-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: NZD & Local Yields Climb On Solid Q1 CPI Details

- Early doors, solid NZ Q1 CPI detail drove NZD and local rates higher. For NZD/USD upside has not extended beyond 0.5900. NZGBs closed just off the worst levels of the session, with yields 6-7bps higher.

- For US Tsys, Jun'24 10Y futures have remained in tight ranges throughout the day testing initial support at 107-16. The BBDXY is lower, but dips have been supported. The yuan defence continues, while verbal jaw boning continued in Korean FX markets. Oil prices eased a touch as the market awaits Israel's response to the weekend attacks.

- Later the Fed’s Mester speaks and the Beige Book is published. The ECB’s Lagarde, Schnabel and Cipollone and BoE’s Bailey appear. In terms of data, March UK CPI/PPI and euro area CPI are released.

MARKETS

US TSYS: Treasury Futures Little Changed After Earlier Testing Support

- Jun'24 10Y futures have remained in tight ranges throughout the day testing initial support at 107-16, before making highs of 107-21+, we now trade - 01+ from NY closing levels at 107-20.

- Cash Treasury curve has erased earlier moves with yields mostly unchanged for the day, the 2Y yield -0.6bp at 4.981%, 10Y -0.6bps to 4.661%, while the 2y10y is back to unchanged at -31.149.

- Bond volatility has spiked with the Move Index up 38.45% MTD to 119.59.

- Looking ahead: Beige Book, TIC Flows and more Fed speakers later in the evening: Cleveland Fed Mester on a Federal Reserve update (Q&A) at 1730ET, Fed Gov Bowman IIF Global Outlook Forum (no text, Q&A) at 1915ET.

JGBS: Mostly Cheaper, 1Y Supply Tomorrow, National CPI On Friday

JGB futures are weaker but sit in the middle of today’s range, -17 compared to the settlement levels, after reversing weakness seen in early rounds of the Tokyo afternoon session. Early afternoon weakness was consistent with the results of today’s BoJ Rinban operations, which saw flat to positive spreads and higher cover ratios for the longer-dated buckets.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Trade Balance data.

- Cash US tsys are dealing slightly richer in today’s Asia-Pac session after yesterday’s cheapening following Fed Chair Powell’s "lack of further progress on inflation" comment.

- Cash JGBs are mostly cheaper across the curve, with yields flat (5-year) to 1.6bps (40-year) higher. The benchmark 10-year yield is 1.2bp higher at 0.883%, after setting a fresh YTD high of 0.885% today.

- Given the recent global trend of inflation prints coming in hotter than expected, the stakes are likely higher for this Friday’s Japan National CPI release.

- The swaps curve has twist-steepened, with rates 2bps lower to 1bp higher. Swap spreads are tighter.

- Tomorrow, the local calendar sees weekly International Investment Flow, Tertiary Industry Index, Tokyo Condominiums for Sale and Machine Tool Orders data alongside 1-year supply. The MoF will also conduct an Enhanced-Liquidity Auction for 15.5-39-year OTR JGBS.

AUSSIE BONDS: Cheaper, Narrow Ranges, Employment Report Tomorrow

ACGBs (YM -4.0 & XM -4.0) are holding cheaper after dealing in relatively narrow ranges in the Sydney session. There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined Westpac Leading Index.

- Cash US tsys are dealing little changed in today’s Asia-Pac session after yesterday’s cheapening following Fed Chair Powell’s "lack of further progress on inflation" comment.

- Cash ACGBs are 4bps cheaper, with the AU-US 10-year yield differential at -29bps.

- Swap rates are 4-5bps higher.

- The bills strip has bear-steepened, with pricing -1 to -7.

- RBA-dated OIS pricing is 3-6bps firmer for 2025 meetings. A cumulative 13bps of easing is priced by year-end.

- Tomorrow, the local calendar will see the Employment Report for March. There will be a lot of focus and uncertainty around this release after the outsized 116.8k rise in new jobs in February due to the timing of new starts around holidays. There could be payback for the outsized March outcome, which was the highest since the pandemic-affected November 2021.

- Bloomberg consensus expects a moderate 10k rise with the unemployment rate returning to its November/December level of 3.9%.

- Tomorrow’s local calendar also sees NAB Business Confidence for Q1.

AUSTRALIAN DATA: Westpac Lead Index Signals Weak But Positive Growth

The Westpac leading index fell 0.05% m/m in March with the 6-month annualised rate at -0.2% after being flat the previous month. This rate leads detrended growth by 3 to 9 months and so is signalling subdued but positive growth continuing into H2 2024, which the RBA has in its latest forecasts. It expects Q4 growth to be 1.8% y/y after 1.3% in Q2. Westpac expects the Board to be on hold in May.

- Westpac continues to forecast 2024 GDP growth of 1.6% similar to 2023 but below trend at around 2.5% y/y.

- The improvement in the 6-month rate since September has been due to equities, unemployment expectations and commodities in AUD. The latter though fell 5.1% m/m in March and may be at a turning point. The yield spread, US IP and dwelling approvals were all a drag.

Source: MNI - Market News/Refinitiv

NZGBS: Yields Sharply Higher After Q1 CPI Signals Sticky Domestic Inflation

NZGBs closed just off the worst levels of the session, with yields 6-7bps higher. The key event of today’s session was the release of Q1 CPI.

- While Q1 CPI printed in line with consensus at 0.6% q/q and 4.0% y/y, the continued stickiness of domestically driven non-tradeables inflation is likely to keep rates on hold for some time, especially as we’ve seen most of the disinflationary impact from tradeables.

- The 10-year NZGB slightly underperformed its $-bloc counterparts, with the NZ-US and NZ-AU yield differentials 2bps and 1bp wider on the day.

- Nevertheless, NZ-US 10-year yield differential at +26bps sits near its tightest level since mid-2021. Before the recent narrowing, this differential had oscillated between +30 and +80bps since late 2022.

- Swap rates closed 3bps higher than pre-CPI levels and 5bps higher on the day.

- RBNZ dated OIS pricing closed is 3-9bps firmer after the data across meetings, with late-24/early-25 leading. A cumulative 30bps of easing is priced by year-end versus 38bps before the data.

- Tomorrow, the local calendar is empty apart from the NZ Treasury’s planned sale of NZ$275mn of the 4.5% May-30 bond, NZ$175mn of the 2.0% May-32 bond, NZ$50mn of the 2.75% May-51 bond and NZ$30mn of the 3% Sep-30 Inflation-Linked bond.

NEW ZEALAND DATA: Domestic Price Pressures Sticky, Prolonged Hold

Q1 CPI printed in line with consensus at 0.6% q/q and 4.0% y/y up from Q4’s 0.5% q/q but the lowest annual rate in almost 3 years helped by base effects. The RBNZ is unlikely to be concerned that it came in above its 3.8% y/y forecast as it was expecting some near term volatility. However, the continued stickiness of domestically-driven non-tradeables inflation is likely to keep rates on hold for some time, especially as we’ve seen most of the disinflationary impact from tradeables.

- The non-tradeables CPI rose 1.6% q/q, higher than the RBNZ’s 1.1% forecast, to be up 5.8% y/y, down only 0.1pp from Q4. There are some components in this measure that the RBNZ cannot impact but others it can. In Q1 it was driven by rents, construction of new houses and cigarettes and tobacco. The latter was due to an increase in excise, so outside the RBNZ’s control, but it does have some impact on the other two. Domestic price pressures remain high.

- Services inflation remains a concern rising 1.3% q/q and 5.3% y/y, up from Q4’s 1.1% and 4.7%. It is another sign of sticky domestically driven inflation.

- Rents rose 4.7% y/y in Q1, which Statistics NZ notes is “the highest rate since the series was introduced in September 1999”. High immigration is adding significantly to housing demand.

- Tradeables CPI fell 0.7% q/q, it sharpest quarterly fall since Q2 2020, to be up 1.6% y/y, down from 3.0%. Goods inflation moderated further to 3.3% y/y from 4.7%, lowest in 3 years.

- The RBNZ’s measure of underlying inflation is released today at 1300 AEST. It is expected to continue trending lower.

Source: MNI - Market News/Refinitiv

FOREX: NZD Up Post Sticky CPI, USD Weaker Elsewhere

The USD sits marginally off recent highs, last around 1265.25, off nearly 0.10% versus end NY levels from Tuesday. An NZD/USD bounce has been the standout today, up nearly 0.50%, post stronger than expected Q1 CPI details.

- The Kiwi is higher versus all G10 currencies, with the expectation that the RBNZ is unlikely to lower its OCR anytime soon. NZGBs are 6-8bps higher today, with most of the move coming post NZ CPI.

- NZD/USD was last near 0.5900, earlier highs were at 0.5908. Apr 15 highs at 0.5950 will be viewed as upside resistance. Support seen at 0.5864, Nov 11 lows.

- AUD/USD has been dragged higher, last near 0.6415, close to 0.20% firmer. Outside of spill over from NZD gains, we have seen a better China equity tone (amid assurances from the regulator), while US equity futures are also higher, up over 0.20%.

- The AUD/NZD cross is lower, last near 1.0860, close to recent lows. The AU-NZ 2y swap has edged lower down 1.5bps to -94.50bps.

- USD/JPY has traded very a tight range, last near 154.60/65, down slightly. US yields are close to unchanged. Earlier we had solid Japan export growth for March, but it was in line with expectations. The South Korean and Japan FinMins also discussed the respective weakness of their two exchange rates.

- Later the Fed’s Mester speaks and the Beige Book is published. The ECB’s Lagarde, Schnabel and Cipollone and BoE’s Bailey appear. In terms of data, March UK CPI/PPI and euro area CPI are released.

ASIA PAC EQUITIES: Equities Mixed, Powell's Hawkish Comments And FX Moves The Focus

As Asian markets break for lunch, regional equities trade mixed. Japanese equities the worst performers, while Taiwan equities perform the best up about 1.5%. Local currencies have been the main focus in the region today, with the yen front and center as investors watch closely for any intervention from the BoJ, while comments from Fed Chair Jerome Powell indicated that policymakers will wait longer then expected before cutting interest rate due to a string of unexpectedly high inflation reports. Earlier New Zealand CPI was the main economics data point in the region and was in line with expectations at 4%, this is the lowest figure in almost three years, although still comfortably above the RBNZ target range of 1-3%.

- Japanese stocks initially opened slightly higher, but quickly turned negative as investors weigh the implications of Jerome Powell's remarks on the Federal Reserve's future interest rate adjustments and watch for any risk of currency intervention. The yen has remained stable at trading around 154.60 throughout the session after experiencing a sudden and brief rally overnight. While a weakening yen, currently at a three-decade low, could benefit exporters, there is mounting unease about the speed of its decline and the currency's volatility. Equities have recovered somewhat from earlier moves lower with he Topix now down 0.40% after being down as much as 1.30%, while the Nikkei fares slightly better down 0.12%.

- South Korea’s Kospi is lower today down 0.15%, local yields are higher with the KTB 10Y above 3.60% for the first time since mid-December, while the KRW is off lows now trading at 1,389.70. Foreign investors has sold 160b won of equities today, while retail investors have purchased 246b won.

- Taiwan equities are higher today largely tracking mainland China's markets higher with the Taiex now up 1.50% at 20,187 and now testing the 20-day EMA. The index is still 3.30% off recent highs after failing to break the 20,800 last week. Foreign investors have sold $1.3B of equities on Tuesday, the largest amount since Jan 17th the second highest for the past year, for a total outflow of $2.8b of outflows over the past 4 trading days.

- Australian equities are unchanged today, gains in Financials are being offset by loses in Mining and Health Care names. Earlier Westpac Leading Index fell to -0.05% in March from 0.08% in Feb. The ASX200 is off 3.60% from recent highs and hovers just above support at 7,600.

- Elsewhere in SEA, New Zealand Equities are 0.60% higher after CPI data fell to 4%, the weakest reading in almost three years. Thailand's SET Index is down 2.06% as the market returns from holidays, the Indonesian JCI is up 0.21%, Philippines PSEi is up 1%, Singapore equities are up 0.50%, while Malaysian equities are down 0.15%

ASIA EQUITIES: China & HK Equities Higher, Small-Caps Up On CSRS Clarification

Hong Kong and China equity markets are mostly higher today. On Tuesday the CSI2000 was down 7.16% after a report from the CSRC, however they since clarified and said the latest delisting rules would target “zombie” listed companies but not small-cap stocks in the index, the tighter delisting rules also won’t have an impact on the market in the short term. The index has rebounded the majority of Tuesday sell-off to be up 5.50% today, although is still down around over 8% the past week, versus the CSI300 which is unchanged over the same time. Elsewhere, China's banks may become a focus today after Fitch revises down outlooks.

- Hong Kong equities are mixed today, the HSTech Index is down 0.20%, the Mainland Property Index is unchanged, while the HSI is down 0.07%. In China, the CSI300 is up 0.70%, while the focus has been on smaller-cap and growth indices with the CSI1000 up 3.28% and the ChiNext is 1.34% higher.

- China Northbound saw 2.8b of inflows on Tuesday, with the 5-day average at -0.83billion, while the 20-day average sits at 0.21billion yuan.

- In the property space, Chinese developers, saw their shares rise in Hong Kong afternoon trading, possibly due to reports suggesting the establishment of a national real estate platform to acquire unfinished properties for affordable housing. CIFI Holdings closed 4.5% higher, while Sunac China rose 4.4% and Sino-Ocean closed 4% higher. The positive sentiment followed news that CIFI had received government financing support for 15 projects, with 68 projects included in the "white-list." However, concerns about falling home prices persisted, with Bloomberg's gauge of Chinese developers' stocks narrowing losses to 2.4%.

- On Tuesday, Chinese President Xi Jinping defended his country's export practices during talks with German Chancellor Olaf Scholz, highlighting the positive impact of China's clean technology exports on global inflation and climate change efforts. Despite Western pressure to address overcapacity and unfair trade practices, Xi emphasized the importance of objective market perspectives and warned against protectionism, while Scholz pressed for better market access and fair competition conditions for German firms during his visit to China.

- Looking ahead, Hong Kong has Unemployment data due on Thursday, while China's 1 & 5 yr LPR on Monday is the next focus

ASIA EQUITY FLOWS: Equities Head Lower, As Foreign Investors Dump Stock

- China equities flows have been mixed recently with an outflow of 2.80b yuan on Tuesday, there has been little direction as CSI300 failed to break above the 3,600 mark, although over the past few days there has been a divergence between small-cap and large-cap indices. On Tuesday China's GDP data show a strong beat coming in at 5.3% vs 4.8% although Industrial Production and Retail Sales data missed estimates. Equity flow momentum is flat, with the 5-day average now -0.83b, 20-day average at 0.21b and the longer term 100-day average now just 0.38B yuan.

- Taiwan equities saw another day of outflows with a -$1.34b leaving the market marking the fourth straight day of selling by foreigners for a total of about $2.8b. The Taiex was down 2.28% on Monday and now off 4.70% over the past week after failing to break the 20,800 level and now trades below the 20-day EMA at 19,900. The 5-day average is now -$554m, vs the 20-day at -$309m both well below the longer-term trend of $134m

- South Korea equities have now marked three straight days out net selling by foreign investors and the largest outflow since 15th March, with $305m leaving the market. The Kospi is now off 6.40% from recent highs, and has broken below the 20, 50 & 100-day EMA, sellers are in control with the 14-day RSI now at 34.50. The 5-day average to $87m, the 20-day average to $284m and the 100-day average to $181m.

- Philippines equities broke below the 6,800-mark Apr 5th, a level that had acted at support for the prior month or so, the PSEi is now off 9.42% from its highs made on Apr 2nd and broke through the support zone of 6,600 on Monday, the index now trades down at 6,400. Equity flows have been negative for 8 straight days for a total outflow of -$87m. The 5-day average is -$11m, the 20-day average is -$8.25m, while the $1.47m.

- Indonesia returned from a long break on Tuesday and foreign investors have continued selling equities, with a $151m outflow, marking the 10th straight session out outflows for a total of $860m the JCI is now down 5.20% from recent cycle highs. The 5-day average is now -$128m, the 20-day average is -7m, while the longer term 100-day average is still positive at $14.7m Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| China (Yuan bn)* | -2.8 | -4.2 | 58.2 |

| South Korea (USDmn) | -306 | 437 | 13809 |

| Taiwan (USDmn) | -1335 | -2773 | 1846 |

| India (USDmn)** | -388 | 302 | 1339 |

| Indonesia (USDmn) | -152 | -640 | 950 |

| Thailand (USDmn)*** | -50 | 243 | -1666 |

| Malaysia (USDmn) ** | -111 | -217 | -447 |

| Philippines (USDmn) | -21 | -56.6 | 97 |

| Total (Ex China USDmn) | -2362 | -2706 | 15928 |

| * Northbound Stock Connect Flows | |||

| ** Data Up To Apr 15th | |||

| *** Data up to Apr 11th |

OIL: Crude Lower As Fed Easing Seems Delayed But Watching Geopolitics

Oil prices have trended lower throughout the APAC session as there were no new developments in either the Middle East or Russia on Tuesday while US crude stocks rose sharply and Fed cuts are likely to be delayed. The market remains wary though of anything in the geopolitical space. The USD index is down 0.1%.

- WTI is down 0.7% to $84.77/bbl, close to the intraday low of $84.71. Brent is 0.6% lower at $89.49 having breached $90 early in the session. It is just off its low of $89.44.

- The Middle East remains firmly within the market’s radar after Israel said it would respond to Iran’s drone/missile attack but when it feels the time is right. Iran replied that it would promptly retaliate.

- In the options market, calls are trading at their widest premium over puts since the Hamas attack on Israel in October and 3mn barrels have been bought betting that prices reach $250 by June, according to Bloomberg.

- Bloomberg reported that US crude stocks rose 4.09mn barrels last week, according to people familiar with the API data. But there were inventory drawdowns of refined products, gasoline -2.5mn and distillate -427k. The official EIA data is out later today.

- Later the Fed’s Mester speaks and the Beige Book is published. The ECB’s Lagarde, Schnabel and Cipollone and BoE’s Bailey appear. In terms of data, March UK CPI/PPI and euro area CPI are released.

GOLD: Advance Takes A Breather

Gold is little changed in the Asia-Pac session, after closing unchanged at $2382.89 on Tuesday.

- Bullion proved resilient in the face of Fed Chair Powell’s "lack of further progress on inflation" comment, which pressured US Treasuries.

- The DXY was also firmer on Powell's comments amid expectations the ECB, the BoC, and possibly the BoE could cut before the Fed. USD-JPY also edged up on expectations the BoJ will remain accommodative.

- The yellow metal is up around 15% YTD, with the advance partially driven by haven demand as geopolitical tensions in the Middle East and Ukraine continue to percolate.

- According to MNI’s technicals team, attention remains on $2452.5, a Fibonacci projection. Initial firm support is at $2276.1, the 20-day EMA.

- After outperforming on Monday, silver fell 2% yesterday to ~$28/oz, leaving the metal around 5% off its recent 3-year high.

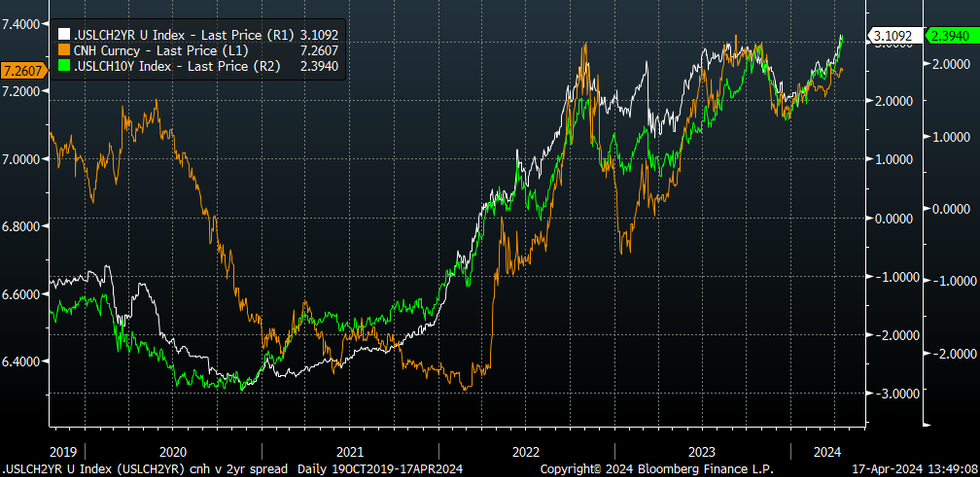

CNH: Yuan Defense Continues, But Relative Yield Spreads Still Point To USD/CNH Upside

USD/CNH is slightly lower, last near 7.2600, but has maintained tight ranges overall in the first part of Wednesday dealings. This keeps us comfortably within April to date ranges.

- Sources of support have been from the steady CNY fixing outcome. Yesterday's set above 7.1000 saw USD demand emerge, but there was no follow through. The authorities are still guarding against the pace of depreciation.

- CNH liquidity also remains tight. The 1 month CNH Hibor in HK above 5%, close to fresh highs since 2018. Still, US-CH government bond yield differentials point to higher USD/CNH levels see the chart below.

- Insofar as these differentials represent a rough proxy for monetary policy differentials between the two economies, it suggests downside in USD/CNH will be limited in the near term, albeit without a sharp pull back in spreads.

- Some sell-side analysts have turned more cautious on further China policy easing post yesterday's Q1 GDP beat, but tightening is clearly not on the agenda.

- Onshore USD/CNY spot is also showing very limited downside and continues to trade close to the top end of the daily fixing band, which still suggests underlying onshore depreciation pressures.

Fig 1: USD/CNH Versus US-CH Government Bond Yield Differentials

Source: MNI - Market News/Bloomberg

ASIA FX: USD/Asia Pairs Mixed, Won Rebounds, THB Weakens As Onshore Market Re-Open

USD/Asia pairs are mixed, with CNH modestly stronger, while KRW has rebounded strongly. A number of SEA currencies are weaker, most notably THB, with the country's onshore markets returning from a 3 day break. The better tone to some regional equity markets, along with lower BBDXY levels, has likely helped cap USD/Asia upside. The data calendar is fairly light tomorrow.

- USD/CNH sits slightly lower, last under 7.2600. This keeps us comfortably within April to date ranges. Sources of support have been from the steady CNY fixing outcome. CNH liquidity also remains tight. The 1 month CNH Hibor in HK above 5%, close to fresh highs since 2018. Still, US-CH government bond yield differentials point to higher USD/CNH levels. Onshore USD/CNY spot is also showing very limited downside and continues to trade close to the top end of the daily fixing band, which still suggests underlying onshore depreciation pressures.

- Spot USD/KRW sits back near 1385, up slightly from session lows just under 1383, but still 0.7% stronger in KRW terms. We had fresh jaw boning this morning from both the BoK Governor and FinMin who are in the US at the moment for G20 meetings. Yesterday's highs around 1400 likely remain a short term line in the sand for the pair. For spot USD/KRW the 20-day EMA sits back near 1358.6.

- USD/SGD is down a touch last near 1.3640. Recent highs rest at 1.3670. We had weaker than expected export data earlier. Headline exports fell -8.4% m/m, -20.7% y/y. Electronic exports were down -9.4% y/y (prior +5.2%). the GSD NEER (per Goldman Sachs estimates) is slightly higher though, last -0.73% from the top end of the band (end Tuesday levels were -0.78%).

- Thailand markets return today, after being shut since last Thursday (11th of April). The early FX trend is a fairly muted one, but as the session has progressed USD gains have firmed. USD/THB was last near 36.84, +0.60% firmer. This is close to earlier April highs, a break above these levels would likely see 37.00 targeted. On the downside, the 20-day EMA is back near 36.375.

- USD/PHP spot has broken above 57.00 in the first part of Wednesday trade. The pair was last around 57.24, fresh highs back to Nov 2022, -0.40% weaker in PHP terms for the session, (earlier highs were at 57.266). BSP Governor Remolona stated yesterday that the 57.00 level was not a strong resistance point as far as the authorities were concerned. He also added that tensions in the South China Sea were another source of PHP pressure.• The Governor also cautioned against rate cut expectations, with inflation at risk of being above the target for the third year (BBG).

- USD/IDR is up around 0.30% in the first part of Wednesday trade, last near 16230. Earlier highs were at 16260. Some pent up demand for onshore dollars may be a factor, given markets only returned yesterday from an extended break. Still, the slightly improved regional equity tone has helped push the 1 month USD/IDR NDF down from recent highs.

INDONESIA: Indonesian Sov Curve Steeper, Retail Sales Rose 3.5% y/y

The Indonesian sov curve has twist-steepened today, pivoting at the 10yr as yields trade flat to 3bps higher. Retail sales estimate increased by 3.5% y/y, and 4.1% m/m according to BI.

- The INDON sov curve has twist-steepened on Wednesday with the 2Y yield 1.5bps higher at 5.24%, 5Y yield is 2bps higher at 5.32%, further out the 10Y yield is unchanged after moving 18bps higher on Tuesday, the 10y trades 5.47% off earlier highs of 5.51%, while the 5-year CDS is unchanged at 80.50bps and at the highest levels since mid Nov 2023.

- The INDON to UST spread has tighten with the 2yr now 25.5bps (-3.5bps), 5yr is 62.5bps (-2bps), while the 10yr is 81bps (unchanged)

- In cross-asset moves, the USD/IDR is 0.33% higher at 16,229, the JCI is 0.54% higher, Palm Oil is 1.89% lower, while US Tsys yields are mostly unchanged

- Indonesia's retail sales estimate increased by 3.5% year-on-year and by 4.1% month-on-month in March, supported by rising activity during Ramadan and ahead of the Eid-al-Fitr festivity. The growth was driven by higher sales of clothing, spare parts and accessories, and automotive fuel, with retailers anticipating continued solid sales through May, expecting price pressure to ease post-Eid.

- Looking ahead: Calendar remains empty until Trade Balance on Monday and BI rate decision on Wednesday

PHILIPPINES: Philip Sov Curve Flattens, PHP Move Not Large Enough To Impact Policy

The Philip sov debt curve has bear-flatten today, with yields 1-4bps higher. Earlier Bangko Sentral ng Pilipinas Governor Eli Remolona entioned the recent slide in the PHP isn't large enough to impact monetary policy.

- The PHILIP curve has bear-flattened today, with front-end yields up 2-4bps, while the longer end is mostly unchanged, the 2Y yield 4bps higher at 5.09%, 5Y yield is 3bps higher at 5.355%, 10Y yield is unchanged at 5.50%, while 5yr CDS is unchanged to 69bps.

- Moves over the past week have been large with the 2y now 26bps higher, 5y now 35bps higher and the 10yr now 40bps higher.

- The Philip to US Treasury has tighten over the past day with the 2y now 9bps (-3bp), the 5yr is 63bps (-3bps), while the 10yr is 84bps (-1.5bp).

- Cross-asset moves: the USD/PHP is up 0.50% at 57.285, PSEi Index is up 0.57%, while US Tsys yields are mostly unchanged.

- Looking Ahead, Balance Of Payments Overall on Friday

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/04/2024 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 17/04/2024 | 0600/0700 | *** |  | UK | Producer Prices |

| 17/04/2024 | 0900/1100 | *** |  | EU | HICP (f) |

| 17/04/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 17/04/2024 | 0900/1100 |  | EU | ECB's Cipollone in Italian Banking Meeting | |

| 17/04/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 17/04/2024 | 1205/1305 |  | UK | BoE's Greene on IIF Panel | |

| 17/04/2024 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/04/2024 | 1300/1500 |  | EU | ECB's Cipollone at IIF Global Outlook Forum | |

| 17/04/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 17/04/2024 | 1545/1745 |  | EU | ECB's Schnabel Speaks At IRFMP | |

| 17/04/2024 | 1600/1700 |  | UK | BoE's Bailey In IIF Fireside Chat | |

| 17/04/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 17/04/2024 | 1800/1400 |  | US | Fed Beige Book | |

| 17/04/2024 | 1800/1900 |  | UK | BoE's Haskel At Kings College London Panel | |

| 17/04/2024 | 2000/1600 | ** |  | US | TICS |

| 17/04/2024 | 2130/1730 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.