-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN OPEN: Powell Up

EXECUTIVE SUMMARY

- ECB’S SCHNABEL SAYS RATE HIKE TO TAME INFLATION MAY COME IN JULY (BBG)

- RUSSIA SEEKS TO ANNEX OCCUPIED TERRITORY (BBG)

- BLINKEN TO OUTLINE CHINA POLICY ON THURSDAY

- DIDI FACES SEC PROBE INTO TURBULENT $4.4 BILLION NEW YORK DEBUT (BBG)

- HAWKISH RBA REPRICING CONTINUES

- CHINA’S INDEPENDENT REFINERS START BUYING RUSSIAN OIL AT STEEP DISCOUNTS (FT)

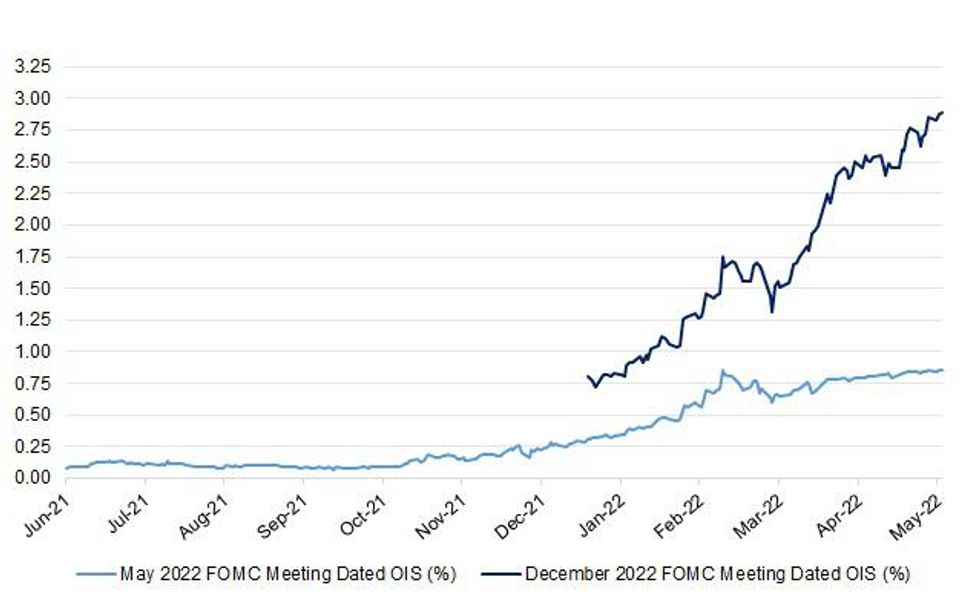

Fig. 1: May & December 2022 FOMC Meeting Dated OIS (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: The Bank of England should double the pace of its interest rate rises to 0.5 percentage points this week to maintain credibility in the face of surging inflation, according to a majority of members on The Times’s shadow monetary policy committee. Six of the nine shadow MPC members, who include economists and former Bank rate-setters, backed a break with tradition to aggressively lift interest from the current 0.75 per cent to 1.25 per cent this week — the highest since the financial crisis. Rate-setters face inflation running at almost four times the central bank’s target rate of 2 per cent in the coming months and a cost-of-living crisis that is due to slow economic growth. Consumer price inflation stands at 7 per cent and is due to rise further this year. (The Times)

ECONOMY: U.K. credit card borrowing is set to jump almost 8% to a five-year high in 2022, adding to evidence that a surge in the cost of living is straining household finances. Demand for consumer credit may climb a further 5.5% in 2023 on top of this year’s expected 7.9% rise, according to the consultancy EY. The increase would mark a reversal of the trend during the pandemic when many people stayed at home and didn’t spend money, leading to a 12% drop in consumer credit in the past two years, EY said. (BBG)

ENERGY: The U.K. says some energy suppliers are overcharging customers, effectively borrowing from households at a time when living costs are surging. Those suppliers have been increasing monthly direct debits “beyond what is required,” business secretary Kwasi Kwarteng said on Twitter. Regulator Ofgem has been reviewing the behavior of companies, and suppliers have three weeks to respond. The regulator has the power to issue fines if it finds evidence of wrongdoing. (BBG)

EUROPE

ECB: The European Central Bank may need to raise interest rates as soon as July to stop "extremely high" inflation from getting entrenched, ECB board member Isabel Schnabel told German newspaper Handelsblatt on Tuesday. "Talking is no longer enough, we need to act," Handelsblatt quoted Schnabel as saying. "From today's perspective, a rate increase in July is possible in my view." A precursor to any rate hike must be the end of bond purchases, and this could come at the end of June, said Schnabel, the ECB's head of market operations. (BBG)

ECB: ECB President Lagarde tweeted the following on Tuesday: “Today’s virtual #Eurogroup was dedicated to the banking union.The @ecb fully supports @Paschald's efforts to push for a detailed workplan. A complete banking union is key to fostering growth and stability, and to strengthening Europe’s financial integration.” (MNI)

ECONOMY: Europe’s jobs market has stalled since Russia invaded Ukraine, a survey showed, adding to evidence that the war is weighing on the region’s economic recovery. There were fewer help-wanted advertisements on jobs-search website Indeed in the week to April 22 than there would have been had the pre-war growth trend continued. Countries that rely most on Russia for imports and in energy-intensive sectors such as manufacturing and transportation were hardest hit. The research, carried out with Central Bank of Ireland economist Raemonn Lydon and shared exclusively with Bloomberg, underscores the fine line that the European Central Bank and Bank of England are treading as they weigh how fast to tighten monetary policy. While war-fueled inflation is damaging spending power and the recovery, raising interest rates too aggressively could exacerbate that effect. (BBG)

SWITZERLAND: The proportion of Swiss people who are prepared to support participation in an expanded European Union border agency, or Frontex, is growing, according to a poll for national broadcaster SRG. Around 69% of respondents would be willing to increase Frontex financing, up from 63% in a similar poll in March. Meanwhile, the proportion against it decreased from 29% in March to 25% in April. 6% are still undecided. The referendum will be held on May 15. The poll also notes skepticism has decreased among people that say they don’t trust the government. About 60% of these individuals are now in favor of the expansion of Frontex, which significantly reinforces the existing majority.

U.S.

FED: Quarles, who left the Fed in December after his term as vice chair had expired, also suggested that the central bank would have acted earlier to try to rein in inflation but for uncertainty over President Joe Biden’s decisions on its leadership. “Had clarity been provided, I think the Fed would have acted earlier,” Quarles said. But Biden “didn’t do that for a number of months,” he said. (BBG)

ECONOMY: President Biden to deliver 2pm ET speech on economic growth, jobs, deficit reduction, according to White House daily guidance. (BBG)

ECONOMY: The U.S. economy will probably fall into a recession as the Federal Reserve combats multidecade-high inflation, Randal Quarles, the Fed’s former vice chair for supervision, said. “Given the intensity of inflation, the degree to which unemployment has been driven down -- to bring that back into an equilibrium, it’s unlikely the Fed is going to be able to manage that to a soft landing,” he said on the IntraFi Network’s Banking with Interest podcast. “The effect is likely to be a recession.” (BBG)

OTHER

GLOBAL TRADE: BMW Group and Audi have suspended shipments of cars by rail from Germany to China, the biggest market for both carmakers, due to the Ukraine war. Most of the 846,237 vehicles BMW delivered to Chinese customers last year were produced at its joint venture factory in Shenyang, but between 150,000 and 200,000 were imported from Europe. Beginning in September, BMW began dispatching cars bound for western provinces by train, at a pace then set to reach 16,000 a year. “Due to the current geopolitical situation, our train transport on the Silk Road and Trans-Siberian railway have temporarily been switched to alternative routes or transportation modes to ensure planning and supply security,” said BMW. “Vehicles for China and Mongolia are now transported by ship from Bremerhaven.” (FT)

GLOBAL TRADE: Major Taiwanese Apple Inc supplier Foxconn said on Wednesday that it is continuing production in China's Zhengzhou, which announced on Tuesday it would impose new COVID-19-related movement curbs for May 4-10. "Our park has maintained production unchanged," it said in a statement, referring to the industrial area where its facilities are located in the central Chinese city. (RTRS)

GLOBAL TRADE: Brazilian exports to the 22 countries in the League of Arab Nations rose in the first quarter amid a spike in agricultural commodities prices and a drive to stock up on food, according to a statement sent to Reuters on Tuesday. Brazil’s total exports to the group reached $3.86 billion in the period, an almost 34% increase from the same time a year ago, the statement from the Arab-Brazil Chamber of Commerce said. A boost in sales to the Arabs nations also reflects Russia’s and Ukraine’s reduced participation in the global grains and fertilizer trade, the statement noted, referring to two major suppliers of products like wheat and sunflower oil. (RTRS)

U.S./CHINA: U.S. Secretary of State Antony Blinken will deliver a speech on Thursday outlining U.S. policy towards China, the State Department said. Blinken will give the speech at 11 a.m. Eastern Time (1500 GMT) at Washington's George Washington University, at an event hosted by the Asia Society think tank, the State Department said in a statement. A source familiar with plans for the China strategy told Reuters last week that the contents covered publicly by Blinken were not expected to be very detailed and would largely be a compilation of statements the administration has already made about China. (BBG)

U.S./CHINA: The U.S. Securities and Exchange Commission is looking into Didi Global Inc.’s initial public offering in the U.S., according to the company. The Chinese ride-hailing giant said in a filing posted May 2 that it’s cooperating with the probe. The firm, which debuted on the New York Stock Exchange last year, said it couldn’t “predict the timing, outcome or consequences of such an investigation.” Amid the scrutiny, Didi has said it plans to leave the U.S. market for Hong Kong. However, the firm has said it won’t move forward until its NYSE delisting is complete. The company’s shareholders will vote on the matter at a special meeting on May 23. (BBG)

U.S./CHINA: President Joe Biden on Tuesday accused the Chinese government of trying to interfere in negotiations over a broad China competition bill that would bolster domestic semiconductor manufacturing. “Fundamentally, this is a national security issue. This is one of the reasons why the Chinese Communist Party is lobbying folks to oppose this bill,” Biden said Tuesday in Troy, Alabama. “And it’s an issue that unites Democrats and Republicans. So, let’s get it done.” The Chinese Embassy in Washington has been seeking meetings with administration officials, congressional offices, think tanks and companies to gather information about the status of the bill and what provisions are likely to make it to the president’s desk, people familiar with the meeting requests said. Administration officials have all declined the requests, as have many of the congressional offices, according to the people. (BBG)

AUSTRALIA: The Commonwealth Bank, ANZ, NAB and Westpac will pass on the full value of the Reserve Bank’s increase in interest rates to mortgage customers as the era of ultra-cheap home loans comes to an end. CBA on Tuesday night was the first bank to respond to the RBA’s historic lift in the cash rate from 0.1 per cent to 0.35 per cent, while ANZ and Westpac followed soon after. NAB announced its rise on Wednesday morning. (WA Today)

RBNZ: New Zealand’s central bank said a “sharp” decline in house prices is possible as it raises borrowing costs aggressively to tackle inflation. “While a gradual decline in house prices to more sustainable levels is desirable from a financial stability perspective, a sharp correction remains a plausible outcome that would have broad economic implications,” the Reserve Bank said in its semi-annual Financial Stability Report Wednesday in Wellington. “A large fall in house prices would significantly reduce housing wealth and could lead to a contraction in consumer spending, especially when combined with borrowers cutting back discretionary spending due to rising interest rates and higher living costs.” (BBG)

NORTH KOREA: The United States would like the U.N. Security Council to vote during May to further sanction North Korea over its renewed ballistic missile launches, the U.S. Ambassador to the United Nations, Linda Thomas-Greenfield, said on Tuesday. The United States circulated an initial draft resolution to the 15-member council last month that proposed banning tobacco and halving oil exports to North Korea and blacklisting the Lazarus hacking group. The United States is president of the Security Council for May. (RTRS)

NORTH KOREA: North Korea launched at least one apparent ballistic missile on Wednesday, Japan’s Defense Ministry said, as the nuclear-armed country continues its ramped-up pace of weapons testing. The South Korean military also confirmed the launch of what it said was an unidentified projectile into the Sea of Japan. The North has conducted a string of launches at a record-setting pace this year, with some observers fearing leader Kim Jong Un could also soon oversee an underground nuclear test for the first time since 2017, when it tested what it said was a thermonuclear weapon. (Japan Times)

BOC: Home price growth in Canada is "unsustainably strong" and higher interest rates are needed to moderate demand, a senior Bank of Canada official said on Tuesday, while also noting the inflationary risks of the country's overheating economy. Senior Deputy Governor Carolyn Rogers, answering audience questions following her first speech since joining the governing council, said the central bank does expect home price growth to moderate "a bit" as interest rates go up. (RTRS)

MEXICO: Mexico Foreign Minister Marcelo Ebrard comments at press conference in Washington where he has met with Secretary of State Antony Blinken and Secretary of Homeland Security Alejandro Mayorkas. Mexico, U.S. agree on the need for a regional solution regarding migration. U.S. is “concerned” about the potential jump in migrants at its border with Mexico when Title 42 ends. Mexico is applying migration laws out of national interest, Ebrard says. (BBG)

MEXICO: U.S. officials agreed to a proposal from Mexico's government to launch a job creation program in Central America aimed at fostering growth in the region, Mexican Foreign Minister Marcelo Ebrard said on Tuesday. (RTRS)

MEXICO: Mexico’s government should be very careful if using price controls, which usually can’t curb inflation for long periods of time, according to deputy central bank governor Jonathan Heath. “My personal opinion is that price controls only work in the short term, which means a lot of care has to be taken in their instrumentation,” Heath wrote. “However I don’t mind ‘out-of-the-box’ thinking in the search for policies that could help us counteract inflation.” (BBG)

BRAZIL: Investigators from Brazil's electoral courts have given the Economy Ministry 10 days to explain a huge tax cut on industrial goods such as televisions and refrigerators over concerns about its legality and impact on the October election. In a letter dated April 28 to Economy Minister Paulo Guedes and seen by Reuters, Deputy Electoral Attorney General Paulo Gustavo Branco gave the ministry the deadline to respond to concerns raised by federal lawmaker Marcelo Ramos. (RTRS)

RUSSIA: Nearly 10 weeks into the war and with its troops making only marginal gains in Ukraine’s east, Russia is focused on consolidating military and political control over the territory it has taken so far. The Kremlin is installing occupation governments, ordering locals to use rubles for transactions and, according to three people involved in the efforts, planning hastily organized referendums in some areas to open the way for full annexation. The people spoke on condition of anonymity given the risk of retribution discussing sensitive information. The Kremlin did not respond immediately to a request for comment. (BBG)

RUSSIA: Ukraine isn’t retreating and is even gaining some ground in its fight against the Russian invasion, Zelenskiy told the Wall Street Journal in a video interview from Kyiv. But he added his country could use “a breather” through a cease-fire, which he said would be possible only if Putin agreed to a personal meeting with him. Zelenskiy reiterated Ukraine’s desire to get Crimea back from Russia even as he acknowledged that it’s not possible to get “everything immediately.” (BBG)

RUSSIA: The U.S. and its allies are providing additional intelligence -- as well as artillery, tanks and drones – to Ukrainian troops as Russia continues its military operations in the eastern and southern parts of the country, Defense Secretary Lloyd Austin said. If Putin issues a formal declaration of war, Austin told a Senate panel, he “will be able to mobilize more people,” but the conscripts will be poorly trained and plagued by difficulties with logistics and leadership. Austin also predicted a strong international reaction if Putin uses cyber or chemical weapons. (BBG)

RUSSIA: The U.S. took the rotating one-month presidency of the United Nations Security Council vowing to use its leadership to keep international attention focused on Russia’s war in Ukraine, including the conflict’s impact on food security around the world. Secretary of State Antony Blinken will lead a Security Council meeting on food security on May 19, Ambassador Linda Thomas-Greenfield told reporters. This week, Secretary-General Antonio Guterres will open a council meeting on the situation in Ukraine, the U.S. envoy said. (BBG)

RUSSIA: French President Emmanuel Macron told Russian President Vladimir Putin in a phone call on Tuesday that he is willing to work with international organisations to help lift the Russian embargo on Ukrainian food exports via the Black Sea, Macron's office said. The Elysee office also said Macron had reiterated that a ceasefire was needed in Ukraine and that he had told Putin that he was deeply concerned about the situation in Donbas and Mariupol. "I have called on Russia to live up to its international responsibility as a UN Security Council member by putting an end to this devastating attack," a statement quoted Macron as saying. (RTRS)

RUSSIA: German Chancellor Olaf Scholz is considering sending seven rapid-fire artillery systems to Ukraine in another step to shore up the country’s efforts to fend off Russian forces. Defense Minister Christine Lambrecht has recommended delivery of the PzH 2000 -- a self-propelled, armored howitzer -- according to officials familiar with the matter. Scholz is weighing the request, but there are also several other proposals on the table and he hasn’t granted final approval yet, said the people, who asked not to be identified because the discussions are confidential. (BBG)

CHILE: Chile’s Constitutional Convention approved Tuesday a proposal declaring the country’s central bank an autonomous body of technical nature. The plenary rejected and sent back to committee for further review articles including: One that demanded that it consider employment, climate change, and the government’s economic policy when deciding its monetary policy. Another that enshrined its current role of ensuring currency stability to keep inflation under control. Another that blocked the bank from purchasing financial instruments issued by the government. One that cuts duration of governor’s period to three years from five. One that would allow Supreme Court to dismiss board members, after a request from the majority of congress or the bank’s board. (BBG)

METALS: Mexico is working with governments of Argentina, Bolivia and Chile to create a lithium association so the countries can share their expertise to exploit the battery mineral, Mexican President Andres Manuel Lopez Obrador said on Tuesday. "We're going to work. We're already doing so together on development, on exploration, processing, new technologies," Lopez Obrador told a regular news conference. Bolivia, Chile and Argentina sit atop the so-called "lithium triangle," a region containing nearly 56% of the world's resources of the metal, according to the most recent figures from the United States Geological Survey (USGS). (BBG)

ENERGY: Russia cut natural gas production 0.4% to 261.4 billion cubic meters in the first four months of the year, down from the same period last year, Interfax reports, citing Energy Ministry CDU-TEK data. Gas pumping fell 5.2% to 61.2bcm in April from year ago. (BBG)

OIL: The OPEC cartel -- which has struggled for many months to revive oil supplies halted during the pandemic -- effectively failed to increase output at all last month, as members remained plagued by capacity constraints. While Iraq made a substantial boost, countries such as Libya and Nigeria saw their production fall amid operational disruptions and diminished investment, according to a Bloomberg survey. Even group leader Saudi Arabia didn’t hike by as much as permitted by their agreed quota. (BBG)

OIL: While Asia is still snapping up cheap Russian oil from ports that normally deliver to Europe, customers appear to be backing away from cargoes on Russian-owned vessels. That’s undermined flows from Pacific Ocean terminals, cutting nationwide shipments. Seaborne exports of the nation’s crude fell back in the seven days to April 29 compared with the previous week, even as the volume shipped to Asia from ports on the Black Sea, Baltic and Arctic coasts soared. A total of 34 tankers loaded about 24.8 million barrels from Russian export terminals, according to vessel-tracking data and port agent reports collated by Bloomberg. That put average seaborne crude flows at 3.55 million barrels a day, down by 14% against the week ended April 22. (BBG)

OIL: China’s independent refiners have been discreetly buying Russian oil at steep discounts as western countries suspend their own purchases and explore potential embargoes because of the war in Ukraine. An official at a Shandong-based independent refinery said it had not publicly reported deals with Russian oil suppliers since the Ukraine war started in order to avoid attracting scrutiny and being hit by US sanctions. The official added that the refinery had taken over some of the purchase quota for Russian crude from state-owned commodity trading firms, which are seen to represent Beijing and have mostly declined to sign new supply contracts. (FT)

CHINA

CORONAVIRUS: Beijing shuts down over 40 metro stations from Wednesday across seven lines, Beijing Subway announces in a WeChat post on Wednesday. All entrances and exits in those stations have been closed, but passengers can still change to another line in the closed stations. It is to be decided when the stations will be reopened. (BBG)

PROPERTY: An average 57% slump in April-contracted sales for Chinese developers tracked by Bloomberg Intelligence suggests Covid-19 outbreaks and weaker economic outlook threaten to deepen the housing market slowdown and delay recovery for the sector’s liquidity, according to analyst Kristy Hung. Policy stimulus may do little to turn around near-term sales, with Agile Group Holdings Ltd., Shimao Group Holdings Ltd. and Sunac China Holdings Ltd. leading the plunge in April. (BBG)

OVERNIGHT DATA

AUSTRALIA APR, F S&P GLOBAL SERVICES PMI 56.1; FLASH 56.6

AUSTRALIA APR, F S&P GLOBAL COMPOSITE PMI 55.9; FLASH 56.2

Australia’s service sector continued to grow strongly in April, according to the S&P Global Australia Services PMI, following the easing of COVID-19 disruptions at the start of the second quarter. The pace of growth accelerated while easing of border restrictions also enabled a surge in foreign demand. “Price pressures meanwhile continued to pass through from goods to services, leading to record input price inflation and a strong rise in output prices in the Australian service sector. This continued to impact business sentiment and will be watched for the potential to hamper growth past the unleashing of pent-up demand. (S&P Global)

AUSTRALIA MAR RETAIL SALES +1.6% M/M; MEDIAN +0.5%; FEB +1.8%

AUSTRALIA MAR HOME LOANS VALUE +1.6% M/M; MEDIAN -1.9%; FEB -3.5%

AUSTRALIA MAR INVESTOR LOAN VALU +2.9% M/M; MEDIAN -2.5%; FEB -1.1%

AUSTRALIA MAR OWNER-OCCUPIER LOAN VALUE +0.9% M/M; MEDIAN -2.5%; FEB -4.7%

NEW ZEALAND Q1 UNEMPLOYMENT RATE 3.2%; MEDIAN 3.2%; Q4 3.2%

NEW ZEALAND Q1 EMPLOYMENT CHANGE +2.9% Y/Y; MEDIAN +3.1%; Q4 +3.5%

NEW ZEALAND Q1 EMPLOYMENT CHANGE +0.1% Q/Q; MEDIAN +0.1%; Q4 +0.0%

NEW ZEALAND Q1 PARTICIPATION RATE 70.9%; MEDIAN 71.0%; Q4 71.1%

NEW ZEALAND Q1 AVERAGE HOURLY EARNINGS +1.9% Q/Q; MEDIAN +0.7%; Q4 +1.4%

NEW ZEALAND Q1 PVT WAGES INC OVERTIME +0.7%; MEDIAN +0.7%; Q4 +0.7%

NEW ZEALAND Q1 PVT WAGES EX OVERTIME +0.7%; MEDIAN +0.7%; Q4 +0.7%

NEW ZEALAND APR ANZ COMMODITY PRICE -1.9% M/M; MAR +3.9%

SOUTH KOREA APR FOREIGN RESERVES $449.30BN; MAR $457.81

UK APR BRC SHOP PRICE INDEX +2.7% Y/Y; MAR +2.1%

MARKETS

SNAPSHOT: Powell Up

Below gives key levels of markets in the second half of the Asia-Pac session:

- Japanese markets are closed.

- ASX 200 down 2.885 points at 7313.3

- Chinese markets are closed.

- JGB 10-Yr future up 5 ticks at 149.42, cash JGBs are closed.

- Aussie 10-Yr future down 10 ticks at 96.46, yield up 9.8bp at 3.494%

- US 10-Yr future down 17.1875 ticks at 118.34375, cash Tsys are closed.

- WTI crude up $1.08 at $103.49, Gold down $2.54 at $1865.58

- USD/JPY down 0 pips at Y130.14

- ECB’S SCHNABEL SAYS RATE HIKE TO TAME INFLATION MAY COME IN JULY (BBG)

- RUSSIA SEEKS TO ANNEX OCCUPIED TERRITORY (BBG)

- BLINKEN TO OUTLINE CHINA POLICY ON THURSDAY

- DIDI FACES SEC PROBE INTO TURBULENT $4.4 BILLION NEW YORK DEBUT (BBG)

- HAWKISH RBA REPRICING CONTINUES

- CHINA’S INDEPENDENT REFINERS START BUYING RUSSIAN OIL AT STEEP DISCOUNTS (FT)

US TSYS: Limited Pre-FOMC Futures Trade In Asia

The combination of diminished Asian liquidity (including a cash Tsy market closure on the back of a holiday in Japan), proximity to the impending FOMC decision and a lack of meaningful macro news flow means that futures have meandered in narrow ranges during Asia-Pac dealing.

- TYM2 is last -0-05+ at 118-11, sticking to the 0-05+ range that was established early in the session, operating on a limited ~49K lots. Weakness in Aussie bonds provided some very modest pressure, while the latest bout of Hang Seng Tech Index weakness, linked to an SEC probe into Didi Global’s NY IPO, and another missile launch from North Korea provided some counter.

- Eurodollar futures sit 1.0 to 4.0 ticks below settlement levels through the reds.

- Looking ahead, the aforementioned FOMC decision headlines on Wednesday (see our full preview of that event here), with the latest quarterly Tsy refunding announcement, ADP employment data and ISM services survey also due.

AUSSIE BONDS: Perfect Storm Results In More Cheapening

A perfect storm weighed on the ACGB space during Wednesday’s Sydney session, with momentum, continued hawkish re-pricing of the wider market’s RBA expectations, a swift post-RBA move higher in BBSW fixings and trans-Tasman impetus from the firmer than expected wage data in the latest NZ labour market report all applying pressure at different points in the day.

- Some focus was given to newswire headlines re-running sell-side RBA rate calls that were published yesterday, with Westpac’s Bill Evans now looking for a 40bp hike in June, while Goldman Sachs look for back-to-back 50bp rate hikes over the next two meetings and a cash rate of 2.60% by year-end.

- BBG’s WIRP function points to the IB strip pricing in a cumulative ~265bp of tightening across the 7 scheduled meetings in the remainder of the calendar year, which would take the cash rate to 3.00%.

- This dynamic allowed YM & XM to tag fresh cycle lows, although the early bear flattening impulse on the YM/XM curve has receded, with YM -9.0 & XM -10.0. The very front end of the cash ACGB curve provided the weakest point, further out, super longs have cheapened more than the bely.

- Local data was firmer than expected, with retail sales moving to a record outright level and housing finance data providing comfortable beats vs. wider expectations (moving higher across all 3 major metrics vs. expectations for a dip across the 3).

- The IR strip runs 8-19 ticks softer through the reds, with IRU2 providing the weakest point, aided by the aforementioned BBSW fixing dynamics.

EQUITIES: Mostly Lower Ahead Of FOMC; Chinese Tech Hit By SEC Probe Of Didi

Asia-Pac equity indices trade mostly lower at typing, bucking a positive lead from Wall St. as Chinese and Japanese markets remain shuttered for national holidays.

- The Hang Seng sits 1.3% softer at typing after opening in the red, with a fresh round of weakness in China-based tech spurred by Chinese ride-hailing giant Didi Global (ADR -7.0% after hours) revealing that the U.S. SEC was investigating its 2021 IPO. Large-caps such as Alibaba Group and Tencent Holdings fell by >3% each come the Asian session, spurring a 3.1% decline in the Hang Seng Tech Index. Meituan (-5.9%) led losses amidst China-based tech names, contributing to the gloom in the sector following news of a non-executive director selling a large part of his stake in the company at a discount to its current price.

- The ASX200 fares a little better than most equity index peers, sitting a little below neutral levels at typing. The Australian equity benchmark has reversed earlier gains on broad weakness in tech stocks, with the S&P/ASX All Technology Index dealing 1.0% softer at typing, with heavyweights Block Inc and REA Group underperforming. Materials stocks broadly struggled with losses observed in the major miners (BHP, Mineral Resources, Rio Tinto), while financials outperformed, led by gains in the “big four” banks.

- U.S. e-mini equity index futures are back from session highs, dealing flat to 0.1% higher at typing.

OIL: Supply Worry Creeps In As Chinese COVID Cases Fall, EU Sanctions Eyed

WTI and Brent are ~$1.00 firmer apiece, operating a little above Tuesday’s worst levels at typing. Both benchmarks have caught a minor bid as worry re: tight global supply remains evident, with prior concern re: demand destruction in China continuing to ease from extremes seen earlier in April.

- To elaborate on the latter, fresh COVID case counts in China have continued to decline, although lockdowns in parts of Shanghai look set to continue as community transmission persists (authorities are looking at zero community transmission before lifting lockdowns). Elsewhere, authorities in Beijing escalated pandemic control measures slightly on Wednesday, shutting 40 subway stations (~10% of the city’s network) concentrated around the Chaoyang district (previously flagged epicentre of Beijing’s outbreak so far).

- A BBG survey has pointed to OPEC increasing output by ~10K bpd in April amidst supply woes in Libya and Nigeria, compounding well-documented sentiment re: the group’s inability to meet monthly target production increases (noting that a similar survey for Mar pointed to a 90K bpd increase for that month).

- The latest round of U.S. API inventory estimates crossed late on Tuesday, with source reports pointing to a larger-than-expected drawdown in crude inventories and a decline in gasoline and distillate stockpiles, while a build in Cushing hub stocks was observed. Up next, U.S. EIA inventory data crosses at 1430 GMT, with WSJ estimates calling for declines in crude, gasoline, and distillate inventories.

- Looking ahead, the European Commission is expected to propose a sixth round of sanctions on Russia later on Wednesday, with potential details on embargoes of Russian crude imports.

GOLD: Southbound Ahead Of FOMC

Gold sits ~$6/oz worse off at typing to print ~$1,862/oz, operating around session lows and extending a pullback from Tuesday’s best levels.

- To recap Tuesday’s price action, the precious metal’s rebound from 11-week lows ($1,850.5/oz) was blunted as initial tailwinds from a retreat in U.S. real yields and the USD (DXY) unwound later in the NY session, ultimately seeing gold top out at $1,878.1/oz before paring gains.

- Looking ahead, Apr ADP Employment Change (BBG median +385K, +431K Mar), crosses at 1215 GMT, ahead of Fed Chair Powell’s May FOMC presser at 1830 GMT. While the Fed is widely expected to announce QT and a 50bp hike for May, some focus will likely be on potential shifts in language surrounding the possibility of larger rate hikes further into ‘22.

- May FOMC dated OIS currently point to back-to-back 50bp rate hikes for the May and June meetings, with a ~40% chance of a 75bp move for June now priced in.

- From a technical perspective, gold has broken support at $1,854.7/oz (May 2 low), exposing further support at $1,848.8 (76.4% retracement of Jan28-Mar8 rally) and $1,821.1/oz (Feb 11 low). Resistance is seen some distance away at $1,900/oz (May 2 high).

FOREX: Light Risk-On Flows Emerge Ahead Of FOMC Rate Decision, Offshore Yuan Whip-Saws

Light risk-on flows emerged in G10 FX space with Fed rate decision looming large, as U.S. e-mini futures lodged some gains. Activity remained limited by public holidays in several financial centres across Asia, including mainland China and Japan. When this is being typed, high-beta currencies sit atop the G10 pile, while the Swiss franc lags behind.

- New Zealand's labour market report failed to make an impression as its main parameters were narrowly mixed. The unemployment rate held steady, while participation shrank a tad and previous employment growth readings were revised lower, yet wage data remained firm. Our analysis showed that annual employment growth ended a run of upside surprises seen in the previous quarters.

- Offshore yuan's price action was fairly choppy amid holiday-thinned liquidity. Spot USD/CNH knee-jerked higher as Beijing shut over 40 metro stations. Those gains proved short-lived and the rate sank into negative territory, before gradually trimming losses.

- All eyes are on the FOMC who will conclude their monetary policy meeting today and are widely expected to tighten policy. Consensus looks for a 50bp rate hike as pressure is mounting on the Fed to contain elevated inflation.

- Today's data highlights include U.S. ADP employment change, trade balance & ISM Services Index as well as a slew of Services PMIs from across the globe.

FOREX OPTIONS: Expiries for May04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0550-70(E820mln), $1.0600(E1.9bln), $1.0700(E1.1bln)

- USD/JPY: Y130.30-50($656mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/05/2022 | 0600/0800 | ** |  | DE | Trade Balance |

| 04/05/2022 | 0715/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 04/05/2022 | 0745/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 04/05/2022 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 04/05/2022 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 04/05/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 04/05/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 04/05/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 04/05/2022 | 0900/1100 | ** |  | EU | Retail Sales |

| 04/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 04/05/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 04/05/2022 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 04/05/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 04/05/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (Final) |

| 04/05/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 04/05/2022 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 04/05/2022 | 1800/1400 | *** |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.