-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Flash PMIs Follow Up After ECB

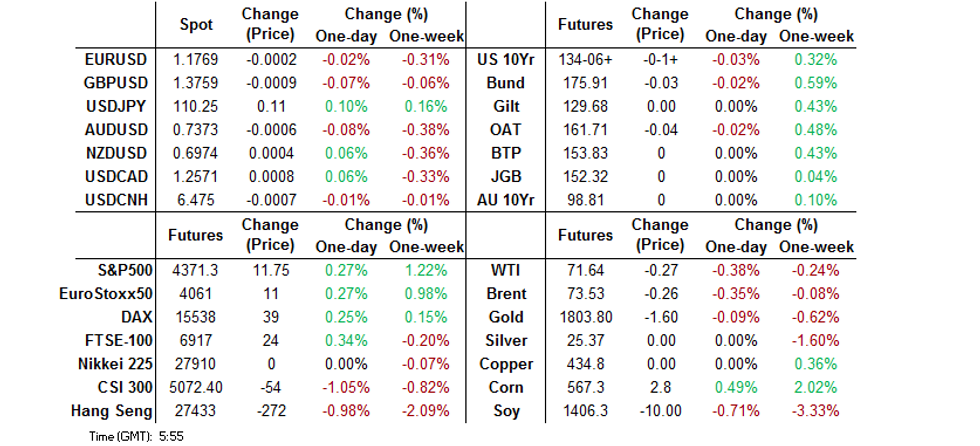

- A lack of macro headline flow has allowed the major FX pairs and U.S. Tsy futures to consolidate overnight, with cash Tsys closed until the London open owing to a Japanese holiday.

- The Australian COVID situation continues to get most of the regional attention, with no sign of a moderation in NSW cases evident.

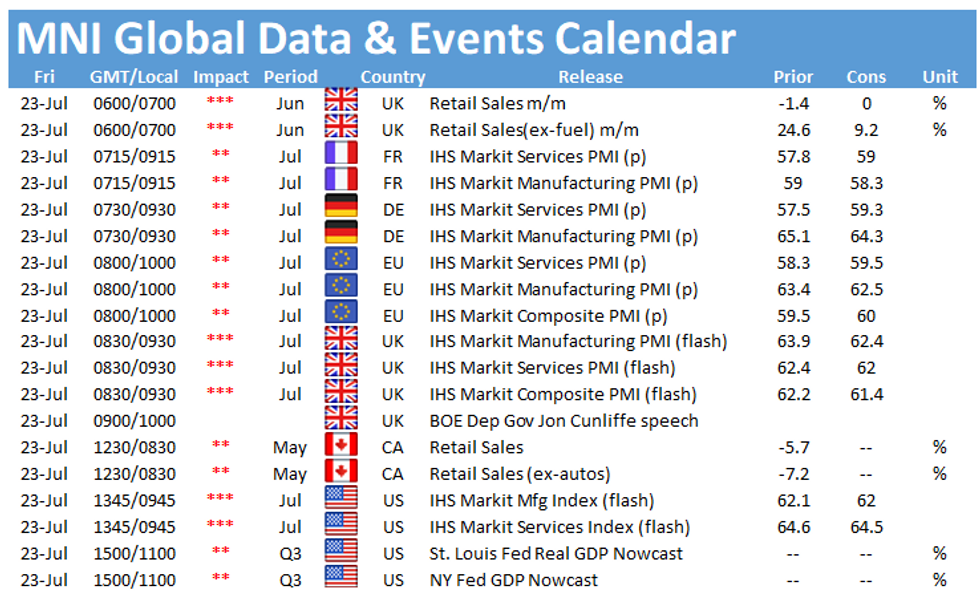

- Flash PMI readings from Europe headline the broader docket on Friday.

BOND SUMMARY: T-Notes Tight With Cash Closes, COVID Does Little For Aussie Bonds

T-Notes sticking to a narrow 0-03 range in Asia-Pac hours, -0-02+ at 134-05+ at typing, operating on very light volume of ~23K. A Japanese holiday (and subsequent closure of cash Tsys during Asia-Pac hours) is limiting broader participation, with a lack of macro news flow also evident. Flash Markit PMI data headlines the local docket during NY hours.

- In Australia, the daily NSW COVID figures have stolen the headlines, with the state discovering 136 new cases. The situation around SW & W Sydney was described as a "national emergency." Some restrictions will be tightened in a couple of suburbs as a result, with the NSW Premier calling for access to additional Pfizer vaccine doses. The NSW Premier also noted that "there is no doubt that the numbers are not going in the direction we were hoping they would at this stage. It is fairly apparent that we will not be close to zero next Friday." An extension of the lockdown in Sydney was already widely expected. In terms of the exposure of today's new cases, NSW health noted that "53 cases were in isolation throughout their infectious period and 17 cases were in isolation for part of their infectious period. 53 cases were infectious in the community, and the isolation status of 13 cases remains under investigation." The local COVID situation has resulted in at least an 8-week suspension of the Australia-NZ travel bubble. Elsewhere, ACGB Apr '26 supply passed smoothly, with the weighted average yield pricing 0.76bp through prevailing mids at the time of supply (per Yieldbroker). Although the uptick in the cover ratio vs. the prev. auction was largely driven by the smaller notional amount on offer, there was still a modest uptick in the metric when adjusted for auction size. The supportive factors for takedown of ACGB supply are well known (international appeal, abundant liquidity, negative RBA-adjusted supply and the potential for the RBA to walk back its tapering announcement are the dominant ones). Futures hold to narrow ranges, with YM & XM printing 0.5 below their respective settlement levels, while the cash ACGB curve has twist flattened, with 15+-Year paper richening by ~1.5bp on the day. The release of the weekly AOFM issuance schedule was bland.

FOREX: AUD Underperforms, Weighed Down By COVID-19 Concerns

Early gains for Antipodean pairs were tempered as the session wore on, particularly in Australia where PMI surveys dropped, the Sydney lockdown was extended and the trans-Tasman travel bubble was suspended due to the elevated number of coronavirus cases. AUD/USD id down 2 pips, while NZD/USD is up 9 pips.

- Japan observed a national holiday on Friday which resulted in the closure of Japanese financial markets, the holidays will result in thinner liquidity during Asia-Pac trading. USD/JPY up 13 pips as the greenback rises slightly from opening levels, but stays within yesterday's range.

- Offshore yuan hovered in a narrow range, USD/CNH last down 16 pips and sticking to a 60 pip range through the session, the pair briefly touched 6.47 but bounced from the level. The PBOC set USD/CNY reference rate at 6.4650, in line with sell side estimates and essentially flat from the day before.

- GBP/USD is down 7 pips, data showed UK GfK consumer confidence for July was slightly better than expected at -7, which is the highest reading since February 2020. Elsewhere there were reports that Northern Ireland could suspend checking goods entering from Britain if the UK signs up to an unacceptable Brexit deal.

FOREX OPTIONS: Expiries for Jul23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700-10(E1.5bln), $1.1725-35(E1.2bln), $1.1800(E724mln), $1.1865-70(E1.1bln), $1.1925(E731mln)

- USD/JPY: Y110.75($500mln)

- GBP/USD: $1.3775-85(Gbp643mln)

- EUR/GBP: Gbp0.8525(E510mln)

- AUD/USD: $0.7400-20(A$1.1bln)

- USD/CAD: C$1.2470-75($576mln)

ASIA FX: Most Asia EM Currencies Fall As Risk Appetite Wanes

- CNH: Offshore yuan is hovering around neutral levels, the pair briefly touched 6.47 but bounced from the level. The PBOC set USD/CNY reference rate at 6.4650, in line with sell side estimates and essentially flat from the day before.

- SGD: Singapore dollar rose, data earlier showed Singapore final 2Q private residential prices rise 0.8% Q/Q but CPI data later in the session will be more closely watched.

- TWD: Taiwan dollar is stronger, USD/TWD consolidating below the 28.00 handle. There government will downgrade the coronavirus alert level on July 27.

- KRW: Won is stronger but off opening highs as markets consider the government's decision to extend restrictions, coronavirus cases dropped from a record high yesterday but remain elevated.

- MYR: Ringgit is weaker, data showed CPI grew slightly slower than expected at 3.4% against consensus of 3.5%.

- IDR: Rupiah is lower, weighed on by the Bank of Indonesia after it lowered the 2021 growth target yesterday due to impact of the pandemic.

- PHP: Peso declined, weighed on by reports that Manila would be under general community quarantine with stricter curbs from July 23-31.

- THB: Baht fell, data showed the trade surplus widened less than expected as imports shot above expectations.

ASIA RATES: Futures In China Hit Recent Highs, Resuming Uptrend

Futures in China made a fresh contract high after resuming their move higher, while futures in South Korea rose on coronavirus concerns. Participants in India await an INR 260bn bond sale.

- INDIA: Yields lower early trade, reversing some of Thursday's rise. Markets await the results of an INR 260bn bond auction which includes the second tap of the new 10-Year issue. Yields rose yesterday despite a strong showing at the RBI's GSAP operation with cutoff yields lower than expected, which could indicate some set up ahead of today's auction. Elsewhere local currency corporate bonds are on track for their best week in four as the average yield on a three-year corporate issue falls 7bps.

- SOUTH KOREA: Futures higher from the off in South Korea, 10-year contract sharply higher from the open after declining from contract highs at 128.37 earlier this week. 3-Year future weighed down by BoK rate hike expectations sees a more muted move. In the cash space yields are lower in early trade, which a touch of bull steepening evident. as officials declare a two-week extension to the toughest set of lockdown measures currently in place in greater Seoul. There were 1,630 new cases in the past 24 hours, down from a record high of 1,842 yesterday.

- CHINA: The PBOC matched maturities with injections today, repo rates are lower today and moving back into more comfortable ranges while the 7-day repo rate has moved back above the overnight repo rate after briefly inverting earlier this week. Futures are higher today, resuming their recent rally after dropping for the past two sessions. 10-Year future makes a new contract high as stocks drop into negative territory and snap a four-day winning streak. Elsewhere, guidelines published by the central government late yesterday show plans to promote the advanced manufacturing sector and "appropriately increase" local government bond quotas in central provinces.

- INDONESIA: Yields higher in Indonesia, bonds weighed on by the Bank of Indonesia after it lowered the 2021 growth target yesterday due to impact of the pandemic. The Central Bank kept rates on hold by lowered growth forecasts to 3.5% to 4.3% from 4.1% to 5.1% estimated previously. Elsewhere there were reports from the finance ministry that the government could tap offshore bond markets for a dollar sale in Q3 or Q4

EQUITIES: Asia Markets Negative But US Futures On The Rise Again

Markets in the Asia-Pac region struggled to capitalize on gains in US equity markets, with returns mixed as regional coronavirus concerns weigh, Japan observes a national holiday on Friday. This resulted in the closure of Japanese financial markets, the holidays will result in thinner liquidity during Asia-Pac trading. Markets in mainland China were lower, snapping a four-day winning streak while the Hang Seng also saw losses of over 1%. Markets in South Korea, Taiwan and Australia managed to keep their heads above water, barely, while other regional markets also declined though moves were less pronounced. US futures are higher, gearing up for a fourth day of gains after declining sharply at the start of this week. Moves toward record highs for US markets are fueled by earnings season.

GOLD: Still Trading Between The Lines

Spot bullion trades a handful of dollars softer on the day at typing, just shy of $1,805/oz.

- This comes after a couple of brief and shallow forays below Wednesday's low on Thursday. Softer U.S. real yields helped gold firm into the NY close (a well-received round of 10-Year TIPS supply aided that particular dynamic). Still, the July 12 low and key near-term support ($1,791.7/oz) remains unchallenged, leaving the technical overlay unchanged.

OIL: Benchmarks On Track For Weekly Gain

Crude futures are hovering around neutral levels in Asia-Pac trade, holding Thursday's gains. WTI is down $0.26 from settlement levels at $71.64, Brent is down $0.29 at $73.50; both benchmarks are on track to post weekly gains after recovering from an 8-week low. Both WTI and Brent crude futures traded constructively Thursday, adding to the recovery from the week's low and remaining on course for 10% gains. Gains came despite the more mixed performance from equity markets as traders took the view that OPEC+'s recent agreement will likely fail to meet the demand from a tighter market throughout H2 this year, helping boost and steepen the front-end of the futures curve.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.