-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Chinese Equities Bid, USD Offered

- Asia-Pac hours saw a relief rally for Chinese equities, aided by a (modest) net liquidity injection from the PBoC and a CNBC sources piece which suggested that China will continue to allow IPOs in the U.S.

- The USD had already moved lower in the wake of yesterday's FOMC decision, but the rally in Chinese equities allowed this to extend further.

- Advanced Q2 GDP data out of the U.S. headlines the broader docket on Thursday.

BOND SUMMARY: Core FI Off Best Levels As Chinese Equities See A Relief Bid

A bid for Chinese equities amid suggestions that China will not ban domestic companies from listing equities in the U.S. (per CNBC sources) allowed core FI to move away from best levels of the day during Asia-Pac hours, although ranges were contained.

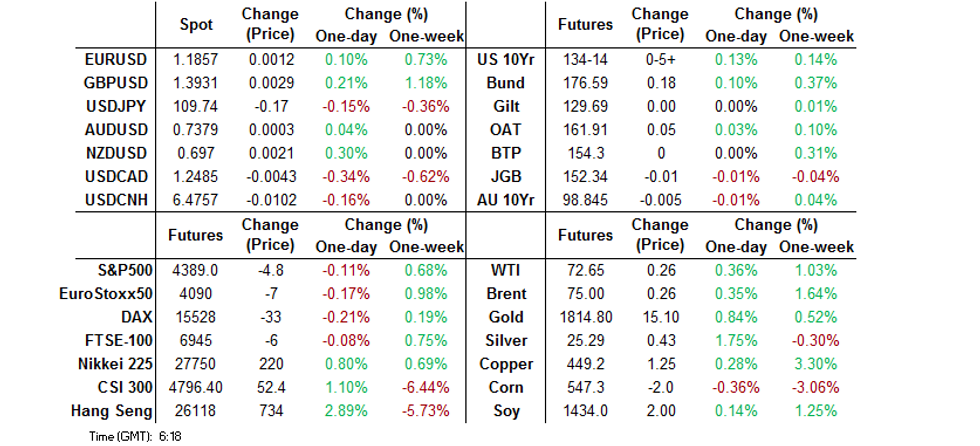

- T-Notes last +0-05+ at 134-14, operating within a 0-03+ range on volume of ~72K. Cash Tsys are little changed to 1.0bp cheaper across the curve, with a very modest bear steepening bias evident after the light bull flattening that was evident during Fed Chair Powell's Wednesday press conference. 8.0K of screen selling of TUU1 provided the highlight on the flow side. The early NY evening saw the Senate advance the bipartisan infrastructure agreement to the debate/amendment stage, with Democratic Senator Sanders noting that he has the 50 votes required to force the measures through.

- JGB futures continued to coil in Tokyo trade, last printing 2 ticks below yesterday's settlement levels. Cash JGBs were little changed to ~1.0bp richer, with some light outperformance for 30s and 40s evident. Much of the local focus continues to fall on the domestic COVID situation (Chiba is set to request the implementation of a state of emergency today). There was little to extract from the latest 2-Year JGB auction, which saw the low price meet broader dealer expectations (as per the BBG dealer poll), with the cover ratio marginally softer than the prev. auction as the tail moved a little wider. Still, there were no problems with digestion of the supply.

- The record daily number of new COVID cases in NSW (239), coupled with tighter mobility restrictions in 8 Sydney virus hotspots provided some incremental support for Aussie bond futures, before the aforementioned downtick from best levels. YM & XM are unchanged at typing. Appetite for a notable push higher seems to be lacking at present, as the market awaits fresh cues.

JAPAN: Japanese Flows Surrounding Foreign Bonds Dominate Weekly Data

The latest round of weekly Japanese international security flow data (covering a 2-week period in the wake of the Japanese holidays that were observed at the back end of last week) was dominated by Japanese flows surrounding foreign bonds.

- The week ending 16 June saw a net Y782.7bn purchase of foreign bonds, bringing an end to 3 straight weeks of net selling by Japanese investors. This was followed up by Y1.087tn worth of net sales of foreign bonds in the week ending July 23, resulting in a net Y304.7bn of sales of foreign bonds on the part of Japanese investors over the 2-week period.

- Net flows under the remaining categories were much more limited in size.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -1087.4 | 782.7 | -1714.1 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 133.5 | -128.9 | -274.7 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -223.2 | 362.3 | 3592.7 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -58.5 | -17.5 | -532.7 |

Source: MNI - Market News/Bloomberg/Japanese Ministry Of Finance

RBNZ: A Look At Market Pricing

Just to zero in on market pricing in the wake of the most recent RBNZ-related interview published by our policy team, which saw former RBNZ Assistant Governor Grant Spencer tell us that "the Bank is likely to begin raising interest rates in August, hike again in November and take its official cash rate to 2.00% or more by the third quarter of next year." The OIS strip is currently pricing a ~60% chance of a 25bp hike at the Bank's August meeting, with a cumulative ~75bp (3x 25bp hikes in total) of tightening come the end of the Bank's July '22 meeting priced. Plenty of sell-side calls look for a more aggressive tightening cycle than the market currently prices (as we have covered in recent weeks).

FOREX: AUD Dented By NSW Covid Situation, China's Reported Nod For U.S. IPOs Triggers Risk-On Flows

AUD went offered as NSW reported 239 new Covid-19 infections, a record daily increase in its caseload, while officials announced tighter mobility restrictions in 8 Sydney virus hotspots. Major AUD crosses ground lower but generally held tight ranges.

- USD/CNH ignored an in-line PBOC fix but then took a hit as CNBC reported that China will continue to allow domestic firms to go public in the U.S. The spot faltered past yesterday's low.

- The aforementioned CNBC report reduced demand for safe haven currencies. The DXY fell to a fresh two-week low, extending its post-FOMC losses, while USD/JPY posted a marginal uptick.

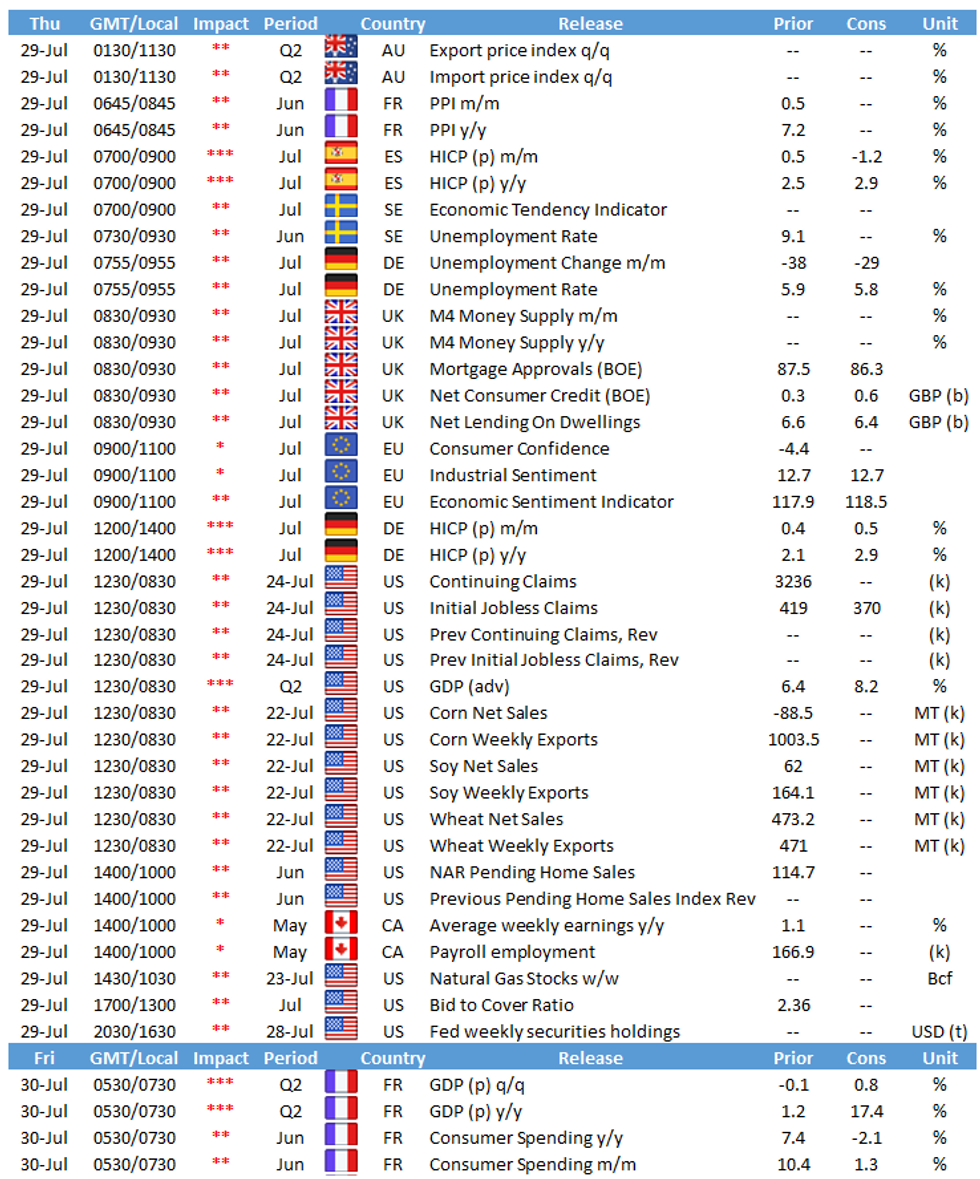

- German unemployment & flash CPI will take focus in European hours, with U.S. docket headlined by advance Q2 GDP & weekly jobless claims.

FOREX OPTIONS: Expiries for Jul29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1795-00(E1.3bln), $1.1850-70(E3.0bln), $1.1895-00(E750mln)

- USD/JPY: Y110.00-10($593mln), Y110.90($705mln)

- GBP/USD: $1.3750-55(Gbp539mln)

- AUD/USD: $0.7385-00(A$835mln), $0.7500(A$556mln)

- USD/CAD: C$1.2315-30($1.0bln), C$1.2445-55($540mln)

- USD/CNY: Cny6.4000($1.2bln), Cny6.4500($500mln), Cny6.4615($1.3bln), Cny6.5000($945mln)

ASIA FX: Broad Gains

Most Asia EM currencies gained as risk sentiment turned more positive and the greenback held its post-FOMC declines.

- CNH: Offshore yuan gained, building on Wednesday's advance. CNH was at first slightly weaker by risk sentiment was spurred by a report that China will continue to allow Chinese companies to IPO in the US.

- SGD: Singapore dollar gained. On the coronavirus front PM Lee said he expects that the heightened alert of coronavirus restrictions should be over before Aug. 21.

- TWD: Taiwan dollar is higher, USD/TWD consolidating below the 28.00 handle. There were reports of USD sales from exporters.

- KRW: Won is stronger, there were 1,674 coronavirus cases reported in the past 24 hours, down from a record high of almost 1,900 yesterday. Sentiment was boosted by robust Samsung earnings.

- MYR: Ringgit gained, the Malaysian FinMin Zarful said the 2021 fiscal deficit may rise between 6.5%-7% of GDP, and will seek parliament approval to lift the debt ceiling. Zarful also said GDP would likely miss earlier estimates.

- IDR: Rupiah bucked the trend and declined. Although Indonesia's daily Covid-19 cases eased further, the death toll continues to climb. The local press flagged concerns surrounding Indonesia's reporting and counting methods, with Jakarta Post noting that "the government [does not include] deaths outside of healthcare facilities in its daily official tally".

- PHP: Peso is higher, the Presidential Palace announced that Metro Manila will remain under General Community Quarantine (second-loosest level) with heightened restrictions in the first two weeks of Aug, despite the increase in new Covid-19 infections.

- THB: Baht strengthened, despite coronavirus woes. Thailand logged its highest daily number of new Covid-19 cases today, adding 17,669 infections. It was also Thailand's deadliest day, with 165 new fatalities. This comes after Wednesday's record-breaking increase in new cases.

ASIA RATES: Rising Tide Lifts All Boats In China

- INDIA: Yields lower in early trade, even amid general risk on sentiment in the region which has boosted oil prices. Bonds are expected to come under pressure as the session goes on. Markets will look out for an announcement from the RBI about bond purchases next week, with hopes that more illiquid issues will be eligible again. Risk on sentiment should also be supported by lower case numbers in India. There were 43,654 cases yesterday, down from a peak of over 400k in May. Health officials said late yesterday India will meet its target of supplying more than half a billion COVID-19 vaccine doses to states by the end of this month

- SOUTH KOREA: Futures lower on Thursday as risk assets rebound in South Korea thanks to a generally more benign risk tone and a dip in coronavirus case numbers. 10-Year futures have been grinding lower throughout the session after finishing at highs yesterday. Short end US-South Korea spreads are slightly wider after the FOMC decision. US-SK 2-Year spread at 113.82bps from lows of 119.625bps hit earlier in July. Following the FOMC decision yesterday Vice Fin Min Lee said that the announcement was expected to have little impact on local markets and added that the government was closely watching the virus trend and its impact on markets as well as other instability factors. Positive risk sentiment has been boosted by earnings including Samsung who reported earnings earlier.

- CHINA: The PBOC injected a net CNY 20bn of liquidity into the financial system today, the first injection since the end of June. Repo rates have fallen as a result, the overnight repo rate at 1.6329% from highs above 2.10% yesterday, the 7-day repo rate down 26bps on the day at 2.2373% but still above the PBOC's rate. The moves comes after a rout of Chinese assets and several other attempts by officials to stem the wave of selling including soothing articles in state media and the CSRC meeting with banks. Risk sentiment has rebounded in China with equity markets seeing gains, a rising tide lifts all boats and Chinese bond futures are also higher.

- INDONESIA: Yields mixed with the curve twist flattening. Although Indonesia's daily Covid-19 cases eased further, the death toll continues to climb. The local press flagged concerns surrounding Indonesia's reporting and counting methods, with Jakarta Post noting that "the government [does not include] deaths outside of healthcare facilities in its daily official tally". Markets still digesting the move by the IMF to downgrade its 2021 growth forecast for Indonesia to +3.9% Y/Y from +4.3% projected in April, as the spread of the Delta variant is expected to weigh on economic recovery.

EQUITIES: Chinese Indices Lead The Way Higher

Risk sentiment rebounded in the Asia-Pac region despite a slight negative lead from the US. Chinese assets found favour again which was key to direction in the region, the PBOC injected liquidity for the first time since June, the CSRC held meeting with banks to assuage fears and there were reports that China will continue to allow Chinese companies to IPO in the US. These factors culminated in gains of around 1.5% for markets in mainland China, though indices are off opening highs. Gains were broad based; markets in Japan are higher by around 0.4%, moves more muted due to elevated coronavirus cases. South Korean bourses saw gains of around 0.4% helped by a robust earnings report from Samsung. US futures are mixed; e-mini Nasdaq leads the way lower with losses of around 0.3% and set to extend losses from yesterday, after market Facebook dropped after warnings of a slowdown in revenue growth. S&P futures are marginally lower while Dow futures are just keeping their head above water.

GOLD: Drawing Support From A Confluence Of Factors

The post-FOMC push lower in U.S. real yields and the DXY, in addition to some respite for Chinese equities and suggestions that China will not ban domestic companies from listing in the U.S. have combined to support bullion over the last 12 hours or so. Spot last deals the best part of $10/oz higher at $1,817/oz. Initial resistance is still some way off, located at the July 15 high/bull trigger ($1,834.1/oz).

OIL: Crude Futures Build On Gains After Supportive Inventory Data

Crude futures are higher in Asia-Pac trade supported by positive risk sentiment in the region with Chinese equity markets rebounding after a recent selloff. WTI & Brent print ~$0.30 above their respective settlement levels as a result.

- Oil benchmarks rose yesterday with WTI and Brent crude both closing in positive territory. Oil received further support from the weekly DoE inventories report, with the headline crude stockpile seeing a draw of 4mln barrels over the week, close to double market expectations.

- From a technical perspective after taking out the July 26 high at $72.43 bulls will target the 76.4% retracement of the Jul 6 - 20 downleg at $73.46. Brent bulls seek a break of the 76.4% retracement of the Jul 6 - 20 downleg at $75.39.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.