-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI EUROPEAN MARKETS ANALYSIS: Some Pre-Powell Consolidation In Asia

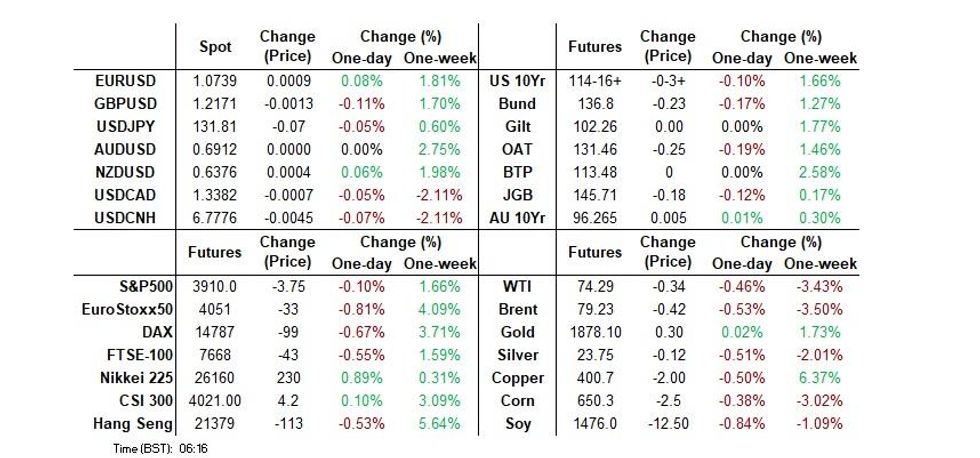

- The BBDXY index has tracked late NY ranges through today's Asia Pac session. We currently sit at 1236.50, down slightly on closing levels. As was the case during the NY session, dips towards 1235 have seen USD support emerge, but we haven't seen much upside momentum either. The market may be awaiting fresh cues with a host of central bankers due to speak later at a Riksbank conference, headlined by Fed Chair Powell.

- A more cautious tone in the equity space has emerged as we have progressed through Asia-Pac dealing. U.S. equity futures have spent most of the session in the red, although we are away from worst levels. S&P 500 e-minis are holding above 3900 for now (~-0.30%), while Nasdaq futures are slightly weaker at this stage.

- Looking ahead, outside of the aforementioned central bank speak, data events are fairly light on Tuesday, with U.S. small business optimism and wholesale inventories on tap.

US TSYS: Cross-Asset Flows Dominate In Muted Asia Session, Powell In Focus

TYH3 deals at 114-17, -0-03, in the middle of its narrow 0-07+ range on volume of ~75K.

- Cash Tsys are flat to 1bps richer across the major benchmarks as we approach the European session.

- Cross-asset flows came to the fore as local participants seemed more willing than usual to remain sidelined ahead of Fed Chair Powell’s Tuesday address.

- After a muted start, Tsys richened as pressure on the USD, as USD/CNH printed its lowest level since mid-August, and a recovery off session lows in U.S. equity futures aided the space.

- The USD then pared its losses, and U.S. equity futures re-tested session lows, briefly pressuring Tsys which marginally cheapened before recovering to again deal richer as the USD gave up its gains to deal a touch softer.

- The space looked through the Tokyo CPI print, in which headline and core-core readings ticked up in line with expectations. The core print came in a touch above expectations.

- Fedspeak from Chair Powell headlines today's docket, while wholesale inventories is also on the wires. On the supply side, we will see the latest 3-Year Tsy auction.

JGBS: Local Data, Speculation On MonPol & BoJ Inaction Weigh

JGBs have been on the backfoot throughout Tokyo trade, with futures operating a little off worst levels into the bell, -13, after more than erasing the post-Tokyo uptick that was witnessed during the final overnight session of last week.

- Cash JGBs are flat to 3.5bp cheaper with the long end leading the weakness, aided by payside swap flow in 30+-Year paper, which saw swap spreads in that zone widen. 10-Year yields were limited by their proximity to the upper boundary of the BoJ’s YCC settings.

- Post-holiday trade was seemingly shaped by participants placing more focus on domestic factors, in the form of continued speculation re: the potential for a further BoJ policy tweak (hence the super-long swap spread widening) and a firmer than expected core CPI reading out of Tokyo (alongside as expected upticks in both the headline and core-core readings).

- A lack of off-schedule BoJ purchases probably promoted further cheapening as the day wore on.

- Note that the latest 3-month Bill auction was cancelled owing to partial unavailability of the BOJ-NET system.

- 30-Year JGB supply headlines tomorrow’s domestic docket.

AUSSIE BONDS: Contained Trade, Proximity To Powell & Tomorrow’s Data Limit Conviction

ACGBs wound through Tuesday’s Sydney session with a lack of overt headline catalysts apparent, leaving them operating in a contained, two-way fashion since Monday’s settlement. YM closed +1.0, while XM was +0.5, as the major cash ACGB benchmarks ran 0.5-1.5bp richer across the curve.

- Bills were 1-7bp richer through the reds, bull flattening, while RBA dated OIS was little changed to marginally softer, showing 18bp of tightening for next month’s meeting, alongside a terminal cash rate of just under 3.90%.

- Local headline flow was sparse at best, with previously outlined corporate/supra issuance pricing, while WATC mandated for ’28 FRN issuance on the semi side.

- The domestic docket picks up on Wednesday, with monthly CPI, retail sales and job vacancies readings all slated. Participants will also have to adjust to Fed Chair Powell’s latest round of communique, which will cross in Tuesday’s NY session.

NZGBS: A Touch Firmer On The Day, Awaiting a More Meaningful Catalyst

The early move lower in NZGB yields saw a marginal extension, although there was lack of meaningful headline catalysts apparent during Tuesday’s Asia-Pac session, leaving the imprint of Monday’s modest richening in U.S. Tsys front and centre.

- The major NZGB benchmarks finished ~4bp richer in a parallel shift.

- RBNZ dated OIS pricing was little changed to marginally lower, showing 67bp of tightening for the Feb ’23 meeting and a terminal OCR of just below 5.50%.

- Swap rates unwound some of their initial move lower to finish little changed to 4bp lower across the curve, meaning that swap spreads finished flat to wider after narrowing in early dealing.

- Local headline flow remained non-existent, with only lower tier local data scheduled for the remainder of the week.

FOREX: USD Off Smalls, But Doesn't Make Fresh Lows

The BBDXY index has tracked late NY ranges through today's Asia Pac session. We currently sit at 1236.50, down slightly on closing levels. As was the case during the NY session, dips towards 1235 have seen USD support emerge, but we haven't seen much upside momentum either. The market may be awaiting fresh cues with a host of central bankers due to speak later at a Riksbank conference.

- Yen initially strengthened on a firmer core CPI reading but this proved to be short lived. We eventually hit a low of 131.39 post the Tokyo fix. After this we steadily recover back to 132.00 before selling interest emerged (the pair last 131.75).

- AUD/USD dipped towards 0.6890 as risk appetite in the equity space faltered, but we are now back to 0.6910/15, close to flat for the session. Higher iron ore, back to $119/ton has provided a positive offset.

- NZD/USD has outperformed slightly, last near 0.6385 (+0.15% for the session).

- Outside of the upcoming central bank speak, data events are fairly light, with US small business optimism and wholesale inventories on tap.

FX OPTIONS: Expiries for Jan10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0825-50(E512mln), $1.1222-38(E1.6bln)USD/JPY: Y131.80-00($520mln)

- GBP/USD: $1.2000(Gbp867mln), $1.2065-85(Gbp510mln)

- AUD/USD: $0.6800(A$501mln)

- USD/CAD: C$1.3500($2.0bln)

ASIA FX: USD/CNH Still Biased Lower, Weaker Equities Curbing IDR

USD/Asia pairs have mostly seen downside traction today, although moves haven't been as large as yesterday. The bias remains for USD/CNH weakness, with onshore spot continuing to lead the way. KRW and THB remain on the front foot and were joined by PHP today. IDR remains a laggard. The data calendar remains light tomorrow, with the South Korean unemployment rate due, along with Malaysian IP figures.

- USD/CNH hit just under 6.7600 before support emerged, the pair last at 6.7735/40. Onshore spot remains firmer in CNY terms, last at 6.7640. The CNY fixing moved back to a firmer bias, although the 5-day trend remained close to neutral.

- USD/KRW 1 month hasn't been able to get below 1235, but moves above 1240 have drawn selling interest. China is suspending some visas for South Korean citizens in response to Korea's entry restrictions against China citizens amid the domestic covid outbreak.

- USD/THB hit fresh lows close to 33.30 in early trade, but we are slightly higher now, back above 33.40. Current levels are still slightly firmer for the session, while the baht comfortably remains the best performer within EM Asia FX to date in 2023, up nearly 3.5%. The baht remains a favored play on the China re-opening theme, with the authorities yesterday walking back a requirement that arrivals need to show vaccine proof. The authorities expect 7-10million Chinese arrivals by air this year, although only modest arrivals are expected in Q1 (~300k). Thailand (along with China), is one of the few EM Asia economies where growth is forecast to be stronger in 2023 relative to 2022.

- The PHP is leading gains among Asia FX so far today. USD/PHP was last at 54.835, -0.55% for the session and fresh lows back to late June 2022. 54.50 and beyond that, 54.00, seem reasonable downside targets if the weaker USD trend continues. On the topside, the simple 200-day MA is at 55.32. Better than expected trade figures has aided peso sentiment, exports rising 13.2% Y/Y for Nov (11.5% forecast), while imports slipped to -1.9% Y/Y (+3.0% forecast). This pushed the trade deficit to -$3.68bn, slightly wider than last month, but below the -$4.13bn forecast.

- USD/IDR is back to 15590, slightly up on the session, although moves closer to 15600 have drawn selling interest. Local equities are underperforming, now down 10% from their September 2022 peak, as a rotational play unwinds within EM Asia equities.

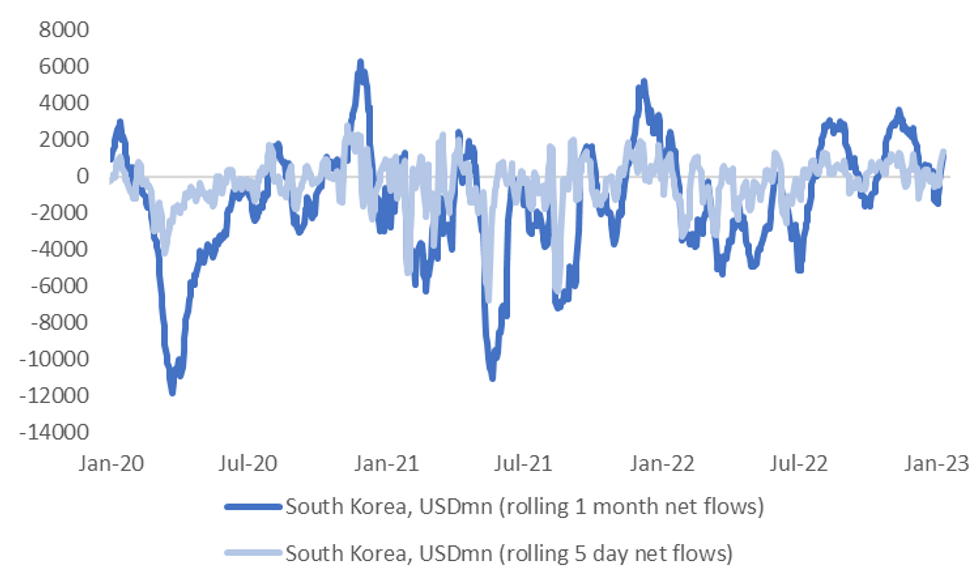

KRW: Won Outperformance Persists On Equity Rebound/Strong Portfolio Inflows

The 1 month NDF got just below 1234 in NY trading before recovering into the close near 1239. The 1234 region coincides with lows in the pair from late May in 2022. Onshore spot ended yesterday's session at 1243.85, a gain of 2% against the USD, while the 1 month NDF rose 1.17%.

- Won gains may have been tempered by a loss of momentum in the equity space through the NY session. Still, the SOX and MSCI IT index outperformed broader market moves. To recap, the Kospi rose 2.63% yesterday, with offshore investors adding $548.77mn to local stocks.

- This brings net inflows for the past 5 sessions to an impressive $1.4bn, although over the past month, net inflow momentum is still below peaks we saw in 2022, see the chart below.

- On the data front, the BoP goods balance remain in deficit in Nov, -$1.567bn, while the current account slipped back into deficit -$621.7mn (from $883.4mn). Given the dated nature of this data it is unlikely to have a large impact on market sentiment today.

Fig 1: South Korea Net Equity Inflow Momentum Starting Off 2023 Strongly

Source: MNI - Market News/Bloomberg

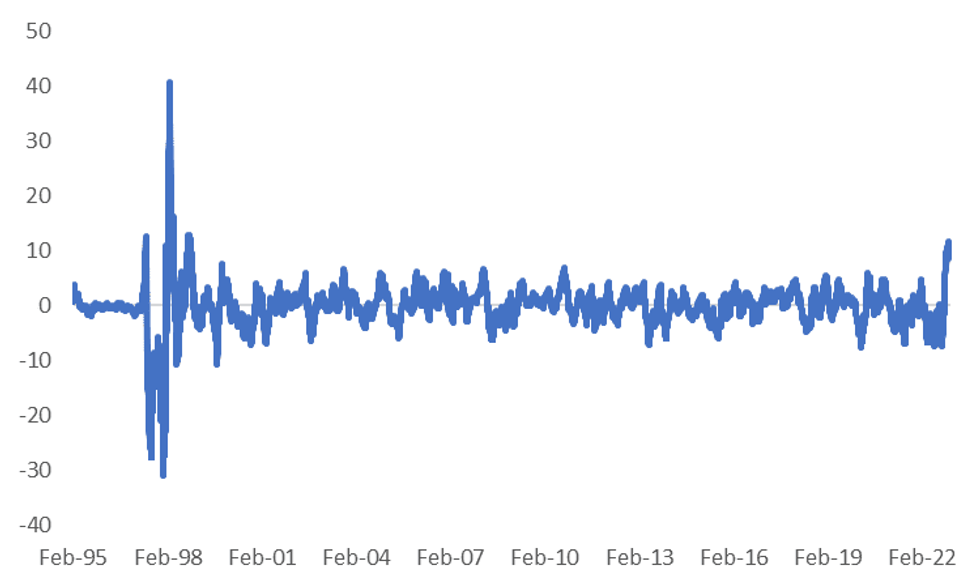

THB: Baht Leads The Charge In Early 2023

USD/THB hit fresh lows close to 33.30 in early trade, but we are slightly higher now, back above 33.45. Current levels are still slightly firmer for the session, while the baht comfortably remains the best performer within EM Asia FX to date in 2023, up nearly 3.5%, with KRW the next best (+2.15%), slightly outperforming CNH.

- From the highs in late October around 38.50 in USD/THB, downside momentum in the pair in recent months has been very strong. The rolling 2-month rate of change in THB versus the USD, is beyond 11%, see the chart below.

- We have to go back to the late 1990s and post the Asia financial crisis to see a stronger rate of change over such a timeframe.

- The baht remains a favored play on the China re-opening theme, with the authorities yesterday walking back a requirement that arrivals need to show vaccine proof. The authorities expect 7-10million Chinese arrivals by air this year, although only modest arrivals are expected in Q1 (~300k). Thailand (along with China), is one of the few EM Asia economies where growth is forecast to be stronger in 2023 relative to 2022.

- How arrival trends unfold will likely be watched closely by the market, as will broader USD sentiment. BoT/domestic rhetoric around FX trends will also be monitored. Today the Shippers' council has stated the strong baht will hurt export growth.

- Whilst the baht recovery has been very strong, spot USD/THB levels are still comfortably above 2022 lows near 32.00, while the THB NEER is through 2022 highs, but remains close to 6% away from early 2020 levels.

- The 20-day EMA sits back at 34.45, while any moves back towards 34.00 may also draw selling interest.

Fig 1: Rolling 2-month THB/USD Spot Changes

Source: MNI - Market News/Bloomberg

EQUITIES: Consolidation After Strong Start To 2023

A more cautious tone in the equity space has emerged as we have progressed through today's session. US equity futures have spent most of the session in the red, although we are away from worst levels. The active Eminis contract holding above 3900 for now (~-0.30%), while Nasdaq futures are slightly weaker at this stage.

- Weakness in regional equity markets have persisted this afternoon, although losses have been large. Some consolidation may be taking place, following the very strong start to the year for regional bourses (+3.8% for the MSCI Asia Pacific Index YTD).

- The HSI is down 0.34% at this stage, while the CSI 300 and Shanghai Composite are down modestly. The Kospi and Taiex and both close to flat.

- Indonesian stocks are underperforming, last down 1.5%, and off by more than 10% from September highs last year.

- Japan equities are performing better, up 0.70% for the Nikkei, although Japan markets were closed yesterday, so this may reflect some catch up.

GOLD: Rangebound Ahead Of Key Event Risks

Gold has tracked recent ranges through today's session. Since early yesterday we haven't spent too much time outside of the $1870/$1880 range. We currently track close to the bottom end of this range, last near $1872, against earlier highs of $1876. This leaves us close to unchanged for the session to date, slightly outperforming a more supportive USD tone against the majors.

- We have a number of major central bank speakers due later today as part of a Riksbank conference, headlined by US Fed Chair Powell. This, along with US CPI on Thursday, are the major near term event risks for gold.

- The technical picture remains firm, with the 20-day EMA continuing to push higher (last at $1823.5), while the 61.8% retracement of the 2022 downtrend comes in at $1896.45, in terms of upside targets.

- Gold ETF holdings remain fairly steady though.

OIL: Off Monday's Highs As A More Cautious Risk Tone Emerges

Oil hasn't been able to build on positive momentum from Monday's session, last tracking down 0.55% for Brent to $79.20, while WTI is off by slightly less, around $74.30/bbl currently. These falls only partially unwind Monday's gains, but underscores the struggles oil has to generate meaningful upside traction at the current juncture. We remain within recent ranges for both benchmarks though.

- The broader risk tone has been a more cautious one today, with US equity futures tracking lower and the USD finding some support. This has weighed at the margins, particularly ahead of key central bank speak later.

- Optimism around China demand was bolstered further late yesterday, as the authorities issued a generous quota for crude oil imports. Still, this is not overwhelming current supply side dynamics.

- In terms of oil specific event risks in the upcoming US session, the EIA releases its short term energy outlook, while the API weekly report on oil inventories is also due.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/01/2023 | 0700/0800 | * |  | NO | CPI Norway |

| 10/01/2023 | 0700/0800 | ** |  | SE | Private Sector Production |

| 10/01/2023 | 0745/0845 | * |  | FR | Industrial Production |

| 10/01/2023 | 0800/0900 | ** |  | ES | Industrial Production |

| 10/01/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 10/01/2023 | 1010/0510 |  | CA | Governor Macklem at Riksbank Conference | |

| 10/01/2023 | 1010/1010 |  | UK | BOE Governor Bailey at Riksbank conference | |

| 10/01/2023 | 1010/1110 |  | EU | ECB's Isabel Schnabel at Riksbank conference | |

| 10/01/2023 | 1010/1910 |  | JP | BOJ Governor Haruhiko Kuroda at Riksbank conference | |

| 10/01/2023 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 10/01/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 10/01/2023 | 1400/0900 |  | US | Fed Chair Jerome Powell at Riksbank conference | |

| 10/01/2023 | 1400/1500 |  | DE | Buba Vice President Claudia Busch as Riksbank conference | |

| 10/01/2023 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 10/01/2023 | 1500/1000 | ** |  | US | Wholesale Trade |

| 10/01/2023 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.