-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Notable Cross-Asset Flows Spill Into Asia

- Asia-Pac hours were subjected to notable cross-market flows, albeit to a more modest degree than Thursday's NY offering, with positioning and UK fiscal matters front and centre post-U.S. CPI.

- Sterling was volatile amid reports surrounding UK Cll'r Kwarteng's early departure from the annual IMF meetings and suggestions that the government may rip up parts of its controversial fiscal plans. There was talk of officials drafting options for the Truss/Kwarteng tandem, with many flagging the potential for a U-turn on the pledge to cancel a scheduled corporation tax hike.

- Looking ahead, focus will turn to U.S. retail sales & preliminary results of Uni. of Mich. survey. The central bank speaker slate features Fed's George, Cook and Waller, ECB's Holzmann, BoC's Macklem & Riksbank's Ohlsson.

US TSYS: Off Best Levels As Early Bid Fades

Cash Tsys run flat to 1bp richer into London hours, with TYZ2 +0-01 at 111-01+ operating around the middle of its 0-14 Asia range, on volume of ~95K.

- Tsys have moved away from best levels after leaning on the latest headlines surrounding the potential for another fiscal U-turn in the UK for support during the first half of the overnight session.

- ECB source reports from both BBG & RTRS flagged an apparent ease amongst hawks re: organic balance sheet run off getting underway at some point in H123, with their focus being on interest rates when it comes to the main monetary policy tool.

- Headline flow was relatively limited elsewhere, with the PBoC Governor reaffirming the Bank’s well-known support for the continued deployment of prudent monetary policy, Meanwhile, Chinese CPI & PPI data provided very modest downside surprises.

- Block sales were seen in FV (-2.0K) & TY (-2.9K) futures, with mixed blocked flow in TYX2 109.50 puts (+5K) and TYZ2 110.50 puts (-5K).

- Looking ahead, Gilt market gyrations will be eyed, with the BoE’s temporary purchases set to conclude today and continued fiscal/political rumours doing the rounds in London.

- Friday’s NY docket includes retail sales and the UoM sentiment survey (watch the inflation components in the latter). We will also get Fedspeak from Waller, Cook & George ahead of the weekend.

JGBS: Flatter Into The Weekend

JGBs have generally followed the lead of the wider cross-asset gyrations, with futures operating around the middle of their Tokyo range as we move towards the bell, last +3, while cash JGBs sit flat to 2bp richer across the curve, flattening as super-long paper leads the bid.

- The latest round of 5-Year JGB supply passed smoothly with the low price just about topping wider expectations, tail holding tight and cover ratio moving to the highest level observed at a 5-Year auction since November ’21. It would seem that outright and relative value appeal, coupled with carry & roll considerations, outweighed the impact of any worry surrounding ongoing wider market vol., facilitating a solid auction.

- Comments from BoJ Governor Kuroda & Japanese Finance Minister Suzuki failed to move the needle on BoJ policy & JPY intervention, respectively.

- Elsewhere, an MoF official provided no comment when questioned on potential JPY intervention on Thursday.

- CPI data (due Friday) headlines next week domestic docket.

JAPAN: Japan Sheds Foreign Bonds, While Offshore Investors Scoop Up Japanese Equities

The latest round of weekly international security flow data from the Japanese MoF revealed the largest round of net weekly selling of foreign bonds on the part of Japanese investors since February, as they recorded a fifth consecutive week of net selling of offshore paper.

- Elsewhere, Japanese investors were net buyers of foreign equities for a fourth consecutive week, registering the largest round of net buying observed since July.

- Foreign investors were net sellers of Japanese bonds for a third consecutive week, although the net selling was rather paltry when compared to levels observed over the two prior weeks, as 10-Year JGB yields operated around the upper end of the BoJ’s permitted YCC boundary, while the Bank has continued to reaffirm its support for its current policy settings.

- Foreign investors broke a run of six straight weeks of net sales when it comes to Japanese equities, recording the largest round of net purchases seen since April in the process.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -1713.7 | -886.3 | -4904.9 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 879.2 | 569.8 | 1916.7 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -109.7 | -1565.6 | -3981.7 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 1393.9 | -501.8 | -598.5 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

AUSSIE BONDS: Flattening Impulse Maintained

Aussie bonds flattened in sympathy with the overnight session move in futures/Thursday’s move in U.S. Tsys, albeit following the wider gyrations observed in core global FI markets during Sydney dealing, leaving YM -9.0 and XM -0.5 into the bell, off of worst levels of the session, with cross-market gyrations and UK fiscal matters at the fore.

- Cash ACGB trade sees 9bp of cheapening to 1.5bp richening across the major banchmarks, with a pivot around 10s.

- A solid round of ACGB Apr-27 supply was noted, while next week’s AOFM issuance slate is somewhat vanilla.

- EFPs are incrementally wider on the session, with the 3-/10-Year box marginally flatter.

- Bills print 7-13bp cheaper through the reds, IRH3 through IRH4 leading the cheapening there.

- RBA dated OIS indicated a terminal rate of just over 4.05, ~!0bp or so higher on the day.

- Looking ahead, next week’s local docket is headlined by the monthly labour market reading (Thursday), with the minutes from the RBA’s most recent monetary policy decision (Tuesday) also due.

NZGBS: Off Lows, Lack Of Idiosyncratic Drivers Leaves Wider Themes At The Fore

The latest round of speculation surrounding the potential for another meaningful fiscal U-turn in the UK allowed the NZGB space to unwind the bulk of its early session losses, with the major benchmarks running 0.5bp cheaper to 1.0bp richer at the close, as the curve twist flattened, pivoting around 5s.

- A slowing of the headline rate of expansion in the latest domestic m’fing PMI survey had little impact, with all of the major sub-metrics outside of finished stocks exhibiting a slower rate of expansion or moving into contractionary territory.

- Elsewhere, comments from NZ FinMin Robertson re: the need to slow spending to head off inflation (in a global context) received little attention, as you would expect given the well-developed inflationary narratives.

- RBNZ dated OIS indicates a terminal OCR of just under 5.00%, marginally higher on the day.

- Looking ahead, Q3 CPI data headlines next week’s NZ docket, with a slight moderation expected in both the Y/Y & Q/Q headline metrics (although the BBG median consensus looks for +6.5% Y/Y, well above the RNZ’s 1-3% target band).

FOREX: UK Fiscal Headlines, PBOC Comments Prop Up Risk Sentiment

Sterling was volatile amid reports surrounding UK Cll'r Kwarteng's early departure from the annual IMF meetings and suggestions that the government may rip up parts of its controversial fiscal plans. There was talk of officials drafting options for the Truss/Kwarteng tandem, with many flagging the potential for a U-turn on the pledge to cancel a scheduled corporation tax hike.

- GBP/USD showed a delayed reaction to those headlines, posting a ~60 pip spike at one point to print session highs at $1.1366. The leap higher in cable sapped strength from the broader USD, with the BBDXY still lower on the day, even as GBP/USD gradually erased gains. Reminder that the BoE's emergency bond-buying scheme is set to expire on Friday.

- Comments from PBOC Gov Yi lent further support to risk sentiment, as the official vowed to promote increased lending to critical sectors. China's inflation data were marginally weaker than expected, causing no material perturbations in the FX markets.

- The yen was subject to renewed selling pressure as participants shied away from safe havens. USD/JPY rejected intraday resistance from Y147.45/46 on two approaches, failing to re-test yesterday's 30-year high of Y147.67.

- Japanese officials chose to keep the market in the dark about their potential intervention on Thursday. FinMin Suzuki stuck to his usual script, noting that officials are monitoring markets with a high sense of urgency and stand ready to take appropriate responses.

- The Antipodeans led high-betas higher amid better risk appetite. The Aussie dollar led gains, with AUD/NZD now poised to snap a four-day losing streak. Oil-tied NOK an CAD were also firmer.

- Focus will turn to U.S. retail sales & preliminary results of Uni. of Mich. survey. Central bank speaker slate features Fed's George, Cook and Waller, ECB's Holzmann, BoC's Macklem & Riksbank's Ohlsson.

ASIA FX: CNH and IDR Lag, SGD Outperforms On MAS Tightening & GDP Beat

Asian FX is mostly firmer, in line with trends from the G10 space, although CNH and IDR are lagging these broader trends. SGD has outperformed on the MAS tightening and a solid Q3 GDP beat from this morning. Still to come is India wholesale inflation for September. This weekend the China once every 5-yr party congress kicks off. On Monday, the China 1yr MLF rate is expected to be left unchanged at 2.75%. Q3 GDP prints on Tuesday, along with September activity data. BI announces rates next Thursday.

- USD/CNH remained within recent ranges. We got above 7.1950, before sinking back to 7.1600, amid broad USD weakness. The pair has subsequently pushed back above 7.1800. Inflation prints argue for easier financial conditions in China, while more elevated covid case numbers are likely weighing at the margin.

- USD/KRW is back lower, spot hitting close to the 1425 level, before edging back up to 1427.50. Onshore equities are up firmly, +2.5% to 2215/20. The authorities warned against one-sided/herd behaviour in markets after last night's CPI print.

- USD/INR opened lower but couldn't sustain levels sub 82.20 and we are now back above 82.30. Moves above 82.40 continue to draw selling interest, so we have seen some recovery in the INR NEER. Coming up is wholesale inflation data for September, along with the RBI minutes from the last policy meeting.

- USD/SGD is down around 0.60% from NY closing levels, after the MAS tightened policy further. The move was less aggressive than some in the market expected. However, the outcome, coupled with a strong rebound in Q3 GDP (+1.5%) has driven outperformance. The pair last traded just above 1.4220.

- Spot USD/IDR has added 26 figs and last deals at 15,388, with topside technical focus falling on the 61.8% retracement of the 2020 sell-off/Apr 23, 2020 high at 15,574/15,598. Bank Indonesia will announce the outcome of its monetary policy review next Thursday. Analysts surveyed by Bloomberg so far are almost evenly split, with 5 expecting a 25bp rate rise and 6 looking for a 50bp hike.

CHINA: Inflation Data Continues To Argue For Easier Financial Conditions

China headline inflation printed slightly below expectations, 2.8% y/y, versus 2.9% expected. It was still firmer than last month (2.5% y/y in August). Outside of food price momentum was soft though. Food inflation rose 8.8% y/y, (6.1% prior), while non-food was up just 1.5% (1.7% prior). A core inflation measure (ex food and energy) was up just 0.6% y/y, the softest pace since March 2021. The chart below overlays this measure against the 2yr government bond yield.

- Only 2 sub categories recorded y/y rises (food and household items, albeit just for this latter category (1.4% versus 1.3% last month). The 6 other sub categories were either down or the same in y/y terms as last month.

Fig 1: China Core CPI & 2yr Government Bond Yields

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

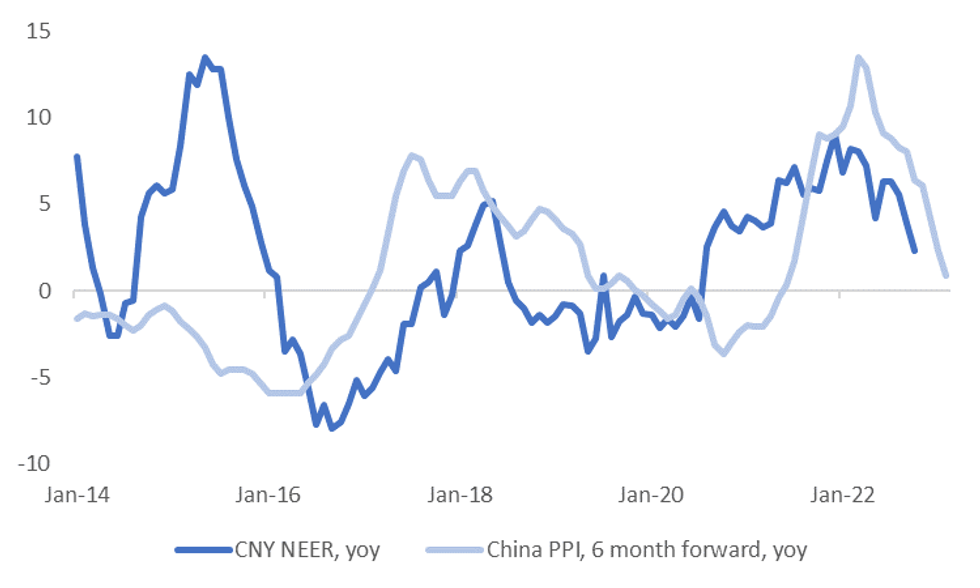

- For the PPI, it fell by -0.1% m/m, bringing the y/y pace sub 1% (0.9%), which was slightly weaker than expected. The chart below overlays the headline PPI y/y (pushed forward by 6 months) against the CNY NEER y/y (sourced from J.P. Morgan).

- Waning PPI momentum continues to point to less need for elevated NEER levels.

- The PPI decline was led by further down shifts in mining and raw materials upstream price pressures, although manufacturing, -1.9% y/y, and durable goods -0.6% y/y, were other soft points.

Fig 2: J.P. Morgan CNY NEER Y/Y Versus Headline PPI Y/Y

Source: J.P. Morgan/MNI - Market News/Bloomberg

Source: J.P. Morgan/MNI - Market News/Bloomberg

EQUITIES: Strong Rebound As US Equity Recovery Extends

Strong gains are evident across Asia Pac equities, following the sharp turn around in US markets overnight. After a mixed start US futures are tracking higher today, up a further 0.65-0.75% across the 3 main indices. Within Asia, gains have been led by tech sensitive sectors/countries.

- The HSI is up +3.4% at this stage, the tech sub index +4%, on track for its first gain since the middle of last week. Property stocks are up further, +2.7%, following yesterday's report of a possible property tax cut. Bank names have also continued to rally.

- China's Shanghai Composite is up +1.57%, lagging somewhat broader trends. The Texas Pension Fund, which has $184bn AUM, is cutting its China weight to 1.5% from 3%. While not a large sum, it is indicative of the trend around more cautious financial ties between the two economies.

- China inflation data also hinted that easier financial conditions are required for the economy.

- The Nikkei 225 is up 3.5%, the Kospi +2.6% and the Taiex nearly 3%, as tech related sectors do well. We are coming from depressed levels though, with the Kospi struggling to get positive traction above 2200 this month (last is 2218).

- The ASX 200 is up nearly 2%.

GOLD: Rebounds As USD Falters

Gold is sitting slightly higher compared to NY closing levels, last around $1670 (+0.20-0.25% for the session so far). Earlier in the session we dipped to just under $1660, but rebounded amidst broad based USD weakness.

- Gold continues to follow broader USD sentiment, albeit with a lower beta compared to some other asset classes. The DXY is only down slightly from NY closing levels at this stage.

- Higher beta assets like equities and AUD, NZD and NOK are all enjoying firmer gains at this stage.

- From a level’s standpoint, dips sub $1645 were supported overnight (post the CPI print), while we couldn't sustain a move above the $1680 level.

- Longer term we still have late September lows just under $1620, while the 50-day MA (currently $1711.63) has provided resistance on the topside in recent months.

OIL: Steady, But On Track For Weekly Drop

Brent crude is basically unchanged for the session, last at $94.55/bbl. We have consolidated following the overnight +2% gain. WTI was last just above $89.10/bbl. For Brent, this past week has seen support on dips below the 50-day MA, which comes in at $93.85/bbl, so this could be a level to watch on the downside. Early highs from this week/late last week above $98/bbl remain intact. Both crude benchmarks are headed for a weekly loss if current levels hold.

- The surge in US oil inventories, reported overnight has done little to dent sentiment. There is speculation this partly reflects the US SPR release from earlier in the year. There is also still concern around supply, particularly as we head into the northern hemisphere winter months.

- Reflecting this, Brent's prompt spread is down from highs seen last week, but isn't showing a clear downward trend either.

- US-Saudi tensions are elevated, with the US unhappy in terms of the country's role in last week’s OPEC+ supply cut decision. US President Biden said further relief on domestic gasoline prices is coming next week (although didn't spell out specifics).

- Elsewhere, the IEA cut its demand forecast for 2023 by 470k bpd. Weaker economic conditions/tighter policy settings prompted the 20% forecast drop.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/10/2022 | 0600/0800 | * |  | DE | Wholesale Prices |

| 14/10/2022 | 0645/0845 | *** |  | FR | HICP (f) |

| 14/10/2022 | 0700/0900 | *** |  | ES | HICP (f) |

| 14/10/2022 | 0900/1100 | * |  | EU | Trade Balance |

| 14/10/2022 | - |  | EU | ECB Lagarde & Panetta IMF/World Bank Annual Meetings | |

| 14/10/2022 | - | *** |  | CN | Trade |

| 14/10/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 14/10/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 14/10/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 14/10/2022 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 14/10/2022 | 1400/1000 | * |  | US | Business Inventories |

| 14/10/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 14/10/2022 | 1400/1000 |  | US | Kansas City Fed's Esther George | |

| 14/10/2022 | 1430/1030 |  | US | Fed Governor Lisa Cook | |

| 14/10/2022 | 1615/1215 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.