-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Risk-Positive End To The Asian Week

- The late relief rally in U.S. equities and downtick in U.S. Tsys extended in a headline-light Asia session. Tech stocks led the bid during Asia hours.

- The above dynamic meant that JPY found itself at the bottom of the G10 FX table.

- The flash reading of U.S. Uni. of Mich. Sentiment, Norwegian GDP, Eurozone industrial output & final French CPI take focus on the data front today. Elsewhere, comments are due from Fed's Mester & Kashkari as well as ECB's de Guindos, Centeno, Nagel & Schnabel.

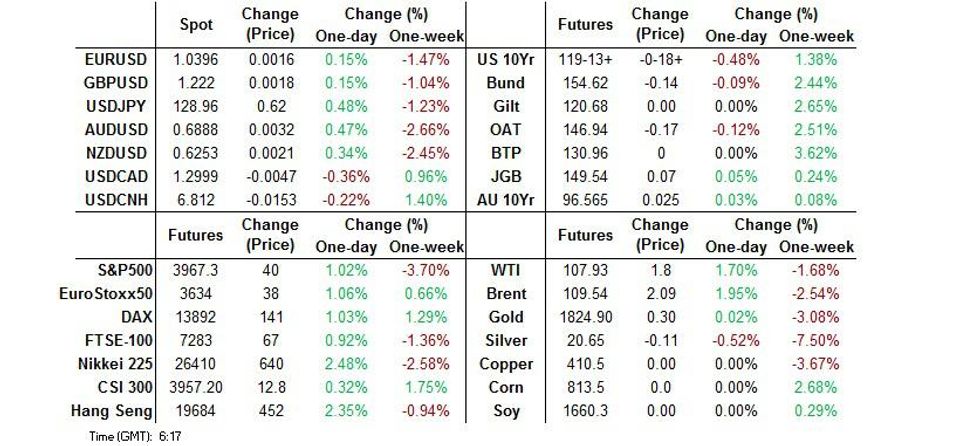

US TSYS: Bear Steepening In Asia

Tsy trade lacked an overt catalyst during Asia hours, with the late NY bounce in equities extending, allowing Tsys to move further away from Thursday’s best levels, with bear steepening in play. This comes after Thursday’s bull steepening was driven by general recession fears and worry re: COVID in China.

- The S&P 500 e-mini is +1.0%, aided by a tech-led rally in both Hong Kong & the U.S.

- That leaves the major cash Tsy benchmarks 2.5-5.0bp cheaper on the day, with TYM2 last printing -0-16+ at 119-15+, 0-05+ off the base of the contract’s 0-13+ session range, on volume of ~105K.

- A lack of meaningful headline flow meant sporadic bursts of activity were in the driving seat during Asia-Pac hours.

- Late NY rhetoric from Fed Chair Powell had nothing in the way of meaningful impact on the space, as he reiterated his preference for 50bp hikes at the next couple of meetings, while indicating two-way risks around wider tightening i.e. an ability to do more or less dependent on the evolution of economic matters, as he stressed that inflation is “way too high.” Powell also noted that the Fed’s ability to engineer a soft landing may be based on factors that are outside of its control. Earlier Thursday saw U.S. Tsy Sec Yellen reiterated her hope that the Fed will be able to fight off inflation without causing a recession.

- U.S. hours will bring terms of trade data, in addition to the latest UoM sentiment reading and Fedspeak from Mester (’22 voter) & Kashkari (’23 voter).

JGBS: Flatter Finish To The Week, Potentially Aided By Lifers

JGB futures traded either side of late overnight levels during early Tokyo dealing, with wider swings in risk appetite at the fore and a lack of notable market moving headline flow evident. A 2.5% rally in the Nikkei 225 likely capped the early bid in JGBs, with futures back below late overnight levels as a result, last +7.

- The wider JGB curve bull flattened, with the major benchmarks running little changed to 2bp richer. This was a product of Thursday’s firming across wider core FI markets, which has perhaps facilitated some lifer-based demand in the longer end of the curve.

- Rhetoric from BoJ Governor Kuroda reaffirmed the need for monetary easing, even as he noted that market functioning may be impaired by the BoJ’s actions. He also noted that it is inappropriate to link an exit from the Bank’s ultra-loose policy settings with his term as Governor.

- Elsewhere, comments from Japanese FinMin Suzuki reaffirmed well-known views re: wider currency market dynamics.

- BoJ RInban operations covering 1- to 10-Year JGBs saw a modest uptick in offer/cover ratios, but this had little impact on the space.

AUSSIE BONDS: Back From Best Levels On Bid In Equities

An uptick in e-minis & Hong Kong tech stocks pressured Aussie bond futures away from their overnight peaks ahead of the weekend, with YM +9.0 & XM +2.5 at typing. The longer end of the cash ACGB is curve now running little changed to marginally cheaper on the day.

- Note that there hasn’t been much in the way of obvious short cover in YM to trigger the move away from cycle cheaps during recent sessions, with open interest little changed vs. levels observed at the time where the contract printed its current cycle low. There has been a modest down tick in XM open interest (2%) in recent days, although this isn’t particularly large in the grander scheme of things.

- The 3-/10-Year EFP box has twist flattened.

- The latest round of ACGB May-32 supply saw firm enough pricing, with the weighted average yield printing 0.65bp through prevailing mids, although the cover ratio wasn’t particularly firm, printing at 2.32x. Note that the auction was still comfortably covered, albeit with cover shy of that which was witnessed during RBA QE times.

- Next week will bring wage price data (our policy team’s latest insight piece flagged their understanding that the Reserve Bank of Australia is comfortable with wages growth exceeding the rate of inflation and sees this as a return to normal conditions and unlikely to drive higher prices and create more pressure for interest rate hikes) and the Bank’s May meeting minutes. Market pricing re: RBA tightening is back from recent extremes, but still aggressive, with a year-end cash rate of ~2.70% priced in the IB strip, per BBG WIRP. Elsewhere, there will be focus on the run in to the Federal Election (21 May), with the opposition Labor Party leading the opinion polls, and the latest monthly labour market report.

FOREX: Yen Turns Tail As Risk Regains Poise

Risk sentiment found poise towards the end of the week in Asia as U.S. e-mini futures crept higher. Headline flow offered little to add to the familiar narrative, leaving participants to reflect on familiar dynamics. Some positivity may have been linked to reassuring comments from Shanghai authorities on the local COVID-19 outbreak, as they expected to achieve zero community transmission in mid-May.

- The yen went offered amid reduced appetite for safe haven assets. Japan's economic officials reiterated their usual comments. FinMin Suzuki pointed to two-way impact of a weaker yen and noted that the government is watching the FX market closely, while BoJ Gov Kuroda stressed the importance of FX stability but also backed continued powerful monetary easing.

- Firmer crude oil prices lent support to commodity-tied currencies. The Aussie dollar paced gains in the space, despite the absence of notable domestic catalysts.

- The PBOC extended a streak of firmer than expected yuan fixings to nine days, while the deviation from the expected level widened to 69 pips. Offshore yuan showed little in the way of immediate reaction to the fixing and rose to a fresh cycle high of CNH6.8380, before reversing gains later in the session.

- The HKMA stepped up HKD purchases in defence of its currency peg, bringing their total value to HKD6.947bn.

- The flash reading of U.S. Uni. of Mich. Sentiment, Norwegian GDP, EZ industrial output & final French CPI take focus on the data front today. Comments are due from Fed's Mester & Kashkari as well as ECB's Guindos, Centeno, Nagel & Schnabel.

FOREX OPTIONS: Expiries for May13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0835-50(E865mln)

- GBP/USD: $1.2100(Gbp647mln), $1.2200(Gbp674mln)

- USD/JPY: Y129.95-00($520mln)

- AUD/USD: $0.6725(A$1.3bln), $0.7200-05(A$946mln), $0.7400(A$1.1bln)

USD: Still Beaming

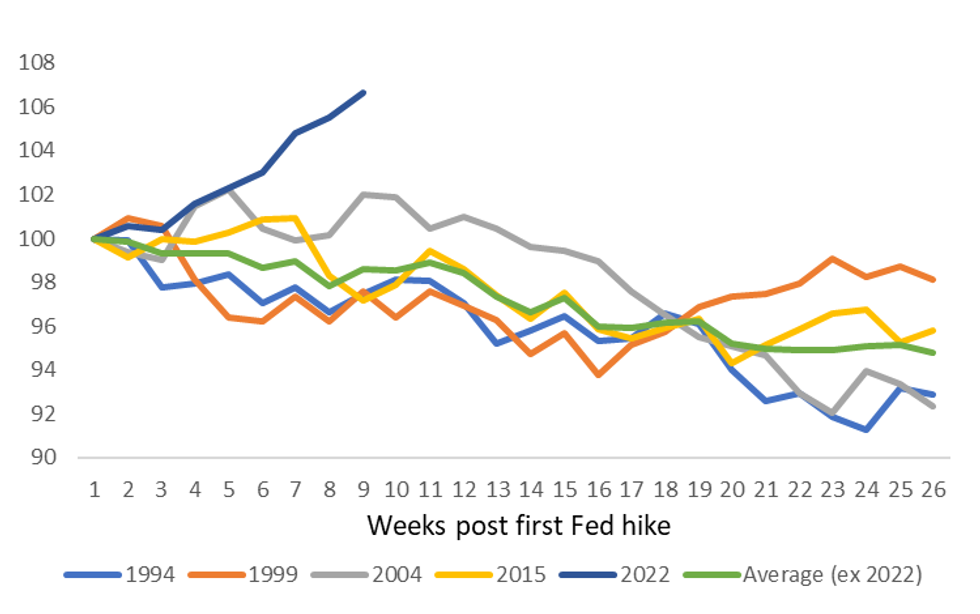

The DXY pushed close to 105.00 during the NY session, which is fresh cyclical high. We are weaker today as equities show some stability, but week to date gains stand at +1.00%, following last week's 0.68% gain. This would mark the 6th straight week of USD gains. Last week we noted that the USD was benefiting from the smile theory. See this linkfor more details and also see, MNI Global Macro Outlook - May 2022: USD Breakout Implications.

- Last week's post FOMC dip in the USD is now a distant memory. It continues to enjoy broad based support.

- The DXY has now added ~6.5% since the first Fed hike of the current tightening cycle, clearly bucking the normal trend, see the first chart below

Fig 1: DXY Performance Post The Onset Of Fed Tightening Cycles

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

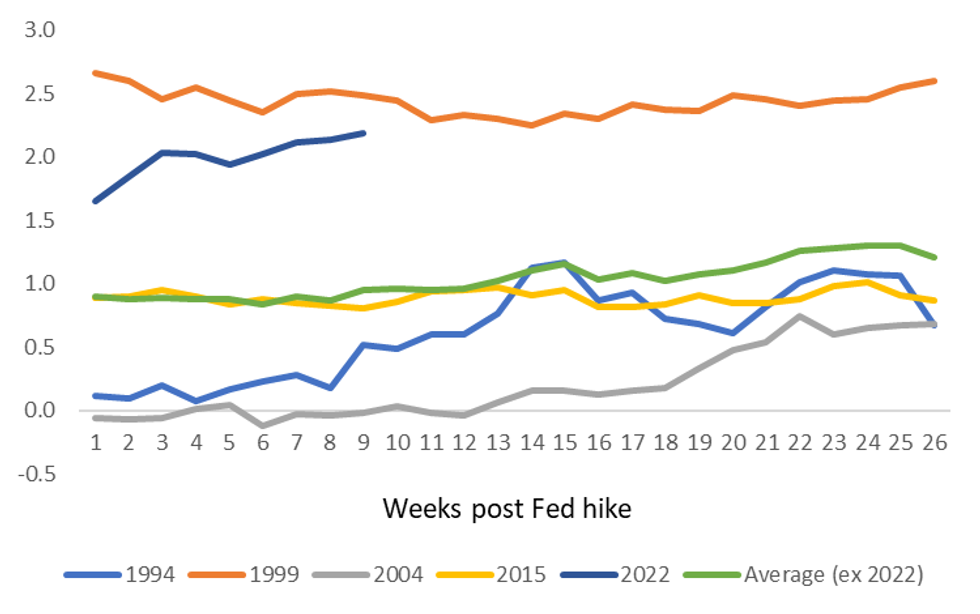

There has been a plateauing in Fed hiking expectations, which has seen USTs move off recent highs. Still, the general direction has remained favorable, see the second chart below. On a 2 year basis, the spread has moved 12bps in the USDs favor in the past week against the EUR, 18bps against GBP, but -14bps against JPY.

- This has been reflected in relative FX performance over the past week, with the USD gaining more against EUR and GBP, while easing modestly against JPY. As we noted yesterday, a flatlining of US Fed tightening expectations risked taking away a key source of support for USD/JPY.

- U.S. monetary policy tightening should still lead the way in the near-term, at least vs. G3 counterparts. This was one of pillars of USD support we noted last week.

Fig 2: Yield Differential Still In USD's Favour (2yr tenor, unweighted average against G3)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

The other key driver of USD outperformance, continued risk aversion in equities/concerns around the global slowdown, also remains in place.

- Global growth forecasts haven't moved a great deal further to the downside in the past week, at least according to the Bloomberg consensus, although risks clearly remain to the downside.

- This, coupled with continued equity market risk aversion, has arguably had a bigger influence on higher beta G10 FX performance over the past week e.g. AUD & NZD.

ASIA FX: Reprieve

Risk sentiment improved, lending support to most Asia EM currencies, with a few outliers.

- CNH: Spot USD/CNH traded on a softer footing, despite initially shrugging off a firmer than expected yuan fixing. The PBOC increased appreciation bias while setting the mid-point of permitted USD/CNY trading band to nearly 70 pips as it continues to lean against redback weakness. It seems that some positive musings on the outlook for China's dire COVID-19 situation and a broader risk reprieve rather than PBOC fixing lent support to offshore yuan.

- KRW: The won regained poise even as South Korea's uneasy northern neighbour test-fired three short-range ballistic missiles and confirmed an "explosive spread" of fever and six deaths from COVID-19.

- IDR: The rupiah retreated to its worst levels since Apr 2021 ahead of comments from Bank Indonesia officials. Elsewhere, Finance Ministry's fiscal policy czar noted that state budget can still serve as a "shock absorber" against price increases.

- MYR: The ringgit reversed losses as Q1 GDP data topped expectations. The report showed that the economy grew 5.0% Y/Y in the three months through end-March, printing above the median estimate of +4.0%. A notable downward revision to the prior quarterly reading was a fly in the ointment.

- PHP: Spot USD/PHP continued to trade within touching distance from PHP52.500. Better than expected GDP data released Thursday fuelled debate on monetary policy outlook.

- THB: The baht was rangebound and last trades a touch lower on the day. However, spot USD/THB struggled to re-test yesterday's high after BoT Asst Gov expressed readiness to intervene in support of the baht. These comments were weighed against China's crackdown on "unnecessary" travel, which bodes ill for the recovery of Thailand's tourism sector.

- INR: Spot USD/INR extended its pullback from an all-time high printed Thursday, following the release of above-forecast CPI data out of India.

- HKD: The HKMA stepped up its defence of its currency peg, increasing HKD purchases to HKD6.947bn. Spot USD/HKD continues to hug the upper end of its permitted trading band.

EQUITIES: Strong Finish To A Losing Week

Virtually all Asia-Pac equity indices are higher at typing, bucking a mixed lead from Wall St. on Thursday. High-beta equities across geographies caught a bid, with reduced appetite for havens evident in Asia-Pac dealing. Broader gauges of regional equities however still point to heavy losses, with the MSCI AC Asia Pacific Index down ~4.1% for the week prior to today’s rally.

- The Nikkei 225 sits 2.5% better off at typing, extending a rise from two-month lows made on Thursday. The move higher comes as sentiment in large caps firmed amidst positive earnings calls from some constituents, mixing with tail-winds from another bout of JPY weakness during the session. On the former, Softbank Group (+11.1%) led large-cap peers higher after reporting earnings, largely unwinding this week’s losses after hitting two-month lows on Thursday.

- The Hang Seng Index deals 2.0% firmer at typing, recording gains in virtually all sub-indices. China-based tech companies outperformed, with the Hang Seng Tech Index sitting 3.9% higher on gains in familiar large-cap names for another day (Tencent, JD.com etc.). Looking ahead, participants will be keeping a close eye on Baidu, Bilibili, and other Chinese internet technology giants this month, with debate re: their possible inclusion in the main Hang Seng Index during the latter’s quarterly reshuffle doing the rounds, ahead of the decision later this month (20 May).

- The ASX200 trades 1.7% higher at typing, pulling away from 15-week lows made on Thursday. High-beta tech led gains, with the S&P/ASX All Technology Index rising from two-year lows on Thursday to deal 5.1% firmer at writing, led by a ~13% rise in index heavyweight Block Inc (with the latter unwinding approx. half of Thursday’s loss, initially sparked by the implosion of the third-largest stablecoin in the cryptocurrency space).

- U.S. e-mini equity indices are 0.8% to 1.3% better off at typing, extending a move off of their respective troughs on Thursday amidst the previously flagged improvement in risk appetite.

GOLD: Back From Fresh 3-Month Lows; Dollar Rally Saps Strength

Gold is ~$3/oz firmer to print $1,825/oz at writing, extending a move higher after briefly dipping to three-month lows early in the session (at $1,811.7/oz).

- The precious metal is on track to see a fourth consecutive weekly close, potentially recording its largest weekly decline since end-Mar at current prices.

- To recap Thursday’s price action, gold closed ~$30/oz lower, facilitated by downward pressure from a broad uptick in U.S. real yields, and the USD (DXY) hitting fresh cycle highs. On the latter, the DXY is firmly on track to record a sixth consecutive higher weekly close, currently trading at levels last witnessed in Dec ‘02.

- Looking back, a note that nonfarm payrolls, CPI, and PPI readings for Apr previously came in above expectations, reinforcing the narrative for recent Fed hawkishness, and exacerbating recent gloom surrounding non-yielding precious metals.

- Nonetheless, June and July FOMC dated OIS are continuing to price in a cumulative ~105bp of tightening by the July meeting, suggesting little change in expectations for 2 x 50bp hikes at both meetings for now, in line with recent Fedspeak.

- From a technical perspective, the downtrend remains intact. Gold has broken initial support at $1,832.1/oz (May 11 low), exposing further support at $1,821.1 (Feb 11 low) and $1,780.4 (Jan 28 low and key support. On the upside, initial resistance is situated at $1,865.4/oz.

OIL: Higher In Asia; IEA Revises Crude Shortfall Projections For ‘22

WTI is ~+$1.20 and Brent is ~+$1.40, extending a move higher from their respective best levels on Thursday, and operating a little off session highs at typing. Both benchmarks are nonetheless on track for their first weekly loss in three, with worry re: reduced economic growth and energy demand remaining front and centre.

- EU lawmakers may delay potential Russian energy sanctions over well-documented Hungarian resistance, with a previously flagged video call between parties remaining unscheduled. Looking ahead, the next round of discussions between EU leaders re: the matter will likely happen in end-May.

- Turning to China, Shanghai reported six COVID cases “in the community” for Thursday, (increase from Wednesday’s two cases), keeping in mind that Chinese officials have placed the lifting of lockdowns to be conditional on three days of zero community spread. Elsewhere, city authorities in Beijing have denied rumours of an impending city-wide lockdown with some media reports of stockpiling behaviour doing the rounds on Thursday, keeping in mind that Shanghai’s current lockdown was similarly preceded by authorities declaring two days prior that no such measures would be taken. Beijing recorded 50 new cases on Thursday, against 46 on Wednesday.

- Elsewhere, the International Energy Agency’s (IEA) monthly Oil Market Report crossed on Thursday. The group revised supply shortfall projections for ‘22 downwards, pointing to a fall in Chinese energy demand and demand destruction from higher oil prices mixing with output increases elsewhere, suggesting that the impact on global supplies from sanctions on Russian energy may be less severe than initially feared.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.