-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Data Slightly Better, But Deflation Still Evident

- Oil prices spiked at the open on headlines of a joint US/UK military strike on the Houthis in Yemen. This was in response to escalating Houthi attacks on commercial shipping in the Red Sea over recent months.

- US tsys are flat to 2bps cheaper, with a flattening bias, most likely in response to higher oil prices. In afternoon trade, JGB futures are richer but off the session highs, +16 compared to settlement levels, after 30-year supply showed mixed demand metrics.

- The USD is down slightly against the majors, but up from session lows. China data was slightly better than expected but is not painting an upbeat economic picture, with deflation still evident. The consensus, at this stage, still looks for a 10bps cut in the 1yr MLF on Monday.

- Looking ahead, attention turns to UK growth figures and then US December PPI data.

MARKETS

US TSYS: Cash Bonds Cheaper After US & UK Airstrikes

TYH4 is trading at 112-10, +0-00+ from NY closing levels.

- US tsys are flat to 2bps cheaper, with a flattening bias, most likely in response to higher oil prices after US and UK airstrikes hit Houthi rebel targets in Yemen.

- Military actions against the Iran-backed group were initiated in response to a series of attacks on vessels in the Red Sea.

- These strikes signify a substantial escalation in the ongoing conflict in the Middle East, which commenced with the Hamas attack on Israel in early October. If this conflict expands, it has the potential to drive oil prices higher.

- After yesterday’s US CPI data, which was more-or-less in line with expectations, the market now awaits PPI data later today. MN Fed President Kashkari also speaks about economic conditions (1000ET).

JGBS: Futures Higher But Off Best Levels, 30Y Auction Weighs

In afternoon trade, JGB futures are richer but off the session highs, +16 compared to settlement levels, after 30-year supply showed mixed demand metrics, with the low price failing to meet dealer expectations but the cover ratio increasing to 3.003x from 2.616x in December. It is noteworthy that December’s cover was the lowest level seen at a 30-year auction since 2015. The auction tail was also shorter compared to December's auction, which had recorded the longest tail in history. The 30-year yield is ~1bp higher in post-auction dealings.

- There wasn’t much in the way of domestic data drivers to flag, outside of the previously outlined current account balance, bank lending and weekly international investment flow data.

- Cash US tsys are trading flat to 2bps higher, with a flattening bias, most likely in response to higher oil prices after US and UK airstrikes hit Houthi rebel targets in Yemen.

- After yesterday’s US CPI data, which was more-or-less in line with expectations, the market now awaits PPI data later today. Fed Kashkari also speaks about economic conditions.

- Cash JGBs are richer out to the 10-year, with the futures-linked 7-year as the best performer (-1.3bps). The benchmark 10-year yield has declined by 1.0bp, settling at 0.593%.

- Swaps curve has maintained its bull-flattening out to the 20-year, with rates 0.5bp to 1.3bps lower.

JGBS: Mixed Demand Metrics For 30Y Supply

30-year supply sees mixed demand metrics, with the low price failing to meet dealer expectations (which stood at 99.50, per the BBG poll) but the cover ratio increasing to 3.003x from 2.616x in December. It is noteworthy that December’s cover was the lowest level seen at a 30-year auction since 2015.

- Today's auction result was therefore better than Tuesday's 10-year supply, which once again showed poor demand metrics across the board.

- With the outright yield and curves at similar levels to early December, a more sanguine view of the BoJ policy outlook and bullish sentiment towards long-end global bonds appear to have assisted today’s bid.

- JGB futures are little changed after initially gapped lower after the lunch break.

- The 30-year JGB has initially cheapened 1bp in post-auction trade.

AUSSIE BONDS: Richer But Off Best Levels, US PPI Data Later Today

ACGBs (YM +6.0 & XM +3.0) sit richer, with a steepening bias, but are off the Sydney session’s best levels. There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined housing loan commitments data.

- The shift away from session highs therefore seems to be more closely tied to US tsys activities during today's Asia-Pacific session. Benchmark yields are trading flat to 2bps higher.

- Cash ACGBs are 3-5bps richer, with the AU-US 10-year yield differential 1bp wider at +10bps.

- Swap rates are 2-4bps lower, with the 3s10s curve steeper.

- The bills strip has maintained its bull-flattened, with pricing +1 to +7.

- RBA-dated OIS pricing is 3-5bps softer for meetings beyond May.

- (AFR) The next chairman of the $206bn Future Fund will come from outside the organisation, and Treasurer Jim Chalmers is understood to be willing to delay an appointment to find the right leader. (See link)

- On Monday, the local calendar sees the MI Inflation Gauge, Job Advertisements and CBA Household Spending data.

- TCV has mandated NAB, UBS and Westpac for a new AUD 5.25% 15 September 2038 fixed rate benchmark bond, according to UBS. The transaction is expected to launch and price soon, subject to market conditions.

NZGBS: Very Strong Close, Outperformed The $-Bloc

NZGBs closed on a solid note, with benchmark yields 9-10bps lower. This came despite the local calendar being empty and US tsys dealing cheaper in today’s Asia-Pac session.

- US tsys are 1-2bps cheaper most likely in response to higher oil prices following US missile strikes in response to Houthi attacks.

- The NZGB 10-year managed to outperform its $-bloc counterparts, with the NZ-US and NZ-AU 10-year yield differentials 3-4bps tighter.

- Swap rates closed 8-12bps lower, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed 1-11bps softer across meetings, with November leading. A cumulative easing of 96bps is priced by November.

- House sales provisionally fell to a record low in the three months through September, according to CoreLogic NZ.

- Next week, the local calendar is empty on Monday but sees the NZIER Business Opinion Survey on Tuesday. Card spending data is on Wednesday.

- The market awaits US PPI data later today. MN Fed President Kashkari also speaks about economic conditions.

OIL: Prices Spike Higher On US/UK Military Strikes In Yemen

Brent couldn't sustain early moves above $79/bbl, the front end benchmark last near $78.80/bbl, still +1.85% higher for the session. Earlier highs of $79.37/bbl were very close highs from Jan 4. For WTI we were last in the $73.40/bbl region, up by nearly 2%, but also off earlier highs near $74/bbl. Both benchmarks are now close to flat for the week, paring losses in recent sessions.

- The spike today has reflected joint US/UK joint military strikes in Yemen targeting the Houthis. This is in response to attacks on commercial ships by the Houthis over recent months.

- The US & UK authorities have stated the strikes aren't designed to escalate tensions, but this will be a focus, particularly around risks of Iran becoming more involved in a broader conflict.

- Elsewhere, China crude import volumes rose in Dec, with 2023 being a record year for imports as the country emerged from Covid lockdown conditions.

- This, along with a softer USD sentiment, has likely aided oil at the margins.

EQUITIES: Mixed Trends, Nikkei 225 +6% For The Week

Regional equities are mixed as we approach the weekend. Japan markets are higher, albeit with more modest gains compared to recent sessions. Trends are mixed elsewhere. US equity futures are down, but up from session lows. Eminis are off 0.14% but remain above 4800, Nasdaq futures are down around 0.10%. The US/UK military strikes on Yemen (in response to Houthi attacks on Red Sea commercial shipping) has likely added some risk aversion at the margins.

- The Nikkei 225 is up around 1%, the index on track for its best week in nearly 2 years. The Topix is up a more modest 0.20% at this stage. Foreign investors bought local shares last week, and will have likely done so this week.

- China markets are down slightly at the break. The CSI 300 off 0.17%. Inflation data and trade figures for Dec were slightly better than expected but are unlikely to shift the macro needle. At this stage, the consensus looks for a 10bps cut in 1yr MLF on Monday.

- The HSI is close to flat at the break.

- South Korea shares continue to underperform, the Kospi off 0.70% at this stage. Offshore investors are net sellers today, -$254mn in outflows, after strong inflows yesterday likely associated with the Lee family selling Samsung shares.

- Taiwan's Taiex is close to flat, as Saturday's election comes into focus.

- In SEA, most markets are up outside of Singapore, although gains are modest at this stage.

JAPAN DATA: Offshore Investors Return To Local Stocks In The First Week Of 2024

In the week ending January 5, offshore investors added ¥296.2bn to Japan stocks. This followed outflows in the final two weeks of 2023. The prior trend had generally been solid in terms of positive momentum since the end of September. In terms of offshore purchases of local bonds, we saw net outflows of -¥402.7bn, nearly offsetting the inflows seen in the final week of 2023.

- Japan buying of offshore bonds picked up in the first week of this year, while purchases of offshore stocks was also positive, see the table below. Again, the trend around offshore bond purchases was mostly positive through Dec.

Table 1: Japan Weekly Investment Flows

| Billion Yen | Week ending Jan 5 | Prior Week |

| Foreign Buying Japan Stocks | 296.2 | -337.3 |

| Foreign Buying Japan Bonds | -402.7 | 460.7 |

| Japan Buying Foreign Bonds | 542.3 | -204.8 |

| Japan Buying Foreign Stocks | 190.7 | 40.3 |

Source: MNI - Market News/Bloomberg

FOREX: USD Off Lows, A$ & Yen Marginally Higher

The USD index is down, but up from lows, with the BBDXY last near 1223.25 (earlier lows at 1222.58). The main focus today has been the spike in oil prices after the US & UK military strikes on Yemen, targeting the Houthis. Oil prices are off highs, but US yields are a touch higher (more so at the front end), which may have aided the USD from lows.

- AUD/USD got to highs of 0.6714, but we now sit back at 0.6700, around +0.20% higher for the session. To the extent higher oil prices boosts broader energy prices, the oil spike can be seen as a positive. A more cautious equity tone has likely trimmed risk appetite though. Housing finance figures were close to expectations.

- NZD/USD has largely followed the A$ trajectory, the pair last just above 0.6240.

- USD/JPY saw lows of 144.85, with some haven demand evident on the military strike headlines. However, the slightly firmer US yield backdrop has likely kept dips supported. The pair last near 145.00, around 0.20% stronger in yen terms for the session.

- Looking ahead, attention turns to UK growth figures and then US December PPI data.

GOLD: Higher On Haven Demand Following Yemen Airstrikes

Gold is slightly higher in the Asia-Pac session, after closing 0.2% higher at $2028.91 on Thursday, having bottomed out at $2013.4 to test support at $2013.2 (50-day EMA).

- Bullion was helped higher on Thursday by a softer USD index and lower US Treasury yields following US CPI data.

- Today’s strength however appears linked to haven demand as US and UK airstrikes hit Houthi rebel targets in Yemen.

- Military actions against the Iran-backed group were initiated in response to a series of attacks on vessels in the Red Sea.

- These strikes signify a substantial escalation in the ongoing conflict in the Middle East, which commenced with the Hamas attack on Israel in early October. If this conflict expands, it has the potential to drive bullion prices higher.

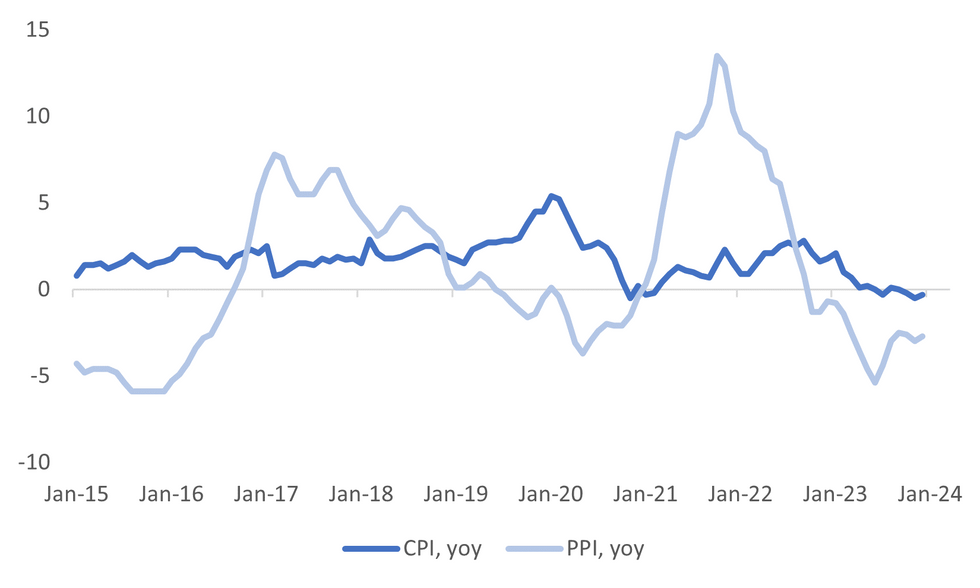

CHINA DATA: Dec Inflation Close To Expectations. Core Steady At 0.6% Y/Y

China Dec inflation outcomes were close to expected. The headline CPI fell -0.3% y/y (-0.4% forecast and -0.5% prior). In m/m terms we rose 0.1%, the first rise since September last year. Consumer goods were -1.1% y/y, services +1.0% y/y. Food prices were 0.5% y/y, non-food at -3.7% y/y, both slight improvement on Nov outcomes. Core (ex food & energy) was unchanged at 0.6% y/y.

- By product for CPI, there weren't a great deal of shifts versus Nov outcomes. Food and transport & communication were the biggest drags both down around -2% y/y. Positives remained in terms of clothing, medical care and recreation.

- On the PPI side, we were slightly weaker than expected at -2.7% y/y (-2.6% forecast, -3.0% prior). Again, there wasn't much shift from Nov trends in terms of the detail. Mining at -7.0% y/y remains the biggest drag, while manufacturing was -3.2% y/y. Consumer goods remained at -1.4%, weighed lower by food and durables.

- The data shouldn't really shift the macro narrative, albeit that deflation pressures didn't get any worse through the tail end of 2023 for China.

- As we noted earlier, market expectations are for a 10bps cut in the 1yr MLF on Monday.

Fig 1: China CPI & PPI Y/Y

CHINA DATA: Dec Trade Slightly Better Than Expected, Commodity Import Volumes Mostly Higher

China Dec trade figures were slightly better than expected. Headline exports were +2.3% y/y (1.5% forecast and 0.5% prior). Imports were positive at 0.2% y/y, versus -0.5% forecast and -0.6% projected. The trade surplus was $75.34bn, a touch above expectations, while $68.40bn was the prior outcome.

- The broader improvement in the export trend has been evident since mid 2023, although the recovery remains modest at this stage and sub trends seen in Taiwan and South Korea (in y/y growth terms).

- Base effects also inflated the Dec print for China, given Dec 2022 underperformed.

- Export growth to most countries was negative, although there were pockets of strength in terms of Russia (+21.6%) and Brazil +23.3%).

- On the import side, commodity import volumes were mostly positive. Coal rose strongly, as did oil, +13.9% m/m. Iron ore was down in m/m terms, but remains elevated from a levels standpoint. Natural Gas import volumes rose as well. In value terms, most commodity imports were higher.

- So overall some tentative signs of better export and import growth, but it is unlikely to be enough to turn the market more positive on the near term growth outlook.

ASIA FX: China Data Slightly Better Than Expected, CNH Steady Near 7.1700

Asia FX has tracked relatively tight ranges in Friday trade to date. There has been slight underperformance against modestly lower USD index levels. An offset has come from higher oil prices, as the US/UK launched military strikes against the Houthis in Yemen. We still wait for China aggregate finance/new loans data for December. India CPI and IP prints later. On Monday the focus will be on whether China cuts the 1yr MLF rate (current consensus is for a 10bps cut to 2.40%). Note the BoT policy briefing is also scheduled for Monday morning local time.

- USD/CNH currently tracks near 7.1700, slightly lower for the session. On the data front, we have had inflation and trade figures for Dec. On balance they were slightly better than expected, but are not painting an upbeat picture. Export growth was inflated by base effects while CPI and PPI remain in deflation territory. Onshore equities are mixed after a positive rebound yesterday.

- 1 month USD/KRW got close to 1309 in early trade, but sits back at 1312 in recent dealings, little changed for the session. Onshore equities continue to underperform, down 0.80%, as offshore investors sell local shares, -$308.3mn, unwinding some yesterday's impressive inflow. Troubled local builder Taeyoung won a vote to start restructuring (BBG).

- TWD has been relatively steady. The 1 month USD/TWD NDF is near 30.90 as Saturday's election comes into view. Onshore equities are down a touch.

- USD/INR has drifted lower, last under 83.00, not too far from mid Dec lows. We sit comfortably off recent highs close to 83.40. Local equities are maintaining a positive tone, although offshore investors have been net sellers so far this week. We have CPI and IP data coming up later.

- USD/IDR is slightly lower, but has maintained tight ranges overall, last near 15545/50 in spot terms. USD/THB spot is holding above 35.00, while USD/PHP is a little weaker and back above 56.00.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/01/2024 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 12/01/2024 | 0700/0700 | ** |  | UK | Index of Services |

| 12/01/2024 | 0700/0700 | *** |  | UK | Index of Production |

| 12/01/2024 | 0700/0700 | ** |  | UK | Trade Balance |

| 12/01/2024 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 12/01/2024 | 0745/0845 | *** |  | FR | HICP (f) |

| 12/01/2024 | 0745/0845 | ** |  | FR | Consumer Spending |

| 12/01/2024 | 0800/0900 | *** |  | ES | HICP (f) |

| 12/01/2024 | 1230/1330 |  | EU | ECB's Lane Speech + Q&A at REBUILD Annual Conference | |

| 12/01/2024 | - | *** |  | CN | Trade |

| 12/01/2024 | - | *** |  | CN | Money Supply |

| 12/01/2024 | - | *** |  | CN | New Loans |

| 12/01/2024 | - | *** |  | CN | Social Financing |

| 12/01/2024 | 1330/0830 | *** |  | US | PPI |

| 12/01/2024 | 1500/1000 |  | US | Minneapolis Fed's Neel Kashkari | |

| 12/01/2024 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/01/2024 | 1700/1200 | ** |  | US | USDA GrainStock - NASS |

| 12/01/2024 | 1700/1200 | *** |  | US | USDA Winter Wheat |

| 12/01/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.