-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: DXY Edges Away From Post-FOMC Highs, Evergrande Matters Still Eyed

- Evergrande matters continued to headline, with less worry re: contagion evident (eventhough there has been no news of the coupon payment on a US$ bond issued by the company, which is due today), while the company's Chairman pointed a top priority to help retail investors redeem their investment products.

- The DXY pulled backed from its post-FOMC high after a hawkish dot plot supported the greenback in the wake of the decision.

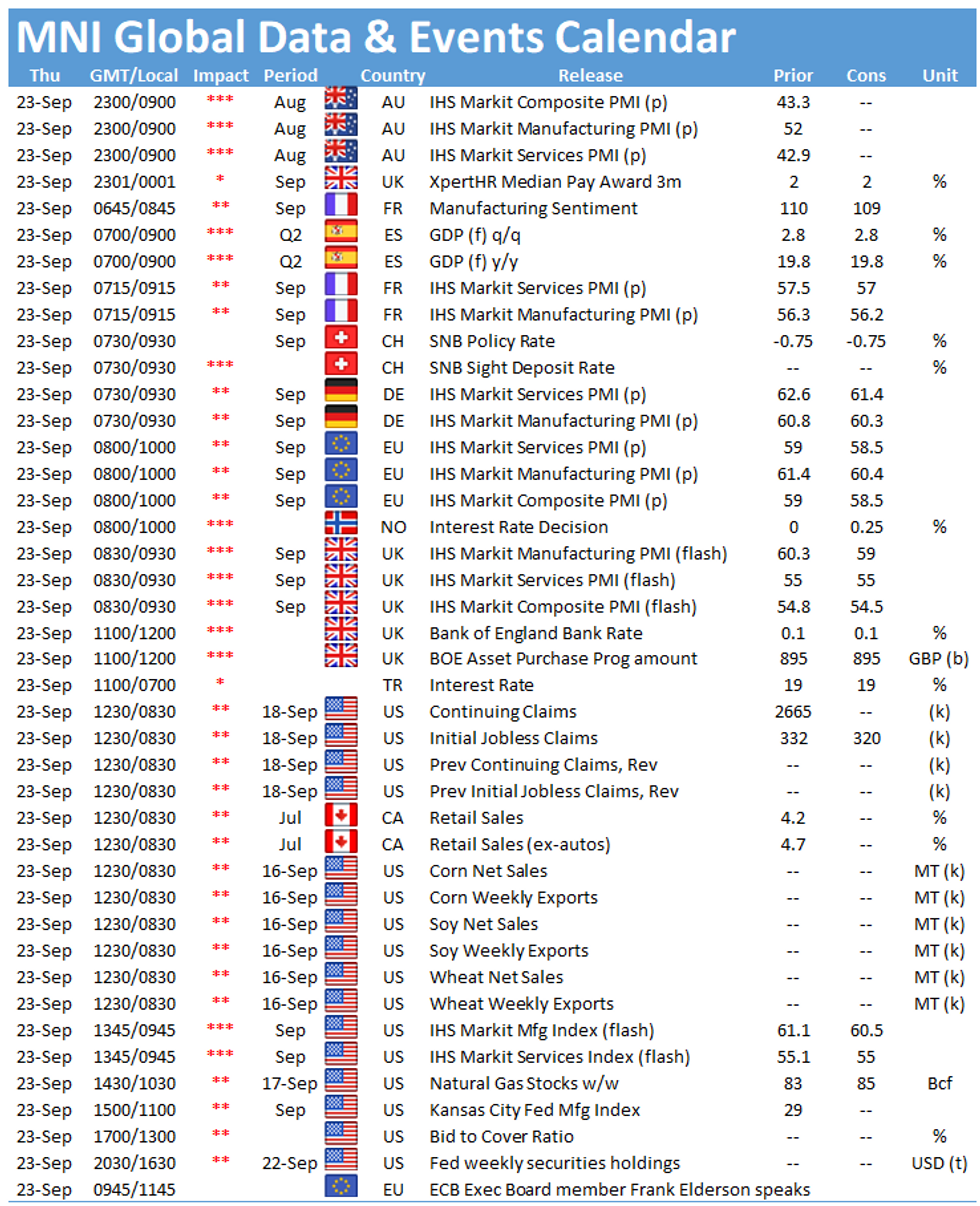

- Central bank decisions from the BoE, Norges Bank & SNB will cross on Thursday, with preliminary PMI data from across the globe also due.

BOND SUMMARY: U.S. Tsy Futures Nudge Lower Overnight, Aussie Bonds Flatten

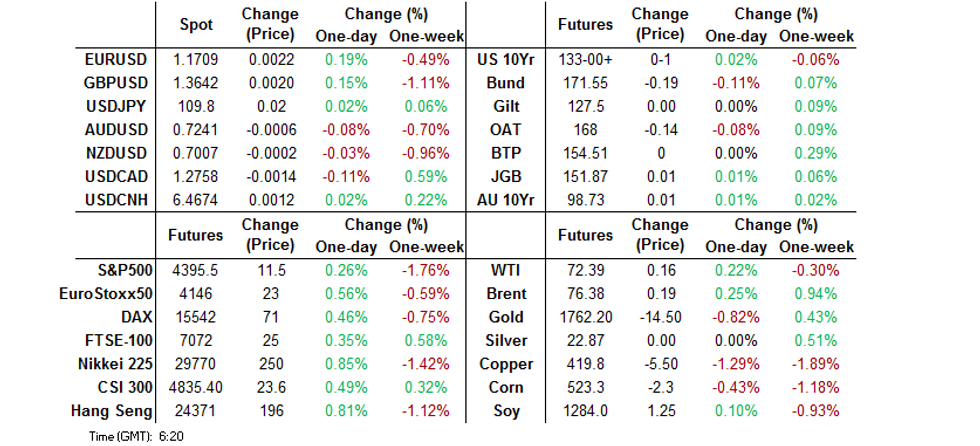

Tsy futures traded lower in Asia-Pac hours as the region reacted to a more hawkish than expected FOMC dot plot, while the market seems less worried re: Evergrande contagion. T-Notes last +0-01 at 133-00+, after a round of screen selling helped the contract lower overnight. Cash Tsys are closed until London hours owing to a Japanese holiday. Short end flow was headline by a 5.0K screen seller of EDZ2.

- Early Sydney trade saw Aussie Bond market participants react to the post-FOMC flattening impetus provided by U.S. Tsys, supporting XM. Local news flow saw the state of Victoria record a fresh high in terms of new daily COVID cases detected in the state of Victoria (766), although those headlines hit after the bid, and COVID case counts haven't impacted the space for some time given policymakers' focus on the vaccination drive and living with COVID. The space then moved away from best levels of the day alongside U.S. Tsys, leaving YM -2.0 and XM +1.0 at typing, while the longer end of the cash ACGB curve has richened by ~2bp.

FOREX: Post-FOMC Impetus Dominates In Holiday-Thinned Trade

Post-FOMC reverberations influenced G10 price action as regional participants reacted to the latest showing from Fed policymakers, who signalled that tapering asset purchases could start as soon as in November and be completed in mid-2022. This initial impetus moderated as the Asia-Pac session progressed, with the DXY pulling back from a fresh one-month peak.

- The Antipodeans sold off in early trade and remained on the back foot. NZD/USD pierced the $0.6994/93 area, which limited losses over the last two days, printing its worst levels in almost a month.

- Japanese markets were closed as the country observed a public holiday, which limited activity in the Asia-Pac timezone.

- Central bank action picks up today, with the BoE, SNB and Norges Bank due to deliver monetary policy decisions. PMI data from across the globe, Canadian retail sales and U.S. jobless claims take focus on the data front.

FOREX OPTIONS: Expiries for Sep23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700(E3.5bln), $1.1745-50(E2.3bln), $1.1790-00(E1.6bln), $1.1815-25(E850mln)

- USD/JPY: Y108.25-35($699mln), Y108.95-00($700mln), Y109.50-70($1.3bln), Y109.85-00($967mln)

- GBP/USD: $1.3600(Gbp576mln), $1.3700(Gbp533mln), $1.3800(Gbp718mln)

- AUD/USD: $0.7240-50(A$1.2bln)

- USD/CAD: C$1.2600($1.7bln), C$1.2620($920mln), C$1.2650($503mln), C$1.2705-25($840mln)

- USD/CNY: Cny6.4790-00($985mln), Cny6.50($762mln)

ASIA FX: Early Post-FOMC Impetus Subsides, Idiosyncratic Catalysts Eyed

Most currencies from Asia EM basket faced some initial pressure on the back of post-FOMC impetus, which gradually wore off. Regional participants assessed the Evergrande situation.

- CNH: Offshore yuan sold off in early trade but managed to regain poise thereafter. The Evergrande story continued to draw attention as coupon payment deadline for the real estate giant's 2022 dollar note loomed large.

- KRW: Spot USD/KRW reopened sharply higher, as onshore South Korean markets reopened after the Chuseok holiday, printing its best levels in a year. The rate eased off as the won recovered, with local economic officials pledging to monitor risks to financial market stability.

- IDR: The rupiah traded on a softer footing. FinMin Indrawati outlined a narrower forecast range for Q3 GDP growth (+4.0-5.0% Y/Y vs. +4.0%-5.7% Y/Y projected before).

- MYR: The ringgit managed to swing into a gain after Malaysian government pledged to reopen interstate travel and swathes of the tourism industry after inoculating 90% of the adult population.

- THB: The baht struggled to recoup its initial losses as concerns over Thailand's decision to raise the official debt ceiling continued to linger. Spot USD/THB showed at its highest point in more than four years.

- PHP: The peso was among the worst performers in the region and spot USD/PHP hit its best levels in a month ahead of the announcement of monetary policy decision from the Philippine central bank.

- TWD: TWD treaded water, with the local central bank also due to deliver their monetary policy decision today.

- SGD: USD/SGD sold off ahead of the release of Singapore's CPI data later today.

EQUITIES: Edging Higher

Less worry surrounding spill overs re: China Evergrande seemed to support the broader risk tone in early Asia-Pac dealing, with participants welcoming restructuring/nationalisation speculation surrounding the name, although a lack of clarity surrounding a US$ coupon payment on one of the company's offshore bonds (due today) saw the name, and various regional property metrics, move back from early peaks.

- The major regional equity indices have all nudged higher during Asia-Pac hours, aided by the positive lead from Wall St., with a bid in IT & energy names allowing the ASX 200 to outperform.

- E-minis haven't been derailed by a hawkish FOMC dot plot (released Wednesday), nudging higher overnight.

- Japanese markets were closed on Thursday, sapping some liquidity out of the region.

GOLD: FOMC Dot Plot Weighs

Spot gold has shed $5/oz during Asia-Pac trade, to last deal just above $1,760/oz. This comes after contained 2-way volatility in the wake of Wednesday's FOMC decision, with the event ultimately resulting in an uptick in U.S. real yields and the broader USD as the FOMC's latest dot plot was more hawkish than exp., which weighed on gold. The technical parameters have not changed Monday's low ($1,742.5/oz) provides initial technical support ahead of the 76.4% retracement of the Aug 9-Sep 3 rally ($1,724.5/oz). Meanwhile, firm resistance remains located at the Sep 14 high ($1,808.7/oz).

OIL: Ticking Higher In Asia

WTI & Brent sit just above their respective settlement levels, aided by the aforementioned uptick in regional equity indices during Asia-Pac trade. Less worry surrounding spill over from China Evergrande has supported the broader risk complex over the last 24 hours or so.

- Wednesday saw Iraq became the latest OPEC member to tip its hat to spare capacity that it currently has when it comes to crude production.

- Wednesday's official DoE inventory release wasn't as bullish as the API estimates that came on Tuesday, although worry surrounding the potential for deeper U.S. sanctions on Iran quickly reinstated the bid on Wednesday.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.