-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Oil Pares Early Gains

- Oil prices are currently close to unchanged during APAC session although they have been trading in a range of about a dollar. Earlier in the session they received some support from the failed uprising in Russia, as it remains a major oil producer.

- Elsewhere the spillover from the unrest is Russia has been limited, risk sentiment firmed through the Asian session with the USD moderately pressured and US equity futures firmer.

MARKETS

US TSYS: Marginally Richer In Asia

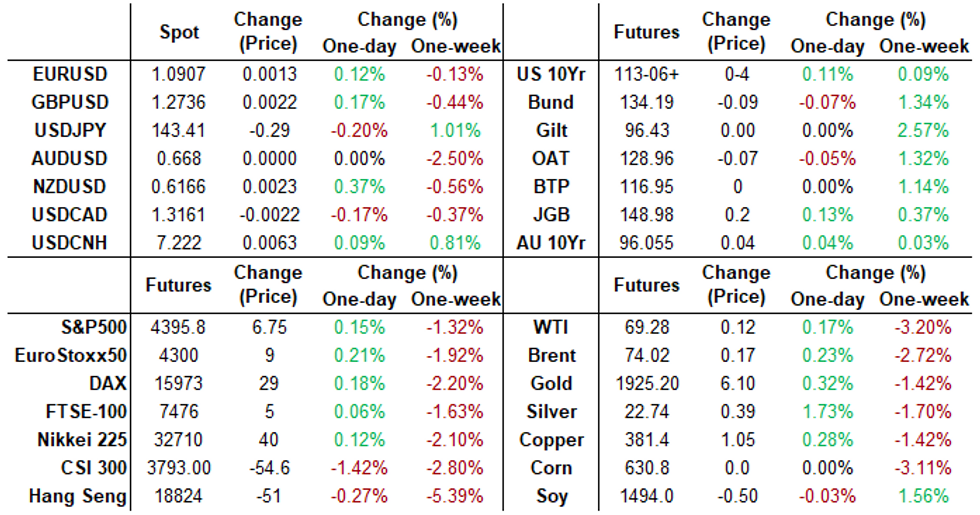

TYU3 deals at 113-05+, +0-03, a 0-04+ range has been observed on volume of ~60k.

- Cash tsys sit ~1bp richer across the major benchmarks.

- Tsys richened in early dealing as participants digested news of the political unrest in Russia over the weekend.

- Gains were marginally pared, there was little follow through on the move and tsys observed narrow ranges for the majority of the session.

- Little meaningful macro news flow crossed in Asia today.

- There is a thin data calendar in Europe on Monday. Further out Dallas Fed Mfg Activity is due. We also have the latest 2 Year supply.

JGBs: Futures Stronger, Light Calendar Today, 20-Year Supply Tomorrow

JGB futures are trading on a high note in the Tokyo afternoon session at 148.94, +19 compared to the settlement levels.

- Apart from the previously mentioned Summary of Opinions from the BoJ's June meeting, which included a board member's suggestion to discuss a potential revision to the treatment of yield-curve control (See link ICYMI), there have been minimal domestic factors worth highlighting.

- Given the absence of significant local news, it appears that the domestic market has been impacted by the slight uptick in US tsys during Asia-Pac trading, which was triggered by the political unrest in Russia over the weekend.

- The cash JGB curve bull flattens beyond the 1-year zone in Tokyo afternoon trade. Beyond the 1-year zone, yields are 0.3-1.8bp lower with the 30-year zone as the best performer. The benchmark 10-year yield is 0.5bp lower at 0.364%, below the BoJ's YCC limit of 0.50%. The 20-year is 1.1bp lower at 0.960%, showing no concession on the curve, ahead of tomorrow’s supply.

- Swap rates are lower beyond the 2-year with swap spreads wider across the curve.

- The local calendar tomorrow sees the release of Coincident & Leading Indicators for April (final), along with 20-year supply.

AUSSIE BONDS: Showing Strength, Watching Russian Headlines, CPI Monthly On Wednesday

ACGBs showed strength in the Sydney session (YM +6.0 & XM +4.0). The trading range remained relatively narrow, lacking significant domestic catalysts. Instead, the movements in the local market seemed to be influenced by the slight upward trajectory of US tsys, which responded to the political unrest that occurred in Russia over the weekend. Asia-Pac trading saw cash US tsy yields 1-2bp lower. It is worth highlighting, however, that global markets, including commodities like oil and gold, as well as stocks and currencies, demonstrated a notable sense of stability throughout Monday's Asian trading session.

- Cash ACGBs are 4-7bp richer with the 3/10 curve steeper and the AU-US 10-year yield differential +4bp at +24bp.

- Swap rates are 4-7bp lower with the 3s10s curve steeper.

- The bills strip bull flattens with pricing +5 to +9.

- RBA-dated OIS pricing is 3-7bp softer across meetings.

- The local calendar is light tomorrow with the weekly highlights being Wednesday’s CPI Monthly and Thursday's Retail Sales releases. CPI monthly is expected to print at 6.1% y/y, after the unexpected jump to 6.8% in April. Meanwhile, retail sales are expected to provide further confirmation that the consumer slowdown is underway.

NZGBs: Richer, Narrow Range, Global Markets Calm Despite Russian Unrest

NZGBs closed 5-6bp richer after trading in a relatively narrow range in local trade. With a lack of significant local news, it seems that the domestic market has been influenced by the slight strengthening of US tsys during Asia-Pac trade, triggered by the political unrest in Russia over the weekend. However, it is worth noting that global markets, including commodities such as oil and gold, as well as stocks and currencies, displayed a sense of stability during Monday's Asian trading session.

- Swap rates closed 4-6bp lower with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed 1-4bp softer for meetings beyond July with terminal OCR expectations at 5.64%.

- The local calendar is light until Thursday when the latest ANZ Business Outlook survey is to be released. On Friday, consumer sentiment is expected to continue to signal ongoing recessionary conditions, as households deal with the headwinds of high inflation and interest rates.

OIL: Crude Loses Early Gains From Russian Unrest

Oil prices are currently close to unchanged during APAC session although they have been trading in a range of about a dollar. Earlier in the session they received some support from the failed uprising in Russia, as it remains a major oil producer. But WTI is flat now at around $69.18/bbl, close to the intraday low of $69.01. Brent is marginally higher at $73.92, close to the low of $73.76. The USD index is down 0.1%.

- WTI breached $70 early in APAC trading but couldn’t hold it and has trended down since. Brent approached $75 but stopped at $74.80. Technicals remain bearish.

- The unrest in Russia over the weekend is generally not expected to impact output. According to Bloomberg, Goldman Sachs thinks the market will remain focussed on fundamentals but RBC believes that the risk of further trouble “must be factored into our oil analysis”.

- Later there is the German IFO survey for June and the US Dallas Fed June manufacturing index. ECB President Lagarde will give opening remarks at the ECB Forum.

GOLD: Stronger On Russian Unrest & Recessionary Fears

Gold edges higher to 1925.71 (+0.25%) in Asia-Pac trading as geopolitical uncertainty increases following the weekend’s attempted mutiny by Russian mercenary group Wagner. The upside for gold may however prove limited after Wagner leader Yevgeny Prigozhin suddenly halted his dramatic advance toward Moscow.

- Ahead of the weekend, bullion closed 0.4% higher as the market weighed recessionary signals that came from the latest round of PMI data. Advance PMIs for June suggested that the Eurozone economy had slowed sharply with the service sector PMI dropping more than expected and the manufacturing PMI falling further into contractionary territory. In the US, the manufacturing PMI fell more than expected into contractionary territory and sat just above the lows from December of last year.

- Nonetheless, gold closed 1.9% lower last week as hawkish commentary from global central banks weighed.

FOREX: USD Moderately Pressured In Asia

The greenback is moderately pressured in Asia today, risk sentiment remains resilient after Russian political instability over the weekend.

- Kiwi is the strongest performer in the G-10 space at the margins. NZD/USD is up ~0.4% and last prints at $0.6165/70. The pair has firmed above the 20-Day EMA ($0.6161). AUD/NZD is down ~0.3%, falling below the 200-Day EMA. The cross last prints at $1.0835/45.

- AUD is a touch firmer however ranges have been narrow with little follow through.

- The Yen is firmer after comments from vice finance minister Kanda that FX intervention can't be ruled out. The BOJ Summary of Opinions noted that one member asked for an early revision of YCC. USD/JPY is ~0.2% lower.

- Elsewhere in G-10 GBP and EUR were ~0.1% firmer.

- Cross-asset wise; BBDXY is down ~0.2% and e-minis are up ~0.2%. 2 Year US Treasury Yields are down ~1bp.

- There is a thin data docket in Europe today.

TRADE: Trade & IP Growth Appear To Have Stabilised At Lacklustre Rates

The CPB global data for April showed that the deterioration in trade and production growth appears to have stopped in line with the S&P Global PMI. They are now moving sideways with global IP posting slight growth of 1.4% y/y after 0.7% in March. Trade is stagnating falling 0.8% y/y after rising 0.8% y/y. However, it is concerning that both are losing momentum and IP has posted monthly falls for two consecutive months. The May manufacturing global PMI was steady at 49.6 for the third consecutive month, signalling a slight contraction in industrial activity but there shouldn’t be a material deterioration in the months ahead. Services are driving growth with the global services PMI at 55.5.

Global growth

Source: MNI - Market News/Refinitiv/Bloomberg

AUSTRALIA: Housing Only Slightly Overvalued Now

With rents up 4.9% y/y in Q1 and house prices down 8.9%, housing was only 2.3% overvalued down from 6.4% in Q4 and 19.6% in Q1 2022, as measured by the ratio of house prices to CPI rents. Housing may no longer return to “fair value” going forward as rents are expected to rise further. But this will depend on how far prices rise, as the Q2 average already increases the degree of overvaluation to 2.5% assuming rents rise at Q1’s quarterly pace.

Australia housing valuation

Source: MNI - Market News/Refinitiv

AUSTRALIA: Rising House Prices To Add To Affordability Woes

House prices began to rise again in March after 10 consecutive monthly declines and are now 3% above the February trough but the rise is going to put additional pressure on already stretched housing affordability. It appears that buying a home is going to get more difficult over the months ahead, thus increasing demand for rentals at a time when dwelling approvals are their lowest level since 2012. The RBA has also noted that rising house prices could support consumer demand.

- If the tightening of monetary policy seen since May 2022 is excluded and we just look at the house price to disposable income ratio (assuming Q2 disposable income will rise in line with Q2 2022 and the April/May average of house prices), then affordability has improved because of the correction in house prices. Our estimate of the ratio is 1.6% below trend in Q2 but is up from -3.4% in Q1 because of rising prices.

- Our Q2 estimate of the housing affordability index, which includes mortgage rates, is 35.4% below trend, which is a further deterioration from Q1’s -30.5% driven by higher rates and house prices. Given the 2.7% y/y rise in population over 15yrs in May and the significant housing shortage, prices are likely to continue to rise putting further downward pressure on house prices.

Source: MNI - Market News/Refinitiv

*Q2 = average (Apr/May) CoreLogic house prices/rates, income rises by same as Q2:22

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/06/2023 | 0700/0900 | ** |  | ES | PPI |

| 26/06/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 26/06/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 26/06/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 26/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 26/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 26/06/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 26/06/2023 | 1730/1930 |  | EU | ECB Lagarde Opens ECB Forum |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.