-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Markets Show Slight Disappointment In Underwhelming Chinese Growth Target

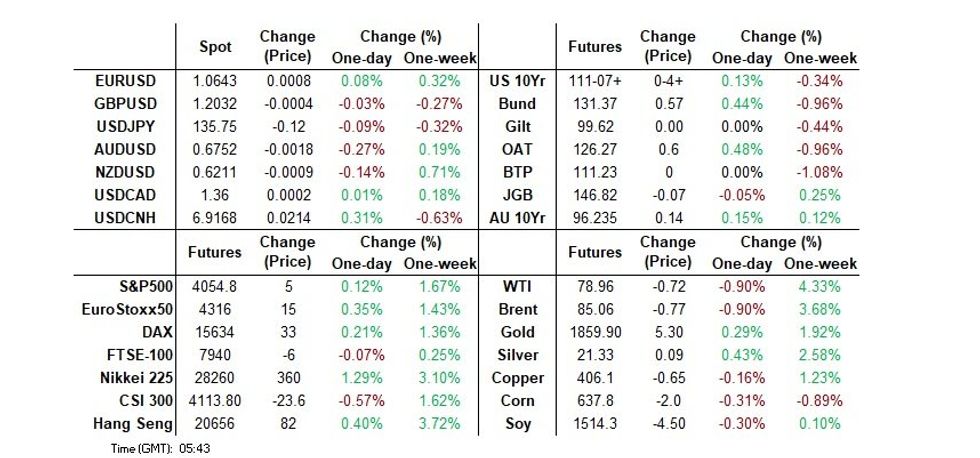

- Tsys managed to extend Friday’s richening during Asia-Pac trade, with the setting of China’s annual GDP growth (“around 5%”) at the less optimistic end of the spectrum of potential outcomes providing support.

- USD indices sit little change versus closing levels from the end of last week. The BBDXY is under 1246.50 currently. This masks some divergences within the G10 complex, with JPY generally outperforming higher beta plays within the space.

- Looking ahead, Swizz Feb CPI is on tap, while the ECB's Lane also speaks. In the US, factor orders and the final durable goods print are out. There is no Fed speak scheduled ahead of Chair Powell's testimony (to run across Tuesday & Wednesday).

US TSYS: Chinese GDP Growth Target Lends Light Support In Asia

TYM3 +0-04+ at 111-07+, 0-02 off the peak of its 0-08 range on volume of ~86K. Cash Tsys are 0.5-2.0bp richer, bull steepening.

- Tsys managed to extend Friday’s richening during Asia-Pac trade, with the setting of China’s annual GDP growth (“around 5%”) at the less optimistic end of the spectrum of potential outcomes providing support.

- Desks also pointed to a more notable willingness amongst regional participants to undertake some short squaring activity given Friday’s stabilisation/rally, with eyes on this week’s tier one event risk (Powell’s two-day testimony to Congress and the monthly labour market report). Indeed, headline flow was very subdued in Asia hours, outside of some non-market moving rhetoric from China’s NPC.

- Early Asia-Pac trade saw a modest tick lower for Tsy futures, potentially aided by weekend comments from San Francisco Fed President Daly (non-voter), as she pointed to a willingness to do more re: rate hikes if it looks like inflation is accelerating (alongside an already apparent need to deploy further rate hikes and signalling re: higher for longer rates).

- The European docket is fairly limited on Monday, save a speech from ECB chief economist Lane. In the U.S., factory orders and final durable goods readings will cross in NY hours. The highlights of the week include Fed Chair Powell’s semi-annual testimony to Congress (Tuesday & Wednesday) and Friday’s NFP print. Ahead of these events, the OIS strip is pricing ~30bp of tightening for this month’s FOMC & a terminal rate of ~5.45%.

JGBS: Tight Start To The Week, Many Cautious Ahead Of BoJ

We didn’t get much in the way of meaningful market moves for JGBs during the first trading session of the week, with participants seemingly somewhat cautious ahead of outgoing BoJ Governor Kuroda’s final monetary policy meeting, even with an overwhelming majority looking for no move from the Bank on Friday (albeit with varying degrees of conviction).

- The major cash JGBs generally traded within -/+1bp of Friday’s closing levels, with 40s presenting the weakest area on the curve. Futures are -8 into the close after breaching their overnight base, but lacked meaningful extension.

- Weekend comments from LDP upper house Secretary General Seko pointed to no reason to change the BoJ-government inflation accord, while he also expects policy continuity under BoJ Governor-in-waiting Ueda (from a “stance” perspective). Seko also outlined a fiscal package that will look to combat inflation (up to Y5tn in size, to be put forth by 17 March).

- Elsewhere, a JTUC survey flagging multi-decade highs for wage hike demands from Japan’s trade unions (released Friday) got some attention.

- Various notable Japanese investment companies weighed in with their views on the JGB market via a Nikkei piece.

- Finally, Japan-South Korea relations seem to be moving in the right direction, although we don’t expect this to be a needle mover for JGBs.

- Looking ahead, Tuesday’s local docket includes 30-Year JGB supply and the latest round of household wage data.

AUSSIE BONDS: Strong Bid Ahead Of RBA Decision Tomorrow

ACGBs strengthened on Monday, aided by a richening in U.S Tsys (on Friday & in Asia dealing) and a well-received auction of ACGB Sep-26, leaving YM +9.0 & XM +14.0 at the close. Also adding support, at the margin, was the February MI Inflation Gauge, which showed tentative signs of peak inflation, and the market’s initial reaction to the Chinese NPC setting an annual growth target (“around 5%”) at the less ambitious end of expectations. Cash ACGBs were 9-14bp richer with the 3/10 curve 5bp flatter.

- AU/US cash 10-year yield differential was -2bp at -18bp, after hitting an intraday high of -13bp.

- 3s10s swaps curve bull flattened 6bp on the day with rates 9-15bp richer and 10-year EFP slightly narrower.

- Bills close at session highs to be 5-11bp richer (except IRH3 +1bp), led by the reds.

- A 25bp hike from the RBA tomorrow is almost a lock according to RBA-dated OIS with the market pricing a 92% chance of such an outcome. Beyond the March meeting, however, the market is less certain with a 74% chance of a 25bp hike in April priced and a cumulative 33bp of tightening priced by May. Terminal rate pricing is around 4.14% versus its recent peak of 4.35%. At the core of this uncertainty is the possibility that the RBA could change its policy guidance in the all-important last paragraph of the decision statement tomorrow in response to the downside surprises, amongst others, to Q4 WPI, Q4 GDP and January monthly CPI.

MNI RBA Preview - March 2023: 25bp In March, Guidance The Focus

EXECUTIVE SUMMARY:

- As the RBA is widely expected to hike rates 25bp to 3.6% at its March 7 meeting, the focus is likely to be on the statement and any changes to the forward guidance. There may be a tempering of February's more hawkish language given the softer data since that decision but while inflation remains "too high", the message in the inflation phrases in the statement will probably be unchanged. But the RBA is likely to keep its options open.

- According to RBA-dated OIS, the market is pricing a 92% chance of a rate hike on Tuesday. Beyond the March meeting, however, the market is less certain with a 72% chance of a 25bp hike in April priced and a cumulative 33bp of tightening priced by May.

- The recent shift in the data is likely to make post-March RBA decisions even more dependent on the “incoming data”.

- Click to view full preview:RBA Preview - March 2023.pdf

AUSTRALIA: MI Inflation Gauge Elevated, Maybe Q1 The Peak?

The Melbourne Institute’s inflation gauge for February posted a smaller monthly increase of 0.4% m/m compared with 0.9% last month bringing the annual rate to down slightly to 6.3% y/y from 6.4%, the second highest since the series began with January the highest. Possibly this indicator is very tentatively pointing to a peak in inflation at the start of 2023 but also that Q1 inflation could be higher than Q4. The RBA is widely expected to hike rates 25bp on Tuesday and with this data showing that price pressures remain elevated and are not yet easing significantly, the guidance is likely to maintain its tightening tone.

- The trimmed mean eased moderately too. It rose 0.7% m/m and 4.9% y/y in February down from 0.9% m/m and 5.3% y/y the previous month. The monthly increase exceeding that of the headline series signals that domestically-driven price pressures remain.

- The MI inflation gauge Q1 average to date is up 1.5% q/q and 5.9% y/y, stronger than Q4’s 1.3% q/q and 5.7% y/y.

Source: MNI - Market News/Refinitiv/ABS/Melbourne Institute

NZGBS: Stronger But Underperforming $-Bloc Ahead Of Syndication Pricing

NZGBs close 3-8bp richer with the 2/10 cash curve 5bp flatter. While the 2-year retraced some early strength, the 10-year closed near its richest level aided by a post-auction bid for ACGBs and some light U.S Tsy strength in Asia-Pac trade. The stronger tone to global FI could reflect China’s official 2023 annual growth target of “around 5%” (less ambitious end of expectations).

- The NZGB 10-year benchmark did however underperform its $-bloc peers, ahead of tomorrow’s pricing of the new May-30 bond (sized at a minimum of NZ$3.0bn, capped at NZ$5.0bn). The NZ/US and NZ/AU 10-year yield differentials were 3bp and 4bp wider, respectively.

- Swaps bull flatten with rates 2-10bp lower, leaving the 10-year swap spread slightly tighter and the 2s10s swap spread box slightly flatter.

- RBNZ dated OIS was flat to -2bp across meetings led by August. April meeting pricing remains around 40bp of tightening with terminal OCR pricing just shy of the RBNZ’s projected OCR peak of 5.50% at 5.49%.

- Q4 construction data printed -1.6% Q/Q today, but any message from this data is likely to be discounted given the upside bias to the outlook as NZ rebuilds from recent severe weather devastation.

- With the local calendar light until February’s card spending data (Thu) and Manufacturing PMI (Fri), the market will likely find itself guided by events in Australia and the U.S.

FOREX: Yen Firms Against Higher Beta Plays

USD indices sit little change versus closing levels from the end of last week. The BBDXY is under 1246.50 currently. This masks some divergences within the G10 complex, with JPY generally outperforming higher beta plays within the space.

- This is most evident in terms of AUD/JPY, which is down around 0.4% for the session so far. This puts us back at 91.60/65.

- AUD/USD is back to 0.6750/55 but is up from session lows (close to 0.6740). The A$ has weakened with lower metals prices, most notably iron ore, which is off over 2% (near $122.50/ton). This comes after some disappointment around China's 5% growth target for 2023 announced yesterday. Late last week speculation had been of a target higher than this.

- NZD/USD us also weaker, but outperforming the A$ at the margins. The pair last around 0.6210/15. Data releases in both AU and NZ didn't shift the sentiment needle.

- USD/JPY got to a low of 135.37, but has recovered, now back to 135.65, which is around 0.15% sub closing levels from last week. Lower US yields, (-0.5 to -1.8bps lower across the US cash Tsy curve) has aided the yen.

- Other pairs have seen modest moves, with EUR/USD slightly higher, tracking in the 1.0645/50 area.

- Looking ahead, Swizz Feb CPI is on tap, while the ECB's Lane also speaks. In the US, factor orders and the final durable goods print are out. There is no Fed speak scheduled ahead of Chair Powell's testimony tomorrow.

FX OPTIONS: Expiries for Mar06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0450(E550mln), $1.0630-50(E864mln)

- USD/JPY: Y135.00-10($547mln), Y135.75-00($615mln), Y137.00-24($1.5bln)

- GBP/USD: $1.1874-91(Gbp2.3bln), $1.2050-60(Gbp2.7bln)

- AUD/USD: $0.6735(A$582mln), $0.6760-65(A$644mln), $0.6775-85(A$1.2bln)

- NZD/USD: $0.6180-00($1.0bln)

- USD/CAD: C$1.3324($1bln), C$1.3600($562mln)

- USD/CNY: Cny6.9500($1.0bln)

ASIA FX: CNH Lags, KRW & INR Outperform

CNH has underperformed mixed trends elsewhere in the USD/Asia space. Disappointment around the 2023 growth target has weighed on China related asset sentiment. KRW has generally held recent gains, while INR is also still on the front foot. Overall moves haven't been large though. Tomorrow, we get Jan-Feb trade figures From China, South Korea Q4 GDP revisions, Taiwan CPI and trade figures, along with Thailand and Philippines CPI prints.

- USD/CNH has seen selling interest emerge around the 6.9200 level. We last tracked slightly lower at 6.9160/70, 0.30% weaker in CNH terms versus Friday's close. Onshore equities are down around 0.50%, while Northbound flows have been negative (near -1.8bn yuan). The prospects of less policy stimulus has weighed on the equity space, with some disappointment around the 5% growth target for this year.

- 1 month USD/KRW climbed in the first part of trade, but didn't get beyond 1298, we now sit back at 1293/94, only slightly below NY closing levels from Friday. The Kospi is up over 1%, with offshore investors flow positive. The NPS (Korea's National Pension Service) has stated it stands ready to revive the swap facility with BoK if needed. Feb inflation pressures were lower than expected.

- The Rupee is mostly trading on the front foot, with USD/INR back under the 81.80 level. This follows further onshore equity gains and decent offshore equity inflow momentum. Lower US yields are also helping. The pair is sub is 100-day EMA as well.

- USD/PHP is relatively steady. The pair last in the 54.80/85 region. We are close to multi-week lows, but haven't been able to sustain much downside. On the data front, all eyes rest on tomorrow's CPI outcome. The market looks for 8.9% y/y, (8.7% prior), while the BSP has a 8.5% to 9.3% forecast range. BSP Governor Medalla noted at the end of last week, that a breach of the 9% handle could mean a 50bps hike at the March 23 meeting.

CHINA: Trade Figures Out Tomorrow, New Export Order Bounce Contrasts With Official Rhetoric

While the focus remains on China's NPC, note that tomorrow Feb trade figures are due. This data will be in YTD Y/Y terms, as it covers the Jan-Feb period to account for the China LNY. The next read in y/y terms will not be out until April.

- For exports, the market forecast is -9.0% YTD Y/Y (range of estimates is -12% to +2%). For imports the same metric is expected to print at -5.5% (range of estimates -8.7% to +2%). The trade balance is forecast at $81.75bn YTD.

- The tone from China officials has been generally warning of external headwinds in terms of the growth backdrop. The Ministry of Commerce noted late last week that pressure on foreign trade has increased markedly. It is also willing to have candid talks with the US to reduce trade and investment restrictions (see this link for more details).

- Last week's PMI data hinted at an improved export outlook though, with a strong bounce in export orders. The chart below overlays the export orders from the manufacturing PMI (in y/y change terms) against y/y export growth.

Fig 1: China Export Growth & New Export Orders (Manufacturing PMI)

Source: MNI - Market News/Bloomberg

EQUITIES: Gains Outside of China/HK

Outside of China and Hong Kong, most regional equities are tracking higher, following the strong lead from US markets during Friday's session at the end of last week. US futures started weaker today, but have recovered firmly, with Eminis breaching the 4060 level, before retracing somewhat. The short term technicals are better with the active eminis contract now trading above its 20 and 50-day EMA.

- China/HK stocks have been left somewhat disappointed by the 'around 5%' growth target announced at yesterday's NPC for 2023. It implies less stimulus measures, which the equity market has taken as a negative. The CSI 300 is off by around 0.55%, with property stocks weighing, as the NPC didn't suggest any dramatic shifts in terms of housing policy.

- The HSI is around flat, which is away from worst levels, but is underperforming better trends elsewhere in the region. The prospect of additional curbs on US investment is China is also acting as a headwind.

- Elsewhere the mood is more positive. The Nikkei is at +1.20%, while the Kospi and Taiex are both around +1% higher as well.

- Indian shares are also rallying, up a further 1% as Adani related stocks rose in early trade.

- On the Singapore bourse is down in SEA.

GOLD: Bullion Now Flat On The Day, Focus On Powell Tuesday And Wednesday

Gold prices are trading in a narrow range during the APAC session after rising 1.1% on Friday supported by lower US yields and dollar. Bullion is currently around $1855.55/oz, close to the intraday high, after reaching a low of $1850.87 following the disappointing China growth target. China is the largest consumer of the precious metal. The USD index is down slightly.

- Gold remains in a bearish trend but broke through the 50-day EMA of $1846 on Friday and has remained above that level, which has strengthened the short-term bullish conditions. The next level to watch is $1870.50, the February 14 high. Key short-term support is at $1804.90, the February 28 low, and a break through this would see recent bearish activity resume.

- There are no Fed speakers today and only US January factory orders and final durable goods orders print. The focus will be on Fed Chairman Powell’s appearances before a Senate panel on Tuesday and the House financial services committee on Wednesday. He is expected to reiterate that rates need to rise further, which will be negative for gold.

OIL: Crude Weaker On China Growth Target, Focus On Powell This Week

Oil prices rose strongly on Friday but during APAC trading today have struggled after China announced a more cautious 2023 growth target. China is the largest oil importer globally. WTI is down 0.7% to $79.10/bbl, close to the intraday low, following a high of $79.92. Brent is down 0.7% to $85.22/bbl, also close to the intraday low. The USD index is down slightly today.

- WTI is holding just above the 100-day moving average. It rose 4.6% last week and broke through resistance at the 50-day EMA. Further gains could signal a test of resistance at $80.78, the February 13 high. Brent is holding above both its 50- and 100-day moving averages.

- Saudi Arabia is not concerned about the short-term outlook for crude, as it increased the prices for most of its April shipments to Europe and Asia.

- There are no Fed speakers today and only US January factory orders and final durable goods orders print. The focus will be on Fed Chairman Powell’s appearances before a Senate panel on Tuesday and the House financial services committee on Wednesday. He is expected to reiterate that rates need to rise further.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/03/2023 | 0730/0830 | *** |  | CH | CPI |

| 06/03/2023 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/03/2023 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/03/2023 | 1000/1100 | ** |  | EU | Retail Sales |

| 06/03/2023 | 1000/1100 |  | EU | ECB Lane Lecture at Trinity College | |

| 06/03/2023 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/03/2023 | 1500/1000 | ** |  | US | Factory New Orders |

| 06/03/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 06/03/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.