-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Struggle Into Weekend

- Regional Asia Pac equities are tracking lower to end the week. This follows negative leads from US/EU stocks through Thursday. China shares are among the weakest performers, off by a little over 1%. Likely US curbs on investment in China, have weighed.

- Yen has outperformed today. USD/JPY is back sub 134.00 (we touched a low of 133.76, last 133.80/90). The stronger than expected core CPI print for March (3.8%y/y versus 3.6% expected), drove the initial round of yen strength. Headlines that the G7 were considering a full export ban on Russia drove the next round of strength, although there wasn't much follow through.

- Looking ahead, preliminary PMI data from across the globe will cross, along with UK retail sales. There will also be a range of ECB speakers and comments from Fed Governor Cook (with the Fed going into pre-meeting blackout this weekend).

US TSYS: Tight Ranges, Back From Block Buy-Inspired Bests

Cash Tsys saw a light extension of Thursday’s bull steepening theme during Asia-Pac hours, with the major benchmarks last 0.5-1.5bp richer. TYM3 is +0-04 at 120-25 into London hours, just off the top of a tight 0-04 range, on modest volume of ~49K.

- A round of activity surrounding a block buy of TU futures (+6.4K) provided the highlight of the session and promoted the early bull steepening.

- The space looked through a story from Japan’s Kyodo News, which suggested that countries are considering a near-total ban on exports to Russia. A reminder that BBG ran a similar story on Thursday.

- There was no impact from the latest round of firmer than expected core CPI data out of Japan, as it isn’t seen as much of a needle mover when it comes to next week’s BoJ monetary policy meeting.

- The weekly update from the Fed saw a modest uptick in both discount window and BTFP usage, while FIMA usage nudged lower.

- Fedspeak from Harker & Bostic stuck to the respective, well-documented views.

- Preliminary PMI data from across the globe headlines Friday. There will also be a range of ECB speakers and comments from Fed Governor Cook (with the Fed going into pre-meeting blackout this weekend).

JGBS: At Bests, Look Past Higher Than Expected CPI

JGB futures (147.76, +28 compared to settlement levels) have climbed above overnight highs in the afternoon session, despite a stronger-than-anticipated Japanese CPI. This behaviour likely stems from the market's confidence that the data will have little impact on next week's BoJ monetary policy meeting. The move to session highs appeared to have been assisted by a slight strengthening by US Tsys in Asia-Pac trade and robust Rinban operations.

- Cash JGBs remain mixed across the curve with yields 0.8bp higher to 2.1bp lower with the 2-year benchmark the weakest and the 7-year the strongest. The 10-year JGB is 0.5bp richer at 0.467%, below the BoJ's YCC limit of 0.50%.

- Low to average offer/cover ratios in today's BoJ Rinban operations (covering 1- to 25-Year JGBs) have provided some light support in early afternoon trade. The exception has been the 1-3-year zone.

- The swaps curve flattening in the morning session has given way to a steepening. Swap spreads are tighter across the curve, apart from the 7-year zone.

- Looking ahead, next week’s economic calendar is relatively heavy ahead of the BOJ policy decision on Friday with the Tokyo CPI, Retail Sales and Industrial Production as the highlights. 2-year JGB supply is also scheduled.

AUSSIE BONDS: Stronger, Tight Range, Underperforms US Tsys

ACGBs sit richer (YM +3.0 & XM +2.5) after trading in a relatively narrow range for the Sydney session. The bid tone was assisted by a slight richening in global bonds in Asia-Pac trade. US Tsy yields sit 1-2bp lower in Asia-Pac trade.

- Cash ACGBs are 2-3bp richer with the 3/10 curve unchanged and the AU-US 10-year yield differential +2bp at -6bp.

- Swap rates are 5bp lower with EFPs little changed.

- Bills strip is marginally flatter with pricing +2 to +5.

- RBA-dated OIS pricing is flat to 4bp softer across meetings with 19bp of cumulative tightening priced by August.

- Next week sees the release of the much-awaited Q1 CPI data. With the almost a full 25bp rate hike priced by August, market pricing may need to be reassessed if the quarterly lends further support to the notion that inflation has peaked, as flagged by the CPI monthly release. BBG consensus expects Trimmed Mean CPI to be +1.4% Q/Q and +6.7% Y/Y versus +1.7% and +6.9% in Q4.

- Until then, participants will eye US Tsys’ response to the US earnings season, Fedspeak and global Flash PMIs.

- Elsewhere, Treasurer Chalmers commented in a statement that Australia is set to introduce a Sovereign Green Bond Program in Mid-2024.

NZGBS: Closed At Bests, Add to Post-CPI Rally

NZGBs have strengthened through the session to close at bests with the 2- and 10-year benchmark yields 9bp lower. Today’s move comes after yesterday’s 7-9bp richening sparked by a lower-than-expected print for Q1 CPI. The move to session highs has been assisted by a slight bid tone to global bonds in Asia-Pac trade. US Tsys sit 1-2bp lower in Asia-Pac trade. NZGBs have nonetheless outperformed their $-bloc peers with the NZ/US and NZ/AU 10-year yield differentials respectively 3bp and 4bp lower.

- Swap rates are 11bp lower with implied swap spreads narrower.

- RBNZ dated OIS closed 3-13bp softer across meetings with Apr-24 leading. 19bp of tightening priced for the May meeting versus 24bp before the. Easing expectations for Feb-24, off the expected terminal OCR of 5.52% (July), are currently 46bp.

- RBNZ Deputy Governor Hawkesby's speech notes from today's address covered familiar ground stating that the extent of moderation in the domestic economy will determine the direction of future monetary policy.

- The local calendar is light next week with ANZ Business and Consumer Confidence (Thu) as the highlights. In Australia, Q1 CPI is scheduled for Wednesday.

- Until then, participants will eye US Tsys’ response to the US earnings season, Fedspeak and global Flash PMIs.

FOREX: Multiple Supports For Yen, Slumping Iron Ore Hurts The A$

Yen has outperformed today. USD/JPY is back sub 134.00 (we touched a low of 133.76, last 133.80/90). The stronger than expected core CPI print for March (3.8%y/y versus 3.6% expected), drove the initial round of yen strength. Headlines that the G7 were considering a full export ban on Russia drove the next round of strength, although there wasn't much follow through.

- These headlines were largely in line with what Bloomberg reported yesterday, which may have capped the market reaction.

- Still, weaker regional equities, led by China (-1%) have aided yen safe haven demand. This, coupled with a further slump in iron ore prices (off by 5%), amid demand concerns has hurt A$ sentiment. AUD/USD is back to 0.6710/15, -0.45% for the session and the weakest G10 performer.

- AUD/JPY is back to 89.90, against recent highs near 90.80. Note the 50-day MA comes in just under 90.00. NZD/USD has been dragged lower, last under 0.6160, which is slightly under the simple 200-day MA.

- EUR/USD and GBP/USD have been offered slightly, while the BBDXY is a touch higher to 1225.80.

- In the cross asset space, US yields are down a touch, while US equity futures have been close to flat for much of the session.

- Looking ahead, preliminary PMI data from across the globe will cross, along with UK retail sales. There will also be a range of ECB speakers and comments from Fed Governor Cook (with the Fed going into pre-meeting blackout this weekend).

FX OPTIONS: Expiries for Apr21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0973-80(E920mln), $1.1050(E1.7bln)

- GBP/USD: $1.2350(Gbp545mln)

- USD/JPY: Y134.00-20($829mln)AUD/USD: $0.6795-00(A$521mln), $0.6845(A$1.4bln)

- USD/CAD: C$1.3520-40($670mln)

- USD/CNY: Cny7.0100($740mln)

ASIA FX: Firmer USD, But Recent Ranges Respected

USD/Asia pairs have gravitated higher, with only USD/THB seeing some downside traction today. We have respected recent ranges though. Equity sentiment has been weaker around the region, led by China and South Korea, which has supported dollar sentiment. Note Indonesia, Malaysia and the Philippines have been closed today. Indonesia and Malaysia remain closed on Monday. Elsewhere the data calendar is light, with Taiwan IP and potentially Thailand trade figures due Monday.

- USD/CNH is back above 6.8900, last near 6.8950, 0.15% weaker in CNH terms for the session. Weaker local equities, off by more than 1%, with the US likely to announce fresh investment curbs weighing at the margin. The CNY fixing was neutral. The FX regulator expects trade surpluses to continue and that CNY expectations remain stable.

- USD/KRW has been biased higher, but spot has found selling interest around the 1330 level, last 1328/29. The 1 month NDF sits close to 1326.50. The first 20-days trade data for April showing continuing headwinds, with export growth to the US slowing. Some onshore analysts are also turning more cautious on the local equity market outlook, amid concerns around heavy retail investor positioning.

- Spot USD/TWD is a touch higher, last just above 30.60, so remaining within recent ranges. Local equities are weaker, -0.70%, as offshore investors sold -$467.5mn of local equities yesterday. Some carry over from the weaker than expected March export orders data from yesterday (-25.7% y/y, -18.6% expected) has likely been evident.

- USD/THB is lower today, back to 34.30/35, around 0.25% stronger in baht terms for the session. This is bucking the generally the firmer USD/Asia trend elsewhere, but likely reflects some catch up to USD weakness post yesterday's onshore close. More broadly, we continue to track a range trade for the pair. On the topside, the 100-day EMA around 34.53, presents a cap on the upside, while dips sub 34.20 have been supported. Portfolio flows have been negative this month across both bonds and equities and may need to firm to bring lower USD/THB levels.

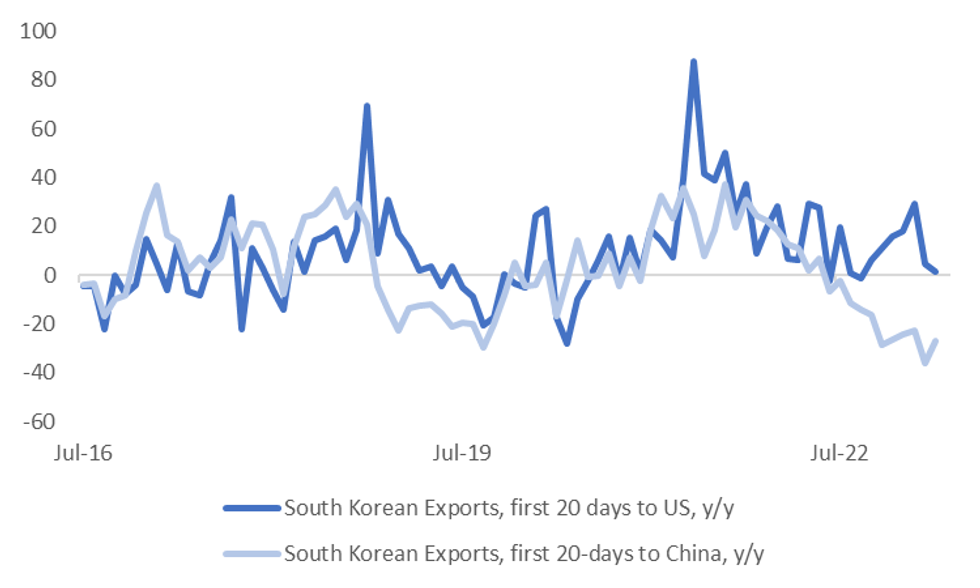

SOUTH KOREA: Export Growth To US Slowing, Other Headwinds Persist

South Korea first 20-days trade data struck similar tones with recent trends. Exports were down -11% y/y for the first 20-days of the month. It was the same in terms of the daily average for exports in the first 20-days. Note for the first 20-days of March exports were down -17.4% y/y, for the full month of March exports were down -13.6% y/y.

- Chip exports were down -39.3% y/y, versus -44.7% for the first 20-days of March. Exports to China remained soft -26.8% in y/y terms, which remain around recent lows.

- Exports to the US were better +1.4% y/y for the first 20-days of April, but the trend is still slowing. We were running comfortably above double digit pace late last year, earlier this year, see the chart below.

- So, whilst external demand from China is expected to improve, some offset could come from weaker momentum out of the US.

- On the import side, we were at -11.8% y/y for the first 20-days of April. Lower commodity prices are likely helping at the margin, but the first 20-days trade deficit still stood at -$4.14bn.

Fig 1: South Korean Exports, First 20-days Of April, To China & The US

Source: MNI - Market News/Bloomberg

EQUITIES: China Equities Slump, Amid Likely Fresh US Investment Curbs

Regional Asia Pac equities are tracking lower to end the week. This follows negative leads from US/EU stocks through Thursday. China shares are among the weakest performers, off by a little over 1%. Likely US curbs on investment in China, have weighed. US futures have largely tracked sideways.

- The CSI 300 is off by 1%, the Shanghai Composite by a slightly more. US President Biden is reportedly looking at introducing curbs on US investment into China, within the next few weeks (reportedly with G-7 backing per BBG reports).

- The HSI has seen some negative spill over, off by 0.64%, with the tech sub-index off by 1.81% at this stage.

- The Kospi is down by 1.00%, the Kosdaq around 1.75%, as onshore analysts have warned of an over heating market amid heavy retail positioning. The Taiex is down by 0.41%, while the Topix is down around 0.30% at this stage.

- The ASX 200 is down by 0.43%, with miner BHP leading the move lower amid weaker commodity prices.

- In SEA most markets are down a touch, but note Indonesia, Malaysia and the Philippines are closed.

GOLD: Holding Above $2000, Flat Versus Levels A Week Ago

Gold has drifted a little lower through the course of today's session. We were last near $2002, down 0.15% for the session and only reversing part of Thursday's 0.50% gain. This is consistent with a slightly firmer USD backdrop (ex JPY). The weaker tone to regional equities hasn't aided safe haven demand, although moves in US futures and yields have been more muted.

- We got above $2010 post the Asia close on Thursday, an +$40 rebound from Wednesday session lows. Still, gold is currently tracking close to flat for the week.

- In terms of levels, recent highs come in between $2010/$2015, while on the downside, the 20-day EMA comes in just under $1989.

- Gold ETF holdings have flatlined somewhat over the past week.

OIL: Tracking Down Sharply For the Week Amid Demand Concerns

Brent crude is unchanged versus Thursday closing levels, last around $81.10. We lost nearly 4.5% through the Wednesday/Thursday sessions. At this stage, Brent is down ~6% for the week, tracking for the first weekly loss since mid March. WTI is slightly above $77/bbl, with this level holding through the tail end of Thursday's session.

- Brent is now sub the 50-day EMA (just under $82.40/bbl), with bears likely to target a break back sub $80/bbl, highs from late March.

- Demand concerns remain a clear headwind in the near term. A South Korean refinery plans to trim run rates in July.

- Weakness in other commodities, like iron ore today, amid signs of weaker China demand, are also likely weighing on oil sentiment at the margins.

- Looking ahead to next week, there isn't much in the way of oil specific event risks outside of the weekly inventory readings.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/04/2023 | 0600/0700 | *** |  | UK | Retail Sales |

| 21/04/2023 | 0700/0900 |  | EU | ECB de Guindos Remarks at Fundacion La Caixa | |

| 21/04/2023 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 21/04/2023 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 21/04/2023 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 21/04/2023 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 21/04/2023 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 21/04/2023 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 21/04/2023 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 21/04/2023 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 21/04/2023 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 21/04/2023 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 21/04/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 21/04/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 21/04/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 21/04/2023 | 1430/1630 |  | EU | ECB Elderson at Peterson Institute Climate Event | |

| 21/04/2023 | 1745/1945 |  | EU | ECB de Guindos at Colegio de Economistas de Madrid Event | |

| 21/04/2023 | 2035/1635 |  | US | Fed Governor Lisa Cook |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.