-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: S&P 500 E-Minis See Another Fresh All-Time High

EXECUTIVE SUMMARY

- FED MINUTES SHOW UPBEAT BUT PATIENT POLICY STANCE (MNI)

- U.S. PANEL TO HOLD HEARING ON TECH BILL TO COMBAT CHINA (RTRS SOURCE)

- U.S. EXPRESSES 'GREAT CONCERN' ABOUT CHINESE EFFORTS TO INTIMIDATE TAIWAN (RTRS)

- BIDEN: U.S. SENATE READYING LEGISLATION ON SEMICONDUCTORS (RTRS)

- EU FAILS TO FIND UNITED RESPONSE TO ASTRA RISKS (BBG)

- AUSTRALIA TRADE MINISTER TELLS CHINA SOVEREIGNTY NON-NEGOTIABLE (RTRS)

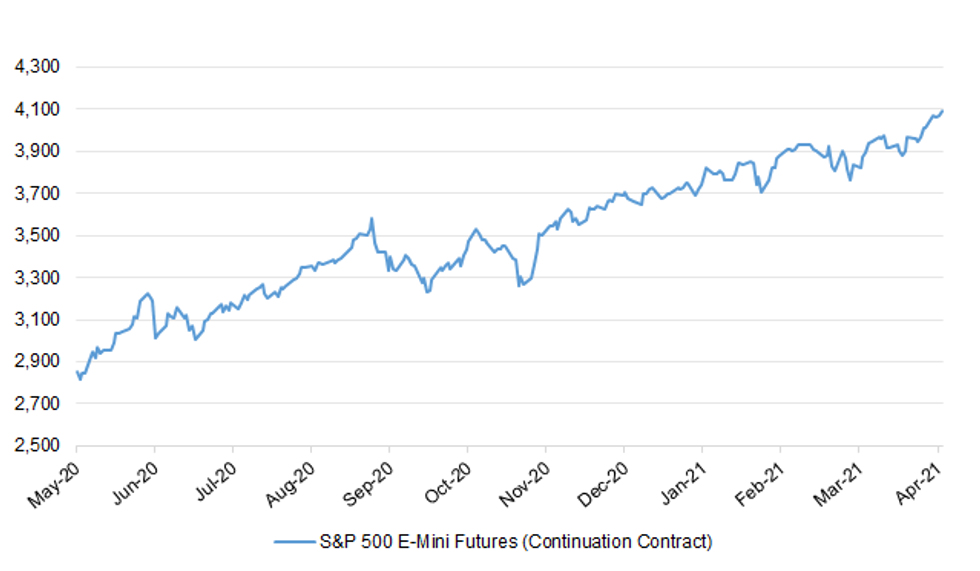

Fig. 1: S&P 500 E-Mini Futures (Continuation Contract)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

CORONAVIRUS: Britain will pass the threshold for herd immunity on Monday, according to dynamic modelling by University College London (UCL), placing more pressure on the Government to move faster in releasing restrictions. (Telegraph)

CORONAVIRUS: Under-30s in the UK are to be offered an alternative Covid vaccine to the AstraZeneca jab due to the evidence linking it to rare blood clots. The recommendation comes after a review by the UK drugs regulator found that by the end of March 79 people had suffered rare blood clots after vaccination - 19 of whom had died. The regulator said this was not proof the jab had caused the clots. But it said the link was getting firmer. (BBC)

CORONAVIRUS: The U.K. government said it remains on course to meet its Covid-19 vaccination targets, and moved quickly to assuage safety concerns after AstraZeneca doses were effectively ruled out for people under 30. "When you get the call, get the jab," Health Secretary Matt Hancock said Wednesday on Twitter, shortly after the U.K.'s drug regulator issued its highly-anticipated safety review of Astra's vaccine. The U.K. is "on track" to offer a first vaccine dose to all adults by the end of July, he said. The Medicines and Healthcare products Regulatory Agency said 79 people among the more than 20 million who have received the Astra shot in Britain had suffered rare blood clots, 19 of whom had died. But while it found a "reasonably plausible link" to the vaccine, it did not block its usage. (BBG)

CORONAVIRUS: Covid passport laws being considered could have "sunset" clauses to reassure Tory rebels that the measures will be temporary, The Telegraph understands. (Telegraph)

ECONOMY: The UK labour market is starting to thaw, with recruiters reporting the strongest rebound in permanent hiring for six years in March as businesses prepared for the lifting of lockdown measures. A monthly survey, compiled by IHS Markit for advisory firm KPMG and the Recruitment & Employment Confederation, pointed to the first upturn in permanent staff appointments since December, with the highest proportion of recruiters since April 2015 reporting month-on-month growth. Recruiters also reported accelerating growth in temporary billings, and the sharpest increase in overall vacancies since 2018. (FT)

EUROPE

ECB: ECB President Lagarde tweeted the following on Wednesday: "We had important and productive discussions at today's #G20 meeting. Multilateral cooperation and policy support are key for ensuring that our economies emerge from the pandemic at the same speed and no-one is left behind." (MNI)

ECB: The best approach in the current context is to "keep calm and stay the course in monetary policy," European Central Bank Governing Council member Olli Rehn says at UBS central bank virtual forum. "In my view it's better to be safe than sorry and maintain a sufficient degree of monetary policy accommodation" during the coronavirus pandemic. "We have both upside and downside risks to the outlook, depending on the speed of the vaccine rollout and potential appearance of virus mutations." (BBG)

CORONAVIRUS: The European Union failed to form a united response to links between AstraZeneca Plc's Covid-19 vaccine and a rare type of blood clots. At a meeting that ran until late Wednesday, EU health ministers promised in a statement to continue discussions on vaccination planning. The EU's immunization program has been bogged down by poor planning, supply delays and increasingly a lack of solidarity. (BBG)

GERMANY: Germany is about to start bilateral negotiations with Russia to obtain its Sputnik V COVID-19 vaccine, a source told Reuters on Wednesday, adding that any final agreement depended on Russia providing key data to the European Medicines Agency (EMA). The European Commission told health ministers of EU member states on Wednesday that Brussels was not planning to start talks with Russia on a preliminary contract for Sputnik V as it did with other vaccine providers, a person with knowledge of the matter told Reuters on condition of anonymity. (RTRS)

ITALY: Italy will from now on recommend the AstraZeneca COVID-19 vaccine only for people over aged 60, the country's top health adviser said after the European regulator found possible links between the vaccine and rare cases of blood clots. Health Minister Roberto Speranza took the decision following consultation with experts and "other institutional figures," Franco Locatelli, head of Italy's Superior Health Council, told reporters on Wednesday. (RTRS)

SPAIN: Spain joined other European nations on Wednesday in limiting the use of the AstraZeneca vaccine to the elderly due to concerns over links to extremely rare blood clotting. Spanish Health Minister Carolina Darias announced after meeting with regional health chiefs that authorities would limit shots to those over 60 years old. (AP)

U.S.

FED: MNI BRIEF: Fed Minutes Show Upbeat But Patient Policy Stance

- Federal Reserve officials became more upbeat about the economy's prospects in the minutes of last month's meeting, while showing no hint of taking their foot off the monetary accelerator amid vaccine progress and more fiscal relief - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: Federal Reserve Governor Lael Brainard said that while U.S. economic outlook has "brightened considerably," it remains well away from the central bank's goals. "Brighter outlook, but of course our monetary policy forward guidance is premised on outcomes not the outlook, and so it is going to be some time before both employment and inflation have achieved the kinds of outcomes that are in that forward guidance," Brainard said on CNBC's "Closing Bell." She spoke shortly after the Fed released minutes from the March Federal Open Market Committee meeting, during which officials voted unanimously to hold short-term borrowing rates near zero and to continue buying at least $120 billion of bonds each month. (CNBC)

FED: Chicago Federal Reserve Bank President Charles Evans on Wednesday said he is optimistic and confident in his forecast for stronger growth this year, but said that the Fed will need to see actual progress toward its goals, not just improved forecasts, before reducing its massive bond buying program. "We are going to have to go months and months into the higher inflation experience before I'm going to even have an opinion on whether or not this is sustainable or not, and that's going to be uncomfortable," Evans said, noting he expects prices to rise in coming months. "We really have to be patient and be willing to be bolder than most conservative central bankers would choose to be if we are going to actually get inflation expectations to move up in a sustainable fashion." (RTRS)

FED: Fed's Barkin: Hope and expectation worst of pandemic has passed. Biggest economic risk now is supply-chain constraints. Seeing evidence inflation pressures starting to build. Still seeing signs that blunt ability to raise prices. (Dow Jones)

FED: Dallas Fed President Robert Kaplan reiterated his longstanding worries that low rates and the Fed's bond purchases could fuel excesses and imbalances in markets. Once the pandemic has receded, he said, the Fed should pare its bond buying and move toward raising rates in 2022, and signaled he may even be open to doing both at once. "My thought is the tapering would come first," Kaplan said in a virtual discussion organized by UBS. "I think in my mind it would be substantially completed before you dealt with Fed funds rate, but I would like to retain flexibility on that." (RTRS)

FED: The size of the U.S. central bank's balance sheet, now more than $7 trillion, is "far" from hitting any limits, San Francisco Federal Reserve Bank President Mary Daly said on Wednesday, noting that there are really only two constraints on its ultimate size. "One is we can't be the only maker in the market, because then we start actually influencing things in a way we don't want to," Daly said at an event put on by the University of Nevada, Reno. "And the second is the optics of the balance sheet, as people like to call them, the tolerance for people thinking that we are not actually influencing the market pricing across the board because we are too large...but neither of those things right now is binding us." (RTRS)

FED: MNI INTERVIEW: Fed Seeks Community Input To Weigh Jobs Progress

- The Federal Reserve is meeting with community leaders more than scheduled as it seeks to determine its progress towards redefined employment goals and wade through heightened uncertainty from the Covid shock, a member of the central bank's Community Advisory Council told MNI. "We did meet throughout the year and had more meetings than normal," said Lora Smith, executive director of the Appalachian Impact Fund in Eastern Kentucky. "The chairman was very engaged with us," she said of Fed Chair Jerome Powell - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL: President Joe Biden said Wednesday that he is willing to negotiate on the proposed corporate tax rate hike in his $2 trillion infrastructure plan. "I'm willing to listen to that," Biden said at the White House when asked if he would consider a lower corporate tax rate than 28%, as his plan currently calls for. "We've got to pay for this," Biden added, noting that there are "many other ways we can do it." "But I'm willing to negotiate that," he said. (CNBC)

FISCAL: President Joe Biden promoted his $2.25 trillion infrastructure plan in a White House speech on Wednesday, and described its passage as urgent to keep the U.S. competitive against China. "It's a once-in-a generation investment in America," Biden said. "It is a the single largest investment in American jobs since World War II." Ahead of his remarks, administration officials said the plan -- criticized by many congressional Republicans for including corporate income taxes -- enjoys broad support from ordinary Americans and is overdue after decades of under-investment in roads, child care and other programs. White House Press Secretary Jen Psaki declared that "the evidence is unanimous that the American people support" Biden's vision for the U.S. economy, citing initial polling around the infrastructure plan. (BBG)

FISCAL: U.S. Senate Minority Leader Mitch McConnell said on Wednesday that infrastructure legislation could win support from Republicans in Congress if it targets traditional projects involving roads, bridges and broadband and does not unwind 2017 tax cuts. "If we could agree on what the definition of infrastructure is – and I think it clearly must include roads and bridges and broadband – there may be a way forward. But it needs to be credibly paid for, not through completely revisiting the tax reform act of 2017," McConnell told a press conference in Madisonville, Kentucky. (RTRS)

FISCAL: Treasury Secretary Janet Yellen on Wednesday touted the Biden administration's proposed changes to the corporate-tax code and said in detail that the plan would be fairer, reduce incentives for companies to shift factories and income overseas, and generate revenues for domestic priorities. Treasury officials said the Made In America tax plan, tied to President Joe Biden's $2 trillion infrastructure overhaul, would recoup about $2 trillion in corporate profits into the U.S. currently derived overseas. Estimates calculated by the Treasury Department and the Joint Committee on Taxation found that fixing incentives to offshore business could raise an amount of revenue equal to $700 billion. (CNBC)

FISCAL: The White House will release a sketch of its budget plans on Friday, a spokesman said, offering a long-awaited glimpse into the U.S. administration's policy priorities. President Joe Biden's so-called "skinny" budget will offer a partial outline of the money the administration is requesting from Congress.

CORONAVIRUS: Alabama Governor Kay Ivey lifted the state's mask mandate, saying the order would go into effect on Friday. Individuals are still "strongly encouraged" to wear face coverings when in public or in close contact with others, the governor said in a statement. Texas and Indiana also dropped their mask mandates. (BBG)

OTHER

U.S./CHINA: U.S. Commerce Secretary Gina Raimondo said on Wednesday that tariffs imposed during the Trump administration "have in fact helped save American jobs in steel and aluminum industries." "What do we do with tariffs? We have to level the playing field," Raimondo said at a White House briefing. "China's actions are uncompetitive, coercive, underhanded -- they've proven they'll do whatever it takea." In 2018, then President Donald Trump imposed 25% tariffs on imported steel and 10% on imported aluminum from most countries, arguing that these protections were necessary for U.S. national security to maintain healthy domestic production. (RTRS)

U.S./CHINA: The U.S. Senate Commerce Committee is set to hold a hearing on April 14 on a bipartisan measure to bolster U.S. technology research and development efforts in a bid to address Chinese competition, according to a notice seen by Reuters. The bill, titled the "Endless Frontier Act," was first proposed in 2020 calling for $110 billion over five years to advance U.S. technology efforts and cosponsored by Senate Democratic Leader Chuck Schumer and Republican Senator Todd Young. The committee could hold a separate hearing later in April to debate legislative language, sources said. (RTRS)

U.S./CHINA: The U.S. is not discussing a boycott of the 2022 Winter Olympics in Beijing due to alleged human rights abuses, White House press secretary Jen Psaki said on Wednesday. "Our position on the 2022 Olympics has not changed. We have not discussed and are not discussing any joint boycott with allies and partners," Psaki said Wednesday. A State Department spokesman indicated on Tuesday in an exchange with reporters that the U.S. was discussing whether to skip the Olympics in Beijing as part of a boycott with allies. Some Republicans have called on the Biden administration to boycott the Winter Olympics in Beijing over China's treatment of Uighurs and its crackdown on rights in Hong Kong. (RTRS)

U.S./CHINA/TAIWAN: The United States said on Wednesday in response to new Chinese military activity around Taiwan that it noted with "great concern" a pattern of ongoing Chinese intimidation efforts in the region. State Department spokesman Ned Price reiterated at a regular briefing that the U.S. commitment to Taiwan was "rock solid." (RTRS)

GLOBAL TRADE: U.S. Senate leaders are preparing to introduce legislation on semiconductors, President Joe Biden said on Wednesday as the nation wrestles with an ongoing shortage of the critical technology used in a range of devices from cars to computers. "We're working on that. (Senate Majority Leader) Chuck Schumer and, I think, (Senate Republican Leader Mitch) McConnell are about to introduce a bill along those lines," Biden said during remarks about his own plan to boost the nation's infrastructure. Schumer and McConnell's offices did not immediately comment. (RTRS)

GLOBAL TRADE: Adewale Adeyemo, Treasury Secretary Janet Yellen's deputy, on Wednesday said increasing the U.S. corporate tax rate to 28% will not make American companies less competitive, because the Biden administration is confident it can win the support of developed nations to set a minimum tax worldwide. "We've worked very closely with our international counterparts to counter what has been a race to the bottom in terms of international taxation," Adeyemo, who goes by Wally, told CNBC's Sara Eisen. "We believe through both the things we're going to do globally in terms of the G-20, where the United States has made clear that we're back and we're looking forward to leading the world, we're able to reach an agreement that will draw in the vast majority of developed countries in the world to set a minimum tax," the No. 2 Treasury official said. (CNBC)

GLOBAL TRADE: MNI EXCLUSIVE: G20 Tax Deal Unlikely Despite U.S. Drive

- Wide divergences between countries on the issue of a minimum corporate tax as proposed by U.S. Treasury Secretary Janet Yellen as well as on a Digital Services Tax make an agreement by the G20's summer deadline unlikely, despite the initial welcome the initiative has received, European officials told MNI. France, the UK and Italy seem likely to balk at any agreement without a similar one on a Digital Services Tax, said the sources familiar with the talks, which are ongoing at a technical level within the OECD - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CORONAVIRUS: World Bank President David Malpass on Wednesday said the slow rollout of COVID-19 vaccines in Europe was concerning and disappointing, and could even weigh on the economic growth forecasts of Germany, Europe's largest economy. Malpass said German officials told members of the Group of 20 major economies that vaccination problems could lead to a "softening of GDP forecasts. Malpass also said he was very concerned about the current situation facing people in Latin America and the Caribbean, but a strong recovery in the United States could help stimulate demand for products from the region. (RTRS)

JAPAN: The Japanese government will decide as soon as Friday to apply stricter coronavirus measures in Tokyo after Governor Yuriko Koike said the metropolitan government was preparing to ask the central government for the imposition, the Sankei newspaper reports, without attribution. The central government is also considering imposing stronger measures in Kyoto and Okinawa prefectures and may make the decision when it decides for Tokyo. (BBG)

JAPAN: MNI BRIEF: BOJ, FSA Check Risk Management on Archegos Losses

- Bank of Japan officials judge the impact of losses by U.S. investment firm Archegos' on the nation's financial firms and system is limited but they are paying great attention to risk management practices - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: The latest NAB/SEEK employment report notes that "SEEK new job ads rose 10.3% m/m in March to be 24.3% above pre-pandemic February 2020 levels. The increase in the month takes the level of job ads in trend terms to their highest since early 2008, with some states and territories at an all-time high. The strong growth in SEEK job ads continues to indicate an ongoing lift in labour demand, reflective of the better-than-expected economic recovery, but also reflects some dislocation in labour supply as a result of interstate and international border closures. Overall the data suggests a further tightening of the labour market in the coming months even with the end of the JobKeeper wage subsidy on 28 March." (MNI)

RBA: As the nation plots its economic recovery from the pandemic, from vaccine rollouts to financial support for struggling sectors, it seems the right time to also examine the policies of the Reserve Bank of Australia. As The Age reported on Tuesday, ALP Treasury spokesman Jim Chalmers has joined a growing group of influential economists who have called for a review into the bank's operations in the light of its failure to meet its primary function of keeping inflation between 2 per cent and 3 per cent a year. (The Age)

AUSTRALIA/CHINA: Australian Trade Minister Dan Tehan said the government will protect the country's sovereignty and national interest, in response to a warning from China's ambassador that it will "respond in kind" if Canberra joins sanctions on officials accused of human rights abuses. "That's something we've made very clear is non-negotiable," Tehan said in an interview with Bloomberg Television Thursday. "But that doesn't mean that we can't have productive relationships. Good friends always are able to have very difficult conversations." International tensions have flared over reports of forced labor being used to harvest cotton in China's western province of Xinjiang, prompting several countries to sanction Communist Party officials. (BBG)

NEW ZEALAND: New Zealand on Thursday temporarily suspended entry for all travellers from India, including its own citizens, for about two weeks following a high number of positive coronavirus cases arriving from the South Asian country. The move comes after New Zealand recorded 23 new positive coronavirus cases at its border on Thursday, of which 17 were from India. (RTRS)

SOUTH KOREA: President Moon Jae-in's Democratic Party was handed its worst defeat in five years in mayoral elections in South Korea's two biggest cities, a troubling sign for his progressive bloc just 11 months before a presidential vote. Final results released Thursday showed conservative Oh Se-hoon scored a landslide victory in the race in Seoul over ruling party candidate Park Young-sun, a former minister for startups. Oh picked up 57.5% of the vote to 39.2% for Park. In Busan, Park Hyung-jun of the conservative People Power Party defeated Kim Young-choon from Moon's ruling party by 62.7% to 34.4%, data from the National Election Commission showed. (BBG)

NORTH KOREA: The United States is prepared to engage in some form of diplomacy with North Korea if it will lead to denuclearization on the peninsula, White House spokeswoman Jen Psaki said Wednesday. She said the U.S. remains committed to denuclearization of North Korea. "We have a clear objective as it relates to North Korea, which is denuclearizing the Korean Peninsula," the spokeswoman said at a daily press briefing. "We are, of course, continuing to enforce sanctions. We are consulting with allies and partners. We are prepared to consider some form of diplomacy if it's going to lead us down the path toward denuclearization." (Yonhap)

CANADA: Ontario has declared its third provincewide state of emergency as the number of COVID-19 cases surge, issuing a stay-at-home order effective 12:01 a.m. Thursday. The province is also expanding vaccine eligibility for more people over the age of 18 in regions hardest hit by the virus, starting with Toronto and Peel Region. Premier Doug Ford said mobile teams are being organized to offer vaccines in high-risk congregate settings: residential buildings, faith-based locations and places occupied by large employers in hot-spot neighbourhoods. Education workers in high-risk neighbourhoods will be allowed to book vaccinations starting next week, he said. "I continue to ask everyone to get a vaccine as soon as you're eligible to do so," Ford said, adding that those who are eligible but haven't taken the vaccine are "putting your life in jeopardy." (CBC)

MEXICO: Mexico's Foreign Minister Marcelo Ebrard will soon travel to the U.S. to press for more vaccines from its northern neighbor to help get through a supply crunch during the next three months, Mexico's deputy foreign minister said Wednesday. Ebrard will make the trip to thank the U.S. for the "rapid" delivery of 2.7 million doses of the AstraZeneca vaccine, Deputy Foreign Minister Martha Delgado told Bloomberg News in an interview. Ebrard will also keep pushing Mexico's request for more doses, she said. Delgado said Mexico had a "permanent petition" for any available vaccines from the U.S., such as the AstraZeneca shot that has yet to be approved by regulators there. (BBG)

BRAZIL: A Brazilian Supreme Court judge on Wednesday suspended extensions of drug patents in the country, a preliminary decision that could lower costs for drugs critical to treating COVID-19 patients at the expense of pharmaceutical firms. Justice Dias Toffoli cited the "public health emergency arising from COVID-19" in his ruling. The ruling, which takes effect immediately, must still go before the full Supreme Court for consideration and could be reversed. The case was originally set to be considered by the court on Wednesday but was later pulled from the agenda for proceedings. (RTRS)

BRAZIL: Brazilian President Jair Bolsonaro said on Wednesday that he would not interfere in state-run oil company Petroleo Brasileiro SA, but it was still possible to change the firm's fuel pricing policy. Amid truck driver complaints about high fuel prices, Bolsonaro announced in February that he would replace the chief executive of Petrobras, as the company is commonly known. The move stoked fears of government intervention in fuel prices, which under past administrations has run up huge costs. (RTRS)

RUSSIA: Biden administration officials have completed an intelligence review of alleged Russian misdeeds such as election interference and the SolarWinds hack, setting the stage for the U.S to announce retaliatory actions soon, according to three people familiar with the matter. Possible moves could involve sanctions and the expulsion of Russian intelligence officers in the U.S. under diplomatic cover, said the people, who asked not to be identified discussing private deliberations. Senior officials were expected to meet Wednesday to discuss what steps to take. One person familiar with the deliberations said the U.S. response would likely comprise several elements. That would include sanctions singling out people close to Russian President Vladimir Putin as well as agencies linked to election interference. (BBG)

RUSSIA: The Biden administration said Wednesday that it is disturbed by reports that Russian opposition leader Alexei Navalny's health has deteriorated since his imprisonment and reiterated calls for his immediate release. Navalny, who was detained in January at an airport in Moscow, is on a hunger strike in order to force his jailers to provide access to outside medical care for pain in his back and legs. A lawyer for Navalny said he is suffering from two spinal hernias, AP reported. The Kremlin has declined to comment on his health. (CNBC)

RUSSIA: The White House is in talks to appoint a special envoy to lead negotiations on halting the construction of Russia-to-Germany gas pipeline Nord Stream 2, current and former U.S. officials said, as the Biden administration grapples with how to stymie a nearly completed energy project that would serve as a major financial and geopolitical boon to Moscow. Amos Hochstein, who served as the special envoy and coordinator for international energy affairs under President Barack Obama and was a close adviser and confidant to then-Vice President Joe Biden, was informally offered the role by National Security Adviser Jake Sullivan late last month and is being vetted, the officials said, but he has not yet accepted the job. (POLITICO)

SOUTH AFRICA: An oil blending and storage company secured deals to supply South Africa's state power utility with fuel oil worth more than 15 billion rand ($1 billion) at inflated prices by paying inducements, including donations to the ruling party, a forensic investigation has found. Econ Oil & Energy Ltd. allegedly won the contracts with the help of Thandi Marah, then senior manager of business enablement at Eskom Holdings SOC Ltd., who interfered in the tender processes, said legal firm Bowmans, which Eskom commissioned to conduct the probe. A copy of its final report dated Oct. 12 last year was seen by Bloomberg and confirmed by Eskom. (BBG)

IRAN: White House press secretary Jen Psaki on Wednesday called the ongoing talks with Iran on rejoining the 2015 nuclear deal a constructive early step and would not put a timeline on any decisions. The United States and Iran are holding indirect talks this week in Vienna over a return to the accord. (RTRS)

MIDDLE EAST: The United States committed Wednesday to move all remaining combat forces from Iraq, although the two sides did not set a timeline in what would be the second withdrawal since the 2003 invasion. The first "strategic dialogue" with Iraq under US President Joe Biden's administration comes as Iranian-linked Shiite paramilitary groups fire rockets nearly daily at bases with foreign troops in hopes of forcing a US exit. The two nations agreed in a videoconference led by Secretary of State Antony Blinken and Foreign Minister Fuad Hussein that Iraqi forces were ready to take on more responsibility. (AFP)

MIDDLE EAST: The Saudi-led coalition intercepted a Houthi explosives-laden drone fired from Yemen in the direction of the kingdom's southern city of Khamis Mushait, Saudi state TV reported early on Thursday. Houthi military spokesman Yahya Sarea said on Twitter that Houthis targeted King Khalid air base in Khamis Mushait with a drone. He said the "hit was precise". (RTRS)

COPPER: Codelco, the world's biggest copper producer, has some calming words for traders concerned that a Covid-19 resurgence in Chile will disrupt supply of the metal. "Definitely not," Chairman Juan Benavides said when asked if a tightening of restrictions this week would interrupt the company's operations or shipments. In an interview Tuesday, he said Codelco managed to increase first quarter output despite a surge of infections in Chile. "So far this year, we have a production increase." Through the pandemic, Chilean mines that account for more than a quarter of global supply have been able to maintain high levels of production by introducing shift changes, testing and tracing and delaying non-essential activities. That's been a blessing for Chinese smelters hungry for material amid supply disruptions elsewhere and recovering demand. (BBG)

CHINA

FISCAL: Chinese local government officials will be held accountable should their governments incur additional implicit debts, Finance Minister Liu Kun wrote in the People's Daily. Local governments should take market-oriented approaches to dealing with defaults and gradually dispose of existing implicit debts, Liu said. Local governments will be gradually given control over revenues from consumption taxes, Liu said. (MNI)

INFRASTRUCTURE: China will continue to speed up Internet connections and cut access fees to lower costs for businesses to help develop the digital economy, the State Council said following its weekly executive meeting. The Council urged telecom providers to cut fees for Internet access by 10% for SMEs and give discounts to the elderly, the disabled and other special groups and also improve network services. (MNI)

AUTOS: The nation's vehicle sales likely rose to 2.38m units in March, China Association of Automobile Manufacturers says in statement. March vehicle sales likely rose 64% from Feb., when seven-day Chinese New Year holiday fell. Passenger vehicle sales rose 73.4% from year ago. (BBG)

OVERNIGHT DATA

JAPAN FEB BOP CURRENT ACCOUNT BALANCE +Y2.9169TN; MEDIAN +Y2.0000TN; JAN +Y644.4BN

JAPAN FEB BOP CURRENT ACCOUNT BALANCE ADJ +Y1.7947TN; MEDIAN +Y1.0187TN; JAN +Y1.4974TN

JAPAN FEB TRADE BALANCE BOP BASIS +Y524.2BN; MEDIAN +Y471.8BN; JAN -Y130.1BN

JAPAN MAR TOKYO AVG OFFICE VACANCIES 5.42; FEB 5.24

JAPAN MAR BANKRUPTCIES -14.32% Y/Y; FEB -31.49%

NEW ZEALAND APR, P ANZ BUSINESS CONFIDENCE -8.4; MAR -4.1

NEW ZEALAND APR, P ANZ ACTIVITY OUTLOOK 16.4; MAR 16.6

The preliminary ANZ Business Outlook data for April saw business confidence fall 4 points to -8%, while the own activity outlook was unchanged at +16.4%. Details on the activity side were flat to weaker. Employment and investment intentions were unchanged, and export intentions rose slightly, but capacity utilisation, the best GDP indicator, fell 3 points. Expected credit availability also fell 6 points. The proportion of firms reporting higher employment than a year ago fell 2 points. Cost and inflation pressures remain intense. Expected costs rose 2 points to a net 75% expecting higher costs ahead. A net 53% of respondents intend to raise their prices, up 6 points to a fresh record high, in data that goes back to 1992. Inflation expectations remain well behaved–at 1.96%, they round to the 2% RBNZ CPI target midpoint. Despite intentions to pass costs on where possible, profit expectations fell 3 points, with a net 4% of firms expecting lower profitability ahead. The stresses and strains in the New Zealand economy are starting to show. Although reported own-activity expectations are off their highs, cost pressures are intense, and subdued profitability expectations suggest firms are not optimistic about their ability to recoup all of it. We don't report sector-level results in the preliminary report, but suffice to say that rising costs are an economy-wide issue. Shipping disruptions, rising global commodity prices, the higher minimum wage, and skill shortages are creating something of a perfect storm. It's inflationary, but not growth-friendly, so the RBNZ will look through it as long as it appears transitory. (ANZ)

UK MAR RICS HOUSE PRICE BALANCE 59%; MEDIAN 55%; FEB 54%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS THURS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. This keeps liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1552% at 09:25 am local time from the close of 1.9125% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 37 on Wednesday vs 42 on Tuesday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5463 THURS VS 6.5384

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.5463 on Thursday, compared with the 6.5384 set on Wednesday.

MARKETS

SNAPSHOT: S&P 500 E-Minis See Another Fresh All-Time High

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 111.27 points at 29619.52

- ASX 200 up 62.981 points at 6991

- Shanghai Comp. up 6.567 points at 3486.192

- JGB 10-Yr future up 2 ticks at 151.30, yield unch. at 0.099%

- Aussie 10-Yr future up 1.5 tick at 98.300, yield down 1.4bp at 1.736%

- U.S. 10-Yr future -0-03 at 131-23+, yield down 0.89bp at 1.665%

- WTI crude down $0.21 at $59.56, Gold up $1.58 at $1739.30

- USD/JPY down 17 pips at Y109.68

- FED MINUTES SHOW UPBEAT BUT PATIENT POLICY STANCE (MNI)

- U.S. PANEL TO HOLD HEARING ON TECH BILL TO COMBAT CHINA (RTRS SOURCE)

- U.S. EXPRESSES 'GREAT CONCERN' ABOUT CHINESE EFFORTS TO INTIMIDATE TAIWAN (RTRS)

- BIDEN: U.S. SENATE READYING LEGISLATION ON SEMICONDUCTORS (RTRS)

- EU FAILS TO FIND UNITED RESPONSE TO ASTRA RISKS (BBG)

- AUSTRALIA TRADE MINISTER TELLS CHINA SOVEREIGNTY NON-NEGOTIABLE (RTRS)

BOND SUMMARY: Core FI Coils In Asia

The Asia-Pac session lacked meaningful inputs, which allowed the core global bond markets to operate in narrow ranges on light volume

- T-Notes stuck to a 0-03 range, last -0-03 at 131-23+, with cash Tsys running little changed to 1.0bp richer across the curve. A quick look at the latest round of Japanese BoP data revealed that Japanese investors shed a net Y563.4bn of U.S. Tsys in the month of February, representing the first round of monthly net sales witnessed since August.

- JGB futures dealt either side of unchanged. The contract firmed a little in the wake of the latest 5-Year JGB auction, last +3, with twist steepening of the cash curve evident in the wake of the supply. In terms of auction specifics, the low price witnessed at the latest 5-Year auction topped broader dealer expectations, with the cover ratio firming as the lower degree of uncertainty post-BoJ review and allure of fresh paper outweighed any outright/relative value questions. Elsewhere, the tail width narrowed.

- YM +0.5, XM +1.0 in Sydney. One point of note is that Japanese investors shed a record net Y643bn of Australian government bonds in the month of February, per Japan's latest round of BoP data, representing the first monthly round of net selling witnessed since Feb '20 (this comes after a record annual net purchase amount in calendar 2020).

JGBS AUCTION: Japanese MOF sells Y2.0213tn 5-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.0213tn 5-Year JGBs:- Average Yield -0.091% (prev. -0.062%)

- Average Price 100.48 (prev. 100.78)

- High Yield: -0.087% (prev. -0.054%)

- Low Price 100.46 (prev. 100.74)

- % Allotted At High Yield: 77.7054% (prev. 18.1264%)

- Bid/Cover: 4.547x (prev. 3.250x)

JGBS AUCTION: Japanese MOF sells Y2.7716tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.7716tn 6-Month Bills:- Average Yield -0.0962% (prev. -0.1117%)

- Average Price 100.048 (prev. 100.057)

- High Yield: -0.0962% (prev. -0.1098%)

- Low Price 100.048 (prev. 100.056)

- % Allotted At High Yield: 61.0235% (prev. 98.2904%)

- Bid/Cover: 4.961x (prev. 3.838x)

BONDS: The Offshore Outlook For Japanese FI Participants

Given the start of the new Japanese fiscal year plenty of attention has fallen on the potential for Japanese investors to deploy fresh capital into foreign bonds. Australia & the U.S. continue to present the most attractive destinations from an FX-hedged yield perspective, although the dynamics surrounding the broader reflation trade narrative and its impact on AUD/JPY (assuming that Japanese investors choose to enter a large proportion of Aussie bond positions from an FX-unhedged stance) may be key for allocation in the short term.

Fig. 1: Selected Foreign FX-Hedged (From The Perspective Of A Japanese Investor) & JGB Yields (%)

Source: MNI - Market News/Bloomberg

| FX-Hedged Yield (%) | Conventional Yield (%) | |

|---|---|---|

| U.S. 10-Year | 1.3243 | 1.6739 |

| Germany 10-Year | 0.0757 | -0.325 |

| France 10-Year | 0.326 | -0.075 |

| Italy 10-Year | 1.0924 | 0.693 |

| Spain 10-Year | 0.742 | 0.341 |

| UK 10-Year | 0.5352 | 0.773 |

| Australia 10-Year | 1.5721 | 1.7498 |

| Japan 10-Year | -- | 0.099 |

| Japan 20-Year | -- | 0.462 |

| Japan 30-Year | -- | 0.662 |

| Japan 40-Year | -- | 0.704 |

JAPAN: Foreign Investors Scooped Up Japanese Assets Last Week

The highlights from the latest round of Japanese weekly international security flow data once again surround international net flows re: Japanese assets. After heavy net selling of both Japanese bonds and equities in the previous week, foreign investors flipped to net buying of both asset classes in the most recent week, with foreigners lodging the largest round of weekly Japanese equity net purchases observed since October.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 377.0 | 201.3 | 701.3 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -199.0 | -367.9 | -1149.4 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 568.6 | -2388.5 | -1993.4 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 978.4 | -852.4 | -12.8 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

EQUITIES: Japan Laggard On Lockdown Concerns

Markets are mixed in Asia once again, US markets inched higher to another record, buoyed by a dovish set of Fed minutes, indices closed slightly higher, though the Nasdaq was marginally lower. In Asia markets in Japan are the laggards, nursing losses on reports the government is considering tighter COVID-19 restrictions for Tokyo and other areas. Markets in China and Hong Kong are higher, though struggling to make significant gains. Markets in Australia have outperformed, supported by financials post-RBA earlier this week. US futures are mixed, Dow Jones and S&P futures in minor positive territory, while Nasdaq futures are a shade lower.

OIL: Futures Dip After Two-Days Of Gains

Crude futures are slightly lower, declining after two days of gains. WTI is down $0.39 from settlement levels at $59.38/bbl, while Brent is $0.42 lower at $62/74/bbl.

- Data yesterday showed headline crude stocks fell more than expected, dropping 3.522m bbls against expectations of a 1.638m bbls decline, stocks at Cushing fell 735k bbls. Gasoline stocks did rise, some 4.04m bbls higher, but demand was strong with imports and refinery runs both higher.

- Upside yesterday was also supported by the release of US President Biden's tax plan that would end some fossil fuel subsidies. The plan specifically targeted $35bn in projected subsidies over 10 years, noting that profits of oil and gas companies would be the main victims.

GOLD: Holding

Gold continues to coil, with spot dealing little changed around the $1,740/oz mark. Cross currents from lower to unchanged U.S. real yields and a slightly higher DXY over the last 24 hours or so have roughly netted off. This leaves the technical backdrop unchanged.

FOREX: Looking For Catalysts

G10 FX pairs were rangebound as the absence of market-moving headlines in Asia-Pac hours allowed participants to stay on the sidelines, contemplate familiar themes and await fresh catalysts. The DXY moved away from Wednesday's high.

- GBP led gains in the G10 basket, while NOK was the main laggard, amid a broader correction of yesterday's moves, which allowed JPY to claim back Wednesday's losses.

- The PBOC fixed its USD/CNY mid-point at CNY6.5463, 3 pips below sell side estimates. USD/CNH crept higher through the session.

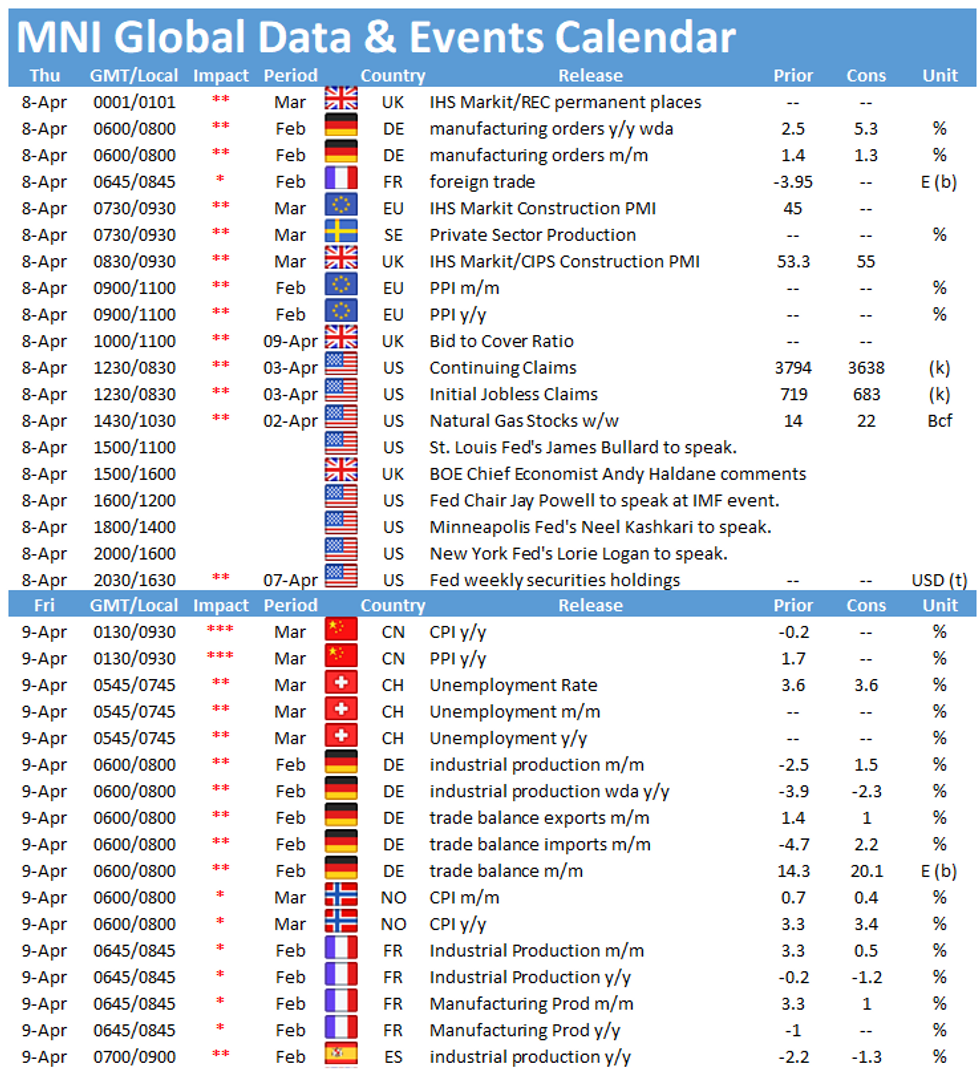

- Today's data highlights include U.S. initial jobless claims, German factory orders & Norwegian industrial output. Central bank speaker slate features Fed's Powell, Bullard & Kashkari as well as Riksbank's Ingves. The ECB will publish the account of its latest MonPol meeting.

FOREX OPTIONS: Expiries for Apr08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1690-1.1700(E2.1bln), $1.1720-30(E1.9bln-EUR puts), $1.1750-55(E1.1bln-EUR puts), $1.1800(E1.94bln, E1.76bln of EUR puts), $1.1840-50(E1.5bln, E1.36bln EUR puts), $1.1885-95(E1.7bln), $1.1900-10(E2.9bln-EUR puts)

- USD/JPY: Y108.45-55($1.3bln-USD puts), Y108.60-70($1.5bln), Y108.80-86($1.2bln), Y109.00-05($561mln), Y109.50($817mln, $767mln USD puts), Y109.75($985mln-USD puts), Y110.15-20($535mln)

- GBP/USD: $1.3890-1.3900(Gbp433mln)

- EUR/GBP: Gbp0.8500(E600mln-EUR puts), Gbp0.8550-55(E981mln-EUR puts)

- USD/CHF: Chf0.9400($540mln)

- AUD/USD: $0.7665-80(A$964mln-AUD puts), $0.7700-20(A$1.6bln)

- EUR/AUD: A$1.5410(E720mln)

- USD/CAD: C$1.2650-55($525mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.