-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: FI Bid On Reports Surrounding Delay Of BoE QT, GBP/USD Fails Above $1.14, Again

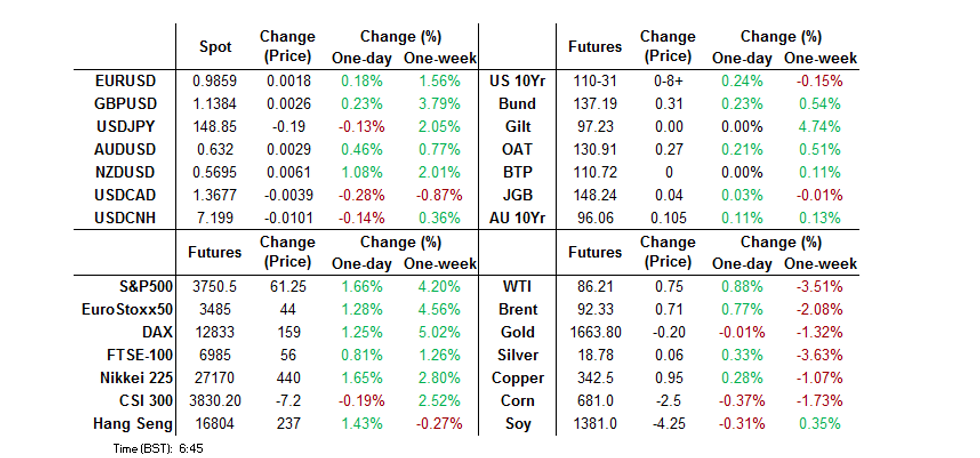

- Core FI markets firmed in Asia as GBP/USD briefly printed above $1.1400 after an FT source report noted that "the Bank of England is likely to delay the sale of billions of pounds of government bonds in a bid to foster greater stability in gilt markets following the UK’s failed “mini” Budget."

- Before that, headline flow was dominated by a much firmer than expected round of NZ CPI data, which triggered a move higher in RBNZ dated OIS and a hawkish round of revisions to sell-side RBNZ outlooks.

- Looking ahead, Tuesday's focus turns to the German ZEW survey, U.S. industrial output & Canadian housing starts. Speeches are due from Fed's Bostic & Kashkari, ECB's Makhlouf & Schnabel and Riksbank's Jansson.

US TSYS: Firmer As Asia Fades NY Weakness & Reacts To BoE QT Delay Reports

Tsys firmed into London hours on the back of an FT source report which suggested that “the Bank of England is likely to delay the sale of billions of pounds of government bonds in a bid to foster greater stability in gilt markets following the UK’s failed “mini” Budget.”

- The space was already trading on the front foot as Asia faded the cheapening observed in Monday’s NY session, after the NY move lacked a clear headline driver.

- That leaves TYZ2 +0-11+ at 111-02, 0-02 off the top of its 0-14 overnight range, operating on decent volume of ~115K (~38K of which has crossed since the BoE story from the FT hit an hour ago). Cash Tsy trade sees 3.0-5.5bp of richening across the curve, with the 5- to 7-Year zone leading and the long end lagging.

- On the flow side, we have seen block sellers of TY futures (-1.8K & -1.9K), pre-BoE headlines, a block sale of TYX2 109.50 puts (-5K) which triggered screen-based flows and screen buying of FVZ2 107.50 calls.

- Gilt markets will be eyed once again, especially given the broader market reaction surrounding the FT story.

- Tuesday’s NY docket will see the release of industrial production data, as well as TIC flows and the NAHB housing market index. We will also get Fedspeak from Bostic & Kashkari.

JGBS: Curve Steepens Little Around 20-Year Supply Dynamics

JGBs have been subjected to some light steepening pressure, after the super-long saw some modest concession into 20-Year JGB supply. Cash JGBs run 0.5bp richer to 1.5bp cheaper ahead of the close, twist steepening.

- The auction saw the low price miss wider dealer expectations, although the cover ratio ticked higher and the tail width moderated from that seen in September. We remind you that last month’s auction was particularly weak, meaning that last month’s cover ratio (which was the lowest observed at a 20-Year auction since ’12) and particularly wide tail provide very low comparison bars. This month’s cover ratio was pretty much bang in line with the 6-auction average.

- The super-long end failed to rally, even as JGB futures caught a light bid on the back of the previously covered speculation re: a delay to the BoE’s implementation of QT. JGB futures trade +6 into the bell, sticking to a narrow range within the boundaries established during the overnight session.

- BoJ Governor Kuroda stressed that JPY weakness is becoming a factor re: inflation (this comes after various reports, including one from our own policy team, flagged an incoming upside adjustment to the BoJ’s inflation projection for the current FY).

- An address from BoJ’s Adachi headlines tomorrow’s domestic docket.

AUSSIE BONDS: Firmer After Two-Way Offshore Cross Currents Drive Activity

Aussie bonds latched on to the wider bid in core global FI markets which came on the back of an FT report which pointed to the likely delay of the BoE’s QT plans, allowing the space to move to best levels of the Sydney session, with YM +9.5 and XM +11.5 ahead of the bell, just off their respective peaks.

- Cash ACGBs run 7-11.5bp richer, with the 10- to 12-year zone outperforming for much of the day.

- EFPs sit wider, albeit off session wides, with the 3-/10-Year box flattening a touch.

- Bills are 2p cheaper to 12bp richer, twist flattening, after bear flattening earlier in the session. RBA dated OIS has seen receive side flow in the wake of the BoE story from the FT, with terminal rate pricing back below 4.00% after showing above 4.10% in the wake of a firmer than expected NZ CPI print earlier in the session.

- The initial impulse from data seen across the ditch weighed on Aussie bonds before the broader core FI bid provided support at different stages of the day.

- An address from RBA Deputy Governor Bullock and the minutes from the October RBA meeting failed to move the needle for markets.

- Looking ahead, the Westpac leading index and A$800mn of ACGB Apr-29 supply are due on Wednesday.

NZGBS: CPI Triggers RBNZ Repricing, Front-End Weakness & Payside Swap Flow

NGBS ultimately twist flattened on Tuesday, recovering from their post NZ-CPI lows, with the firmer than expected headline and non-tradable readings triggering a repricing of RBNZ tightening expectations.

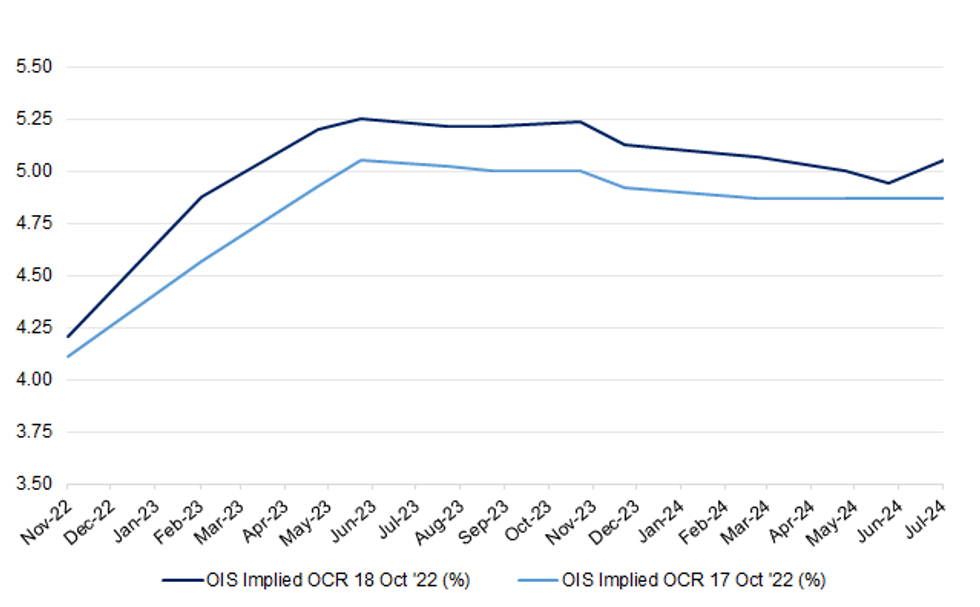

- RBNZ dated OIS now price a terminal OCR of ~5.25%, just over 20bp higher on the day and in line with the most aggressive of the new calls from the “Big 4” domestic banks (held by ASB), albeit shy of the intraday peak of just over 5.35%.

- Cash NZGBs were 7.5bp cheaper to 0.5bp richer at the close, pivoting around 10s.

- Payside flow dominated in swaps post-CPI, with swap spreads wider across the curve. 2-Year swap rates printed a fresh cycle high of 5.20% before moderating, closing at 5.14%, just over 14bp higher on the day.

- Elsewhere, we saw the RBNZ sectoral factor inflation model accelerate to +5.4% Y/Y in Q3 (against an upwardly revised +5.2% in Q2).

- A light bid in the U.S. Tsy space and lack of overtly hawkish rhetoric from RBA Deputy Governor Bullock across the Tasman, along with the relatively late cycle nature of the NZ economy, probably allowed the space to stabilise a little.

- Non-resident bond holdings of NZ bonds slipped to 57.7% in Sep vs. 58.4% in Aug.

- Tomorrow’s local docket is empty.

RBNZ Dated OIS Pulls Higher after CPI, Sell-Side Get More Hawkish

| RBNZ Meeting | OIS Implied OCR 18 Oct '22 (%) | OIS Implied OCR 17 Oct '22 (%) | Change |

| Nov-22 | 4.21 | 4.11 | 0.10 |

| Feb-23 | 4.87 | 4.57 | 0.30 |

| Apr-23 | 5.20 | 4.93 | 0.27 |

| May-23 | 5.25 | 5.05 | 0.20 |

| Jul-23 | 5.21 | 5.02 | 0.19 |

| Aug-23 | 5.22 | 5.00 | 0.22 |

| Oct-23 | 5.24 | 5.00 | 0.24 |

| Nov-23 | 5.13 | 4.92 | 0.21 |

| Feb-24 | 5.07 | 4.87 | 0.20 |

| Apr-24 | 5.00 | 4.87 | 0.13 |

| May-24 | 4.94 | 4.87 | 0.07 |

| Jul-24 | 5.05 | 4.87 | 0.18 |

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

FOREX: NZD Soars As Hot CPI Print Boosts OCR-Hike Bets, GBP Gains On Potential For BoE QT Delay

The kiwi dollar held the bulk of gains registered on the back of an expectation-busting consumer inflation report, while the fluctuation in risk appetite drove price action across the wider G10 FX space. In New Zealand data, headline inflation printed at +7.2% Y/Y, considerably above the median estimate (+6.5%) and RBNZ projection (+6.4%), supporting the case for continued aggressive monetary tightening from the RBNZ. The insights from the Stats NZ report were reinforced by the RBNZ's preferred metric of core inflation (sectoral factor model), which accelerated to an all-time high of +5.4% Y/Y.

- The addition of hawkish OCR-hike bets sees the OIS strip price ~70bp worth of tightening at the November meeting (+10.9bp on the day), while 2-Year swaps soared to levels last seen in 2008. This came alongside a flurry of hawkish revisions to sell-side views, as the choir of voices calling for a 75bp rate hike next month grew louder, while terminal rate estimates were reset higher.

- Initial risk-on flows were starting to moderate, when a leap higher in U.S. e-mini futures reinstated the positive tone. E-mini S&P 500 contract extended through last week's highs, clearing its 20-EMA in the process, which sent the BBDXY index to new session lows (1,337.57).

- Shortly thereafter, another round of greenback sales came on the back of an FT report noting that the BoE was likely to delay quantitative tightening in pursuit of greater stability in gilt markets. Cable spiked to fresh session highs, testing the $1.1400 figure, while the BBDXY sank to its lowest point since Oct 7 (1,336.69).

- Greenback weakness provided some reprieve to the yen, even as it was the second-worst G10 performer. Participants remained on intervention watch, as top officials stuck to their familiar script, with FinMin Suzuki noting that they "will be watching markets with a sense of urgency today."

- Focus turns to German ZEW survey, U.S. industrial output & Canadian housing starts. Speeches are due from Fed's Bostic & Kashkari, ECB's Makhlouf & Schnabel and Riksbank's Jansson.

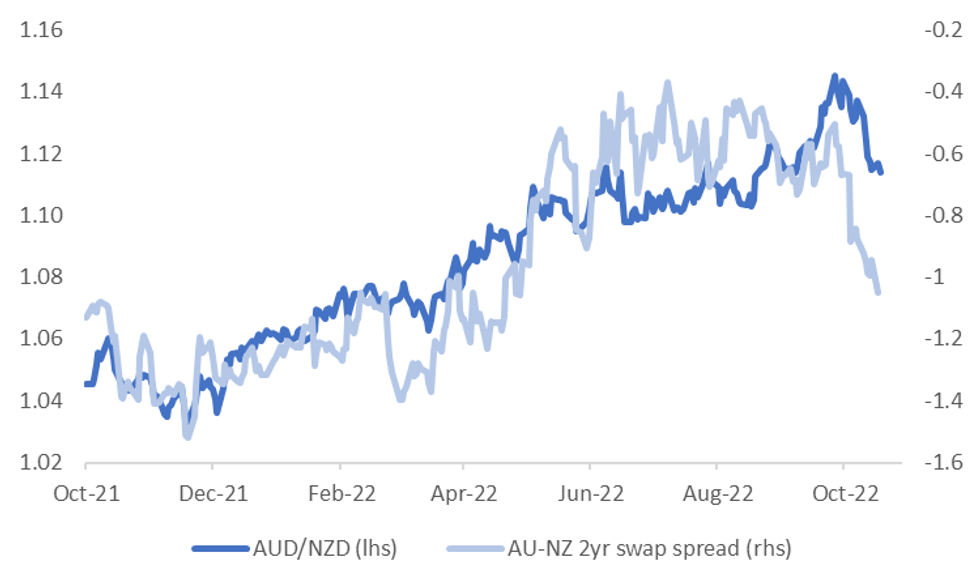

AUDNZD: Rate Spreads Weighing

AUD/NZD is tracking lower post the NZ Q3 CPI beat. The sharp spike in NZ yields suggest we may hold this break of the 100-day MA to the downside. That level comes in just above 1.1140, versus current spot just under 1.1130. Recent lows sit just under the 1.1110 level, while the 200-day MA comes in 1.0981, the 50-day is at 1.1220 on the topside.

- NZ 2yr swaps have surged 20bps for the session so far, to fresh cyclical highs around 5.20%. The chart below plots AUD/NZD against the 2yr swap spread.

- RBNZ terminal pricing is now 5.36%, +35bps for the session.

- Still to come is the RBA minutes following the 25bps hike at the start of the month. RBA Deputy Governor Bullock also speaks.

Fig 1: AUD/NZD Versus 2yr AU-NZ Swap Spread

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

ASIA FX: USD/Asia Pairs Lower, KRW & THB Outperform

USD/Asia pairs have, for the most part, tracked lower through today's session. This is line with USD weakness against the majors, which has accelerated this afternoon, amid higher US equity futures and an FT article stating the BoE is set to delay its quantitative tightening program. The data calendar is light tomorrow outside of Malaysia trade figures.

- USD/CNH is back below 7.2000, generally underperforming the USD sell-off this afternoon. Onshore equities are only up smalls, while the CNY fixing surprise was more modest compared to yesterday. Today's Q3 GDP data and September activity figures release has been delayed, most likely due to the Party Congress. No release date has been scheduled at this stage.

- 1 month USD/KRW is down, last 1420, in line with broader USD weakness. The Kospi is back above +1% for the session.

- Spot USD/INR is lower, back to the 82.10/15 level in the first part of trading. Resistance around 82.40 has held for now. Onshore equities are near +1% for the session so far.

- Spot USD/IDR is back below 15460, around -30 figs for the session. Foreign investors bought a net $155.31mn in Indonesian stocks Monday, the largest daily inflow since Oct 6, although the JCI is barely in positive territory so far for the session. The majority of economists expect a 50bps hike from BI this Thursday.

- USD/PHP has moved away from the 59.00 level (last 58.91). The Philippines' overseas cash remittances printed on Monday. Annual growth was +4.3%, exceeding the +3.0% median estimate in a Bloomberg survey. On a sequential basis, remittances declined to $2.721bn in August from $2.917bn prior, but the fall was less pronounced than expected.

- The baht is one of the better performers for the session, +0.50% against the USD, to be last at 38.02. This is in line with broad USD weakness, although offshore investors continue to sell local equities. Offshore investors were net sellers of $62.08mn in Thai equities Monday. Fiscal Policy Office chief said that the Finance Ministry is preparing new measures to encourage spending, without giving any details at this stage, with the government looking to maintain economic recovery amid deteriorating external conditions.

- USD/MYR is off recent highs, last in the low 4.7100 region. Malaysia's Department of Statistics is planning to revise its Consumer Price Index (CPI) next year amid suggestions that it does not reflect the true cost of living (see this link for more details).

GOLD: Holding Yesterday's Gains

Gold is holding up better than most other commodities (e.g. copper and iron ore). The precious metal sits just above $1651 currently, slightly up on NY closing levels. We gained 0.34% yesterday, amid a broad pull back in the USD.

- Today the USD is slightly firmer against the likes of EUR, GBP & AUD, which has knocked gold off earlier highs, just above $1653.50, but we remain above overnight lows around $1647.

- In terms of topside levels, we did get above $1668 overnight, while moves into the $1670/80 region have generally capped gold since late last week.

- Outside of USD gyrations, the broader technical set up for gold still looks to be a negative one. We are still within striking distance of lows from last week around $1640.

- The steady picture in US real yields is likely lending some support though. The real US 10yr is not breaking higher, holding in a 1.55-1.65% range in recent weeks.

OIL: Oil Prices In A Holding Pattern As Market Struggles With Conflicting Forces

Oil prices are up slightly on the day as markets continue to struggle between signs that the market is tight and global demand concerns. WTI is up about 0.4% to around $86/bbl and the 20-day moving average held as a floor for prices. Brent is up around 0.4% to $92/bbl.

- The Whitehouse is planning an announcement this week relating to a release from the strategic oil reserve of a possible 10 to 15 million barrels to ease pressure on gasoline prices ahead of the mid-term elections, according to Bloomberg. There is also talk of an export cap being imposed on diesel and gasoline in November.

- The oil market remains worried by the impact that China’s continued Zero-Covid policy will have on demand.

- On the supply front, the OPEC+ output cuts hit in November, there’s been unwinding of investments in Russia by foreign entities, and the US EIA also reduced its shale-oil supply forecasts for October to 9mbd from 9.12mbd. However, it expects November production to be up slightly to 9.11mbd.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/10/2022 | 0800/1000 |  | IT | Trade Balance | |

| 18/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 18/10/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 18/10/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 18/10/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 18/10/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 18/10/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 18/10/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 18/10/2022 | 1600/1800 |  | EU | ECB Schnabel Alumni Event at Uni Mannheim | |

| 18/10/2022 | 1800/1400 |  | US | Atlanta Fed's Raphael Bostic | |

| 18/10/2022 | 2000/1600 | ** |  | US | TICS |

| 18/10/2022 | 2130/1730 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.