-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Tsy Futures Continue Drift Lower, BoE Up Next

- The yen was supported by some hawkish BoJ Summary Of Opinion headlines (from the April meeting) in early trade, while JGB futures gapped lower at the open. However, there was little follow through on these moves.

- US Tsy futures are weaker today, but this hasn't provided any meaningful support to the USD, which is only marginally higher. China and Hong Kong equities have rebounded, aided by better China trade data, particularly on the import side.

- Later the Fed’s Daly appears and US jobless claims are released. The BoE decision is announced and the ECB’s de Guindos, Cipollone and McCaul speak as well as BoC’s Macklem and Rogers.

MARKETS

US TSYS: Tsys Futures Edge Lower, Curve Steepens, Jobless Claims & 30Y Supply Later

- Treasury futures are weaker today, following moves overnight. The 10Y contract is down (- 03+) at 108-23, however still well above initial support at 108-15+ (20-day EMA), the front-end is holding up better with the 2Y contract is holding slightly better down (- 00+) at 101-21+.

- Treasuries maintain a firmer tone and are holding on to the bulk of their recent gains. Initial resistance is 109-06+/08+ (Channel top from Feb 1 high / 50-day EMA), while to the downside, initial support is at 108-15+ (20-day EMA).

- The cash treasury curve has continued it's bear-steepening moves, with yields 1-2bps higher, the 2Y is +1bp at 4.847%, while the 10Y is +1.6bps at 4.510%

- Focus in the APAC region today was on Japan where Labor Cash Earnings YoY missed estimates coming in at 0.6% vs 1.4% and down from 1.8% in Feb and the BoJ summaries of opinion with some notable headlines include one member stating that the rate path could be higher than expected while another stated discussions on rate hike timing should also deepen (BBG)

- FED INTERVIEW (MNI): Fed Will Cut Rates More Sparingly In '24-Weber (See link)

- Looking Ahead: Weekly jobless claims data, 30Y supply (after April saw the first tail since November) and then SF Fed’s Daly speaks.

EUROPE: Recession Risk Low

Q1 euro area GDP rose 0.3% q/q following two slightly negative quarters which the business cycle dating committee are unlikely to declare a recession. Our probability estimates are not signalling a risk of a recession in H2 this year either. With growth likely to stay below trend and inflation heading towards the ECB’s target, an easing cycle looks likely to begin soon.

- Our recession probability indicator 6-months ahead estimated from 1985, covering four recessions, has suggested almost no risk of a downturn since the start of last year. In April, it again signalled no risk 6-months ahead.

- The one from 1998, using three recessions, has signalled a probability of around a third throughout this year. Since that is under the breakeven 50% mark, growth in the euro area is likely to struggle rather than experience a prolonged contraction. The April probability rose moderately to 36% from 33% in March. It has been around this rate since December 2023.

- The 3-month change in the real repo rate, real equities, economic sentiment indicator, real 10 year yield and 6-month change in unemployment have all helped to bring the recession probability lower. Real oil prices in euros, real money supply and yield curve have added upward pressure.

- It is worth noting that econometric calculations are only estimates and not predictions.

Source: MNI - Market News

JGBS: Futures Lower, But 10yr JGB Yield Unable To Break Above Late April Highs

JGB futures were heavy at the open but couldn't break sub 144.00. Lows were at 144.04, but we have recovered some ground since then, last 144.26, -.30.

- Early downside impetus reflected a softer US Tsy tone, coupled with some hawkish headlines from the BoJ Summary Of Opinions (April policy meeting). Risks that the rate hike path may be firmer than expected (as one member noted), could see focus of a follow up tightening in June rise.

- BoJ Governor Ueda was also before parliament today and noted the impact of the weaker yen will be monitored from a policy standpoint. Wages data was mixed but still showed a resilient trend on a same sample basis.

- On the supply front we had the 6 month bill sales. The bid to cover was 3.24, versus 4.20 prior. Tomorrow's 30yr bond auction will come under greater focus though.

- In terms of cash JGB yields, we are firmer across the curve, led by the belly. 5-7yr tenors are up a little 3bps. The 10yr is at 0.91%, up 3bps, but is still sub late April highs above 0.93%.

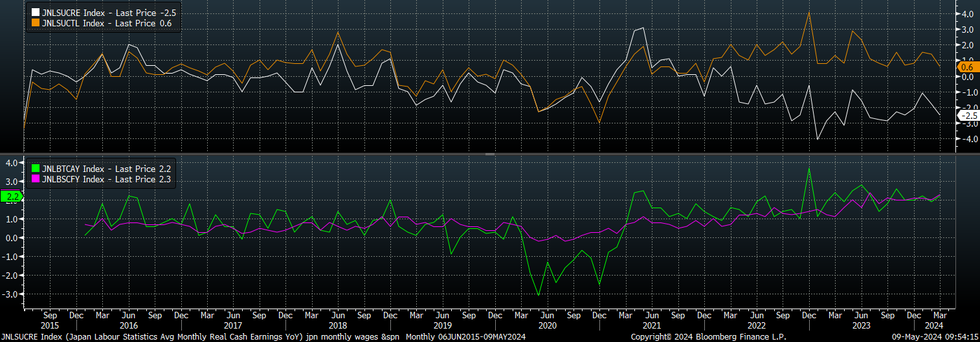

JAPAN DATA: Headline Wage Measures Falter, But Same Sample Base Paints Resilient Picture

Headline wage outcomes came in below expectations for March. Nominal cash earnings were up 0.6% y/y, against a 1.4% forecast. Real cash earnings fell -2.5%y/y against -1.4% forecast, and a revised -1.8% print for Feb.

- Affecting these headline outcomes was a -9.4%y/y dip in bonus payments. Hours worked also fell, -2.7% y/y versus -0.5% prior.

- Still, cash earnings on a same sample base were better in y/y terms, up 2.2% compared with 1.9% prior (2.2% was the forecast). Scheduled full time pay on a same base were 2.3% y/y (against a 1.9% forecast and 2.1% prior).

- The chart below shows the headline measures in the top panel, while the same base measures are presented in the bottom panel.

- The same base measures present a more resilient outlook and should go some way to offsetting the weaker headline prints. The firm wage outcomes negotiated recently are also expected to start impacting the data in April per the BoJ.

Fig 1: Japan Wage Outcomes Y/Y, More Resilient Using Same Sample Base (bottom panel)

Source: MNI - Market News/Bloomberg

RBA VIEWPOINT: Economic Fundamentals Consistent With A Prolonged Hold

The latest CPI and GDP data and May RBA forecasts suggest that a rate cut is not consistent with current and expected economic fundamentals according to our simple policy reaction function. As a positive inflation gap is forecast to mid-2026 and the output gap is only slightly negative, rates should be around 35bp higher to be consistent. This implies that there is still a risk of further tightening in line with the Board’s choice between a hike or a pause in May. The OIS market doesn’t have a full cut priced in until Q3 2025.

Australia policy reaction function %

Source: MNI - Market News

- Q1 CPI and the upward revision to the RBA’s 2024 inflation outlook have resulted in the equation estimating rates 2-4bp higher this year. The inflation gap variable leads by two quarters and so the forecasts are important for the estimates. The RBA revised up Q4 2024 0.6pp to 3.8% and Q2 2025 0.1pp to 3.2%.

- The rate equation estimates including house prices are around 4bp lower for 2024 than in February but around 10bp in Q2 2025, as dwelling inflation has eased on a quarterly basis over the last two quarters. But the results are still consistent with rates on hold for the foreseeable future with the risk of a hike.

- It is worth noting that econometric calculations are only estimates and not predictions.

Source: MNI - Market News/Bloomberg

AUSTRALIA: Pressure On Budget To Support Growth & Hold Back Inflation

The federal budget is announced on May 14 at around 1930 AEST. RBA Governor Bullock said this week that Treasurer Chalmers has reassured her that inflation is at the front of his mind. There seems to be a lot of pressure to increase spending and stimulate growth and thus uncertainty over whether there will be restraint in the near term in order not to fuel inflation. The next election is due by May 2025, which is also likely to influence decisions. The RBA is “vigilant” to upside inflation risks, including the budget.

- Another surplus may be predicted due to favourable conditions for commodities but the budget is also likely to show an overspend but also stronger revenue from income and company taxes. Deficits though are expected to rise across the rest of the forecast horizon.

- Judo Bank’s chief economist has estimated that new spending of $5-10bn would not pressure rates, but over $10bn or 0.5% of GDP could be inflationary. The July 1 tax cuts are estimated to be equivalent to 3 rate cuts.

- Treasury’s inflation forecast was around 0.75pp lower than the RBA’s in its MYEFO at end-2023. With the RBA revising up its CPI forecasts this month back towards its November projections, although Q4 2024 is now 0.5pp higher, the government’s expectations will be watched closely to see if they are revised in tandem.

- Some information has been announced including stage 3 tax cuts (FY25 $23bn), projects for western Sydney ($1.9bn), domestic violence support ($925mn), Future Made in Australia ($1bn), HECS relief ($3bn) plus green hydrogen support. More details will probably be released over the coming days.

AUSSIE BONDS: ACGBs Cheaper, Curve Steepens, China Imports Grow

ACGBs (YM -6.0 & XM -6.5) are cheaper today, erasing moves made on Wednesday, there has been little in the way of local headlines and another empty calendar today. US tsys futures are trading near session lows, while most of today’s focus has been in Japan were there were some hawkish headlines from the BoJ Summary Of Opinions (April policy meeting).

• Cross-asset moves: US equity futures are slightly lower, there has been little movement in the G10 currency space, while global yields are higher.

• China trade figures for April saw export growth rise 1.5% y/y, close to expectations (1.3%), but comfortably above the prior month's -7.5% pace. Imports were stronger than forecast though, up 8.4% y/y (4.7% forecast and -1.9% prior), which should give some confidence that domestic demand remains strong.

• US Tsys curve has steepened yields are 1-2bps higher, with the 2Y yield +1bp at 4.847%, 10Y +1.8bps to 4.512%, while tsys futures trade at intraday lows.

• The ACGB curve has steepened today with yields are 4-58ps higher, the AU-US 10-year yield differential is 3bps higher, now -15bps.• Swap rates are 1-4bp higher.

• The bills strip is slightly richer with pricing 1-2bps lower.

• RBA-dated OIS pricing mixed into year-end, the market is pricing just 3bps of easing to a terminal rate of 4.32%.

• Looking ahead: NAB business surveys on Monday.

NEW ZEALAND DATA: Higher Labour Supply Seen In Applicant Data

SEEK job ads fell 4.4% m/m in April, the third straight monthly decline, to be down 29.6% y/y after falling 0.6% m/m and -27.4% y/y. The weakness was broad based across most regions and major industries except engineering. Applicants per ad rose 4.9% m/m, the seventh consecutive rise, to be its highest level since the series began in 2008 as labour supply has been boosted by strong immigration and labour demand pressured by the slowing economy. Q1 employment data showed a further easing in the labour market but still robust wage growth. The strong rise in applicants per ad should drive a more material moderation.

NZ migration vs applicants per job

Source: MNI - Market News/Refinitiv/SEEK

NZGBS: NZGBs Cheaper, Curve Bear-Flattens, Bond Auction Well Received

NZGBs are 7-9bps cheaper and closed near session lows, with the curve bear-flattening. Earlier NZ FinMin Nicola Willis delivered her pre-budget speech where see said the current economic situation is “challenging for the government books” and there was a 5yr, 10yr & 20yr bond auction which saw decent interest.

- The US Tsys curve is slightly steeper today, yields are 1-2bps higher while the 2y10y is unchanged at -34,488. Tsys futures are trading at intraday lows with the 10y contract down ( - 04+) at 108-22, we still trade comfortably above initial support at 108-13+ (20-day EMA)

- The NZGB curve has bear-flattened the 2Y is +8.2bps at 4.81%, 10Y is +7bps at 4.722%.

- Swap rates are 1-4.5bps higher across the curve

- RBNZ dated OIS has softens 2-5bps out past august with a cumulative 36bps of easing is priced by year-end

- Earlier, we had the 5yr, 10yr & 20yr bond, most demand was in the 5yr & 10yr lines printing NZ$250m and NZ$225m respectively.

- Earlier, FinMin Willis addressed the economic challenges ahead in her pre-budget speech, emphasizing the need for fiscal responsibility and modest spending, mentioning the economic situation is “challenging for the government books”. She mentioned that budget wouldn't be big-spending, but that it would deliver tax relief for middle and lower-income workers. The budget will be delivered May 30th.

- Looking Ahead: BusinessNZ Manufacturing PMI on Friday

FOREX: USD Steady Amid Mixed Cross-Asset Trends

The BBDXY USD Index sits little changed for Thursday trade to date, last near 1256.5. We firmed in earlier dealings but there was little follow through. Higher US yields have been offset at the margin by a better China/HK equity backdrop and firmer China import data, which has aided higher beta FX.

- USD/JPY fell to 155.17 in early dealings as hawkish headlines from the BoJ Summary Of Opinions (April meeting) crossed. Of note was one member stating that the rate path could be higher than expected. We also had fresh verbal FX intervention warnings from the authorities.

- BoJ Governor Ueda was also before parliament and stated the central bank will closely monitor the impact of the weak yen from a policy standpoint.

- Still, USD/JPY dips were supported, and we track near 155.55/60 in recent dealings. We made marginally fresh highs compared to Wednesday levels of 155.70.

- Japan data on wages was mixed with headline outcomes weaker than expected but on a same sample painted a more resilient picture. FX reserves data showed a drop in April, but this may have reflected valuation effects rather than intervention, which took place towards the end of the month and may not be reflected in today's data.

- AUD and NZD have tracked relatively tight ranges. Both currencies were weaker earlier, but sit slightly higher now, aided by the China import beat and better equity tone for China/HK markets. AUD/USD was last 0.6580/85, while NZD/USD was close to 0.6005.

- Later the Fed’s Daly appears and US jobless claims are released. The BoE decision is announced and the ECB’s de Guindos, Cipollone and McCaul speak as well as BoC’s Macklem and Rogers.

ASIA EQUITIES: China & HK Equities Higher As Tech & Property Gain

Hong Kong and China equities are higher today. Property names are benefitting from another city removing restrictions on home buying, following on from last week when Shenzhen relaxed rules, while Hong Kong markets have been supported after comments from HK Exchange CEO where he mentioned IPO's will be coming back and already have 100 applicants in the pipeline. Earlier we had China trade figures for April saw export growth rise 1.5% y/y, close to expectations (1.3%), but comfortably above the prior month's -7.5% pace.

- Hong Kong equities are higher today with the HSTech Index up 1.92%, the index is now up 31.26% from lows mad in Feb. The Mainland Property Index fell about 4% on Wednesday but has recovered most of that today, up 3.13%, the wider HS Index is up 1.23%. China onshore markets are also higher today with the CSI300 up 1%, while small-cap and growth indices outperform large-cap with the CSI1000 up 1.64% and the ChiNext up 1.85%.

- China Northbound saw a -4.0b yuan outflow on Wednesday Equity flow momentum has dropped over the past few days with 5-day average now at 1.08b, still slightly above the 20-day average at 0.65b and the 100-day average at 0.67b yuan.

- China trade figures for April saw export growth rise 1.5% y/y, close to expectations (1.3%), but comfortably above the prior month's -7.5% pace. Imports were stronger than forecast though, up 8.4% y/y (4.7% forecast and -1.9% prior). The trade surplus was below expectations, printing at $72.35bn, largely due to the import beat.

- In the property space, the city of Hangzhou has lifted all restrictions on residential property purchases, effective immediately, as announced by the local housing bureau. The city also plans to enhance credit support for the property sector, which includes offering reduced mortgage payments for select homebuyers. Additionally, Hangzhou will discontinue the practice of reviewing the qualifications of potential homebuyers.

- Looking forward, PPI & CPI on Saturday

ASIA PAC EQUITIES: Regional Asian Equities Mixed, Japan The Top Performer

Asian equity markets are mixed today as US equities trade sideways for a second day. Japanese equities are the top performing in the region after a down day on Wednesday, while South Korea and Australia markets edge lower. There hasn't been much in the way of headlines, other than Japan's Suzuki warning about excessive FX moves again, while Japan also had some data out earlier with Labor cash earnings missing estimates, the BoJ statement of opinion with the Leading & Coincident Index's to come soon and in the EM space Philippines GDP was slightly lower than consensus and Malaysian CB policy rate is due out a bit later.

- Japanese equities are higher today, earlier labor cash earnings YoY missed estimates coming in at 0.6% vs 1.4% and down from 1.8% in Feb, while BoJ summaries of opinion, some notable headlines were one member stating that the rate path could be higher than expected while another stated discussions on rate hike timing should also deepen The JPY continues to be a focus with the USDJPY now trading at 155.56, vs 151.80 post what is speculated to be intervention last week, while government officials continued to issue warnings to the markets this morning. The Nikkei is 0.34% higher, while the Topix performers better up 0.70%

- South Korean equities are lower this morning, earlier we had BoP Current Account Balance which increased from the prior month to $6931.4m, from $6858.3m. The Kospi remains one of the top performing markets in the region and now eyes a test of recent highs, although is down 1.10% today.

- Taiwan equities are slightly lower today, late Wednesday we had trade balance data out which showed the exports to the US surge and shipments to China falling, while the trade surplus narrowed to $6.46b from $8.67b in March. The Taiex is currently down 0.12%

- Australian equities are lower today as Banks and health stocks drag on the benchmark. Energy shares advanced as oil ticked higher. There is very little on the local calendar until Monday when we have NAB business surveys. The ASX200 is down 1.10%.

- Elsewhere in SEA, New Zealand equities are down 0.50%, Singapore equities unchanged, Philippines equities are down 1.00% after 1Q GDP came in at 5.7% just below consensus of 5.9%, Indonesian equities continue to see foreign investors sell with 23 of the past 25 days seeing outflows the JCI trades down 0.50%, while Malaysian equities trade 00.24% ahead of the central bank decision later today.

ASIA EQUITY FLOWS: Asian Equity Flows Mixed As Tech Stocks See Majority Of Inflows

- China equity markets saw another outflow on Wednesday this time 4b yuan, taking the past 5-days to net inflow of 5.4b yuan. Equity markets were weaker again, although major indices still hold onto most of their recent gains and sit in bull market territory. The CSI300 continues to hold above all moving averages, although there seems to be some selling pressure coming through with the 200-day EMA acting as an important support level, the 14-day RSI is dropping although still holds above 50 for the moment, while MACD indictor looks to be turning lower. Looking ahead we have trade balance data on later today with CPI due out over the weekend. Equity flow momentum remains positive although is slowing with the 5-day average now 1.08b still, vs the 20-day average at 0.65b and the 100-day average at 0.67b.

- South Korean equities continue to tick higher, with the likes of Samsung and SK Hynix leading markets higher, while foreign investors have pumped about $2b into the Kospi over the past two weeks. The Kospi is now up 7.50% from lows on Apr 19th and sits well above all moving average, while the RSI and MADC indictors show buyers are well in control, we currently trade just 1.25% off yearly highs. The 5-day average is $264m, comfortably above the 20-day average at $92m and while largely inline with the 100-day average at $186m.

- Taiwan equities were slightly higher on Wednesday with a $132m inflow as foreign investors continue to pump cash into semiconductor names, especially TSMC and Hon Hai. Wednesday also saw trade balance data out which showed the exports to the US surge and shipments to China falling, while the trade surplus narrowed to $6.46b from $8.67b in March. The Taiex is up 7.27% from recent lows and has seen $2.7b on inflows over that period. The 5-day average is now $214m well above the 20-day average of -$182m and the 100-day average at $65m.

- Philippines equities have now marked 6 straight days of outflows, for a total net outflow of $331m. Wednesday we had trade balance data which showed the deficit narrowing to -$3181m from a revised -$3663m in Feb, while the unemployment rate ticked higher to 3.9% from 3.5%.The PSEi traded higher on Wednesday after tapping the 200-day EMA and reversing, finishing the session back above both the 20 & 100-day EMAs. The 5-day average is -$9m, the 20-day average is -$22.4m, while the 100-day average is -$3.1m.

- Indonesian equities have now marked 23 of the past 25 days of outflows and now takes the total flows over that period to -$1.66B. The JCI has largely been able to hold above the 200-day EMA, however on Wednesday close below it, which could signal further weakness. The 5-day average is now -$80m, the 20-day average is -$72m, while the longer term 100-day average is $6m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| China (Yuan bn)* | -4.0 | 5.4 | 77.4 |

| South Korea (USDmn) | 294 | 1322 | 15174 |

| Taiwan (USDmn) | 132 | 1071 | 972 |

| India (USDmn)** | -352 | -608 | -569 |

| Indonesia (USDmn) | -68 | -401 | 144 |

| Thailand (USDmn) | -41 | -66 | -1918 |

| Malaysia (USDmn) ** | 71 | 251 | -262 |

| Philippines (USDmn) | -16 | -44.6 | -294 |

| Total (Ex China USDmn) | 20 | 1523 | 13247 |

| * Northbound Stock Connect Flows | |||

| ** Data Up To Apr 7th |

OIL: Crude Continues Rise, China Imports Fall

Oil prices have continued Wednesday’s climb higher following the EIA reporting a US crude stock drawdown. WTI is up 0.6% to $79.43/bbl, off the intraday high of $79.48, and Brent 0.4% higher at $83.93 after $83.98. The two benchmarks faced resistance at $79.50 and $84. The USD index is flat and so not weighing on crude.

- The EIA reported a US crude stock drawdown of 1.36mn, close to expectations. Gasoline inventories rose 915k and distillate 560k. Refinery utilisation rose 1pp to 88.5%.

- China’s April trade data showed a drop in crude imports of 8.8% m/m due to significant seasonal maintenance outages. Demand is being impacted by tight refining margins, increased EV usage and natural gas consumption. Product exports fell 24% as new quotas are yet to be assigned.

- With less focus on geopolitics, attention has returned to supply/demand and OPEC+’s meeting on June 1. It is expected to extend current output curbs into H2 possibly to year end, but quota compliance is being monitored with Russia and Iraq producing above their allowances.

- Goldman Sachs now expects “lower OPEC+ supply for longer”, but sees excess capacity pushing an increase in flows, according to Bloomberg.

- Later the Fed’s Daly appears and US jobless claims are released. The BoE decision is announced and the ECB’s de Guindos, Cipollone and McCaul speak as well as BoC’s Macklem and Rogers.

GOLD: Ticks Up, But Remains Within Wednesday Ranges

Gold sits slightly above end NY levels from Wednesday, last near $2313.5. This puts us close to +0.2% firmer for the session so far, but we remain comfortably within recent ranges.

- Today has seen a further tick higher in US yields, with the benchmarks 1-2bps firmer. We saw some USD strength earlier but no follow through, the better China/HK equity tone, and firmer China import data, providing some support to higher beta currencies.

- Gold is just under the 20-day EMA, (near $2314). The May 3 low at $2277.4 remains a potential downside target. Late April highs sit back near $2352.6.

CHINA DATA: Imports Rebound More Than Forecast, Export Growth Back In Positive Territory

China trade figures for April saw export growth rise 1.5% y/y, close to expectations (1.3%), but comfortably above the prior month's -7.5% pace. Imports were stronger than forecast though, up 8.4% y/y (4.7% forecast and -1.9% prior). The trade surplus was below expectations, printing at $72.35bn, largely due to the import beat.

- The first chart below overlays y/y export growth against CNY NEER y/y changes. There is a modest divergence, where the NEER looks too strong in y/y terms relative to the export trend but it is modest by historical standards.

- The authorities may continue to guard against the pace of yuan depreciation pressures rather than accept a sharp fall in the hope it boosts exports. Such a move may only raise competitiveness concerns with some of China's key trading partners.

- The export trend is expected to remain on a recovery path this year per the latest from our policy team (see this link).

Fig 1: CNY NEER Versus Export Growth Y/Y

Source: MNI - Market News/Bloomberg

- On the import side, the y/y print took us back towards earlier 2024 highs. It should, at the margin, give some confidence that the domestic demand backdrop is not faltering aggressively.

- The second chart below plots aggregate import growth against the y/y change in spot commodity prices.

- In terms of commodity import volumes, we saw gains for coal (+9.35%m/m) and iron ore (+1.1%m/m), but crude oil fell by 8.8% m/m. Natural gas import volumes were down a touch, but most other commodities were higher.

Fig 2: China Imports Y/Y & Global Spot Commodity Prices Y/Y

Source: MNI - Market News/Bloomberg

PHILIPPINES DATA: Steady GDP Trend, But Details Point To Slowing Domestic Demand

Philippines Q1 GDP rose 1.3% q/q, against a 1.0% forecast and prior 2.1% read. The y/y pace was a touch below expectations at 5.7% (5.9% forecast) but still showed improvement on the Q4 outcome of revised 5.5% increase.

- The trend around growth looks reasonably steady, although the detail suggests the weight of earlier policy tightening is starting to bite.

- Private consumption rose 4.6% in y/y terms, but this was down from the 5.3% pace seen in Q4. In q/q terms we were down sharply. Back in Q1 2022 consumption growth peak at 10% y/y.

- Investment spending also slowed sharply to 2.3% q/q from 10.2%. The biggest drag came from durable equipment (off -4.8% y/y) but construction investment also slowed to 6.8%y/y from 10.1%.

- Positive offsets came from higher government spending (+1.7%y/y, from -1.0%). Exports also recovered strongly to +7.5% y/y (from -2.5% y/y in Q4 last year).

- Officials noted that the country can still achieve this year's growth target of 6-7%, which was recently revised down from 6.5-7.5%.

- It also comes ahead of the next week's BSP decision. Today's result coupled with lower April CPI should leave the central bank firmly on hold. It is still likely to be too early for dovish pivot given external developments.

ASIA FX: Mixed Trends, 1 Month USD/KRW Testing 20-day EMA Resistance

USD/Asia pairs are mixed in the first part of Thursday trade. Overall ranges have been fairly tight, mirroring price action in terms of the majors. CNH is close to unchanged, while the won has weakened. Most other currencies sit a touch higher versus the USD. Still to come today is the BNM decision, no change is expected. Tomorrow the data calendar is relatively quiet, although we do get Indian IP figures later on.

- USD/CNH has stuck fairly close to the 7.2300 level, although moves above this level have drawn some selling interest. Local and HK equities are higher led by property and tech names. April trade figures showed a rebound in growth, particularly on the import side, which should allay fears of a sharp slowdown in domestic demand.

- 1 month USD/KRW has drifted higher, the pair last near 1366, which is close to its 20-day EMA. Onshore equities are lower, off by 1%. We had March current account data show a further rise in the surplus position, but sentiment in the FX space didn't change. President Yoon also gave his first press conference in 2yrs and set out an agenda for his remaining time in office. Addressing inflation and raising the domestic birth rate are key focus points.

- USD/PHP sits down a touch, last under 57.40. We had Q1 GDP print close to expectations earlier, although the detail showed softer domestic demand conditions. This should lead to a pause from the BSP next week.

- USD/THB is back under 36.90m around 0.20% stronger in baht terms. Moves towards or above the 37.00 region continue to draw selling interest.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/05/2024 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 09/05/2024 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 09/05/2024 | 1130/1230 |  | UK | BoE Press Conference | |

| 09/05/2024 | 1215/1415 |  | EU | ECB's De Guindos remarks at Panel Civico | |

| 09/05/2024 | 1215/1415 |  | EU | ECB's Cipollone remarks at seminar on financial instrument tokenisation | |

| 09/05/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 09/05/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 09/05/2024 | - | *** |  | CN | Trade |

| 09/05/2024 | 1300/1400 |  | UK | BOE's Decision Maker Panel Data | |

| 09/05/2024 | 1400/1000 |  | CA | Bank of Canada Financial System Review (and Survey) | |

| 09/05/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 09/05/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 09/05/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 09/05/2024 | 1615/1715 |  | UK | BOE's Pill MPR Virtual Q&A | |

| 09/05/2024 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 09/05/2024 | 1800/1400 |  | US | San Francisco Fed's Mary Daly | |

| 09/05/2024 | 1900/1500 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.