-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Erdogan Forces Another Record High In USD/TRY

- Turkish President Erdogan highlights July-August as a potential period for rate cuts at the CBRT, USD/TRY prints fresh record highs before moving back from extremes.

- Mixed news out of Australia with Q1 GDP on the firm side & the Melbourne COVID lockdown extended for 1 week.

- Core markets generally limited in Asia.

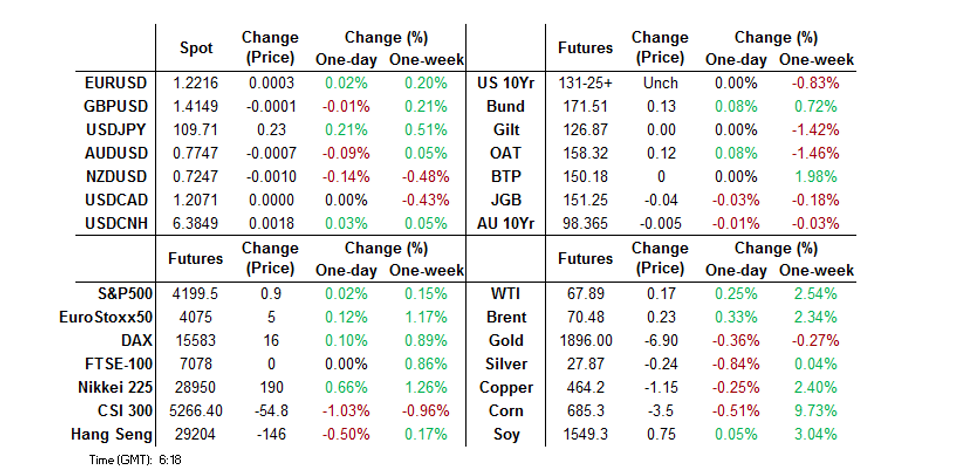

BOND SUMMARY: Pretty Steady

T-Notes were happy to hold within the upper half of yesterday's range in Asia-Pac dealing, last printing unch. at 131-25+, with cash Tsys trading little changed to ~1.0bp cheaper, 20s leading the cheapening. There has been nothing in the way of notable headline or market flow for Tsys, with participants taking a bit of a breather after Tuesday's recovery from session lows. Fedspeak from Bostic, Harker, Evans & Kaplan headlines on Wednesday, with the release of the latest Beige Book also due.

- Another narrow session leaves JGB futures 1 tick below yesterday's settlement level, while cash JGBs run little changed to ~0.5bp cheaper across the curve. There has been little in the way of top tier news flow, with BoJ's Adachi reiterating his dovish leaning and the latest round of BoJ Rinban operations experiencing mixed offer/cover ratios when compared to the previous operations for each bucket. 10-Year JGB supply headlines locally on Thursday.

- YM -1.0, XM -1.0. Both contracts have recovered from worst levels of the day after the latter had a brief look below early Sydney/overnight lows on the back of stronger than consensus Q1 GDP readings for Australia, although the sell-side had largely adjusted to the view that risks were skewed to the upside re: the release in the wake of the partials prints, limiting the follow through and stickiness of the move. Both the Q/Q & Y/Y readings were within the range of estimates provided in the BBG survey. The 7-day extension of the COVID-related lockdown covering the Melbourne area (although the regional Victoria area may not see its restrictions extended) was also noted, and may have provided some incremental support during the second half of trade. Still, participants continue to discuss the prospects for the tapering of RBA bond purchases in the wake of the tweaks to yesterday's post-meeting statement. Elsewhere, Bills trade unchanged through the reds, with a post-fix bout of buying activity noted in IRM1 after 3-Month BBSW fixed at the lowest level witnessed since late March. A reminder that Deputy Governor Debelle & Assistant Governor Bullock will appear before the Senate Economics Legislation Committee (Estimates) this evening. The final monthly trade balance and retail sales readings headline the local docket tomorrow.

FOREX: AUD Gives Back After Lockdown Extended

AUD/USD gained after Q1 GDP data printed 0.3ppts above estimates at 1.8% Q/Q, but came off best levels after the lockdown in Melbourne was extended by 7 days though the wider Victoria area was spared. The pair last up 6 pips.

- NZD/USD up around 5 pips. RBNZ head of financial markets Rayner said that the balance sheet will remain large for a long time, and that new monpol tools will likely remain mainstream for as long as global rates remain near record lows. There was also an interview with RBNZ Gov Orr doing rounds, he said strong global demand for New Zealand primary products is ensuring the economy remains resilient during the Covid-19 pandemic and is helping offset tourism losses. Data earlier showed New Zealand terms of trade rose 0.1% Q/Q against estimates of a 0.3% decline.

- JPY lost some ground, USD/JPY up 15 pips heading into the European session. BoJ's Adachi gave a speech and was positive on the economy while reiterating his dovish leanings saying the BoJ needed to maintain its ultra-loose policy.

- The yuan moved in a narrow range, USD/CNH last down 13 pips. The PBOC fixed USD/CNY 4 pips below sell side estimates, the first fix indicating a preference for a stronger yuan in four days. US Tsy Sec Yellen held an introductory virtual meeting with the Vice Premier Liu He and said talks were constructive.

- GBP/USD is higher as sterling gains. Comments from Japan economy minister Nishimura indicated the process of getting the UK to join as a member of the TPP in underway.

- TRY collapsed to a record low against the greenback after President Erdogan called on the central bank to cut rates in a bid to reduce inflation.

ASIA FX: Rangey

A mixed session with narrow ranges for most Asia EM FX as the greenback posted some small gains.

- CNH: Offshore yuan is stronger, moving in a narrow range. The PBOC fixed USD/CNY 4 pips below sell side estimates, the first fix indicating a preference for a stronger yuan in four days. US Tsy Sec Yellen held an introductory virtual meeting with the Vice Premier Liu He and said talks were constructive.

- SGD: Singapore dollar is flat, sticking to a narrow range throughout the session, markets look ahead to PMI data later in the session.

- TWD: Taiwan dollar is weaker for the second day, retreating from the strongest levels since March 1997. One-month USD/TWD volatility rose to highest since March.

- KRW: The won is weaker USD/KRW rising from the lowest levels since February. Data earlier in the session showed May CPI rose in line with estimates at 2.6%, above the central banks 2% target which has been acknowledged by policy makers. Vice FinMin Hong said t South Korea would take measures to block excessive inflation expectations.

- MYR: Ringgit is flat, moving in a tight range as markets continue to assess the impact of two week lockdown imposed this week. The pair just below its 50-DMA.

- IDR: Rupiah is slightly stronger, CPI rose above estimates at 0.32% Y/Y while core CPI rose 1.37%, also beating estimates. Manufacturing PMI rose to 55.3 in May from 54.6.

- PHP: Peso is lower, dropping from a four-year high. Late yesterday the House of Representatives approved a PHP 401bn pandemic relief bill and a proposal changing some economic provisions in the Constitution.

- THB: Baht is flat, giving back earlier gains seen after a strong bond auction. Demand was robust due to a dovish central bank and safe haven demand as the latest wave of COVID-19 casts doubts on the economy reopening.

ASIA RATES: South Korea Yields Hit Multi-Year Highs After CPI Overshoot

- INDIA: Yields lower in early trade. Markets look ahead to an INR 360bn state debt sale and sovereign bill sales today for clues as to demand at sovereign auctions later this week, the RBI monpol meeting will begin today which could keep some participants on the sidelines.

- SOUTH KOREA: 10-Year yield hitting the highest level since November and close to hitting the highest since 2018 at 2.203% as inflation rises at the fastest pace in nine years at 2.6%, sparking speculation that the BoK will be forced to raise rates to reign in prices. Also weighing on bonds are reports from earlier this week that the DPP will seek additional fiscal measures, including another budget, this year.

- CHINA: Repo rates declined with the 7-day repo rate dropping back below 2.20%. Futures initially opened lower but regained ground to trade around neutral levels. MOF sold 3- & 7-year upsized bonds. US Tsy Sec Yellen held an introductory virtual meeting with the Vice Premier Liu He and said talks were constructive.

- INDONESIA: Curve twist steepens. CPI rose above estimates at 0.32% Y/Y while core CPI rose 1.37%, also beating estimates. Manufacturing PMI rose to 55.3 in May from 54.6. Markets look ahead to today's dollar-denominated sukuk bond sale, overseas investors returned to be net buyers of Indonesian debt in April and May.

GOLD: Resistance Holds

Little to really pen for gold over the last 24 hours, after failure at technical resistance and a recovery from intraday lows in the DXY allowed spot to trade just below $1,900/oz, where it currently resides. For more on the recent movement in gold, including a technical overview and coverage of fundamental drivers, please refer to our recent analysis piece.

OIL: Creeps Up From Highest Close Since 2018

Oil is higher in Asia-Pac trade on Wednesday, approaching Tuesday's highs after giving back some gains into the close. WTI is up $0.24 from settlement levels at $67.96/bbl while Brent is up $0.24 at $70.49/bbl. Yesterday's close was the highest since 2018 as markets priced in a more protracted period of negotiations that could stall Iran's re-entry to international oil markets Saudi Arabia's energy minister also helped engender bullish sentiment saying there were clear signs of improvement in the demand picture as the OPEC+ group confirmed a supply increase in July. As a note API figures are delayed to the US holiday on Monday and so will be published later today.

FOREX OPTIONS: Expiries for Jun02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2095-05(E800mln), $1.2400-10(E550mln)

- USD/JPY: Y111.25($500mln)

- AUD/USD: $0.7710-15(E667mln), $0.7740-50(A$1.2bln-AUD puts)

- AUD/JPY: Y83.15(A$943mln-AUD puts)

- NZD/USD: $0.7200-20(N$1.5bln-NZD puts)

- USD/CNY: Cny6.38($760mln), Cny6.40($926mln)

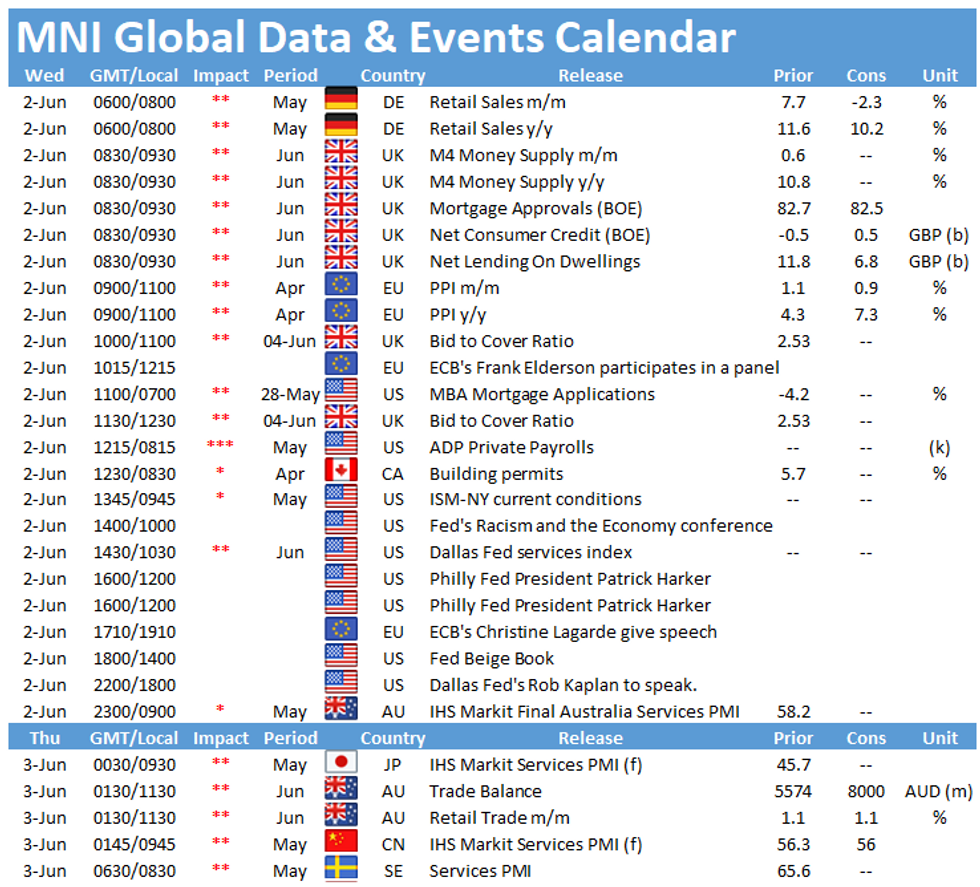

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.