-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK ANALYSIS-Ireland Election Preview

MNI POLITICAL RISK - Trump Tariffs Initiate Talks With Mexico

MNI EUROPEAN MARKETS ANALYSIS: 2024 May Be Another Tough Year For Exporters To China

- China NPC headlines have broadly been in line with market expectations. Accordingly, market impact has been limited. China equities recovered from earlier lows, but HK markets remain under pressure, weighed by the tech sector. A fresh chip ban by the US Commerce Department is weighing on sentiment.

- In the FX space, AUD and NZD are underperforming amid the negative equity tone. It has been relatively quiet in the fixed income space. Treasury futures have done very little today in the Asian session, volumes remain low and ranges tight making lows of 110-23 and highs of 110-26+ where we trade now.

- Elsewhere as China reopened, a strong bounce in demand was expected in 2023 that would provide strong demand for those countries with a large export exposure. GDP growth was 5.2% but many exporters didn’t see a recovery in export growth and as a result have become slightly less reliant on the Asian giant. Australia, Indonesia and Singapore are the exceptions. 2024 looks like it may be another tough year for exporters, see below for more details.

- Later the Fed’s Barr speaks and February services ISM/PMI and final January durable goods orders print. European PMIs are also released.

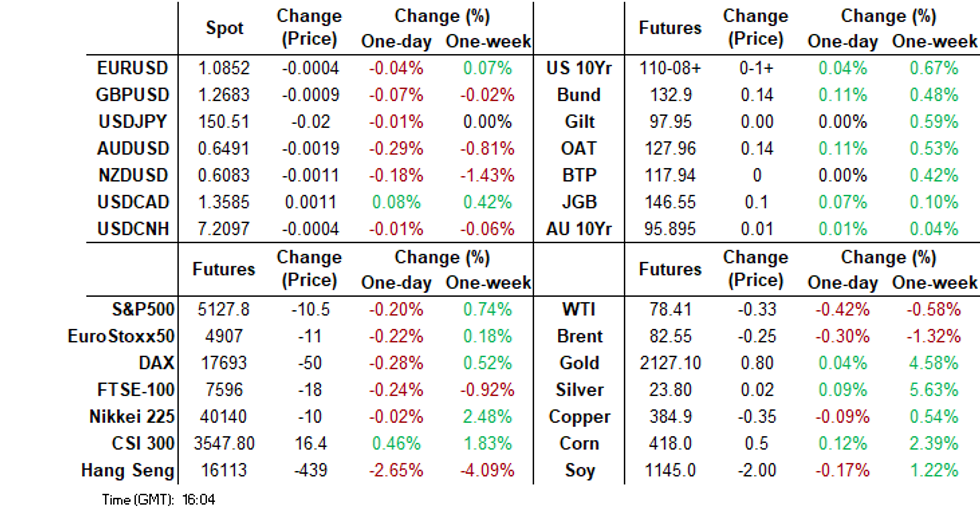

MARKETS

US TSYS: Treasury Futures Edge Higher, Ranges Tight, Volumes Low

GLOBAL: Container Rates Peaked, Dry Freight Keeps Rising

Global shipping rates declined again last week and despite continued attacks on shipping around Yemen, appear to have already peaked, as global trade growth remains soft. But contracts are usually agreed in March and so developments this month are likely to be important.

- Rates are sharply higher than a year ago but well below the increases seen in 2021 but they had been disinflationary until late last year. It is an issue central banks are watching, but as the RBNZ said expect to normalise and it’s second round effects that matter.

Source: MNI - Market News/Refinitiv

- Last week the Baltic dry index rose 18.1%, the fourth consecutive weekly increase and is now up 5.2% since the end of 2023. February was up over 150% y/y, in comparison May 2021 rose over 500% y/y.

- FBX container rates in contrast fell over February with the global measure up 15% m/m and the China/east Asia to east coast North America route +32% but to the Mediterranean fell 6%. The global rate fell 2.6% w/w last week, the third consecutive weekly decline.

- Asia to Mediterranean container shipping rates have fallen for six weeks straight declining 6.6% w/w last week but are still almost 100% higher than the end of 2023. In February they rose 75% y/y but in August 2021 they were up almost 600% y/y. While the disinflationary pressure from shipping on European inflation has ended, it was negative from August 2022 to December 2023, the recent easing signals that container rates are unlikely to be a threat.

- China/east Asia to east coast North America route remains 162% above end 2023, despite falling for the last three weeks.

Source: MNI - Market News/Refinitiv

JGBS: Futures Stronger After A Smooth Absorption Of 10Y Supply

JGB futures are holding an uptick, +2 compared to settlement levels, after 10-year supply was smoothly absorbed, with the low price matching wider expectations and the tail shortening. The cover ratio however declined to 3.239x from 3.648x at February’s auction. It is worth noting that today’s cover ratio remains higher than December’s, which was the lowest seen at a 10-year auction since 2021.

- With an outright yield similar to the February outing, growing expectations that the BoJ could remove NIRP as early as this month (18-19 March) possibly weighed on the bid at today’s auction.

- It was also notable that the relative affordability of 10-year JGBs compared to futures, as indicated by the spread between the 7- and 10-year JGBs, was around its highest point since 2015.

- There hasn’t been much in the way of domestic data drivers to flag, outside of the previously outlined Tokyo CPI.

- Cash JGBs are dealing mixed, with yields 1.2bps lower (20-year) to 1.3bps higher (30-year). The benchmark 10-year yield is 1.0bp lower at 0.709% versus the Nov-Dec rally low of 0.555%.

- Swaps are richer, with the belly of the curve slightly outperforming (rates 1bp lower). Swap spreads are tighter apart from the 10-20-year zone.

- Tomorrow, the local calendar is empty.

JAPAN DATA: Tokyo CPI Close To Expectations, Detail Still Shows Some Pockets Of Inflation Pressure

Feb Tokyo CPI was close to expectations in y/y terms. The headline was +2.6% y/y, versus 2.5A% forecast and the 1.8% prior outcome. The ex fresh food measure rose 2.5%, in line with expectations (1.8% prior). The ex fresh food, energy metric was 3.1% y/y, also in line with forecasts and compares with 3.3% prior (which was revised from the originally reported 3.1%).

- In m/m terms, headline inflation rose 0.3% (seasonally adjusted) the firmest pace since Oct last year. The core measures were both up 0.1% m/m, while good prices rose 0.3% and services gained 0.2% (same as last month).

- The ex all food and energy index rose 0.3% m/m (not seasonally adjusted), the firmest pace since Oct last year.

- By sub-index, the main drags came from off and fresh food, both down in m/m terms. Most other sub-indices saw either a pick up in m/m inflation or the same pace as prior. Entertainment was +1.1% m/m and household goods +0.8% m/m, were among the strongest contributors.

- In y/y terms it was a similar story, with food items slowing, but a generally firmer trend elsewhere.

- So, whilst core measures were slower in y/y terms versus Jan and are well off 2023 highs, the detail still suggests some underlying inflation pressures are evident.

AUSSIE BONDS: Cheaper, Subdued Session, Q4 GDP Tomorrow

ACGBs (YM -1.0 & XM -0.5) sit slightly cheaper after dealing in narrow ranges during today’s Sydney session. Once again, the domestic data drop (Q4 Net Exports, Current Account Balance and Government Consumption & Capex) failed to move the market as it awaits Fed Chairman Powell's policy testimony to Congress Wed-Thu and the Payrolls Report Friday.

- Cash US tsys are dealing little changed in today's Asia-Pac session after yesterday's bear-flattening. Tuesday’s US data calendar includes S&P Final PMIs, ISM Services and Factory Orders.

- (AFR) A sharp decline in the number of Australians travelling overseas and a large fall in imports of consumer goods like toys, clothes, cars and appliances may have prevented the economy from contracting in December. (See link)

- Cash ACGBs are flat to 1bp cheaper, with the AU-US 10-year yield differential 1bp lower at -11bps.

- Swap rates are 1bp higher to 1bp lower, with the 3s10s curve flatter.

- The bills pricing is -1 to -2.

- RBA-dated OIS pricing is little changed.

- Tomorrow, the local calendar sees Q4 GDP.

- Tomorrow, the AOFM plans to sell A$800mn of 2.75% Nov-29 bond.

AUSTRALIAN DATA: Robust Q4 Net Export Contribution Due To Weak Imports

Australia’s Q4 current account surplus was a lot wider than expected at $11.8bn, largest since Q2 2022, and Q3 was revised to a surplus of $1.3bn from -$0.2bn. The large shift was driven by strong commodity exports and a narrower net income deficit. The ABS expects the $3.9bn rise in net trade volumes to add 0.6pp to Q4 GDP growth, due to weak import volumes, which now skews risks to the upside for consensus’ 0.2% q/q forecast after inventories shifted them to the downside.

- Goods and services import volumes fell 3.4% q/q in line with soft domestic demand. Export volumes fell 0.3% q/q.

- The Q4 goods & services surplus widened over $8bn to $32.4 with goods rising around $6bn to $30.2bn and services over $2bn to a surplus of $2.2bn. Goods export values rose 3.1% q/q, after declining the previous 3 quarters, to still be down 8.7% y/y. The rebound was driven by increases in coal and metal ore export prices and volumes.

- Goods import values fell 1.8% q/q to be down 1.8% y/y with consumer goods falling 3.4% q/q and -2.8% y/y, due to vehicles, and capital goods -3.5% q/q but +3.3% y/y. Services imports fell 5.5% q/q, driven by less overseas travel, but are up 9.3% y/y due to strong growth through Q2 and Q3.

- The trade balance was helped by a 2.2% q/q increase in the terms of trade, which improved to -3.9% y/y from -9.1% in Q3. Goods & services export prices rose 3.1% q/q while import prices +0.8% q/q.

- The net income deficit narrowed $1.9bn to $20.2bn due to lower profits.

Source: MNI - Market News/ABS

NZGBS: Cheaper, Tracking US Tsys Ahead Of Fed Chair Powell’s Testimony (Wed)

NZGBs closed at or near the session’s worst levels, with benchmark yields 1-3bps higher.

- With the domestic calendar relatively light, local participants appear to have been content to monitor US tsys for directional guidance ahead of Fed Chairman Powell's policy testimony to Congress Wed-Thu and the Payrolls Report Friday.

- US tsys are currently dealing flat to 1bp cheaper in today’s Asia-Pac session.

- NZ Finance Minister Nicola Willis said “Lower-than-expected tax revenue is consistent with the economy being weaker than forecast in the half-year update” in response to questions in parliament.

- (Bloomberg) -- NZ population growth is masking weakness in consumer demand, the Treasury Dept. says in Fortnightly Economic Update. Per capita retail trade volumes fell 2.6% q/q in Q4. (See link)

- NZ’s commodity export prices rose 3.5% m/m in February versus a revised +2.1% in January, according to ANZ Bank.

- Swap rates finished with a twist-flattening. Rates closed 1bp higher to 1bp lower.

- RBNZ dated OIS pricing closed flat to 5bps firmer, with Feb-25 leading. A cumulative 48bps of easing is priced by year-end.

- Tomorrow, the local calendar sees the Volume of All Buildings for Q4.

FOREX: USD Index A Touch Higher, AUD & NZD Weighed By Weaker Equity Trends

The USD index sits marginally higher in recent dealings, last near 1242. Overall though it has been a muted session for G10 FX.

- Cross asset moves have been supportive in the equity space, with US futures sitting lower at this stage, with Nasdaq underperforming (-0.30%). US yields are down, but only a touch.

- We have had a number of data releases across Japan, Australia and NZ, but sentiment hasn't been shifted. To be fair these have mostly been second tier data outcomes with Tokyo CPI arguably the most significant print, but that was close to expectations.

- The China NPC headlines around aggregate growth were on expectations ("around 5% for 2024"). Again sentiment hasn't moved much. China equities sit higher on potentially state support (Rtrs), but HK markets are down quite sharply.

- AUD and NZD sit marginally lower, in line with the weaker regional equity tone for the most part. AUD/USD last near 0.6500, while NZD/USD tracks just under 0.6090. Overall ranges have been fairly tight though.

- USD/JPY is near 150.50, little changed for the session. Earlier dips to 150.36 were supported.

- Looking ahead, the Fed’s Barr speaks and February services ISM/PMI and final January durable goods orders print. European PMIs are also released.

ASIA STOCKS: China Equities Out-Perform, Tech Stocks Lower After AMD Ban

Hong Kong and China equities plummeted on the open down 1-3%, however there was a sharp reversal especially in China Large Cap equities, with the CSI300 now 0.50% higher, after being down 0.60%. The market is focused on the NPC meeting in Shanghai. So far, major headlines indicate China's GDP growth target for this year is around 5%, a budget deficit of 3% of GDP, an increase in urban jobs by 12 million, targeting an urban unemployment rate of 5.5%, boosting defense spending by 7.2%, and setting a CPI growth target at 3%.

- Hong Kong Equity are underperforming with the HSTech Index the worst performing area of the market down 3.18% after the US Commerce Department announced it will bar exports of powerful AI processors made by AMD to China, the Mainland Property Index is down 2.10%, while the HSI is off 2.10%. China's National Team may have supporting the local markets today as equity markets gapped lower on the open only to be bid back up very quickly, while large cap are out-performing smaller cap indices in line with what National Team mandates. The CSI300 up 0.45%, the smaller cap CSI1000 is down 0.60%.

- China Northbound flows were -7.1b yuan on Friday, with the 5-day average now 3.5b, while the 20-day is at 2.66b yuan.

- Country Garden's sales drop the most in seven years amid wind-up fears, while contracted sales plunged 85% from the same period a year earlier verses 75% fall in January. Meanwhile, Vanke, China's 2nd largest developer by sales has seen their equities and bonds plunge in value as investors grow concerned over their ability to continue servicing their debts.

- Goldman was out earlier noting that they expect China's three pillars (Property, Infrastructure and Exports) of growth will weaken over the next decade and caution investors from adding to exposure in the region.

- Earlier Hong Kong had S&P Global PMI at 49.7 a decline from the prior month of 49.9., while Caixin China PMI Composite was unchanged at 52.5, and Caixin China PMI Services was 52.5 vs 52.9 expected

- Looking ahead, the NPC meeting will continue over the next few days although there is no set time frame, although expected to last about a week.

ASIA PAC EQUITIES: Equities Mixed, Japan Banks Outperform on Higher CPI, Eyes On NPC

Regional Asian Equities are mixed today. The focus in the Asia region today has been on the NPC meeting in Shanghai, however there have been some economic data out regionally with Tokyo CPI increasing to 2.6% vs 2.5% expected up from 1.60% in Jan, while SK 4Q GDP inline with expectations at 2.2% and Australia BoP Current Account Balance was A$11.8b vs A$5.0b expected.

- Japan equities opened lower but have pushed higher since mid morning, Tokyo CPI increased more than expected and has helped Banking stocks today with the Topix Banks Index up 1.37%, while construction names push higher after general contractor Obayashi's surprise plan to hike its ROE and dividend targets with the TOPIX up 0.60%. The Nikkei 225 is back above 40,000 and up 0.20% after breaking back below earlier, tech stocks are leading the move higher.

- South Korean equities are lower today, giving back some of the gains made yesterday, after researchers behind LK-99 claimed to have synthesized a new material showing superconducting behavior at room temperature. GDP data was out earlier and was in line with expectations, while Monday saw a $743m of equities inflows the highest since Feb 2. The Kospi is down 0.50%

- Taiwan Equities are higher today as TSMC again leads the way higher up 1.20%. Taiwan saw $1.15b of foreign equity inflows on Monday, the Taiex is up 0.60%.

- Australian equities closed down 0.15%, with financials and consumer discretionary stocks are weighing on performance. The market will be closely watching the NPC meeting for signs of a push to boost demand for Australia's natural resources.

- Elsewhere in SEA, most markets are trading lower with the expectation of New Zealand closing up 0.25% while Malaysia down 1.00%, Indonesia down 0.30%, Singapore down 0.35% and India down 0.50%

ASIA EQUITY FLOWS: Asian Equity Flows Pick Up As SK/Taiwan Benefit From Tech Surge

- China equities saw the 2nd day of outflows as investors position for the upcoming NPC that begins today, as China is set to announce its 2024 growth target and outline its strategy for supporting the slowing economy. Short-term momentum has been growing with the 5-day average at 3.55b vs the 20-day at 2.66b while the 100-day average remains negative at -0.43b yuan.

- South Korean equity surged higher on Monday after their break on Friday, investors seem to becoming more comfortable with the government's "Corporate Value-Up Program" where they will look to close the gap between Korean of Global equities known as the "Korea Discount". The 5-day average now sits at $300m vs $148 the week prior, while the 20-day average is $343m

- Taiwan equities saw an inflow of $1,15b on Monday, the third largest inflow for the year. Equities were up 1.95%, with flows into semiconductor names dominating flow. The 5-day average now sits at $228m vs the 20-day at $298m

- Indonesian equities continue to see foreign equity outflows, now at 7 out of the past 8 trading days of negative flows. The JCI has been rangebound since mid Feb unable to to break out of the 7250/7350 range. The 5-day average sits at -$32m while the 20-day average is $30m

- Thailand equities similar to Indonesia have see 5 of the past 6 days of negative flows, with the SET now trading close to 1 year lows. Top Government officials have been calling for cuts to be cut to spur growth, later today CPI data is due out expected to show a slight increase from prior month but still negative at -0.80%. The 5-day average continues to trend down at -$40m, while the 20-day is at -3.8m

- India equities continue to trend higher reaching new highs on Monday. Short term momentum is picking up with $261m on inflows on Friday, taking the 5-day average to $163m well above the 20-day average of $35m

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| China (Yuan bn)* | -7.1 | 17.8 | 33.8 |

| South Korea (USDmn) | 743 | 1499 | 9116 |

| Taiwan (USDmn) | 1152 | 1141 | 6223 |

| India (USDmn)** | 262 | 818 | -2395 |

| Indonesia (USDmn) | -24 | -163 | 1132 |

| Thailand (USDmn) | -16 | -204 | -828 |

| Malaysia (USDmn) ** | -42 | -106 | 380 |

| Philippines (USDmn) | 14 | 36.0 | 235 |

| Total (Ex China USDmn) | 2090 | 3022 | 13863 |

| * Northbound Stock Connect Flows | |||

| ** Data Up To March 1 |

OIL: Oil Markets Subdued As Concerned About Demand From China

Crude continued to trend lower during the APAC session today after falling sharply yesterday on supply concerns. Commodities in general have struggled. Brent is down 0.2% to $82.62/bbl but is off the intraday low of $82.50. WTI is 0.4% lower at $78.46 after a low of $78.37. The USD index is flat.

- China’s NPC announced a 5% growth target for 2024, close to 2023’s outturn, with 3% for CPI. Monetary policy will be flexible and fiscal policy proactive. There are also plans to reduce energy intensity. The news didn’t support markets as they continue to be concerned re demand from the world’s largest oil importer and will watch for measures to stimulate growth.

- Energy markets will continue to monitor developments in the US with the focus on Fed comments and Friday’s February payrolls. There have also been a number of large US crude inventory builds in recent weeks while product stocks have declined. Last week’s data as reported by the API is released later today.

- Crude continues to get support from ongoing tensions in the Middle East with ceasefire talks showing no progress and vessels still being attacked off Yemen.

- Later the Fed’s Barr speaks and February services ISM/PMI and final January durable goods orders print. European PMIs are also released.

GOLD: Steady After Another Solid Gain On Monday

Gold is slightly lower in the Asia-Pac session, after closing 1.5% higher at $2114.48 on Monday.

- Monday’s move continued the surge higher after punching through the latest resistance at $2100. The all-time high is $2135.4 (Dec 4 high).

- Bullion’s move came despite US Treasuries paring much of Friday’s post-ISM Manufacturing’s gain. US Treasury yields finished the NY session 3-7bps higher, with the curve flatter.

- Traders are now likely to look ahead to Fed Chairman Powell's policy testimony to Congress Wed-Thu and the US Payrolls Report Friday.

- Bloomberg quoted TD on the yellow metal: “We still think it could go higher as well,” said Ryan McKay, senior commodity strategist at TD Securities. That’s because some discretionary macro traders are underinvested in the metal “relative to historical norms heading into a Fed cutting cycle.”

ASIA: 2024 May Be Another Tough Year For Exporters To China

MNI (Australia) - As China reopened, a strong bounce in demand was expected in 2023 that would provide strong demand for those countries with a large export exposure. GDP growth was 5.2% but many exporters didn’t see a recovery in export growth and as a result have become slightly less reliant on the Asian giant. Australia, Indonesia and Singapore are the exceptions. 2024 looks like it may be another tough year for exporters.

- China’s NPC announced a 5% growth target for 2024, close to 2023’s outturn but without the favourable base effects and post-pandemic rebound to support it. Monetary policy will be flexible and fiscal policy proactive. The news didn’t boost sentiment and growth concerns remain and so expectations that there will be stimulus measures to support the economy persist.

- Australia’s exports to China moderated in 2023 but remained robust at 12.1% y/y in December helped by continued strong commodity demand and elevated prices, and some improvement in trade relations. The share of exports going to China jumped over 7pp last year to 36.4%.

- In 2022 almost 23% of Korea’s exports went to China, this dropped to 19.7% last year and so their share of the economy fell 2pp to 7.3%. China remains an important destination for Korea but it has become less reliant on it as a market. 3-month average export growth returned to positive territory early this year after declining for over 18 months.

Source: MNI - Market News/Refinitiv

Exports to China y/y% 3-month ma

Source: MNI - Market News/Refinitiv

ASIA FX: CNH Unmoved By NPC, Modestly Higher USD/Asia Levels Elsewhere

Some USD/Asia pairs are higher, amidst a weaker regional equity backdrop. However, follow through USD strength has been limited and we are away from best levels. CNH is close to unchanged, with NPC headlines broadly in line with market expectations. Tomorrow, we have South Korean CPI due, which is the main focus point for the session.

- USD/CNH hasn't drifted too far away from 7.2100 in another low vol session. China equities initially opened weaker, post early NPC headlines. However, we recovered into positive territory, albeit with fairly modest gains at this stage. A growth target of 5% was in line with market expectations for 2024, while the authorities vowed to keep the yuan basically stable. Government bond yields are lower, except for the 30yr tenor. Ultra long issuance, announced at the NPC (1 trillion yuan), may be a factor. Still, we are only 2bps higher.

- 1 month USD/KRW rose to 1332.75 amid local equity market losses, with tech sentiment coming under pressure amid a US government band on AMD chip exports to China. The Kospi sits off 0.70%, while the Kosdaq is down by 0.90%. Q4 GDP revisions were unchanged at 0.6% q/q.

- USD/IDR sits slightly higher, last near 15750. We sit just below recent highs just above this level. The pair remains is an uptrend versus lows from mid to late Feb sub 15600. Late Jan highs rest near 15850. The pair is above all key EMAs with the 20-day the nearest at 15672. Comments from President Elect Prabowo crossed earlier. The incoming President is very bullish on the growth outlook, stating growth can be at 8% within 4-5yrs. The fiscal deficit can rise to 2.8% from the current 2.5%, without breaching the 3% threshold. Comments from BI also crossed. The central bank sees a weaker USD in H2, which should pave the way for easier policy settings under BI's financial stability focused framework. This is in line with the rough sell-side consensus.

- Spot USD/PHP sits unchanged for the session in recent dealings, last near 55.97. We remain well within recent ranges, with key EMAs clustered near by. The 200-day is a little lower, back at 55.93. Late Feb highs printed near 56.32, which was reportedly driven by month USD demand. The earlier Feb CPI data hasn't shifted sentiment. It was firmer than expected, but core CPI continued to lose momentum in y/y terms.• After the print the BSP stated it is appropriate to keep policy settings unchanged (the next policy meeting is in early April), while noting base effects could keep inflation suppressed in Q1 but could re-accelerate in Q2 due to el nino effects.

- USD/THB sits a touch higher, last near 35.83, but the pair remains above recent lows. Feb inflation data was close to expectations, -0.77% y/y for headline, +0.43% y/y for core. The Commerce Ministry noted that March inflation may drop more (due to energy subsidies) before turning positive in May.

INDONESIA: Indon Sov Debt Curve Steeper, BI To Hold Rates at 6% for Some Time

Indonesian USD Sovereign Debt curves are steeper on Tuesday with yields -2 to +2bps across the curve, while US Treasury Yields are unchanged. Indonesia's likely next president Prabowo Subianto said at a Forum that he is determined to maintain the government’s current trajectory of fiscal prudence and wise management.

- The 2Y is -1.1bps lower at 4.88%, 10Y is +1.4bps higher at 5.02%, while 5yr CDS is up 0.5bp to 70bps

- The spread difference between USD Indon & US Treasury yields has been closing in the front end as 2Y now 29bps from 38bps a month ago, while the 10Y is now 80.5bps moving 4bps wider over the past month

- Cross market moves, the USD/IDR is 0.06% higher, the JCI is 0.12% lower, whilst US Tsys yields are unchanged

- Bank Of Indonesia Governor Perry Warjiyo, says the bank will maintain it's policy rate at 6% "for some time" and could consider easing in 2h. BI remains watchful of rupiah amid global volatility, pledges to keep inflation within 1.5%-3.5% target, while headline inflation is seen at 2.8% in 2024, falling to 2.6% in 2025

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/03/2024 | 0745/0845 | * |  | FR | Industrial Production |

| 05/03/2024 | 0900/1000 | *** |  | IT | GDP (f) |

| 05/03/2024 | 1000/1100 | ** |  | EU | PPI |

| 05/03/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/03/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 05/03/2024 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/03/2024 | 1500/1000 | ** |  | US | Factory New Orders |

| 05/03/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 05/03/2024 | 1700/1200 |  | US | Fed Governor Michael Barr | |

| 05/03/2024 | 2030/1530 |  | US | Fed Governor Michael Barr |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.