-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Recession Cares Spurs Bull Flattening Post Data

EXECUTIVE SUMMARY

US

FED: Federal Reserve Governor Chris Waller on Wednesday said he was warming up to the idea of slowing the pace of rate interest rate hikes to 50 basis poins at the FOMC's next meeting in December, citing signs of dampening demand that will help bend the steep trajectory of inflation.

- A "very welcome" moderation in CPI growth last week and some signs that the labor market may be loosening, along with the "significant, cumulative effect" of having already raised rates aggressively earlier this year, bolster the case for slowing the pace of rate hikes while "continuing to climb," he said.

- "The data of the past few weeks have made me more comfortable considering stepping down to a 50-basis-point hike," he said in remarks prepared for an economics forecast luncheon in Phoenix, Ariz. For more see MNI Policy main wire at 1435ET.

FED: New York Fed President John Williams Wednesday pushed back against the notion that there is a trade-off between price stability and financial stability goals, and stressed the need to find solutions that strengthen the financial system.

- "The time is now to find solutions that strengthen our financial system without compromising our monetary policy goals," said Williams, the FOMC vice chair, speaking at a conference on resiliency in the U.S. Treasury market. "If the Treasury market isn’t functioning well, it can impede the transmission of monetary policy to the economy."

- "Using monetary policy to mitigate financial stability vulnerabilities can lead to unfavorable outcomes for the economy," he said. "Monetary policy should not try to be a jack of all trades and a master of none. There must be a better way." Regulators this year have ramped up efforts to reform the Treasury market including mandating central clearing. (See: MNI: US Treasury Clearing To Limit Contagion, Create New Risks).

CANADA

CAN: Canada's inflation rate was unchanged at 6.9% in October while core prices edged back toward record highs, the last such figures central bankers see before deciding whether to hike another 50bps next month or to step back to a quarter-point move.

- Consumer prices climbed 0.7% on a monthly basis, less than the 0.9% economists predicted, and the year-over-year pace also lagged the forecast of 7%. Headline inflation is still closer to June's four-decade high of 8.1% than the Bank of Canada's 2% target that policy makers say won't be reached until the end of 2024.

- The "median" core index the preferred by the BOC quickened to 4.8% from 4.7%, close to the record 4.9% set in June. The "trim" core index also moved up to 5.3% from 5.2%, also nearer to the record of 5.5%. The Bank recently abandoned its focus on the "common" core measure.

US TSYS: Rising Bonds Lifts All Durations

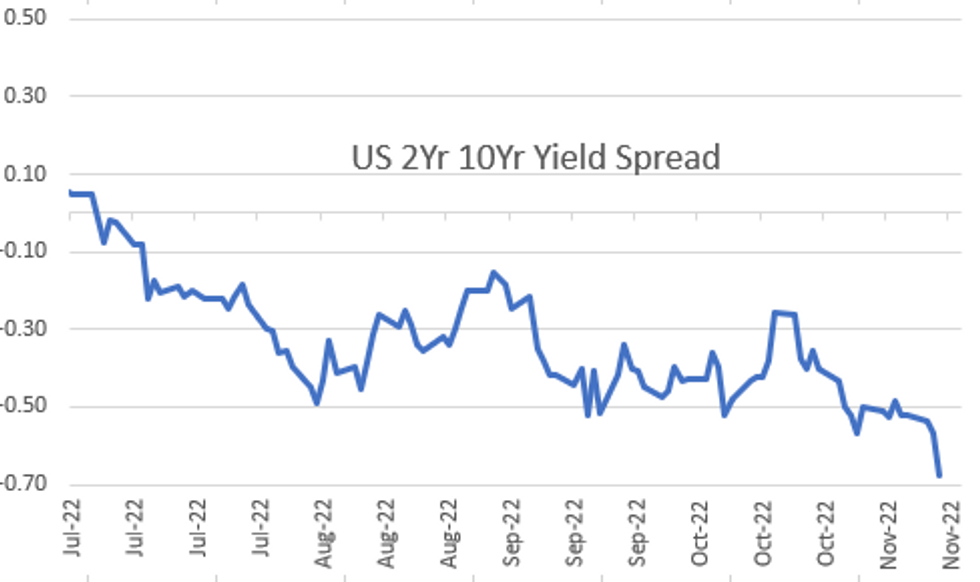

Focus on bull curve flattening as 2s10s falls to new all-time inverted low of -67.982 with Bonds extending session highs in late trade (30YY 3.8369% low), short end lagging after stronger Retail Sales (+1.3% vs. 1.0% est, ex-auto +1.3% vs. 0.5% est).

- Stronger revisions to prior, and a robust +0.7% M/M control group number (which is what feeds into the GDP calculations).The 1.3% overall gains included positive M/M readings in most categories.

- Short end came under heavy pressure for much of the session, tempering yr-end "step-down" pricing. Back on track in late trade: Fed funds implied hike for Dec'22 down to 49.3bs from 49.8bp, Feb'23 cumulative 83.6bp vs. 85.3bp, to 4.686%, terminal 4.905% in Jun'23 (5.08% pre-CPI).

- Tsy futures gapped higher after strong $15B 20Y bond auction (912810TM0) trades through: 4.072% high yield vs. 4.102% WI; 2.64x bid-to-cover vs. prior month's 2.5x.

- Indirect take-up climbs to 75.35% vs. 63.70% prior month; direct bidder take-up 15.40% vs. 19.86% prior; primary dealer take-up 9.25% vs. 16.43%.

OVERNIGHT DATA

- US OCT RETAIL SALES +1.3%; EX-MOTOR VEH +1.3%

- US SEP RETAIL SALES REVISED +0.0%; EX-MV +0.1%

- US OCT RET SALES EX GAS & MTR VEH & PARTS DEALERS +0.9% V SEP +0.6%

- US OCT RET SALES EX MTR VEH & PARTS DEALERS +1.3% V US OCT +0.1%

- US OCT RET SALES EX AUTO, BLDG MATL & GAS +0.9% V SEP +0.7%

- A solid October retail sales report, with stronger revisions to prior, and a robust +0.7% M/M control group number (which is what feeds into the GDP calculations).

- The 1.3% overall gains included positive M/M readings in most categories.

- As usual, the impact of inflation will be a point of contention for October's retail sales beat - real retail sales is close to flat Y/Y (vs the 8.3% Y/Y gain in nominal).

- US OCT IMPORT PRICES -0.2%

- US OCT EXPORT PRICES -0.3%; NON-AG -0.3%; AGRICULTURE -1.0%

- US SEP BUSINESS INVENTORIES +0.4%; SALES +0.2%

- US SEP RETAIL INVENTORIES +0.4%

- US NAHB HOUSING MARKET INDEX 33 IN NOV

- US NAHB NOV SINGLE FAMILY SALES INDEX 39; NEXT 6-MO 31

- US OCT INDUSTRIAL PROD -0.1%; CAP UTIL 79.9%

- US SEP IP REV TO +0.1%; CAP UTIL REV 80.1%

- US OCT MFG OUTPUT +0.1%

- US DATA: Manufacturing Struggles Evident In Industrial Production

- Industrial production surprisingly dipped -0.1% M/M in October (cons 0.1%) after a downward revised 0.1% M/M in Sep (0.4% initially), and with similar relative weakness when just looking at manufacturing.

- It offers a weaker perspective than the beat for retail sales just earlier, more in line with most recent weakness in core durable goods orders in Sept (-0.4% M/M, Oct released next week).

- The ISM mfg of 50.2 in October suggests potential further downside in 3M/3M trend rates to the +1.5% annualised in Oct - see chart.

- Capacity utilisation meanwhile also fell more than expected, at 79.9% (cons 80.4) from 80.1 (80.3 initially) although that's only the lowest since June and remains historically elevated.

- US MBA: MARKET COMPOSITE +2.7% SA THRU NOV 11 WK

- US MBA: REFIS -2% SA; PURCH INDEX +4% SA THRU NOV 11 WK

- US MBA: UNADJ PURCHASE INDEX -46% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 6.90% VS 7.14% PREV

- CANADA OCT CPI 6.9% YOY VS FORECAST 7.0%, SEPT 6.9%

- CANADA OCT CPI 0.7% MOM VS FORECAST +0.9%, SEPT +0.1%

- CANADA OCT CPI EX FOOD & ENERGY +0.3% MOM; 5.3% YOY

- CANADA OCT CORE TRIM CPI 5.3% YOY FROM SEPT 5.2%

- CANADA OCT CORE MEDIAN CPI 4.8% FROM SEPT 4.7%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 25.38 points (-0.08%) at 33568.25

- S&P E-Mini Future down 31.75 points (-0.79%) at 3968

- Nasdaq down 176.4 points (-1.6%) at 11182.55

- US 10-Yr yield is down 8.2 bps at 3.688%

- US Dec 10Y are up 21.5/32 at 113-7.5

- EURUSD up 0.0038 (0.37%) at 1.0388

- USDJPY up 0.12 (0.09%) at 139.4

- WTI Crude Oil (front-month) down $1.33 (-1.53%) at $85.58

- Gold is down $5.36 (-0.3%) at $1773.67

- EuroStoxx 50 down 32.31 points (-0.83%) at 3882.78

- FTSE 100 down 18.25 points (-0.25%) at 7351.19

- German DAX down 144.48 points (-1%) at 14234.03

- French CAC 40 down 34.44 points (-0.52%) at 6607.22

US TSY FUTURES CLOSE

- 3M10Y -8.365, -55.903 (L: -57.272 / H: -42.323)

- 2Y10Y -9.832, -67.324 (L: -67.877 / H: -54.969)

- 2Y30Y -11.879, -50.268 (L: -51.546 / H: -36.848)

- 5Y30Y -4.806, 1.353 (L: -0.207 / H: 7.162)

- Current futures levels:

- Dec 2Y up 0.5/32 at 102-14.125 (L: 102-11.125 / H: 102-16.375)

- Dec 5Y up 9.25/32 at 108-9.75 (L: 107-25.75 / H: 108-11.25)

- Dec 10Y up 21/32 at 113-7 (L: 112-08 / H: 113-08)

- Dec 30Y up 61/32 at 126-14 (L: 124-02 / H: 126-17)

- Dec Ultra 30Y up 87/32 at 134-21 (L: 131-09 / H: 134-24)

US 10YR FUTURE TECH: (Z2) Bull Flag

- RES 4: 115-14+ 50.0% retracement of the Aug 2 - Oct 21 downleg

- RES 3: 114-17 High Sep 20

- RES 2: 113-30 High Oct 4 and a key resistance

- RES 1: 113-05+ Intra-day High Nov 16

- PRICE: 113-00 @ 1445 GMT Nov 16

- SUP 1: 111-08/109-10+ 20-day EMA / Low Nov 04

- SUP 2: 108-26+ Low Oct 21 and the bear trigger

- SUP 3: 108-06+ Low Oct 2007 (cont)

- SUP 4: 107.23 3.0% 10-dma envelope

Short-term trend direction in Treasuries remains up. The current pause in the uptrend appears to be a bull flag, reinforcing bullish conditions. The contract has pierced the 50-day EMA, at 112-12+. A clear break of this EMA would strengthen the case for short-term bulls and open 113-30, the Oct 4 high and a key resistance. On the downside, key support lies at 108-26+, the Oct 21 low. Initial support lies at 111-08, the 20-day EMA.

US EURODOLLAR FUTURES CLOSE

- Dec 22 +0.018 at 95.010

- Mar 23 -0.005 at 94.820

- Jun 23 -0.005 at 94.810

- Sep 23 -0.010 at 95.075

- Red Pack (Dec 23-Sep 24) -0.005 to +0.065

- Green Pack (Dec 24-Sep 25) +0.080 to +0.110

- Blue Pack (Dec 25-Sep 26) +0.120 to +0.130

- Gold Pack (Dec 26-Sep 27) +0.135 to +0.140

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00372 to 3.81729% (+0.00243/wk)

- 1M +0.00714 to 3.91071% (+0.03542/wk)

- 3M +0.02458 to 4.67429% (+0.06815/wk) * / **

- 6M -0.00300 to 5.08200% (-0.00200/wk)

- 12M +0.00472 to 5.46486% (+0.01357/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.67429% on 11/16/22

- Daily Effective Fed Funds Rate: 3.83% volume: $97B

- Daily Overnight Bank Funding Rate: 3.82% volume: $275B

- Secured Overnight Financing Rate (SOFR): 3.80%, $1.149T

- Broad General Collateral Rate (BGCR): 3.77%, $441B

- Tri-Party General Collateral Rate (TGCR): 3.77%, $407B

- (rate, volume levels reflect prior session)

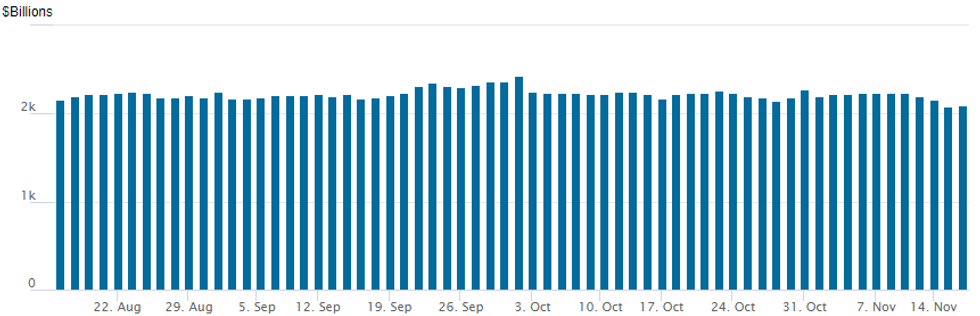

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage bounces slightly to $2,099.070B w/ 103 counterparties vs. $2,089.574B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

PIPELINE: $3B National Australian Bank 2Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 11/16 $3B #NAB (National Australian Bank) $1.35B 2Y +80, $1.65B 5Y SOFR+105

- 11/16 $1B #Open Text 5Y 6.9%

- 11/16 $1B Kommuninvest 2Y SOFR +20

- 11/16 $850M #Dominion Energy 10Y +175

- 11/16 $500M #General Mills 3NC1 +110

EGBs-GILTS CASH CLOSE: German Inversion Deepens

European yields dropped sharply Wednesday in a mostly bull-flattening motion.

- German 2s10s inversion set a fresh record for this cycle as part of a global flattening move, which occurred despite largely in-line/above-expected global data (including 41-year high UK CPI).

- A multitude of ECB speakers (de Cos, Villeroy, Muller, Makhlouf among others) leaned mostly dovish on aggregate - terminal rate pricing fell 3bp on the day.

- BTP spreads fell again but 10Y/Bund climbed 6bp off session lows.

- Banks' early TLTRO repayments come into focus later this week (see our analysis of expectations, including links to MNI Policy exclusive interviews).

- Gilts outperformed, with yields across the curve now well below pre-Sept mini-budget. Focus now turns to the UK Autumn Statement Thursday (preview here).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 7.5bps at 2.095%, 5-Yr is down 11.1bps at 1.955%, 10-Yr is down 11.2bps at 1.996%, and 30-Yr is down 11.5bps at 1.937%.

- UK: The 2-Yr yield is down 10.8bps at 2.993%, 5-Yr is down 12.4bps at 3.19%, 10-Yr is down 14.6bps at 3.149%, and 30-Yr is down 15.8bps at 3.313%.

- Italian BTP spread down 1.4bps at 193.8bps / Greek up 9bps at 225.3bps

FOREX: Early USD Index Declines Reverse Course, CNH Underperforms On Housing Data

- Following the late knock to risk sentiment on Tuesday following reports of a missile strike crossing the Ukrainian border into Poland, the market fallout looks more contained Wednesday with the greenback initially resuming its most recent weakening trend before the USD index reverted back to unchanged levels approaching the APAC crossover.

- The stabilisation of markets follows firm intelligence reports that the errant missile strike was Ukrainian in origin, rather than Russian, leaving the triggering of NATO's collective defence far less likely after an emergency meeting this morning. Nonetheless, the sharp moves continue to underpin the fractious nature of markets at present, with front-end implied vols generally higher across G10.

- The late strength for the USD was partially underpinned by a firmer US retail sales report for October where the 1.3% overall retail sales gains included positive M/m readings in most categories. However, the dollar’s intra-day recovery could also be attributed to currency markets taking pause for breath, further evidenced by the mixed performance across G10.

- CNH was the worst performer, falling 0.8% against the greenback as data showing a continued decline in China's new home prices facilitated the upswing in USD/CNH. The value of new residential properties fell 0.37% M/m last month, which was the fastest pace of decline since Feb 2015.

- Faring better were both the Euro which consolidates just south of 1.04 and GBP which tracked either side of the 1.19 mark ahead of tomorrow’s awaited Autumn Statement.

- Overnight, Australian CPI will hit the wires before Philly Fed and Housing starts headline the US docket.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/11/2022 | 1230/0730 |  | US | Atlanta Fed's Raphael Bostic | |

| 17/11/2022 | 1230/1230 |  | UK | BOE Pill Speech at the Bristol Festival of Economics | |

| 17/11/2022 | - |  | UK | Autumn Statement with New OBR forecasts / Updated DMO Remit | |

| 17/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 17/11/2022 | 1300/0800 |  | US | St. Louis Fed's James Bullard | |

| 17/11/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 17/11/2022 | 1330/0830 | *** |  | US | Housing Starts |

| 17/11/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 17/11/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 17/11/2022 | 1415/0915 |  | US | Fed Governor Michelle Bowman | |

| 17/11/2022 | 1430/1430 |  | UK | BOE Tenreyro Speech at Asociacion Argentina de Economia Politica | |

| 17/11/2022 | 1440/0940 |  | US | Cleveland Fed's Loretta Mester | |

| 17/11/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 17/11/2022 | 1540/1040 |  | US | Minneapolis Fed's Neel Kashkari | |

| 17/11/2022 | 1540/1040 |  | US | Fed Governor Philip Jefferson | |

| 17/11/2022 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 17/11/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 17/11/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 17/11/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 17/11/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 17/11/2022 | 1845/1345 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.