-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Evergrande Wants To "Step Out Of The Darkness"

EXECUTIVE SUMMARY

- EVERGRANDE'S HUI SAYS CO. WILL STEP OUT OF DARKNESS (SEC. TIMES)

- EVERGRANDE TUMBLES FURTHER AFTER S&P SAYS DEFAULT IS LIKELY (BBG)

- PELOSI HOPES FOR $3.5TN, BILL BUT THERE MAY BE ADJUSTMENTS (BBG)

- RBNZ'S HAWKESBY QUASHES BETS ON AGGRESSIVE RATE HIKE IN OCTOBER (BBG)

- TRUDEAU WINS HISTORIC THIRD TERM, BUT WITHOUT COVETED MAJORITY (BBG)

Fig. 1: Hang Seng Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: Some supply-chain issues related to the divorce deal between the U.K. and the European Union remain to be seen since Covid-19 hid some of the impacts of Brexit, according to Ireland's prime minister. Those issues "have yet to be fully manifested," Micheal Martin said in an interview with Bloomberg Television. As new problems emerge, he said the U.K. needs to engage with the same approach as the EU to solve the the Northern Ireland protocol part of the deal. The U.K. has "indicated" to Martin that it will do that. (BBG)

ECONOMY: Britain's worst labour market shortages in decades are being driven by employers struggling to recruit low-paid workers, research suggests, while vacancies in other areas are still significantly below pre-pandemic levels. A report by Institute for Fiscal Studies said employment opportunities were still 30% below their usual level for almost three-quarters of the workforce, despite reports focusing on severe shortages of staff in several sectors of the economy such as road haulage, care and warehouse work. It said a surge in job vacancies to record levels in recent months had been driven almost entirely by low-paying work, in which new job openings were about 20% higher than before Covid-19. (Guardian)

ENERGY: The UK government will not bail out failing power and gas companies amid the unprecedented high prices in the country, Business and Energy Secretary of State Kwasi Kwarteng said Sept. 20. Kwarteng said despite several companies going out of business under pressure from soaring gas and power prices, there was no issue of security of supply, and no risk for consumers. (Platts)

ENERGY: Britain's National Grid on Monday said a planned outage of 1000 MW of capacity at IFA interconnector in Sellindge in Kent has been extended until Oct. 23. "The remaining 1000 MW is unavailable until March 27, 2022 and our investigation into the fire at our site in Sellindge is ongoing," the grid said in an update on its website. (RTRS)

EUROPE

ECB: Bank of France Governor Francois Villeroy de Galhau says there is a temporary spike in inflation due to supply difficulties and high oil and raw-material prices. "Today, temporarily -- and I underline the temporarily -- inflation is above" our 2% target, he says in question-and-answer session following a speech at the Institute de France in Paris. "There could be a discussion in the euro area about the exact length of these supply difficulties, and therefore what the exact level of inflation will be to the closest decimal. But, and I want to say this very clearly: there is no doubt that inflation in the euro area will come back below our 2% target between now and 2023. It's even more true for core inflation excluding energy. And based on this, there is no doubt we must keep accommodative monetary policy." (BBG)

NETHERLANDS: A Dutch budget proposal due to be unveiled on Tuesday will show that its economy will emerge from a pandemic-induced contraction, even as the European Union warns the country isn't doing enough to invest in green policies. The Bureau for Economic Policy Analysis will project that the economy will grow by 3.9% this year and 3.5% in 2022, according to a report by Dutch newspaper de Telegraaf. That compares with a 3.8% contraction last year. The Dutch response to the Covid-19 crisis has outpaced many Western neighbors, with nearly 86% of adults having received at least one vaccination. The Netherlands is also expected to spend 40.9 billion euros ($48 billion) on its recovery effort this year. (BBG)

U.S.

CORONAVIRUS: Covid-19 is officially the most deadly outbreak in recent American history, surpassing the estimated U.S. fatalities from the 1918 influenza pandemic, according to data compiled by Johns Hopkins University. Reported U.S. deaths due to Covid crossed 675,000 on Monday, and are rising at an average of more than 1,900 fatalities per day, Johns Hopkins data shows. The nation is currently experiencing yet another wave of new infections, fueled by the fast-spreading delta variant. (CNBC)

FISCAL: House Speaker Nancy Pelosi said that Democrats must be prepared for adjustments to the reconciliation legislation and to an agreed to top-line spending number with the Senate, according to a letter sent to House Democrats. Pelosi said the adjustments may be need to made according to the Byrd rule. House and Senate Budget Committees reviewing the legislation now for possible Byrd violations in order to narrow exposure to such challenges. (BBG)

FISCAL: Democratic congressional leaders on Monday said they will try to pass a bill that both prevents a government shutdown and suspends the U.S. debt limit as they try to dodge two possible crises in one swoop. Congress faces a Sept. 30 deadline to fund the federal government. Separately, Treasury Secretary Janet Yellen has told lawmakers that the U.S. will likely not be able to pay its bills sometime in October if Congress does not suspend or raise the debt ceiling. The House plans to vote this week on legislation that addresses both issues. The bill would fund the government through December and suspend the debt ceiling through the end of 2022, House Speaker Nancy Pelosi, D-Calif., and Senate Majority Leader Chuck Schumer, D-N.Y., said in a joint statement. (CNBC)

FISCAL: Republican leader Mitch McConnell says Senate Democrats will not get Republicans' help with raising the debt limit. (BBG)

CORONAVIRUS: President Joe Biden's chief medical adviser said that a vaccine for children ages 5 to 11 will likely be available before Halloween. "There's a really good chance it will be" available before the Oct. 31 holiday, Anthony Fauci, director of the National Institute of Allergy and Infectious diseases, said during an interview on MSNBC. He also said he would be in favor of schools mandating shots for kids once they are fully approved. Fauci's comments came after Pfizer Inc. and BioNTech SE said their shot safely produced strong antibody responses in younger children. (BBG)

CORONAVIRUS: The U.S. capital will require vaccines for all adults who regularly enter schools and child-care facilities by Nov. 1, according to an update Monday from Washington Mayor Muriel Bowser. There will be no testing opt-out. Student athletes 12 and older will also required to get the shots to participate in school-based sports. (BBG)

OTHER

GLOBAL TRADE: FedEx Corp. plans to raise its delivery rates in 2022 by the most in at least a decade as the courier shoulders rising costs in what it called a "challenging operating environment." The average cost of package delivery will rise 5.9% at both the Express and Ground units beginning on Jan. 3, FedEx said in a statement. Rate increases in the freight business range from 5.9% to 7.9%, depending on the delivery zone, the company said. A fuel surcharge at all three units will kick in on Nov. 1. "These changes reflect incremental costs associated with the challenging operating environment, while enabling FedEx to continue investing in service enhancement, fleet maintenance, technology innovations, and other areas to serve customers more effectively and efficiently," FedEx said. (BBG)

GLOBAL TRADE: Japanese manufacturers seek a bigger presence in advanced materials for chips and electric vehicles, a key export sector caught up in the great-power competition between the U.S. and China. (Nikkei)

GLOBAL TRADE: China appealed a World Trade Organization dispute ruling that rejected the nation's claims against the U.S. relating to safeguard measures that the Trump administration imposed on solar panels imported from Chinese manufacturers. Earlier this month, a WTO panel said China failed to establish that Washington's safeguards against imports of certain crystalline silicon photovoltaic cells are inconsistent with the WTO's rules on the measures. China notified the WTO of its appeal decision on Monday, the Geneva-based body said in an emailed statement. (BBG)

GLOBAL TRADE: U.S. Trade Representative Katherine Tai and her new British counterpart agreed to continue U.S.-UK discussions aimed at addressing the market-distorting practices of China and other non-market economies, Tai's office said on Monday. (RTRS)

GLOBAL TRADE: Irish Prime Minister Micheal Martin says he's supportive of a global tax accord but isn't ready to sign on just yet. Continuity is important and a minimum tax rate of "at least" 15% raises some uncertainty, Martin says in a Bloomberg Television interview. "We've been broadly supportive of the process, but we haven't signed up to the consensus yet because of some aspects of it which we believe don't give the certainty of continuity," Martin says. (BBG)

GLOBAL TRADE: Australia Prime Minister Scott Morrison on Tuesday said any trade talks with the European Union will be worked through in "the weeks and months ahead" as he deals with fallout of the decision to cancel a $40 billion submarine deal with France. (RTRS)

GEOPOLITICS: President Joe Biden and French President Emmanuel Macron will speak by phone soon, White House Press Secretary Jen Psaki said, following French outrage after the U.S. cut a submarine deal with Australia. Biden plans to "reaffirm our commitment to working with one of our oldest and closest partners on a range of challenges that the global community is facing," Psaki told reporters on Monday. French government spokesman Gabriel Attal said on BFM TV over the weekend that Biden had requested the call. (BBG)

JAPAN: Japan will decide on Sept. 28 whether to lift a state of emergency, broadcaster FNN reported, citing government officials. Prime Minister Yoshihide Suga will make the final decision, according to the report. The country's fourth state of emergency was extended through September following a delta- variant-fueled surge in Covid-19 cases and is in effect in 19 of the country's prefectures. Meanwhile, Finance Minister Taro Aso said Japan will need more time to reach its balanced-budget goal because of Covid-19. (BBG)

JAPAN: Sankei/FNN released a joint opinion poll conducted on September 18/19, asking bout the preferred candidate for the next LDP leader from the four candidates who have thrown their hats in the ring. Taro Kono ranked first with 55.8%, maintaining his considerable lead over his competitors. Fumio Kishida was second with 17.9%, Sanae Takaichi came third with 16.4%, with Seiko Noda bringing up the rear with 2.9%. (MNI)

RBA: MNI BRIEF: RBA Considered Keeping AUD5bn Weekly Bond Purchases

- The Reserve Bank of Australia considered maintaining its bond purchases at AUD5 billion a week and then review the program in November, but instead decided to extend the program at AUD4 billion a week until February to give greater clarity to the market into 2022 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: Melbourne's construction industry is shutting down for at least two weeks amid concerns that extremist groups who have infiltrated the union movement are behind violent anti- vaccination protests in Australia's second-largest city. "We have seen appalling behavior on site and on our streets, and now we're acting decisively and without hesitation," Victoria state Industrial Relations Minister Tim Pallas said in an emailed statement, announcing the closure from Tuesday. Concerns had been raised about the sector's compliance with public health measures and directions. (BBG)

RBNZ: New Zealand's central bank has damped speculation it could start its tightening cycle with a 50 basis-point interest-rate hike next month, signaling it's more likely to take a cautious approach, economists said. In a speech published by the Reserve Bank on Tuesday, Assistant Governor Christian Hawkesby said that amid uncertainty, and when risks are evenly balanced, "central banks globally tend to follow a smoothed path and keep their policy rate unchanged or move in 25 basis-point increments." The comment prompted investors to scale back bets on a 50-point rate increase at the RBNZ's next policy meeting on Oct. 6, while economists saw it as vindication of forecasts for a 25-point move. While the central bank has given clear signals it wants to lift rates amid strong inflation pressures, largest city Auckland is still in lockdown to contain a coronavirus outbreak and considerable uncertainty remains. (BBG)

CANADA: Prime Minister Justin Trudeau is poised to win a third term in a snap election but fall short of regaining the parliamentary majority he was seeking. CTV News and the Canadian Broadcasting Corp. projected his governing Liberal Party will win a plurality of seats and form a minority government. (BBG)

IRAN: Ministers from Britain, China, France, Germany and Russia will not meet with Iran at the United Nations this week to discuss a return to nuclear deal talks, European Union foreign policy chief Josep Borrell told reporters on Monday. Diplomats were tentatively planning for a ministerial meeting of the parties to the 2015 nuclear deal on Wednesday on the sidelines of the annual U.N. gathering of world leaders. (RTRS)

OIL: About 18% of the U.S. Gulf's oil and 27% of its natural gas production remained offline on Monday, more than three weeks after Hurricane Ida, regulator Bureau of Safety and Environmental Enforcement (BSEE) said. (RTRS)

OIL: Royal Dutch Shell, the largest U.S. Gulf of Mexico oil producer, said damage to offshore transfer facilities from Hurricane Ida will cut production into early next year, slashing deliveries of a type of crude oil prized by refiners. (RTRS)

CHINA

CREDIT: China Evergrande Group Chairman Hui Ka Yan tells staff that he firmly believes the company will step out of the darkest moment soon, Securities Times reports, citing a company letter. Evergrande spokesperson confirmed authenticity of letter. Co. will accelerate full-on resumption of construction to ensure handing over of buildings. Co. will show responsibility to home buyers, investors, partners and financial institutions. (BBG)

CREDIT: China Evergrande Group is unlikely to receive direct government support and is on the brink of defaulting on upcoming debt payments, S&P Global Ratings said. The distressed developer's troubles could further hit investor confidence in China's property sector and junk-rated credit markets more broadly, according to an S&P report dated Sept. 20. (BBG)

PROPERTY: Stewart Leung Chi-kin, executive committee chairman of the Real Estate Developers Association of Hong Kong, said he was unaware of individual meetings between China's central authorities and developers, broadcaster TVB News reported Monday evening. Leung made the comments in response to a Sept. 17 Reuters report. He has asked major developers and said they have been in constant communications with the Hong Kong government. Both the developers and the government have their own reasons for not being able to provide more land supply, Leung said. (BBG)

PROPERTY: Sun Hung Kai Properties said the company had never heard of the information suggested in reports about Chinese government pressuring Hong Kong developers, according to a statement to media Monday night. Sun Hung Kai hasn't heard of such information and it never agrees with monopolistic behaviors, the developer said. The developer actively cooperates with the Hong Kong government by participating in land sharing programs and building transitional housing, it said. Sun Hung Kai is positive on the long-term development potentials in Hong Kong and mainland China and will continue investing. (BBG)

PROPERTY: Guangzhou R&F Properties Co. shares logged their highest intraday jump in a week early on Tuesday after it secured an 8.00 billion Hong Kong dollar (US$1.03 billion) financial commitment from key shareholders. The stock climbed as much as 13% in the morning to HK$4.84 before giving up some of the gains amid broad-based weak sentiment in the Chinese property sector. Guangzhou R&F Properties had said late Monday that it expects to receive HK$2.40 billion of the funding, which is being provided by two of its executive directors, on Tuesday. The rest of the money will be provided within the next two months. The financial support will assuage any liquidity fears around Guangzhou R&F and help the company address its short-term debt obligations. (Dow Jones)

CORONAVIRUS: China reported 42 local coronavirus cases for Monday, all of which were found in the southeastern province of Fujian, according to a statement from the National Health Commission. The nation's current delta outbreak, which began earlier in the month, has so far been contained to Fujian. (BBG)

OVERNIGHT DATA

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 103.3; PREV. 103.1

Consumer confidence barely moved last week, rising just 0.2%. Last week's labour market data revealed some softness in the economy with employment falling by 146k in August due to the prolonged lockdowns. This might have dampened sentiment, which fell 4.9% in NSW and 1.1% in Victoria. But confidence rose 7.3% in Queensland and 6.7% in South Australia, making up for the fall. Falling COVID case numbers in NSW plus Victoria's plan for opening may boost confidence over the coming week. A notable development was the jump in inflation expectations to 4.7% for a second time this month. This could be due to the increase in retail petrol prices in the past two weeks. (ANZ)

NEW ZEALAND Q3 WESTPAC CONSUMER CONFIDENCE 102.7; Q2 107.1

Since our last survey in June, economic confidence among New Zealand households has taken a knock. That's not a surprise given the dialling up of the Alert Level in recent weeks. However, what was surprising was the extent of the drop in confidence that we've seen. In September our Westpac McDermott Miller Consumer Confidence Index fell 4.4 points, taking it to a level of 102.7. That was a much more modest fall than we saw in June last year after Covid first arrived on our shores and when confidence dropped to an 11-year low of 97.2. Digging under the surface, there is growing nervousness about the outlook for the economy over the coming years. But despite concerns about the broader economic landscape, most households are still feeling relatively upbeat about their own financial situation. In fact, an increasing number of households have told us that their financial position has improved over the past year. And most of those we spoke to expect that their finances will continue to strengthen over the year ahead. (Westpac)

NEW ZEALAND AUG CREDIT CARD SPENDING -6.3% Y/Y; JUL +6.9%

NEW ZEALAND AUG CREDIT CARD SPENDING -14.3% M/M; JUL +0.2%

MARKETS

SNAPSHOT: China Evergrande Wants To "Step Out Of The Darkness"

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 549.3 points at 29950.89

- ASX 200 up 17.029 points at 7265.2

- Shanghai Comp. is closed

- JGB 10-Yr future up 11 ticks at 151.82, yield down 1.3bp at 0.041%

- Aussie 10-Yr future up 3.0 ticks at 98.700, yield down 2.8bp at 1.275%

- U.S. 10-Yr future -0-04+ at 133-04, yield up 1.36bp at 1.324%

- WTI crude up $0.69 at $70.98, Gold down $3.25 at $1760.92

- USD/JPY up 13 pips at Y109.57

- EVERGRANDE'S HUI SAYS CO. WILL STEP OUT OF DARKNESS (SEC. TIMES)

- EVERGRANDE TUMBLES FURTHER AFTER S&P SAYS DEFAULT IS LIKELY (BBG)

- PELOSI HOPES FOR $3.5TN, BILL BUT THERE MAY BE ADJUSTMENTS (BBG)

- RBNZ'S HAWKESBY QUASHES BETS ON AGGRESSIVE RATE HIKE IN OCTOBER (BBG)

- TRUDEAU WINS HISTORIC THIRD TERM, BUT WITHOUT COVETED MAJORITY (BBG)

BOND SUMMARY: Tsys Cheapen, ACGBs Off Highs, JGBs Bid After Long Weekend

A greater sense of stability, which saw the Hang Seng briefly pare all of its early losses at one point, applied some light pressure to the U.S. Tsy space during overnight trade. That left T-Notes -0-04+ at 133-04 ahead of London dealing, while cash Tsys run little changed to 1.5bp cheaper across the curve, with 10s leading the way lower. There wasn't much in the way of notable market flow observed. 20-Year Tsy supply provides the focal point during Tuesday's NY session. Housing starts and building permits data will also cross in NY hours.

- JGBs opened firmer after the long weekend, before ticking away from best levels. The space then saw a fresh, albeit modest bid, aided by domestic equities ticking back towards their intraday lows. Futures last +12, while the belly of the cash JGB curve sits ~1.0bp richer vs. Friday's closing levels. The cover ratio eased at the latest liquidity enhancement auction for off-the-run 1- to 5-Year JGBs, although the metric remained above the 4.00x marker. Elsewhere, the pricing of the spreads moved deeper into negative territory this time out, which is a positive in terms of demand. All in all, the auction was digested smoothly enough.

- Aussie bonds drifted away from best levels after showing higher at the re-open, taking a broader sense of direction from the U.S. Tsy space, although the moves in ACGBs were a little more extreme as participants reacted to the moves witnessed after yesterday's Sydney close and subsequent bounce from lows S&P 500 e-minis. The minutes from the RBA's most recent monetary policy meeting didn't provide much in the way in the way of fresh, material information. YM +1.5 & XM +3.0.

JGBS AUCTION: Japanese MOF sells Y398.8bn of 1-5 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y398.8bn of 1-5 Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.007% (prev. -0.005%)

- High Spread: -0.005% (prev. -0.002%)

- % Allotted At High Spread: 3.7158% (prev. 26.2886%)

- Bid/Cover: 4.064x (prev. 4.831x)

JGBS AUCTION: Japanese MOF sells Y2.7636tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.7636tn 6-Month Bills:

- Average Yield -0.1141% (prev. -0.1189%)

- Average Price 100.056 (prev. 100.059)

- High Yield: -0.1100% (prev. -0.1168%)

- Low Price 100.054 (prev. 100.058)

- % Allotted At High Yield: 73.8648% (prev. 78.3200%)

- Bid/Cover: 4.955x (prev. 3.620x)

EQUITIES: A Little More Stable, E-Mini Bounce Extends

It was a bit of a topsy turvy Asia-Pac session for equities, with markets running in both directions, although the low base that Monday provided re: a relative comparison in stability allowed the market to feel a little more at ease, with e-minis moving further away from Monday's lows after Wall St. trade saw U.S. equities record their worst day in months.

- The Hang Seng fully reversed its early losses at one point, before drifting lower as we moved towards the lunch bell. It would seem that the feeling that the Evergrande situation may prove to be contained as opposed to China's Lehman-like event became a little more widespread during Tuesday's Asia-Pac trade, although we shall see how Chinese onshore markets react when they return from the elongated weekend on Wednesday. Note that S&P pointed towards a likely default on the part of Evergrande, which most now expect.

- The Nikkei 225 shed ~1.5% after the long weekend in Tokyo, playing catch up to the broader risk environment witnessed on Monday.

- A reminder that Monday saw one of J.P.Morgan's noted strategists write that "the market sell-off that escalated overnight we believe is primarily driven by technical selling flows (CTAs and option hedgers) in an environment of poor liquidity, and overreaction of discretionary traders to perceived risks. However, our fundamental thesis remains unchanged, and we see the sell-off as an opportunity to buy the dip." This may have been a supportive factor when it came to Monday's late bounce from lows (as the comments got a wider airing in the financial press).

OIL: Unwinding Some Of Monday's Losses

Crude has advanced since Monday's settlement, with WTI & Brent futures sitting ~$0.70 above their respective settlement levels, as e-minis move away from their Monday lows.

- Crude supply-demand dynamics continue to underpin in the background, with Shell the latest to flag damages to its facilities in the wake of Hurricane Ida, which will hamper production into '22.

- Broader risk-off flows and an early uptick in the USD (which was subsequently unwound) pressured crude on Monday, with the 2 major benchmarks finishing more than $1.00 lower on the day.

- The weekly API inventory estimates headline on Tuesday ahead of Wednesday's weekly DoE inventory report.

GOLD: Some Stabilisation After A Breach Of Initial Support

Gold has hugged a tight range during Tuesday's Asia-Pac session, with spot last dealing little changed, just shy of $1,765/oz. This comes after the defensive tone, coupled with some stabilisation in U.S. real yields and the broader USD's pullback from best levels of the day, allowed bullion to regain some poise on Monday. Note that this came after a brief and limited foray bellow the recent lows during a holiday-thinned Asia-Pac session on Monday. Yesterday's low ($1,742.5/oz) now provides initial technical support ahead of the 76.4% retracement of the Aug 9-Sep 3 rally ($1,724.5/oz). Meanwhile, firm resistance remains located at the Sep 14 high ($1,808.7/oz). Participants await Wednesday's FOMC decision, with a particular focus on the central bank's language surrounding tapering matters.

FOREX: RBNZ Speak Pulls Rug From Beneath NZD Despite Firmer Risk Sentiment

The kiwi went offered amid dovish RBNZ repricing inspired by a speech from Asst Gov Hawkesby, who signalled the Reserve Bank's cautious approach to raising the OCR, noting that "when there is a typical amount of uncertainty, and the risks are evenly balanced, then central banks globally tend to follow a smoothed path and keep their policy rate unchanged or move in 25 basis point increments." Market pricing no longer suggests that participants are sitting on the fence re: October monetary policy meeting. The OIS strip now prices exactly 25bp worth of tightening at the upcoming MPC gathering, which is tantamount to one standard sized OCR hike.

- AUD/NZD rose to its best levels in a week as AU/NZ 2-year swap spread moved away from multi-year lows. The Antipodean cross had been weighed on by growing central bank outlook divergence over the recent months.

- NZD was the odd one out among commodity-tied G10 FX amid an uptick in broader risk appetite. Most high-betas (AUD, CAD, NOK) edged higher as sentiment finally got some reprieve after the recent turmoil surrounding China's Evergrande.

- Selling pressure hit the yen amid reduced demand for safe haven currencies. Although equity benchmarks in Japan ground lower, U.S. e-mini futures managed to register gains.

- Regional liquidity and headline flow were limited by market closures in China, Taiwan and South Korea. China and Taiwan will reopen tomorrow.

- U.S. housing starts & current account balance, Riksbank MonPol decision and comments from ECB Vice Pres de Guindos take focus from here.

FOREX OPTIONS: Expiries for Sep21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1685-00(E843mln), $1.1800(E655mln), $1.1900-20(E1.6bln)

- USD/JPY: Y108.55-65($651mln), Y109.00($1.3bln), Y109.50($679mln), Y109.65-70($807mln)

- EUR/JPY: Y127.00(E630mln)

- AUD/USD: $0.7315-20(A$585mln)

- USD/CAD: C$1.2675($550mln), C$1.2800($1.5bln)

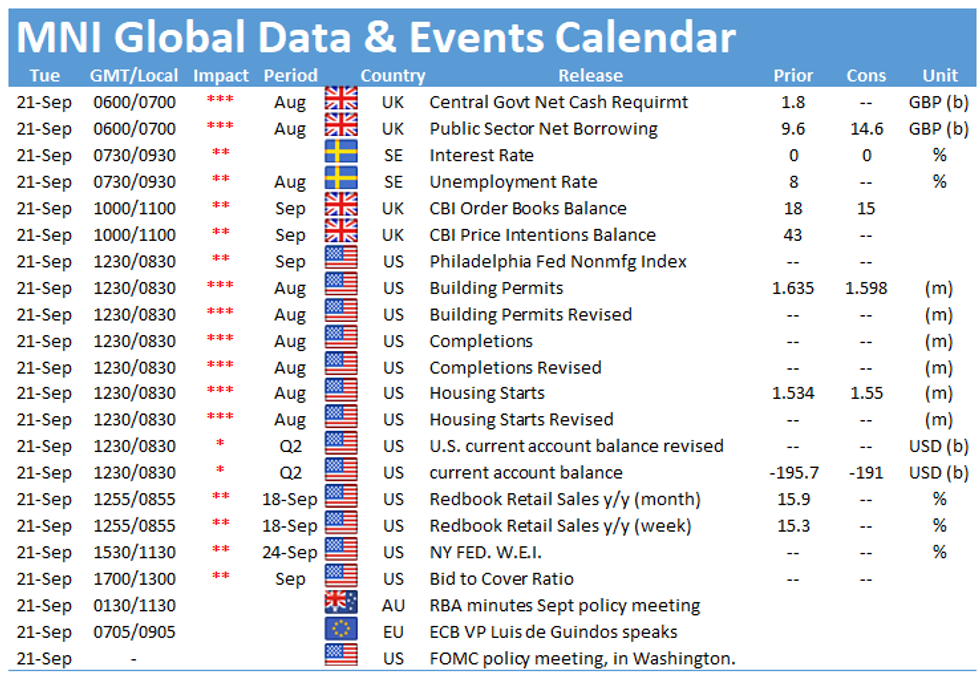

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.