-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Tsys Follow EGBs Lower, Focus On GDP, Core PCE

- MNI CANADA: BOC Favors Gradual Approach To Rate Cuts, Minutes Show

- MNI US DATA: Core Durable Goods Orders In Line For A Third Flat Quarter

US TSYS Unwinding Tuesday's PMI Rally, Curves Bear Steepen Near 3M Highs

- Treasuries remain weaker after the bell, off late morning lows amid moderate two-way positioning in the second half. Rates followed EGBs lead on the open with BTP, Bund and Gilt yields supported after Bund supply and higher than expected Australia CPI.

- Treasury futures held near lows following this morning's largely in-line Durables/Cap goods data - brief short cover support on down-revisions to prior: Durable Goods Orders (2.6% vs 2.5% est; prior down-revised to 0.7% from 1.3%), Cap Goods Orders Nondef Ex Air (0.2% vs 0.2% est, prior down revised to 0.4% from 0.7%.).

- Futures remained weaker after the $70B 5Y note auction (91282CKP5) tailed: drawing 4.659% high yield vs. 4.655% WI; 2.39x bid-to-cover vs. 2.41x for the prior auction.

- Jun'24 10Y futures marked a 107-20 low (-14.5) in the first half, traded 107-25 after the bell, 10Y yield climbs to 4.6686% high. 2s10s curve bear steepened to -27.488 - steepest level since February 1.

- In turn, projected rate cut pricing swung back to recent lows: May 2024 -2.6% w/ cumulative -0.6bp at 5.322%; June 2024 at -16.2% vs. -13.6% this morning w/ cumulative rate cut -4.7bp at 5.282%. July'24 cumulative at -12.6bp vs. -11.6bp earlier, Sep'24 cumulative -24bp vs. -22.9bp.

- Thursday Data Calendar: Wkly Claims, GDP, Core PCE Index.

CANADA

BOC (MNI): BOC Favors Gradual Approach To Rate Cuts, Minutes Show: Bank of Canada officials agree that when they begin lowering interest rates the pace of cuts will be gradual, according to minutes from the last decision published Wednesday that also showed more confidence inflation pressures are normalizing.

- "While there was a diversity of views about when conditions would likely warrant cutting the policy rate, they agreed that monetary policy easing would probably be gradual, given risks to the outlook and the slow path for returning inflation to target," the Summary of Deliberations said. "While members were still more concerned about the upside risks to the inflation outlook, they viewed both the upside and downside risks as less acute."

- Governor Tiff Macklem held the key lending rate at 5%, the highest since 2001, for a sixth straight decision on April 10, saying he's more confident price stability is returning and a rate cut at the June meeting is within the realm of possibility. Most economists see a June cut but concede waiting until July is possible.

NEWS

SECURITY (MNI): Biden Signs Ukraine & Israel Package, Shipments Start In Coming Hours: US President Joe Biden has signed into law the national security aid package that will provide USD95bn in military aid to Ukraine, Israel and to bolster US allies in the Indo-Pacific.

SPAIN (MNI): Sanchez Announces He May Retire As Premier: Spanish Prime Minister Pedro Sánchez has announced in a “letter to citizens” on Xthat he is considering retiring as premier and will make his decision on April 29. The letter comes after a Spanish judge opened a preliminary investigation in Sanchez’s wife, Begoña Gómez, over accusations of corruption.

SECURITY (MNI): Israeli War Cabinet To Meet Tomorrow, Discuss New Hostage Plan, Rafah: Israeli media reporting that the Israeli War Cabinet will meet tomorrow to discuss a new strategy for securing the release of hostages and an upcoming IDF operation in the Gazan city of Rafah.

ISRAEL (MNI): RTRS-IDF 'Poised To Launch' Rafah Op. Just Needs Gov't Approval: Reuters reporting that according to an official from the Israeli Defence Ministry, the Israeli military is "poised to launch the Rafah military operation immediately", and is just awaiting gov't approval.

SECURITY (MNI): Ukraine Escalates Attacks On Russian Infrastructure: Reuters reporting that an overnight Ukrainian drone attack struck, and partially destroyed, an "oxygen station" at the Novolipetsk Metallurgical Plant in Russia’s Lipetsk region, around 400kms northwest of Ukraine’s Kharkiv Oblast.

OVERNIGHT DATA

US DATA (MNI): Core Durable Goods Orders In Line For A Third Flat Quarter: Core durable goods orders increased the 0.2% M/M expected in the March preliminary data, but it followed a downward revised 0.4% M/M in Feb (initially 0.7%).

- Core shipments also increased 0.2% M/M as expected after an unrevised -0.6% M/M after some recent volatility.

- Trend rates show shipments rising 2% annualized in Q1 after 0.0% in Q4, but a third consecutive flat quarter for orders suggests the increase in shipments won’t be sustained.

- We have noted multiple times though the disconnect with ISM manufacturing readings still in contraction territory despite improving in recent months.

US DATA (MNI): Mortgage Applications Shrug Off Further Increase In Rates: MBA mortgage applications fell a seasonally adjusted 2.7% M/M last week after increasing 3.3% the prior week.

- Declines were led by refis (-5.6% after +0.5%) whilst purchases dipped -1.0% after +5.0%.

- The 30Y conforming mortgage rate increased a further 11bps on the week to 7.24%, its highest since late November.

- Mortgage rates have increased 33bps since late March yet composite applications are surprisingly 0.6% higher over that period (albeit still less than 50% of 2019 levels).

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 22.01 points (-0.06%) at 38479.84

- S&P E-Mini Future up 1.25 points (0.02%) at 5107.75

- Nasdaq up 15.6 points (0.1%) at 15711.89

- US 10-Yr yield is up 4.1 bps at 4.6417%

- US Jun 10-Yr futures are down 9/32 at 107-25.5

- EURUSD up 0.0002 (0.02%) at 1.0703

- USDJPY up 0.41 (0.26%) at 155.24

- Gold is down $0.58 (-0.03%) at $2321.49

- European bourses closing levels:

- EuroStoxx 50 down 18.29 points (-0.37%) at 4989.88

- FTSE 100 down 4.43 points (-0.06%) at 8040.38

- German DAX down 48.95 points (-0.27%) at 18088.7

- French CAC 40 down 13.92 points (-0.17%) at 8091.86

US TRASURY FUTURES CLOSE

- 3M10Y +2.122, -78.062 (L: -82.734 / H: -75.376)

- 2Y10Y +4.971, -28.515 (L: -33.897 / H: -27.488)

- 2Y30Y +5.547, -15.257 (L: -21.374 / H: -14.405)

- 5Y30Y +1.962, 11.612 (L: 8.21 / H: 12.243)

- Current futures levels:

- Jun 2-Yr futures down 1.25/32 at 101-18 (L: 101-16.25 / H: 101-19)

- Jun 5-Yr futures down 4/32 at 105-2.5 (L: 104-30.75 / H: 105-06.25)

- Jun 10-Yr futures down 9/32 at 107-25.5 (L: 107-20 / H: 108-02)

- Jun 30-Yr futures down 23/32 at 114-0 (L: 113-20 / H: 114-24)

- Jun Ultra futures down 1-04/32 at 119-26 (L: 119-12 / H: 120-31)

US 10Y FUTURE TECHS: (M4) Bearish Trend Condition

- RES 4: 109-25 50-day EMA

- RES 3: 109-26+ High Apr 10

- RES 2: 108-26 20-day EMA

- RES 1: 108-22+ High Apr 19

- PRICE: 107-26 @ 11:06 BST Apr 24

- SUP 1: 107-13+ Low Apr 16

- SUP 2: 107-07+ 76.4% of the Oct - Dec ‘23 bull leg (cont)

- SUP 3: 106-27 2.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 4: 106-08 3.00 proj of Dec 27 - Jan 19 - Feb 1 price swing

Treasuries are trading lower today. The trend outlook is unchanged and the direction remains down. Last week’s move lower reinforces current conditions and the move down has resumed this year’s bear trend. Furthermore, moving average studies remain in a bear-mode set-up, highlighting a clear downtrend. Sights are on 107.07+ next, a Fibonacci retracement. Firm resistance is 108-26, the 20-day EMA.

SOFR FUTURES CLOSE

- Jun 24 steady at 94.745

- Sep 24 -0.010 at 94.910

- Dec 24 -0.020 at 95.090

- Mar 25 -0.025 at 95.280

- Red Pack (Jun 25-Mar 26) -0.035 to -0.03

- Green Pack (Jun 26-Mar 27) -0.05 to -0.04

- Blue Pack (Jun 27-Mar 28) -0.06 to -0.055

- Gold Pack (Jun 28-Mar 29) -0.07 to -0.065

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00131 to 5.31816 (+0.00006/wk)

- 3M +0.00090 to 5.32445 (+0.00035/wk)

- 6M -0.00805 to 5.28965 (-0.00885/wk)

- 12M -0.02235 to 5.18826 (+0.00045/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.757T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $689B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $679B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $74B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $253B

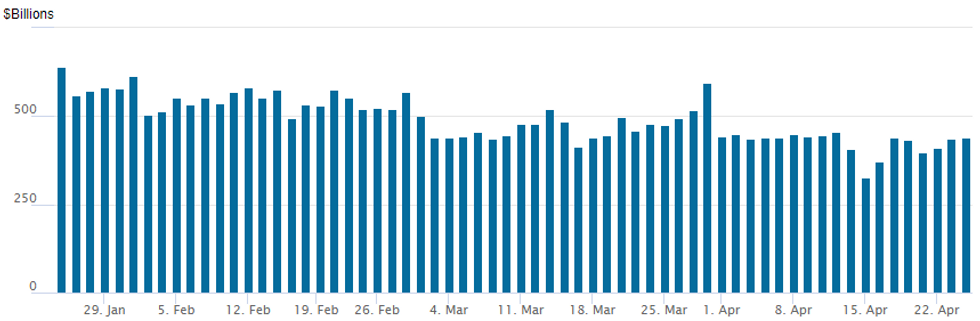

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs to $441.215B vs. $435.880B Tuesday. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

- Meanwhile, the latest number of counterparties rebounds to 82 vs. 71 prior.

PIPELINE: $2B OCP 2Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 4/24 $2B #OCP $1.25B 10Y +230, $750M 30Y +295

- $16.5B Priced Tuesday

- 4/23 $5B *Abu Dhabi $1.75B 5Y +35, $1.5B 10Y +45, $1.75B 30Y +90

- 4/23 $5B *Citibank $2B 2Y +52, $1B 2Y SOFR, $2B 10Y +97

- 4/23 $3B *Canada Gov Int Bond 5Y +10

- 4/23 $2B *CK Hutchinson $1B 5Y +80, $1B 10Y +100

- 4/23 $1.5B *CDP (Italian bank) 5Y +145

- 4/23 $Benchmark Kuwait Int Bank Reg S 5.5Y Sukuk investor calls

EGBs-GILTS CASH CLOSE: UK Curve Belly Leads Broader Sell-Off

Core European FI pulled back sharply Wednesday, with Gilts underperforming Bunds and periphery EGB spreads widening.

- Global bond weakness began with the Asia-Pacific overnight session as above-expected Australian inflation data kicked off a round of hawkish central bank repricing.

- The sell-off carried on steadily through the day as supply was digested (Gilt syndication, Bund auction), German IFO data came in firm, and Bund and Gilt futures saw downside technical breaks.

- Implied 2024 ECB rate cuts were pared by 4bp to 72bp; for the BoE, the 48bp implied was 7bp less than seen in the prior session.

- The shift in the BoE outlook translated into belly underperformance on the UK curve, while the German curve bear steepened. With less ECB accommodation implied, periphery EGB spreads widened, exacerbated by risk-off moves elsewhere.

- Thursday's agenda includes French confidence surveys and German GfK consumer confidence, and appearances by ECB's Schnabel and Lagarde.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.4bps at 2.971%, 5-Yr is up 7.8bps at 2.588%, 10-Yr is up 8.6bps at 2.588%, and 30-Yr is up 8.2bps at 2.732%.

- UK: The 2-Yr yield is up 9.5bps at 4.446%, 5-Yr is up 9.7bps at 4.221%, 10-Yr is up 9.3bps at 4.334%, and 30-Yr is up 8.2bps at 4.798%.

- Italian BTP spread up 5.3bps at 140bps / Spanish up 2.3bps at 79.6bps

FOREX: USDCAD Outperforms Following Data, USDJPY Extends Above 155.00

- Despite the solid moves in core fixed income markets on Wednesday, G10 currencies traded in relatively narrow ranges. Higher yields have moderately benefitted the dollar index (+0.16%), whilst continuing to weigh on the Japanese yen.

- USDJPY sprung to life approaching the US data, breaching the 155.00 handle for the first time since 1990. Stops may have been triggered through this mark, prompting an initial cycle high of 155.17. Despite the level breach, and trend conditions remaining firmly bullish, the pair had an immediate & sharp 35 pip turnaround to print 154.81 before the durable goods data release.

- Since then, USDJPY has extended higher as we approach the APAC crossover. breaching to print a fresh high 155.37. Above here, there is nothing on the technical front until 156.00 and 156.47. The usual caution regarding both verbal and actual intervention will continue to be in focus as we approach Friday's Bank of Japan decision.

- USDCAD (+0.28) received a boost following soft Canadian retail and manufacturing sales, leaving the Canadian dollar as the poorest performing major currency in G10. USDCAD has breached yesterday’s high of 1.3714 and a clear break opens 1.3855 next, the Nov 10 ‘23 high. Note that moving average studies remain in a bull-mode position, highlighting a clear rising trend.

- Higher core yields appeared to have a greater impact on emerging market currencies, with the likes of MXN, PLN and ZAR all underperforming. USDMXN (+0.70%) in particular has risen back above the 17.00 mark and will eye another test of 17.3860, the Jan 17 high, which represents an important reversal trigger.

- All focus turns to the advance reading of first quarter GDP in the US on Thursday, before Friday’s Bank of Japan decision.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/04/2024 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 25/04/2024 | 0600/0800 | ** |  | SE | PPI |

| 25/04/2024 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 25/04/2024 | 0700/0900 | ** |  | ES | PPI |

| 25/04/2024 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 25/04/2024 | 0700/0900 |  | EU | ECB's Schnabel Speech for 'ChaMP' | |

| 25/04/2024 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 25/04/2024 | 1100/0700 | *** |  | TR | Turkey Benchmark Rate |

| 25/04/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 25/04/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 25/04/2024 | 1230/0830 | *** |  | US | GDP |

| 25/04/2024 | 1230/0830 | * |  | CA | Payroll employment |

| 25/04/2024 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 25/04/2024 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 25/04/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 25/04/2024 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 25/04/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 25/04/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 25/04/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.