-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA OPEN: Yields Recede Amid Varied Fed Speak, Mixed Data

- MNI: Harker-Fed Can Hold Rates Steady, Supports High-For-Long

- MNI INTERVIEW: Fed "Sweating" Yields But Lean To Hike- English

- MNI: Macklem Sees BOC Hike Debate Ahead Of Oct 25 Decision

- MNI UMich: Sentiment Deteriorates As Inflation Concerns Re-emerge

US

FED: Federal Reserve Bank of Philadelphia President Patrick Harker said Friday that recent data supports holding interest rates at their current level but but added they will need to stay high for a while.

- "Absent a stark turn in what I see in the data and hear from contacts, both in one-on-one conversations and in forums like this, I believe that we are at the point where we can hold rates where they are," he said in prepared remarks. "By doing nothing, we are still doing something. And, actually, we are doing quite a lot."

- "I do subscribe to the new moniker, 'higher for longer.' I didn’t coin it, but my expectation is that rates will need to stay high for a while," he said in remarks for the Delaware State Chamber of Commerce.

- Harker said a steady disinflation is under way and he expects it to continue with inflation dropping below 3% in 2024 and leveling out at the Fed's 2% target thereafter. While this week's CPI report came out modestly on the upside, "I do not want to overreact to the normal month-to-month variability of prices," he said. For more see MNI Policy main wire at 0900ET.

- Unemployment remains below 4% and elevated job vacancies suggest could be even tighter than is generally believed, he said in an interview. The September job report released last week showed the economy adding 336,000 jobs, more than triple the pace Fed officials view as consistent with a balanced economy.

- “The Fed would be happier if the labor market were a little bit less tight,” he said, especially at a time when consensus surveys suggest economic growth picked up to a 3% pace in the third quarter from around 2% earlier this year. The Fed's September dot plot showed officials believe they can tighten a bit more to pull inflation back to target without boosting unemployment much above 4%, which would be an incredible soft landing, said English, who was director of the Fed board's Division of Monetary and Secretary to the Federal Open Market Committee. For more see MNI Policy main wire at 0906ET.

CANADA

BOC: Bank of Canada Governor Tiff Macklem said Friday he anticipates again discussing options of holding interest rates or raising them ahead of the next decision on Oct. 25 amid evidence of slowing but sticky inflation, adding that a rise in global bond yields can't replace any needed policy action.

- “We will be resuming that conversation” outlined in the minutes from the last decision, he told reporters on a call from IMF meetings in Morocco.

- “What I expect it will focus on is do we stay with a policy rate at 5% and let past interest-rate increases work through the economy and relieve price pressures, or is the weight of the evidence of all of those economic indicators when you put them together is it telling us that more action is needed to restore price stability,” he said. For more see MNI Policy main wire at 0925ET.

US TSYS Geopol Risk, Mixed UofM Data Buoy Rates

- Middle East conflict lent to Friday morning's risk-off/safe haven bid in US rates. Meanwhile, Russia war with Ukraine enters day 597. Dec'23 10Y futures marked an early session high of 108-00 before slipping back to 107-23.5 ((+16) after the bell; curves bull flattening: 2Y10Y -5.299 at -42.896.

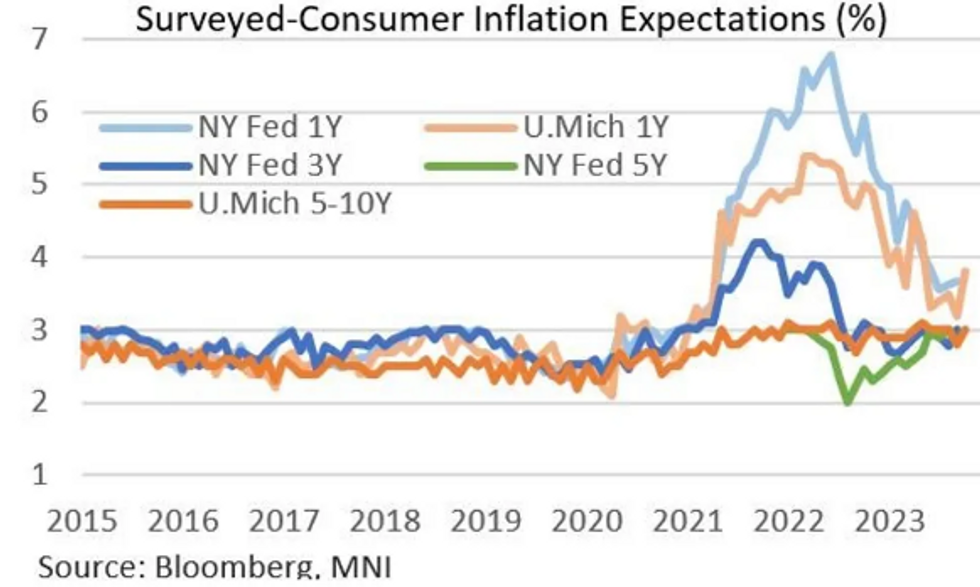

- Tsys pare gains briefly, rebound slightly after University of Michigan data comes out mixed: Sentiment lower (63.0 vs. 67.0 est, 68.1 prior), Current Conditions (66.7 vs. 70.3 est, 71.4 prior), Expectations (60.7 vs. 65.7 est, 66.0 prior). Inflation expectations higher 1 Yr Inflation (3.8% vs. 3.2% est, 3.2% prior), 5-10Y (3.0% vs. 2.8% est, 2.8% prior).

- "After stabilizing earlier this year, concerns about inflation have grown again. These concerns underpin the sharp 15% deterioration in consumers’ assessments of their personal finances in this month. About 49% of consumers reported that high prices are eroding their living standards, up substantially from 39% last month and matching the all-time high last recorded in July 2022. Consumers pointed specifically to prices of food and groceries (highest share in over a year) as well as gas and fuel (highest in 2023)."

- Projected rate hikes into early 2024 consolidating: November holding at 7.8%, w/ implied rate change of +1.9bp to 5.348%, December cumulative of 8.3bp (10.6bp late Thu) at 5.412%, January 2024 cumulative 8.1bp (10.6bp late Thu) at 5.410%. Fed terminal at 5.438% in Jan'24. Fed terminal at 5.41% in Jan'24-Feb'24.

- Focus on Monday Data Calendar: Empire Mfg, Fed Speak, Tsy Bill Sales. Q4 equity earnings resume with Charles Schwab Monday; Bank of NY Mellon, Bank of America, Goldman Sachs on Tuesday.

OVERNIGHT DATA

- UMICH OCT. PRELIM 1Y INFL EXPECTATIONS 3.8% (3.2% EXP; 3.2% SEP)

- UMICH OCT PRELIM 5-10Y INFL EXPECTATIONS 3.0% (2.8% EXP, 2.8% SEP)

- UMICH OCT. PRELIM CONS SENTIMENT 63.0 (67.0 EXP., 68.1 SEP)

- UMICH OCT. PRELIM CURR CONDITIONS 66.7 (70.3 EXP., 71.4 SEP)

- UMICH OCT. PRELIM EXPECTATIONS 60.7 (65.7 EXP., 66.0 SEP)

- UNIV OF MICHIGAN CONSUMER SENTIMENT PRELIMINARY OCT INDEX 63.0

- UMICH CURRENT ECONOMIC CONDITIONS PRELIMINARY OCT INDEX 66.7

- UMICH CONSUMER EXPECTATIONS PRELIMINARY OCT INDEX 60.7

Preliminary University of Michigan consumer sentiment survey for October showed a sharp uptick in near-term inflation expectations alongside a deterioration in confidence and expectations.

- 12-month ahead inflation expectations hit a 5-month high 3.8% (up from 3.2% prior, vs 3.2% expected), while 5-10 year expectations rose to 3.0% (from 2.8% prior, and equal to Jun-Aug levels).

- Consumer sentiment fell to 63.0 (from 68.1 prior and 67.0 expected), with current conditions down 4.7pp to 66.7 (vs 70.3 expected) and expectations off 5.3pp to 60.7 (vs 65.7 expected). All of those were 5-month lows.

- Per the U-of-Michigan release, the rise in inflation expectations and the drop in sentiment are unsurprisingly linked:

- "After stabilizing earlier this year, concerns about inflation have grown again. These concerns underpin the sharp 15% deterioration in consumers’ assessments of their personal finances in this month. About 49% of consumers reported that high prices are eroding their living standards, up substantially from 39% last month and matching the all-time high last recorded in July 2022. Consumers pointed specifically to prices of food and groceries (highest share in over a year) as well as gas and fuel (highest in 2023)."

- The limited rise in longer-term expectations means this report will probably have little impact on the Fed's view of the public's inflation expectations more broadly, with the 1Y jump arguably attributable to short-term gas price fluctuations among other factors noted above. That said, the FOMC will be mindful of the apparent stalling out of progress in inflation expectations, and of any further upticks, as it assesses whether overall expectations remain well-anchored enough to bring the tightening cycle to an end.

- US SEP IMPORT PRICES +0.1%

- US SEP EXPORT PRICES +0.7%; NON-AG +1.0%; AGRICULTURE -1.1%

MARKETS SNAPSHOT

- Key late session market levels:

- DJIA up 39.97 points (0.12%) at 33669.36

- S&P E-Mini Future down 22.25 points (-0.51%) at 4358.25

- Nasdaq down 157.6 points (-1.2%) at 13416.53

- US 10-Yr yield is down 7 bps at 4.6269%

- US Dec 10-Yr futures are up 15.5/32 at 107-23

- EURUSD down 0.0017 (-0.16%) at 1.0511

- USDJPY down 0.3 (-0.2%) at 149.51

- WTI Crude Oil (front-month) up $4.56 (5.5%) at $87.47

- Gold is up $59.25 (3.17%) at $1928.10

- European bourses closing levels:

- EuroStoxx 50 down 62.11 points (-1.48%) at 4136.12

- FTSE 100 down 45.18 points (-0.59%) at 7599.6

- German DAX down 238.37 points (-1.55%) at 15186.66

- French CAC 40 down 101 points (-1.42%) at 7003.53

US TREASURY FUTURES CLOSE

- 3M10Y -5.71, -88.092 (L: -92.427 / H: -82.798)

- 2Y10Y -5.31, -42.907 (L: -43.935 / H: -37.142)

- 2Y30Y -6.058, -27.921 (L: -29.943 / H: -20.514)

- 5Y30Y -2.931, 13.083 (L: 11.162 / H: 17.496)

- Current futures levels:

- Dec 2-Yr futures up 1/32 at 101-10.625 (L: 101-09.375 / H: 101-13)

- Dec 5-Yr futures up 7/32 at 105-5.5 (L: 104-30.75 / H: 105-12)

- Dec 10-Yr futures up 15.5/32 at 107-23 (L: 107-09 / H: 108-00)

- Dec 30-Yr futures up 1-10/32 at 112-25 (L: 111-20 / H: 113-14)

- Dec Ultra futures up 1-24/32 at 117-7 (L: 115-23 / H: 118-01)

US 10Y FUTURE TECHS: (Z3) Bounce Fades as CPI Boosts Yields

- RES 4: 109-12+ 50-day EMA

- RES 3: 108-26+ High Sep 22

- RES 2: 108-14+ High Sep 29

- RES 1: 108-11 High Oct 11

- PRICE: 107-23 @ 16:33 BST Oct 13

- SUP 1: 106-14 2.0% Lower Bollinger Band

- SUP 2: 106-03+/00 Low Sep 4 / Round number support

- SUP 3: 105-11 2.0% 10-dma envelope

- SUP 4: 104-26 2.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

Markets traded firmer through the 20-day EMA Wednesday, further building momentum and signalling a possible base at the early October lows. The near-term strength stalled on Thursday, however, with prices under pressure as CPI topped estimates. For bears to regain control, weakness through 106-12 would signal a fade in the short-term momentum, and open further losses. The near-term upside opens for further gains toward late September levels at 108-14+, the Sep29 high. With last week’s lows yet to be re-tested, a further stabilisation in prices could signal a near-term reversal higher.

SOFR FUTURES CLOSE

- Dec 23 +0.015 at 94.560

- Mar 24 +0.020 at 94.670

- Jun 24 +0.020 at 94.870

- Sep 24 +0.010 at 95.115

- Red Pack (Dec 24-Sep 25) steady to +0.035

- Green Pack (Dec 25-Sep 26) +0.045 to +0.075

- Blue Pack (Dec 26-Sep 27) +0.085 to +0.095

- Gold Pack (Dec 27-Sep 28) +0.105 to +0.110

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00083 to 5.33533 (-0.00574/wk)

- 3M +0.00896 to 5.40283 (-0.00391/wk)

- 6M +0.02414 to 5.46408 (+0.00962/wk)

- 12M +0.04785 to 5.41705 (+0.02049/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $103B

- Daily Overnight Bank Funding Rate: 5.32% volume: $255B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.467T

- Broad General Collateral Rate (BGCR): 5.30%, $579B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $568B

- (rate, volume levels reflect prior session)

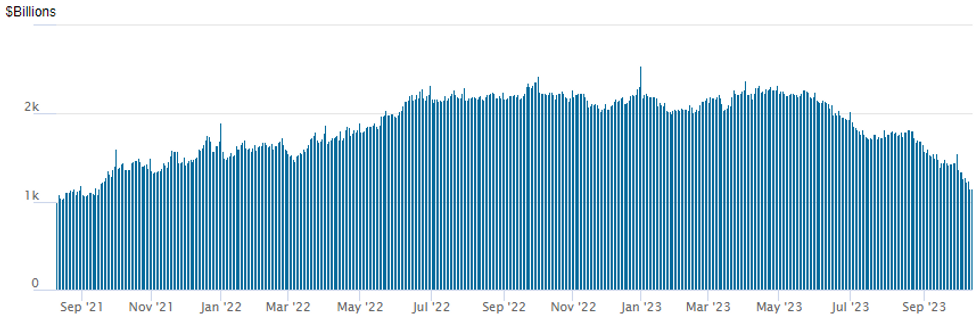

FED REVERSE REPO OPERATION: New Cycle Low

NY Federal Reserve/MNI

Repo operation usage extends to new lowest since mid-September 2021 at $1,157.319B w/98 counterparties vs. $1,151.818B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: No New Corporate Issuance Friday

- Date $MM Issuer (Priced *, Launch #)

- 10/13 $Benchmark KDB 3Y, 3Y SOFR, 5Y, 10Y

- $500M Priced Thursday, $21.75B total for the week

- 10/12 $500M *Shinhan Formosa 5Y SOFR+108

EGBs-GILTS CASH CLOSE: Safe Haven Bid Into The Weekend

Friday's trade saw a strong safe haven bid develop going into the weekend, with geopolitical risk boosting core European FI.

- Bunds and Gilts climbed for most of the session before fading toward the cash close.

- At their strongest intraday point, bonds regained the ground lost Thursday after the strong US inflation report - as the dollar gained and equities fell in anticipation of potential risk-off weekend developments in the Middle East.

- The German curve bull flattened with the UK's twist flattening.

- In line with the safe-haven bid, periphery spreads widened for most of the session, with 10Y BTP widening past the 200bp mark once more to close on the wides (204bp). ECB's Visco and Simkus played down fragmentation risks and the need for ECB intervention over spreads.

- The UK takes centre-stage next week with labour market data out Tuesday and CPI on Wednesday.

- Potential ratings actions after Friday's close include Moody's on the EU and DBRS on Malta.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.2bps at 3.139%, 5-Yr is down 3.7bps at 2.679%, 10-Yr is down 4.9bps at 2.737%, and 30-Yr is down 4.2bps at 2.933%.

- UK: The 2-Yr yield is down 0.4bps at 4.846%, 5-Yr is down 1.1bps at 4.46%, 10-Yr is down 3.7bps at 4.386%, and 30-Yr is down 3.5bps at 4.829%.

- Italian BTP spread up 6.2bps at 203.9bps / Greek up 5.8bps at 156.3bps

FOREX USD Index Ends Week On Firm Footing Amid US Inflation Worries/Risk Off

- US PPI, CPI and the University of Michigan inflation expectations data beat expectations this week. One of these in isolation could have been brushed off by the Fed, but all three happening on three consecutive days could be too much to ignore. This has underpinned a strong greenback recovery and the USD index looks set to close the week around 0.65% higher.

- Furthermore, equities slipped to their worst levels of the session amid headlines from Politico stating that an Israeli ground invasion of Gaza is imminent. Additional newswires then confirmed Israeli military a number of a small raids have been conducted by their personnel inside the Gaza Strip. The first time that it has confirmed forces are on the ground.

- The real haven flow on Friday has seen the Swiss Franc outperform all others in G10. EURCHF trades down 1% on the session and the move has been exacerbated by the break below the year’s lows at 0.9516, triggering an extension to lows of 0.9457 as of typing. The next notable downside target resides at 0.9410, the September 2022 lows.

- GBPUSD also trades with a downward bias, continuing to grind lower throughout the US session with US PPI, CPI and the University of Michigan inflation expectations data all beating expectations this week and underpinning the greenback recovery. For now, last week’s fresh cycle lows remain in view, which has reinforced bearish conditions over the medium-term. 1.2028, the Mar 16 low will be the key downside target and any short-term gains are considered corrective.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/10/2023 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 16/10/2023 | 0830/0930 |  | UK | BOE's Pill Speech at the OMFIF BOE's Pill Speech at the OMFIF | |

| 16/10/2023 | 0900/1100 | * |  | EU | Trade Balance |

| 16/10/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 16/10/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 16/10/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 16/10/2023 | 1430/1030 | ** |  | CA | BOC Business Outlook Survey |

| 16/10/2023 | 1430/1030 |  | US | Philadelphia Fed's Pat Harker | |

| 16/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 16/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 16/10/2023 | 2030/1630 |  | US | Philadelphia Fed's Pat Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.