-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA PAC Weekly Macro Wrap:

MNI EUROPEAN MARKETS ANALYSIS: US Yield Moves Still Dominating Sentiment

- US cash Tsys have been pressured in today's Asian session, local participants faded Friday's richening alongside weakness in Oil and Gold as escalation fears in the Israel/Hamas conflict eased.

- Elsewhere, JGB futures are holding cheaper, -18 compared to the settlement levels, after gapping lower at the open following a Sunday article in the Nikkei newspaper that reported BOJ officials are pondering whether to tweak the settings of the yield-curve control program at the upcoming policy meeting.

- South Korean data suggested a further improvement in the global backdrop in terms of early October trade data. Risk appetite has been mixed though, with regional equities still under pressure, while the US yield rebound has aided broader USD sentiment.

- Later the US Chicago Fed index for September is released and is forecast to improve marginally. There are no Fed or ECB speakers on the schedule.

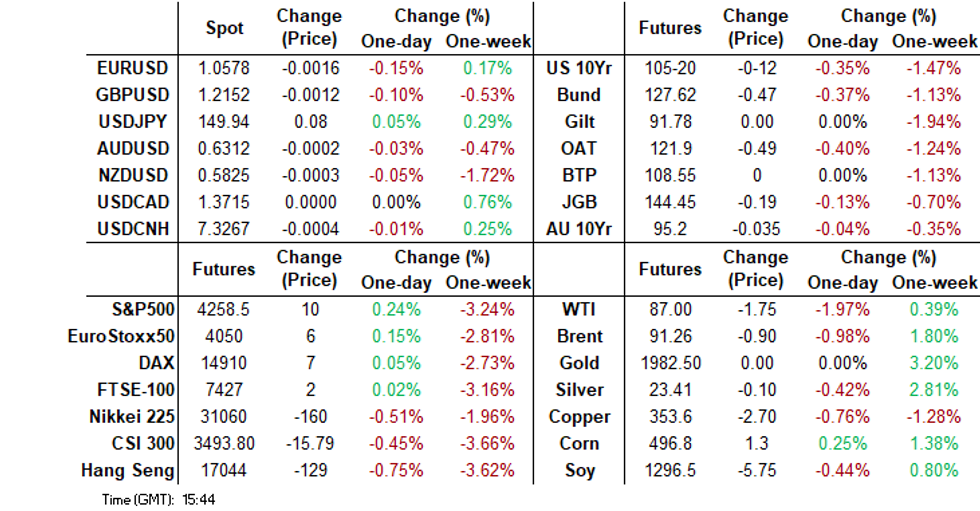

MARKETS

US TSYS: Pressured In Asia

TYZ3 deals at 105-19, -0-13, a 0-11 range has been observed on volume of ~125k.

- Cash tsys sit ~5bps cheaper across the major benchmarks.

- Tsys have been pressured in today's Asian session, local participants faded Friday's richening alongside weakness in Oil and Gold as escalation fears in the Israel/Hamas conflict eased.

- In early dealing spillover from JGBs weighed after a Sunday article in the Nikkei newspaper reported that BOJ officials are pondering whether to tweak the settings of the yield-curve control program at the upcoming policy meeting.

- Support in TY comes in at 105-10+, low from Oct 19 then 104-27+ 2.0% 10-DMA Envelope.

- The docket is thin today with just the Chicago Fed National Activity Index due.

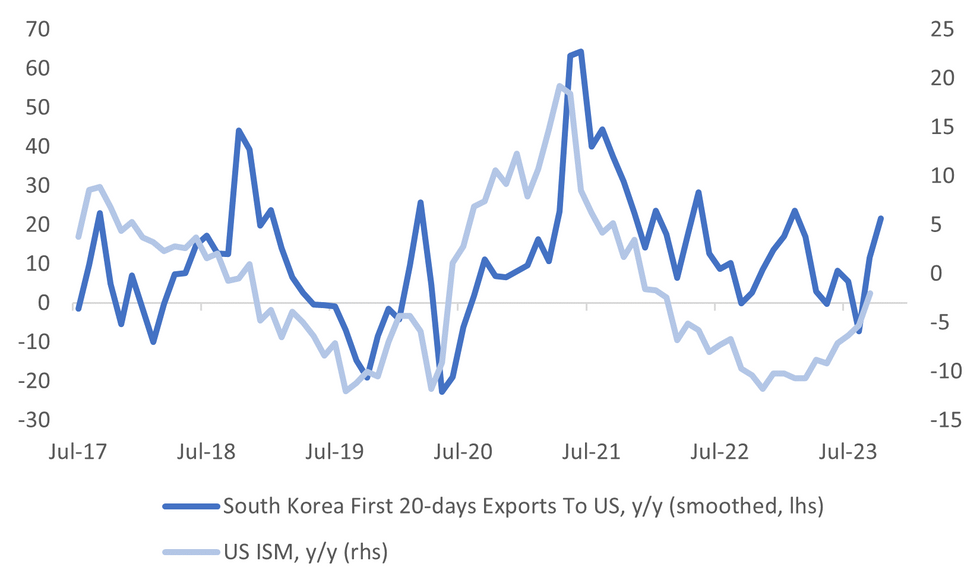

SOUTH KOREA/US: South Korean Exports To The US Suggest Resilient Backdrop

South Korea's first 20-days trade data for October continues to suggest a fairly resilient US growth backdrop, at least at face value. Exports rose to US +12.7 y/y in the first 20-days of October. This was down from the heady +30.5% pace seen in September (first 20-days). Nevertheless, the trend still looks to be improving.

- The chart below shows the 2 month moving average of exports to the US, against the y/y change in the US ISM index.

- The improvement in exports is consistent with further improvement in the ISM, which could take us back above the 50.0 expansion/contraction point.

- Note the correlations between the two series are lower, back to around 45% for the past 3 year. We were above 60% back in early 2022.

Fig 1: South Korean Exports To The US & US ISM Print

Source: MNI - Market News/Bloomberg

SWITZERLAND: Voters Shift To The Right, Support For Greens Drops Sharply

Switzerland held federal elections on Sunday for its National Council and first round for the Council of States (runoffs will be held through November). The anti-EU and anti-immigrant Swiss People’s Party (SVP) won the election again increasing its share of the vote by 3.3pp to 28.6%. The Social Democrats were second increasing their share by 1.1pp to 18% but both Green parties saw a drop in support.

- The vote will give the SVP another 9 seats bringing the total to 62 well ahead of the SD on 41. The right as a whole have increased their share of the 200 seat Council with the 11 seat loss of the two Green parties weighing on the left’s.

- The other party to increase its support in the October 22 poll was the Centre which saw a 0.8pp increase in the vote share to 14.6% putting them in third place ahead of the liberals (FDP) who fell 0.7pp to 14.4%. The Centre will hold the balance of power in the National Council.

- Turnout was low at 46.9% but better than 2019’s 45.1%.

- On December 13 the seven members of the governing Federal Council will be elected. Only one of the current members is not standing again and it is usual practice that their party, which in this case is SD, will put forward another candidate. Currently there are 2 councillors from the SVP, SD, Liberals and one from the Centre. But with the Centre coming in third, they may contest one of the Liberals councillor positions.

JGBS: Futures Weaker, BOJ Tweak Fears Weigh, Curve Bear Steepens

JGB futures are holding cheaper, -18 compared to the settlement levels, after gapping lower at the open following a Sunday article in the Nikkei newspaper that reported BOJ officials are pondering whether to tweak the settings of the yield-curve control program at the upcoming policy meeting. The article didn’t say where it obtained the information.

- The local calendar was empty today, apart from BOJ Rinban operations covering 1- to 25-year JGBs. These operations saw positive spreads and generally higher cover ratios, which, as expected, has generated some pressure in the Tokyo afternoon session.

- The cash JGB curve has bear-steepened, with yields 0.1bp to 6.1bps higher. The benchmark 10-year yield is 1.2bps higher at 0.854%, above BOJ's YCC soft limit of 0.50% but below its hard limit of 1.0%. It is also slightly lower than the fresh cycle high of 0.866% set today.

- The swaps curve has also bear-steepened, with rates 0.6bp to 3.5bps higher. Swap spreads are mixed across maturities.

- Tomorrow the local calendar sees Jibun Bank Japan PMI and Department Store Sales data.

- The US docket is thin today, with just the Chicago Fed National Activity Index due.

AUSSIE BONDS: Near Session Cheaps As US Tsys & JGBs Weaken, RBA Governor Speech Tomorrow

ACGBs (YM -2.0 & XM -4.5) sit near Sydney session cheaps. With the domestic data calendar empty today, the local market has likely been on headlines and US tsys watch.

- To that end, US tsys are continuing to tick lower through the Asian session, as participants continue to fade Friday's richening. Weakness in JGBs is also weighing after a Sunday article in the Nikkei newspaper reported that BOJ officials are pondering whether to tweak the settings of the yield-curve control program at the upcoming policy meeting. Cash tsys sit 5-7bps cheaper. TYZ3 deals at 105-18+, -0-13+ compared to the NY closing level on Friday.

- Cash ACGBs are 2-5bps cheaper, with the AU-US 10-year yield differential unchanged at -19bps.

- Swap rates are 2-5bps higher, with the 3s10s curve steeper and EFPs little changed.

- The bills strip is little changed, with pricing -2 to +1.

- RBA-dated OIS pricing is flat across meetings, with terminal rate expectations at 4.36% (+29bps) ahead of Wednesday's Q3 CPI data.

- Tomorrow, the local calendar sees Judo Bank PMI data and RBA Governor Bullock’s speech at CBA’s Annual Conference. This event could be an opportunity to set out her thinking about the outlook or the framework for policy, given it is her first set-piece speech since becoming Governor.

AU RATES: AU Hike Expectations Are Outlier In The $-Bloc

Market expectations for terminal interest rates in the $-bloc have generally softened over the past week, with one notable exception being Australia.

- Canada stands out as the top performer, experiencing a 15bps softening in anticipation of the upcoming BOC policy decision this week. This shift in sentiment can be predominantly attributed to the September CPI figure that fell short of expectations last week.

- NZ has been the second-best performer, displaying an 8bps softening, which can also be linked to a CPI data shortfall.

- In contrast, the RBA-dated OIS pricing has shown a 12bps firming over the past week in anticipation of the Q3 CPI data release scheduled for Wednesday.

- Terminal rate expectations and the cumulative tightening currently stand at: 5.41%, +8bps (FOMC); 5.09%, +17bps (BOC); 4.34%, +27bps (RBA); and 5.63%, +13bps (RBNZ).

Figure 1: $-Bloc STIR

Source: MNI – Market News / Bloomberg

AUSTRALIAN DATA: High Au-NZ Correlations Imply Easing Q3 Australian CPI Plus Services

NZ’s Q3 CPI came in below RBNZ and consensus forecasts but remains elevated. It rose 1.8% q/q to be up 5.6% y/y down from 6% in Q2 driven by transport, council rates and rents. There is a very high correlation between NZ and Australian quarterly CPI annual inflation data, implying that there should be further moderation when the latter is published on October 2025. Bloomberg consensus is forecasting it to ease to 5.3% from 6%, which would bring it below NZ’s again.

Australia vs NZ CPI y/y%

Source: MNI - Market News/Refinitiv

- The correlation is also very high between Australia’s trimmed mean CPI and the RBNZ’s measure of core, which finally turned down in Q3 suggesting a further moderation in Australia’s. Consensus is projecting a drop to 5% from 5.9%, which would bring it below NZ’s 5.2%.

- Sticky services inflation remains a key concern for the RBA. NZ’s was lower than Australia’s in Q2, which looks like it was the peak as NZ’s eased 0.5pp to 5.6% in Q3. The 3-year rolling correlation has been around 80% for the last three quarters and so the move in NZ services may mean that Australia will see a moderation in Q3 too, which would likely reassure the RBA.

- Also domestically driven, NZ non-tradeables CPI inflation fell in Q3 to 6.3% but remains high. In Q2 it was 0.3pp below Australia’s rate.

Source: MNI - Market News/Refinitiv

EQUITIES: Eminis At Simple 200-day MA, China Equity Weakness Continues

Asia Pac equities have been under pressure in the first part of Monday trade. All the major indices are lower, although note Hong Kong markets have been closed today for a public holiday, which has likely had some impact on broader liquidity. Higher US futures have probably provided some offset, but this hasn't been enough to turn markets back into positive territory. Eminis are +0.18%, last near 4256, which is close to the simple 200-day MA. Nasdaq futures are up by a similar amount.

- Risk appetite has improved modestly, as Israel is yet to invade Gaza, as hostage negotiations continue. This has seen oil prices move lower, but the USD and US Tsy yields have firmed.

- China equity weakness remains a focus point. The CSI 300 is off another 0.60% to the break. This puts the index sub 3500 and below November 2022 lows.

- The Taiex is off nearly 1%. Broader tech headwinds are weighing, while a reported probe by China into key Apple supplier Hon Hai (a subsidiary of Foxconn) is also likely impacting sentiment negatively.

- The Kospi is down as well, but a more modest 0.50%. Japan benchmark indices are off by a similar amount.

- In SEA, Indonesian markets are close to -1.2% lower, continuing their recent pull back (following last week's surprise rate hike). Malaysian stocks are faring better, sitting around flat at this stage.

FOREX: Greenback Marginally Firmer, Narrow Ranges In Asia

The USD is a touch firmer in Asia however ranges have been narrow and there has been little follow through on moves thus far. BBDXY is up ~0.1%. Oil and Gold have ticked lower alongside US Tsys as escalation fears in the Middle East softened. US Equity Future are firmer.

- USD/JPY printed a high at ¥150.11 in early dealing amid thin liquidity before paring gains to sit unchanged from Friday's closing levels at ¥149.90/95. Technically the outlook remains bullish, resistance sits at ¥150.16, Oct 3 high and bull trigger. Support comes in at ¥149.08 the 20-Day EMA.

- AUD is little changed from opening level, AUD/USD prints at $0.6310/15. Q3 CPI on Wednesday is in focus with the RBA closely watching the release. The trend for AUD/USD is bearish, support comes in at $0.6286 which is the bear trigger. Resistance is at $0.6393, high from Oct 18.

- Kiwi is dealing in narrow ranges and is a touch below from Friday's closing level. A $0.5820/30 range has been observed today.

- Elsewhere in G-10 CHF is down ~0.3%, however liquidity is generally poor in Asia.

- The data docket is thin on Monday.

OIL: Crude Lower Today As Gaza Invasion On Hold For Now

Oil prices have trended lower today falling almost a percent as negotiations to release Israeli hostages has put the ground invasion of Gaza on hold. There has been little new news during the APAC session but there has been a pullback in risk sentiment with equity markets down across the region. The USD index is 0.1% higher but off its intraday high.

- WTI is down 0.9% to $87.25/bbl and Brent -0.8% to $91.42. Both are off their intraday lows of $87.03 and $91.14 respectively. Brent has spent most of the session below $92.

- Later the US Chicago Fed index for September is released and is forecast to improve marginally. There are no Fed or ECB speakers on the schedule. This week the data focus is on US preliminary October PMIs and core consumption for September. The main sensitivity for crude markets is likely to be developments in the Middle East; an expansion to other countries remains the key risk.

GOLD: Retreats From A Five Month High As Middle East Tensions Ease

Gold is 0.5% lower in the Asia-Pac session, retreating from the five-month high of $1997.22 set on Friday. This move can be attributed to easing fears over the weekend that Middle East tensions would spread to major powers after the release of two US citizens held hostage in Gaza and the US pushing Israel to delay its invasion.

- The precious metal has also been pressured by US Treasuries in today's Asia-Pac session. Cash tsys are 5-7bps cheaper across the major benchmarks after Friday's bull-steepening.

- Bullion closed +0.4% at $1981.40 on Friday, holding its clearance of resistance of $1982.4 (Jul 20 high), according to MNI’s technicals team.

- Next resistance is seen at $2003.4 (76.4% retrace of May 4 – Oct 6 bear leg).

ARGENTINA: Incumbent Vs Libertarian In November Runoff, Uncertainty Persists

With 86% of the vote for President counted the current Economy Minister Massa, a Peronist, is in first place with 36% of the vote and libertarian Milei is second with 30%. There will a runoff election held on November 19. Pro-business Bullrich was third on 24% and it will remain to be seen where her votes will go in November poll.

- According to Bloomberg, the Argentine peso is 20% stronger versus the greenback on local cryptocurrency exchanges following the announcement of the results. Before this election the government said that it would keep the peso peg until November 15 and then the official peg would be devalued 3% per month. Milei plans to dollarize the economy in an effort to save it from collapse.

- Bloomberg is reporting that this is the worst outcome for investors and that there will be another month of uncertainty, as neither Massa nor Milei has released details of their policies. Also the incumbent interventionist Peronist government is likely to implement additional fiscal stimulus in the lead up to the runoff to get its candidate over the line thus fuelling inflation further which currently stands at 138%. This strategy seems to have worked in getting Massa into first place in Sunday’s election.

- With the end to Bullrich’s campaign, there is a risk that a coalition between her party and Milei’s may not be enough to force a change in government. The Peronists have run Argentina for most of this century.

- Turnout was 74%, higher than for the primaries.

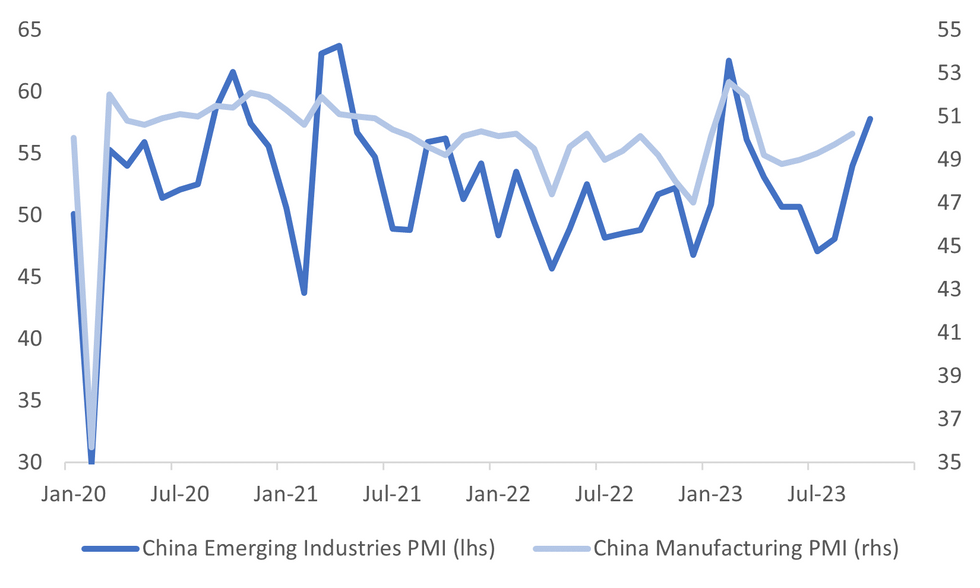

CHINA DATA: Emerging Industries PMI Recovered Further In October

Recent data prints point to a further recovery in the China economic backdrop. Last week the emerging industries PMI rose further in terms of the October print. The headline index stands at 57.8 now, up from 54 in September and well above the 47.1 trough in July. We are still below the earlier 2023 highs (62.5 in February).

- The chart below overlays this index against the official manufacturing PMI. The official index tends to exhibit much less volatility than the emerging industries PMI, although the directional correlation remains reasonable.

- The other point to note is that South Korean exports to China fell -6.1 y/y in the first 20-days of October. Whilst still negative, we are well above earlier 2023 lows from a y/y momentum standpoint (-36.2 y/y in March).

Fig 1: China Emerging Industries PMI Continued To Recover In October

Source: MNI - Market News/Bloomberg

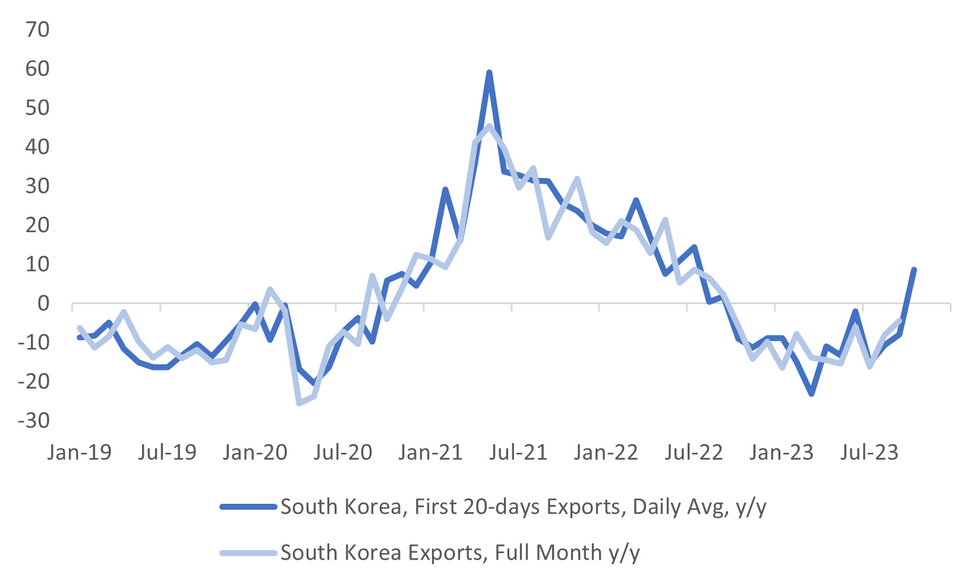

SOUTH KOREA DATA: Export Growth Tracking Firmer, But Trade Deficit Re-widens

The first 20-days of October trade data continues to suggest an improving external demand backdrop. Headline exports rose 4.6% y/y. This compares with the first 20-days of September, which printed +9.8% y/y. Still, in daily average terms, exports were up 8.6% y/y. This is a sharp turnaround on the daily average for the first 20-days of September, -7.9%.

- Base effects played a role, but still, it continues to suggest further improvement in y/y momentum export growth. The chart below overlays the 20-day daily average export growth against full month export growth for South Korea.

- Less drags were evident from two headwinds that have been present on the export side. China exports fell -6.1% y/y, versus -9% y/y for the prior read. Chip exports were down -14.1% y/y in the first 20-days of September but this metric now stands -6.4% y/y.

- Exports to the US remained positive at +12.7% y/y, albeit down from the prior heady pace.

- On the import rise, we rose 0.6% y/y, up from the prior -1.5% pace.

- The trade deficit re-widened to -$3.75bn against a prior (-$489mn). We do tend to see improvement in the trade position in the final 10days of the month, although the rebound in global energy prices is likely weighing on the country's overall position.

Fig 1: Export Growth Recovered Further In October

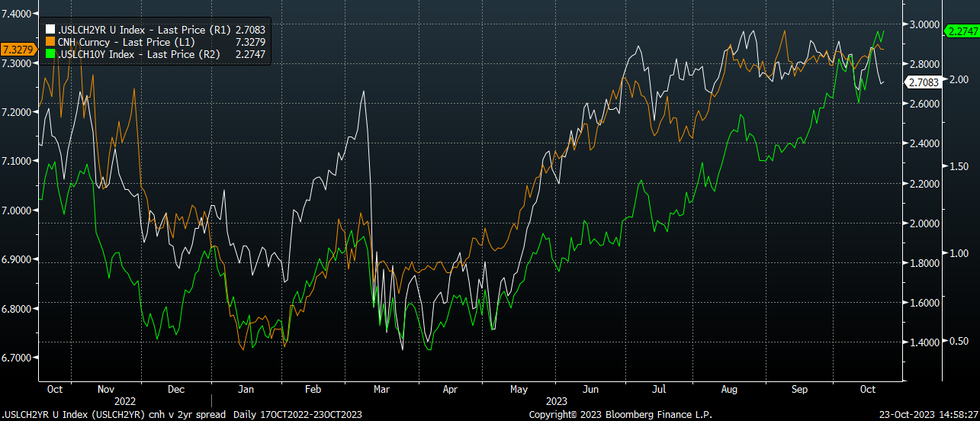

CHINA FX: CNH Steady, US-CH 10yr Rate Differentials Continue To Trend Higher

USD/CNH has had a relatively quiet start to the week. The pair tracking recent ranges and last near 7.3280, little changed versus closing levels at the end of last week. Local equities continue to weaken, although as we noted earlier, this perhaps less of a headwind for the local FX given equity losses elsewhere in terms of the major indices. The China to rest of the world equity trend only sits down slightly.

- In terms of rate differentials with the US, we have diverged somewhat recently. The US-CH 2yr government bond yield spread is down from recent highs back to +270bps, but the 10yr spread has continued to track higher, last at +228bps.

- This largely reflects gyrations in terms of the US Tsy yield curve, with the recent steepening trend dominating. Still, the China 2yr yield has recovered from earlier 2023 lows, last near 2.42% (back in August lows were around 2.07%).

- USD/CNH hasn't followed the 2yr spread lower (white line on the chart below), see the chart below. In the past 3 months the correlation between USD/CNH and the 10yr spread (green line on the chart), has been stronger though at +69%, versus +36% for the CNH and the 2yr spread with the US.

Fig 1: USD/CNH & 2yr US-CH & US-CH 10yr Spread

Source: MNI - Market News/Bloomberg

ASIA FX: Fresh Highs In USD/IDR Prompt BI Intervention

Most USD/Asia pairs have tracked higher today, mostly notably USD/IDR, which prompted fresh intervention from the authorities. CNH has been steady, as has PHP. KRW and TWD has seen modest losses amid further equity weakness, although both currencies are away from earlier October lows. Still to comes is Taiwan IP. Tomorrow, South Korea's PPI is up early, followed by Thailand trade data later on.

- USD/CNH has had a relatively quiet start to the week. The pair tracking recent ranges and last near 7.3270, little changed versus closing levels at the end of last week. Local equities continue to weaken, although as we noted earlier, this perhaps less of a headwind for the local FX given equity losses elsewhere in terms of the major indices. The China to rest of the world equity trend only sits down slightly. In terms of rate differentials with the US, we have diverged somewhat recently. The US-CH 2yr government bond yield spread is down from recent highs back to +270bps, but the 10yr spread has continued to track higher, last at +228bps. This latter spread has had a higher correlation with CNH in the past 3 months (relative to the 2yr spread).

- 1 month USD/KRW has drifted higher amid broader regional equity losses. The pair was last near 1352, around 0.25% weaker in KRW terms versus end levels from last week. The Kospi is down a further 0.75%. This has offset further signs of an improved external demand backdrop.

- Spot USD/TWD is a little higher in the first part of Monday trade. The pair last at 32.37. We are sub earlier October highs closer to 32.45, but dips in the pair remain supported. The 20-day EMA sits back 32.23, with dips to and just under this level being supported in recent months. Coming up later we September IP. The market looks for -8.0% y/y, versus -10.53% prior. This follows last Friday's export orders data for September, which was a bit weaker than expected at -15.6% y/y (-13.9% forecast), with tech and IT related sub indices dipping further in y/y terms. This goes against the recent run of better than expected export data.

- USD/IDR is off highs, as the BI intervened to curb USD gains. The pair sits back near 15950, slightly below earlier highs of 15962. The earlier break above 15900 but the pair to fresh highs going back to earlier in 2020. Last week's surprise BI rate hike has done little to calm sentiment in the FX space at this stage.

- The SGD NEER (per Goldman Sachs estimates) has ticked higher in early dealing on Monday and sits a touch off the base of the recent ranges after ticking lower last week. The measure sits ~0.7% below the top of the band. USD/SGD continues to consolidate in a narrow range about the 20-Day EMA ($1.3686). The pair is unchanged from Friday's closing levels at $1.3725/30. September CPI is due this afternoon, headline inflation is forecast to tick marginally higher to 4.1% Y/Y from 4.0%. There is no estimate for the Core measure which came in at 3.4% Y/Y in August.

- The Ringgit has been pressured in early trade as onshore participants digest higher US Tsy Yields on Monday. USD/MYR sits a touch under YTD highs, the pair is up ~0.2% and last prints at 4.7775/7800. The local docket is empty this week.

- The Rupee has opened dealing a touch softer, USD/INR a touch firmer last printing at 83.16/17. USD/INR fell beneath the 20-Day EMA (83.1869) on Friday paring recent gains before support came in ahead of the 83 handle. RBI Gov Das noted on Friday that the bank needs to be extra vigilant on inflation and needs to see CPI easing to 4% on a sustainable basis.

- USD/PHP has largely ignored the more positive USD/Asia trends seen elsewhere today. The pair remains comfortably within recent ranges, last just under 56.84. This leaves the well established 56.50/57.00 range firmly intact for now. The simple 50-MA (56.73) has been somewhat of a support point in recent weeks and has trended higher over this period. The main local focus is on tensions with China. This comes after two Philippines vessels collided with China boats in the South China Sea. The Philippines government reportedly summoned the China Ambassador, while headlines also crossed that the Philippines was studying if the collision triggers its defense pact with the US.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/10/2023 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 23/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 24/10/2023 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 24/10/2023 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 24/10/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 24/10/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 24/10/2023 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 24/10/2023 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 24/10/2023 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 24/10/2023 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 24/10/2023 | 0800/1000 |  | EU | ECB Bank Lending Survey (Q3 2023) | |

| 24/10/2023 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 24/10/2023 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 24/10/2023 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 24/10/2023 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 24/10/2023 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 24/10/2023 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 24/10/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 24/10/2023 | 0900/0500 | * |  | US | Business Inventories |

| 24/10/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 24/10/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 24/10/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 24/10/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/10/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 24/10/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 24/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 24/10/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.