-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY14.2 Bln via OMO Friday

MNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI ASIA OPEN: Retail Sales Beat Estimates; New High for Dow

- MNI US: Biden Trails Trump In All Seven Swing States, YouGov

- MNI US: House Democrats Push Back Against DNC Plan To Nominate Biden Early

- MNI CANADA DATA: A Lift In Near-Term Underlying Inflation But Not Enough To Rule Out A Second Cut Next Week

- MNI US DATA: Strong Retail Sales Report Suggests Upside Risks To Consumption Outlook

US TSYS Near Highs, Gradual Unwind to Retail Sale Reaction

- Treasuries look to finish near early session highs - gradually unwinding the hawkish reaction to this morning's better than expected Retail Sales data.

- Overall retail sales saw flat (-0.02% unrounded) growth M/M, slower than the +0.3% registered in May (upward rev from 0.1%) , but above the -0.3% expected. Sales ex-autos (+0.4% vs 0.1% expected) and ex-auto/gas (+0.8% vs +0.2% expected) impressed, and also with higher revisions.

- Tsy curves bull flattened on the day, largely reversing Monday's twist steepening with 2s10s -4.431 at -27.448. Tsy Sep 10Y futures trade +12 at 111-11.5 vs. 111-12.5 high - just off Mar 25 high of 111-13. Major resistance at 111-31 (1.382 proj of the Apr 25 - May 16 - 29 price swing).

- Projected rate cut pricing into year end remains slightly cooler vs. late Monday levels (*): July'24 at -6.5% w/ cumulative at -1.6bp at 5.313%, Sep'24 cumulative -26.6bp (-27.5bp), Nov'24 cumulative -42.9bp (-44.1bp), Dec'24 -65.4bp (-65.8bp).

- Focus turns to Wednesday's Build Permits, House Starts, Beige Book, Tsy 20Y Bond auction reopen and upcoming earnings from Citizens Financial, US Bancorp, Discover Financial and Ally Financial.

NEWS

US (MNI): Biden Trails Trump In All Seven Swing States, YouGov

A YouGov surveyof swing states has found that President Joe Biden faces "long odds" for getting re-elected: "He trails in all seven states, six of which he won in 2020 — a significant decline from his position in those states in March."

- The survey supports a string of recent swing state polling, most recently from the NYT/Siena College yesterday, showing that Trump is bolstering a lead in the battleground states.

- YouGov notes: "Voters themselves think that Biden is in trouble. In none of the states did more voters think Biden was more likely to win than Trump."

US (MNI): House Democrats Push Back Against DNC Plan To Nominate Biden Early

Axios reporting that a group of House Democrat lawmakers are, "reviving a fight over President Biden's candidacy," after a brief respite following the assassination attempt against former President Donald Trump. The groups action comes in light of reports that the Democratic National Committee intends to hold a virtual roll call of delegates to confirm Biden as Democratic Party nominee weeks in advance of the August 19 Democratic Party Convention.

US (MNI): Democrat Sen Menendez Guilty On Federal Corruption Charges

Democratic Senator Bob Menendez (D-NJ) has been found guilty by a New York City jury on federal charges of selling his influence as chair of the Senate Foreign Relations Committee to protect business contacts and promote Egypt's interests.

UK (MNI): 17 July King's Speech To Outline New Gov'ts Legislative Priorities

The State Opening of Parliament takes place on 17 July, with King Charles III delivering the King's Speech from the throne in the House of Lords at ~1130BST (0630ET, 1230CET). The King's Speech is prepared by the new gov't of PM Sir Keir Starmer and outlines its legislative aims for the coming parliament. The Speech will detail 35+ draft laws

FRANCE (MNI): Macron To Accept Gov't Resignation By End Of Day:

President Emmanuel Macron has told PM Gabriel Attal that he will accept the resignation of the latter's gov't by the end of the day. According to reports from individuals at the meeting, Macron told Attal that he would remain in place as PM in a caretaker capacity "managing current affairs" for "a certain time", "a few weeks".

OVERNIGHT DATA

US DATA (MNI): Strong Retail Sales Report Suggests Upside Risks To Consumption Outlook

June's advance retail sales report was much stronger than expected, including positive revisions to prior data, suggesting continued strength in consumption at the end of Q2.

- Overall retail sales saw flat (-0.02% unrounded) growth M/M, slower than the +0.3% registered in May (upward rev from 0.1%) , but above the -0.3% expected. Sales ex-autos (+0.4% vs 0.1% expected) and ex-auto/gas (+0.8% vs +0.2% expected) impressed, and also with higher revisions.

- Closely-watched Control Group sales rose 0.9%, far exceeding the 0.2% expected and up from 0.4% in May. The 0.86% unrounded was a shade slower than March's 0.87%, but basically the joint-highest rate of growth in 14 months.

US DATA (MNI): Rebound In Core Import Prices Could Pose Some Fed Concern

Import price inflation was stronger than expected in June, coming in flat M/M (-0.2% expected, -0.2% prior rev from -0.4%), with the ex-petroleum prices +0.2% (-0.2% expected, -0.3% prior, unrev). Export prices conversely were softer than expected, at -0.5% M/M (-0.1% expected, -0.7% prior rev from -0.6%).

- The upside import surprise has two potential implications for monetary policy. The first is the read-through to June PCE inflation, for which the import price index provides the final albeit very small piece of the puzzle after CPI and PPI.

US DATA (MNI): Another Single Regional Decline Weighs On NAHB Housing Index

NAHB housing market index was close to expectations in July, falling just 1pt to 42 (cons 43) for technically its lowest since December.

- Declines in present sales (from 48 to 47) and prospective buyer traffic (from 28 to 27) were partly offset by a small uplift in future sales (from 47 to 48) after a particularly weak run.

- Present sales and prospective buyer traffic are both also at their weakest since Dec.

- The regional breakdown shows another large decline in a different area. Northeast housing sentiment fell a heavy 15pts to 47. It follows the midwest seeing a 10pt decline in May and the west seeing an 11pt decline in April, neither of which have seen any recovery.

- Once again, there is a sizeable discrepancy between relative S&P 500 homebuilder price to book ratios and the housing market, with the latter far less optimistic.

CANADA DATA (MNI): A Lift In Near-Term Underlying Inflation But Not Enough To Rule Out A Second Cut Next Week

At face value, Canadian inflation was about as expected in June, with headline at 2.7% Y/Y (cons 2.7), with the Q2 average of 2.8% confirming a miss of the BoC’s 2.9 from April.

- Further, the average of median and trim dipping fractionally to 2.75% Y/Y (cons 2.75) from a slightly downward revised 2.8%.

- There were offsetting surprises, with median softer at 2.6 (cons 2.7) and trim hotter 2.9 (cons 2.8). Trimmed CPI sees a third month below 3% Y/Y, median a fourth.

- The latest run rates look slightly firmer than limited analyst expectations though, with the 3-mth median/trim average accelerating to 2.9% annualized after 2.5% but nevertheless a fifth month in the 1-3% target range.

CANADA DATA (MNI): Housing Starts Extent Recent Sideways Trend Amidst Noise

Housing starts fell by more than expected in June, to 242k (cons 254k) after 265k, but the series historical volatility and landing just before Canadian CPI had little impact.

- The latest path sees starts fall a seasonally adjusted 9% M/M in June after jumping 10% in May.

- Urban multi-units are again the driver here (-11.7% after 12.8%) whilst urban single units continue their latest recovery (1.8% after 3.4%).

- The volatility in multi-units aside, their outright level continues to dominate those of single units, with more than 4x multi-unit projects than single units in June.

- The outright level of starts remains higher than pre-pandemic levels, with starts so far this year averaging 15-20% higher than the 2019 average. The relative acceleration in home building will be welcome for relieving housing pressures but there is still a ways to go amidst booming population growth.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 715.25 points (1.78%) at 40928.03

- S&P E-Mini Future up 28.25 points (0.5%) at 5711.25

- Nasdaq up 6.7 points (0%) at 18480.79

- US 10-Yr yield is down 6.8 bps at 4.1615%

- US Sep 10-Yr futures are up 12/32 at 111-11.5

- EURUSD up 0.0006 (0.06%) at 1.09

- USDJPY up 0.29 (0.18%) at 158.35

- WTI Crude Oil (front-month) down $1.07 (-1.31%) at $80.82

- Gold is up $44.39 (1.83%) at $2466.73

- European bourses closing levels:

- EuroStoxx 50 down 35.28 points (-0.71%) at 4947.83

- FTSE 100 down 18.06 points (-0.22%) at 8164.9

- German DAX down 72.86 points (-0.39%) at 18518.03

- French CAC 40 down 52.68 points (-0.69%) at 7580.03

US TREASURY FUTURES CLOSE

- 3M10Y -6.547, -117.462 (L: -117.849 / H: -111.641)

- 2Y10Y -3.818, -26.835 (L: -28.62 / H: -20.68)

- 2Y30Y -5.256, -5.502 (L: -7.936 / H: 1.643)

- 5Y30Y -3.316, 29.045 (L: 27.636 / H: 32.851)

- Current futures levels:

- Sep 2-Yr futures up 1.375/32 at 102-20.25 (L: 102-17.5 / H: 102-21.625)

- Sep 5-Yr futures up 5.75/32 at 107-20 (L: 107-13.25 / H: 107-22)

- Sep 10-Yr futures up 12/32 at 111-11.5 (L: 110-30 / H: 111-12.5)

- Sep 30-Yr futures up 1-02/32 at 120-8 (L: 119-03 / H: 120-11)

- Sep Ultra futures up 1-21/32 at 127-25 (L: 126-00 / H: 127-31)

US 10Y FUTURE TECHS: (U4)Trend Structure Remains Bullish

- RES 4: 112-25 High Mar 8

- RES 3: 111-31 1.382 proj of the Apr 25 - May 16 - 29 price swing

- RES 2: 111-13 High Mar 25

- RES 1: 111-12+ Intraday high

- PRICE: 111-09+ @ 11:03 BST Jul 16

- SUP 1: 110-12+/110-01+ 20- and 50-day EMA values

- SUP 2: 109-02+/109-00+ Low Jul 1 / Low Jun 10 and key support

- SUP 3: 108-27+ Low Jun 3

- SUP 4: 108-24+ Trendline drawn from the Apr 25 low

A bullish theme in Treasuries remains intact. Last week’s gains confirmed an extension of the bull cycle that started Jul 1. The move higher resulted in a breach of 111-01, Jun 14 high. This signals scope for an extension near-term with the focus on 111-13 next, Mar 25 high. Clearance of this hurdle would open 111-31, a Fibonacci projection. Initial firm support is at 110-12+, 20-day EMA.

SOFR FUTURES CLOSE

- Sep 24 steady at 94.965

- Dec 24 +0.005 at 95.375

- Mar 25 +0.015 at 95.760

- Jun 25 +0.015 at 96.055

- Red Pack (Sep 25-Jun 26) +0.020 to +0.035

- Green Pack (Sep 26-Jun 27) +0.040 to +0.050

- Blue Pack (Sep 27-Jun 28) +0.050 to +0.055

- Gold Pack (Sep 28-Jun 29) +0.060 to +0.065

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00060 to 5.33399 (+0.00619/wk)

- 3M -0.00653 to 5.27924 (-0.00687/wk)

- 6M -0.02203 to 5.12855 (-0.03625/wk)

- 12M -0.03518 to 4.80059 (-0.06495/wk)

- Secured Overnight Financing Rate (SOFR): 5.34% (+0.00), volume: $2.175T

- Broad General Collateral Rate (BGCR): 5.33% (+0.01), volume: $792B

- Tri-Party General Collateral Rate (TGCR): 5.33% (+0.01), volume: $770B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $88B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $245B

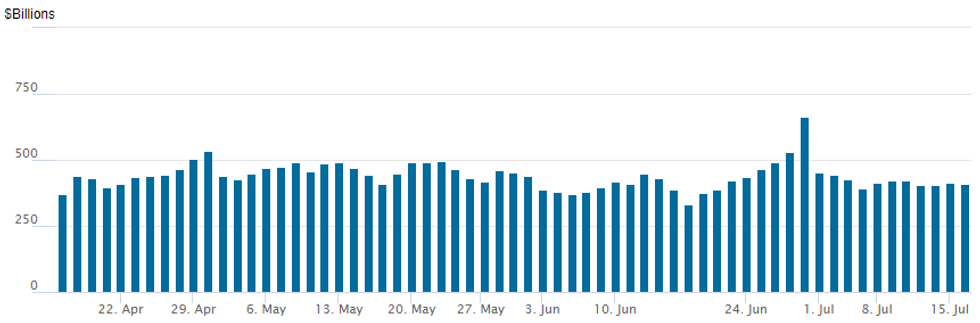

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage recedes up to $409.594B from $413.280B on Monday. Number of counterparties at 67 from 65 prior. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

PIPELINE $2B Wells Fargo US$ Issuance Launched

- Date $MM Issuer (Priced *, Launch #)

- 7/16 $5.5B #Goldman Sachs $2.5B 6NC5 +97, $3B 11NC10 +117

- 7/16 $2B #Wells Fargo PerpNC5 6.85%

- 7/16 $Benchmark Mitsubishi 5.25Y investor calls

- 7/16 $Benchmark Gvt of Hong Kong investor calls

- Expected Wednesday

- 7/17 $Benchmark World Bank (IBRD) 3Y SOFR+28a, 2031 Tap SOFR+45a

EGBs-GILTS CASH CLOSE: Solid Gilt Gains Ahead Of UK CPI

European government bonds strengthened Tuesday despite strong US economic data briefly casting doubt on near-term Fed rate cut narratives.

- Core FI rallied in morning trade, alongside a move lower in equities and oil, but the constructive move stalled out in early afternoon.

- While US retail sales and import price readings were higher than expected, thereby trimming Federal Reserve easing expectations slightly, the global core bond sell-off was capped by soft Canadian inflation data.

- Core European FI subsequently recovered most losses, with Gilts outperforming Bunds on the day. The UK curve bull steepened, with Germany's bull flattening. Periphery spreads closed mixed, with BTPs outperforming and GGBs underperforming.

- Attention turns to Wednesday's UK CPI data - MNI's preview is here (including an outlook for Thursday's labour market release).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.6bps at 2.763%, 5-Yr is down 5.2bps at 2.393%, 10-Yr is down 4.5bps at 2.427%, and 30-Yr is down 4.4bps at 2.616%.

- UK: The 2-Yr yield is down 8bps at 3.985%, 5-Yr is down 5.2bps at 3.887%, 10-Yr is down 5.2bps at 4.049%, and 30-Yr is down 5.8bps at 4.548%.

- Italian BTP spread down 0.3bps at 127.2bps / Greek up 0.8bps at 96.5bps

FOREX: Greenback Firms on Above Consensus Retail Sales, Antipodeans Lag

- The USD index gained some moderate ground on Tuesday following above-expectation US retail sales figures in June. While the DXY remains 0.15% higher approaching the APAC crossover, we are off best levels as most major pairs slowly retrace the post-data reaction.

- Underperforming on the session has been both AUD and NZD, falling over half a percent with the softer Chinese data on Monday still potentially weighing at the margin.

- AUDUSD notably traded back down to test the prior breakout level around 0.6715, a level that closely matches with initial firm support at 0.6708, the 20-day EMA. Overall, bullish conditions remain intact for the pair and the latest pullback appears to be a correction.

- In similar vein, NZDUSD trades half a percent lower and is now below 0.6050. Overnight NZDUSD straddle pricing points to a 35 pip breakeven which incorporates the second quarter CPI print scheduled Wednesday, potentially pointing to 0.6000 marking strong support for the pair. We pointed out yesterday that some desks have noted RBNZ cut expectations seem to be relatively stretched at this point, potentially setting a high bar for tomorrow’s data to confirm the market’s bias.

- USDJPY has exhibited an 86 point range and trades close to 158.50 at typing. The Japanese Yen has remained in the spotlight following last week’s US inflation data and subsequent intervention from the BOJ. Latest reports suggest that the Japanese government intervened to the tune of Y5.6trl across two phases last Thursday and Friday, in what appears to be a more tactical approach to strengthen the currency.

- Focus turns to inflation data for both New Zealand and the UK on Wednesday. US building permits and industrial production is also scheduled.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/07/2024 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 17/07/2024 | 0600/0700 | *** |  | UK | Producer Prices |

| 17/07/2024 | 0900/1100 | *** |  | EU | HICP (f) |

| 17/07/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 17/07/2024 | 1030/1130 |  | UK | King's Speech | |

| 17/07/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 17/07/2024 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/07/2024 | 1230/0830 | *** |  | US | Housing Starts |

| 17/07/2024 | 1300/0900 |  | US | Richmond Fed's Tom Barkin | |

| 17/07/2024 | 1315/0915 | *** |  | US | Industrial Production |

| 17/07/2024 | 1335/0935 |  | US | Fed Governor Christopher Waller | |

| 17/07/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 17/07/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 17/07/2024 | 1800/1400 |  | US | Fed Beige Book |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.