-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Q2 GDP Slows, Retail Spending Soft

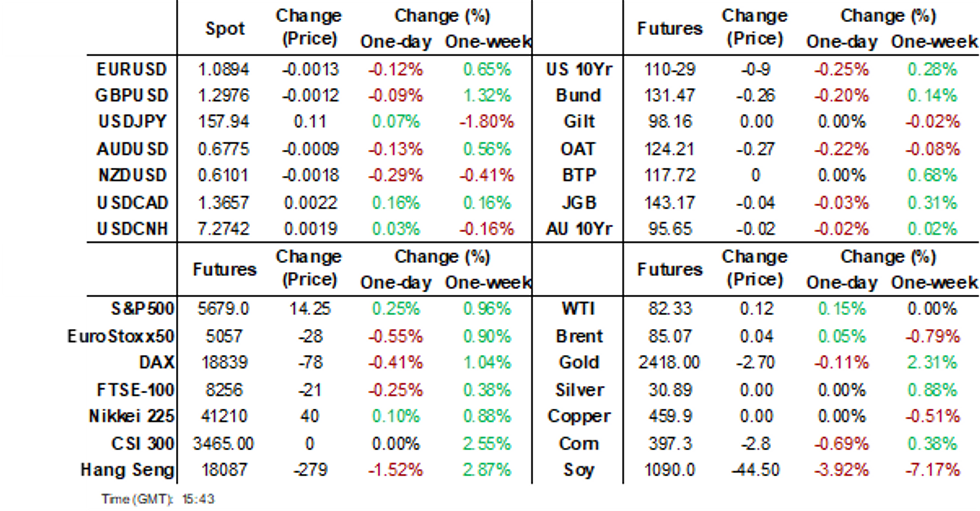

- The presidential odds have swung further in favor of the Republicans and Trump over the weekend, post the assassination attempt. US Tsys opened lower, amid higher volumes, but didn't have follow through. The USD is firmer, but sits away from best levels.

- China Q2 GDP was weaker than forecast. Rising 0.7% q/q, versus 0.9% forecast (prior was 1.6%). House prices also fell in June, albeit less than the May decline. Focus is on the Third Plenum in the first half of this week.

- Looking ahead, the US Empire Survey is due. ECB speak from Lagarde is also out. Later on Fed speak from Chair Powell will be in focus (ahead of the blackout period).

MARKETS

US TSYS: Tsys Futures Steady After Opening Lower, Powell To Speak Later

- Treasury futures are steady after opening trading lower, front-end quickly erased most of the early losses with TUU4 trading just -0-00¾ at 102-17⅞, while TYU4 is -0-09 at 110-29.

- Volumes surged this morning, although tapered off as the day progressed we still sit average recent average with TU 68k, FV 105k & TY 164k

- Cash trading is close today with Japan out, but looking at moves in futures the treasury curve has bear steepened, while the long-end is 4-6bps cheaper.

- Looking across volatility markets, despite the weekend events haven markets have been relatively stable with the VIX little changed. Implied volatility for September TY futures has bounced of yearly lows of 5.41 and now trades at 5.71

- Projected rate cut pricing into year end look firmer vs. early Friday (*): July'24 at -6.5% w/ cumulative at -1.6bp at 5.313%, Sep'24 cumulative -25.2bp (-24.1bp), Nov'24 cumulative -41.4bp (-38.5bp), Dec'24 -62.9bp (-59.6bp).

- Today, Fed Chair Powell makes his final scheduled appearance ahead of the pre-July FOMC meeting communications blackout period & Empire Manufacturing

US POLITICS: Presidential Odds Swing Further Trump's Way

The presidential odds have swung further in favor of the Republicans and Trump over the weekend, post the assassination attempt. Trump, who initially considered delaying his trip to Wisconsin, and The Republican National Convention, by two days has decided against that and has just arrived in Milwaukee for the RNC.

- According to PredictIt, Trump jumped 6pts over the weekend and now sits with a 67% chance of winning, verses Biden who dropped 1pt to 26%, while Kamala dropped 8pts since Friday.

- Biden who briefly spoke moments ago has said "We need to lower temperature in politics"

- Odds that Biden will lead the Democratic party to the next election surged on Friday after an energetic speech in Detroit where he vowed to "shine a spotlight" on Trump. Democratic nominee odds are now Biden at 70%, up from 48% on Friday, while Kamala is now at 21% down from 44% on Friday

US PredicIt % presidential candidate winning

Source: MNI - Market News/PredictIt

AUSSIE BONDS: Drifted Cheaper, No Cash US Tsy Trading In Asia-Pac Today

ACGBs (YM flat & XM -2.0) have ground cheaper throughout today’s Sydney session.

- With the domestic calendar largely empty until Thursday’s release of the June Employment Report, the local market has drifted weaker.

- Expectations of sustained strong pricing at today's Jun-51 auction proved accurate, as the weighted average yield printed through prevailing mids and the cover ratio printed around levels seen at recent longer-dated auctions.

- After today’s supply, the AOFM plans to sell another A$500mn of the 3.00% 21 November 2033 bond on Wednesday and A$700mn of the 2.75% 21 November 2027 bond on Friday.

- Cash ACGBs are flat to 2bps cheaper.

- The cash AU-US 10-year yield differential, currently at +16bps, is at its highest level since February. This places it in the upper half of the +/-30bps range observed since November 2022. However, it's worth noting that cash US tsys are not trading during today's Asia-Pac session due to a public holiday in Japan.

- Swap rates are 1-2bps higher, with the 3s10s curve steeper.

- The bills strip is little changed, with pricing flat to +1.

- RBA-dated OIS pricing is flat to 2bps softer for 2025 meetings. Terminal rate expectations drop to 4.42% versus its recent high of 4.52%.

- Tomorrow, the local calendar will see the Westpac Leading Index.

AUST/US BONDS: AU-US Curve Correlation Higher Than History Suggests It Should Be

Over the past couple of months, there have been two episodes of a noticeable reduction in the cross-market curve correlation between Australia and the US. Those episodes suggested a focus on domestic drivers rather than US and global factors.

- In both instances, the dips in correlation can be attributed to higher-than-expected CPI prints in Australia. The first occurred in late April, coinciding with the release of Q1 CPI, while the second was linked to the May CPI Monthly release.

- Similar to the late April episode, the most recent dip was short-lived, with the cross-market correlation between the cash AU 3/10 and the US Treasury 2/10 curves quickly returning to the upper end of its range for the year.

- However, considering that global curve correlations tend to weaken as global policy tightening matures and policy rates diverge into their respective easing cycles, the current level may also prove to be fleeting.

Figure 1: Rolling 10-day Correlation – ACGB 3/10 Curve Vs. US Tsy 2/10 Curve

Source: MNI – Market News / Bloomberg

AUST/US BONDS: AU-US 10-Year Yield Differential Highest Since Feb But Below FV

Today, the AU-US 10-year cash yield differential sits at +14bps. It's worth noting that cash US tsys are not trading during today's Asia-Pac session due to a public holiday in Japan.

- The cash AU-US 10-year yield differential, currently at +14bps, is at its highest level since February. This places it in the upper half of the +/-30bps range observed since November 2022.

- However, a simple regression of the AU-US cash 10-year yield differential against the AU-US 1Y3M swap differential over the current tightening cycle indicates that the 10-year yield differential is currently 17bps too low versus its fair value (i.e., +31bps versus +14bps).

- The 1y3m differential is a proxy for the expected relative policy path over the next 12 months.

Figure 1: AU-US Cash 10-Year Yield Differential (%)

Source: MNI – Market News / Bloomberg

NZGBS: Closed On Strong Note, Post-RBNZ Rally Continues

NZGBs closed on a strong note, with benchmark yields 4-6bps lower.

- Outside of the previously outlined Performance Services Index and REINZ House Sales, there hasn't been much in the way of domestic drivers to flag.

- Cash US tsys have been closed during today’s Asia-Pac session due to a holiday in Japan.

- Today’s move brings the cumulative post-RBNZ Decision rally to 19-29bps, with the 2/10 curve 10bps steeper.

- It is also noteworthy that the NZGB 10-year yield finished at its lowest closing level this year at 4.45%.

- On a relative basis, as well, the recent rally has been impressive, with the NZ-AU 10-year yield differential closing at +11bps, its lowest level since August 2022.

- Swap rates closed 5-6bps lower.

- RBNZ dated OIS pricing is 4-5bps softer for late-2024/2025 meetings. A cumulative 65bps of easing is priced by year-end.

- Tomorrow, the local calendar will see Non-Resident Bond Holdings data, ahead of Q2 CPI on Wednesday. Bloomberg consensus expects the annual rate to decline to 3.4% from 4.0% in Q1.

- On Thursday, the NZ Treasury plans to sell NZ$225mn of the 3.00% Apr-29 bond, NZ$225mn of the 4.25% May-34 bond and NZ$50mn of the 2.75% Apr-37 bond.

FOREX: USD Firms On Lower US Tsys Futures, NZD Underperforming

The USD holds firmer against all the majors, but is away from best levels. The BBDXY USD index last tracked near 1251.4 (up around 0.15%), against earlier highs of 1252.31.

- The USD was firmer from the open, as the market digested the weekend news of the Trump assassination attempt and increased odds of a Trump win in November. US President Biden called for the US political temperature to be lowered, while Trump's speech at the National Republican Convention this week will reportedly call for unity.

- US Tsy futures gaped lower at the open, providing further USD support, but there was not follow through and we sit higher in latest dealings. There is no cash Tsy trading today as Japan markets are shut. US equity futures sit 0.20-0.30% firmer at this stage.

- USD/JPY got to 158.42 earlier, but sits back at 158.00 in latest dealings, slightly higher for the session. Intervention speculation continues in the near term.

- The Kiwi is down against most G10 currencies as NZGB yields fall to their lowest since June and the USD strengthens on the back of a haven bid in the USD, while NZ Performance Services Index fell to 40.2 in June, this is the fourth consecutive monthly decline and the lowest since August 2021. NZD/USD last near 0.6100, off 0.3%. AUD/NZD is 0.22% higher today at 1.1110, after earlier testing Friday's highs of 1.1118. The AU-NZ 2yr swap continues to tick higher and now sits at -9bps, back at November 2020 levels after rallying 41bps in July.

- AUD/USD is down a touch, last near 0.6775. Weaker China GDP/retail sales data didn't impact sentiment greatly.

- NOK & SEK are off by 0.45% and 0.35% to be the worst G10 performers, although liquidity will be lighter in these pairs during Asia Pac hours.

- Looking ahead, the US Empire Survey is due. ECB speak from Lagarde is also out. Later on Fed speak from Chair Powell will be in focus (ahead of the blackout period).

ASIA STOCKS: HK & China Stocks Mixed, Third Plenum Gets Underway, Data Mixed

China & Hong Kong's equity markets are mixed today. Investors are closely monitoring the Third Plenum policy meetings that kicked off today although there has yet to be any headlines out in relation to it. While earlier the PBoC maintained it's 1yr MLF at 2.50% which was widely expected, there was also a flurry of other China data out, GDP was 4.7% vs 5.1% expected, while industrial Production was 5.3% vs 5.0% expected, and Retail Sales were well below expectations coming in at 2.0% vs 3.4%.

- Hong Kong equities are lower today with the HSTech Index is down 2.45%, property stocks are the worst performing with the Mainland Property Index down 2.63% and the HS Property Index is down 2.20% the wider HSI is down 1.40%.

- China equity markets are mixed today with the CSI 300 is 0.20% higher, small-cap indices are lower with the CSI 1000 down 0.70% and the CSI 2000 is down 1.45%, while the growth focused ChiNext is off 0.55%.

- The Biden administration imposed visa restrictions on Chinese officials for alleged human rights abuses, while Beijing sanctioned six US companies involved in arms sales to Taiwan. The US cited repression in Xinjiang, Hong Kong, and Tibet, while China claimed the arms sales violated its sovereignty. This escalation follows renewed US criticism of Beijing's support for Russia in the Ukraine conflict, with President Biden warning of potential cuts in European investment in China if this support continues.

- China's Third Plenum kicks off today until the 18th and is anticipated to consolidate existing policy directions rather than introduce and new groundbreaking shifts in a change from previous meeting. The focus will likely be on reinforcing recent policy strategies to foster long-term growth drivers, enhance stimulus effectiveness, and tackle challenges like a potential housing downturn, rising barriers to foreign markets and critical technologies, and demographic pressures. With a 5% growth target for the year, the Plenum aims to bolster economic confidence, though the absence of major new initiatives could risk disappointing expectations, according to BBG.

- Looking ahead, focus will be on any headlines from the Third Plenum.

ASIA PAC STOCKS: Asian Equities Off Earlier Lows, ASX Hits Record Highs, Japan Out

Asian equity markets are mixed today as markets digests the attempted assassination of Trump and US rate cut expectations grow with the market now pricing a 91% chance of a cut in September. Australian equities have hit their highest ever level, while Taiwan & South Korean equities are both lower as investors look to book some profits after a stellar run of late, foreign investors have been better sellers of local tech stocks over the past few sessions.

- Japan is out today for Marine Day, Japanese equity futures are 0.20-0.30% higher today after falling 1-3% on Friday.

- South Korean stocks are lower today as foreign investors sell tech stocks, while local investors purchase tech. Elsewhere Money supply jumped 0.50% in May from -0.3% prior. The Kospi is 0.06% lower, while the Kosdaq is little changed.

- Taiwanese stocks opened higher this morning with moves from TSMC dictating index moves. TSMC will released earnings later this week, with analysts expecting a 30% jump in profit. Equity flows saw the largest outflow in two weeks on Friday, as foreign investors took profit on tech stocks. Currently the Taiex is down 0.20%

- Australian equities are higher today with the ASX200 breaking 8,000 for the first time and trades up 0.63% today.

- Elsewhere, New Zealand equities are 0.10% higher, Malaysian equities are 0.40% higher, Philippines equities are 1% higher, Indian equities are 0.30% Singapore equities are little changed while Indonesian equities are 0.60% lower.

ASIA EQUITY FLOWS: Asian Equities Higher, As Inflows Increase

- South Korea: South Korean equities saw inflows of $441m yesterday, contributing to a net inflow of $2.4b over the past five trading days. We have marked seven straight sessions of inflows, with tech stocks seeing the majority of those flows, the Kospi is up 2.78% over the past week while the Kosdaq is 1.81% higher. The 5-day average inflow is $481m, higher than the 20-day average of $213m and the 100-day average of $132m. Year-to-date, South Korea has experienced substantial inflows totaling $19.85b.

- Taiwan: Taiwanese equities had inflows of $61m yesterday, resulting in a net outflow of $909m over the past five trading days. Taiwan ended a 3-day run of outflows on Thursday with the 5-day average outflow currently -$182m, compared to the 20-day average inflow of $19m and the 100-day average outflow of -$8m. Year-to-date, Taiwan has accumulated inflows of $3.66b.

- India: Indian equities experienced inflows of $262m yesterday, contributing to a net inflow of $1.5b over the past five trading days. Recently, Indian equity flows have shown significant volatility, with large inflows and outflows, but have generally been positive since the election. The 5-day average inflow is $301m, higher than the 20-day average of $288m and the 100-day average outflow of $-33m. Year-to-date, India has seen net inflows of $1.96b.

- Indonesia: Indonesian equities recorded inflows of $37m yesterday, resulting in a net inflow of $54m over the past five trading days. Recently, Indonesian equity flows have shown a mixed but generally negative trend, with significant outflows towards the end of June, which could have been link to month end profit taking, the overall pattern suggests persistent investor caution although the JCI is 9% off cycle lows. The 5-day average outflow is -$11m, close to the 20-day average inflow of $16m and the 100-day average outflow of -$6m. Year-to-date, Indonesia has experienced outflows totaling -$246m.

- Thailand: Thai equities saw outflows of -$16m yesterday, resulting in a net outflow of -$41m over the past five trading days. Thailand's equity flows have exhibited a predominantly negative trend, with consistent outflows observed over several weeks, indicating sustained investor caution and reduced confidence in the market. The SET is up 3% over the past week with tech stocks the largest contributor. The 5-day average outflow is -$8m, close to the 20-day average outflow of -$33m and the 100-day average outflow of -$26m. Year-to-date, Thailand has seen significant outflows amounting to -$3.34b.

- Malaysia: Malaysian equities experienced inflows of $83m yesterday, contributing to a 5-day net inflow of $122m. Malaysia's equity flows have shown a mixed trend recently, with fluctuating flows. Notably, there was a significant downturn observed around mid-March to early April where the KLCI traded sideways. However, positive momentum has been seen in May and June, large inflows in May and June, suggesting renewed investor interest and confidence in the market. The 5-day average inflow is $24m, higher than the 20-day average inflow of $1m and the 100-day average outflow of $-2m. Year-to-date, Malaysia has experienced inflows totaling $13m.

- Philippines: Philippine equities saw inflows of $1m yesterday, with a 5-day net outflow of -$0.3m. Recent equity flows have shown volatility with notable fluctuations in daily movements. Overall, the market has exhibited mixed sentiment, reflecting both cautious investor behavior and occasional bursts of optimism amid global economic shifts. The 5-day average inflow is $0m, better than the 20-day average outflow of -$2m and the 100-day average outflow of -$7m. Year-to-date, the Philippines has seen outflows totaling -$523m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | 441 | 2403 | 19851 |

| Taiwan (USDmn) | 61 | -909 | 3659 |

| India (USDmn)* | 262 | 1504 | 1960 |

| Indonesia (USDmn) | 37 | 54 | -246 |

| Thailand (USDmn) | -16 | -41 | -3341 |

| Malaysia (USDmn) | 83 | 122 | 13 |

| Philippines (USDmn) | 1 | -0.3 | -523 |

| Total | 869 | 3133 | 21373 |

| * Up to 10th July |

OIL: Largely Tracking Sideways, Firmer USD A Cap Today

Brent crude sits little changed in the first part of Monday trade, last above $85.15/bbl. Earlier we had a brief dip sub $84.50/bbl, but no follow through. Front month WTI was last around $82.40/bbl, slightly up for the session but well within recent ranges.

- For front month Brent, we remain clustered around key EMAs. The lowest is the 200-day near $83.90/bbl. Beyond that lies mid June lows just under $82/bbl. Recent highs rest at $87.95/bbl, recorded on July 5.

- Focus remains on fall out on the Trump assassination attempt from the weekend and increased odds of a Trump Presidency. This has aided USD sentiment (with Tsy futures lower), which may be curbing oil sentiment at the margins.

- Elsewhere, we had weaker than expected China activity and Q2 GDP figures. IP growth remains more of a positive, against a softer consumer backdrop.

- Prompt spreads still suggest a near term supportive backdrop, while the technical picture for WTI is holding up. For WTI futures, sights are on $85.27, the Apr 12 high and a bull trigger. Initial firm support to watch is $80.01, the 50-day EMA.

GOLD: Steady In Asia Despite Assassination Attempt

Gold is steady in the Asia-Pac session, after the attempted assassination of former US president and Republican contender Donald Trump over the weekend.

- On Friday, bullion closed 0.2% lower at $2411.43 after higher-than-expected US PPI data.

- The weekly gain of 1% nevertheless kept the yellow metal around its highest level since May 22.

- PPI increased 0.2% m/m, and core prices rose by 0.4%, above the 0.2% median forecast. The pickup in core PPI was driven by a jump in retail and wholesale margins and is unlikely to be sustained, according to analysts. Also, most of the inputs for the core PCE deflator support forecasts for a tame print, well below the Fed’s June FOMC forecast.

- US Treasuries ended the week with a bull-steepening. The US 2-yield yield was down 6bps, with the 10-year down 3bps.

- Lower rates are typically positive for gold, which doesn’t pay interest.

- According to MNI’s technicals team, the breach of $2,387.8, the Jun 7 high, has opened key resistance at $2,450.1, the May 20 high. Initial support to watch lies at the 50-day EMA, at $2,336.2.

CHINA DATA: Q2 GDP Below Expectations, Consumer Side Still Appears Soft

China Q2 GDP was weaker than forecast. Rising 0.7% q/q, versus 0.9% forecast (prior was 1.6%). The y/y print was 4.7%, versus 5.1% forecast and 5.3% prior.

- The q/q rise of 0.7% was the weakest since the 2.1% dip in Q2 2022 (last year we saw a 0.8%q/q rise). The y/y pace was the slowest since the start of 2023. This is likely to keep stimulus calls alive, particularly in light of recent credit/inflation data outcomes.

- In terms of the June monthly activity data it was a familiar trend in terms of outcomes. The weak point came in terms of retail sales, which rose 2.0% y/y, versus 3.4% forecast, 3.7% was the prior outcome. Retail spend is back to the late 2022 pace.

- IP growth was 5.3% y/y, versus 5.0% forecast and 5.6% prior. Fixed asset investment was 3.9% ytd y/y, in line with forecasts.

- Property investment was -10.1% ytd y/y, slightly better than forecast but in line with the May outcome. Sale were -26.9% ytd y/y, versus -30.5% in May, so some slight improvement as eased purchased restrictions has spurred more positive transactions in some cities.

- Earlier data showed house prices still falling but at a reduced pace, but we remain some distance from turning positive.

Fig 1: China Industrial Production & Retail Sales Y/Y

Source: MNI - Market News/Bloomberg

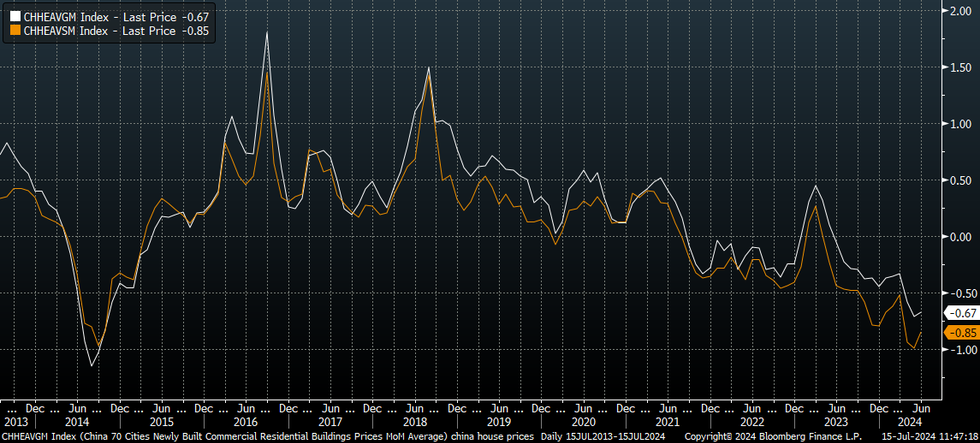

CHINA DATA: House Price M/M Falls Pared, But Still Some Distance From Positive Territory

China house price data for June showed continued m/m drops, albeit not as large as what were recorded in May. New homes fell -0.67%m/m, against a -0.71% dip in May. Used home prices were down -0.85%m/m, versus -1.00% in May (per BBG).

- Both metrics saw the sharpest m/m falls in May going back to 2014, although we still some distance from returning to positive territory., see the chart below.

- In m/m terms, for new homes, 4 cities record a rise, 2 unchanged and 64 saw a decrease (this was 68 last month). For existing homes, 66 cities saw a fall (70 last month), while 4 saw an increase.

- In terms of the larger cities, in m/m terms for new homes, Shanghai saw a +0.4% gain for June (+0.6% in May), Beijing was -0.6% (-1.1% in May), Guangzhou was -1.2% (-1.4% in May) and Shenzhen -0.7%, same as May. In y/y terms, falls accelerated for Beijing, Guangzhou and Shenzhen, but remained positive for Shanghai.

- Beijing and Shanghai saw m/m rises for existing homes.

Fig 1: China House Prices (White Line - New, Orange Line - Existing)

Source: MNI - Market News/Bloomberg

ASIA FX: USD/Asia Pairs Higher, KRW Underperforms, Indonesian Trade Surplus Narrows

USD/Asia pairs are higher in the first part of Monday trade, in line with broader USD gains against the majors, as Trump Presidency odds rise in the aftermath of the weekend's assassination attempt. US Tsy futures gapped lower at the open, but have since stabilized. Equity sentiment is mixed in the region, with less follow through from firm US/EU markets on Friday.

- USD/CNH got to earlier highs of 7.2862, but we sit back at 7.2740 in recent dealings, little changed for the session. USD/CNY spot is up, last around 7.2600. The CNY fixing was close to unchanged. Earlier data showed house prices continued to fall, albeit at a slightly reduced pace in June. Q2 GDP rose less than expected, while June activity data still pointed to a weak consumer backdrop. This will keep stimulus in focus as the Third Plenum unfolds in the first half of this week.

- On-going stimulus calls, coupled with US election risks, are likely to remain yuan headwinds.

- USD/KRW spot has rallied back above 1380, last near 1382, 0.50% weaker in won terms. This puts us back above both the 20 and 50-day EMA resistance points. Friday lows were at 1370.65. The won is displaying its usual sensitivity to broader USD shifts. Local equities are close to flat, but inflow momentum waned through the tail end of last week.

- USD/IDR is another seeing upward pressure, with the pair back to 16175/80, around 0.20% weaker in IDR terms. We are still sub the 20 and 50-day EMA resistance points, with the 50-day near 16200. We had the June trade figures earlier, which showed export growth at 1.17% y/y, versus 4.81% forecast. Imports rose 7.58%y/y, close to forecasts. The trade surplus printed just under $2.4bn, below consensus, but only modestly.

- USD/PHP is also up around 0.25%, last back above 58.50, while other pairs have seen more modest USD gains.

- USD/THB is tracking steadily, last near 36.20, leaving baht a modest outperformer.

ASIA SOVS: Asia Sovs Little Changed, Local FX Lower, ID Trade Surplus Narrows

Asian EM Sovs are mixed today, the INDON curve is slightly out-performing the PHILIP curve. Earlier, Indonesia's trade surplus narrowed a touch, while the PHP dropped the most in over a month.

- The INDON curve has bull-flattened today yields are flat to 2bps higher, with better buying through the 7-10yr part of the curve, while the PHILIP curve has bear-flattened.

- The front-end PHILIP curve continues to trade 5bps tighter than INDON but flattens out and trades 5-8bps wider out the curve.

- Cross-asset: Local currencies are weaker today, with the USD/IDR up 0.24% at 16,176, while the USD/PHP is 0.30% higher at 58.562. Equities are mixed with the JCI down 0.60%, while the PSEi is 1% higher.

- The Indonesian Trade Surplus narrowed to $2.390b from $2.925b, with exports rising just 1.17% vs 4.81% expected and down from 2.85% prior, while imports jumped 7.58% vs 7.20% expected up from a -8.84% drop prior. External debt has also risen to $407.3b in May from $398.8b prior

- Looking ahead, Philippines has Overseas cash remittances for may due out later today, while Bank Indonesia is expected to keep rates at 6.25% on Wednesday

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/07/2024 | 0700/0900 |  | EU | ECB's Lagarde and Cipollone in Eurogroup meeting | |

| 15/07/2024 | 0900/1100 | ** |  | EU | Industrial Production |

| 15/07/2024 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/07/2024 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 15/07/2024 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/07/2024 | 1430/1030 | ** |  | CA | BOC Business Outlook Survey |

| 15/07/2024 | 1435/1035 |  | US | San Francisco Fed's Mary Daly | |

| 15/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 15/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 15/07/2024 | 1630/1230 |  | US | Fed Chair Jerome Powell |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.