MNI ASIA OPEN: US Funding, ME Tensions, Confidence Dips

- MNI FED BRIEF: Fed Gov Bowman Wants Measured Approach To Rate Cuts

- MNI US: Senate Expected To Take Up Govt Funding Measure On Thursday

- MNI SECURITY: We Are Not Eager To Start Ground Invasion, Israeli Diplomat At UN

- MNI US DATA: Labor Differential Pointing To Clear Upside Risks To U/E Rate

US TSYS: Curves Twist to New 2+ Year Highs, Consumer Confidence Dips

- Treasuries looked to finish mixed Tuesday, curves twisting steeper with the short end outperforming. Rates bounced off modestly weaker levels after this mornings lower than expected Conference Board consumer survey.

- Data was markedly weaker than expected in September. Consumer confidence fell to 98.7 (cons 104.0) for a sizeable slip after an upward revised 105.6 (initial 103.3) in Aug. Declines were seen in both the present situation and expectations components.

- Dec'24 10Y Tsy futures are currently +3.5 at 114-28 vs. 114-09.5 low -- still well off initial technical resistance at 115-02+/23+ High Sep 19 / 11 and the bull trigger.

- Curves steepened with the short end outperforming, new 2+ highs in the 2s10s curve climbing to 20.213, 5s30s taps 62.011 high.

- Projected rate cuts into early 2025 gain traction, latest vs. this morning's levels (*) as follows: Nov'24 cumulative -39.8bp (-38.5bp), Dec'24 -78.6bp (-74.4bp), Jan'25 -113.0bp (-108.0bp).

- Cross asset summary: Stocks held modest gains after the bell, near all-time highs, Eminis 5793.50, the Dow 42,232.0; Gold marked new high of 2,660.50.

- Looking ahead to Wednesday's session: MBA Mortgage apps, New Home Sales, $28B 2Y FRN, $62B 17W bill auctions, $70B 5Y at 1300ET.

US

FED BRIEF (MNI): Fed Gov Bowman Wants Measured Approach To Rate Cuts

Federal Reserve Governor Michelle Bowman on Tuesday argued for a "more measured approach" to lowering interest rates, citing upside risks to inflation and a higher neutral rate than before the pandemic. She dissented to the FOMC's decision last week to begin its rate cutting cycle with a 50 basis point move.

- Lowering rates too quickly risks reigniting price pressures as businesses and consumers spending the cash they have been holding onto until rates are lower, she said in remarks prepared for the 2024 Kentucky Bankers Association. Global supply chains remain vulnerable and fiscal policy expansionary. "The upside risks to inflation remain prominent," she said. "While it has not been my baseline outlook, I cannot rule out the risk that progress on inflation could continue to stall."

NEWS

US (MNI): Senate Expected To Take Up Govt Funding Measure On Thursday

Senate Minority Whip John Thune (R-SD) has told reporters that he expects the Senate will take up a Continuing Resolution to extend government funding for three-months on Thursday. The CR, is expected to come in front of the House of Representatives tomorrow where a strong contingent of Democrat reps will vote in favour of the bill to clear the two-thirds majority required to pass the package under suspension of rules.

SECURITY (MNI): We Are Not Eager To Start Ground Invasion, Israeli Diplomat At UN

Reuters reporting that Israel's U.N. Ambassador, Danny Danon, has told reporters in New York City that Israel is open to ideas for de-escalating the conflict in Lebanon. Danon said: "As we speak there are important forces trying to come up with ideas and we are open-minded for that. We are not eager to start any ground invasion anywhere ... We prefer a diplomatic solution."

FRANCE (MNI): New Fin Min-'Budget Situation Serious':

France's newly-appointed Minister of Economy, Finances and Industry Antoine Armand speaking to France Inter earlier this morning continued the previous rhetoric from PM Michel Barnier outlining the difficult fiscal situation the country finds itself in.

OVERNIGHT DATA

US DATA (MNI): Labor Differential Pointing To Clear Upside Risks To U/E Rate

The Conference Board consumer survey was markedly weaker than expected in September. Consumer confidence fell to 98.7 (cons 104.0) for a sizeable slip after an upward revised 105.6 (initial 103.3) in Aug. Declines were seen in both the present situation and expectations components.

- Most notably considering the focus on the labor market, there was another sizeable decline for the labor differential, to 12.6 after another downward revision to 15.9 (initial 16.4).

- This labor differential doesn’t always guide the monthly change in the unemployment rate but directionally it continues to imply further sizeable increases having briefly held at 4.25/4.22% in Jul/Aug after swift increases earlier in the year.

- Jobs plentiful 30.9 after 32.7 (initial 32.8) for a fresh low since Mar 2021, Jobs hard to get 18.3 after 16.8 (initial 16.4) for the highest since Feb 2021.

US DATA (MNI): City House Price Inflation Proving Stickier Than Rural Areas

FHFA house prices registered a third relatively tepid month in July, rising 0.12% M/M (sa, cons 0.2) after two flat months (although June was revised up slightly from -0.07 to 0.00). The year-ago rate is still solid at 4.5% Y/Y although 3m/3m pace has slowed to just 1.3% annualized. The S&P CoreLogic 20-city measure meanwhile is running hotter despite surprising lower, with 0.27% M/M in July (sa, cons 0.4) after two months averaging 0.43% M/M.

US DATA (MNI): Philly Fed Non-Mfg A Mixed Bag But Some Notable Weak Spots

The Philly Fed non-mfg index bounced back from a surprisingly sharp -25.1 in Aug to -6.1 in Sept, slightly better than the -9.3 expected. We had noted after last month’s release that there was an unusually large disconnect between firm’s perceptions of their own activity versus how they saw regional activity (the latter being the headline figure on screens).

- This mostly corrected this month, primarily from the regional side being less weak but also with firms’ own activity not being quite at optimistic as in Aug, with 1.5 vs 8.3 prior.

- The details for the overall survey are decidedly mixed. New orders slid from -0.3 to -17.8 for their lowest since Apr 2023 (only lower in Apr/May 2020 for a series starting in 2011) but employment components improved (full-time 0.0 after -14.9, part-time 16.1 after -0.5 for its highest since Mar 2022).

- Price components slowed, with prices paid at 19.5 after 30.0 for the lowest since Oct 2020 and prices received at 6.2 after 9.8 although that’s only the lowest since May.

MNI: US REDBOOK: SEP STORE SALES +5.2% V YR AGO MO

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 36.6 points (0.09%) at 42160.27

- S&P E-Mini Future up 7.5 points (0.13%) at 5783.75

- Nasdaq up 75.9 points (0.4%) at 18049.9

- US 10-Yr yield is down 1.5 bps at 3.7337%

- US Dec 10-Yr futures are up 2.5/32 at 114-27

- EURUSD up 0.0062 (0.56%) at 1.1172

- USDJPY down 0.32 (-0.22%) at 143.29

- WTI Crude Oil (front-month) up $1.26 (1.79%) at $71.63

- Gold is up $31.09 (1.18%) at $2659.80

- European bourses closing levels:

- EuroStoxx 50 up 55.15 points (1.13%) at 4940.72

- FTSE 100 up 23.05 points (0.28%) at 8282.76

- German DAX up 149.84 points (0.8%) at 18996.63

- French CAC 40 up 95.93 points (1.28%) at 7604.01

US TREASURY FUTURES CLOSE

- 3M10Y -2.357, -89.972 (L: -92.274 / H: -84.131)

- 2Y10Y +3.583, 19.583 (L: 15.874 / H: 20.213)

- 2Y30Y +5.111, 55.345 (L: 50.508 / H: 55.971)

- 5Y30Y +3.292, 61.791 (L: 58.488 / H: 62.011)

- Current futures levels:

- Dec 2-Yr futures up 2.375/32 at 104-13.5 (L: 104-08.25 / H: 104-13.75)

- Dec 5-Yr futures up 3.25/32 at 110-12.25 (L: 110-00.75 / H: 110-13)

- Dec 10-Yr futures up 2.5/32 at 114-27 (L: 114-09.5 / H: 114-29)

- Dec 30-Yr futures down 4/32 at 125-0 (L: 123-29 / H: 125-06)

- Dec Ultra futures down 8/32 at 134-0 (L: 132-19 / H: 134-08)

US 10YR FUTURE TECHS: (Z4) Trades Through The 20-Day EMA

- RES 4: 116-07 1.764 proj of the Aug 8 - 21 - Sep 3

- RES 3: 116-00 Round number resistance

- RES 2: 115-31 1.618 proj of the Aug 8 - 21 - Sep 3

- RES 1: 115-02+/23+ High Sep 19 / 11 and the bull trigger

- PRICE: 114-25.5 @ 1400 ET Sep 24

- SUP 1: 114-11+ :ow Sep 23

- SUP 2: 114-00+ Low Sep 4

- SUP 3: 113-23 50-day EMA

- SUP 4: 113-12 Low Sep 3 and a key support

Treasuries maintain a bullish theme and the latest pullback appears to be a correction - for now. The contract has traded through the 20-day EMA, at 114-23+. A clear break of it would signal scope for a deeper retracement, potentially towards 113-23, the 50-day EMA. For bulls, a resumption of gains would refocus attention on 115-23+, the Sep 11 high and a bull trigger. A break would resume the uptrend.

SOFR FUTURES CLOSE

- Dec 24 +0.045 at 96.090

- Mar 25 +0.045 at 96.675

- Jun 25 +0.040 at 96.985

- Sep 25 +0.045 at 97.115

- Red Pack (Dec 25-Sep 26) +0.035 to +0.045

- Green Pack (Dec 26-Sep 27) +0.015 to +0.030

- Blue Pack (Dec 27-Sep 28) +0.005 to +0.010

- Gold Pack (Dec 28-Sep 29) -0.005 to +0.005

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00031 to 4.85447 (-0.00275/wk)

- 3M -0.00912 to 4.65883 (-0.03242/wk)

- 6M -0.02407 to 4.30962 (-0.04177/wk)

- 12M -0.02828 to 3.79522 (-0.03627/wk)

- Secured Overnight Financing Rate (SOFR): 4.83% (+0.00), volume: $2.198T

- Broad General Collateral Rate (BGCR): 4.82% (+0.01), volume: $811B

- Tri-Party General Collateral Rate (TGCR): 4.82% (+0.01), volume: $781B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 4.83% (+0.00), volume: $93B

- Daily Overnight Bank Funding Rate: 4.83% (+0.00), volume: $284B

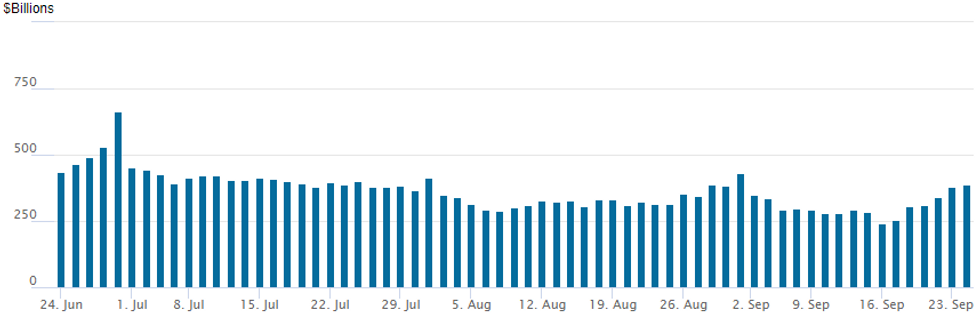

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage climbs to $388.977B this afternoon from $380.372B prior. Compares to $239.386B on Monday September 16 2024 -- the lowest level since early May 2021. Number of counterparties at 65 from 71 prior.

PIPELINE: Corporate Issuance Roundup: $14.8B Debt to Price Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 9/24 $3B *KFW 5Y +29

- 9/24 $2.5B *BNG 2Y SOFR+34

- 9/24 $2.5B *Meituan $1.2B 3.5Y +115, $1.3B 5Y +125

- 9/24 $1.5B #Kommunalbanken 5Y SOFR+48

- 9/24 $1.5B #Aker BP $750M 10Y +143, $750M 30Y +173

- 9/24 $1.2B *KNOC $400M 3Y +72, $300M 3Y SOFR+90, $500M 5Y +85

- 9/24 $1B #NBN $500M 3Y +62, $500M 5Y +77

- 9/24 $600M #New York Life 3Y +45

- 9/24 $500M #Met Tower 3Y +57

- 9/24 $500M #Jackson National Life 5Y +115

- 9/24 $Benchmark Credit Agricole PerpNC10 6.7%

- 9/24 $Benchmark Saudi Aramco 5Y, 10Y investor calls

BONDS: EGBs-GILTS CASH CLOSE: German Short End Rallies Again

The core EGB short-end rally continued Tuesday, with 2Y German yields seeing the lowest close since Dec 2022 on deepening central bank easing prospects.

- EGBs and Gilts weakened in early trade, weighed down by news overnight that China was enacting economic stimulus measures.

- Another soft German data point in September IFO failed to have much of a positive bond impact.

- But global core FI rallied in the European afternoon, with a weak US consumer confidence reading boosting Treasuries, and Bunds/Gilts on the follow.

- ECB October rate cut expectations continue to ratchet up amid the poor survey data this week: now priced at 60% implied of 25bp, vs 40% at Monday's close (post-PMIs) and 20% to start the week. BoE Nov cut pricing (last up 1bp at 30bp, or 25bp + 20% of a 50bp cut) deepened less dramatically.

- Bunds outperformed Gilts, with the German curve bull steepening. The UK curve bear steepened modestly.

- Periphery EGB spreads tightened, with a broader risk-on move keyed by the China stimulus.

- Wednesday's docket includes an appearance by BoE's Greene, French consumer confidence, Spanish PPI, and the Riksbank decision (MNI preview here).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5.2bps at 2.097%, 5-Yr is down 3.2bps at 1.968%, 10-Yr is down 0.8bps at 2.148%, and 30-Yr is down 0.2bps at 2.479%.

- UK: The 2-Yr yield is up 0.3bps at 3.918%, 5-Yr is up 1.8bps at 3.772%, 10-Yr is up 1.8bps at 3.941%, and 30-Yr is up 1.9bps at 4.515%.

- Italian BTP spread down 2bps at 133.2bps / Spanish down 1bps at 78.7bps

FOREX: Antipodean FX Outperforms as China Announces Stimulus Package

- After pausing for breath over the past two trading sessions, lower front-end yields (aided by weaker-than-expected US consumer confidence) in the US have helped tilt the USD index back into its weakening trend, currently down 0.27% as we approach the APAC crossover. 101.50 has proved supportive so far and markets will be eyeing a daily close below this level, something that has not occurred since July 2023.

- While the China stimulus news has failed to spark a huge boost for major equity benchmarks, the potential ramifications of renewed China optimism is filtering through to risk sensitive currencies such as the Australian, Canadian and New Zealand dollars.

- NZD (+0.89%) is the strongest in G10, with the latest leg higher gaining momentum through the August highs around 0.6300. Today’s high at 0.6328 matches the year’s peak from Jan 02, with 0.6369 the most obvious short-term target for the move.

- AUD slightly lags the move, but has been subject to some decent two-way action on Tuesday. As noted, the RBA not discussing a rate hike at today’s meeting was seen as a very modest dovish development.

- Elsewhere, EURUSD has made very slow progress back above 1.1150 and seems content to trade within the 1.11/1.12 for now as offsetting themes of weak Eurozone growth and optimistic global sentiment play out. USDJPY trades around 143.40, which is towards the bottom of another substantial, near 1%, intra-day range.

- Australian CPI and US new home sales headline the economic calendar on Wednesday.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 25/09/2024 | 2301/0001 | * |  GB GB | Brightmine pay deals for whole economy |

| 25/09/2024 | 0130/1130 | *** |  AU AU | CPI Inflation Monthly |

| 25/09/2024 | 0600/0800 | ** |  SE SE | PPI |

| 25/09/2024 | 0600/1400 | ** |  CN CN | MNI China Liquidity Index (CLI) |

| 25/09/2024 | 0645/0845 | ** |  FR FR | Consumer Sentiment |

| 25/09/2024 | 0700/0900 | ** |  ES ES | PPI |

| 25/09/2024 | 0730/0930 | *** |  SE SE | Riksbank Interest Rate Decison |

| 25/09/2024 | 0800/0900 |  GB GB | BOE's Greene Speech on Consumption | |

| 25/09/2024 | 0900/1000 | ** |  GB GB | Gilt Outright Auction Result |

| 25/09/2024 | 1100/0700 | ** |  US US | MBA Weekly Applications Index |

| 25/09/2024 | 1300/1500 |  EU EU | MNI Connect Video Conference on ‘The EU and Global Trade Challenges’ | |

| 25/09/2024 | 1400/1000 | *** |  US US | New Home Sales |

| 25/09/2024 | 1430/1030 | ** |  US US | DOE Weekly Crude Oil Stocks |

| 25/09/2024 | 1530/1130 | ** |  US US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 25/09/2024 | 1700/1300 | * |  US US | US Treasury Auction Result for 5 Year Note |