-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: USD Holds Firm In Asia, Equities Offered

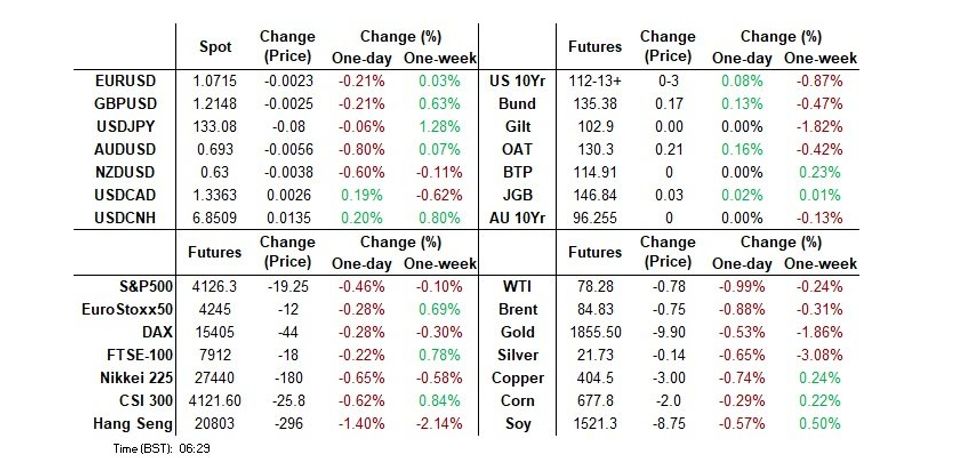

- The greenback is firmer in the Asian session today, with regional equities and U.S. equity futures softer in the wake of U.S. CPI, weighing on risk sentiment.

- Core FI markets firmed as the Asia-Pac session wore on.

- In Europe today we have CPI & RPI from the UK, further out there is Empire Manufacturing and US Retail Sales, along with comments from ECB President Lagarde.

US TSYS: Marginally Richer In Asia

TYH3 deals at 112-14, +0-03+, a touch off the top of its 0-05 range on volume of ~70k.

- Cash Tsys sit flat to 1bp richer across the major benchmarks.

- Tsys opened Wednesday cheaper as Asia-Pac participants focused on yesterday's CPI numbers and hawkish Fedspeak from Dallas Fed President Logan in early regional trade.

- A recovery off session lows was facilitated by a move in ACGBs as Governor Lowe didn't deliver any fresh hawkish messaging at a Senate appearance.

- The modest richening move then held through the session, with a couple of block buys in TU futures helping underpin the move, alongside weakness in e-minis and the major regional equity indices.

- Little meaningful macro headline flow was observed.

- In Europe today we have CPI/RPI from the UK, further out there is Empire Manufacturing and Retail Sales. We also have the latest 20-Year Tsy Supply.

JGBS: Firmer & Flatter On Global Cues & Presence Of Rinban

JGB futures pared the modest losses seen in the overnight session and more to sit +7 on the day ahead of the bell, with an uptick in core global FI markets and the presence of the BoJ Rinban operations (covering 1- to 3- & 5- to 25+-Year JGBs) helping generate a light bid. The major cash JGB metrics sit flat to ~3.5bp richer, with a flattening bias apparent, while 10-Year yields operate around the upper boundary permitted under the BoJ’s current YCC settings. Swap rates are essentially flat across the curve, dealing either side of unchanged.

- There hasn’t been much in the way of meaningful domestic headline flow to digest, with PM Kishida outlining the positive characteristics he identified in his nominee for BoJ Governor, Ueda. He also underscored his desire for continued close work between the government and the Bank.

- The aforementioned BoJ Rinban operations continued the run of subdued offer/cover ratios (1.3-2.4x across the buckets covered by today’s purchases).

- 5-Year JGB supply headlines the local docket on Thursday.

AUSSIE BONDS: Mid-Session Reversal Sees ACGBs Outperform U.S. Tsys

YM and XM reverse almost all of the early weakness to close -1.0 and flat, respectively, after RBA Governor Lowe's Senate Economics Committee Hearing failed to deliver a message that was meaningfully more hawkish than the one contained in last week’s RBA communique. YM and XM were down as much as -10.0 in early trade. Cash ACGBs saw yields pullback from the morning highs to be flat to up 1bp out to the 10-year zone and flat to -2bp for the 15-30yr benchmarks.

- Swaps rates closed flat to up 2bp after scaling back most of the morning’s weakness to leave the 3s10s curve 2bp flatter.

- The AU-US 10-year yield differential closed at ~+2bp off the morning wides of +6bp.

- Bills were 3-4bp up from session lows, closing +1 to -6 through the reds.

- While March meeting RBA-dated OIS pricing has shown little movement over recent days, attaching a 92% chance of a 25bp hike, terminal rate expectations have moved in a 4.10%-4.22% range with current pricing for Sep/Oct-23 at just over 4.15%.

- In the run-up to tomorrow’s all important January Australian labour market data, the market is likely to find its guidance from abroad with January prints for UK CPI and U.S. retail sales the most noteworthy global data releases.

NZGBS: Follow ACGBs In Mid-Session Reversal

NZGBs failed to hold the morning session’s U.S. Tsy induced selling pressure, delivering a 4bp reversal across the curve in line with their trans-Tasman counterparts. At the close, NZGB yields were 3.5bp higher for the 2-year benchmark and 1bp higher for the 10-year with a 2bp further inversion of the 2/10 bond curve.

- The swings in NZ swaps were even larger with the 2-year swap rate higher by as much as 10bp in morning trade before reversing to close up 5bp. 10-year swap rate rose 4.5bp in early trade but managed to close 3.5bp lower with the curve 8.5bp more inverted.

- RBNZ-dated OIS reversed early session upward pressure to close basically unchanged with the amount of tightening priced for this month’s meeting at 56bp and terminal OCR pricing sitting around 5.40%.

- There wasn't much in the way of domestic matters to shape price action.

- Looking ahead, the market is likely to find its guidance from abroad with January prints for UK CPI and U.S. retail sales the most noteworthy global data releases on Wednesday, while Australian labour market data may provide some trans-Tasman impetus on Thursday. The weekly NZDM supply will come in the form of NZGB-28, -33 & -37.

FOREX: Greenback Firms, Weaker Equities Weigh On Risk Sentiment

The greenback is firmer in the Asian session today, regional equities and US equity futures are softer weighing on risk sentiment.

- Yen is little changed and is outperforming as risk off flows support the JPY. USD/JPY is ~0.1% softer however the pair did print a session low of ¥132.55 below parting losses to deal at current levels.

- AUD is pressured, amid the equity pullback, and is the weakest performer in G-10 space at the margins. There were no new hawkish surprises in Gov Lowe’s appearance at a Senate committee. The pair deals at session lows $0.6930/40, downside support comes in at $0.6856 the low from 6 Feb.

- NZD/USD is also softer as weaker risk sentiment weighs. The pair is dealing at session lows, downside breaks of $0.63 have been supported in recent trade. AUD/NZD is ~0.2% softer, dealing a touch above the $1.10 handle.

- EUR and GBP are both ~0.2% softer, as the broad based USD bid weighs.

- Cross asset wise; Hang Seng is down ~1.3% and e-minis are down ~0.4%. BBDXY is up ~0.2%, since breaking above its 20-day EMA in early Feb the index has found support on the EMA and it is now emerging as a level to watch. The index dropped below the 20-day EMA post yesterday US CPI but recovered as rising US yields boosted the greenback.

- In Europe today we have CPI/RPI from the UK, further out there is Empire Manufacturing and US Retail Sales.

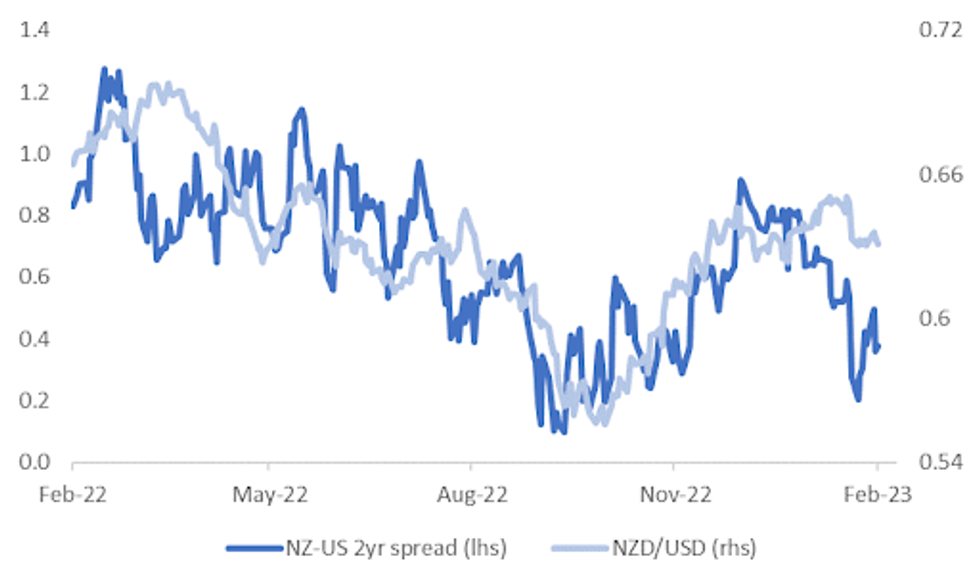

NZD: Threatening Another 0.6300 Test, RBNZ Coming Into View

Since falling below $0.64 in early February, after the stronger than expected NFP print in the US, NZD/USD has seen fairly tight ranges persist.

- The pair has seen support below $0.63, and faced resistance above its 20-Day EMA, with a ~2% range persisting. We are back towards the bottom end of the range currently, last around 0.6310/15, so another 0.6300 test may be in the offering.

- 2 year rate differentials moved against the NZD, see the chart below, although we are above late Jan lows, last around +37bps.NZD/USD still looks too high as has been the case for much of this year.

- Bears target January lows at $0.6191. Bulls look to break $0.64, targeting 2 Feb high at $0.6538 in an extension.

- The RBNZ's OCR decision next Wednesday presents the next macro risk event for the NZD. OIS markets have ~55bps of tightening priced into the meeting, and the terminal rate of ~5.4%.

Fig 1: NZD/USD Versus NZ-US 2yr Swap Spread

Source: MNI - Market News/Bloomberg

FX OPTIONS: Expiries for Feb15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0490-00(E554mln), $1.0650-70(E1.3bln), $1.0700(E1.2bln), $1.0715-20(E694mln), $1.0800-05(E1.1bln), $1.0830-50(E1.3bln)

- USD/JPY: Y130.00($1.1bln), Y130.15-21($1.1bln), Y134.00($1.2bln)

- AUD/USD: $0.7000(A$1.2bln)

- USD/CAD: C$1.3300(E700mln), C$1.3400(E690mln)

- USD/CNY: Cny6.8500($2.2bln), Cny6.9500($1.3bln), Cny7.0000($1.3bln)

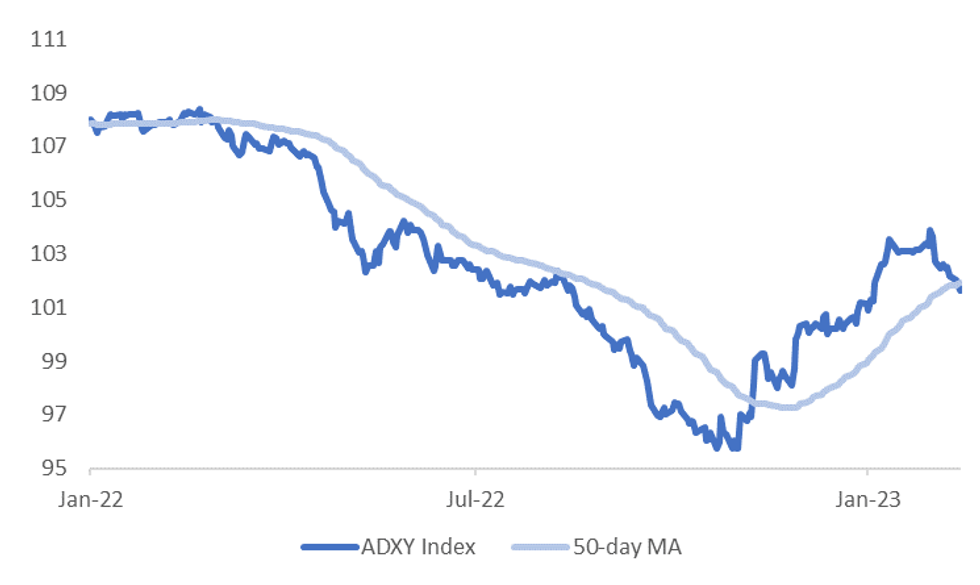

ASIA FX: Struggling, ADXY Back Sub 50 Day MA

USD/Asia pairs are higher across the board, albeit to varying degrees. The firmer USD tone post yesterday's US CPI print has persisted, while lower regional equities have also weighed today. The ADXY index is back sub its 50-day MA for the first time since Nov last year (see this link). KRW and THB are the weakest performers, while INR and CNH have outperformed modestly. Still to come is Indian trade data. Tomorrow is headlined by the BI and BSP decisions (BI likely to remain on hold, while BSP will hike, most likely by 50bps). China new home prices for Jan also print.

- USD/CNH is back above 6.8500, +0.20% firmer for the session. This is highs back to early Jan, but the CNH losses have been more modest compared to elsewhere today. Local equities are struggling, while the 1yr MLF rate was held at 2.75% as expected.

- 1 month USD/KRW is back to the 1282/83 region, levels last seen in late Dec last year. Tech related equity sentiment has been weaker today, while the won's high beta nature has again been on display. Offshore investors have sold -$335.6mn of local shares today.

- USD/INR is ~0.1% firmer, printing at 82.85/90. We are close to recent highs near 83.00, so be mindful of intervention risks. Indian Equities have seen foreign investors buy a net of $389mn on Friday and Monday, however the net for the month is an outflow of ~$217mn. On the wires today we have January Trade Balance. The Bloomberg survey median is for a deficit of $23.5bn.

- There have been a host of Thailand headlines, with the central bank stressing that the path to policy normalization will be gradual and there is no need to raise rates aggressively. The central bank also stated the degree of baht volatility and the currency's current levels are manageable for local businesses. This followed calls earlier in the year, from certain sectors of the economy, to curb baht strength. USD/THB is back above 34.10, around 0.95% higher for the session.

- USD/IDR is up modestly, +0.30% to 15200/05. This is slightly below recent highs and still wedged between key EMA levels. Jan trade figures were reasonably close to expectations, the surplus at $3.87bn ($3.25bn expected and $3.965bn prior). Export growth was firmer though at +16.37%, +12.50% forecast. BI is expected to remain on hold tomorrow.

ASIA FX: Unwinding Early 2023 Gains

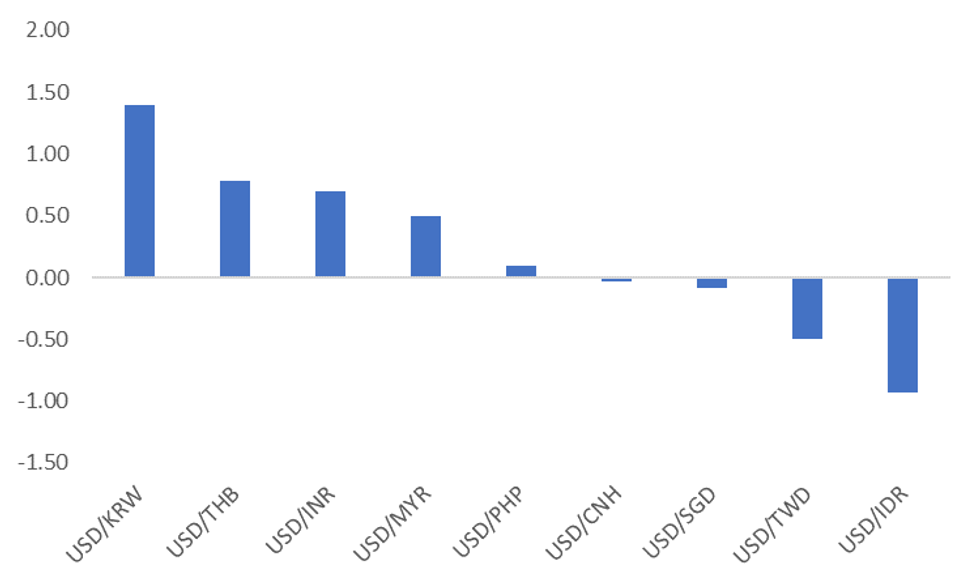

Asian currencies have continued to falter as today's session has progressed. Even CNH, which was resilient earlier, has fallen, with USD/CNH now above 6.8500. The Korean won has lost over 1%, while MYR and THB are off by 0.90% at this stage. The ADXY is now back below its simple 50-day MA for the first time since Nov last year, see the first chart below.

- The combination of the higher for longer threat from the Fed is benefiting broader USD sentiment, while the China re-opening theme has run out of some momentum, particularly in the equity space. US-China tensions haven't helped this backdrop either. Regional central banks have also likely had one eye on FX competitiveness given a still modest export growth backdrop.

- For the ADXY the simple 200-day MA sits lower at 100.67, versus current levels at 101.64. The 20-day sits above at 102.82.

Fig 1: J.P. Morgan ADXY Versus 50-Day MA

Source: J.P. Morgan, MNI - Market News/Bloomberg

- The second chart below plots the deviation in USD/Asia pairs from their respective 50-day MAs. USD/KRW and USD/THB are the firmest in terms of current deviation, followed by USD/INR and USD/MYR.

- At the other end of the spectrum, IDR and TWD are proving to be more resilient. PHP, CNH and SGD currently sit relatively close to their respective 50-day MAs.

- This resilience may prove difficult to sustain if the headwinds outlined above persist though.

Fig 2: USD/Asia FX Pairs -Deviation From 50-day MA

Source: MNI - Market News/Bloomberg

MNI Bank Indonesia Preview - February 2023: BI To Pause, May Be Done

EXECUTIVE SUMMARY

- Bank Indonesia is widely expected to leave rates unchanged at 5.75% at its February 16 meeting. This would be the first pause since tightening began in August and BI's tone indicates that it sees the terminal rate at 5.75%. In its January statement it said that the 225bp of cumulative tightening would be “sufficient to ensure core inflation remains within the 3.0%±1% target corridor” and that headline inflation would return to it in H2 2023.

- January inflation data eased, consistent with BI expectations, and data on cost and price pressures in the PMI also showed a moderation. BI noted that the recent appreciation in the currency should also help return inflation to target through lower import prices.

- Rates are likely on hold now with the next move a cut but if expectations for Fed rates are revised up, then the risk is that Bank Indonesia will need to resume tightening to stabilise the IDR.

- For the full piece, see here:BI Preview - February 2023.pdf

MNI BSP Preview - February 2023: +50bps Likely, But A Close Call

EXECUTIVE SUMMARY

- The Bloomberg consensus for tomorrow’s BSP meeting sits at +50bps, which would take the policy rate to 6.00%. However, 11 out of 23 economists surveyed by Bloomberg expect only a +25bps move, with the remainder in the 50bps camp. So, whilst tighter policy is clearly expected, the market is close to being evenly split between a 25bps or 50bps outcome. Our bias rests with a 50bps hike, although it is clearly a close call.

- The case for tighter policy once again remains straight forward and is centered on price pressures. The continued move higher in both headline and core inflation pressures is clear justification for further policy adjustments. The Jan CPI report blew market and BSP expectations out of the water. The other concern for the BSP may be inflation expectations becoming entrenched.

- The case for going only 25bps rests with the cumulative impact of previous tightening. Since the BSP started raising rates, a cumulative 350bps of rate hikes has been delivered since March last year. BSP Governor Medalla has also stated that non-monetary policy measures need to be optimized to bring down inflation pressures. On balance though, we see the risks skewed towards a 50bps tightening given known inflation outcomes.

- Click to view the full preview here:BSP Preview - february 2023.pdf

EQUITIES: Most Regional Markets Tracking Lower, China Equity Longs Viewed As Crowded

Regional equities are on the back foot. The risk off tone evident in the USD space has likely seen some negative spill over, with fears of a higher for longer Fed the main headwind for risk appetite. A number of specific news flow items have also likely dented sentiment in specific markets today. US futures are lower, with eminis down 0.40%, the Nasdaq off by 0.50%, at this stage.

- The HSI is down by -1.3% at this stage, while in China the CSI 300 is off by 0.43%. The Bank Of America Global Fund Manager survey highlighted that for Feb 23, long China equities is now viewed as the most crowded trade (replacing the long USD trade from Jan).

- Such positioning may be a factor limiting further gains. The HSI China Enterprise Index is now 10% off its Jan highs, so we may already be seeing some adjustment.

- Renowned investor Warren Buffet has also cut his stake in Taiwan semiconductor manufacturer TSMC in reported filings. The Taiex is down 1.45% so far today. The Kospi is down 1.40%. Higher core yields will also be weighing on the tech space all else equal.

- Losses elsewhere have been more modest, but only Thai and NZ shares have managed to post modest gains today. Indian markets are also attempting to push higher.

GOLD: Bullion Retreats As USD Advances

Gold prices are down 0.4% during APAC trading to $1846.90/oz as the USD has rallied 0.25%. They fell following the US CPI which saw the monthly increase in headline rise and the annual inflation rates higher than expected. But gold bounced back and range traded late in the NY session.

- Bullion remains above its Tuesday low of $1843.36 today but is now below its 50-day simple MA and the Feb 14 low of $1850.50. Near-term support is $1825.50, the January 5 low.

- Fed speakers on Tuesday talked of the need for further rate hikes to rein in inflation but were not of the same view regarding where the terminal rate would be. A hawkish tone to the Fed has been weighing on bullion this month.

- Later today January US retail sales print and a strong outcome of 1.8% m/m is expected but the control group is forecast to rise only 0.3%. There are also US business inventories and IP and UK inflation data. No Fed officials are scheduled to speak.

OIL: Crude Continues Falling As Fed And Rising US Stocks Weigh On Market

Oil prices continued their downward move during APAC trading. WTI is down a further 0.8% to $78.40/bbl after falling 1.6% on Tuesday and Brent is down 0.8% to $84.90 after -1.6%. Both are close to their intraday lows. The USD DXY is up 0.2%.

- Brent has moved just below its 100-day simple MA and WTI is approaching its 50-day MA. Brent remains well above support of $83.05, the February 9 low, and WTI above $76.52, the February 9 low.

- The down move in crude has been driven by the large 10.51mn barrels build in US stocks reported by the API. Gasoline inventories rose 846k and distillate 1.73mn. The official EIA data is published later today. Inflation worries and their implications for US rates are also weighing on oil.

- OPEC revised up its 2023 oil demand forecasts in its monthly report due to higher demand from China. It also now expects a slightly tighter market this year. The IEA publishes its monthly outlook today.

- Later today January US retail sales print and a strong outcome of 1.8% m/m is expected but the control group is forecast to rise only 0.3%. There are also US business inventories and IP and UK inflation data. No Fed officials are scheduled to speak.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/02/2023 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 15/02/2023 | 0700/0700 | *** |  | UK | Producer Prices |

| 15/02/2023 | 0800/0900 | *** |  | ES | HICP (f) |

| 15/02/2023 | 0930/0930 | * |  | UK | ONS House Price Index |

| 15/02/2023 | 1000/1100 | ** |  | EU | Industrial Production |

| 15/02/2023 | 1000/1100 | * |  | EU | Trade Balance |

| 15/02/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 15/02/2023 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 15/02/2023 | 1330/0830 | *** |  | US | Retail Sales |

| 15/02/2023 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/02/2023 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 15/02/2023 | 1400/1500 |  | EU | ECB Lagarde at Plenary Debate on ECB Annual Report | |

| 15/02/2023 | 1415/0915 | *** |  | US | Industrial Production |

| 15/02/2023 | 1500/1000 | * |  | US | Business Inventories |

| 15/02/2023 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 15/02/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 15/02/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 15/02/2023 | 2100/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.