-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsys Quickly Reject Core PPI Outcomes

- MNI US/MACRO: Solid Private Sector Net Lending Amidst Dual Deficits, But Mixed Undercurrents

- MNI US/ISRAEL: US Pres Biden, Israel And Hamas Have Agreed To Gaza Ceasefire Framework

- MNI US DATA: Mixed Core PPI Outcomes In June, But Upward Revisions Across The Board

US

US/MACRO (MNI): Solid Private Sector Net Lending Amidst Dual Deficits, But Mixed Undercurrents

The full release of the U.S. national accounts for Q1 continue to lay bare the scale of private sector net lending that is occurring under large fiscal deficits and sizeable current account deficits.

- Coming out of the post-pandemic period, which saw historically large transfers from the government to the private sector (and specifically households), the private sector is currently a net lender to the tune of more than 4% GDP.

- With the exception to the build-up to the dotcom crisis and then the Great Financial Crisis, this is close to the long-term historical norm and on its own isn’t particularly problematic.

NEWS

US (MNI): Democrat Donors Freeze USD$90M In Pledges If Biden Becomes Dem Nominee

The New York Times reporting that some "major Democratic donors" have told the largest pro-Biden super PAC that around USD$90 million of campaign contributions are now "on hold" if President Biden secures the Democratic Party presidential nomination.

US (MNI): 18th House Rep Calls On Biden To Drop Out, Jeffries Sends Letter To Dems

First-term Colorado Democrat House Representative, Brittany Pettersen (D-CO), has become the 19th Democratic lawmaker to publicly call on President Biden to drop out of the presidential race. Pettersen writes in a statement: "Joe Biden saved our country once, and I'm joining the growing number of people in my district and across the country to ask him to do it again. Please pass the torch to one of our many capable Democratic leaders so we have the best chance to defeat Donald Trump..."

US/ISRAEL (MNI) Biden: Israel And Hamas Have Agreed To Gaza Ceasefire Framework

US President Joe Biden has issued a statement on social mediaclaiming that Israel and Hamas have both agreed to the three-phrase Gaza ceasefire-for-hostage framework that he outlined in a White House speech on May 31. Biden: "Six weeks ago I laid out a comprehensive framework for how to achieve a ceasefire and bring the hostages home. There is still work to do and these are complex issues, but that framework is now agreed to by both Israel and Hamas. My team is making progress and I'm determined to get this done."

WHITE HOUSE (MNI): Harris Overtakes Biden Again In Dem Nom Betting After Pres' Gaffes:

Vice President Kamala Harris has once again overtaken President Joe Biden in political betting markets with regards to who will be the Democratic party's presidential nominee come November.

FRANCE (MNI): Attal Seeks Renaissance Presidency, Would Be Unable To Continue As PM:

Prime Minister Gabriel Attal has confirmed that he will seek the presidency of the centrist Rennaisance party group in the National Assembly, a move that would be incompatible with his continuation in office as PM.

POLITICAL RISK (MNI): ESTONIA-Kallas To Resign As PM 15 July To Take Up EU Role:

Estonia's ERR reporting that PM Kaja Kallas is set to offer her resignation to President Alar Karis on Monday 15 July as she prepares to take up the role of European Commission High Representative for Foreign Affairs and Security Policy.

US Treasuries Near Late Highs, Discounting June PPI & Up-Revisions

- Reversing the initial negative reaction to this morning's PPI data, Treasury futures look to finish mildly higher, at or near late session highs Friday as as economists deemed the data as more mixed than the initial hawkish reaction warranted.

- The Sep'24 10Y contract currently trades +2.5 at 111-07.5 near initial technical resistance is at 111-10+ (High Jul 8) followed by 111-13 (High Mar 25). Clearance of this hurdle would open 111-31, a Fibonacci projection. Curves are bull steepened with 2s10s +3.251 at -27.456, 5s30s +1.557 at 29.122.

- In turn, projected rate cut pricing into year end look firmer vs. early Friday (*): July'24 at -6.5% w/ cumulative at -1.6bp at 5.313%, Sep'24 cumulative -25.2bp (-24.1bp), Nov'24 cumulative -41.4bp (-38.5bp), Dec'24 -62.9bp (-59.6bp).

- Treasuries gapped lower after higher than expected PPI Final Demand MoM (0.2% vs. 0.1% est, with prior PPI up-revised to 0.0% from -0.2%), YoY (2.6% vs. 2.3% est, 2.2% prior).

- The Sep'24 10Y contract traded down to 110-25.5 low (-11.5), well above initial technical support of 110-07+/109-31 (20- and 50-day EMA values) before consolidating and reversing course.

- Futures inched higher after the latest UofM data came out near steady to lower than expected (current Conditions 64.1 vs. 66.0 - the lowest since late 2022) while inflation expectations come out in-line to slightly lower than expected with both 1Y and 5-10Y at 2.9%.

OVERNIGHT DATA

US DATA (MNI): Mixed Core PPI Outcomes In June, But Upward Revisions Across The Board

PPI final demand: 0.22% M/M (cons 0.1) in June after -0.03 (revised up from initial -0.25). Net upward revisions worth 0.18pps.

- PPI ex food & energy: 0.44% M/M (cons 0.2) in June after 0.28 (revised up from initial 0.05). Net upward revisions worth 0.21pps.

- But PPI ex food, energy & trade: 0.04% M/M (cons 0.2) after 0.16% (revised up from initial 0.01). Net upward revisions worth 0.12pps.

US DATA (MNI): 5-10Y U.Mich Inflation Expectations Surprise Lower But Within Typical Range

U.Mich consumer sentiment was softer than expected in the July preliminary report, falling to 66.0 (cons 68.5) after 68.2, leaving it at its weakest since Nov’23.

- Inflation expectations were as expected for the short-term but more notably drifted lower 5-10Y out.

- 1Y: 2.9% (cons 2.9%) after 3.0%, lowest since March.

- 5-10Y: 2.9% (cons 3.0%) after 3.0%, lowest since the 2.8% in March which marked a rare break from the 2.9-3.1% that is has mostly held since mid-2021.

- Note that for the 5-10Y figures, three of the six months in the first half of the year saw a -0.1pp revision with the final release (Mar, May & Jun), two saw no change and one saw a 0.1pp upward revision (Jan).

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 289.44 points (0.73%) at 40039.83

- S&P E-Mini Future up 31.5 points (0.56%) at 5670.5

- Nasdaq up 127.2 points (0.7%) at 18408.64

- US 10-Yr yield is down 3.3 bps at 4.177%

- US Sep 10-Yr futures are up 3/32 at 111-8

- EURUSD up 0.0039 (0.36%) at 1.0906

- USDJPY down 1.02 (-0.64%) at 157.82

- WTI Crude Oil (front-month) down $0.38 (-0.46%) at $82.24

- Gold is down $2.87 (-0.12%) at $2412.59

- European bourses closing levels:

- EuroStoxx 50 up 66.89 points (1.34%) at 5043.02

- FTSE 100 up 29.57 points (0.36%) at 8252.91

- German DAX up 213.62 points (1.15%) at 18748.18

- French CAC 40 up 97.19 points (1.27%) at 7724.32

US TREASURY FUTURES CLOSE

- 3M10Y -2.812, -116.747 (L: -116.894 / H: -111.185)

- 2Y10Y +3.057, -27.65 (L: -31.203 / H: -26.807)

- 2Y30Y +3.594, -6.129 (L: -10.726 / H: -5.669)

- 5Y30Y +1.456, 29.021 (L: 26.394 / H: 29.804)

- Current futures levels:

- Sep 2-Yr futures up 2.875/32 at 102-19 (L: 102-13.75 / H: 102-19.125)

- Sep 5-Yr futures up 3.5/32 at 107-17.75 (L: 107-06.75 / H: 107-18)

- Sep 10-Yr futures up 3/32 at 111-8 (L: 110-25.5 / H: 111-08)

- Sep 30-Yr futures up 4/32 at 119-31 (L: 119-06 / H: 120-01)

- Sep Ultra futures up 7/32 at 127-16 (L: 126-11 / H: 127-16)

US 10YR FUTURE TECHS: US 10YR FUTURE TECHS: (U4) Bull Cycle Remains In Play

- RES 4: 112-25 High Mar 8

- RES 3: 111-31 1.382 proj of the Apr 25 - May 16 - 29 price swing

- RES 2: 111-13 High Mar 25

- RES 1: 111-10+ High Jul 8

- PRICE: 111-04 @ 1230 ET Jul 12

- SUP 1: 110-07+/109-31 20- and 50-day EMA values

- SUP 2: 109-02+/109-00+ Low Jul 1 / Low Jun 10 and key support

- SUP 3: 108-27+ Low Jun 3

- SUP 4: 108-22+ Trendline drawn from the Apr 25 low

Treasuries rallied Thursday and held the bulk of the upside into the Friday close. This confirms an extension of the bull cycle that started Jul 1. The move higher has resulted in a breach of 111-01, the Jun 14 high. This cancels a recent bearish threat and instead signals scope for an bullish continuation near-term with the focus on 111-13 next, the Mar 25 high. Clearance of this hurdle would open 111-31, a Fibonacci projection. Initial firm support is at 110-07+, the 20-day EMA.

SOFR FUTURES CLOSE

- Sep 24 +0.010 at 94.945

- Dec 24 +0.030 at 95.340

- Mar 25 +0.040 at 95.715

- Jun 25 +0.050 at 96.020

- Red Pack (Sep 25-Jun 26) +0.040 to +0.050

- Green Pack (Sep 26-Jun 27) +0.015 to +0.035

- Blue Pack (Sep 27-Jun 28) -0.005 to +0.010

- Gold Pack (Sep 28-Jun 29) -0.015 to -0.005

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00100 to 5.32780 (+0.00037/wk)

- 3M -0.01526 to 5.28611 (-0.02078/wk)

- 6M -0.04028 to 5.16480 (-0.06167/wk)

- 12M -0.07906 to 4.86554 (-0.13995/wk)

- Secured Overnight Financing Rate (SOFR): 5.34% (+0.00), volume: $1.920T

- Broad General Collateral Rate (BGCR): 5.32% (-0.01), volume: $773B

- Tri-Party General Collateral Rate (TGCR): 5.32% (-0.01), volume: $755B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $90B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $270B

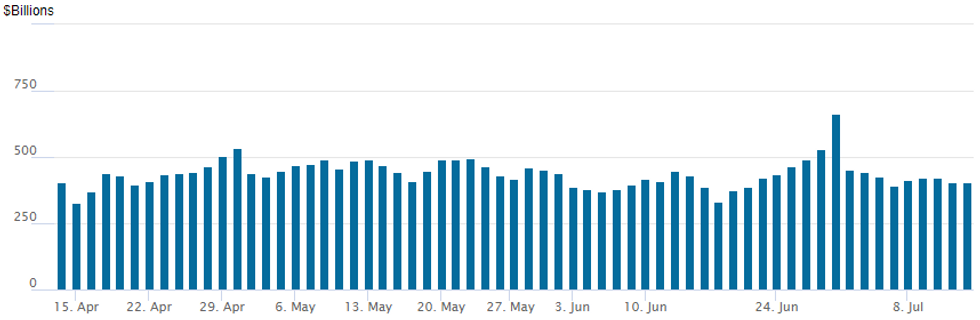

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage inches up to $406.590B from $403.708B on Thursday. Number of counterparties: 73 from 71 prior. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

EGBs-GILTS CASH CLOSE: Yields Partially Rebound From Thursday's Drop

European yields partially rebounded Friday from the prior session's US CPI-induced drop.

- Yields rose in early trade, amid small upward revisions in French and Spanish final June inflation data, and an uptick in oil prices.

- Pressure peaked in early afternoon after US producer price indices came in stronger than expected.

- But the move faded after PPI details looked less worrying, with the effect later compounded by soft US consumer sentiment data (UMichigan), helping European yields close toward the lower end of the daily range and well below the week's highs.

- Periphery spreads tightened modestly, led by BTPs, with equities rising sharply (Eurostoxx futures +1.3%). 10Y OAT/Bund spread closed flat on both the day and the week (65.6bp).

- Next week's risk events include UK CPI Wednesday, with the ECB decision Thursday - while there are no expectations of a rate cut, communications will be eyed for the outlook for September's expected easing.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.1bps at 2.823%, 5-Yr is up 3.6bps at 2.475%, 10-Yr is up 3.3bps at 2.496%, and 30-Yr is up 2.5bps at 2.683%.

- UK: The 2-Yr yield is up 1.8bps at 4.086%, 5-Yr is up 2.6bps at 3.948%, 10-Yr is up 3.5bps at 4.109%, and 30-Yr is up 2.6bps at 4.615%.

- Italian BTP spread down 2.4bps at 129.7bps / Spanish down 0.5bps at 76.4bps

FOREX: Greenback Weakens Further, JPY & GBP Strength in Spotlight

- Higher-than-expected US PPI data did little to affect post-CPI sentiment in currency markets, and a subsequent bounce for major equity indices weighed on the greenback into the week’s close. The USD index sits 0.3%, set to post its lowest close in around five weeks.

- The Japanese Yen was once again in the spotlight, following the apparent confirmation that the BOJ intervened on Thursday, following the US inflation figures. Price action remained volatile in today’s session and another sudden jolt to the downside has prompted speculation that another round of intervention may have occurred.

- USDJPY resides 0.58% lower on the session around 157.90, having tested the pullback low at 157.38. This level has held well, suggesting decent support layered at the Thurs/Friday lows. The 50-dma has been pierced, but a close below the mark at 157.78 today would be the first since March of this year.

- For reference, according to a Bloomberg analysis of central bank accounts. Scale of intervention was probably around ¥3.5 trillion ($22 billion), based on a comparison of Bank of Japan accounts and money broker forecasts.

- GBP strength into the London close has helped GBPUSD (+0.56%) again print the best levels since mid-'23. On the weekly chart, a close at current levels would be the first above the 200-week moving average since the false break last year, and would open M/T targets at 1.3142 - the 76.4% retracement for the Jun'21 (post COVID high) - Sep'22 (Truss budget low) downleg.

- For EURGBP, weakness through the June low puts the cross at the lowest level since Aug'22. We note that this resumes the downtrend and places the immediate focus on 0.8366, the 2.236 projection of the Apr 23 - 30 - May 9 price swing.

- On Monday, Fed Chair Powell makes his final scheduled appearance ahead of the pre-July FOMC meeting communications blackout period. Elsewhere next week, CPI data from Canada, New Zealand and the UK is scheduled, with Thursday marking the ECB’s July decision.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/07/2024 | 0200/1000 | *** |  | CN | GDP |

| 15/07/2024 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 15/07/2024 | 0200/1000 | *** |  | CN | Retail Sales |

| 15/07/2024 | 0200/1000 | *** |  | CN | Industrial Output |

| 15/07/2024 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate M/M |

| 15/07/2024 | 0700/0900 |  | EU | ECB's Lagarde and Cipollone in Eurogroup meeting | |

| 15/07/2024 | 0900/1100 | ** |  | EU | Industrial Production |

| 15/07/2024 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/07/2024 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 15/07/2024 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/07/2024 | 1430/1030 | ** |  | CA | BOC Business Outlook Survey |

| 15/07/2024 | 1435/1035 |  | US | San Francisco Fed's Mary Daly | |

| 15/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 15/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 15/07/2024 | 1630/1230 |  | US | Fed Chair Jerome Powell |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.