-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsys Yld Declines Ahead Shortened Holiday Week

- MNI INTERVIEW: Fed Should Prep For Chance Of Fewer Cuts-Lacker

- MNI US: House Passes Minibus To Conclude FY24 Appropriations

- MNI INTERVIEW: ECB Mindful Of US Rates - Bank of Greece Deputy

- MNI ROME: Superbonus Impact On Italy's '24 Budget Deficit "Limited"

- MNI US: Home Affordability Improved For Third Month Running – Atlanta Fed

Atlanta Federal Reserve

Atlanta Federal Reserve

US

INTERVIEW (MNI): Fed Should Prep For Chance Of Fewer Cuts-Lacker: Federal Reserve officials should remain clear-eyed about the risk that inflation will prove more persistent than expected, forcing them to hold off longer on the start of rate cuts, former Richmond Fed President Jeffrey Lacker told MNI.

- “I’m open to the notion that two or three rate cuts end up being warranted this year, but the committee would do well to prepare markets for other possibilities, in particular that inflation stalls out, and just spelling out what it means – they don’t get rate cuts this year,” Lacker said in an interview.

- The biggest mistake officials made in the 1970s was letting their guard down too soon, he noted, saying the Fed was at a “critical moment” once again.

NEWS

US (MNI): House Passes Minibus To Conclude FY24 Appropriations, Greene Submits MTV: The House of Representatives has successfully passed a six-bill minibus of FY24 legislation to conclude the lower chamber's work on FY2024 legislation. The package now heads to the Senate where Senate leadership will seeks to fast-track the bill to avert a partials government shutdown at midnight.

INTERVIEW (MNI): ECB Mindful Of US Rates - Bank of Greece Deputy: The European Central Bank will be mindful of any divergence between its own and Federal Reserve interest rates, given the implications for the euro exchange rate and financial markets, Bank of Greece Deputy Governor Theodore Pelagidis told MNI.

ROME (MNI): Superbonus Impact On Italy's '24 Budget Deficit "Limited": The impact on Italy’s budget deficit from the Superbonus tax credits for home renovations should be “much more limited” in 2024 than in 2023, when the programme was largely responsible for the country missing its fiscal targets by almost 2% of GDP, sources close to the matter told MNI.

SECURITY (MNI): Netanyahu Tells Blinken Israel Will Proceed With Rafah Operation: Wires reporting that Israeli Prime Minister Benjamin Netanyahu told US Secretary of State Antony Blinken, in a Tel Aviv meeting today, that Israel will proceed with a ground invasion of Rafah, "even if we have to do it alone."

EU/CHINA (MNI): Dutch Prime Minister Mark Rutte will travel to China next week to discuss trade and business and hold a bilateral meeting with Chinese President Xi Jinping and Premier Li Qiang on Wednesday. According to a statement from the Dutch government, "discussions will include bilateral and economic relations, the war in Ukraine and the situation in the Middle East."

US TSYS Rates Discount Thursday's Data, Finish Week Near Highs

- Treasuries look to finish higher Friday, trading sideways after marking session highs around midmorning. No particular headline driver, rates see broad based support around midday following a large buy of 35,000 SFRM4 (3M Jun'24 SOFR futures) noted at 94.905 (+0.015) at around 1112ET, trades 94.915 last.

- After the bell, Jun'24 10Y futures trade +11.5 at 110-24 vs. 110-26.5 high. Key short-term resistance to watch is 111-00+, the 50-day EMA. A clear break of this average is required to suggest scope for a stronger recovery.

- Underlying futures discounted yesterday's flash PMI inflation build, trading back near highs for the week while projected rate cut pricing gained ground: May 2024 at -16.5 vs. -14.5% this morning w/ cumulative -4.1bp at 5.286%; June 2024 -69.3% vs. -64.1% earlier w/ cumulative rate cut -21.5bp at 5.113%. July'24 cumulative at -33.5bp vs. -31.5bp.

- Monday Data Calendar: Fed Speak, New Home Sales, Dallas Fed Mfg. Trading floors and Globex are closed next Friday for Good Friday/Easter holiday.

OVERNIGHT DATA

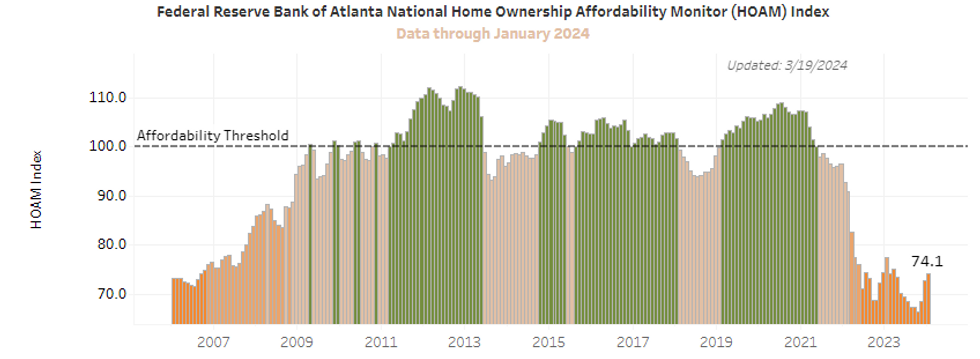

US (MNI): Home Affordability Improved For Third Month Running – Atlanta Fed: The Atlanta Fed’s updated home ownership affordability monitor showed a third consecutive increase in January, helping support yesterday’s surprise jump in existing home sales in February.

- Gains have been led by declining home prices and interest rates.

- As you can see in the chart though, the index remains far below the affordability threshold. Full monitor here.

US (MNI): NY Fed Staff Surprised By Economic Strength But Core PCE Forecast Lowered: NY Fed staff have published an update for their DSGE model forecasts and how it compares with their Dec’23 update.

- “Once again, the model was surprised by the strength of the economy. The model attributes this forecast error in part to higher-than-expected productivity, and in part to stimulative financial conditions.”

- GDP growth is seen stronger this year at 1.9% Y/Y in 4Q24 (revised from 1.2%), before an unrevised 0.7% Y/Y for 4Q25.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 265.73 points (-0.67%) at 39517.51

- S&P E-Mini Future down 6.5 points (-0.12%) at 5296.25

- Nasdaq up 22.7 points (0.1%) at 16425.01

- US 10-Yr yield is down 5.1 bps at 4.2158%

- US Jun 10-Yr futures are up 11/32 at 110-23.5

- EURUSD down 0.0057 (-0.52%) at 1.0803

- USDJPY down 0.17 (-0.11%) at 151.45

- Gold is down $18.2 (-0.83%) at $2163.13

- European bourses closing levels:

- EuroStoxx 50 down 21.16 points (-0.42%) at 5031.15

- FTSE 100 up 48.37 points (0.61%) at 7930.92

- German DAX up 26.69 points (0.15%) at 18205.94

- French CAC 40 down 27.8 points (-0.34%) at 8151.92

US TREASURY FUTURES CLOSE

- 3M10Y -3.049, -117.466 (L: -120.018 / H: -114.678)

- 2Y10Y -1.257, -38.403 (L: -40.173 / H: -36.203)

- 2Y30Y -0.483, -20.849 (L: -23.433 / H: -18.82)

- 5Y30Y +0.977, 18.971 (L: 17.095 / H: 19.552)

- Current futures levels:

- Jun 2-Yr futures up 1.875/32 at 102-11.625 (L: 102-09 / H: 102-12.5)

- Jun 5-Yr futures up 6.75/32 at 107-2.75 (L: 106-27.75 / H: 107-04.5)

- Jun 10-Yr futures up 11/32 at 110-23.5 (L: 110-12.5 / H: 110-26.5)

- Jun 30-Yr futures up 25/32 at 119-25 (L: 119-02 / H: 120-05)

- Jun Ultra futures up 1-05/32 at 127-24 (L: 126-22 / H: 128-09)

US 10Y FUTURE TECHS: (M4) Remains Below Resistance

- RES 4: 112-04+ High Mar 8 and bull trigger

- RES 3: 111-24 High Mar 12

- RES 2: 111-00+ 50-day EMA

- RES 1: 110-26+ High Mar 21 & 22

- PRICE: 110-24 @ 1130ET Mar 22

- SUP 1: 109-24+ Low Mar 18 and the bear trigger

- SUP 2: 109-14+ Low Nov 28

- SUP 3: 109-12+ 1.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 4: 108-25+ 2.00 proj of Dec 27 - Jan 19 - Feb 1 price swing

Despite this week’s gains, Treasuries maintain a softer tone and the latest move higher appears to be a correction. Moving average studies are in a bear-mode position and this highlights a downtrend. Key short-term resistance to watch is 111-00+, the 50-day EMA. A clear break of this average is required to suggest scope for a stronger recovery. On the downside, the bear trigger is unchanged at 109-24+.

SOFR FUTURES CLOSE

- Jun 24 +0.020 at 94.910

- Sep 24 +0.020 at 95.215

- Dec 24 +0.030 at 95.520

- Mar 25 +0.035 at 95.785

- Red Pack (Jun 25-Mar 26) +0.045 to +0.065

- Green Pack (Jun 26-Mar 27) +0.060 to +0.070

- Blue Pack (Jun 27-Mar 28) +0.055 to +0.060

- Gold Pack (Jun 28-Mar 29) +0.060 to +0.060

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00070 to 5.32871 (-0.00004/wk)

- 3M -0.00748 to 5.31248 (-0.02000/wk)

- 6M -0.01678 to 5.22900 (-0.04614/wk)

- 12M -0.03306 to 5.00378 (-0.07481/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.849T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $684B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $678B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $93B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $248B

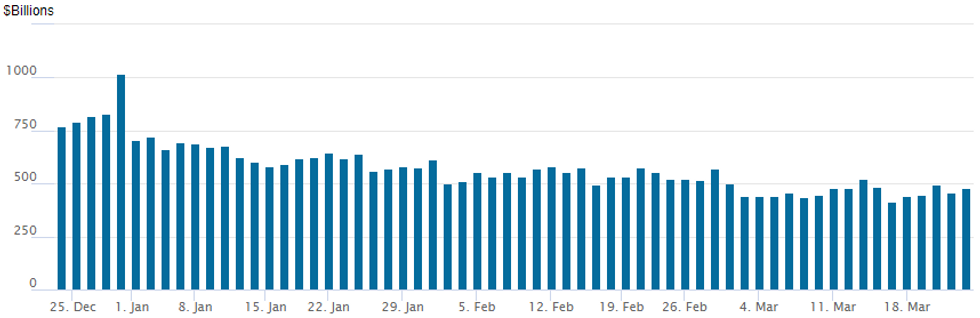

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage rebounds to $478.531B from $460.631B yesterday. Last Friday saw usage fall to $413.877B - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties slips to 72 vs. 74 yesterday (compares to 65 on January 16, the lowest since July 7, 2021)

PIPELINE: $1B Hilton Worldwide 2Pt on Tap

- Date $MM Issuer (Priced *, Launch #)

- 3/22 $2.75B Truist Insurance 7NC3

- 3/22 $1B Hilton Worldwide 5NC2, 8NC3

- 3/22 $500M Bombardier 7NC3

- 3/22 $Benchmark Old Republic investor calls

- Expected next week:

- 3/25 $Benchmark CSL 10Y, 30Y investor calls

- 3/25 $Benchmark AIA 10Y investor calls

EGBs-GILTS CASH CLOSE: Further Gains To Cap Dovish Central Bank Week

Gilts and Bunds completed a strong week with a 5th consecutive session of gains Friday, as multiple dovish central bank developments buoyed global core FI.

- Though there were few market-moving developments on the day, Friday's positive tone was attributed to multiple dovish-leaning central bank results (BoJ, SNB, Fed, BoE) earlier in the week.

- The rally extended sharply around midday, with Bund yields' fall through the Mar 14 low of 2.355% rippling through to UK and US markets. From a futures perspective, Gilt tested but failed to break through psychological 100.00 level, with 99.91/100.37 remaining key S/T resistance.

- German IFO and UK retail sales data were each above-consensus, but didn't have much market impact. ECB/Bundesbank's Nagel said at an MNI event that "if I were to put it into probabilities - June has a higher probability than April" for the first ECB rate cut.

- Periphery EGB spreads closed wider. Note expected ratings reviews after hours Friday (Fitch on Portugal, Scope on Spain), against a backdrop of recent ratings upgrades (S&P on Portugal) helping periphery EGB spreads compress.

- Next week's highlights include the beginning of the March Eurozone flash inflation round (Spain, France, Italy).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 4.8bps at 2.827%, 5-Yr is down 7.1bps at 2.334%, 10-Yr is down 8.1bps at 2.324%, and 30-Yr is down 8.4bps at 2.494%.

- UK: The 2-Yr yield is down 5.4bps at 4.124%, 5-Yr is down 6.1bps at 3.817%, 10-Yr is down 6.5bps at 3.93%, and 30-Yr is down 4.6bps at 4.447%.

- Italian BTP spread up 4.9bps at 131.9bps / Portuguese PGB spread up 3.3bps at 66.9bps

FOREX Greenback Dominates Amid Global Dovish Repricing

- The greenback was among the strongest performers in G10 on Friday, and comfortably the best performer on the week amid a phase of global central bank re-pricing - particularly dovish shifts in Europe and the UK.

- Dollar strength put the USD Index back above 104.00 and within range of the mid-February multi-month highs. The USD Index is on track to form a key bullish indicator - a golden cross formation - at the close. The signal, formed when the 50-dma rises above the 200-dma, was last printed in September last year, and pre-saged a further 2% rally to the '23 high.

- A corrective pullback in GBP/USD persists, with the pair showing below the 200-dma on Friday, mirroring the build in BoE rate cut pricing since Thursday’s decision. Over 80bps of rate cuts are now priced for this calendar year, up from ~60bps at the beginning of the week. This narrows the gap with next support for GBP/USD undercuts at 1.2536, the Feb14 Low and the bear trigger at 1.2519.

- Focus in the coming week shifts away from global central banks, and is front-loaded with Good Friday keeping markets only partially open on March 29th. Nonetheless, key comms will be watched from BoE's Mann (who dropped her vote for a hike this week) and Fed's Waller on Wednesday.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/03/2024 | 0800/0900 | ** |  | ES | PPI |

| 25/03/2024 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 25/03/2024 | 1225/0825 |  | US | Atlanta Fed's Raphael Bostic | |

| 25/03/2024 | 1400/1000 | *** |  | US | New Home Sales |

| 25/03/2024 | 1415/1415 |  | UK | BOE Mann At Royal Economic Society Annual Conference | |

| 25/03/2024 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 25/03/2024 | 1430/1030 |  | US | Fed Governor Lisa Cook | |

| 25/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 25/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 25/03/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.