-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Yields Shunt Lower In Asia

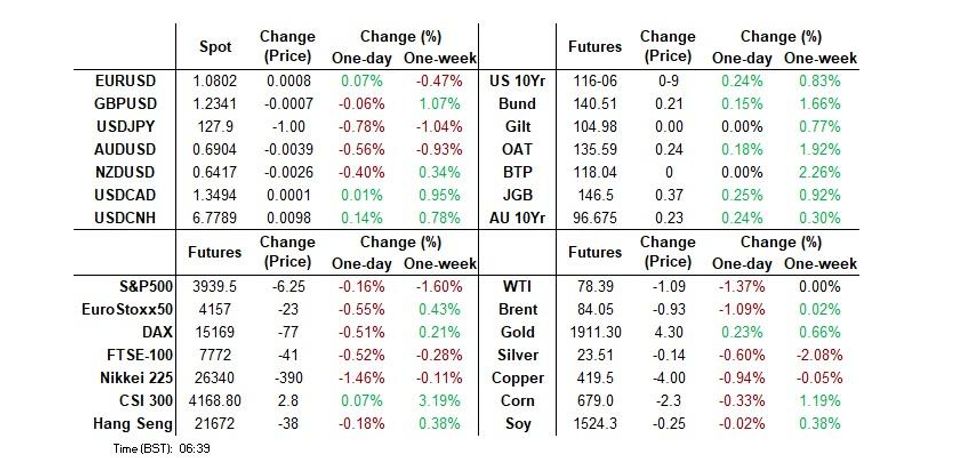

- The USD has lost some momentum, with lower U.S. cash Tsy yields hurting sentiment. Yields are off 4-5bps across the curve. This continues trends from the U.S. session, with the 10yr yield off 22bps since Tuesday’s NY close. Gains against the USD haven't been uniform though, with the AUD still struggling for upside traction.

- Technicals, a well-received round of 20-Year JGB supply & a soft labour market report out of Australia provided catalysts for the bid in core global FI markets in Asia.

- Looking ahead, U.S. building permits and housing starts plus jobless claims and the Philly manufacturing survey are published. ECB’s Lagarde is also scheduled to speak, along with ECB's Knot & Schnabel. Fed's Brainard & Collins will also cross the wires. The Norges Bank monetary policy decision and comments from SNB's Schlegel round off the major global central bank slate.

US TSYS: Richer In Asia, TYH3 Deals Through 200-DMA

TYH3 deals at 116-06, +0-09, marginally off the top of its 0-13+ range on elevated volume of 133K.

- Cash Tsys are 4-5bps richer across the major benchmarks, the belly is marginally outperforming.

- Spillover from bids in ACGBs, in lieu of softer than expected Australian labor market data, and JGBs, as post-BOJ positioning dominated in Tokyo, supported Tsys in early trade.

- Tsys firmed further as technical flows came into play, TYH3 dealt through overnight highs and its 200-DMA, as 10K of screen lifts helped the extension. 5-, 7- and 20-Year yields also showed below their own 200-DMAs.

- A smoothly digested 20-Year JGB auction aided the bid at the margins.

- ECBs Lagarde's speech at the WEF headlines the European session, while the Norges Bank monetary policy decision is also on the wires. Further out we have U.S. housing starts, weekly jobless claims and the latest Philly Fed survey. There is Fedspeak from Boston Fed President Collins and Fed VC Brainard, as well as the latest 10-Year TIPS supply.

JGBS: Firmer, Led By Futures

The super-long end of the JGB curve pared its morning losses and now sits flat to richer on the day in the wake of a well-received round of 20-Year JGB supply (see our earlier bullet for more colour on that matter). That leaves the major JGB benchmarks running flat to 5bp richer across the curve, with intermediates and futures operating a little off their Tokyo morning peak, and the super-long end lagging the bid which has been driven by futures.

- Futures failed to test yesterday’s post-BoJ spike high.

- Swap rates are lower across the curve, shedding 2-7bp, with 10s leading the move as swap spreads tighten.

- On the wage front the latest RTRS survey revealed that “more than half of Japanese companies are planning to raise wages this year” with ”24% of the companies polled said they planned on across-the-board bumps in base salary along with regularly scheduled wage increases. Another 29% said they would carry out regular pay increases only, while 38% were undecided.”

- Local headline flow saw reports of China partially resuming work visa issuance for Japan.

- Looking ahead, CPI data and the latest round of BoJ Rinban operations headline Friday’s domestic docket.

JAPAN: Japan Buys Offshore Bonds For 2nd Week, Offshore Investors Dumped Japanese Paper Into BoJ

Weekly international security flow data from the Japanese MoF revealed the largest round of net weekly purchases of foreign bonds on the part of Japanese investors since Nov ’21 (Y1.232tn), with the Fed pivot narrative likely aiding those flows, even with FX-hedging costs remaining elevated. The 4-week rolling sum of the measure flipped into positive territory for the first time since September, after a second consecutive week of net purchases.

- Elsewhere, the well-documented speculation surrounding a YCC tweak ahead of yesterday’s BoJ meeting resulted in notable net sales of Japanese bonds (Y3.896tn) on the part of international investors, which represents the third largest round of weekly net sales on record. That was the 5th straight week of net sales recorded in the metric.

- Japanese investors were small net buyers of international equities for a 7th straight week.

- Meanwhile, international investors were small net buyers of Japanese equities.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 1232.1 | 569.5 | 1251.2 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 491.5 | 829.4 | 2500.9 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -3896.0 | -269.7 | -9633.2 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 185.6 | -199.2 | -147.4 |

AUSSIE BONDS: Firmer On Global & Domestic Matters, RBA Hike Pricing Moderates

Softer than expected domestic labour market data allowed ACGBs to build on their overnight bid that was derived from soft U.S. data and post-BoJ spill over, with a subsequent round of richening providing further legs to the rally as the Sydney day wore on.

- That left YM +21.0 & XM +23.0 at the close, a little shy of their respective session highs, with the impressive run of early year richening gathering further steam. YM broke above its December peak, allowing bulls to look to the August peak, while XM failed to better its own Dec peak, which presents the immediate point of technical resistance. Cash ACGBs were 17-23bp richer across the curve, with the belly leading the bid.

- Bills finished 11-24bp richer through the reds, as the strip flattened. RBA dated OIS came in on the above mix of factors, with 16bp of tightening now showing for the Feb ’23 meeting, alongside terminal OCR pricing of 3.54%.

- The labour market data saw an unexpected fall in headline employment, while the unemployment rate was actually steady after November’s reading was marked 0.1ppt higher. Note that the fall in unemployment was a product of a move in part-time employment, with illness having a notable impact on hours worked. We don’t think that the release is a game changer for the RBA in isolation, given still elevated vacancy levels and the continued depiction of a very tight labour market.

- Friday’s local docket is empty.

AUSTRALIA: Jobs Growth Disappoints But Remains Tight, Coming Months Key

Employment in December disappointed by falling 14.6k after rising a downwardly revised 58.3k in November. The unemployment rate was stable at 3.5%. However, the details showed that the shift from part-time to full-time employment continued in the face of a very tight labour market. One month doesn’t make a trend and overall the data show a strong labour market but the next couple of reports will be important for assessing if it is easing.

- Full-time employment rose 17.6k in December after 33.3k the previous month. Whereas part-time fell 32.2k after rising 25k. Overall 2022 added 452k jobs with full-time contributing 496.8k while part-time contracted 44.8k. Importantly, overall and full-time jobs are showing robust and rising 3-month momentum, while part-time continues to deteriorate.

- The unemployment rate was revised up in November from 3.44% to 3.47%, which pushed it up 0.1pp after rounding. In December it was slightly higher again at 3.51%. It may have troughed in October at 3.41% as the number of unemployed have risen 15.5k since then, but the latter is volatile. The participation rate was 0.2pp lower at 66.6%, still historically high.

- The underemployment and underutilisation rates also rose to 6.1% and 9.6% respectively. Underemployment is in line with the 2022 average while underutilisation remains below.

- Hours worked have been impacted by illness more so than usual over the last year. Hours fell a further 0.5% m/m in December but the ABS noted that they were again reduced due to a 50% increase in the hours lost due to illness than usual. On the year they are up 3.2% y/y with full-time up 4.5%.

- See press release here.

Source: MNI - Market News/ABS

AUSTRALIA: Inflation Expectations Tick Up, Struggling To Hold Below 5.5%

The Melbourne Institute’s consumer inflation expectations series for January rose to 5.6% from 5.2% last month, in line with higher January petrol prices. In November it had fallen 0.8pp. While they are off of their June 2022 peak of 6.7%, they remain elevated and have been zigzagging for the last 5 months and struggling to sustain a move below 5%, which is not good news for the short-term inflation outlook and could be concerning for the RBA.

Fig. 1: Australia Headline CPI y/y% vs MI consumer inflation expectations

Source: MNI - Market News/ABS/Refinitiv/MI

NZGBS: Firmer On The day On Global Cues, Belly Leads The Bid

The wider global core FI dynamics supported NZGBs, allowing them to build on their early richening (which was linked to post-BoJ moves and soft U.S. data).

- That left the major cash NZGB benchmarks 13-18bp richer at the close, with the belly of the curve outperforming and the wings lagging.

- Swap rates were 11-16bp lower as that curve flattened, leaving swap spreads wider in the main.

- RBNZ dated OIS came in at the margins on the global forces, showing just over 60bp of tightening for next month’s meeting, alongside a terminal OCR of 5.40%.

- New Zealand Prime Minister Ardern announced that she will be stepping down as leader of the Labour Party by 7 February, tendering her resignation as Prime Minister. Labour will vote on party leadership on 22 January. She also noted that the next election will be held on 14 October.

- The latest M/M food price print revealed a 1.1% move higher in December, with domestic inflationary pressures already well documented.

- Today’s NZGB supply went smoothly to well, with cover ratios of 1.7-3.5x observed.

- Non-resident NZGB holdings moved to the highest proportion observed since ’17 in December.

- Friday’s domestic docket is headlined by the latest manufacturing PMI print.

FOREX: USD Slips On Lower Yields, JPY Outperforming

The USD has lost some momentum, with lower US cash Tsy yields hurting sentiment. Yields are off 4-5bps across the curve. This continues trends from the US session, with the 10yr yield off 22bps since Tuesday’s NY close. Gains against the USD haven't been uniform though, with the AUD still struggling for upside traction.

- Yen has been the main beneficiary of lower US yields, with USD/JPY currently close to session lows at 129.20/25 (we touched 128.16 earlier). Focus remains on yesterday's NY low close to 127.60, while the bear trigger in the low 127.20 region waits beyond that.

- Equity sentiment has improved somewhat, although US futures are still in the red. HK/China chares have recovered from earlier lows, now sitting back in positive territory.

- These moves haven't aided the AUD, which is down over 0.5% to the low 0.6900 region following disappointing jobs data. A large (>$2bn) option expiry tomorrow at 0.6900 may also be influencing spot. Despite the move lower in US yields, AU-US yield differentials are generally moving against the AUD.

- NZD/USD has been dragged lower, but remains above 0.6400 (last 0.6425). EUR/USD is a touch higher, tracking above 1.0800 currently.

- Looking ahead, US building permits and housing starts plus jobless claims and the Philly manufacturing survey are published. ECB’s Lagarde is also scheduled to speak.

AUDNZD: Technical Tide Turns, Key Risk Events Eyed

AUD/NZD has fallen ~1.7% this week, breaking out of the recovery bull channel the cross had been in, see the chart below.

- The pair is now dealing below its key EMA's as the technical picture begins to turn.

- Bears now target $1.06, a break through here opens up 2022 lows from Dec at $1.0471.

- Bulls look for a break back above $1.08, opening up the 100-day EMA at $1.0881.

- The recent moves have come in spite of relative commodity outperformance for AUD, and may reflect profit taking ahead of key risk events today and next week after the ~4.5% rally from December lows.

- Dec Labour report from Australia is out today, while next week Q4 CPI from Australia and New Zealand is on tap on Wednesday.

Fig 1: AUD/NZD Spot Below Key EMAs

Source: Market News International (MNI)/Bloomberg

NZD: Yield Correlations Weaken, Global Commodity & Agriculture Firms

NZD/USD correlations with Global Commodity and Agriculture prices have firmed over the last week. The table below presents levels of correlations between NZD and key macro drivers (note the yield differential reflects swap rates).

- NZD/USD is up ~1% in the last week, the strength looks to be driven by rising global commodity and agriculture prices as well as strong performance in global equities.

- The easing in the VIX continues to aid the NZD at the margins.

- Conversely the recent correlation with yield differentials has softened, and the NZD has shrugged off weakness in Milk Futures, although the monthly correlation remains relatively strong.

| 1wk | 1mth | |

| 2yr yield differential | -0.58 | -0.32 |

| 5yr yield differential | -0.33 | -0.43 |

| 10yr yield differential | -0.52 | -0.54 |

| Global commodity prices | 0.72 | 0.16 |

| Agriculture | 0.87 | -0.14 |

| Milk Futures | -0.61 | 0.59 |

| Global equities | 0.51 | 0.71 |

| US VIX index | -0.33 | -0.61 |

MNI Norges Bank Preview - January 2023: Likely Unchanged as Rate Cycle Nears Peak

EXECUTIVE SUMMARY

- Bank seen unchanged for first time since tightening campaign began

- Inflation pressures still building, meaning future hikes likely

- Markets well priced for no change, but minority sell-side view sees further hike in January

- Full preview including summary of sell-side views here:MNINBPrevJan23.pdf

FX OPTIONS: Expiries for Jan19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0550(E548mln), $1.0635-55(E1.7bln), $1.0800-20(E1.3bln), $1.0980(E519mln)

- USD/JPY: Y127.95-14($3.0bln), Y128.50($1.4bln), Y130.00($1.3bln), Y131.00-10($1.1bln), Y132.00($2.6bln)

- EUR/JPY: Y140.00(E1.6bln)

- GBP/USD: $1.2100-20(Gbp741mln)

- USD/CNY: Cny6.5900($1.3bln), Cny6.7000($1.5bln), Cny6.7500($931mln)

ASIA FX: USD/Asia Pairs Follow USD/JPY Lower, BI & BNM Decisions Still To Come

USD/Asia moved off earlier highs, aided by lower USD/JPY levels. Equity sentiment also picked up from lows for key bourses. Still to come today is the BI and BNM decisions, with both central banks expected to hike by 25bps. Tomorrow, the China 1yr and 5yr LPR decisions are due, but no change is expected. Malaysia CPI also prints, along with the South Korean PPI.

- USD/CNH met resistance once again at 6.7900. The pair last at 6.7740/50, well within recent ranges. The move lower was aided as broader USD sentiment softened against the major, particularly the yen, while a recovery in China/HK equity sentiment, also helped. Position lightening may still take place tomorrow, ahead of the LNY break.

- 1 month USD/KRW spiked above 1240 earlier in the session, but now sits back at the 1233.50 level, around +0.25% versus NY closing levels. A resilient equity backdrop, plus continued equity flows (near $200mn) have helped, although the pair remains above NY session lows around the 1225 level.

- USD/SGD printed a fresh cycle low at 1.3129 before rebounding strongly as the USD recovered off its lowest level since late May 2022. The pair was last printing 1.3220/25. Despite the sharp turnaround in USD/SGD, technicals remain bearish for the pair. We sit comfortably below the 20,50,100,200 EMAs. The next target for bears is the 2018 low at 1.3009, bulls first look to break 20-Day EMA at 1.3342 to halt the bear's momentum. The SGD NEER (per Goldman Sachs estimates) is drifting lower today. We sit slightly lower relative to the top end of the band (-0.86% currently). We were around -0.60% this time last week.

- USD/THB is firmer. The pair pushed above 33.15 in early trade, reflecting some catch up with a firmer USD backdrop after yesterday's onshore spot close. Still, we found selling interest and sit back at 33.04 presently, still +0.55% for the session. USD/THB has stabilized in the past week.

- USD/IDR is range bound around the 15100 currently. The market awaits the BI decision due later, with +25bps expected.

- USD/MYR is close to YTD lows, last around the 4.3150/55 region. BNM's decision, also due later, is also expected to deliver a +25bps hike. The 50-day MA is threatening to break below the 200-day, presenting a so-called death cross for USD/MYR.

CNH: Resistance Holding At 6.7900, But Seasonality Less Positive Beyond January

USD/CNH reached a high of 6.7899 (BBG), which is close to recent resistance around 6.7900 seen this week. We have stabilized somewhat now, back to the low 6.7800 region. The broader risk tone is slightly softer, with Hong Kong shares lower, led by tech, although losses are being pared at the time of writing. Weakness in the Golden Dragon index, off nearly 6% in the past two sessions not helping at the margins.

- Northbound equity flows are more moderate, so far today, under 2bn yuan. The past month has seen over 105bn yuan in inflows, so we may be consolidating somewhat. The CSI 300 rally has stalled after the ~3% rally through Friday/Monday.

- Tomorrow will also be the last trading session for onshore markets ahead of the LNY break next week, so again that may helping drive position squaring in USD/CNH to some degree.

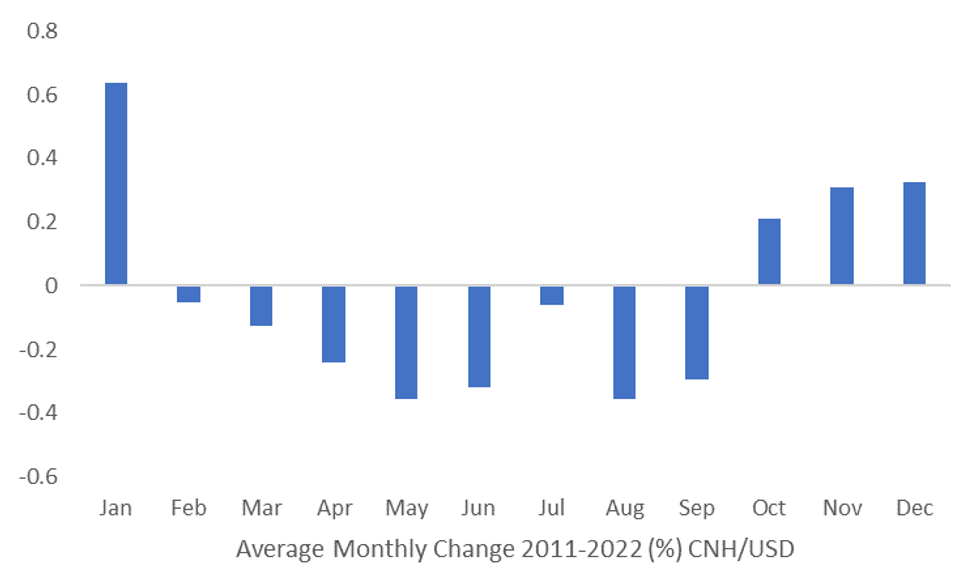

- January tends to the strongest seasonal month of the year for CNH, with average gains of 0.64% against the USD going back to 2011, see the chart below. It is has risen in 8 out of 13 January's over this period (assuming we maintain the current ~2% gains into month end).

- The seasonality is less positive as we progress further into Q1, although Q2 is the weakest quarter of the year, on average, since 2011.

Fig 1: CNH Seasonality Less Positive As We Progress Beyond January (Sample Since 2011)

Source: MNI - Market News/Bloomberg

MNI Bank Indonesia Preview - January 2023: Inflation Means Another 25bp

EXECUTIVE SUMMARY

- Bank Indonesia is likely to hike rates another 25bp to 5.75% at its January 19 meeting due to continued price pressures and need to defend the currency. If the Fed hikes by 25bp, as expected, at its February meeting, then this would keep the rate differential unchanged and aid FX stabilisation.

- Some analysts are expecting BI to pause in January but with both headline and underlying inflation edging up in December and BI reiterating that it will respond to ensure that core remains under the upper end of its target band, another rate increase is likely this month. FX stability and ensuring continued foreign inflows are also a BI priority and while the IDR has appreciated somewhat since the last meeting, further support is likely from the central bank.

- Another 25bp is certainly possible in February given BI expectations that inflation pressures will remain elevated in H1 2023 and the need to attract foreign inflows. But given more dovish Fed expectations and lower commodity prices, BI is likely close to its terminal rate.

- For the full piece, see here.BI Preview - January 2023.pdf

MNI BNM Preview - January 2023: +25bps Likely, But Getting Closer To A Pause

EXECUTIVE SUMMARY

- The consensus looks for a 25bps hike from BNM tomorrow. Our base case also sits in the +25bps camp. Like elsewhere in the region, headline inflation pressures have cooled. The latest CPI y/y coming in at 4.0%, compared with 2022 highs at 4.70%. Still, this is only a modest move lower, while core inflation pressures continued to trend higher, the last print at 4.2% y/y, which was a fresh cyclical high.

- Growth rates remain elevated, but are expected to cool as we progress through 2023. The continued trend move down in the unemployment rate (latest at 3.6%), coupled with still elevated wages growth, +4.7% y/y for the manufacturing sector, should help keep domestic activity supported in the near term though.

- For this meeting, with inflation pressures still persisting, the path of least resistance is expected to be a further 25bps hike. The statement is likely to be monitored for signs around future monetary policy shifts, particularly scope for a pause in the tightening cycle. We are likely getting closer to this point.

- See the full preview here:

EQUITIES: Japan Markets Weaken, China/HK Dips Supported

Asia Pac equities are a mixed bag. Japan bourses are noticeably weaker, unwinding some of the recent gains. China/HK equities started weaker, but are back in positive territory now. US futures remain in the red back are away from lows for the session, with more focus on the continued pull back in US yields.

- The Nikkei 225 is tracking around 1.5% lower at this stage. This is in line with a firmer JPY, which has rallied beyond pre-BoJ levels. We were 3.75% higher over the last two sessions, so this is only giving back some of those gains.

- The HSI was down 1.5% in early trade, as tech sold off 2.5%, but is now back in positive territory. A health briefing will be held later. HK will end quarantine for covid cases from Jan 30.

- The CSI 300 is +0.20% currently, around highs for the session. The index looks to be consolidating ahead of the LNY holiday period after breaking higher late last week/earlier this week.

- Elsewhere the Kospi is modestly firmer, +0.25%, despite negative tech leads from the US session on Wednesday. Offshore investors have added +$197.9mn to local equities today.

- The ASX 200 is up 0.50%, despite softer employment data locally. Bank stocks are higher, with some optimism we are getting closer to the end of the hiking cycle.

GOLD: Bullion Higher Today, Dips Holding Above $1900/oz

Gold prices are up 0.3% during the APAC session to around $1909.30/oz, close to the intraday high but below Wednesday’s high of $1925.895. Bullion fell after hawkish Fed comments offset the impact of soft data on the USD but has recovered somewhat today on a slightly weaker dollar.

- Gold is holding above $1900 and remains in a bullish trend with higher highs and higher lows after it traded at a new trend high earlier this week. Today’s low was $1901.04 after Wednesday’s $1908.69.

OIL: Crude Down Further On US Recession Fears, Increased Stocks

The oil market has returned to being concerned about global growth after Wednesday’s US data was weaker than expected and Fed speakers came out hawkish. WTI is down a further 1.5% during the APAC session to around $78.25/bbl, close to the intraday low and the lowest since Friday.

- Brent is also trading close to its intraday low at around $83.88/bbl and down 1.3% from the NY close. It broke through the bull trigger at $87.00 on Wednesday affirming the bullish theme and opening up $89.18, the December 1 high. WTI also cleared its bull trigger and opened up $83.27.

- The IEA noted that in Q1 2023 supply is expected to exceed demand by about 1mbd but as China drives a pickup in demand over the rest of the year the outlook should improve. But a tightening of the market could drive prices sharply higher if there any supply issues. Russian output remains a significant uncertainty.

- API reported a 7.6mn crude inventory build in the US after +14.865mn the previous week. Rising stocks have also been weighing on prices. The EIA reports it inventory data later.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/01/2023 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 19/01/2023 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 19/01/2023 | 1000/1100 | ** |  | EU | EZ Current Account |

| 19/01/2023 | 1030/1130 |  | EU | ECB Lagarde Panellist at World Economic Forum | |

| 19/01/2023 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 19/01/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 19/01/2023 | 1330/0830 | *** |  | US | Housing Starts |

| 19/01/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 19/01/2023 | 1400/0900 |  | US | Boston Fed's Susan Collins | |

| 19/01/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 19/01/2023 | 1600/1100 | ** |  | US | DOE weekly crude oil stocks |

| 19/01/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 19/01/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 19/01/2023 | 1700/1800 |  | EU | ECB Schnabel in Finanzwende Webinar | |

| 19/01/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 19/01/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 19/01/2023 | 1815/1315 |  | US | Fed Vice Chair Lael Brainard | |

| 19/01/2023 | 2335/1835 |  | US | New York Fed's John Williams | |

| 20/01/2023 | 2350/0850 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.