-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessChicago Business Barometer™ - Eased To 40.2 In November

Chicago Business Barometer™ - Eased To 40.2 In November

MNI EUROPEAN MARKETS ANALYSIS: Will CPI Be Hot Or Cold?

- Risk sentiment soured as a worsening COVID-19 outbreak in China's manufacturing hub of Guangzhou resulted in tighter curbs across the country, dampening hopes for a sooner re-opening. Against this backdrop, participants were wary of taking more risk ahead of the release of U.S. CPI data, today's key risk event.

- Comments from Minneapolis Fed President Kashkari (’23 voter) pushed back against the idea of an impending pivot, suggesting any conflict within the central bank’s dual mandate is some way down the line while underscoring the need to combat inflation.

- This came after a late NY rally in which Tsys richened to fresh session highs, aided by continued liquidity issues and industry contagion worry surrounding one of the major cryptocurrency exchanges and comments from Chicago Fed President Evans (who retires in early ’23), who pointed to the benefits of slowing the pace of rate hikes “as soon as we can.”

- Apart from U.S. inflation figures, today's data highlights include U.S. jobless claims & Norwegian CPI. There is plenty of central bank inbound, from Fed, ECB & BoE officials.

MNI US CPI Preview: Can Cars Drive A Core CPI Slowdown?

EXECUTIVE SUMMARY

- Core CPI inflation is seen slowing slightly to 0.5% M/M in October after surprise persistence at 0.58% in Sept. The analyst survey is skewed slightly lower although the Cleveland Fed Nowcast implies upside risk.

- The bulk of the expected moderation in October core is seen coming from used cars declining at a faster pace and a health insurance reset. So it’ll likely be changes outside of these components that are of note, especially service components with rents expected to continue to increase extremely strongly.

- A similar 0.1-0.2pt beat to last month could see a delay in the Fed’s anticipated downshift to 50bp hikes into 2023 or augur a longer string of hikes, either way pushing the terminal rate higher still and driving a sharp flattening in the Treasury curve.

- PLEASE FIND THE FULL REPORT HERE:USCPIPrevNov2022.pdf

US TSYS: Light Twist Flattening In Pre-CPI Asia Trade

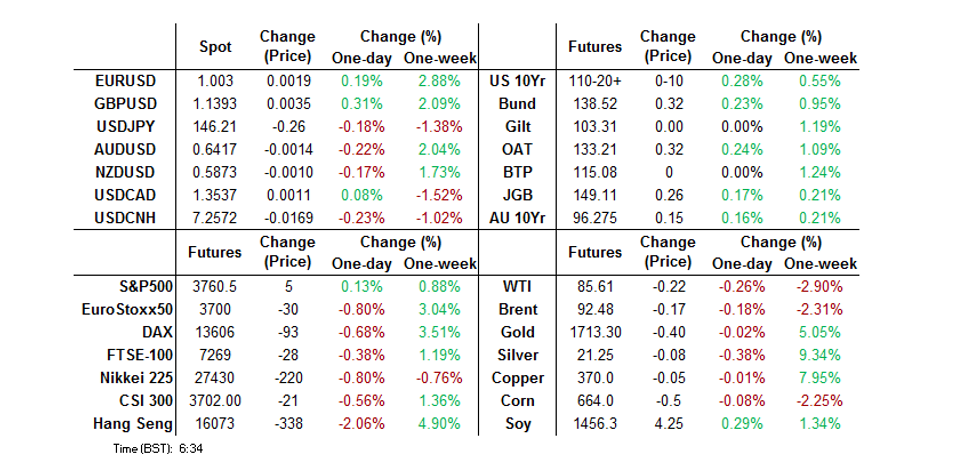

Cash Tsys twist flattened in Asia-Pac hours, running 0.5bp cheaper to 2bp richer across the curve, pivoting around 3s, with 7s outperforming. TYZ2 looked through Wednesday’s high, before backing off to deal +0-12 at 110-22+, 0-03 off the peak of its 0-08 range, on solid volume of ~95K.

- Some idiosyncracies in the Antipodean rates space helped support Tsys overnight.

- Comments from Minneapolis Fed President Kashkari (’23 voter) pushed back against the idea of an impending pivot, suggesting any conflict within the central bank’s dual mandate is some way down the line while underscoring the need to combat inflation.

- This came after a late NY rally in which Tsys richened to fresh session highs, aided by continued liquidity issues and industry contagion worry surrounding one of the major cryptocurrency exchanges and comments from Chicago Fed President Evans (who retires in early ’23), who pointed to the benefits of slowing the pace of rate hikes “as soon as we can.”

- Looking ahead, the latest CPI print presents the key risk event on Thursday (see our full preview of that release here). CPI data will be supplemented by weekly jobless claims data, 30-Year Tsy supply (which comes in the wake of yesterday’s soft 10-Year auction) and a deluge of Fedspeak.

JGBS: Futures Hold Firm While Long End Bid Reverses & More

The JGB curve has twist steepened today, with the early bid in the long end giving way, probably in light of the extent of the move witnessed since yesterday’s solid round of 30-Year JGB supply.

- That leaves the major benchmarks running 1bp richer to 3.5bp cheaper, with the curve pivoting around 20s.

- 7s outperform on the curve given the bid in futures (after a firm overnight session, alongside a rally in wider core global FI markets), which came back in during the Tokyo afternoon alongside an uptick in wider core FI markets, leaving the contract +25 into the bell.

- Local headline flow has been limited, with BoJ Governor Kuroda providing familiar rhetoric, while comments from some of the major sovereign rating agencies re: Japanese policy settings had no tangible impact on the space.

- PPI data and the latest liquidity enhancement auction for 5- to 15.5-Year JGBs headline the domestic docket on Friday.

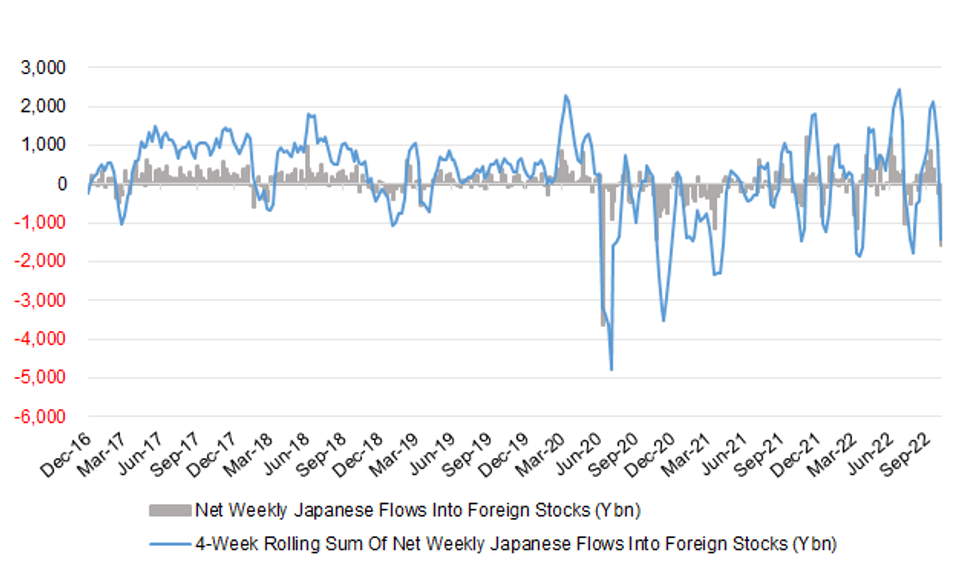

JAPAN: Japan Shed Second Largest Ever Net Amount Of Foreign Equities Last Week

The latest round of weekly international security flow data from the Japanese MoF revealed that Japanese investors were net sellers of both foreign equites and bonds for a second straight week. This came as U.S. yields nudged higher during the week, while U.S. equities softened.

- Note that the level of net weekly sales of foreign equities has only been surpassed on one occasion on record, the weekly record of net sales observed back in ’20.

- Meanwhile, international investors were net buyers of both Japanese equities and bonds, although net flows were somewhat limited in size terms.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -581.8 | -1170.5 | -1204.3 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -1603.1 | -248.1 | -1443.6 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 73.2 | -176.0 | -1671.4 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 340.0 | 336.5 | 731.9 |

Source: Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

Fig. 1: Net Weekly Japanese Flows Into Foreign Stocks (Ybn)

Source: Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

AUSSIE BONDS: Firmer On RBA Speak, Wednesday Catch Up & NZGB Bid

ACGBs have continued to squeeze higher into the bell, running 13-16bp richer across the curve. YM & XM both finished +15.0. The 3-/10-Year EFP box pushed wider as 10s pushed wider. Bills were 4-21bp richer across the curve.

- The bid was aided by RBA Deputy Governor Bullock stating the probable need for interest rates “to go up a little bit further” in front of the Senate Economics Legislation Committee, as she highlighted the idea that Bank is getting closer to a level whereby it could pause to assess the tightening implemented.

- Elsewhere, catch up to Wednesday’s bid in U.S. Tsys, some trans-Tasman spill over from the bid in NZGBS and a move in the COVID warning level in the state of Queensland provided upside impetus ahead of Bullock’s comments.

- The COVID situation in China, with tighter COVID restrictions deployed in a couple of districts in the city of Chongqing, would also have been supportive.

- Melbourne Institute inflation expectations data nudged higher in the latest print, but remained shy of their cycle peak.

- The release of the weekly AOFM issuance slate headlines a light domestic docket on Friday, with post-U.S. CPI adjustment set to dominate the early rounds of Friday’s Sydney trade.

NZGBS: Strong Demand At Auctions Helps Early NZGB Bid Extend

NZGBs firmed further as we moved through Thursday’s session, with the major benchmarks running ~15bp richer on the day come the close. Swap spreads were flat to a touch wider.

- The bid in NZGBs was aided by strong demand at the weekly round of NZGB auctions (covering NZGB-25, -32 & -37).

- Terminal OCR pricing in RBNZ dated OIS came in a touch, to print just below 5.30%. at the local close

- A reminder that the RBNZ published the review of its monetary policy settings in the 2017-2022 window. RBNZ chief economist Conway noted that “the current heightened level of inflation could have been lessened at the margin by an earlier tightening in monetary policy in 2021. However, while we are facing some serious economic challenges, the New Zealand economy has weathered the economic storm created by pandemic and war relatively well. Inflation and unemployment are both low compared to the vast majority of OECD countries.” The release is backwards looking in nature, so fails to provide much in the way of meaningful insight into the future of monetary policy.

- A subsequent address by RBNZ Governor Orr went over old ground.

- Looking ahead, Friday’s domestic docket will see the release of food price data and the latest Business NZ manufacturing survey, although early price action is set to be dominated by post-U.S. CPI adjustments.

FOREX: China's COVID-19 Situation Weighs On Risk, Greenback Slips Ahead Of U.S. CPI

Risk sentiment soured as a worsening COVID-19 outbreak in China's manufacturing hub of Guangzhou resulted in tighter curbs across the country, dampening hopes for a sooner re-opening. Against this backdrop, participants were wary of taking more risk ahead of the release of U.S. CPI data, today's key risk event.

- Fed's Kashkari said that the Fed would do what's needed to bring inflation under control but "monetary policy acts with a lag." Today's CPI data has the potential to move the needle on Fed outlook, with analysts in a Bloomberg survey expecting headline consumer inflation to have eased to +7.9% Y/Y in October from +8.2% prior.

- The BBDXY index ground lower, giving back some of yesterday's gains. The index has now shed 0.35% from the previous day's peak and is testing session lows at typing, with U.S. Tsy yields sitting slightly lower across the curve.

- The Antipodeans went offered amid cautious mood even as USD/CNH retreated on the back of broader dollar weakness. RBA Dep Gov Bullock said that interest rates need to go up a "little bit" further but are close to the level where the Board could take time to evaluate the impact.

- USD/JPY faltered thanks to lower U.S. Tsy yields, with the latest set of comments from BoJ Gov Kuroda offering little new. The official underscored the need for continued deployment of ultra-loose monetary policy, adding that one-sided, rapid yen decline has paused for now.

- Sterling outperformed in G10 FX space, with the cable returning above the $1.1400 mark. The broader European FX bloc was generally firmer, with SEK lagging regional peers.

- Apart from U.S. inflation figures, today's data highlights include U.S. jobless claims & Norwegian CPI. There is plenty of central bank inbound, from Fed, ECB & BoE officials.

FX OPTIONS: Expiries for Nov10 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9700(E1.3bln), $0.9800(E1.7bln), $0.9860-75(E1.2bln), $0.9900(E1.3bln), $0.9950-55(E1.1bln), $0.9990-00(E2.5bln), $1.0050-70(E968mln), $1.0090-00(E1.7bln)

- USD/JPY: Y144.30-50($1.1bln), Y145.00($1.0bln), Y146.00-05($665mln), Y147.00($1.3bln), Y150.00($1.9bln)

- GBP/USD: $1.1225-30(Gbp586mln), $1.1450(Gbp787mln), $1.1600(Gbp969mln)

- EUR/GBP: Gbp0.8790-00(E620mln)

- AUD/USD: $0.6500(A$651mln)

- USD/CNY: Cny7.1500($3.0bln), Cny7.2000($2.0bln), Cny7.2700($6.5bln), Cny7.2820($4.5bln)

AUD: A$ Correlations - Global Risk Factors Back In the Driver's Seat

AUD/USD correlations have swung back sharply in favour of global risk drivers. The table below presents the latest levels correlations for AUD/USD, for the past week and month, with key global macro drivers.

- We have seen a sharp pull back in correlations with yield spreads, which is typically the case once the RBA decision is cleared. The trend in spreads has stabilised somewhat, with the 2 yr differential ranging between -130-140bps in recent sessions.

- The correlations with global commodity prices have rebounded, with base metals slightly firmer than the aggregate index.

- Iron ore's correlation has also risen noticeably in the past week. Likely on account of renewed focus on China's ZCS.

- The global equities correlation has also rebounded, but less so for the VIX.

Table 1: AUD/USD Correlations

| 1wk | 1mth | |

| 2yr yield differential | -0.01 | -0.27 |

| 5yr yield differential | 0.15 | -0.23 |

| 10yr yield differential | 0.11 | -0.40 |

| Global commodity prices | 0.80 | 0.45 |

| Base metals | 0.90 | 0.64 |

| Iron ore | 0.83 | -0.46 |

| Global equities | 0.91 | 0.81 |

| US VIX index | -0.22 | -0.75 |

Source: MNI - Market News/Bloomberg

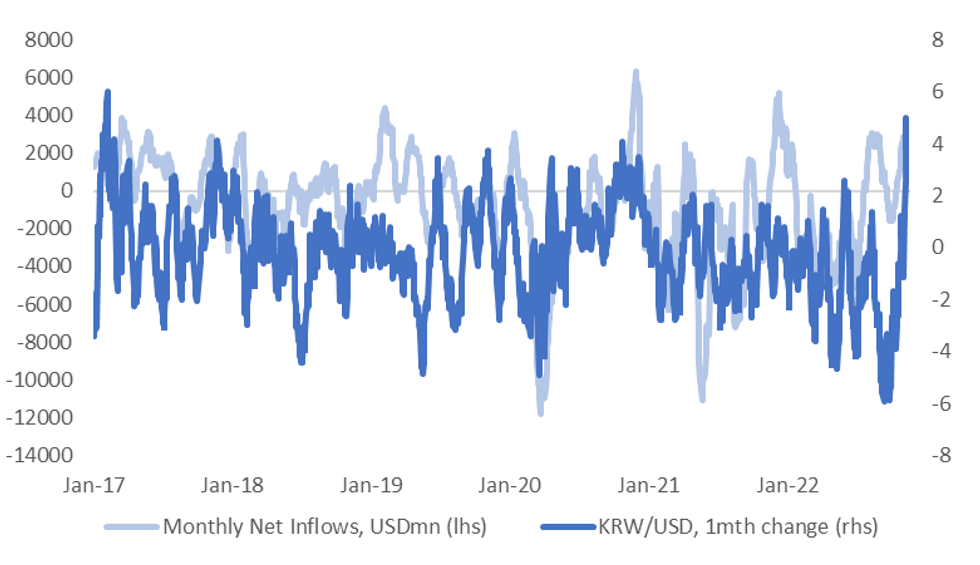

ASIA FX: TWD Outperforms, KRW Consolidates Following Recent Strong Gains

Most USD/Asia pairs have shown a positive bias for the session, but overall moves have been modest. Weaker regional equities have weighed, but the market is also likely taking stock ahead of tonight's US CPI print. Tomorrow the focus will be on Indian industrial production, while Malaysian Q3 GDP is also due.

- USD/CNH looked to re-test overnight highs near 7.2800, but found selling interest around this level. The pair was last around 7.2600. Onshore spot climbed above 7.2700 but also ran out of steam. Domestic covid news was generally negative with rising total case numbers and further restrictions. Onshore equities are mostly weaker.

- USD/KRW is consolidating somewhat. Spot is back near 1372, +0.50% for the session. This follows a 5% gain over the past month, the strongest since early 2017. Onshore equities are down by around 0.55%, while offshore investors have sold local shares today. The government is stepping up support of the housing sector.

- TWD is outperforming, the USD/TWD 1 month NDF down a further 0.5% today to 30.60. We are slightly away from lows, as onshore equities have fallen today. This comes after yesterday's +$800mn in net equity inflows, the strongest daily rise since early August.

- USD/INR is higher, back towards 81.60, with the pair bouncing off the simple 50-day MA (81.27). The rupee is still outperforming on a cross basis, with the NEER back to early October highs. IP figures print tomorrow.

- USD/THB is last around 36.81, back close to session lows. Bears take aim at the 100-DMA, which intersects at 36.641. Foreign investors were net buyers of $53.82mn in Thai stocks Wednesday, even as the SET index dropped. Consumer confidence improved to 46.1 in October, but only remains modestly above recent lows.

- USD/PHP is back to 58.12, +0.11 figs for the session, despite a decent Q3 GDP beat. he economy grew 7.6% Y/Y in the three months through end-September, printing above the consensus forecast of +6.2%. Economic Planning Sec Balisacan said GDP outturn was boosted by economic reopening, setting the nation on track to achieve its +6.5%-7.5% Y/Y growth target for the year. Still, the economy is facing risks from fast inflation and the authorities will monitor the situation to stabilise prices.

- Spot USD/IDR has added 42 figs to last trade at 15,703, with bullish focus falling on Nov 4 high of 15,750. INDOGB yield curve continues to flatten and 5-Year/10-Year spread has now tightened to less than 20bp for the first time since early 2019, as Bank Indonesia implements its "Operation Twist."

KRW: Won Posts Strongest Rolling Monthly Return Since 2017

The firm market bias remains to fade upticks in USD/KRW. The 1 month NDF is already back down to 1361/62, which is -0.70% on NY closing levels. This puts us back below the 100-day EMA (1366.66), while note the overnight low was just under 1355. Onshore spot levels are down slightly from yesterday's close, despite a firmer USD impetus overnight.

- The Kospi is clawing back earlier losses, with the early dip towards 2400 supported, last around 2424, flat for the session.

- The chart below overlays the rolling monthly returns of KRW/USD against rolling offshore net equity flows. The recovery in the won in the past month has been the strongest since early 2017. Even with this recent recovery, the won still remains nearly 13% down for the year. Net equity inflow momentum for the past month is back to late 2021 highs.

- As the chart suggests, such strongly momentum for the won doesn't continue indefinitely, likewise for the flow backdrop. Hence some slowing in the rate of gains may not be a surprise.

- In the near term though, a lot is likely to depend on how tonight's US CPI outcome unfolds, with downside surprises likely to encourage USD bears that a broader peak is in place for the dollar.

Fig 1: KRW/USD Rolling Monthly Changes Against Net Equity Inflows

Source: MNI - Market News/Bloomberg

EQUITIES: Covid Headwinds Continue To Weigh on China/HK Indices

Most regional markets are lower, following the negative lead from US markets overnight. Losses have mostly been in the -1% to -2% range. A modestly firmer tone to US futures hasn't provided much of an offset, although gains are fairly limited (+0.20+ 0.30%) ahead of the all important US CPI print tonight. Stress in the crypto space will be the other watch point, with Bitcoin up +3.2% so far today, but this follows a 25.5% drop in the previous 2 sessions.

- China's domestic covid news has generally been negative. Total daily case numbers have continued to climb, near 8.5k, versus 7.7k reported yesterday. Two districts in the Chongqing region also tightened covid related restrictions further.

- The CSI 300 is off by around 1% at this stage, while the Shanghai Composite is down 0.50%. The property sub-index continues to recovery, up a further 0.50%, building on yesterday's +2% rise, which came on the back of additional funding support for the sector.

- The HSI is off close to 1.90%, with Alibaba weighing. Citi reported that Singles Day sales spending is likely to be soft given China's weaker macro backdrop (per Bloomberg reports). Note also the Golden Dragon Index fell 6.65% overnight.

- The rebound in the Kospi has stalled, the index off 0.70%, with offshore investors unloading -$176mn shares so far today. The Taiex is also down 1%, while the Nikkei 225 is down a little over 1%. Broader tech indices weakened overnight, weighing on sentiment in the space today.

GOLD: Consolidates Above $1700 Ahead US CPI

Gold continues to consolidate above $1700, the precious metal last just above $1709, +0.15% for the session. This is line with a softer USD backdrop, with the DXY off close to 0.30% for the session.

- Trading ranges haven't gone much beyond $1700-$1720 since Tuesday's surge higher during the US session. Dips towards the $1700 level are still supported, but upside moves above $1715 can't be sustained.

- The simple 100-day MA comes in at $1715.17, which could be acting as a resistance point.

- Focus tonight will be firmly on the US CPI print. The recent bounce in gold has outperformed US real yields but is following broader USD trends fairly closely.

OIL: Range Trading As Tentative Signs Of Market Easing

Oil appears to be in a holding pattern ahead of US data after falling overnight with the deterioration in risk appetite. Both WTI and Brent are currently very close to yesterday’s close around $85.80/bbl and $92.70. They have been in a tight range during the session awaiting US CPI to be released later.

- The EIA reported a larger-than-expected 3.925mn build in crude inventories in the US in the latest week, its highest level since July 2021, after a 3.115mn drawdown the previous week. Importantly, production rose 200 kbd, tentatively suggesting a slight easing of supply conditions. But gasoline stocks fell 900k and distillate fell 500k barrels.

- Further Covid restrictions in the manufacturing centre of Guangzhou in China darkened the oil demand outlook.

- The WTI prompt spread has narrowed since the start of the month suggesting some easing of supply conditions.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/11/2022 | 0700/0200 |  | US | Fed Governor Christopher Waller | |

| 10/11/2022 | 0700/0800 | * |  | NO | CPI Norway |

| 10/11/2022 | 0900/1000 | * |  | IT | Industrial Production |

| 10/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 10/11/2022 | - |  | UK | House of Commons Recess Starts | |

| 10/11/2022 | 1300/1400 |  | EU | ECB Schnabel Discussion at at Bank of Slovenia | |

| 10/11/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 10/11/2022 | 1330/0830 | *** |  | US | CPI |

| 10/11/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 10/11/2022 | 1400/0900 |  | US | Philadelphia Fed's Patrick Harker | |

| 10/11/2022 | 1435/0935 |  | US | Dallas Fed's Lorie Logan | |

| 10/11/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 10/11/2022 | 1600/1100 |  | US | San Francisco Fed's Mary Daly | |

| 10/11/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 10/11/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 10/11/2022 | 1650/1150 |  | CA | BOC Gov Macklem speech, "The evolution of Canadian labour markets" | |

| 10/11/2022 | 1730/1230 |  | US | Fed Governor Loretta Mester | |

| 10/11/2022 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 10/11/2022 | 1830/1330 |  | US | Kansas City Fed's Esther George | |

| 10/11/2022 | 1900/1400 | ** |  | US | Treasury Budget |

| 10/11/2022 | 1900/1400 | *** |  | MX | Mexico Interest Rate |

| 10/11/2022 | 2335/1835 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.