-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: S&P 500 E-Minis Hit New Highs

- Markets generally stuck to tight ranges on low volumes in Asia, S&P 500 e-minis registered another fresh all-time high.

- COVID vaccine matters and isolated pockets of cases continue to draw attention.

- Fedspeak & U.S. fiscal headlines continued to dominate in U.S. Hours.

BOND SUMMARY: Core FI Coils In Asia

The Asia-Pac session lacked meaningful inputs, which allowed the core global bond markets to operate in narrow ranges on light volume T-Notes stuck to a 0-03 range, last -0-02+ at 131-24, with cash Tsys running little changed to 1.0bp richer across the curve. A quick look at the latest round of Japanese BoP data revealed that Japanese investors shed a net Y563.4bn of U.S. Tsys in the month of February, representing the first round of monthly net sales witnessed since August. Weekly jobless claims data, Fedspeak from Powell, Kashkari & Bullard and the mid-month auction announcement headline locally on Thursday.

- JGB futures dealt either side of unchanged. The contract firmed a little in the wake of the latest 5-Year JGB auction, last +3, with twist steepening of the cash curve evident in the wake of the supply. In terms of auction specifics, the low price witnessed at the latest 5-Year auction topped broader dealer expectations, with the cover ratio firming as the lower degree of uncertainty post-BoJ review and allure of fresh paper outweighed any outright/relative value questions. Elsewhere, the tail width narrowed. Local news flow saw several outlets report that the Japanese government may implement stricter COVID-related restrictions in Tokyo and other areas (namely Kyoto and Okinawa) in the coming days. Tokyo Governor Koike subsequently confirmed that the capital will ask for deeper restrictions. PPI & Preliminary machine tool orders data headline locally on Friday.

- YM +1.0, XM +1.5 in Sydney, with little to report. One point of note is that Japanese investors shed a record net Y643bn of Australian government bonds in the month of February, per Japan's latest round of BoP data, representing the first monthly round of net selling witnessed since Feb '20 (this comes after a record annual net purchase amount in calendar 2020). The release of the weekly AOFM issuance slate & A$800mn of ACGB 0.25% 21 November 2025 supply headline locally on Friday.

BONDS: The Offshore Outlook For Japanese FI Participants

Given the start of the new Japanese fiscal year plenty of attention has fallen on the potential for Japanese investors to deploy fresh capital into foreign bonds. Australia & the U.S. continue to present the most attractive destinations from an FX-hedged yield perspective, although the dynamics surrounding the broader reflation trade narrative and its impact on AUD/JPY (assuming that Japanese investors choose to enter a large proportion of Aussie bond positions from an FX-unhedged stance) may be key for allocation in the short term.

Fig. 1: Selected Foreign FX-Hedged (From The Perspective Of A Japanese Investor) & JGB Yields (%)

Source: MNI - Market News/Bloomberg

| FX-Hedged Yield (%) | Conventional Yield (%) | |

|---|---|---|

| U.S. 10-Year | 1.3243 | 1.6739 |

| Germany 10-Year | 0.0757 | -0.325 |

| France 10-Year | 0.326 | -0.075 |

| Italy 10-Year | 1.0924 | 0.693 |

| Spain 10-Year | 0.742 | 0.341 |

| UK 10-Year | 0.5352 | 0.773 |

| Australia 10-Year | 1.5721 | 1.7498 |

| Japan 10-Year | -- | 0.099 |

| Japan 20-Year | -- | 0.462 |

| Japan 30-Year | -- | 0.662 |

| Japan 40-Year | -- | 0.704 |

JAPAN: Foreign Investors Scooped Up Japanese Assets Last Week

The highlights from the latest round of Japanese weekly international security flow data once again surround international net flows re: Japanese assets. After heavy net selling of both Japanese bonds and equities in the previous week, foreign investors flipped to net buying of both asset classes in the most recent week, with foreigners lodging the largest round of weekly Japanese equity net purchases observed since October.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 377.0 | 201.3 | 701.3 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -199.0 | -367.9 | -1149.4 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 568.6 | -2388.5 | -1993.4 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 978.4 | -852.4 | -12.8 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

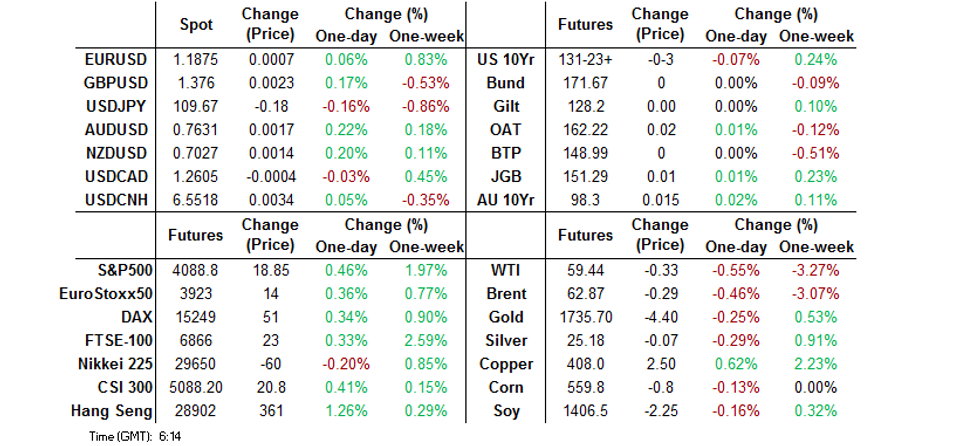

FOREX: Looking For Catalysts

G10 FX pairs were rangebound as the absence of market-moving headlines in Asia-Pac hours allowed participants to stay on the sidelines, contemplate familiar themes and await fresh catalysts. The DXY moved away from Wednesday's high.

- GBP led gains in the G10 basket, while NOK was the main laggard, amid a broader correction of yesterday's moves, which allowed JPY to claim back Wednesday's losses.

- The PBOC fixed its USD/CNY mid-point at CNY6.5463, 3 pips below sell side estimates. USD/CNH crept higher through the session.

- Today's data highlights include U.S. initial jobless claims, German factory orders & Norwegian industrial output. Central bank speaker slate features Fed's Powell, Bullard & Kashkari as well as Riksbank's Ingves. The ECB will publish the account of its latest MonPol meeting.

FOREX OPTIONS: Expiries for Apr08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1690-1.1700(E2.1bln), $1.1720-30(E1.9bln-EUR puts), $1.1750-55(E1.1bln-EUR puts), $1.1800(E1.94bln, E1.76bln of EUR puts), $1.1840-50(E1.5bln, E1.36bln EUR puts), $1.1885-95(E1.7bln), $1.1900-10(E2.9bln-EUR puts)

- USD/JPY: Y108.45-55($1.3bln-USD puts), Y108.60-70($1.5bln), Y108.80-86($1.2bln), Y109.00-05($561mln), Y109.50($817mln, $767mln USD puts), Y109.75($985mln-USD puts), Y110.15-20($535mln)

- GBP/USD: $1.3890-1.3900(Gbp433mln)

- EUR/GBP: Gbp0.8500(E600mln-EUR puts), Gbp0.8550-55(E981mln-EUR puts)

- USD/CHF: Chf0.9400($540mln)

- AUD/USD: $0.7665-80(A$964mln-AUD puts), $0.7700-20(A$1.6bln)

- EUR/AUD: A$1.5410(E720mln)

- USD/CAD: C$1.2650-55($525mln)

ASIA FX: Mostly Weaker Despite USD Pullback

In general, tight ranges and lack of catalysts, the greenback lost some ground but is still above yesterday's opening levels.

- CNH: PBOC fixed USD/CNY at 6.5463, 3 pips below sell side estimates. Offshore yuan is weaker, USD/CNH testing yesterday's high. China's FX reserves fell by US$35bn in March to US$3.17tn largely because of valuation effect from exchange rate conversion and asset price changes. Overall, there remains no evidence China's central bank is intervening to weaken the yuan.

- SGD: Singapore dollar is stronger, USD/SGD remains sandwiched between its 50-day moving average at 1.3363 and the 200-day moving average at 1.3505.

- TWD: Taiwan dollar is higher again, TWD is on track for a fourth day of gains. TWD still boosted by yesterday's reports that Taiwanese authorities were considering travel bubble agreements. After market the Taiwan central bank said it smoothed forex market volatility in March, despite being on the US Treasury's currency manipulator watchlist. Data showed forex reserves fell $4.28b in March from end-Feb., the first M/M decline since May 2019.

- KRW: The won is weaker, but is off worst levels. South Korea reported 700 new coronavirus cases in the past 24 hours, the highest in three months amid rising concerns that the country's vaccination campaign may hit a snag due to safety concerns over AstraZeneca jabs

- MYR: Ringgit is weaker, palm oil futures are slightly lower today after climbing to a two-week high yesterday as traders anticipated better demand over the Ramadan period.

- IDR: Rupiah is lower, Indonesian Health Ministry said it will have to slow the pace of vaccinations, owing to export embargoes imposed by several producing countries.

- PHP: Peso has lost ground, Philippine trade deficit shrank in Feb, but slightly less than expected. Exports fell unexpectedly, while imports grew less than forecast.

- THB: Baht is lower, PM Prayuth expressed a sense of concern with the resurgence of Covid-19 infections in Bangkok and suggested that fresh restrictions might be forthcoming.

ASIA RATES: Dove Is In The Air

Futures mostly higher after a dovish set of FOMC minutes in the US, while the RBI hangover exerts its effects.

- INDIA: Bonds supported after the RBI rate announcement and introduction of a new debt purchase programme. Markets await details of the programme, the first round of purchases is scheduled for next week. Upside could be tempered by upcoming state bond sales.

- SOUTH KOREA: Futures are higher, climbing out of negative territory, yields lower across the curve, some bull flattening seen. South Korea reported 700 new coronavirus cases in the past 24 hours, the highest in three months amid rising concerns that the country's vaccination campaign may hit a snag due to safety concerns over AstraZeneca jabs

- CHINA: The PBOC refrained from injections again, the twenty third straight session. Overnight repo rate unconcerned, last at 1.7559%, around 0.5bps higher. Bond futures coming under pressure, with stocks moving into positive territory as the session wears on. Bloomberg calculations find foreign investors were net sellers of Chinese debt in March for the first time since early 2019.

- INDONESIA: Yields lower for the sixth straight day, President Jokowi announced his support for expanding BI's mandate to include bolstering the economy. The endorsement has seen critics claim the move risks the central bank's independence.

EQUITIES: Japan Laggard On Lockdown Concerns

Markets are mixed in Asia once again, US markets inched higher to another record, buoyed by a dovish set of Fed minutes, indices closed slightly higher, though the Nasdaq was marginally lower. In Asia markets in Japan are the laggards, nursing losses on reports the government is considering tighter COVID-19 restrictions for Tokyo and other areas. Markets in China and Hong Kong are higher, though struggling to make significant gains. Markets in Australia have outperformed, supported by financials post-RBA earlier this week. US futures are mixed, Dow Jones and S&P futures in minor positive territory, while Nasdaq futures are a shade lower.

GOLD: Holding

Gold continues to coil, with spot dealing little changed around the $1,740/oz mark. Cross currents from lower to unchanged U.S. real yields and a slightly higher DXY over the last 24 hours or so have roughly netted off. This leaves the technical backdrop unchanged.

OIL: Futures Dip After Two-Days Of Gains

Crude futures are slightly lower, declining after two days of gains. WTI & Brent sit ~$0.35 below settlement levels.

- Data yesterday showed headline crude stocks fell more than expected, dropping 3.522m bbls against expectations of a 1.638m bbls decline, stocks at Cushing fell 735k bbls. Gasoline stocks did rise, some 4.04m bbls higher, but demand was strong with imports and refinery runs both higher.

- Upside yesterday was also supported by the release of US President Biden's tax plan that would end some fossil fuel subsidies. The plan specifically targeted $35bn in projected subsidies over 10 years, noting that profits of oil and gas companies would be the main victims.

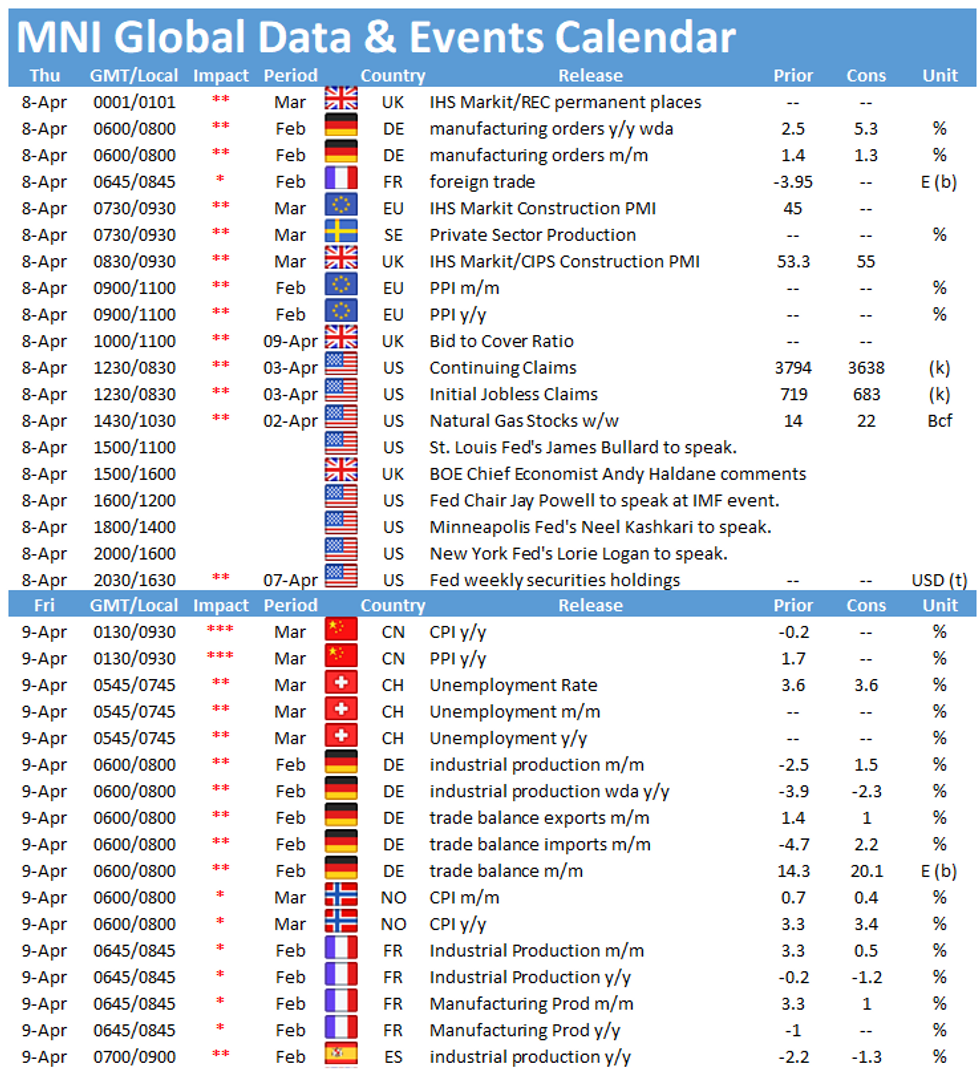

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.