-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Holidays Limit Activity In Asia, UK To Press Pause On Reopening

EXECUTIVE SUMMARY

- G7 LEADERS AGREE ON VACCINES, CHINA AND TAXING CORPORATIONS (CNBC)

- ECB'S LAGARDE: TOO EARLY TO DEBATE THE END OF PEPP PURCHASES (Politico)

- JUNE 21 EASING OF COVID LOCKDOWN RULES DELAYED BY FOUR WEEKS (Times)

- UK ATTACKS "OFFENSIVE" EU AS BREXIT G7 ARGUMENT ESCALATES (BBG)

- BENNET SWORN IN AS ISRAEL'S PRIME MINISTER, ENDING NETANYAHU'S 12-YEAR RULE (Haaretz)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Boris Johnson has been warned by one of the Government's own advisers that a delay to lifting Covid-19 restrictions will have an "extremely damaging" effect on the economy and mental health. Prof Robert Dingwall, who sits on a series of coronavirus advisory committees, including the New and Emerging Respiratory Threats Advisory Group and the Joint Committee on Vaccination and Immunisation, urged the Prime Minister to press ahead with his original roadmap that should have seen "all legal limits on social contact" removed on June 21. (Telegraph)

BREXIT: Boris Johnson's U.K. government doesn't want any of the leaders at the Group of Seven summit to leave Cornwall without knowing just how angry he is with some of them about Brexit. For the second day in a row, Johnson's Foreign Secretary Dominic Raab has taken to broadcast interviews to condemn European "ignorance" about the U.K., as a dispute over post-Brexit trade rules intensifies. He attacked the "lopsided" attitude the European Union is taking to enforcing checks on in goods entering Northern Ireland, a long running sore point between the two sides. (BBG)

ECONOMY: The UK's manufacturing sector is expected to grow twice as fast in 2021 as forecast at the start of the year after an unexpectedly strong rebound in production as companies emerge from the worst of the pandemic. Make UK, which represents 20,000 companies across engineering, manufacturing and industrials, said that output volumes reported in the last quarter were at the highest level since its research began 30 years ago. Employment intentions have also surged and the number of companies planning to increase investment turned positive for the first time since the start of 2020. As a result, Make UK upgraded its growth forecast for manufacturing from 3.9 per cent to 7.8 per cent, above its forecast for GDP of 7.5 per cent. (FT)

EUROPE

- "We have to take the economy through the pandemic and into a recovery phase, which has now started. We need to really anchor the recovery. We always talk about inflation anchoring and we are not oblivious to that. But the recovery needs to be firm, solid and sustainable. You don't remove the crutches from a patient unless and until the muscles have started rebuilding sufficiently so that the patient can walk on his or her own two legs. The same applies to the economy. We are at a turning point where, bearing in mind alternative variants, we are on that recovery path, heading firmly towards a return to the pre-COVID-19 level. According to our latest projections, we see the euro area economy being back to the pre-COVID-19 level during the first quarter of 2022. That said, I am not suggesting that the pandemic emergency purchase program (PEPP) is going to stop on March 31. We have plenty of flexibility, but in terms of economic outlook we are heading in the right direction."

U.S.

POLITICS: Apple informed former Trump White House counsel Don McGahn and his wife that the Justice Department had subpoenaed information about accounts belonging to them in 2018, a person familiar with the matter said Sunday, days after two House lawmakers disclosed they, too, had their information secretly subpoenaed. (AP)

OTHER

NATO: NATO will continue to build its military capabilities and employ a "wide combination of different tools" to counter Russian aggression, but it doesn't aim to "mirror" its rival power, the organization's chief told CNBC Sunday. "NATO's approach to Russia is based on what we call a dual track approach, defense and dialogue," NATO Secretary General Jens Stoltenberg told CNBC's Hadley Gamble from Brussels. "And that's exactly what we do when we now have implemented the biggest reinforcements of our collective defense since the end of the Cold War, and will continue to strengthen our collective defense with high readiness, more troops, and increased investment in our defense." (CNBC)

GEOPOLITICS: Australian frigates will join a British carrier strike group in naval exercises in the Indo-Pacific in a show of strength against China as the world's wealthiest democracies vow to confront Beijing's economic coercion. Prime Minister Scott Morrison discussed the deeper military co-operation with United States President Joe Biden and British Prime Minister Boris Johnson in a meeting — on the sidelines of the Group of 7 summit in Britain — aimed at uniting liberal democracies against threats to open trade.(Sydney Morning Herald)

BOJ: MNI BRIEF: BOJ Sees Gradual Spending Rise, Small Upside Risk

- Bank of Japan officials foresee a gradual recovery in private consumption with limited upside risk from increased vaccination rates but they are finding it difficult to predict the pace of the pickup in pent-up demand and its impact on consumer prices, MNI understands - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN: Japanese Prime Minister Yoshihide Suga gained the support of U.S. President Joe Biden and other Group of Seven leaders for Tokyo's hosting of the Olympics next month, in a boost for the premier's plans to push ahead with the event despite virus concerns. "President Biden affirmed his support for the Tokyo Olympic Games moving forward with all public health measures necessary to protect athletes, staff and spectators," the White House said in a statement following a conversation between the two leaders on the sidelines of the G-7 summit in the coastal Cornwall region of the U.K. The weekend statement also referred to Biden's pride in the U.S. athletes who will be taking part. The final communique from the G-7 leaders also mentioned their support for the holding of the Olympic and Paralympic Games Tokyo in a safe and secure manner "as a symbol of global unity in overcoming Covid-19." (BBG)

SOUTH KOREA: South Korea's daily new virus cases dropped below 500 Sunday for the first time in four days due to fewer tests over the weekend, and health authorities plan to exempt people who were fully vaccinated overseas from mandatory two-week isolation from July. (Yonhap)

SOUTH KOREA/JAPAN: Japan called off agreed-upon talks between President Moon Jae-in and Japanese Prime Minister Yoshihide Suga during the Group of Seven (G-7) meeting in Britain due to Seoul's regular exercise to defend its easternmost islets of Dokdo, a foreign ministry official said Monday. Seoul and Tokyo had reached a tentative agreement to hold a "pull-aside" meeting between their leaders on the sidelines of the G-7 session in the seaside resort of Carbis Bay in Cornwall, the official said. The three-day gathering ended Sunday. "From the beginning, our side, with an open mind, expected Japan to respond," the official said on condition of anonymity. (Yonhap)

ISRAEL: The new Bennett-Lapid government won the Knesset confidence vote, with 60 voting for, 59 against and one abstaining. Having received the confidence of the Knesset, the new government, with Yamina's Naftali Bennett as prime minister, will now be sworn in, unseating Benjamin Netanyahu after 12 years in office. The coalition consists of eight parties – Yair Lapid's Yesh Atid, Naftali Bennett's Yamina, New Hope, Labor, Meretz, United Arab List, Kahol Lavan and Yisrael Beiteinu. A rotation agreement has been agreed upon by Bennett and Lapid in which Bennett will serve as prime minister for two years with Lapid as foreign minister. Later, Lapid will assume the premiership for the following two years with Bennett as interior minister. (Haaretz)

RUSSIA/U.S.: The US sanctions on a number of transactions with Russia's sovereign debt, announced back in April, formally come into force on Monday. US President Joe Biden signed an executive order to impose sanctions on Russia on April 15. Particularly, the United States prohibits its companies from directly acquiring Russian debt liabilities issued by the Central Bank, the National Wealth Fund and the Finance Ministry after June 14, 2021. (TASS)

RUSSIA/U.S.: American President Joe Biden intends to clearly indicate the conditions of better relations between Moscow and Washington at the summit with Russian leader Vladimir Putin in Geneva on June 16. "This is not a contest about who can do better in front of a press conference to try to embarrass each other. It's about making myself very clear what the conditions are to get a better relationship are — with Russia," he said at a press conference following the G7 summit in the seaside resort of Carbis Bay in Cornwall, UK on Sunday. (TASS)

RUSSIA/U.S.: Russian President Vladimir Putin said the main goals of his summit meeting this week with U.S. President Joe Biden will be establishing personal contacts and direct dialog, and creating a mechanism to foster further interaction, according to an interview with Russia's state television channel VGTRK. He signaled there's room for cooperation on environmental issues. The Russian president also said the June 16 meeting could help create the conditions to discuss security issues between the two countries and that he would only consider extraditing alleged cyber-criminals if the U.S. would extradite alleged criminals sought by Russia. (BBG)

CANADA/U.S.: Canadian Prime Minister Justin Trudeau said on Sunday he has spoken with U.S. President Joe Biden about how to lift pandemic-related border restrictions between the two countries but made clear no breakthrough has been achieved. (RTRS)

BRAZIL: A trio of corporate sponsors — Mastercard, Ambev and Diageo — have pulled their brands from the Copa America football competition in Brazil. (FT)

MALAYSIA: The government is studying the possibility of relaxing the standard operating procedure under the present lockdown should daily Covid-19-positive cases drop below 4,000. Senior Minister Datuk Seri Ismail Sabri Yaakob said the matter was, however, subject to advice from the Health Ministry. The government, he said, would be holding a special meeting to discuss the plan to emerge from the full implementation of the movement control order. (Star)

CHINA

OVERNIGHT DATA

JAPAN APR, F INDUSTRIAL OUTPUT +2.9% M/M; FLASH +2.5%

The PSI for May was 56.1 (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). Although this was down 5.1 points from its highest ever result in April, it was still above its long term average of 53.9. BusinessNZ chief executive Kirk Hope said that the drop in the level of expansion for May was not unexpected, given the significant level of activity seen in April. "New Zealand continues to follow global trends with strong New Orders/Business (62.1) and Activity/Sales (58.7). However, Supplier Deliveries (45.1) remains solidly in contraction." BNZ Senior Economist Doug Steel said that "while the current strength in the PSI (and PMI) says good things for economic growth over coming quarters, the obvious supply side stresses suggests significant upward pressure is building on inflation." (BNZ)

MARKETS

SNAPSHOT: Holidays Limit Activity In Asia, UK To Press Pause On Reopening

- Nikkei 225 up 176.45 points at 29124.91

- ASX 200 is closed

- Shanghai Comp. is closed

- JGB 10-Yr future down 4 ticks at 151.85, yield up 0.4bp at 0.039%

- Aussie bonds are closed

- US 10-Yr future unch, at 132-27, yield up 1.01bp at 1.462%

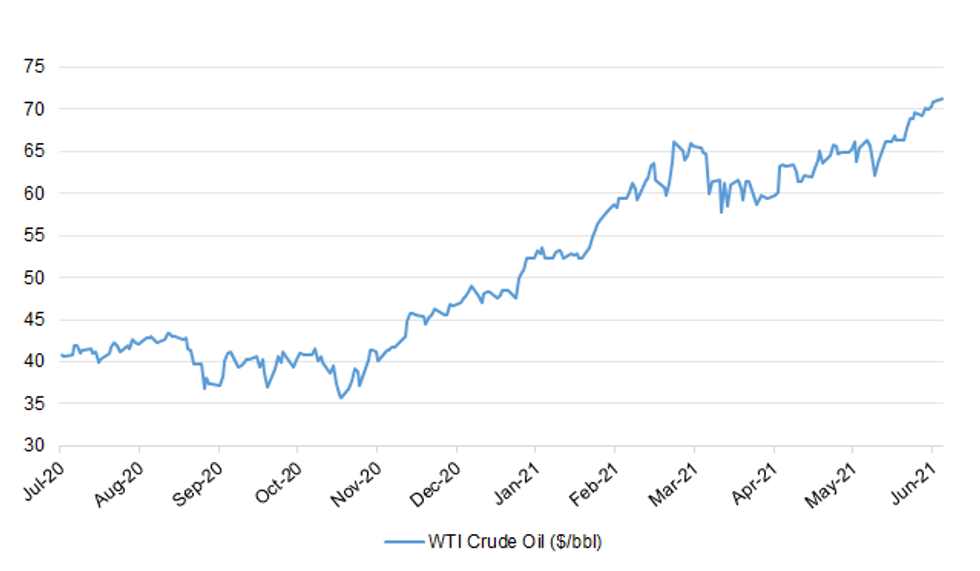

- WTI crude up $0.39 at $71.3, Gold down $15.52 at $1862.02

- USD/JPY up 10 pips at Y109.76

- G7 LEADERS AGREE ON VACCINES, CHINA AND TAXING CORPORATIONS (CNBC)

- ECB'S LAGARDE: TOO EARLY TO DEBATE THE END OF PEPP PURCHASES (Politico)

- JUNE 21 EASING OF COVID LOCKDOWN RULES DELAYED BY FOUR WEEKS (Times)

- UK ATTACKS "OFFENSIVE" EU AS BREXIT G7 ARGUMENT ESCALATES (BBG)

- BENNET SWORN IN AS ISRAEL'S PRIME MINISTER, ENDING NETANYAHU'S 12-YEAR RULE (Haaretz)

BOND SUMMARY: Core FI Tread Water, Holidays Limit Activity In The Region

Core FI tread water as the weekend news flow failed to provide any meaningful impetus, while activity was limited by public holidays in Australia, China, Hong Kong and Taiwan. T-Notes were rangebound and last change hands at 132-27. Cash U.S. Tsy curve bear steepened, with yields last seen 0.4-1.2bp higher. Eurodollar futures trade +0.25 to -0.5 tick through the reds. There is little of note on the U.S. docket today, with Fed officials already in their blackout period ahead of Thursday's FOMC monetary policy decision.

- JGB futures reopened on a slightly softer footing, but traded sideways thereafter. The contract last operates at 151.85, 4 ticks shy of prior settlement. Cash JGB yields were marginally mixed across the curve. The BoJ are set to deliver their latest monetary policy decision this Friday, with national CPI data also due on that day.

EQUITIES: Market Closures Subdue Proceedings

Markets in Australia, China, Hong Kong and Taiwan were closed today which kept liquidity thin and the economic docket light. Markets that were open were higher though moves were muted. Bourses in Japan rose around 0.3% while in South Korea markets hovered around neutral. In the US futures are in positive territory, creeping higher as US yields inch up ahead of the FOMC rate announcement later this week.

OIL: Adds To Recent Gains

After a positive day on Friday oil has added to gains to start the week, breaking above Friday's highs. WTI is up $0.32 from settlement at $71.23/bbl while Brent is up $0.32 at $73.01/bbl. Crude futures rose just shy of 2% last week as markets assessed positive demand cues from the US and Europe. This week focus will fall on talks over the Iran nuclear deal ahead of an Iranian election on June 18.

GOLD: Falls Further

The yellow metal has lost further ground on Monday after declining throughout the session on Friday. Gold last trades down $12.89 at $1,864.63 as US yields inch higher ahead of the FOMC rate announcement later this week. The decline brings into focus the $1856.2, Jun 4 low, a break of the level would reinforce recent bearish concerns following the strong selling pressure on Jun 3. Below opens the 50-day EMA at $1840.1, also seen as a key support area.

FOREX: Market Holidays Limit Activity In Asia

Market holidays in Australia, China, Hong Kong and Taiwan limited activity in the region, with NZD leading gains in G10 FX space, even as New Zealand's PSI fell from a record high. CAD also edged higher, as crude oil traded on a slightly firmer footing, but AUD and NOK struggled to pick up any momentum.

- The DXY inched higher, as participants prepared for Thursday's announcement of the latest monetary policy decision from the FOMC. Despite firming a tad, the index rejected Friday's high.

- USD/CNH rose past the CNH6.4000 mark, which capped gains last Friday, reaching its best levels since Jun 4.

- Sterling looked through a number of press reports noting that PM Johnson will today announce a four-week delay of the lifting of Covid-19 restrictions in England.

- The global data docket is very light today, with ECB's Schnabel & de Cos, BoE's Bailey & Riksbank's Floden set to deliver speeches.

FOREX OPTIONS: Expiries for Jun14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2150(E1.1bln). $1.2200(E1.3bln-EUR puts)

- USD/CHF: Chf0.8800($600mln-USD puts)

- AUD/USD: $0.7750-65(A$943mln), $0.7940(A$1.3bln-AUD puts)

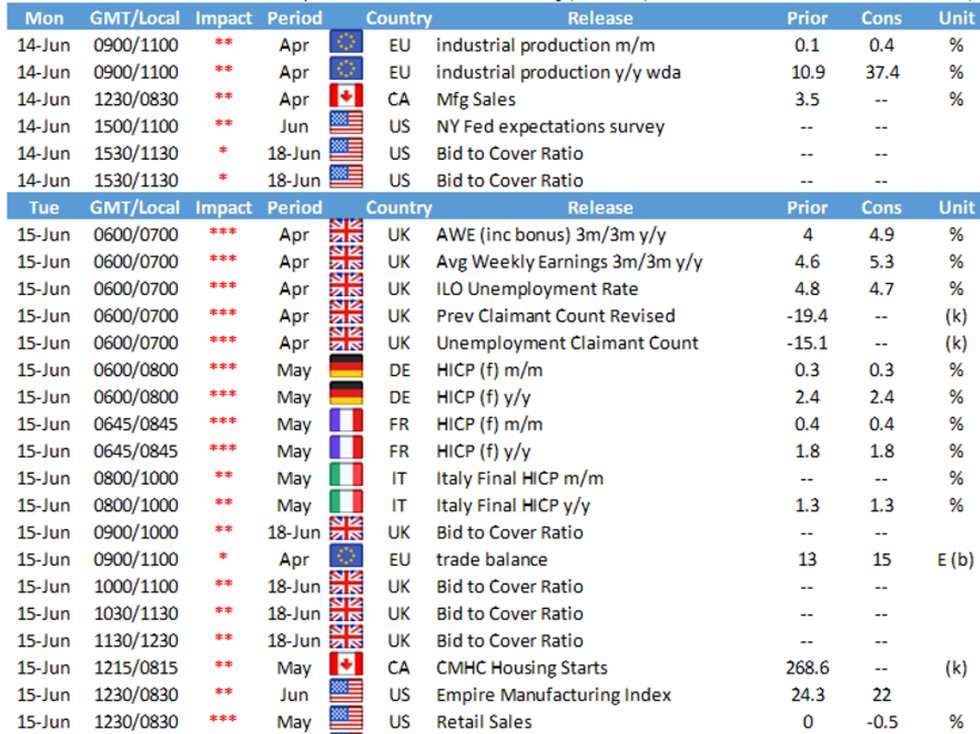

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.