-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Risk Firms After PBOC Fix

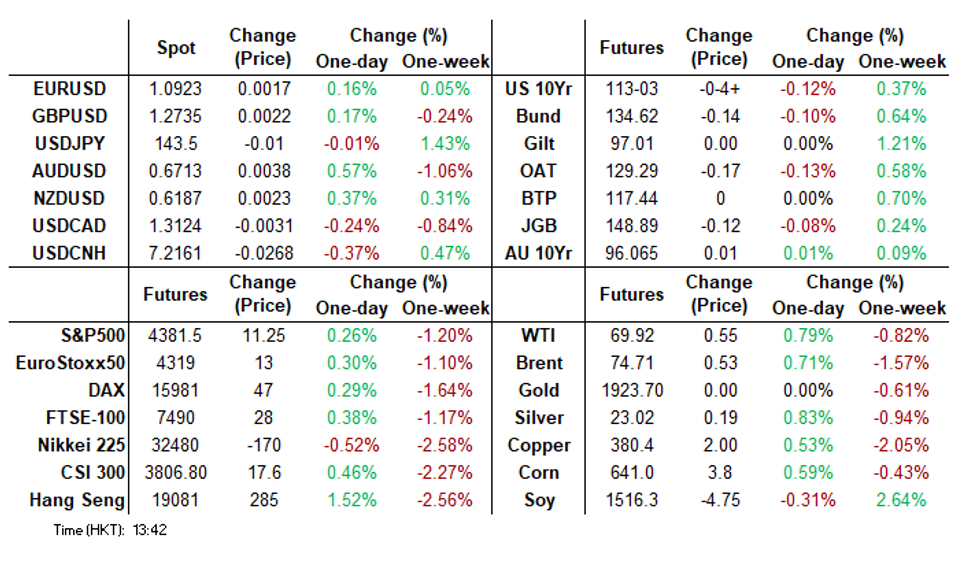

- Risk sentiment was buoyed in Asia after the PBOC fixed the CNY 100 pips lower than expected. USD/CNH sits ~0.4% lower today and AUD is the standout performer in the G-10 space at the margins.

- Elsewhere WTI futures are up ~0.7% and e-minis are ~0.3% firmer. Regional equities are higher, the Hang Seng is up over 1.5% and the CSI300 is up ~0.7%.

- There was a limited reaction in the Fixed Income space with US Tsys little changed, and JGBs softer after a weak 20 Year auction.

MARKETS

US TSYS: Narrow Ranges In Asia

TYU3 deals at 113-04+, -0-03, a touch off the base of the narrow 0-05 range on volume of ~49k.

- Cash tsys sit little changed across the major benchmarks.

- Tsys have been marginally pressured through the Asian session after the PBOC fixed the Yuan 100 pips stronger than forecast which weighed on the USD. However recent ranges have been respected thus far.

- Early in the session tsys were a touch firmer as Asia-Pac participants faded yesterday's issuance-induced retreat from session highs seen early in the NY session, perhaps using the opportunity to enter fresh long positions/close shorts.

- FOMC dated OIS price a terminal rate of 4.30% in November. There are ~70bps of cuts priced for 2024.

- There is a thin docket in Europe today. Further out we have a slew of US data including US new home sales, durable goods and Conference Board consumer confidence. We also have the latest 5-Year Supply.

JGBs: Futures Weaker After 20-Year Supply Sees Weaker Demand

In the Tokyo afternoon session, JGB futures are trading lower at 148.86, -13 from the settlement levels. The weaker demand observed at the auction of 20-year JGBs contributed to this downward trend. The auction price fell short of dealer expectations, and the cover ratio decreased compared to previous auctions. Furthermore, there was a notable increase in the auction tail compared to the May auction. The bid appears to have been influenced by the level of the outright 20-year yield and the richness of the 20-year on a 10/20/30-year butterfly.

- The leading economic indicator was revised at 96.8 in April, from 97.6 in the preliminary release, the Cabinet Office said. The Coincident indicator nuf=dged higher to 97.3 from 97.2.

- Cash JGBs remain mixed across the curve in afternoon trade break with the benchmark 10-year underperforming with its yield 1.1bp higher at 0.371%. The 40-year is the best performer with its yield 0.7bp lower at 1.354%.

- The 20-year zone sits 0.3bp higher at 0.959%, after being as low as 0.946%.

- The swap curve bear steepens with rates 0.5-2.6bp higher. Swap spreads are wider.

- The local calendar tomorrow is light tomorrow ahead of Retail Sales (May), International Investment Flows (June 23) and Consumer Confidence (June) on Thursday.

AUSSIE BONDS: Slightly Richer, At Cheaps, CPI Monthly Tomorrow

ACGBs sit slightly higher (YM +1.0 & XM +2.0). However, current levels are respectively 7bp and 5bp lower than the highs recorded during overnight trading. Given the lack of significant local news, it is likely that local market participants have been closely monitoring headlines and keeping an eye on the movements in US tsys during Asia-Pac trading. US tsy futures are 03+ cheaper at 113-03+, after reaching a high of 113-09 in early Asia-Pac trade.

- Cash ACGBs are 2bp richer with the AU-US 10-year yield differential unchanged at +20bp.

- Swap rates are 2-3bp lower with EFPs little changed.

- The bills strip bull flattens with pricing flat to +5.

- RBA-dated OIS pricing is 1-4bp softer across meetings. A 38% chance of a 25bp hike at the July meeting is priced.

- The local calendar heats up tomorrow with the release of May’s CPI Monthly, ahead of Thursday's release of Retail Sales for May. CPI monthly is expected to print at 6.1% y/y, after the unexpected jump to 6.8% in April. Meanwhile, retail sales are expected to provide further confirmation that the consumer slowdown is underway.

- The AOFM plans to sell tomorrow A$300mn of the 1.75% 21 June 2051 bond.

NZGBS: Gives Back Early Strength, Closes Flat, Review Leaves RBNZ’s Remit Unchanged

NZGBs closed on a low note with benchmark yields 1-2bp higher after trading 5bp lower earlier in the local session. In the absence of domestic catalysts, the local market appears to have been content to be steered by US tsys in Asia-Pac trade. Cash US tsys are 0.5-1bp cheaper, after giving up earlier gains.

- NZ Finance Minister Grant Robertson says the Reserve Bank’s Monetary Policy Committee remit and charter is largely unchanged following the first five-year review, with only minor changes to the monetary policy framework. Adding that the current monetary policy framework “remains fit for purpose”. (See link)

- Swap rates closed 1bp lower with implied swap spreads tighter.

- RBNZ dated OIS pricing closed flat to 2bp softer across meetings with terminal OCR expectations at 5.64%.

- The local calendar tomorrow is light again ahead of the latest ANZ Business Outlook survey on Thursday. On Friday, Consumer Sentiment is expected to continue to signal ongoing recessionary conditions, as households deal with the headwinds of high inflation and interest rates.

- Later today sees a slew of US data including US New Home Sales, Durable Goods and Conference Board Consumer Confidence. We also have the latest 5-Year Supply.

OIL: Crude Higher On Better Risk Appetite

Oil prices have made further modest gains of around 0.6% following Monday’s rise, as commodities have generally risen. WTI is at $69.82/bbl, just off the intraday high of $69.86 and approaching $70. Brent is around $74.76, close to the high of $74.81. The USD index is 0.2% lower.

- Oil fell in early APAC trading with WTI reaching a low of $69.29 and Brent $74.25. The recovery in crude was boosted by better risk sentiment driven by China’s CNY fixing being stronger than forecast.

- Bloomberg is reporting that China’s largest oil company and refiner have taken huge opposing positions in Middle East crude, which is unusual. This has resulted in volatile Dubai crude prices this month and has clouded the true situation in the Middle East market.

- US API inventory data is published today. US May durable goods orders, April house prices, May new home sales, June consumer confidence, June Richmond manufacturing & Dallas services print later. Canada’s May CPI is also released. ECB President Lagarde speaks.

GOLD: Extends Monday's Gain In Asia-Pac Trade

In the Asia-Pac session, gold has gained ground, reaching 1929.21 (+0.3%). This follows a slight increase (+0.1%) on Monday, as investors carefully evaluated escalating geopolitical uncertainty and signals pointing towards a potential recession.

- The price of bullion experienced a rise of up to 0.6% on Monday, primarily driven by the extraordinary mutiny led by Russian mercenary leader Yevgeny Prigozhin. However, the upside potential for this safe-haven asset was limited as Prigozhin abruptly halted his dramatic advance towards Moscow over the weekend.

- The price of the precious metal is primarily susceptible to the movements of real interest rates and the value of the dollar. Past trends indicate that rallies driven by geopolitical risks are typically short-lived in nature.

- According to MNI’s technicals team, the bear cycle in gold remains intact. Trendline support has been breached - the line is drawn from the Nov 3 2022 low and the break reinforces a bearish condition. Furthermore, the move lower confirms a resumption of the downtrend. The focus is on $1903.5, 61.8% of the Feb 28 - May 4 bull cycle. Key resistance is $1985.3, the May 24 high. Initial resistance is at $1948.8, the 20-day EMA.

FOREX: AUD Firms After PBOC Fixing Stronger Than Expected

The AUD is the strongest performer in the G-10 space at the margins firming after the PBOC fixed the Yuan 100 pips stronger than forecast which supported risk appetite and weighed on the USD.

- AUD/USD prints at $0.6710/15 and is up ~0.6%, after firming above the $0.67 handle resistance comes in at $0.6731 the 20-Day EMA. AUD/NZD is up ~0.4% and sits above the 200-Day EMA.

- Kiwi is ~0.2% firmer, NZD/USD prints at $0.6175/80. The Westpac Q2 Employment Confidence Index was on the wires this morning falling 3.9%.

- Yen is little changed, USD/JPY has observed a narrow range with little follow through on moves.

- Elsewhere in G-10, NOK and SEK are both ~0.4% firmer, however liquidity is generally poor in Asia.

- Cross asset wise; BBDXY is down ~0.2% and US Tsy Yields are little changed across the curve. WTI futures are ~0.5% higher.

- May CPI data from Canada headlines today's docket.

GLOBAL: Export Growth Troughed, Asia Ex China Struggling

CPB world export volume growth in April eased to 0.1% y/y from 3.8% the previous month. It appears to have troughed at -2.7% y/y in December 2022 with 3-month momentum signalling some improvement in the months ahead. The stabilisation has been driven by emerging markets, and specifically China, with 3-month momentum rising to 23.1% in April from 11.9% while developed markets are negative 5.1%.

- Asian exports outside of China have been struggling in recent months.

- Developed markets’ export volume growth fell to -1% y/y from +1.4% in March with shipments from the euro area particularly weak at -1.9% y/y down from +1.5% y/y. The US also softened to +0.4% y/y from +8.1% y/y. Advanced Asia ex Japan was also weak falling 5.7% y/y after -3.6%.

- Emerging countries export volumes rose 2% y/y but that was down from 8.2%. After 5 straight months of contraction, China’s shipments rose 16.2% y/y in March and then 11.1% in April. Emerging Asia ex China was weak though falling 8.8% y/y down from -1.1%.

- Export prices rose 0.6% m/m in April but momentum is negative. Energy prices rose 3.4% m/m after 3 straight declines but momentum is very weak and they are down 37.8% y/y. Raw materials rose slightly in April but are down 23.8% y/y. The sharp decline in commodity prices over the last year is going to impact exporters but help to alleviate headline CPI pressures generally.

Source: MNI - Market News/Refinitiv

Global exports y/y%

Source: MNI - Market News/Refinitiv

THAILAND: Trade Deficit Unexpectedly Widens

The customs trade deficit widened in May to $1849mn whereas a significant narrowing was expected. Both imports and exports fell less than in April and less than expected at -3.4% y/y and -4.6% respectively.

- Exports were stronger than forecast due to increased demand for some food products and the weaker currency (USDTHB is up 3.5% since the May 14 election). Manufactured goods rose for the first time in 8 months by 1.5% y/y due to cars. Lower seasonal fruit exports weighed on total agricultural shipments which fell 27% y/y. Exports to China fell 1.5% y/y in May.

- The government expects better export growth in H2 because of increased food exports to China, recovering tourism and stronger global growth. It continues to forecast 2023 export growth of 1-2%. There are downside risks though from slower global growth and weather affecting food output.

Source: MNI - Market News/Refinitiv

MNI INTERVIEW: RBA at Risk of Over Hiking - Ex-Board Member

Daniel O'Leary

Daniel O'LearyThe Reserve Bank of Australia risks overtightening if it hikes the cash rate above its current 4.1% in coming months, as the delayed impact of past increases begins to be felt, ex-board member Bob Gregory told MNI.

Interest rate increases take 12 to 18 months to have an effect, said Gregory, emeritus professor at the ANU’s Research School of Social Sciences, who served on the RBA board between 1985-1995. He pointed to the mortgage market as an example, with a large number of fixed-rate mortgages rolling off over the next few months.

"Much of the reaction to past interest-rate increases is still yet to come," he noted. "The exact timing of the average lag is not clear cut but it is of the order of one or two years.”

According to the Australian Banking Association, Q2 saw a spike in the roll off of fixed-term mortgages, with that figure tapering each quarter out to Q3 2024 (see chart). Mortgage pain, however, has not materialised in house prices, with the RBA recently noting real-estate strength had confounded its models (see: MNI POLICY: House Price Strength Thwarts RBA Models)

Gregory said waiting for unemployment to increase significantly before halting rate increases would be damaging.

"This is a lesson learned during the period of large interest-rate increases in the late 1980s and early 1990s that led to Australia’s worst post-war recession," he added. "Interest rate increases need to stop before unemployment increases start, a difficult judgment to make. Of course, the RBA attempts to look ahead, to account for lags, but forecasting is difficult."

Markets have priced in a small chance the RBA will hike again at its next July 4 meeting, with the rate now expected to peak at 4.5% by November.

LACK OF INDEPENDENCE

Gregory noted the RBA, along with other developed economy central banks, tends to quickly follow U.S. interest rate changes.

"So when our interest rate increases stop is likely to be heavily influenced by when the U.S. Federal Reserve increases stop and this is likely to be too late,” he said. “Past experience indicates that the RBA independence from the Fed decisions is limited and this is likely to be more so today as developed countries, which also tend to follow U.S. policy, have become more synchronised, stimulating their economies in response to Covid and now tightening monetary policy in response to the inflation. At the same time our unemployment begins to increase the Australian situation is likely to worsen in response to world unemployment increases."

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/06/2023 | 0600/0800 | ** |  | SE | PPI |

| 27/06/2023 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 27/06/2023 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 27/06/2023 | 0800/1000 |  | EU | ECB Lagarde Intro at ECB Forum | |

| 27/06/2023 | 0830/0930 |  | UK | BOE Tenreyro Panels ECB Forum | |

| 27/06/2023 | 0830/1030 |  | EU | ECB Panetta Panels ECB Forum | |

| 27/06/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 27/06/2023 | 0930/1130 |  | EU | ECB Elderson Panels ECB Forum | |

| 27/06/2023 | 1200/1400 |  | EU | ECB Schnabel Panels ECB Forum | |

| 27/06/2023 | 1230/0830 | *** |  | CA | CPI |

| 27/06/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 27/06/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 27/06/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 27/06/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 27/06/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 27/06/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 27/06/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 27/06/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 27/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 27/06/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.