-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: USD Nudges Lower Overnight

- JGBs firmed after Friday's notable slide, although 10-Year yields continued to print above the BoJ's YCC cap. The presence of the BoJ’s pre-announced but unscheduled Rinban purchases helped support the space in the morning, with some pre-BoJ meeting short trimming probably helping the general direction of travel as well. We also suggest there was some support from a Nikkei report noting that “many in the central bank believe that it should take a wait-and-see approach on policy changes” ahead of this week’s BoJ monetary policy meeting.

- USD weakness persists.

- Central Bank speak headlines on Monday, with U.S. markets closed for the MLK Day holiday.

US TSYS: Marginally Firmer, Ranges Limited On MLK Day

TYH3 deals at 114-25+, +0-01, in the middle of its 0-06 range on volume of ~46K.

- Cash Tsys are closed today due to the MLK Day holiday, limiting activity in futures.

- Futures dealt in a narrow range in a muted start to the week's trade, before a general bid in JGBs spilled over, allowing futures to firm off session lows before moderating gains.

- There hasn't been much in the way of macro headline flow to digest over the weekend, with Minneapolis Fed President Kashkari ('23 voter) pointing to sticker shock inflation in the local press, while there were some suggestions in the Japanese press that most within the BoJ look for no change in policy settings when the central bank convenes later this week.

- Comments from ECB's de Cos & BoE's Bailey (on financial stability) headline a limited global docket on Monday.

JGBS: Off Best Levels Into The Bell

JGB futures showed through their morning high, but failed to extend meaningfully beyond that point, heading into the bell +21, 20 ticks off their session peak. While cash JGBs run flat to 8.5bp richer, as 40s lead the bid. 10s continue to operate above the BoJ’s permitted YCC cap, lagging the bid on the wider curve. Swap spreads are generally tighter, with benchmarks on the swap curve running ~5-6bp lower, in a parallel shift.

- The presence of the BoJ’s pre-announced but unscheduled Rinban purchases helped support the space in the morning, with some pre-BoJ meeting short trimming probably helping the general direction of travel as well.

- We also suggest there was some support from a Nikkei report noting that “many in the central bank believe that it should take a wait-and-see approach on policy changes” ahead of this week’s BoJ monetary policy meeting.

- Offer/cover ratios observed in the details of the BoJ Rinban operations were contained, printing at 1.8-2.7x, providing further support.

- Domestic PPI data was comfortably firmer than expected, but didn’t generate anything in the way of market reaction, giving the prevailing forces flagged above.

- Pre-BoJ gyrations will continue to dominate on Tuesday, with a liquidity enhancement auction covering off-the-run 5- to 15.5-Year JGBs providing the most notable point on the local docket.

AUSSIE BONDS: Flat, Early Losses Pared

Aussie bonds struggled for any real momentum on Monday, with any dips bought on the back of a bid in the JGB space, while there was a alack of meaningful headline flow apparent and wider market liquidity was hampered by the observance of a U.S. national holiday.

- That left YM and XM at unchanged levels come settlement, with Sydney hours ultimately seeing the paring of the modest losses observed during the two-way overnight session that rounded off last week. Yields were essentially unchanged across the curve, while EFPs oscillated around Friday’s closing levels.

- Bills pared the bulk of their overnight/early Sydney losses to finish mixed, -2 to +1 through the reds, as the strip saw some light twist flattening.

- RBA dated OIS was little changed to a touch firmer on the day, showing 20bp of tightening for next month’s gathering, while terminal cash rate pricing hovered between 3.70-3.75%.

- There wasn’t much in the way of domestic headline flow to go off, with Treasurer Chalmers highlighting the robustness of the country’s labour market, particularly in an international context, while he reaffirmed focus the well-documented challenges that the economy faces.

- We have also saw a steady Y/Y Melbourne Institute inflation reading, printing +5.9%, alongside a notable moderation in the M/M print, which moved to +0.2% from +1.0% in Nov.

- Looking ahead, the latest Westpac consumer confidence survey headlines the domestic docket on Tuesday.

NZGBS: Off Lows, Aided By Swaps

NZGBs moved away from session cheaps after initially adjusting to Friday’s weakness in core global FI markets, with the previously alluded to firming in the JGB space the probable driver of the recovery from cheaps. That left the major benchmarks running ~4bp cheaper at the close, in what was a parallel shift across the curve.

- Swap rates retraced their early move higher, to print flat to 3bp lower at the bell, as that curve flattened, leaving swap spreads tighter, while pointing to some support for NZGBs being drawn from swap flows.

- RBNZ dated OIS pricing operates in familiar territory, with 63bp of tightening priced for next month’s gathering, alongside a terminal OCR of just under 5.45%.

- Local headline flow was non-existent today, leaving macro cues at the fore, although wider market liquidity was thinned out by the observance of a U.S public holiday.

- The local docket remains empty on Tuesday, which will leave macro matters at the fore over the early rounds of this week’s dealing.

FOREX: USD Indices Make Fresh Lows

USD weakness persists. The BBDXY index fell below 1220 before some support emerged. We were last at 1221.60, still -0.20% off NY closing levels. Cross asset signals have been positive from an equity standpoint, less so commodities. Bonds have been reasonably quiet, with US cash trading closed ahead of the MLK holiday.

- USD/JPY remains a strong focus point in G10 markets. The pair got to fresh lows of 127.23 before support kicked in, last around 127.65/70. Earlier highs were at the 128.20 level. 1 week implied vol continues to trend higher, last at 23.22%, ahead of Wednesday's BoJ meeting outcome.

- AUD/USD got to a high of 0.7019 before selling interest capped the move. We were last at 0.6995/00. Slightly weaker metals price action, with China authorities looking to clamp down on iron ore speculation weighing on prices, hurting the A$ at the margins. We were last around $120.00/ton, -4.3% for the session, with copper also off recent highs.

- NZD/USD has outperformed slightly, holding above 0.6400, +0.50% for the session. Like the A$ we found some selling interest closer to 0.6430, but the trend still looks positive.

- NOK has also traded with a firm bias, +0.80% to the 9.8250 region. Spill over from higher oil prices last week likely helping at the margin.

- Looking ahead event risks are light with US markets also impacted by the MLK holdiay.

EUROZONE: Recession Risk Estimates Rise But Still Well Below 100%

High energy costs and rising rates are putting considerable strain on the euro area economy. The European Commission is forecasting a shallow recession that began in Q4 2022 and continued in Q1 2023. This is consistent with our recession probability estimates, which are still well below 100%, but point to a risk that the recession continues into Q2 2023.

- The models estimate that the chance of a recession began to exceed 50% in August indicating the possibility of a recession in Q1 2023. As a recession is defined as two consecutive quarters of negative growth, the models are consistent with the EC’s forecast that Q1 could be the second quarter of contraction.

- The November 2022 update estimates a recession risk above 70% for May 2023. Thus there is a chance that the recession could be longer than expected but as it isn’t fully pricing in a recession yet, any contraction is likely to be shallow.

- We have estimated the probability of a recession 6 months ahead using Probit methodology - one from 1985, which covers 4 recessions, and one from 1998, which covers 3. The 1985 model includes the real repo, real eurostoxx, real oil price in euros, real effective exchange rate, Economic Sentiment Indicator, real M3, real 10yr yield. The 1998 one has the real eurostoxx, real oil price in euros, ESI, unemployment rate, 10yr-2yr yield curve.

Source: MNI - Market News/Refinitiv/EABCN.org

FX OPTIONS: Expiries for Jan16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0550(E1.5bln), $1.0865(E688mln), $1.0900(E529mln), $1.0950(E2.1bln)

- USD/CNY: Cny6.9500($1.4bln)

ASIA FX: USD/Asia Pairs Lower, But USD/CNH Can't Sustain 6.7000 Break

Most USD/Asia pairs have continued to track lower in line with the trend in the majors, although we are away from lows for most pairs. USD/CNH dipped below 6.7000 but saw buying interest emerge. SEA currencies, particularly IDR, THB and PHP continue to see gains as well. Still to come today is Indian wholesale price data, along with trade figures. Tomorrow the focus will largely be on China Q4 GDP and Dec monthly activity figures. Singapore export data is also out.

- USD/CNH got to a low of 6.6975, but saw some USD demand emerge. The pair was last around 6.7120, in what looks like a modest consolidation following sharp falls in recent sessions. Onshore equities were very strong today, the CSI 300 up close to 2.0%, with continued strong northbound inflows. Onshore spot is still flirting with a concerted break sub 6.7000. The CNY fixing was very close to neutral.

- 1 month USD/KRW broke lower in line with the USD/CNH move and fresh weakness in USD/JPY. We got to 1230.60 but are slightly higher now, 1232.60 last. Onshore equities and net inflows continue in terms of recent positive trends in this space.

- Spot USD/IDR fell sub 15000 before some USD demand emerged. The pair last at 15038, still 0.75% firmer in IDR terms for the session. Note the 200-day MA comes in at 15057.47, so a close below this level today may support the rupiah rebound story. Outside of requiring exporters to keep more earnings onshore (as announced last week), the better global risk backdrop, which is encouraging fresh inflows into local bonds, is another support for the rupiah.

- USD/INR dipped in early trade, but is back to 81.37 now, unchanged for the session. The INR had its strongest week last week since early November rising ~1.7%, breaking through its 100-Day EMA on Friday for the first time since early 2022. INR bulls can now target the 200-day EMA at 80.0544, whilst bears first look to close above the 100-day EMA.

- USD/THB got to fresh lows of 32.705, but now sits slightly higher at 32.84, still the strongest levels since early March last year. USD/PHP is back to 54.55, fresh lows back to late June 2022, this is 0.65% firmer for the session. Overseas remittances were firmer, +5.7% y/y for Nov, versus +4.2% expected.

CHINA DATA: China Data Dump Tomorrow, But Markets Have Not Reacted To Weaker Outcomes

(MNI Australia) A reminder that tomorrow delivers Q4 GDP in China, along with the Dec monthly run of activity figures. Expectations are fairly downbeat, not surprisingly, with Covid related headwinds prominent in the month.

- Q4 GDP is forecast at -1.1% q/q, range: -3.0%/+0.8%, prior 3.9%.

- IP is forecast at 0.2% y/y, range -3.7%/+3.7%, prior 2.2%

- Retail sales is forecast at -9.0% y/y, range -14%/0%, prior -5.9%.

- Fixed asset investment is expected at 5.0%, range 4.7%%/5.5%, prior 5.3%

- Property investment is forecast at -10.5%, range -17.5%/-9.5%, prior -9.8%.

- Jobless rate is expected at 5.8%, range 5.5/5.9%, prior 5.7%.

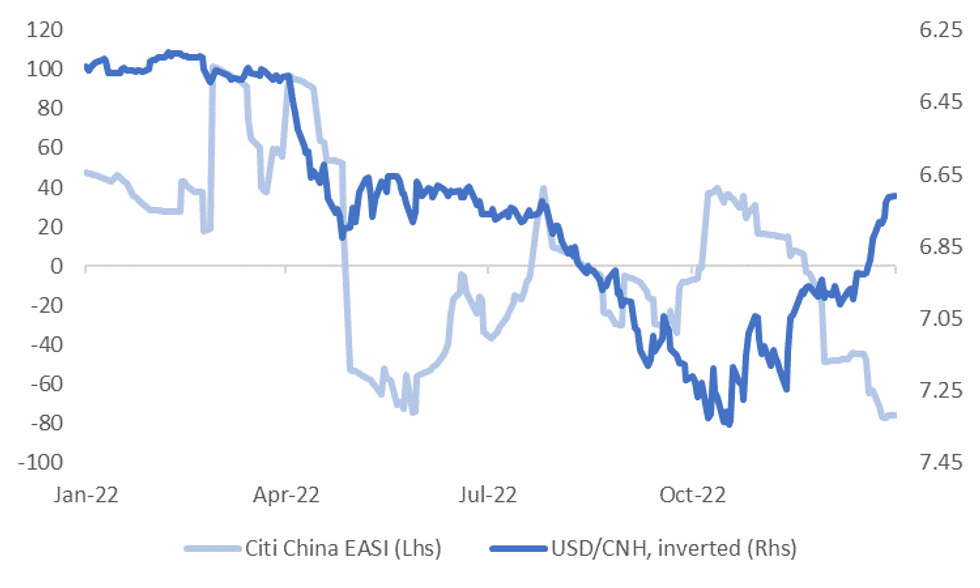

China related asset sentiment is largely shrugging off downbeat data outcomes since the exit from CZS. The chart below overlays the Citi China EASI against USD/CNH, which is inverted on the chart. We are around cyclical lows for the surprise index, but currency sentiment remains on the improve. As highlighted earlier, equity sentiment is also trending higher. So once again we may see limited fallout from the data, with market participants happy to look through softer outcomes and focus on the 2023 outlook.

Fig 1: Citi China EASI & USD/CNH (Inverted)

Source: Citi/MNI - Market News/Bloomberg

ASIA: China Equity Flows Defy Gravity In 2023?

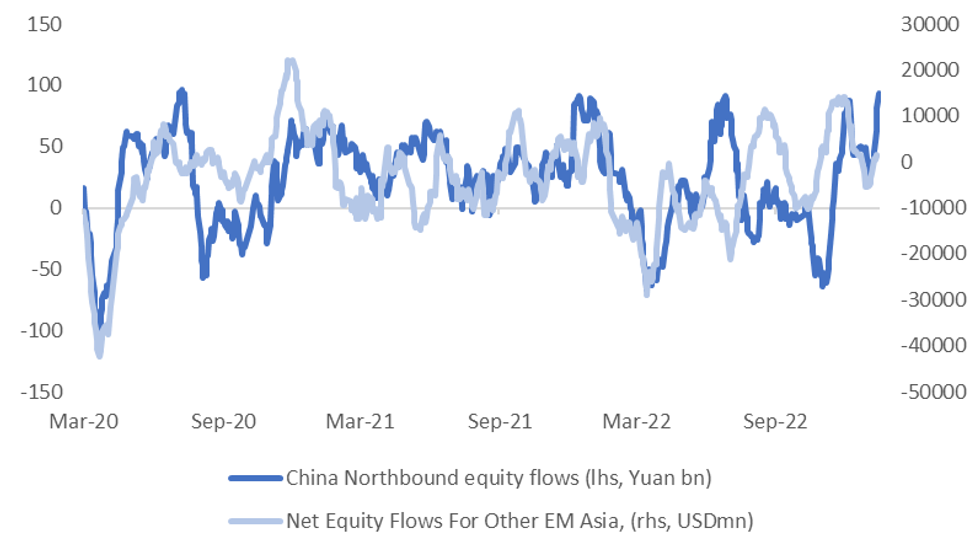

(MNI Australia) Over the past trading month, northbound equity flows are now over 93bn yuan (including today's session), see the chart below. Over the past 3 years northbound flow momentum has not stretched much beyond this point in terms rolling monthly momentum. This might raise some caution about how long current strong momentum can be sustained for. However, as we highlighted earlier, the technical backdrop for China equities is on the improve with mainland indices, see this link for more details.

- Continued Northbound inflows should also benefit CNH all else equal. The correlation of rolling monthly changes in the currency and the monthly sum of flows is 73% at the moment.

Fig 1: China North Bound Flows & EM Asia Net Equity Flows

Source: MNI - Market News/Bloomberg

- The other line on the chart is the net flow picture for the rest of EM Asia - South Korea, Taiwan, India, Thailand, Indonesia, Philippines and Malaysia.

- The two series have been more in line with each other over recent months, which may reflect China's shift away from CZS. The rest of EM Asia line is also showing positive momentum, although is well below highs seen in recent years.

- Taiwan has seen +3443.8mn net inflows in 2023 so far, South Korea, +$2363.2mn, while Thailand is +$530.1mn. This won't just be a China story though, with signs of a reduced pace of Fed tightening clearly benefiting regional equity sentiment as well.

- India (-$1339.1mn and Indonesia (-$333.8mn) have seen outflows YTD. Such trends haven't stopped these respective currencies from rallying against the USD though. IDR strength in the last 3-4 sessions has been very prominent.

EQUITIES: China Equities Look To Break Above Downtrend Resistance

Outside of Japan, regional equity markets have mostly started the week off in a positive fashion. US equity futures were in the red early doors, but are back in positive territory, albeit modestly (+0.10/+0.15%). Much of the focus has been the continued rise in China equities.

- The CSI 300 is up 2% so far today, putting he index above downtrend resistance. This is extending last week’s breach of the 200-DMA, in what is the first foray above that technical parameter since ’21. The market continues to trade the move away from the country’s ZCS framework and signs that the regulatory clampdown on the Chinese tech giants is coming to an end.

- Northbound equity flows continue, with close to 75bn yuan so far in 2023.

- The HSI is up 0.73%, while the Kospi (+0.84%) and Taiex (+0.57%) also continue to press higher.

- Japan stocks are laggards, the Nikkei 225 off by 1.20% so far. The threat of higher yields, coupled with a firmer JPY backdrop, not helping at the margins.

- Only the Straits Times and Malaysian equity bourse are down today.

MNI US EARNINGS CALENDAR - Another 4.5% of the S&P Reports This Week

EXECUTIVE SUMMARY

- Earnings season continues after a mixed start for banks and financials.

- Another 4.5% of the S&P 500 are due to report in the coming week, with banks still in the spotlight.

- Goldman Sachs and Morgan Stanley are due to report on Tuesday, after which over a third of the US financials tracked by the SPDR Financial Select ETF will have released earnings.

- Full weekly schedule including timings and EPS/Sales expectations here: MNIUSEARNINGS130123.pdf

GOLD: Bullion Continues To Rally On USD Weakness

Gold prices are up again today to their highest since late April 2022, as the USD has weakened further. Bullion is up 0.3% to $1926.60/oz while the DXY is down 0.3%. Mixed US data and slowing US inflation have increased expectations of a further slowdown in FOMC tightening at its February 1 meeting and put downward pressure on the dollar and thus driven the gold rally.

- Central bank buying has also supported gold with the People’s Bank of China one of the largest purchasers.

- Gold prices reached a high during APAC trading of $1929.03 after a low of $1916.85. It broke through two resistance levels on Friday and now the next one is at $1934.40, the 25 April 2022 high.

- There is little in the calendar later with the US closed for Martin Luther King’s Birthday. The major event for the week is US retail sales for December on Wednesday, which are expected to decline again.

OIL: Oil Takes Step Back To Consider Global Picture

MNI (Australia) - After rallying last week, oil prices have consolidated somewhat during APAC trading today as they consider the global outlook again. Prices are down 0.5% on Friday’s NY close and are currently trading not far from their intraday lows.

- WTI fell below $80/bbl early in the session and is now around $79.50/bbl, above the the 50-day moving average. Brent is trading at about $84.85. Oil remains in an uptrend and the next level to watch for WTI is $81.50, the January 3 high and bull trigger, and $87.00 for Brent.

- Oil has been rallying on data showing increased traffic in China in response to the reopening. OPEC+ has said that it is going to monitor demand in China and the impact on energy markets from the war in the Ukraine closely. OPEC publishes its outlook on Tuesday followed by the IEA on Wednesday.

- There is little in the calendar later with the US closed for Martin Luther King’s Birthday. The major event for the week is US retail sales for December on Wednesday, which are expected to decline again.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/01/2023 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 16/01/2023 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 16/01/2023 | 1500/1500 |  | UK | BOE Treasury Select Committee Hearing on FST | |

| 16/01/2023 | 1530/1030 | ** |  | CA | BOC Business Outlook Survey |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.