-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI EUROPEAN MARKETS ANALYSIS: Post-FOMC Impulse Moderates, Antipodean FX Soften Despite Data Beats

- Core FI regain poise after FOMC monetary policy decision. JGBs draw support from a decent offering of 20-Year debt, ACGBs move away from lows printed after a strong labour market report out of Australia.

- Most major Asia-Pac equity indices creep higher, albeit Australia's benchmark lags behind. Chinese tech shares continue to struggle on bubbling Sino-U.S. tensions.

- The Antipodeans lead losses in G10 FX space. AUD softens as RBA Gov Lowe continues to push back against rate hikes in 2022, despite stellar jobs data and rising consumer inflation expectations. NZD declines after New Zealand detects first Omicron case, even as Q3 GDP contraction proves smaller than expected.

BOND SUMMARY: Core FI Regain Poise, RBA Musings Drive ACGBs

The spillover from Wednesday's FOMC monetary policy decision applied a modicum of pressure to core FI in Asia-Pac hours, albeit main contracts clawed back losses later in the session as Omicron worry and Sino-U.S. tensions resurfaced.

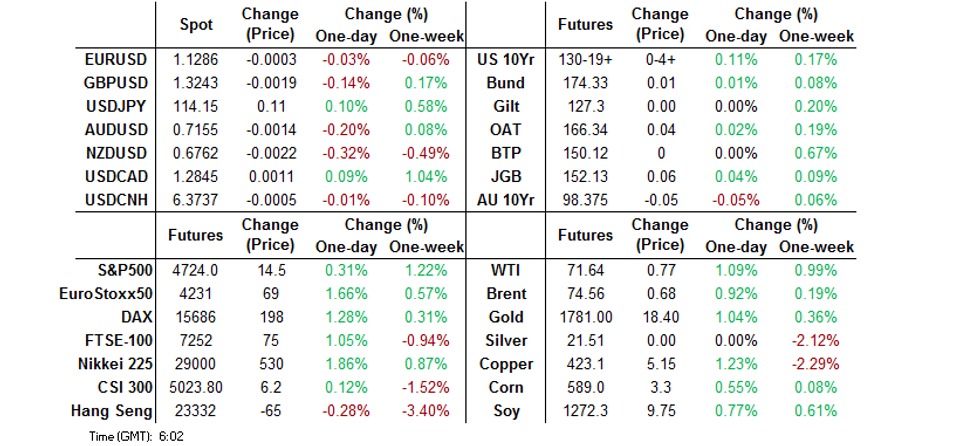

- T-Notes recovered from their Asia-Pac session low of 130-11+ and currently trade +0-04 at 130-19, even as U.S. e-mini futures remain marginally in the green. Cash Tsy curve runs a tad flatter, with yields last seen unch. to -1.0bp. Eurodollar futures trade 0.5-3.0 ticks through the reds. Local data highlights on Thursday include industrial output, housing starts, building permits & weekly jobless claims.

- Initial weakness in JGB futures disappeared after the Tokyo lunch break, which resulted in a rebound to a fresh session high of 152.10. The contract last trades at 152.09, 2 ticks above Wednesday's settlement. Cash JGB curve bull flattened at the margin. The MoF sold Y1.1992tn 20-Year JGBs, with lowest bid topping the forecast level, which may have provided some support to the space. JGBs ignored Japanese data, which showed that trade deficit widened in November, albeit exports growth accelerated for the first time since May.

- RBA Gov Lowe outlined three scenarios of terminating bond purchases in 2022, while stressing that any decisions on QE will be unrelated to interest rate action. The Governor suggested that meeting the inflation target is still a "fair way" off, with rate hikes unlikely to materialise next year. This supported ACGBs in early trade, before they plunged on the back of a stellar labour market report released out of Australia, with all key metrics beating expectations. A surge in consumer inflation expectations to near-decade highs helped add fuel to hawkish RBA bets. ACGB yields shot higher in reaction to the jobs data, with 3-year yield gaining the most. Correction ensued, as broader core FI space lost momentum, which leaves cash ACGB yields trading +6.3bp to -1.3bp across a flatter curve. YM sits -8.1 (off lows) & XM -2.0 (near opening levels). Bills trade 2-12 ticks lower through the reds. Worth noting that Australian Treasury predicted a further tightening in the labour market going forward.

FOREX: Post-FOMC Impulse Evaporates, AUD Seesaws On RBA Speak & Jobs Data

Commodity currencies traded on a softer footing, while the DXY blipped higher, in a marginal reversal of post-FOMC moves. Omicron concerns and Sino-U.S. tensions came back into focus, as the dust settled after yesterday's announcement from the Fed, who accelerated asset purchase taper and projected three rate hikes next year.

- AUD seesawed between gains and losses as the latest comments from Reserve Bank chief and Australia's blowout Nov jobs market report fed into RBA repricing. Gov Lowe noted that "we are still a fair way from" the point where the Board could raise the cash rate, which is not expected to happen next year. He outlined three scenarios for ending bond purchases in 2022, but stressed that decisions on QE will have no implications for interest rate moves. Lowe's remarks were weighed against strong labour market data, with all key metrics smashing expectations, as well as an uptick to consumer inflation expectations which reached near-decade highs.

- NZD was the worst performer in G10 FX space, printing worst levels after Stuff reported that New Zealand found its first case of the Omicron coronavirus variant in a managed isolation facility. New Zealand's Q3 GDP data were shrugged off, even as the quarterly contraction of 3.7% was smaller than expected by sell-side analysts (-4.1%), let alone the RBNZ's projection from the latest Monetary Policy Statement (-7.0%).

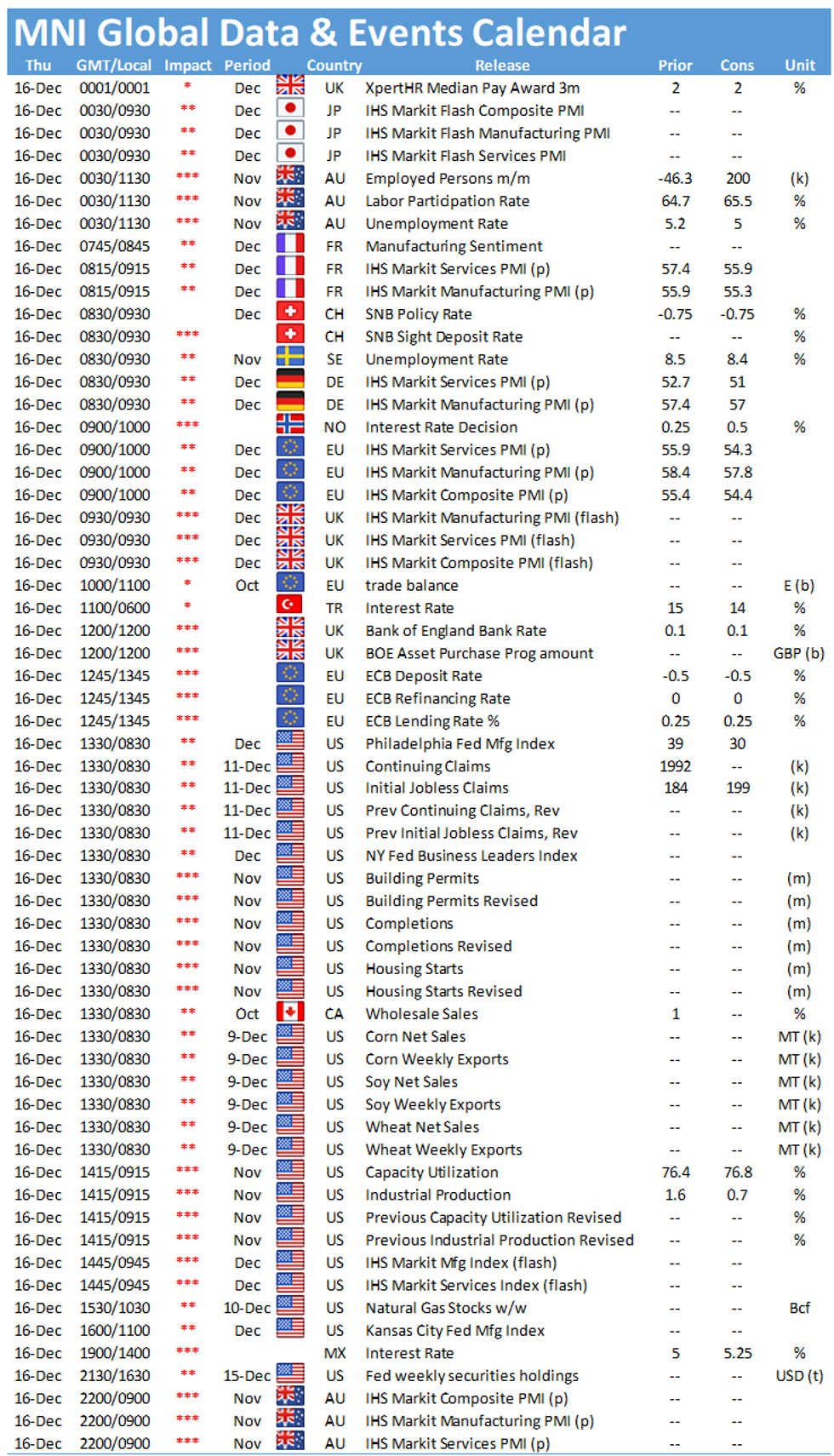

- The Fed inaugurated this week's crowded central bank marathon, set to resume later today with the announcements from the ECB, BoE, Norges Bank and several EM institutions (click the name of a bank to see our preview). Separately, flash PMI readings from the EZ as well as U.S. weekly jobless claims & industrial output take focus on the data front.

ASIA FX: Central Banks Steal Limelight

The impact of yesterday's monetary policy decision from U.S. Fed waned through the session, as focus turned to regional central banks and developments on the Omicron front.

- CNH: Offshore yuan meandered around neutral levels. The PBOC provided no surprises today, as its monetary injections matched maturities, while the yuan reference rate was set just 10 pips above sell-side estimate. Local media suggested that the People's Bank could trim their Loan Prime Rates next week.

- KRW: Spot USD/KRW operated in negative territory, as the won benefited from post-FOMC market flows. South Korea's economic officials noted that they do not expect much impact from the Fed decision but stand ready to intervene and stabilise markets if needed. The won gave up some of its initial gains later in the session, perhaps on the back of worrying Covid-19 dynamics in South Korea.

- IDR: Spot USD/IDR clawed back its initial losses. Indonesia confirmed its first case of Omicron and five more probable cases in Jakarta and Manado, albeit Health Min Sadikin said there are no signs of community transmission yet. Bank Indonesia are set to deliver their monetary policy decision today.

- PHP: Bangko Sentral ng Pilipinas are also poised to conclude their meeting today, but like their Indonesian colleagues are expected to leave interest rates unchanged. Elsewhere, Health Sec Duque said that the Philippines will maintain its current Covid-19 response strategy at least through the year-end. Spot USD/PHP held below neutral levels and printed its worst levels since mid-Nov.

- THB: Spot USD/THB crept higher. Little to write home on domestic headline flow, with participants eyeing next week's monetary policy decision from the Bank of Thailand.

- MYR: Spot USD/MYR was rangebound, with participants looking for fresh catalysts.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.