-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: LNY Break Allows Asia Some Time To Assess Recent Moves

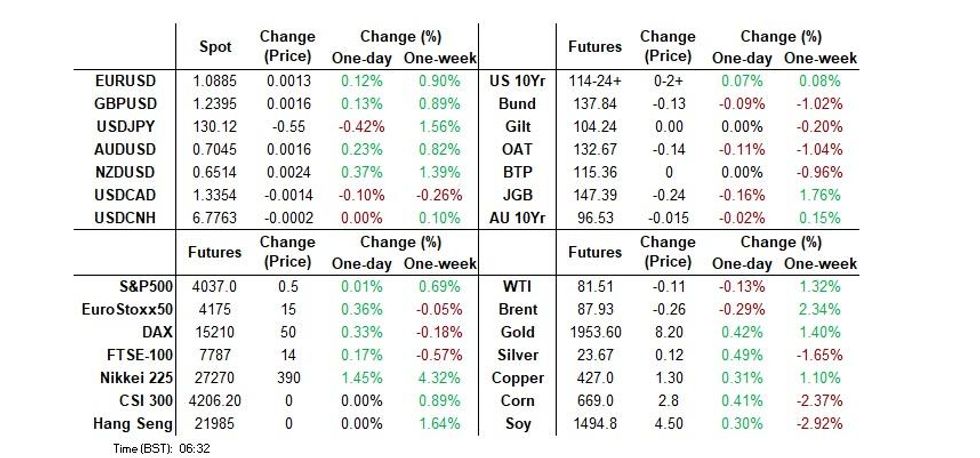

- The BBDXY is still sub NY closing levels, but up from earlier session lows near 1223. We last tracked near 1224.00 (-0.10% for the session). A firmer yen tone has persisted, with JPY up 0.35% at this stage. Other pairs have seen more modest gains against the USD.

- Most USD/Asia pairs are slightly higher, albeit still in reduced liquidity conditions, with many centres still closed for LNY holidays.

- Coming up, flash PMIs for Jan are due across the major economies. In the U.S., the Richmond Fed index is also due. We will also get another round of comments from ECB President Lagarde.

US TSYS: Little Changed In Muted Asian Session

TYH3 deals at 114-24+, +0-02+, and is operating in a narrow 0-04 range on light volume of ~20k.

- Cash Tsys sit 0.5bp richer to 0.5bp cheaper across the major benchmarks.

- China, Hong Kong and Singapore were closed again today, as the impact of the LNY period once again thinned out liquidity in Asia.

- Macro headline flow was also scarce.

- In Europe today flash PMI data from the Eurozone and UK headline the docket. Further out we have PMIs from the U.S. as well as Philadelphia Fed Non-Manufacturing Activity and Richmond Fed Manufacturing Index. On the supply side we have the latest 2-Year Tsy auction.

JGBS: Futures Consolidate Overnight Losses, Long End Bid

JGB futures have dealt either side of late overnight session levels during Tokyo trade, -20 into the bell, as they pull away from session lows after correcting from post-BoJ highs lodged late Monday. Cash JGBs are 1.5bp cheaper (10s are the only benchmark that have cheapened) to 3bp richer, with demand observed in the long end (perhaps as lifers begin to redeploy capital after the post-BoJ steepening).

- The swap curve has twist flattened, with benchmark rates running 2bp higher to 3bp lower, with a pivot observed around 20s.

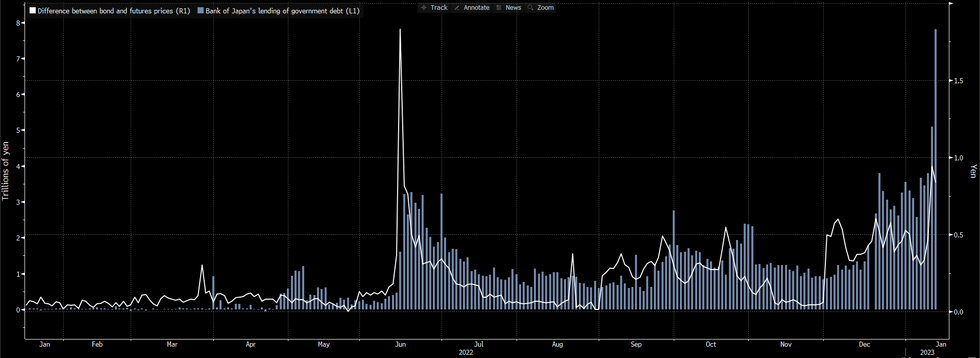

- BBG’s measure of basis between the pricing of JGB futures and their underlying bonds has moderated from the pre-BoJ spike higher. Still, the basis measure identified remains elevated in a historical sense as the BoJ continues to face market functioning issues (see more on that matter here)

- Note that the BoJ’s trimmed mean measure of underlying inflation rose 3.1% Y/Y in December, representing a fresh record high, as pass-through of cost increases continued.

- There was incremental slippage when it comes to the average and high spreads that prevailed at the latest liquidity enhancement auction covering off-the-run 1- to 5-Year JGBs, with the cover ratio also ticking lower. However, these metrics still depict smooth takedown of today’s supply.

- BoJ Rinban operations headline tomorrow.

JGBS: Futures Basis Back From Levels Seen Pre-BoJ Run Higher, But Still Evident

BBG’s measure of basis between the pricing of JGB futures and their underlying bonds has moderated from the pre-BoJ spike higher (which didn’t get anywhere near challenging levels witnessed back in the mid-’22 attack on the BoJ’s YCC parameters).

- The BoJ’s choice to leave its monetary policy settings unchanged, coupled with the well-documented tweaks to the parameters underlying the Bank’s Funds-Supplying Operations against Pooled Collateral (a further backstop to its YCC settings), and the subsequent demand for JGBs related to and coming via that facility (whereby cheap borrowing finances received positions in swaps and longs in JGBs), resulted in a ~360 tick trough to peak rally for futures in recent sessions.

- Still, the basis measure identified remains elevated in a historical sense as the BoJ continues to face market functioning issues that are a product of its upsized JGB purchases against already large JGB holdings (short cover in certain illiquid cash bonds may be keeping a floor on the basis even after futures pulsed back from their YCC speculation induced lows, while other bonds may not even be trading), while continued positioning for a future tweak to BoJ policy settings via futures (albeit less extreme than pre-BoJ levels) also works in the same direction when it comes to basis.

- This is a huge issue when it comes to market efficiencies and makes the JGB futures contract a far less effective hedge for positions in underlying cash JGBs.

Fig. 1: BBG JGB Futures Net Basis Measure Vs. BoJ Lending Of JGBs

AUSSIE BONDS: Most Of Early Weakness Pared

Aussie bond futures ticked away from their respective overnight bases as participants digested the latest NAB business survey, leaving YM -1.0 & XM -1.5, essentially unwinding their modest overnight losses, while cash ACGBs were 0.5 to 1.0bp cheaper across the curve.

- EFPs were essentially flat on the day.

- When it comes to the details, the NAB business confidence reading saw a modest uptick, alongside a downtick in the conditions print. The survey points to slower activity at solid levels and continued tight capacity, but with softening labour demand and price pressures, welcome developments for the RBA on net. However, NAB also noted that the fading of the post-COVID demand bounce and higher rates are impacting business. The risks to growth and potential feed through into the RBA terminal cash rate discussion allowed futures to tick higher in Sydney hours.

- RBA dated OIS was little changed on the day, showing 18bp of tightening for next month’s meeting and a terminal cash rate of 3.55-3.60%.

- Looking ahead, Q4 CPI data headlines the local docket on Wednesday. The BBG survey median looks for the headline CPI print to hit +7.6% Y/Y vs. the 7.3% seen in Q3, while the trimmed mean measure is seen at +6.5% Y/Y vs. the 6.1% observed in Q3.

- This will be further supplemented by the latest Westpac leading index print.

AUSTRALIA: NAB Survey Shows Solid Activity, Easing Labour & Price Pressures

The NAB measure of business conditions fell for the third consecutive month in December to its lowest since January 2022 but still well above the series average. However, business confidence improved 3 points to -0.8, which is still very low compared to the rest of 2022 and below average. Confidence and orders are signalling a further moderation in the months ahead.

- The NAB price components continue to show price pressures on both the input and output sides, but they are easing and pointing to a tentative peak in Q4 2022. Labour cost growth slowed to 2% in December from 2.8% the previous month and purchase costs to 2.5% from 3.9%. On the output side final product inflation moderated to 1.5% from 2% and retail to 2.3% from 2.8%.

- The survey is pointing to slower activity but at solid levels and continued tight capacity but with softening labour demand and price pressures, welcome developments for the RBA. NAB notes that the fading of the post-Covid demand bounce and higher rates are impacting business.

- The drop in business conditions was driven by all three of its components with trading conditions down 10 points, profitability -8 points and employment -5 points (lowest since January 2022). The move was broad-based across sectors and states.

- See press release here.

Source: MNI - Market News/Refinitiv

Fig. 2: NAB survey labour market components

Source: MNI - Market News/Refinitiv

AUSTRALIA: PMIs Point To Slowing But Price Pressures Elevated And Rising

The Judo Bank preliminary January PMIs suggested that private sector output across the economy is contracting. The manufacturing PMI fell below 50 to 49.8 for the first time since May 2020. While the services PMI improved to 48.3 from 47.3, a 3-month high, it is pointing to an easing of demand pressures and a slowdown in GDP, which is likely to be welcomed by the RBA. The composite index improved slightly to 48.2 from 47.5.

- Price indicators remain elevated with input costs rising due to higher staff, energy and raw material costs. They were able to pass this through to customers with the output inflation index moving higher in January.

- Despite both the manufacturing and services PMIs being below 50, Judo Bank notes that the RBA may think that the PMI is not slowing enough to bring inflation back to target and that the risk is that inflation “remains stubbornly high”. Judo Bank expects 25bp hikes in February and March followed by a pause and the chance of further tightening later in the year if “the economy and inflation prove more resilient”.

- The improvement in services was driven by better demand, including from overseas. Whereas manufacturing was weighed down by supply issues and less new business, including export orders. Business confidence remained positive but moved further below the historical average, as respondents worry about higher rates, inflation and the growth outlook, but were more positive on China.

- Employment rose in both manufacturing and services due to staff shortages, despite a very tight labour market and slowing activity.

- See PMI press release here.

Source: MNI - Market News/Refinitiv/Bloomberg/Judo Bank

NZGBS: Early, Modest Cheapening Holds, CPI In View

A near-enough flatline session for the NZ rates space after the initial adjustments, as the continued observance of the LNY holidays limits broader liquidity in Asia-Pac markets and regional headline flow.

- The move higher in U.S. Tsy & German Bund yields observed at the backend of last week spilled over into Monday trade, subsequently applying some pressure to NZGBs in early Tuesday dealing, with the benchmarks running 3.0-4.5bp cheaper at the close as the curve bear steepened.

- Swap rates finished 3-4bp higher, moving in sympathy with bonds.

- Local data flow saw a slowing in the rate of expansion in the latest BusinessNZ PSI print, with the collators noting that “December marked a significant slowdown in a short space of time for the PSI, although the loftiness in New Orders/Business suggested there was still a lot of demand- side pressure at play.”

- Political matters continue to dominate domestic headlines, but these are second order (at best) considerations for markets given the domestic and macro backdrops.

- Tomorrow’s Q4 CPI data presents the domestic highlight of the week, with near-term RBNZ dated OIS pricing steady today, showing just under 65bp of tightening for next month’s meeting, alongside a terminal OCR of just over 5.45%.

FOREX: USD Maintains Recent Ranges, JPY Finds Some Support

The BBDXY is still sub NY closing levels, but up from earlier session lows near 1223. We last tracked near 1224.00 (-0.10% for the session). A firmer yen tone has persisted, with JPY up 0.35% at this stage. Other pairs have seen more modest gains against the USD.

- With many regional centers and China still out for the LNY break, cross asset signals have been fairly muted. US cash Tsy yields mostly steady. The regional equity tone is positive led by Japan stocks, but this is largely following firm gains in offshore markets through Monday's session, particularly in the tech space.

- USD/JPY has traded with a weaker bias, last around 130.20/25. PMI services data was slightly better than expected, while manufacturing was steady and still in contraction territory.

- AU and NZ survey data hasn't shifted the needle ahead of tomorrow's key CPI outcomes for both economies.

- AUD/USD was last at 0.7035, highs for the session were at 0.7045. NZD/USD is attempting a move above 0.6500. Dips in both currencies have been supported. EUR/USD is a touch higher last around 1.0875/80.

- Coming up, flash PMIs for Jan are due across the major economies and the EU area. In the US the Richmond Fed index is also due.

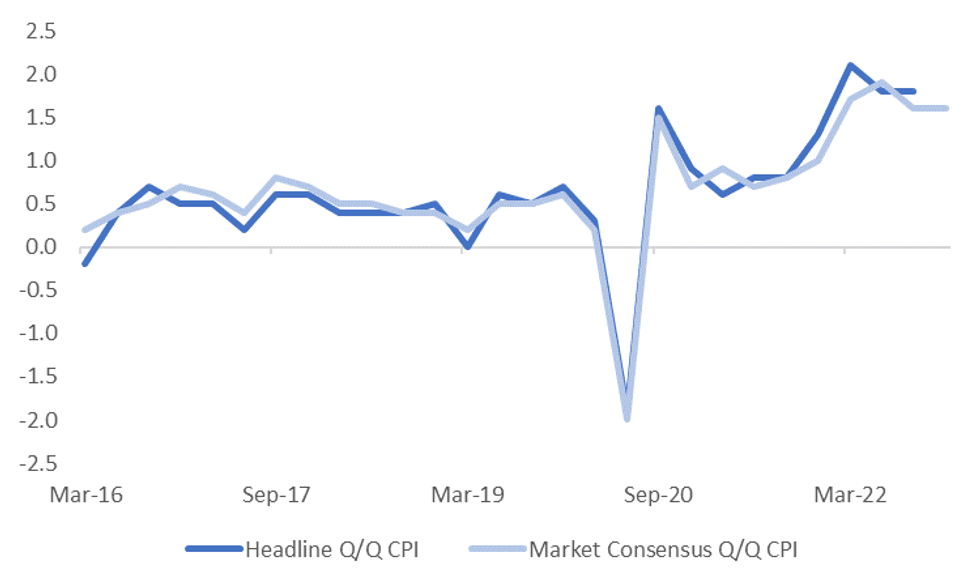

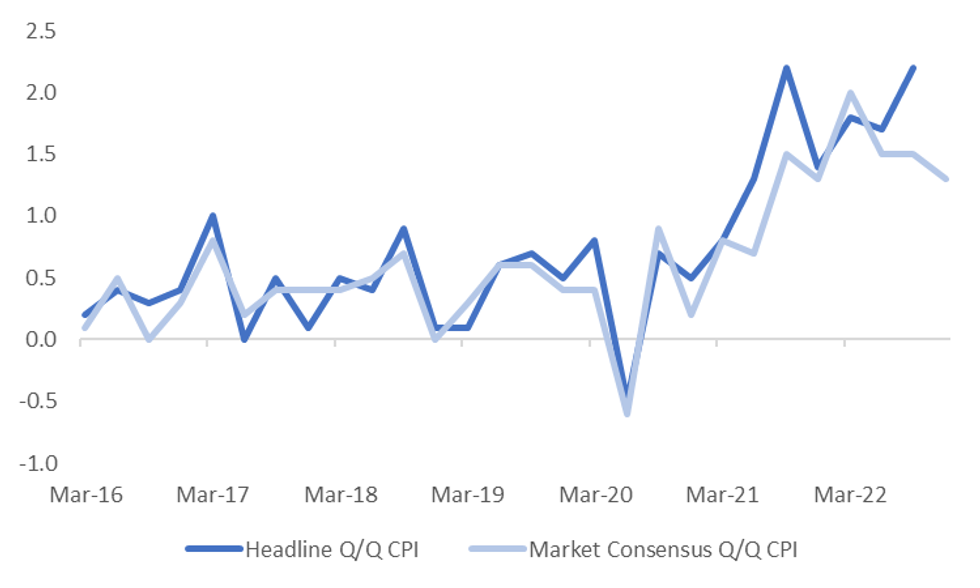

AUD: AUD/USD Has Typically Fallen Post Recent CPI Prints

Q4 Australian CPI prints tomorrow. The headline is expected to ease to 1.6% q/q from 1.8% (range of 1.5% to 2.2%). The trimmed mean is forecast at 1.5% q/q, prior 1.8% (range of 1.2% to 1.8%). Y/Y measures are expected to rise, headline to 7.6%, from 7.3% prior, trimmed mean 6.5%, versus 6.1% previously. Y/Y measures for Dec monthly CPI are also expected to rise (headline to 7.7% from 7.3%, trimmed mean 5.8% from 5.6%).

- Rising utility costs in Q4 are expected to push headline pressures up, although the general consensus is for easing momentum as we progress through 2023.

- Upside surprises, in contrast to NZ, haven't been as strong over the past 18 months, see the first chart below. There is more modest deviation between actual and expected inflation. See this link for the earlier NZ piece ahead of tomorrow's print.

Fig 1: AU Headline Inflation Versus Expectations

Source: MNI - Market News/Bloomberg

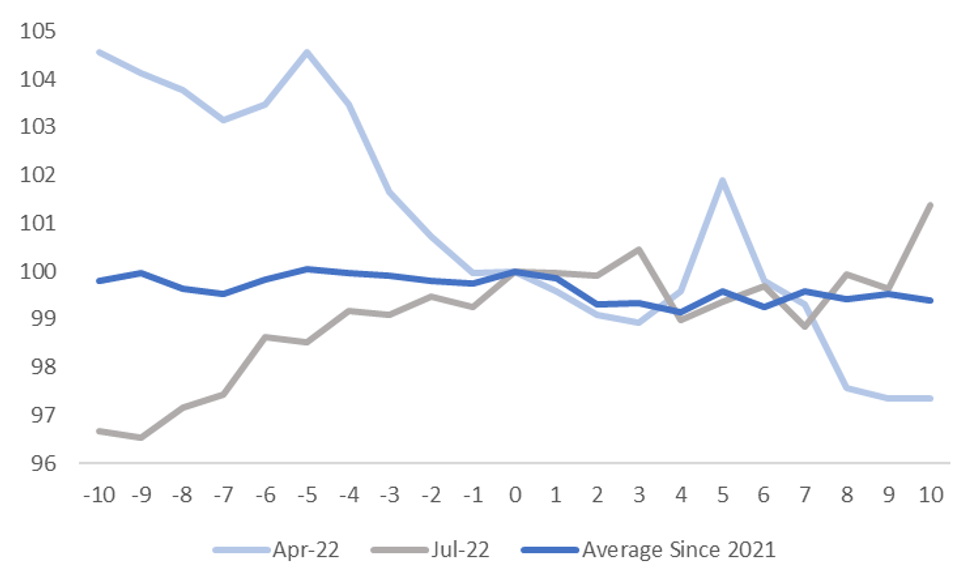

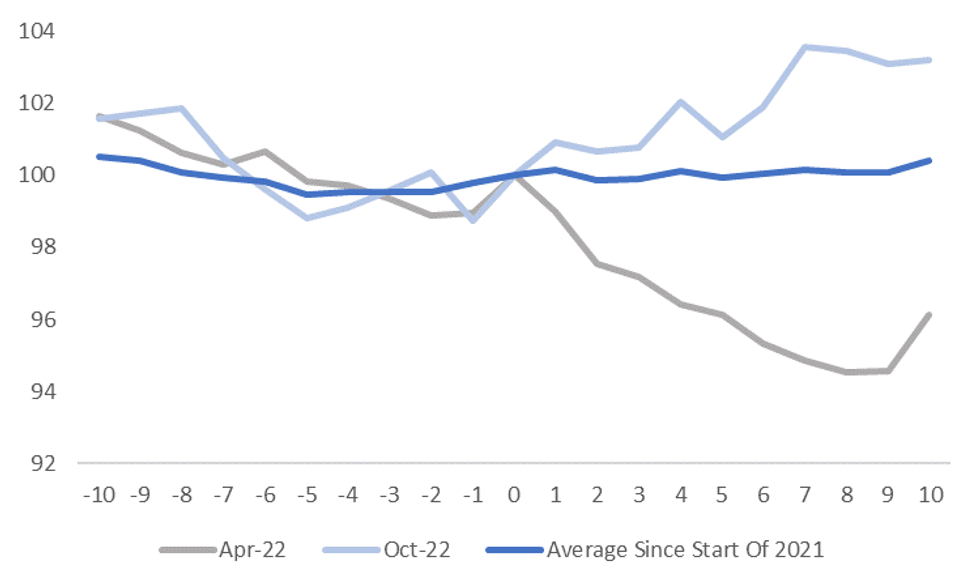

- More modest upside surprises may help explain the more benign AUD reaction post CPI outcomes relative to NZD. The second chart below shows that AUD/USD has typically dropped post CPI prints over the last 2 years.

- In the two weeks after the CPI print the AUD/USD has fallen, on average, by 0.63%, between 2021 and 2022. Indeed, it has been higher 2 weeks post the CPI print on 2 out of 8 occasions, versus 5 out of 8 for NZD.

- The best performance was post the Q2 2022 CPI data in July 2022, AUD/USD rose 1.38% in the two weeks after the print. The worst performance was in April 2022, like NZD.

Fig 2: AUD/USD Reaction 2weeks Before & 2weeks After CPI Prints (2021-2022)

Source: MNI - Market News/Bloomberg

NZD: NZD/USD Has Typically Rallied Following Recent CPI Prints

Tomorrow's NZ Q4 CPI print shapes as a key one ahead of the February RBNZ meeting. Market expectations look for a down shift in q/q pressures to 1.3% (range of 0.9%-1.8%), from 2.2% in Q3. This would take the y/y pace to 7.1% from 7.2%. The market expects tradables q/q to be at 0.8%, from 2.2% in Q3, with a (range of 0.3% to 1.1%), while non-tradeables is forecast at 1.7% q/q, from 2.0% in Q3 (range of 1.4% to 2.0%).

- The general trend has been for upside inflation surprises over the past 18 months, see the first chart below.

- A sharp pull back in petrol prices is expected to weigh on headline momentum from Q4, although underlying inflation pressure trend (non-tradables/core) will still be watched closely in terms of the RBNZ outlook.

- Current market pricing (OIS) has the policy rate peaking close to 5.45% near the middle of the year, versus the current rate of 4.25%.

Fig 1: NZ Headline Inflation Versus Expectations

Source: MNI - Market News/Bloomberg

- The NZD/USD reaction post recent CPI prints has generally been positive, which is not surprising given the upside surprises. 2 weeks after the Q3 print in October last year, NZD/USD was 3.2% higher, in July (post the Q2 print), we were 2.9% higher.

- In April 2022 though, the Q1 CPI miss, coupled with the strengthening USD trend, drove a sharp NZD/USD sell-off.

- The chart below plots the average performance of NZD/USD in the 2 weeks prior and 2 weeks after CPI prints since the start of 2021. On average, NZD is 0.40% higher 2 weeks post, flat after the first week. If we exclude the April 2022 result it is 1% firmer. The 2 other lines on the chart represent the worst (April 2022) and best (October 2022) outcomes post CPI prints for this sample period.

- An upside surprise tomorrow may not carry as much weight as it did in 2022, given we are arguably closer to the end of the tightening cycle.

- A downside surprise may temper peak RBNZ expectations, but softer USD momentum/better risk appetite in the equity space, may help contain the fallout for NZD.

Fig 2: NZD/USD Reaction 2weeks Before & 2weeks After CPI Prints (2021-2022)

Source: MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Jan24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0795-05(E928mln), $1.0900(E561mln)

- USD/JPY: Y128.00-10($924mln), Y130.00($916mln), Y131.00($821mln)

- AUD/USD: $0.7000(A$524mln)

- USD/CAD: C$1.3400($726mln), C$1.3460($610mln)

ASIA FX: USD/Asia Pairs Edge Higher, But IDR Outperforms

Most USD/Asia pairs are slightly higher, albeit still in reduced liquidity conditions, with many centres still closed for LNY holidays. USD/IDR is the main exception, sharply lower in the first part of trade, but from the low 14900 levels we have clawed higher. The dollar is away from lows against the majors, while intervention reports and push back against currency strength are evident elsewhere. Tomorrow, South Korea and Singapore markets return, with Q4 GDP printing in South Korea and inflation figures in Singapore. The BoT decision is also due in Thailand (+25bps expected).

- USD/INR has opened dealing at 81.60/70, up ~0.3% from yesterday's closing levels. This follows yesterday's gain, with USD/INR dips in early trade not sustained, as headlines crossed on reported state bank dollar buying, which came when the pair was sub 81.00. The trough to peak move was ~0.50%. The pair is now trading above its 100-Day EMA, with bulls now targeting the 20-day EMA at 81.85. Bears first look to break Jan 2023 to regain upper hand.

- Onshore Indonesian markets have re-opened today, and USD/IDR is breaking lower. The pair was last at 14943, down nearly 1% versus closing levels from last Friday. Earlier lows were close to 14900, which is back to mid September levels from 2022. We are comfortably below all key EMAs (200 day is 15145.7). IDR is riding the better risk appetite tone, while net inflows into local bonds have rebounded strongly since the start of the year. Foreign holdings are up close to 5%. Up to Jan 19 we had net inflows of just under $2.4bn into local bonds. The onshore 10yr yield has fallen from early Jan highs around 7.10% to 6.63% today.

- USD/THB has been range bound so far today, in a tight 32.70/32.79 range. We were last at the upper end of this range, around -0.15% weaker in baht terms versus yesterday's closing levels. Lows yesterday came in just under 32.60, while moves in to the 33.00/33.20 range have drawn selling interest recently. The main event risk is tomorrow's BoT decision. +25bps is widely expected, see our full preview here. We are still waiting for Dec trade figures as well, which weren't released at the time of writing. The Thai Shippers Group stated earlier the BoT should refrain from raising rates tomorrow and take measures to stabilize the baht in the 34.00-35.00 region.

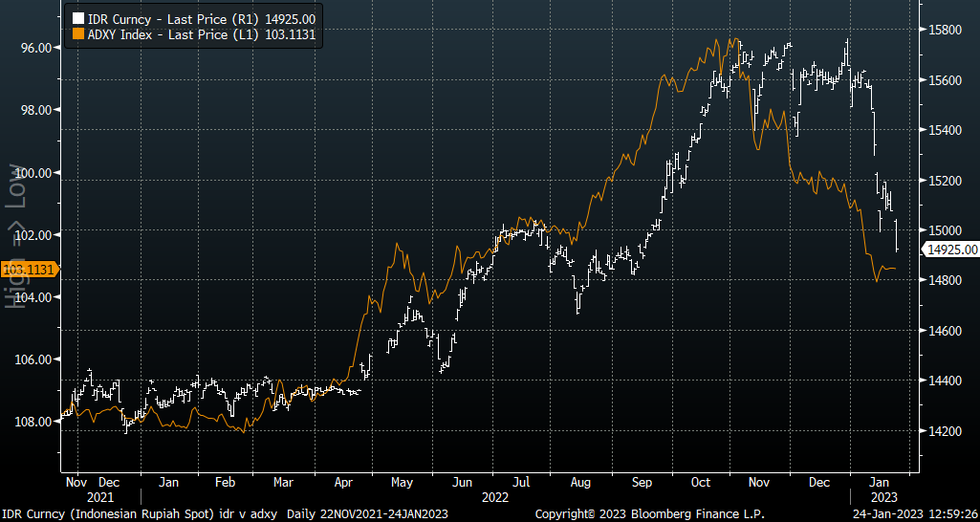

IDR: IDR Playing Catch Up With Firmer ADXY, As Bond Inflows Recover

Onshore markets have re-opened today, and USD/IDR is breaking lower. The pair was last at 14935, down nearly 1% versus closing levels from last Friday. Earlier lows were close to 14900, which is back to mid September levels from 2022. We are comfortably below all key EMAs (200 day is 15145.7).

- IDR is riding the better risk appetite tone, while net inflows into local bonds have rebounded strongly since the start of the year. Foreign holdings are up close to 5%. Up to Jan 19 we had net inflows of just under $2.4bn into local bonds. The onshore 10yr yield has fallen from early Jan highs around 7.10% to 6.63% today.

- Hopes of a less hawkish Fed backdrop is no doubt aiding such flows, with USD/IDR also tracking US real yields lower.

- Equity flows have stabilised somewhat but are still down for the year (-$291.9mn).

- The recent recovery in IDR has bought it more into line with the recovering ADXY trend, see the chart below (note the ADXY is inverted on the chart).

- January tends to be a strong seasonal month for IDR, rising in 7 out of the last 8 January's. This month though the currency is +4% higher against the USD, comfortably the best performing month for this sample period.

- IDR is second behind THB in terms of best performers within the Asian FX bloc YTD.

- The data calendar is quiet over the next week.

Fig 1: IDR Playing Catch Up With ADXY Rebound

Source: J.P. Morgan/Bloomberg/MNI - Market News/Bloomberg

MNI Bank Of Thailand Preview - January 2023: Gradual Normalisation To Continue

EXECUTIVE SUMMARY

- The Bank of Thailand (BoT) is widely expected to hike rates 25bp to 1.5% at its January 25 meeting bringing the cumulative tightening this cycle to 100bp, well below most other Asian central banks.

- The January move is likely to be driven by inflation rising further in December and remaining above the upper end of the 1-3% target band, significantly negative real rates and the growth and tourism recovery. It will also stabilise the rate differential with the US, assuming the Fed hikes 25bp on February 1, thus supporting the THB. These reasons are likely to result in a further hike at the March BoT meeting.

- Expected tourist arrivals have been revised up sharply following the reopening of China and the resultant increase in consumption poses an upside risk to Thai inflation.

- For the full piece, see here:BoT Preview - January 2023.pdf

EQUITIES: Japan Stocks Back To Pre-December BoJ Levels

Regional equity markets are tracking higher, although a lot of markets are still closed for the LNY break. Japan markets have led the way, with the Nikkei 225 up 1.70% at this stage. Tech and semiconductor names have led the rally. This follows the 5% surge in the SOX during Monday's US session.

- Tech optimism is being buoyed by hopes of reduced Fed hawkishness. Underperformance in this sector followed the move higher in US real yields last year.

- The Nikkei is now back around levels that prevailed prior to the mid Dec BoJ meeting, last near 27355.

- Elsewhere, the ASX 200 is tracking modestly higher, up 0.43% at this stage. Thai stocks are also up, while Indian equities are +0.20% in the first part of trade.

- Only Indonesian equities are weaker, down 0.36% at this stage, with markets returning after yesterday's holiday.

- US equity futures are down a touch (-0.05/-0.10% at this stage), but have tracked a tight range through the session.

GOLD: Bullion Holding Onto Recent Gains, Watch US PMIs

Gold is holding onto its gains from recent days and has moved higher today by 0.2% to $1934.05/oz, close to its intraday high of $1937.14, as the USD is weaker. It reached a low of $1911.45 on Monday. Trend conditions for gold remain bullish and initial resistance is at Friday’s high of $1937.60.

- The fear of a recession in the US and expected slowing in Fed tightening has supported the rally in gold prices. But analysts are warning that profit taking could derail the rally. (Dow Jones)

- Later the US preliminary PMIs and the Richmond Fed manufacturing index for January are released. After the soft retail sales data, weak PMIs are likely to increase US slowdown concerns and drive a further rally in gold.

OIL: Range Trading As Various Forces Offset Each Other, Thin Asian Trading

Oil has been trading in a very narrow range today of less than 50c, as liquidity in the market remains thin due to the Lunar New Year holidays. It is off of yesterday’s highs but is holding onto most of its recent gains. WTI is currently trading around $81.67/bbl after an intraday high of $81.88 and Brent is $88.15 after $88.36.

- While WTI is holding above $81/bbl, it needs to clear $82.66, the January 18 high, for the bullish trend to resume and open up $83.14, the December 1 high. Brent has been supported by concerns regarding the supply of Russian crude, which has increased its spread to WTI. The next level to watch for Brent is $89.18.

- Concerns over US recession risk continue to tussle with optimism regarding demand from China.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/01/2023 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 24/01/2023 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 24/01/2023 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 24/01/2023 | 0815/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 24/01/2023 | 0815/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 24/01/2023 | 0830/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 24/01/2023 | 0830/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 24/01/2023 | 0900/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 24/01/2023 | 0900/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 24/01/2023 | 0900/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 24/01/2023 | 0930/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 24/01/2023 | 0930/0930 | *** |  | UK | S&P Global Services PMI flash |

| 24/01/2023 | 0930/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 24/01/2023 | 0945/1045 |  | EU | ECB Lagarde Video Message at Croatia Conference | |

| 24/01/2023 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 24/01/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 24/01/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 24/01/2023 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/01/2023 | 1445/0945 | *** |  | US | S&P Global Services Index (flash) |

| 24/01/2023 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 24/01/2023 | 1630/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 24/01/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 25/01/2023 | 2145/1045 | *** |  | NZ | CPI inflation quarterly |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.