-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI EUROPEAN MARKETS ANALYSIS: Focus on US-China Relations, US Markets Out Today

- China related assets are off their highs from late last week, as the market awaits fresh details on China's stimulus plans. China equities and currency are weaker, but remain away from recent lows. US Secretary of State Blinken concludes his short trip to China today, but it is not clear if he will meet with China President Xi Jinping before departing.

- Elsewhere, Cash tsys are closed today due to the observance of a national holiday in the US. Treasury futures have tracked a tight range. In the FX space, the antipodeans have been pressured in Asia as waning risk appetite has hurt sentiment.

- There is a thin data calendar today, further out the calendar for the week is highlighted by Housing Starts, Philadelphia Fed Non-Mfg Index and Jobless Claims.

MARKETS

US TSYS: Futures Marginally Firmer, Cash Closed Today

TYU3 deals at 113-04, +0-02+, a narrow 0-04 range has been observed on volume of ~22k.

- Cash tsys are closed today due to the observance of a national holiday in the US.

- Tsy futures were firmer in early dealing as US Equity futures firmed to early session highs.

- The USD firmed, with the antipodeans pressured, and equity futures ticked away from best levels with tsys as the lack of detail on potential Chinese stimulus weighed on risk appetite.

- TY dealt in narrow ranges with little follow through for the remainder of the session.

- There is a thin data calendar today, further out the calendar for the week is highlighted by Housing Starts, Philadelphia Fed Non-Mfg Index and Jobless Claims.

JGBS: Subdued Session, Light Calendar, Futures Richer At Session Bests

JBU3 is sitting at Tokyo session highs in afternoon trade at 148.42, +10 compared to the settlement levels.

- With domestic drivers light on the ground, local participants have likely been on headlines and US tsys watch. US tsy futures are trading slightly firmer in Asia-Pac trade. A reminder that cash tsys are closed today due to the observance of a US national holiday.

- Tokyo Condominiums For Sale, the only release today, showed a 21.5% y/y decline in May. There was no immediate market reaction, as expected, to the data.

- Cash JGBs strengthen over the Tokyo session to be flat to 1.2bp richer across the curve with the 10-year benchmark leading. The 10-year yield is at 0.400%, below the BoJ's YCC limit of 0.50%. The 5-year benchmark is 0.4bp lower at 0.077%, ahead of supply later in the week.

- Swap spreads are generally tighter across the curve except for the 7-20-year zone.

- The local calendar tomorrow sees Industrial Production (Apr F), Capacity Utilisation (Apr) and Machine Tool Orders (May F).

BoJ: MNI BoJ Review - June 2023: Unchanged, YCC Timing Shift Still Uncertain

- The June BoJ policy meeting largely unfolded as expected, with no major changes to the key policy parameters or the policy outlook. In the press conference, BoJ Governor Ueda stated that core inflation is likely to moderate sub 2% in the second half of this fiscal year.

- There has been a lot of speculation the BoJ would raise its inflation projections at the July meeting (28th). Ueda stated the central bank will evaluate carefully how prices evolve ahead of that meeting. Ueda also stressed uncertainty around the sustainability of recent wage gains. Outside of inflation/wage developments, offshore developments could also be key, with Fed policy and its influence on USD/JPY important in the run up to next policy meeting.

- Sell-side views certainly see the July meeting as live from a YCC standpoint, but there is no clear consensus that a change will be delivered at the meeting. Market views, and our own, will firm up closer to the date, particularly with more inflation/wage data to hand, coupled with greater clarity around the Fed backdrop.

- Full review here:

AUSSIE BONDS: Richer, Narrow Range, US Holiday

ACGBs are slightly richer (YM +2.0 & XM +3.5) after trading in a narrow range in the Sydney session. With the local calendar light today, local participants have likely been on headlines and US tsys watch.

- US tsy futures are slightly firmer in Asia-Pac trade. A reminder that cash US tsys are closed today due to the observance of a US national holiday.

- Cash ACGBs are 2-4bp richer with the AU-US 10-year yield differential at +23bp (using 10-year US tsys Friday closing level).

- Swap rates are 3-6bp lower with the 3s10s curve flatter and EFPs tighter.

- The bills strip is steeper with pricing +1 to +5.

- RBA dated OIS is 3-8bp softer for meetings beyond September with Feb’24 leading. Terminal rate expectations sit at 4.61%.

- The local calendar is slated to release the RBA Minutes for the June Meeting tomorrow. After the RBA surprised with a 25bp rate hike, the market will be keen for a more detailed account of the decision. RBA Deputy Governor Bullock (1330 AEST) and RBA Assistant Governor Kent (1135 AEST) are also slated to speak tomorrow.

- On Wednesday the Westpac Leading Index prints for May, ahead of Preliminary Judo Bank PMIs for June on Friday.

NZGBS: Richer On The Day, Outperforms ACGBs, US Holiday

NZGBs closed 5-6bp richer after opening slightly cheaper following the weaker lead-in from US tsys trading ahead of the weekend. With the market reaction to the increase in the BusinessNZ PSI limited, the strengthening over the local session appears to have been aided by a slight richening in both US tsy futures (cash tsys are closed for the Juneteenth holiday) and ACGBs in Asia-Pac trading. Nonetheless, NZGBs outperformed with the NZ/AU 10-year yield differential 5bp narrower at 43bp.

- Swap rates closed 1-4bp lower with the 2s10s curve flatter and implied swap spreads 3-4bp wider.

- RBNZ dated OIS closed little changed with terminal OCR expectations at 5.61%.

- NZ services expanded last month, according to the Performance of Services Index compiled by the Bank of New Zealand Ltd. and Business NZ. The May PSI jumped 3.2pts to 53.3 after declining to its lowest level this year in April.

- NZGBs held by international investors, as reported by the RBNZ, rose from 62.1% to 63.2% in May, the highest level since 2016.

- The local calendar is slated to release Q2 Westpac Consumer Confidence tomorrow ahead of May Trade Balance data on Thursday.

EQUITIES: China Stocks Lower, As Market Waits For Greater Stimulus Details

Regional equity markets are mostly tracking lower. A negative lead from Wall St on Friday hasn't helped, while lack of details around fresh stimulus measures/timing from the China authorities post Friday's State Council meeting is also weighing. US equity futures tried to track higher in early trade, but couldn't sustain gains. Eminis were last under 4449 (-0.10% weaker).

- At the break, China's CSI is down 0.84%, with the index back under its simple 200-day MA (3951.08. last 3930.18). The real estate sub index is off by 2.00%. Lack of fresh stimulus detail from Friday's State Council meeting has weighed on sentiment. We are also seeing further growth forecast downgrades from the sell-side, which is an additional headwind.

- HK shares are also weaker, the HSI off by 1.57% at the break, tech shares down 2.63%, after rallying for the past 6 sessions. The Golden Dragon index fell in US trade on Friday, which is likely hurting sentiment.

- Japan's Nikkei 225 has lost ground, now down over 1.1%. The index struggling to breach the 33800 handle, now back close to recent lows near 33300.

- The Kospi is -0.85% weaker, although still above 2600 in index terms. SocGen downgraded South Korean stocks to neutral.

- In SEA markets are weaker, although outside of the Philippines, losses are less than 1%.

- Australia's ASX 200 is the only benchmark tracking higher at this stage, although Indian shares have also opened with a positive bias.

FOREX: Antipodeans Pressured In Asia

The antipodeans have been pressured in Asia as waning risk appetite on the lack of detail on further Chinese stimulus has weighs in Asia.

- AUD/USD is down ~0.5%, last printing at $0.6835/40. Support is at $0.6818 high from May 10, resistance comes in at $0.69, high from June 16. AUD/JPY is down ~0.8% after posting its highest level since Sep 2022 on Friday.

- Kiwi is down ~0.5%, NZD/USD prints at $0.6205/10. Bears focus on a move below $0.62 to target the 20-Day EMA ($0.6158). NZD/JPY is down ~0.6%, the pair has trimmed Friday's gains which saw it print the highest level since early 2015. On the wires early in the session May PSI rose to 53.3 and the prior read was revised higher to 50.1.

- Yen is a touch firmer, USD/JPY briefly printed through Friday's high, however resistance was seen ahead of the ¥142 handle. The pair last sits at ¥141.60/70 ~0.1% softer.

- Elsewhere in G-10 NOK is ~0.3% softer however liquidity is generally poor in Asia. EUR and GBP are little changed from Friday's closing levels observing narrow ranges thus far.

- Cross asset wise; US 10-Year Tsy Futures are a touch firmer as is BBDXY. E-minis have pared early gains to sit ~0.1% lower. WTI futures are ~1.5% lower.

- There is a thin data calendar today, US markets are closed for the observance of a national holiday.

NZD: Global Equities, Milk Futures & Commodities Dominant Drivers

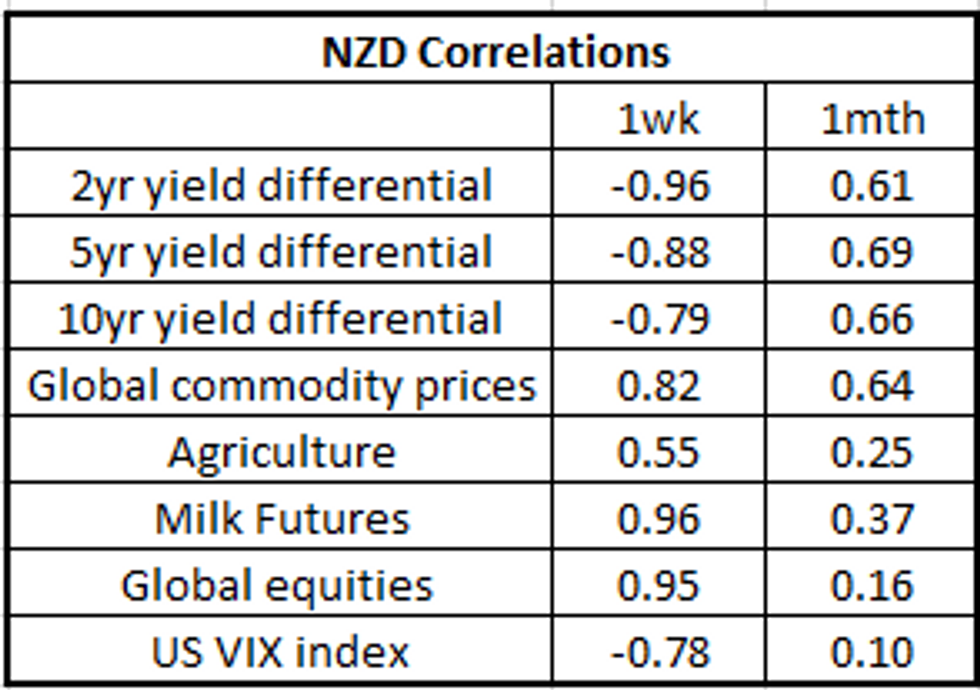

NZD/USD correlations with global equities, milk futures and commodities have strengthened over the past week, standing out as a key macro driver in recent dealings. The table below presents levels of correlations between NZD and key macro drivers (note the yield differential reflects swap rates).

- Recent strength in NZD, up ~1.8% last week, looks to be associated with the recent strength in global equities, milk futures and agriculture.

- The pair looked through last week's narrowing in rate differentials. However over the longer time frame rate differentials are the dominant macro driver, alongside global commodity prices.

Fig 1: NZD/USD Correlation with Global Macro Drivers:

Source: MNI/Bloomberg

OIL: Nerves Drive Crude Lower As Waiting For China Stimulus

Oil prices have given up most of last week’s gains and today are down around 1.5% on the generally weaker risk tone in Asia as markets wait for details on any further policy stimulus in China. The USD index is 0.1% higher.

- WTI is down below $71/bbl again and is currently trading around $70.96, close to the intraday low of $70.82. Brent fell below $76 and is now about $75.48, after a low of $75.34.

- WTI futures contracts are continuing to signal that there is plenty of supply currently. Demand remains an issue for the market as the full impact of monetary tightening is yet to be felt and China’s growth forecasts are being revised down. But the IEA and OPEC expect the market to be in deficit in H2 2023.

- There is little on the calendar later with the US closed today.

GOLD: Slightly Weaker In Asia After First Weekly Decline In Three Weeks

Gold is slightly weaker during the Asia-Pacific session, following its first weekly decline in three weeks. The subdued prices can be attributed to the anticipation of further monetary tightening and a decrease in safe-haven demand.

- Last week, bullion experienced a 0.2% decrease, reflecting indications that both the US Fed and the ECB are likely to continue raising interest rates. This trend negatively affects gold, which does not offer interest-bearing returns.

- Haven assets like gold are facing challenges in gaining momentum, as market sentiment leans towards risk-taking. This sentiment has been strengthened recently by positive indications of improving Sino-US relations and optimism surrounding China's potential implementation of additional stimulus measures to support its sluggish recovery.

- According to MNI technicals team, the bear cycle in gold remains intact. The yellow metal is trading below trendline support drawn from the Nov 3 2022 low - the trendline intersects at $1966.8. The break of this line reinforces bearish conditions and marks a resumption of the downtrend. The focus is on $1903.5, 61.8% of the Feb 28 - May 4 bull cycle. Initial firm resistance is $1985.3, the May 24 high. Clearance of this resistance would signal a short-term reversal instead.

ASIA FX: USD/CNH Rebounds, Mixed Trends In SEA

Most USD/Asia pairs are higher to start the week. USD/CNH has rebounded, although remains well below highs from last week. The market somewhat disappointed by lack of stimulus details. USD/KRW is also higher, but MYR has outperformed. USD/IDR is close to multi-week highs, while USD/INR stays sub 82.00 for now. Tomorrow, the China 1yr and 5yr LPRs are due, with both expected to be cut by 10bps. Malaysian trade figures and Taiwan export orders are also due tomorrow.

- USD/CNH has tracked higher today, getting to a high of 7.1553, but we sit slightly lower now, last near 7.1500. This is above highs from Friday's session, with markets a little disappointed in the lack of details around fresh stimulus measures from Friday's State Council meeting. Onshore equities are also down, the CSI 300 off nearly 1%. US Secretary of State Blinken is wrapping up his trip to China, it remains to be seen if has a meeting with President Xi Jinping before leaving.

- 1 month USD/KRW sits off session highs, last just under 1278. Earlier highs came in close to 1282, as CNH weakened and local equities fell. Sentiment has stabilized somewhat this afternoon though, although more so in the FX space. The pair remains within ranges, with dips below 1270 generating USD support.

- USD/INR is ~0.1% firmer as the Rupee softens in early trade. The pair last prints at 81.95/82.00. The pair has ticked higher in early dealing after printing its lowest level since mid-May on Friday as broader USD trends dominate. Total equity inflows for June sit at $1.525bn, Thursday saw the largest inflow of the month with foreign investors buying $399.28mn in Indian equities. Looking ahead, the data calendar is light with just Q1 BoP Current Account Balance on the wires which is due between today and month end.

- It's been a muted start to the week for the Ringgit on Monday, USD/MYR is little changed from Friday's closing levels in early dealing. On Friday USD/MYR finished ~0.2% lower, the pair couldn't sustain a move through the 4.60 handle and pared losses to finish the week at 4.6150. Palm Oil futures are ~0.5% firm on Monday, this comes after a 6.7% rise on Friday which was the largest daily increase since December. The rally was driven by a rally in Soybean Oil and signs of improving demand in India. Global Investors sold $4.9mn of local equities on Friday bringing the total last week to an outflow of $41mn. On the wires tomorrow we have May Trade Balance, a surplus of MYR13.40bn is expected. On Thursday June 1 Foreign Reserves cross, there is no estimate and the prior read was $112.7bn. Friday's May CPI print headlines the week, CPI is expected to tick lower to 3.0% Y/Y from 3.3%.

- The SGD NEER (per Goldman Sachs estimates) is little changed in early dealing, the measure remains well within recent ranges. We now sit ~0.6% below the upper end of the band. USD/SGD is ~0.1% firmer this morning, as broader greenback trends dominate flows. The pair last prints at $1.3390/1.3400. Looking ahead, Friday's May CPI print headlines the week's docket. Headline CPI is expected to fall to 5.4% Y/Y from 5.7%, and Core CPI is also expected to tick lower to 4.7% Y/Y from 5.0%.

- USD/IDR is approaching late May highs just above 15000. The pair was last at 14991, +0.40% higher in USD/IDR terms versus Friday's onshore closing levels. The simple 100-day MA is not far away, around 15020 in terms of upside resistance, which the 50-day MA is back closer to 14860 on the downside. The 1 month NDF is already above 15000 (last 15010), which is also close to end May highs. Cross asset headwinds are mixed. This week we have the BI decision on Thurs, no change is expected. BI continues to view the FX rate as undervalued, so this may be a renewed focus point, which is something the market is likely to be wary of with USD/IDR spot so close to recent highs.

INDONESIA: Highlights From Local News Wires

Below is a collection of news wires reports from English versions of Indonesian Newspapers and some other major news outlets.

Politics: “Sandiaga implies he won’t become Prabowo’s running mate again” – Jakarta Globe (see link)

Politics: “Jokowi flexes political muscle to seal legacy as Indonesia’s election race heats up” – The Straits Times (see link)

Economy: “Minister hopes IEU-CEPA negotiation completed by end of 2023” – Antara News (see link)

Economy: “SEZ investment reached Rp8.5 trillion in 2023 first quarter: ministry” – Antara News (see link)

- Currently there are 20 Special Economic Zones (SEZ) with 10 industrial and 10 tourism related.

Economy: “Export improvement reflects economic strength: ministry” – Antara News (see link)

Economy: “China’s Maxed-out aluminium industry eyes future in Indonesia” – Bloomberg (see link)

Economy: “Indonesia encourages Norway to invest in EV battery industry” – ScandAsia (see link)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/06/2023 | 1100/1300 |  | EU | ECB Lane Fireside Chat | |

| 19/06/2023 | 1140/1340 |  | EU | ECB Schnabel at Euro50 Group Conference | |

| 19/06/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/06/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 20/06/2023 | 0115/0915 | *** |  | CN | Loan Prime Rate |

| 20/06/2023 | 0600/0800 | ** |  | DE | PPI |

| 20/06/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 20/06/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 20/06/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 20/06/2023 | 1030/0630 |  | US | St. Louis Fed's James Bullard | |

| 20/06/2023 | 1230/0830 | *** |  | US | Housing Starts |

| 20/06/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 20/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 20/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 20/06/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 20/06/2023 | 1710/1910 |  | EU | ECB de Guindos Remarks at German Bernacer Prize |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.