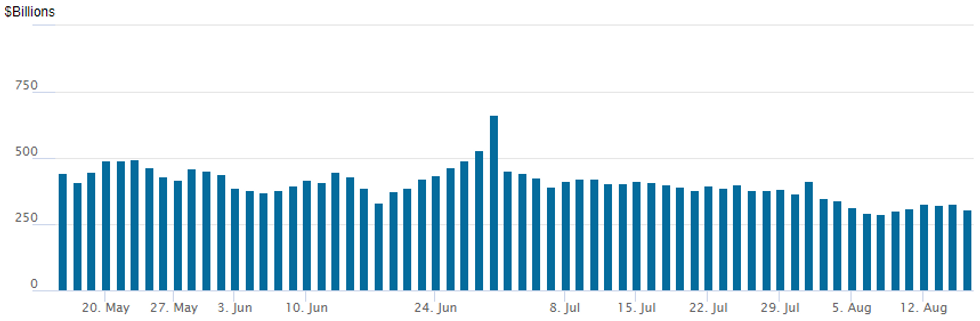

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage recedes up to $307.141B from $328.472B Wednesday -- compares to $286.660B on Wednesday, Aug 7 -- the lowest since mid-May 2021. Number of counterparties slip to 63 from 66 prior.

PIPELINE $1.85B Quest Diagnostics 3Pt Launched

$6.5B to Price Thursday, $29.4B total/wk- Date $MM Issuer (Priced *, Launch #)

- 8/15 $1.85B #Quest Diagnostics $400M 3Y +70, $600M 5Y +85, $850M 10Y +112.5

- 8/15 $1.5B #Cox Communications $750M 10Y +157, $750M 30Y +177

- 8/15 $1.5B #Prime Healthcare 5NC2 9.375%

- 8/15 $850M #Boston Properties +10Y +183

- 8/15 $800M #Western Midstream 10Y +155

- 8/15 $Benchmark Devon Energy customer calls

EGBs-GILTS CASH CLOSE: Robust US Data Sees Bund/Gilt Yields Jump

European yields jumped Thursday after strong US economic data cast fresh doubt on the global rate cut narrative.

- The session started in relatively subdued fashion, with modest overnight weakness in futures, interrupted by a slight uptick after a broadly in-line UK GDP release with softer underlying details.

- The Assumption Day holiday limited EGB trading volumes.

- But Bunds and Gilts turned sharply lower in early afternoon trade on stronger-than-expected US retail sales and jobless claims data, pushing yields higher across the curves and reducing 2024 implied ECB/BoE rate cuts by a few basis points.

- The German curve bear flattened, with the UK's more mixed with underperformance in the belly. Periphery EGB spreads tightened slightly on the day, as equities rallied (Eurostoxx futures +2%).

- A busy week in UK data concludes Friday with Retail Sales, while the Eurozone calendar remains light.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 10.6bps at 2.46%, 5-Yr is up 10.3bps at 2.195%, 10-Yr is up 8.3bps at 2.263%, and 30-Yr is up 5.9bps at 2.482%.

- UK: The 2-Yr yield is up 8.7bps at 3.653%, 5-Yr is up 10.1bps at 3.718%, 10-Yr is up 9.8bps at 3.923%, and 30-Yr is up 7.8bps at 4.48%.

- Italian BTP spread down 1.5bps at 136.9bps / Spanish down 1.3bps at 82.7bps

FOREX USDJPY Rises Above Pre-NFP Levels Amid Higher Yields/Equities

- Better-than-expected US retail sales and jobless claims data provided a strong boost to global equity benchmarks on Thursday. Furthermore, higher core yields as Fed easing bets were trimmed weighed heavily on the Japanese Yen, with USDJPY erasing the entire post-NFP inspired sell-off.

- USDJPY has risen 1.15% on the session and in the process, bridged the gap to 149.01, levels last traded before US employment data on August 02. This extends the pair’s recovery to around 5.15% as the market prices out the likelihood of a 50bp FOMC cut in September.

- The strong risk-on impulse was most notable for crosses such as GBPJPY and AUDJPY, that are nearing 1.5% advances on the day. In similar vein, EURJPY has risen 0.85%, and a close at current or higher levels would mark a breach of key resistance at the 20-day EMA (163.59) and narrows the gap with 164.11 - the 200-dma which has acted as solid support/resistance on several sessions in recent history - most notably across November and December last year.

- Elsewhere, similar dynamics filtered through to Swiss Franc weakness, with USDCHF rising 0.85% and also bridging the gap to pre-NFP levels.

- For major pairs, GBPUSD’s climb undermines the recent bearish theme and price remains above the 20-day EMA - at 1.2807. A continuation higher would highlight a stronger reversal and signal scope for a climb towards 1.2955, a Fibonacci retracement. Key support has been defined at 1.2665, the Aug 8 low, where a break is required to once again resume recent bearish activity.

- RBA and RBNZ Governors may speak overnight before UK retail sales data is due Friday. In the US, building permits and UMich sentiment data will close out the week.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/08/2024 | 0600/0700 | *** |  | UK | Retail Sales |

| 16/08/2024 | 0900/1100 | * |  | EU | Trade Balance |

| 16/08/2024 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 16/08/2024 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 16/08/2024 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 16/08/2024 | 1230/0830 | *** |  | US | Housing Starts |

| 16/08/2024 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 16/08/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.