-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Relief Rally On CPI Miss Holds

EXECUTIVE SUMMARY

- MNI: Fed's George Endorses 'More Measured' Rate Increases

- MNI: Fed’s Mester Says Bigger Risk Is Tightening Too Little

- MNI: Fed’s Harker Sees Slower Hike In Coming Months

- MNI: Logan Says May Soon Be Appropriate For Fed To Slow Hikes

- MNI BRIEF: Inflation Dip ‘Far From A Victory’-Fed’s Daly

- MNI POLICY: BOE Steering Clear Of Reserve Remuneration Change

US

FED: Federal Reserve Bank of Kansas City President Esther George on Thursday joined a growing chorus of officials calling for slower interest-rate increases in coming months, arguing a "steady and deliberate approach" to hikes would help avoid contributing to market volatility.

- "The speed at which rates have increased has likely contributed to the marked increase in policy rate uncertainty," she said in remarks prepared for an annual energy conference hosted by the Kansas City and Dallas Fed banks. "As the tightening cycle continues, now is a particularly important time to avoid unduly contributing to financial market volatility, especially as volatility stresses market liquidity with the potential to complicate balance sheet run-off plans."

- "A more measured approached to rate increases may be particularly useful as policymakers judge the economy’s response to higher rates," she said. For more see MNI Policy main wire at 1331ET.

FED: There is still a high risk of U.S. inflation rising further or remaining stubbornly high and the Federal Reserve should err on the side of tightening too much, Cleveland President Loretta Mester said Thursday.

- “Despite the moves we have made so far, given that inflation has consistently proven to be more persistent than expected and there are significant costs of continued high inflation, I currently view the larger risks as coming from tightening too little,” Mester said in prepared remarks to the Princeton Bendheim Center for Finance.

- The Fed has raised interest rates 375 basis points this year to a 3.75% to 4% range. It is expected to slow the pace of hikes to 50 basis points in December after a weaker-than-expected 7.7% rise in CPI in the year to October. For more see MNI Policy main wire at 1231ET.

FED: The Federal Reserve could slow the pace of interest rate increases in “upcoming months” but will continue to tighten monetary policy until financial conditions are “sufficiently restrictive,” Philadelphia Fed President Patrick Harker said Thursday.

- Harker’s comments come as weaker-than-expected October consumer inflation figures boosted market expectations that the FOMC will step down to a 50-basis-point hike in December after raising rates by 75 basis points for four meetings in a row.

- “In the upcoming months, in light of the cumulative tightening we have achieved, I expect we will slow the pace of our rate hikes as we approach a sufficiently restrictive stance,” Harker told the Risk Management Association in prepared remarks.

- “But I want to be clear: A rate hike of 50 basis points would still be significant.” For more see MNI Policy main wire at 0900ET.

- "While I believe it may soon be appropriate to slow the pace of rate increases so we can better assess how financial and economic conditions are evolving, I also believe a slower pace should not be taken to represent easier policy," she said in openings remarks at a Fed conference.

- "I don’t see the decision about slowing the pace as being particularly closely related to the incoming data," she added. "The restrictiveness of policy comes from the entire policy strategy—not just how fast rates rise, but the level they reach, the time spent at that level, and, importantly, the factors that determine further increases or decreases." For more see MNI Policy main wire at 0951ET.

- “This is just one piece of positive information,” she said. “It’s far from a victory, 7.7% is very limited relief,” she told a virtual Q&A hosted by the European Economics and Financial Centre.

- She said well-anchored long-run inflation expectations are comforting “but we can’t be complacent.” Bringing inflation back to the 2% target is mission number one, she said. “We’re going to continue on that job until that job is fully done.”

- Richmond Fed President Thomas Barkin told MNI this week the central bank could slow the pace of rate hikes while ultimately pushing rates higher than previously anticipated

UK

BOE: There is no sign the government will press the Bank of England to reduce interest it pays on reserves, a move which could save the public sector tens of billions of pounds a year and which has been recommended by former Deputy Governor Paul Tucker and other former senior BOE officials.

- With the Treasury planning big tax rises and spending cuts in its Nov 17 statement, introducing a tiered system slashing rates on the reserves paid to banks in return for bonds they sold during quantitative easing could save around 1.6% of GDP in 2023–24 and 1.2% in 2024–25, according to Tucker, who assumed the BOE would press ahead with plans to sell some of its gilts.

- But Governor Andrew Bailey has said he would view such a move as essentially a tax on banks and so fiscal, not monetary, policy. And, so far, Chancellor Jeremy Hunt seems not to have suggested it, with reports suggesting his focus is more on income tax thresholds and changes to capital gains tax. For more see MNI Policy main wire at 0618ET.

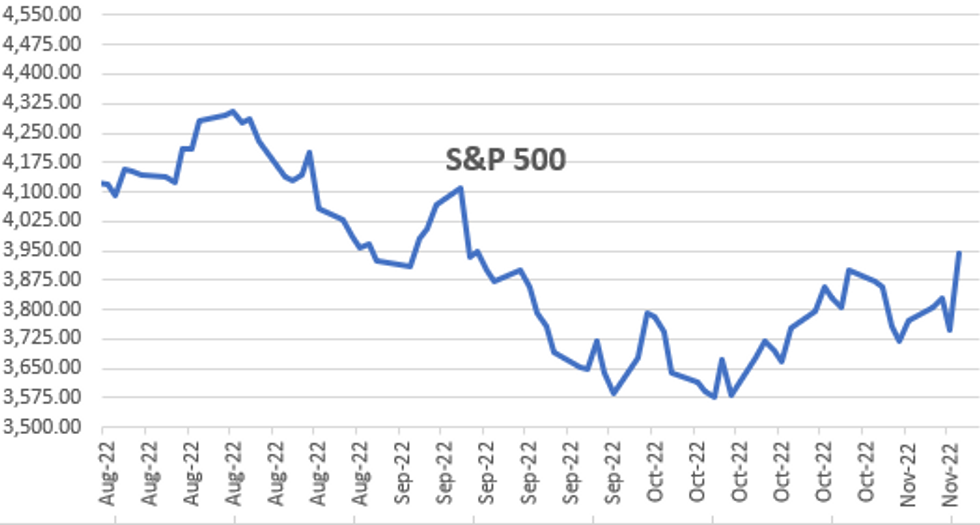

US TSYS: Huge CPI Relief Rally Holds

Huge relief rally in rates (30YY taps 4.0623% low vs 4.2884% high) and stocks (ESZ2 +191.5 at 3947.0) after lower than expected Oct CPI (+0.4% MoM vs. 0.6% est, core +0.27% unrounded vs forecast of 0.5%) cooled rate hike expectations: Dec cumulative down to 49.8bp vs. 57.5bp earlier, 84.7bp to 4.69% for Feb'23 with terminal in May'23 at 4.885%.

- Upbeat but cautious comments from various Fed speakers on the day:

- Dallas Fed Logan: "While I believe it may soon be appropriate to slow the pace of rate increases so we can better assess how financial and economic conditions are evolving, I also believe a slower pace should not be taken to represent easier policy," she said in openings remarks at a Fed conference.

- Cleveland President Loretta Mester: “Despite the moves we have made so far, given that inflation has consistently proven to be more persistent than expected and there are significant costs of continued high inflation, I currently view the larger risks as coming from tightening too little."

- Trading desks note some prop/fast$ selling on the highs, technical selling after Tsy 10Y futures crossed 50-day EMA of 112-12.5 to 112-17 high (+2-06.5), to 112-10 last.

- Tys climb back near midday highs after strong $21B 30Y auction (912810TL2): 3.2bp stop-through with 4.080% high yield vs. 4.112% WI; 2.42x bid-to-cover vs. 2.39x prior month.

OVERNIGHT DATA

- US OCT CPI 0.4%, CORE 0.3%; CPI Y/Y 7.7%, CORE Y/Y 6.3%

- US OCT ENERGY PRICES 1.8%

- US OCT OWNERS' EQUIVALENT RENT PRICES 0.6%

- US OCT CPI Unrounded - Oct'22:

- Unrounded % M/M (SA): Headline 0.438%; Core: 0.272% (from 0.576%)

- Unrounded % Y/Y (NSA): Headline 7.745%; Core: 6.284% (from 6.631%)

- US JOBLESS CLAIMS +7K TO 225K IN NOV 05 WK

- US PREV JOBLESS CLAIMS REVISED TO 218K IN OCT 29 WK

- US CONTINUING CLAIMS +0.006M to 1.493M IN OCT 29 WK

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 1107.75 points (3.41%) at 33628.77

- S&P E-Mini Future up 193.5 points (5.15%) at 3949.75

- Nasdaq up 711 points (6.9%) at 11065.45

- US 10-Yr yield is down 25.9 bps at 3.833%

- US Dec 10Y are up 67.5/32 at 112-14

- EURUSD up 0.0176 (1.76%) at 1.0186

- USDJPY down 5.04 (-3.44%) at 141.48

- WTI Crude Oil (front-month) up $0.55 (0.64%) at $86.38

- Gold is up $46.96 (2.75%) at $1753.54

- EuroStoxx 50 up 118.53 points (3.18%) at 3846.56

- FTSE 100 up 79.09 points (1.08%) at 7375.34

- German DAX up 479.77 points (3.51%) at 14146.09

- French CAC 40 up 126.26 points (1.96%) at 6556.83

US TSY FUTURES CLOSE

- 3M10Y -25.146, -35.961 (L: -36.895 / H: -9.542)

- 2Y10Y -1.377, -50.724 (L: -60.554 / H: -41.222)

- 2Y30Y +4.958, -26.466 (L: -40.583 / H: -15.725)

- 5Y30Y +9.546, 12.054 (L: -5.81 / H: 18.877)

- Current futures levels:

- Dec 2Y up 17.25/32 at 102-14.75 (L: 101-29 / H: 102-17.25)

- Dec 5Y up 1-14.5/32 at 107-28 (L: 106-13 / H: 107-31.75)

- Dec 10Y up 2-03.5/32 at 112-14 (L: 110-12.5 / H: 112-17)

- Dec 30Y up 4-13/32 at 124-02 (L: 119-30 / H: 124-07)

- Dec Ultra 30Y up 5-03/32 at 130-26 (L: 126-05 / H: 131-03)

US 10YR FUTURE TECH: (Z2) Approaching Resistance

- RES 4: 113-27+ High Sep 21

- RES 3: 113-30 High Oct 4 and a key resistance

- RES 2: 112-12+ 50-day EMA

- RES 1: 111-31 High Oct 27 and a key resistance

- PRICE: 111-30 @ 13:44 GMT Nov 10

- SUP 1: 110-12+/109-10+ Intraday low / Low Nov 04

- SUP 2: 108-26+ Low Oct 21 and the bear trigger

- SUP 3: 108-06+ Low Oct 2007 (cont)

- SUP 4: 107.05+ 3.0% 10-dma envelope

Treasuries are rallying sharply higher and price is approaching resistance at 111-31, the Oct 27 high. A break of this level would highlight a stronger short-term reversal and expose the 50-day EMA at 112-12+. Clearance of the 50-day EMA would also strengthen the case for short-term bulls. The broader trend remains bearish - a reversal lower would again refocus attention on support at 109-10+ and 108-26+, the Nov 4 and Oct 21 lows respectively.

US EURODOLLAR FUTURES CLOSE

- Dec 22 +0.090 at 94.990

- Mar 23 +0.160 at 94.820

- Jun 23 +0.225 at 94.870

- Sep 23 +0.305 at 95.145

- Red Pack (Dec 23-Sep 24) +0.365 to +0.410

- Green Pack (Dec 24-Sep 25) +0.340 to +0.385

- Blue Pack (Dec 25-Sep 26) +0.310 to +0.335

- Gold Pack (Dec 26-Sep 27) +0.290 to +0.305

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00272 to 3.81486% (-0.00143/wk)

- 1M -0.00543 to 3.87314% (+0.01500/wk)

- 3M +0.01971 to 4.64971% (+0.09942/wk) * / **

- 6M -0.02272 to 5.13357% (+0.12228/wk)

- 12M -0.00157 to 5.63129% (-0.03514/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.64971% on 11/10/22

- Daily Effective Fed Funds Rate: 3.83% volume: $100B

- Daily Overnight Bank Funding Rate: 3.82% volume: $293B

- Secured Overnight Financing Rate (SOFR): 3.78%, $969B

- Broad General Collateral Rate (BGCR): 3.75%, $405B

- Tri-Party General Collateral Rate (TGCR): 3.75%, $390B

- (rate, volume levels reflect prior session)

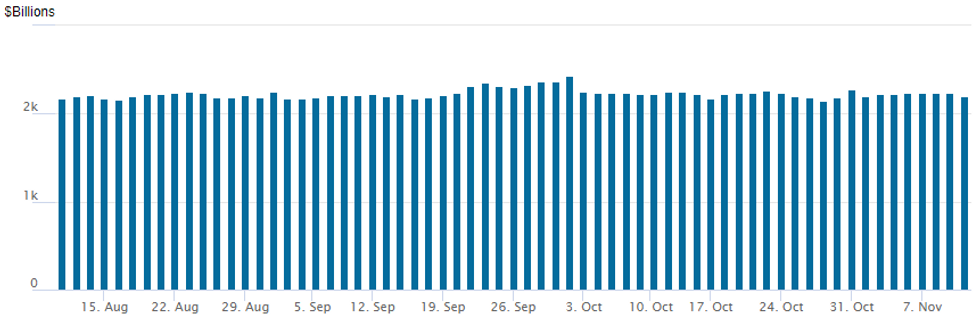

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage falls back to $2,200.586B w/ 95 counterparties vs. $2,237.812B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

PIPELINE: Issuers Sidelined Until After CPI Dust Settles

- Date $MM Issuer (Priced *, Launch #)

- 11/10 $Benchmark - issuance sidelined until after the CPI dust settles

- $18.2B Priced Wednesday, $50.3B since Monday

- 11/09 $8.25B *GE Healthcare: $1B 2Y +105, $1.5B 3Y +120, $1.75B 5Y +150, $1.25B 7.25Y +170, $1.75B 10Y +185, $1B 30Y +210

- 11/09 $2.75B *Citigroup 11NC10 +210

- 11/09 $2.5B *Westpac $1.25B 2Y +82, $1.25B 5Y +122

- 11/09 $2B *Credit Suisse WNG 11NC10 +485

- 11/09 $1B *KeyBank 5Y +160

- 11/09 $700M *Consolidated Edison WNG 30Y +185

- 11/09 $1B *BNP Paribas perpNC5 9.25%

EGBs-GILTS CASH CLOSE: Strong Rally On US Inflation Relief

EGBs and Gilts rallied strongly Thursday in response to a softer-than-expected US CPI reading for October.

- Terminal rate pricing for both the ECB and BoE fell sharply in the aftermath of the inflation data, and closed with about 12bp in hikes removed from each rate path to mid-2022.

- The German and UK curves bull steepened on the day, with the belly outperforming on the German curve, and 10Y on the UK.

- Periphery bonds rallied, with 10Y BTP yields falling nearly 30bp. BTP spreads to Bunds closed below 200bp for the first time since mid-July.

- Attention swiftly turns to UK GDP and final German CPI first thing Friday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 13.1bps at 2.08%, 5-Yr is down 16.6bps at 1.927%, 10-Yr is down 16.3bps at 2.009%, and 30-Yr is down 9.2bps at 1.998%.

- UK: The 2-Yr yield is down 12.7bps at 3.103%, 5-Yr is down 14.3bps at 3.309%, 10-Yr is down 16.5bps at 3.292%, and 30-Yr is down 16bps at 3.406%.

- Italian BTP spread down 12.3bps at 199.2bps / Spanish down 3.3bps at 101.1bps

FOREX: Lower US CPI Weighs Significantly On Greenback, USDJPY Plummets 3.3%

- Lower US Inflation data across the board on Thursday prompted significant weakness for the US dollar, with the USD index plummeting over 2% on the day. Big deflation in core goods (a 7-month low of -0.38% M/M vs +0.02% prior) and core services slowing sharply kept the greenback on the backfoot for the entire session, close to session lows against most counterparts approaching the APAC crossover.

- With 2-yr yields falling over 25bps and markets scaling back their December pricing, 2022’s favourite trade of being short JPY unwound aggressively. USDJPY looks set to post a 512 pip range on the day, currently down 3.25% and below 141 for the first time since September 23. The technical focus now shifts to 140.74, the 100-DMA and 140.36, Low Sep 22 / Intervention Low.

- Surging equity markets also underpinned the likes of AUD and NZD which have both risen by over 2%, with EURUSD (+1.7%) comfortably back above 1.0094 resistance. With this resistance giving way, the bullish case strengthens, again highlighting the bullish significance of the recent bear channel breakout that occurred on Oct 25. The continuation higher narrows the gap with 1.0198, the Sep 12 high, before 1.0273 which is a Fibonacci projection.

- In emerging markets, there has been a notable move in the Brazilian Real. After brushing off the initial post-election optimism, renewed anxieties over the nation’s fiscal trajectory have prompted a 4% move higher for USDBRL, in the face of the broad greenback weakness and rallying LatAm counterparts such as MXN and CLP.

- UK GDP is the data point of note on Friday with Uni-Mich Sentiment data crossing in the US. France, the US and Canada all have national holidays.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/11/2022 | 0700/0700 | *** |  | UK | GDP First Estimate |

| 11/11/2022 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 11/11/2022 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 11/11/2022 | 0700/0700 | ** |  | UK | Trade Balance |

| 11/11/2022 | 0700/0700 | *** |  | UK | Index of Production |

| 11/11/2022 | 0700/0700 | ** |  | UK | Index of Services |

| 11/11/2022 | 0700/0800 | *** |  | DE | HICP (f) |

| 11/11/2022 | 1200/1300 |  | EU | ECB Panetta Speaks at ISPI | |

| 11/11/2022 | 1200/1300 |  | EU | ECB de Guindos Q&A at Encuentro de Economia en S'Agaro | |

| 11/11/2022 | 1310/1310 |  | UK | BOE Tenreyro Speech at Society of Professional Economists | |

| 11/11/2022 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 11/11/2022 | 1600/1700 |  | EU | ECB Lane Panels Jacques Polak Conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.