-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI EUROPEAN MARKETS ANALYSIS: Aussie Falters On Softer Iron Ore & Gas, ACGBs Hold Firm After Strong Auction

- AUD retreats as iron ore, natural gas prices soften; USD goes offered ahead of U.U. FOMC minutes, CPI data

- Demand for core FI peters out after a firmer start but ACGBs remain afloat in the wake of a strong ACGB May '32 auction

- Thermal coal futures in China print another record high

BOND SUMMARY: Initial Impetus Evaporates, ACGB Auction Attracts Strong Demand

Initial demand for core FI futures petered out, even as regional news flow did not add much new to the familiar macro-narrative. Participants prepared for an eventful NY session, including the start to the earnings season. China's monthly trade data provoked a muted market response, with the nation's trade surplus topping expectations on the back of stronger than expected exports growth.

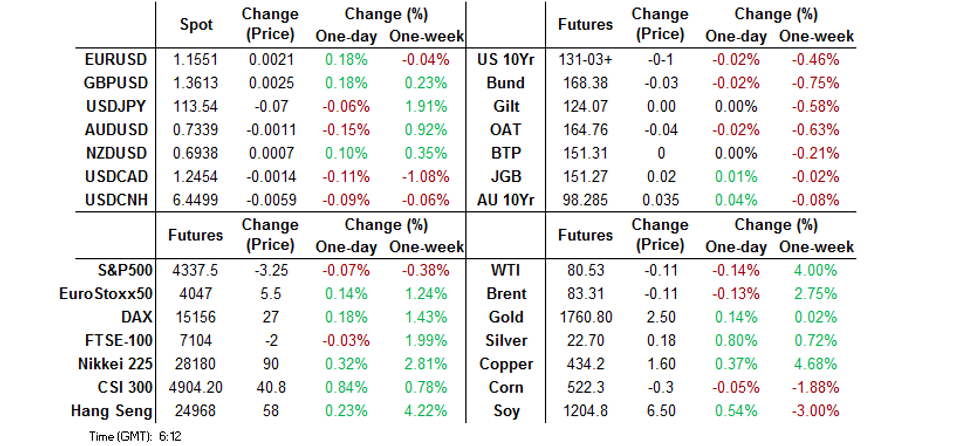

- T-Notes rejected resistance from yesterday's high of 131-07+ and pulled back, swinging into a loss. The contract last changes hands -0-01 at 131-03+, hovering just above the session low of 131-02+. Cash Tsy yields trade unch. to +0.8bp, curve runs a tad flatter. Eurodollar futures last seen unch. to +0.5 tick through the reds. There is an eventful NY session ahead, with the FOMC due to release the minutes from their latest monetary policy meeting after the publication of U.S. CPI data, while policymaker Brainard will speak at a Fed Listens event in Oklahoma. On the supply front, focus turns to 30-Year debt auction.

- JGB futures reopened on a firmer footing but eased off gradually into the Tokyo lunch break. The contract last trades at 151.29, 4 ticks above previous settlement levels. Cash JGB yields sit lower across the curve, with the super-long end outperforming. The annual growth in Japan's core machine orders was faster than forecast, but came alongside an unexpected monthly contraction. The BoJ offered to buy 1-3 & 5-10 Year JGBs as part of their Rinban ops.

- The auction of ACGB May '32 attracted strong demand, drawing the highest bid/cover ratio (5.90x) since that tenor became available. Cash 10-Year ACGBs outperformed after the auction as other tenors ticked away from highs on the back of broader market impetus. Cash ACGB curve still runs flatter at typing, with yields last seen unch. to -3.8bp. Futures remain elevated, YM last +2.0 & XM +3.5. Bills run unch. to +3 ticks through the reds. Comments from Australian Treasurer Frydenberg were ignored, as the official said he expects a deeper Q3 GDP contraction than projected before, adding that it should be followed by a strong rebound.

FOREX: Aussie Loses Shine On Lead From Commodity Markets

The Aussie went offered across the board in a headline-light session, as iron ore and natural gas prices fell. The currency shrugged off comments from Australian Treasurer Frydenberg, who said he expects GDP contraction to be 3.0% Y/Y or more in Q3, adding that the economy should "bounce back strongly" thereafter. Frydenberg poured cold water on jitters surrounding Australia's tense relationship with China, noting that local exporters have identified alternative target markets.

- The yuan caught a bid despite a firmer than expected PBOC fix. The HKMA said that China will sell an additional CNH4.5bn of its 2.41% 2023 bonds and an additional CNH1.5bn of its 3.60% 2028 bonds in Hong Kong on Oct 20. USD/CNH faltered in the lead up to the release of China's trade data and extended losses as stronger than forecast exports growth underpinned a beat in trade surplus.

- The DXY slid in tandem with spot USD/CNH. The greenback lagged behind all of its G10 peers save for AUD. Its weakness allowed USD/JPY to extend its pullback from a three-year high.

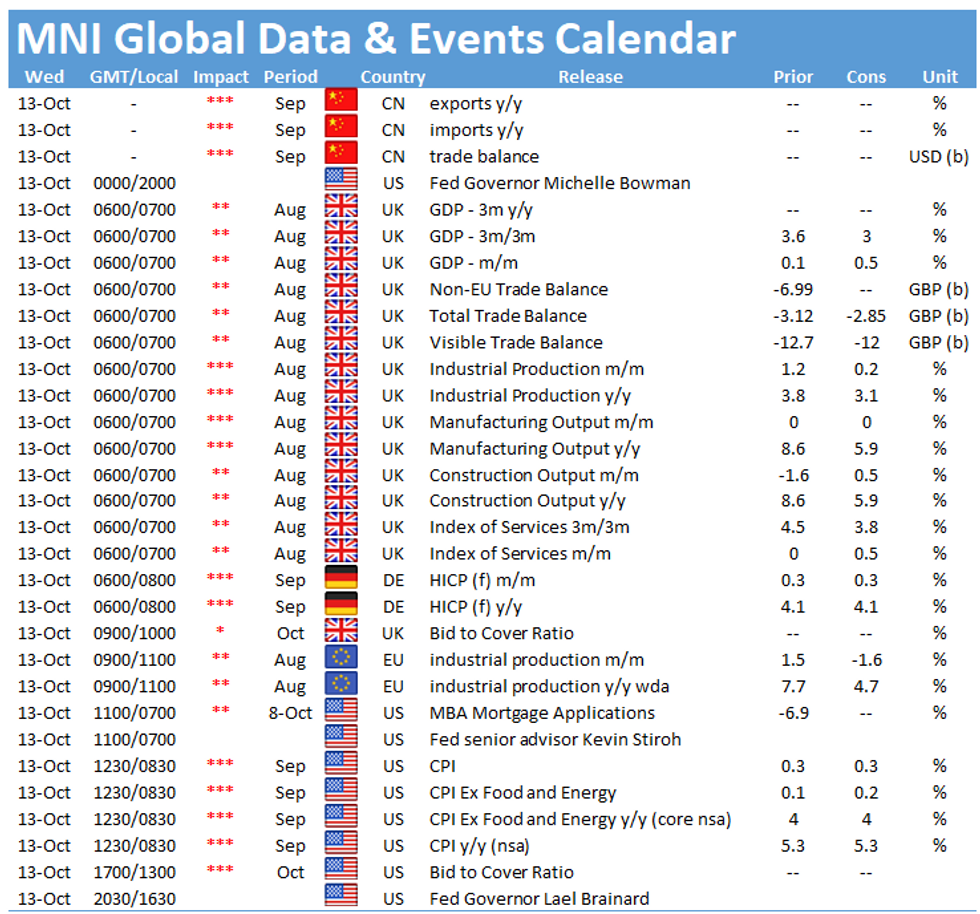

- The minutes from FOMC's September monetary policy meeting and U.S. CPI headline the global economic docket today. Final German CPI & UK industrial output are also due. The speaker slate features BoE's Cunliffe, ECB's Visco & Fed's Brainard.

FOREX OPTIONS: Expiries for Oct13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1500-15(E574mln), $1.1550-60(E703mln)

- EUR/GBP: Gbp0.8510-25(E1.2bln)

- USD/JPY: Y113.00($555mln)

- USD/CAD: C$1.2660-70($778mln)

- USD/CNY: Cny6.4200($1bln), Cny6.4500($1bln), Cny6.4800($1.3bln)

ASIA FX: PHP Outperforms While IDR Lags

- CNH: Offshore yuan strengthened, USD/CNH pushing past yesterday's low as the greenback weakened. Data showed the trade surplus widened as exports rose from the previous month while the pace of import growth slowed.

- SGD: Singapore dollar is stronger, markets look to the MAS policy announcement and Q3 GDP figures tomorrow. The MAS are expected to keep policy settings on hold but there is an outside chance of a hawkish adjustment.

- KRW: Won gained, finding support from BoK hints of a November hike yesterday. Unemployment and export data points were also positive.

- TWD: Taiwan dollar is marginally higher, USD/TWD holding above the 28.00 level

- MYR: Ringgit gained for a fifth session. Markets continue to assess data yesterday which showed industrial output contracted 0.7% Y/Y in August, even as Bloomberg consensus was looking for a 0.3% expansion. This came after industrial production shrank 5.1% in July.

- IDR: Rupiah is the worst performer in the region and is trading flat, Indonesian monthly trade data will be published on Friday. Looking further afield, Bank Indonesia will deliver their monetary policy decision next Tuesday.

- PHP: Peso rose, BSP Gov Diokno told Bloomberg that USD/PHP trading at the PHP50-51 level is "not worrisome" for the central bank and is within the gov't's FX assumption used for budget planning. He added that BSP only intervenes in FX markets to smooth fluctuations.

- THB: Markets in Thailand closed.

ASIA RATES: Lower India CPI Boosts Bonds

- INDIA: Yields lower, curve steepens. Data late yesterday showed CPI rose at the slowest pace in five months, CPI undershot estimates in September at 4.35% slowing from 5.30% in August. The data is likely to assuage some fears that inflation overshoots will force the RBI to act prematurely. However, the exuberance may be shortlived as the base effect is expected to fade from November. Other data showed industrial production rose 11.9%, above estimates of 11.6%. Bonds are also likely to get a boost today as oil prices take a breather from their recent rally. Trade balance data could fall as early as today, the trade deficit is expected to widen to $22.9bn from $13.8bn previously.

- SOUTH KOREA: Futures higher, tracking a move in US Treasury's overnight; short end rates demonstrating the effects of the hawkish hold from the BoK yesterday still holding most of post-BoK declines. Labour market data and export data were both robust, while South Korean PM Kim said earlier that the government is considering introducing a vaccine pass system to benefit fully vaccinated people, as it plans to adopt a gradual scheme named "living with COVID-19" to get back to normal life on Nov. 9.

- CHINA: The PBOC drained CNY 90bn as additional liquidity from the Golden Week holiday continued to roll off; repo rates diverged with the overnight rate and the 7-day repo rate inverted. Overnight repo rate up 25.5bps at 2.1549%, 7-day repo rate down 2.9bps at 2.1889%. Futures higher, 10-Year contract up 7.5 ticks at 99.125 as equity markets struggle. There has been renewed focus on pieces in state media positing that the PBOC could cut the RRR as soon as this quarter, while another piece opines that the Central Bank could roll over this month's MLF later this week with a larger amount. Government bonds are also attractive in comparison to corporate issues as the Evergrande saga drags on, the IMF weighed in and said: ""While the authorities have the tools to step in if the situation were to escalate, there is a risk that broader financial stress may emerge, with implications for both the Chinese economy and financial sector as well as global capital markets at the extreme".

- INDONESIA: Yields mixed across the curve. The Indonesian government met its target of IDR 8tn in bond sales with bids of IDR 50.1tn. Indonesian monthly trade data will be published on Friday. Looking further afield, Bank Indonesia will deliver their monetary policy decision next Tuesday.

EQUITIES: US Markets Remain Under Pressure

Equity markets are mixed in the Asia-Pac region, markets in Hong Kong are closed due to the typhoon which meant liquidity was slightly thinner than usual. Bourses in Japan led the way lower, while mainland China also saw indices struggle to get into positive territory. EM equity markets did fare better, rising after several days of declines with an extra boost from a weaker greenback. In the US e-minis are lower with the Nasdaq underperforming after reports that Apple is likely to cut its production targets for the year. Markets await the start of earnings season while CPI and FOMC minutes later today will be closely watched.

GOLD: Rises As Greenback Softens

Gold crept higher in Asia on Wednesday as the greenback softened, but is below the previous day's high after retreating from intraday best levels in the US session. Near-term attention is on the 50-day EMA at $1777.0 and $1787.4,Sep 22 high and a key resistance. A resumption of strength would reinforce the bullish engulfing candle that signalled a reversal on Sep 30 and a break of $1787.4 would suggest scope for further upside.

OIL: Uptrend Intact

Crude futures slightly softer in Asia but sticking to yesterday's range. WTI and Brent crude futures traded inside the week's range Tuesday, but importantly WTI held north of $80/bbl. This keeps the bullish case intact as markets continue to position for tighter winter supply in the coming months. This week's gains confirm an extension of the current bullish price sequence of higher highs and higher lows, reinforcing the uptrend. Note that the $80.00 psychological hurdle has also been cleared. The focus is on $81.60, a Fibonacci projection. Note that inventory figures have been delayed by a day due to the US Columbus Day holiday while the IEA releases its World Energy Outlook later today.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.