-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Risk-On As Rate Cut Pricing Improves

- MNI FED: In Intermeeting Period, FOMC Participants See No Rush To Cut Rates

- MNI FED: Hawk-Dove Matrix Moves Up A Hawkish Notch

- MNI INTERVIEW: CPI Rent Easing Expected To Continue - Apt List

- MNI US DATA: Softer Than Expected Preliminary PMIs

- MNI US DATA: New Home Sales Beat, Supply Weighing On Prices

US

FED (MNI): In Intermeeting Period, FOMC Participants See No Rush To Cut Rates: In the intermeeting period (March 21 – April 19), several FOMC participants noted that while cutting rates by some magnitude this year was still their baseline, the evident strength in job growth and economic activity meant that there is no rush to initiate rate cuts given higher inflation readings. More details in our full FedSpeak PDF.

- Chair Powell summed up FOMC sentiment by saying that “the recent data have clearly not given us greater confidence and instead indicate that it’s likely to take longer than expected to achieve that confidence”.

- A few FOMC participants revealed their March meeting Fed funds rate “dot” submissions for 2024 (which, recall, revealed a median of 75bp of cuts expected for the year), but above-expected employment (Apr 5) and CPI (Apr 10) reports caused most if not all to reconsider their outlook.

FED (MNI): Hawk-Dove Matrix Moves Up A Hawkish Notch: MNI’s Hawk-Dove Spectrum has effectively been moved up a notch across the board toward the “more hawkish” end for all participants since our March FOMC meeting preview.

- Alberto Musalem became St Louis Fed President on April 2 and will be a 2025 voter, but we have not yet heard from him on his monetary policy views: for now, MNI places him alongside the “median” participant on our scale.

- The March meeting minutes revealed little on the rate outlook that wasn’t already known from the Dot Plot and participants’ commentary – but the focus of the minutes was on balance sheet policy. The "vast majority" of FOMC participants judged it would be "prudent" to begin slowing the pace of runoff "fairly soon”, and participants "generally favored reducing the monthly pace of runoff by roughly half from the recent overall pace."

NEWS

INTERVIEW (MNI): CPI Rent Easing Expected To Continue - Apt List: Rent inflation in the CPI is likely to keep easing in coming months, albeit in fitful moves, bringing the measure back toward the top of its prepandemic range by the end of this year, Apartment List's senior housing economist Chris Salviati told MNI. "My working assumption right now is that we're going to generally continue on the trajectory that we've been on and that gets us under 3.5% by the end of the year," he said in an interview.

US (MNI): Biden To Target Reproductive Rights In Florida Speech: President Biden will travel to Tampa, Florida this evening to deliver a speech on women’s reproductive rights – a bid to keep one of Biden’s primary political strengths in the spotlight in a state which Democrats hope to make competitive in November.

BOE INTERVIEW (MNI):Tough For BOE To Agree Scenarios-NIESR's Millard: It will be tough for the nine members of the Bank of England’s Monetary Policy Committee to agree on parameters for providing regular scenario analysis as recommended by former Fed chair Ben Bernanke in his review of the BOE’s forecasting and communications, the deputy director at the National Institute of Economic and Social Research told MNI.

US TSYS Rates Higher, Curves Steeper on Lower Than Expected Flash PMIs

- Treasury futures hold moderately higher after the bell, curves near session highs with the short end outperforming late (2s10s +3.870 at -32.625). Currently, Jun'24 10Y futures are trading 108-01 (+5.5) vs. 108-08 post-auction high, still well below initial technical resistance of 108-22.5 (High Apr 19).

- Lower than expected flash PMI data helped Treasuries gap higher early Tuesday while a strong 2Y note auction saw futures extend session highs early in the second half. S&P Global US PMIs were softer than expected in preliminary April data, with mfg at 49.9 (cons 52.0) after 51.9 and services at 50.9 (cons 52.0) after 51.7. Stronger than expected new home sales tempered rate support as March marked 693k saar vs 668k prior.

- In-line with firmer rates and steeper curves, projected rate cut pricing moved off recent lows: May 2024 -2.6% w/ cumulative -0.6bp at 5.322%; June 2024 at -16.2% vs. -13.6% this morning w/ cumulative rate cut -4.7bp at 5.282%. July'24 cumulative at -13.6bp vs. -11.1bp earlier, Sep'24 cumulative -25.6bp vs. -21.1bp.

- Look ahead: Wednesday data calendar includes Durable/Capital Goods, Tsy Auctions.

OVERNIGHT DATA

US DATA (MNI): New Home Sales Beat, Supply Weighing On Prices: New home sales were stronger than expected in March at 693k saar (cons 668k).

- Latest revisions see sales jumping 8.8% M/M (cons 0.9%) after a downward revised -5.1% (initial -0.3%) in Feb.

- There are strong March increases seen across the major regions, with a particularly large 28% increase for the smallest northeast region (other three regions between 5.3-8.6% increases).

- Months of supply fell back from 8.8 in Feb to 8.3, although that’s still above the 8.1 seen in Mar’23 and is high historically as opposed to existing homes where supply is still more constrained relative to pre-pandemic levels – see chart.

- This is reflected in pricing, with average new sale prices -1.9% Y/Y vs +4.8% Y/Y for existing.

US DATA (MNI): Annual Retail Sales Revisions Don’t Materially Change The Latest Trend: The annual retail sales revisions saw very little impact to latest months.

- Overall retail sales increased 0.71% M/M in March after 1.02% M/M (pre revision 0.72 after 0.94).

- Control group sales increased 1.12% M/M in March after 0.44% M/M (pre revision 1.14 after 0.30).

- 3M/3M ar run rates as of March: 0.4% overall retail vs 0.2% pre-revision, 3.0% for control group vs 3.0% pre-revision).

- See charts below.

US DATA (MNI): Softer Than Expected Preliminary PMIs: The S&P Global US PMIs were softer than expected in preliminary April data, with mfg at 49.9 (cons 52.0) after 51.9 and services at 50.9 (cons 52.0) after 51.7.

- From the press release: "April saw an overall reduction in new orders for the first time in six months. Companies responded by scaling back employment for the first time in almost four years, with business confidence also waning to the lowest since last November."

- Price pressures: "Rates of inflation generally eased at the start of the second quarter, with both input costs and output prices rising less quickly at the composite level. That said, manufacturing input cost inflation hit a one-year high."

- “Service providers often noted higher staff and shipping costs, though reported the second-lowest overall cost increase for three-and-a-half years.”

- “Prices charged inflation was in line with the series long-run average, though still elevated by pre-pandemic standards. Slower charge inflation was seen across both the manufacturing and services sectors.”

- Builds on recent softening in other soft data indicators: The Fed’s Beige Book last week noted “another frequent comment was that firms’ ability to pass cost increases on to consumers had weakened considerably in recent months, resulting in smaller profit margins” whilst the March ISM Services release saw a surprise slide in prices paid from 58.6 to 53.4 for its lowest since the pandemic.

US APR PHILADELPHIA FED NONMFG INDEX -12.4

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 276.24 points (0.72%) at 38512.85

- S&P E-Mini Future up 61 points (1.21%) at 5108.25

- Nasdaq up 256.9 points (1.7%) at 15708.39

- US 10-Yr yield is down 0.4 bps at 4.6045%

- US Jun 10-Yr futures are up 5.5/32 at 108-1

- EURUSD up 0.0049 (0.46%) at 1.0704

- USDJPY down 0.05 (-0.03%) at 154.8

- Gold is down $5.42 (-0.23%) at $2322.09

- European bourses closing levels:

- EuroStoxx 50 up 71.32 points (1.44%) at 5008.17

- FTSE 100 up 20.94 points (0.26%) at 8044.81

- German DAX up 276.85 points (1.55%) at 18137.65

- French CAC 40 up 65.42 points (0.81%) at 8105.78

US TREASURY FUTURES CLOSE

- 3M10Y +1.21, -79.512 (L: -85.294 / H: -75.903)

- 2Y10Y +4.281, -32.214 (L: -37.627 / H: -32.205)

- 2Y30Y +6.654, -19.423 (L: -27.935 / H: -19.319)

- 5Y30Y +4.49, 10.532 (L: 4.697 / H: 10.559)

- Current futures levels:

- Jun 2-Yr futures up 2.375/32 at 101-19.125 (L: 101-14.875 / H: 101-20.125)

- Jun 5-Yr futures up 4.25/32 at 105-5.75 (L: 104-28.75 / H: 105-09.75)

- Jun 10-Yr futures up 5/32 at 108-0.5 (L: 107-20.5 / H: 108-08)

- Jun 30-Yr futures up 1/32 at 114-18 (L: 114-02 / H: 115-05)

- Jun Ultra futures down 4/32 at 120-24 (L: 120-09 / H: 121-19)

US 10Y FUTURE TECHS: (M4) Trend Needle Points South

- RES 4: 109-27+ 50-day EMA

- RES 3: 109-26+ High Apr 10

- RES 2: 108-28+ 20-day EMA

- RES 1: 108-22+ High Apr 19

- PRICE: 108-04 @ 1234 ET Apr 23

- SUP 1: 107-13+ Low Apr 16

- SUP 2: 107-07+ 76.4% of the Oct - Dec ‘23 bull leg (cont)

- SUP 3: 106-27 2.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 4: 106-08 3.00 proj of Dec 27 - Jan 19 - Feb 1 price swing

Treasuries are in consolidation mode. The trend outlook is unchanged and a bear cycle remains in play. Last week’s move lower reinforces current conditions and the move down has resumed this year’s bear trend. Moving average studies remain in a bear-mode set-up too, highlighting a clear downtrend. Sights are on 107.07+ next, a Fibonacci retracement. Firm resistance is 108-28+, the 20-day EMA.

SOFR FUTURES CLOSE

- Jun 24 +0.010 at 94.745

- Sep 24 +0.030 at 94.920

- Dec 24 +0.045 at 95.110

- Mar 25 +0.055 at 95.305

- Red Pack (Jun 25-Mar 26) +0.045 to +0.060

- Green Pack (Jun 26-Mar 27) +0.025 to +0.040

- Blue Pack (Jun 27-Mar 28) +0.020 to +0.020

- Gold Pack (Jun 28-Mar 29) +0.010 to +0.015

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00114 to 5.31685 (-0.00125/wk)

- 3M +0.00061 to 5.32355 (-0.00055/wk)

- 6M -0.00033 to 5.29770 (-0.00080/wk)

- 12M -0.00543 to 5.21061 (+0.02280/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.01), volume: $1.746T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $697B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $687B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $79B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $255B

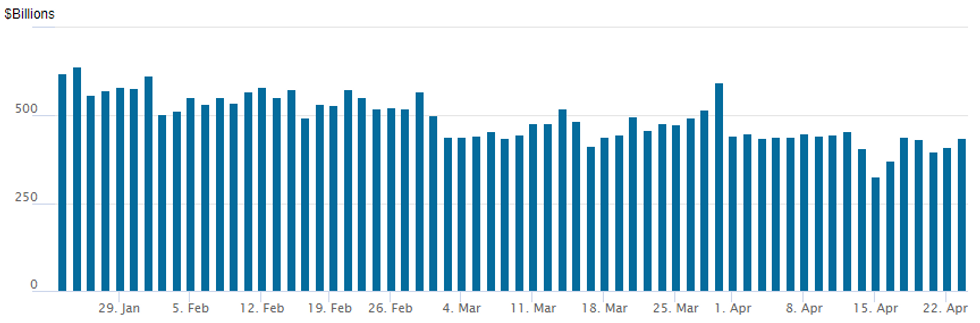

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs to $435.880B vs. $409.816B Monday. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

- Meanwhile, the latest number of counterparties recedes to 71 vs. 73 prior.

PIPELINE: $5B Citibank 3Pt Debt Launched

$16.5B total to price Tuesday:

- Date $MM Issuer (Priced *, Launch #)

- 4/23 $5B #Abu Dhabi $1.75B 5Y +35, $1.5B 10Y +45, $1.75B 30Y +90

- 4/23 $5B #Citibank $2B 2Y +52, $1B 2Y SOFR, $2B 10Y +97

- 4/23 $3B *Canada Gov Int Bond 5Y +10

- 4/23 $2B #CK Hutchinson $1B 5Y +80, $1B 10Y +100

- 4/23 $1.5B #CDP (Italian bank) 5Y +145

- 4/23 $Benchmark Kuwait Int Bank Reg S 5.5Y Sukuk investor calls

FOREX Weak US Data Prompts Dollar Pullback, GBP & MXN Outperform

- The USD index slipped to the lowest level since April 12 on the back of US PMI data releases - with the step lower in the US yields reflecting the poorer-than-expected data. Bolstered risk sentiment filtered through to a strong bid for equities, which in turn benefitted the likes of EUR, AUD and NZD.

- EURUSD's rally puts the pair back at the prior support level around 1.0700, and will likely place pressure on fresh shorts that had been accumulated in recent sessions.

- GBPUSD outperforms having already risen to the best levels of the session ahead of the US data, helped by a moderate turn lower for the broader USD index and slightly more hawkish comments from Bank of England’s Pill.

- Price action after the US PMIs extended the bounce from yesterday’s five-month lows to around 150 pips, with cable consolidating around 1.2450 ahead of the APAC crossover. Overall, the trend condition in GBPUSD remains bearish and moving average studies are in a bear-mode set-up, reinforcing a bearish theme. Sights are on 1.2266, the Nov 14 2023 low. Initial firm resistance comes down to 1.2524, the 20-day EMA.

- The renewed sensitivity to moves in US yields and broader risk sentiment in recent sessions has bolstered the Mexican peso on Tuesday, which outperforms in the EM FX space. USDMXN (-0.80%) has slipped back below the 17.00 handle, briefly printing a low of 16.9717.

- Australia CPI highlights Wednesday’s docket overnight, before German IFO, Canada retail sales and US durable goods are scheduled. Focus will then turn to US GDP figures due Thursday.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/04/2024 | 2301/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 24/04/2024 | 0130/1130 | *** |  | AU | CPI Inflation Monthly |

| 24/04/2024 | 0130/1130 | *** |  | AU | CPI inflation |

| 24/04/2024 | 0600/0800 | ** |  | SE | Unemployment |

| 24/04/2024 | 0600/1400 | ** |  | CN | MNI China Liquidity Index (CLI) |

| 24/04/2024 | 0735/0935 |  | EU | ECB's Cipollone speech at ECB retail payments conference | |

| 24/04/2024 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 24/04/2024 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 24/04/2024 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 24/04/2024 | 0910/1110 |  | EU | ECB's Cipollone panel at ECB Retail Payments Conference | |

| 24/04/2024 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 24/04/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 24/04/2024 | 1230/0830 | ** |  | CA | Retail Trade |

| 24/04/2024 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 24/04/2024 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 24/04/2024 | 1400/1600 |  | EU | ECB's Schnabel remarks at '"Frankfurt liest ein Buch" | |

| 24/04/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 24/04/2024 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 24/04/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 24/04/2024 | 1730/1330 |  | CA | BOC Minutes (Summary of Deliberations) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.